Anthem

Quick Facts

- Voluntary for eligible staff, retirees and dependants at headquarters as well as internationally recruited eligible staff, retirees and dependants away from headquarters who plan to seek care in the US

- Covers medically necessary care at reasonable & customary (R&C) cost

- Area of coverage is worldwide

- No co-insurance for services provided by an in-network provider

- Annual deductible and coinsurance of 20% to 30% for services received from an out-of-network provider

- Teleconsultations available through “LiveHealth Online”

- Health and wellness support available through ActiveHealth

- Emergency medical assistance management through UnitedHealthcare Global Assistance and Risk

- Premium is a percentage on salary. Up to 66% of total premium is subsidized by Member States

Plan Summary

The Anthem Blue Cross PPO provides worldwide coverage for hospitalization and surgical, medical, vision and prescription drug expenses. Under this plan, medically necessary treatment for a covered illness or injury may be obtained at a hospital or from a physician of one’s own choosing, whether an in-network or out-of-network provider. In addition, members of the Anthem Blue Cross plan have access to ActiveHealth as part of participation in this plan. Coverage when travelling or living outside of the US is handled by Blue Cross Blue Shield Global Core.

Information Material - All about Your Plan

Description of Benefits - Anthem Blue Cross PPO

The below resources are official outlines of the available Anthem PPO. We kindly advise you to carefully review the plan details before making a decision on which plan is best suited for your needs.

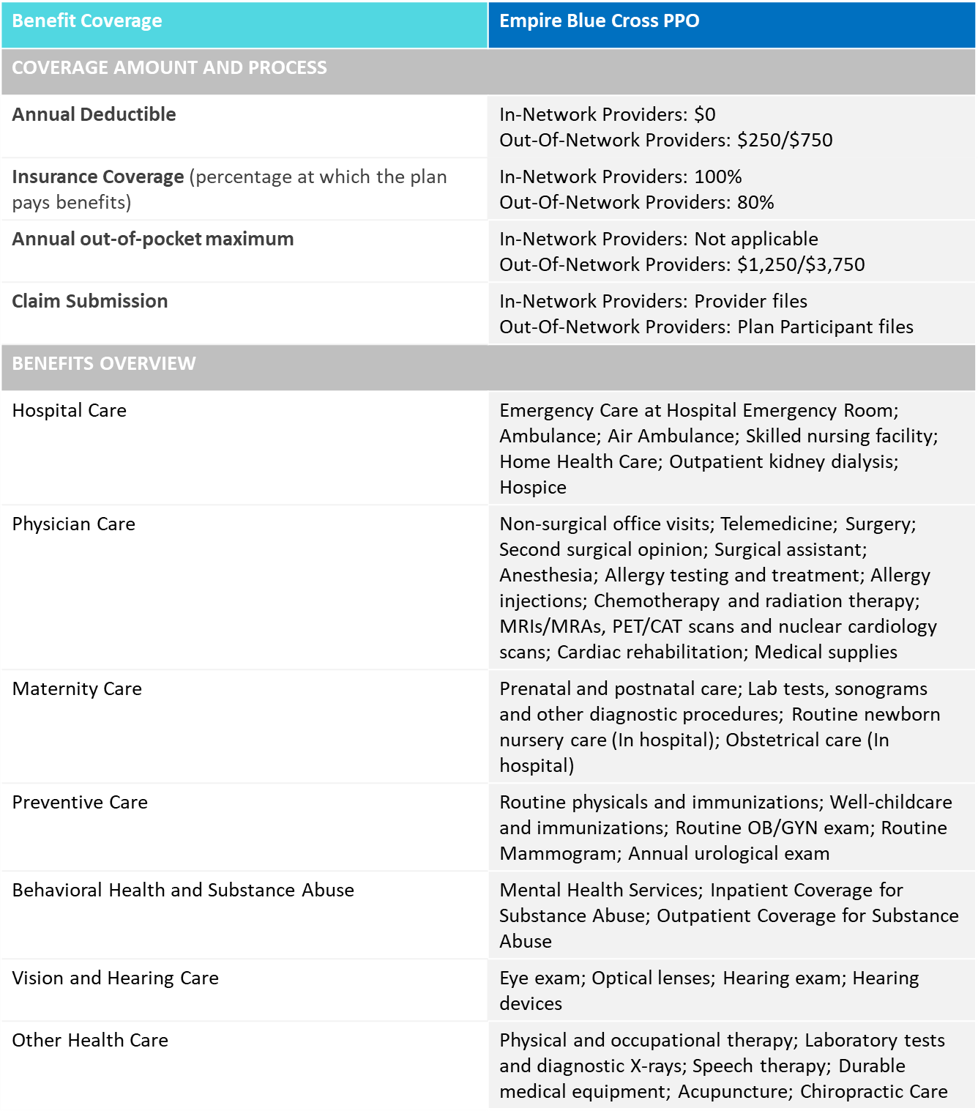

Description of Benefits - Empire Blue Cross PPO

Specific Benefits available through the Anthem Blue Cross PPO

The below resources are related to additional benefits available through the Anthem Blue Cross PPO, such as special programmes, telehealth, international care and the Sydney Health App.

Empire Home Delivery Programme

Care outside the US through Empire Global Core

LiveHealth Online - Telehealth Guide

ActiveHealth

Both Aetna and Anthem Blue Cross offer access to ActiveHealth that provides you with various resources intended to help you take better care of yourself, including coaching and health assessments.

UnitedHealthcare Global Assistance & Risk

UnitedHealthcare Global Assistance & Risk is a facility available to Aetna and Anthem Blue Cross subscribers when they are 100 or more miles away from home. UnitedHealthcare Global Assistance & Risk is a programme providing emergency medical assistance management — including coordinating emergency evacuation and repatriation — and other travel assistance services.

FAQs

What is the time limit to submit medical claims?

All claims must reach Anthem Blue Cross within two years after the date on which the expenses were incurred.

How can I access care outside the US?

The Blue Cross Blue Shield Global Core Program gives UN participants benefits when living or traveling outside the US. More information can be found on www.bcbsglobalcore.com.

Are Assisted reproductive technologies covered under Anthem Blue Cross PPO?

Assisted Reproductive Technologies (ART) including but not limited to in vitro fertilization (IVF), artificial insemination (AI), gamete intrafallopian transfer (GIFT), zygote intrafallopian transfer (ZIFT), and intracytoplasmic sperm injection (ICSI) are not covered under the Anthem Blue Cross PPO plan.

How can I submit a claim for care rendered in the United States?

Once you have registered to the Anthem Blue Cross PPO member page, you can access the claim form section at https://www.anthembluecross.com/login/.

How can I submit a claim for care rendered outside the United States?

Once you have registered to the Global Core member page, you can access the claim form section at https://www.bcbsglobalcore.com/Account/Login.