units: Global Economic Monitoring Branch (GEMB)

Global Economic Monitoring Branch (GEMB)

1 September 2019

Prolonged trade tensions exacerbating the cyclical slowdown in the global economy Global automobile production contracts amid higher tariffs and policy uncertainty Further easing of macroeconomic policies as external headwinds to growth rise

31 July 2019

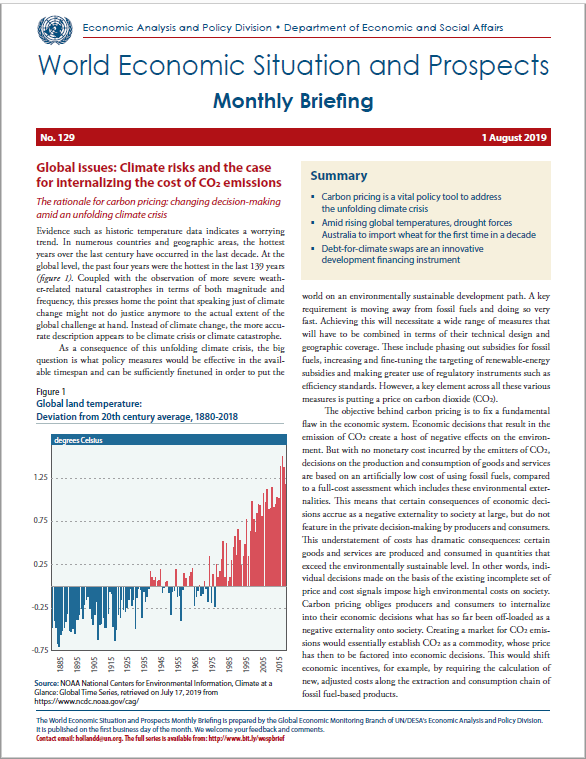

Carbon pricing is a vital policy tool to address the unfolding climate crisis Amid rising global temperatures, drought forces Australia to import wheat for the first time in a decade Debt-for-climate swaps are an innovative development financing instrument

1 July 2019

ODA flows must increase to support SDG-related investment Regional integration in Africa and Asia is crucial for sustainable development China’s direct investment in Latin America slows

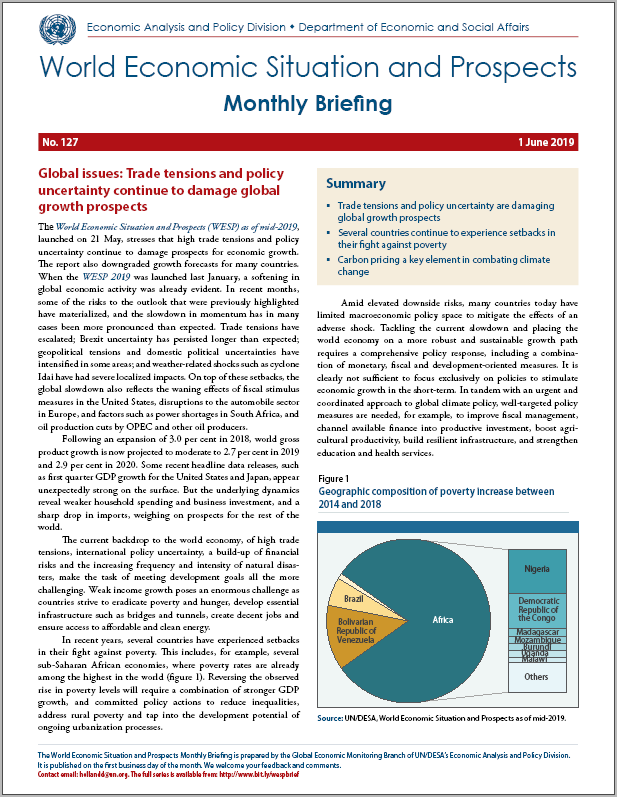

1 June 2019

Trade tensions and policy uncertainty are damaging global growth prospects Several countries continue to experience setbacks in their fight against poverty Carbon pricing a key element in combating climate change

21 May 2019

Global growth outlook has weakened, amid unresolved trade tensions and elevated international policy uncertainty, according to the World Economic Situation and Prospects as of mid-2019. Across both developed and developing countries, growth projections for 2019 have been downgraded.

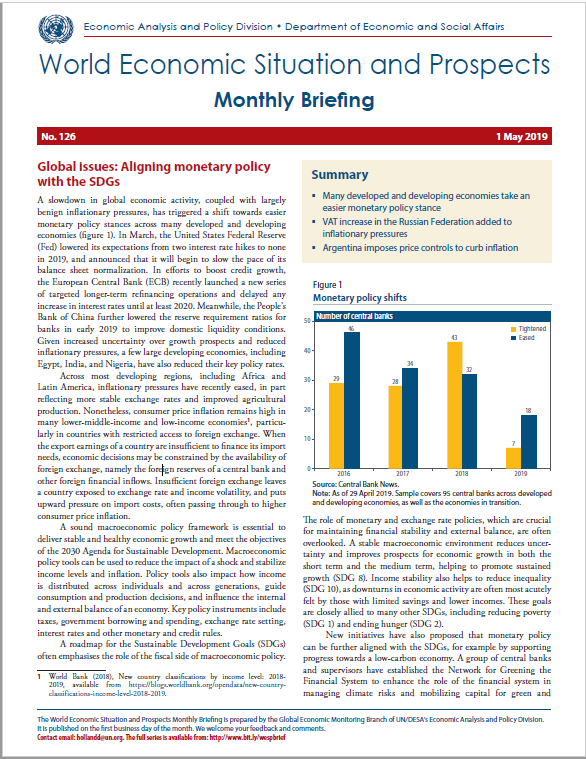

1 May 2019

Many developed and developing economies take an easier monetary policy stance VAT increase in the Russian Federation temporarily adds to inflation Argentina imposes price controls to curb inflation

1 April 2019

Addressing youth employment remains a policy challenge, especially in Africa In North America, central banks pause interest rate rises despite tight labour markets Shortage of young workers prompts Japan to relax immigration policies

1 March 2019

Amid signs of weakening global growth and tightening liquidity conditions, unprecedented debt burdens pose a significant risk to financial stability. The recent upsurge in leveraged loans – a particularly risky form of finance – is also worrying, given its resemblance to the pre-crisis subprime mortgage market. In the current uncertain environment, a shock to investor confidence could trigger fire sales and a downward spiral in asset prices, leading to an increase in credit defaults and bankruptcies.

1 March 2019

Growing demand for leveraged loans may pose a new global financial risk; surge in African sovereign external bond issuance raises concern; China’s recent policy easing may further increase the domestic debt level

Follow Us