World Economic Situation And Prospects: July 2019 Briefing, No. 128

- ODA flows must increase to support SDG-related investment

- Regional integration in Africa and Asia is crucial for sustainable development

- China’s direct investment in Latin America slows

English: PDF (168 kb)

Global issues

ODA flows should increase significantly to achieve the 2030 Agenda

To achieve the 2030 Agenda for Sustainable Development, the international community must embark on a path of collective efforts, including providing support to many developing countries to increase investment in numerous fields. Both upgrading and diversifying productive capacities and advancing communication, energy and transportation infrastructure remain priorities. Several countries, especially among the least developed countries (LDCs), remain heavily reliant on international assistance to advance these efforts. In order to channel the financing needed to close existing investment gaps, concrete actions are needed at the global level, in line with SDG 17 (Strengthen the means of implementation and revitalize the global partnership for sustainable development).

Estimates of the total annual financing needs to reach the SDG targets range between $4.6 trillion and $7.9 trillion at the global level. The total annual investment gap in key sustainable development sectors is estimated at $2.5 trillion by UNCTAD and many States must double their current infrastructure investment levels. Given the fragility of investment in many developing economies, meeting these daunting targets requires stable and steady flows of investment finance.

Investment growth slowed sharply in many developing countries in 2014–2015, especially in low-income countries (see figure 1). This deterioration is partially explained by the commodity price cycle, exacerbated by the escalation of conflict in Yemen, the Ebola crisis, and other security issues and political instabilities. Since 2016, some positive trends have been observed, especially in East and South Asia, which also have large populations of people living below the poverty line. However, investment levels in many developing countries, notably in Africa, remain insufficient to make rapid progress towards the 2030 Agenda. The eventual winding down of the period of ultra-cheap global liquidity is raising additional concerns, in particular in countries where corporate debt levels are elevated and where corporate borrowing has not been matched by investment into productive assets, as funds were channelled instead into financial assets or real estate.

Investment growth slowed sharply in many developing countries in 2014–2015, especially in low-income countries (see figure 1). This deterioration is partially explained by the commodity price cycle, exacerbated by the escalation of conflict in Yemen, the Ebola crisis, and other security issues and political instabilities. Since 2016, some positive trends have been observed, especially in East and South Asia, which also have large populations of people living below the poverty line. However, investment levels in many developing countries, notably in Africa, remain insufficient to make rapid progress towards the 2030 Agenda. The eventual winding down of the period of ultra-cheap global liquidity is raising additional concerns, in particular in countries where corporate debt levels are elevated and where corporate borrowing has not been matched by investment into productive assets, as funds were channelled instead into financial assets or real estate.

The Addis Ababa Action Agenda (AAAA), adopted in 2015, laid out a guiding framework to meet these financing challenges in a coordinated manner. However, the anticipated surge in development finance has not yet taken place. At the same time public investment is constrained by low government revenues (especially in low-income countries, where they remain below 15 per cent of GDP, on average), while domestic private investment is deterred by the lack of domestic savings and underdeveloped financial systems.

Private businesses, facing a range of short-term options, hesitate to commit funds to long-term investment projects, while households often focus on their immediate needs. Private capital flows, which provide the largest share of cross-border finance, declined sharply in 2015–2018. Foreign direct investment (FDI) flows to developing countries which have been weakening since 2015, contracted by 30 per cent by 2017 and fell further to $1.2 trillion in 2018—the level seen immediately after the global financial crisis.

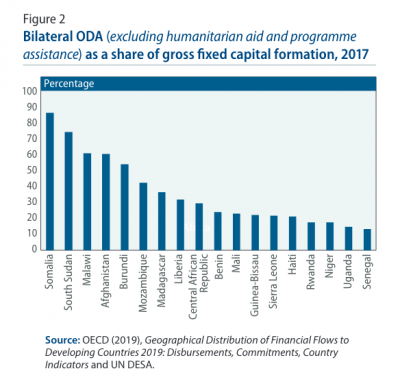

Official development assistance (ODA) flows to low-income countries and LDCs should play an important role in these efforts. ODA flows account for more than two-thirds of external finance for the LDCs. Globally, just over 11 per cent of total bilateral ODA is directed towards investment projects. Figure 2 illustrates the ratio of ODA inflows (excluding humanitarian aid and programme assistance) to gross fixed capital formation in selected low-income countries. This ratio exceeds 20 per cent in at least 15 countries, highlighting the importance of ODA as a source of financing to help close investment gaps.

In 2018, ODA provided by members of the Organization for Economic Cooperation and Development (OECD) Development Assistance Committee (DAC) amounted to $149.3 billion, representing a decline of 2.7 per cent in real terms over 2017. To compare, the volume of global remittances sent by migrant workers was about three times larger. Only five of the DAC members met or exceeded the 0.7 per cent of gross national income (GNI) target. Since 2010, the concessionality of bilateral ODA has also declined, as reliance on concessional loans increased at the expense of grants. In 2016–2017, loans made up 15.2 per cent of ODA, compared to 12.4 per cent in 2010–2012. Over 60 per cent of ODA finance provided for economic infrastructure and services is in the form of concessional loans, mostly in the transport and energy sectors. While this expands available financing, it also increases the risk of currency mismatches for loans in foreign currency and may contribute to a further build-up of external debt in developing countries.

The absorption capacity of the ODA-receiving countries should also increase. The AAAA called for Integrated National Financing Frameworks, yet the progress in defining those frameworks is slow, as each country needs to tailor them to particular sectors. Channeling ODA flows to productive investment will require a complex system of interactions between public and private stakeholders to develop and deepen domestic financial systems and also mobilize domestic finance. The quality of domestic institutions is absolutely crucial for the efficient absorption of resources.

The absorption capacity of the ODA-receiving countries should also increase. The AAAA called for Integrated National Financing Frameworks, yet the progress in defining those frameworks is slow, as each country needs to tailor them to particular sectors. Channeling ODA flows to productive investment will require a complex system of interactions between public and private stakeholders to develop and deepen domestic financial systems and also mobilize domestic finance. The quality of domestic institutions is absolutely crucial for the efficient absorption of resources.

Developed economies

North America: Recent policy changes have not yet materially increased multinational production in the United States

In the first quarter of 2019, GDP in the United States expanded by 3.1 per cent on an annualized basis, up from 2.2 per cent in the previous quarter. This stronger-than-expected headline figure masks a slowdown in both household consumption and business investment growth, and was driven primarily by a sharp drop in import volumes. As May 2019 saw the third major round of tariff hikes between the United States and China, the recent drop in import volumes begs the question as to whether recent policy changes in the United States, including significant cuts in corporate tax rates, incentives to repatriate cash earned overseas, and the imposition and threats of import tariffs, have encouraged US multinationals to repatriate production or increase investment in the United States, driving substitution of imported goods by domestic production. To date, there is little evidence to support this proposition. Rather, the recent drop in import volumes likely represents a disruption in global value chains, suggestive of weaker export and investment growth in the coming quarters.

Bilateral merchandise trade between the United States and China has declined by more than 15 per cent since September 2018, when the second round of tariffs came into effect. This has also been associated with a diversion of trade towards countries such as Viet Nam and Mexico, rather than an expansion of production in the United States. Meanwhile, in response to measures in the Tax Cuts and Jobs Act of 2017, there was a sharp surge in repatriated profits by US multinational firms. However, the bulk of these financial transfers have been directed towards stock buybacks, mergers and acquisitions, rather than an expansion of productive capacity in the United States. Forward indicators point to a sharp slowdown in capital expenditure plans in the United States during the second quarter of 2019, and the growth momentum is projected to moderate.

Developed Asia: Japan strengthens SDGs partnerships with domestic stakeholders

As Japan prepares to host the Group of Twenty (G20) Summit on 28 and 29 June, the Japan Business Federation (Keidanren) is advocating a policy proposal of “Society 5.0 for the SDGs”. Japan faces pressing economic and social challenges, which include a declining population, persistent deflationary pressures, and sluggish GDP growth. To tackle these challenges, the Government is promoting the SDGs in partnership with domestic businesses, civil society and academia. The Society 5.0 concept places a strong emphasis on technological innovations to transform the Japanese economy. Indeed, the recent Tankan Survey indicates that the software, research and development sectors will increasingly drive Japan’s investment growth in 2019. The partnerships for SDGs initiative in Japan demonstrates the pertinent role of the SDGs in a developed country.

Europe: Trade tensions and Brexit weigh on investment

Investment conditions in Europe received a further boost from the European Central Bank’s (ECB) recent signals that it is willing to inject further liquidity into markets if needed. This represents a turnaround from the previous scenario that envisaged the ECB moving away from its historically loose policy stance. The change in policy stems from a multitude of factors that put the economic performance of the region at risk. These include, in particular, the heightened global trade tensions, which create significant uncertainty as to the future trade conditions and, thus, also weigh on investment, especially in the export-dependent economies and sectors of the region. In the United Kingdom, the still undecided nature of the planned exit from the European Union (EU), or Brexit, has created a situation in which companies have little incentive to commit any new investment given a complete lack of visibility regarding the future legal framework for external trade relations. In some sectors like the automobile industry, the consequence of this situation is not only the lack of and diversion of investment projects, but also the relocation of capacities to other localities that offer greater legal certainty and the continued benefit of being part of the EU, which comes with significant legal and regulatory advantages in the form of universal market access to all EU member states.

Economies in transition

CIS: Costs of business credit remain high

In the Commonwealth of Independent States (CIS), despite some monetary relaxation and the fast expansion of consumer credit, business financing remains complicated. In the Russian Federation, international sanctions have affected business confidence. Although sovereign reserves have increased significantly over the past few years, it is unlikely that these resources will be used for public investment. In Ukraine, which is facing a conflict in the East of the country, investment has been recovering steadily since 2016, but is skewed towards real estate. In the countries of Central Asia, banking system fragilities are constraining access to financing for businesses, underscoring the importance of public investment; the majority of inward remittances are channelled into private consumption.

Some initiatives will support investment in the region. The Government of Kazakhstan in April announced the launch of the Coordination Council for the Attraction of Investment, aiming to raise the share of investment in GDP from 20.9 per cent in 2018 to 30 per cent by 2025. At the regional level, the implementation of the Belt and Road Initiative is contributing to the improvement of the energy and railway networks. In addition, the EU in May adopted a new strategy with respect to its relationship with the Central Asian countries, aiming to deepen its engagement, boost resilience against internal and external shocks, support economic modernization and regional connectivity, boost regional trade and investment and support WTO accession bids of Turkmenistan and Uzbekistan. A number of regional development banks are active in the CIS area, investing in multiple projects, including in energy, infrastructure and the social sectors. In South-Eastern Europe, the region has been receiving increased investment from China, in particular, in the energy and infrastructure sectors.

Developing economies

Africa: African Continental Free Trade Area aims to overcome constraints to growth and development

While Africa’s growth is expected to pick up in the near term, the region is facing difficulties in sustaining a robust growth trajectory. In many African countries, weak balance of payments remains a crucial obstacle to stronger growth. In 2019, only Botswana, Eswatini and the Republic of Congo are expected to run current account surpluses. In the rest of Africa, to varying extents, the space for domestic demand expansion depends on foreign capital inflows. The present situation creates a dilemma for policymakers. To achieve the SDGs, domestic demand, namely consumption and investment, needs to expand in real terms. However, an expansionary policy under balance of payment constraints can easily fuel higher consumer price inflation, disproportionately affecting the poor, and potentially trigger major balance of payments turbulences or even crisis. Therefore, African countries need to develop more resilient export capacities to overcome these vulnerabilities. Despite various partnerships at bilateral and multilateral levels, efforts to strengthen export capacity in Africa have rendered limited results. This is mainly because Africa’s exports have structurally been excluded from the mid-stream of global value chains.

The African Continental Free Trade Area (AfCFTA), which entered into force on 30 May, is a momentous regional partnership for Africa’s economic growth and development. The AfCFTA is projected to boost intraregional trade of final goods and to promote stronger productivity growth, amid lower cross-border transaction costs. In addition, the enlarged market size, together with the strengthening of productive capacities, can encourage the production of critical intermediate manufacturing inputs such as special tools, dies and moulds. In this way, the AfCFTA promotes African insertion into the mid-stream of global value chains, which can significantly contribute to strengthening conditions for growth and development across the continent.

East Asia: Regional integration crucial in boosting the region’s sustainable development prospects

The further escalation of trade tensions between the United States and China has created significant uncertainty surrounding the multilateral trading system. In several parts of the world, growing discontent with globalization has resulted in the adoption of more inward-looking policies. Despite the rising challenges to multilateralism however, the Asian economies have continued to strengthen trade, investment and financial linkages within the region. A recent report by the Asian Development Bank (ADB) highlighted that Asia’s share of intra-regional trade rose to 57.8 per cent in 2017 from 57.2 per cent in 2016, and is well above the share of 46 per cent seen in 1990. Intraregional FDI also rose in 2017, accounting now for more than half of all FDI inflows in the region. Policymakers’ commitment towards fostering deeper regional cooperation and integration has been reflected through the progress on several major initiatives. These include the ASEAN Economic Community, the Belt and Road Initiative, and the Asian Infrastructure Investment Bank. These initiatives will facilitate the channelling of the region’s surplus funds towards productive investments within Asia.

In particular, the region’s massive infrastructure gap, particularly in the transport sector, is constraining productivity growth and dampening medium-term development prospects. According to the ADB, the developing Asia region needs to invest $1.7 trillion per year in infrastructure until 2030 in order to maintain its growth momentum, achieve sustained poverty reduction, and combat climate change.

South Asia: India increasingly attractive to foreign capital

According to ESCAP estimates, South Asia would be on track to achieve the SDGs with an estimated additional investment of $1.00 per person per day until 2030. Considering the entire population of the region, the annual needs translate into over $700 billion per year until 2030. Given that 18 per cent of the regional population is below 9 years old, and 37 per cent below 19 years old, human capital investment will remain the top priority for many years. Meanwhile, as the impact of climate change intensifies, the necessary infrastructure investment will increasingly consume more of government revenues. Financing sources for all required investments remain a substantial concern to the South Asian economies. Private capital is overwhelmingly directed towards sectors with the most favourable risk-return balance, leaving governments to continue to finance public goods with a lower financial return.

In India, rapid economic growth, political stability, rising wealth, and openness to foreign investors draw substantial attention from financial markets. Despite this, FDI to India remained at a constant annual $62–64 billion, including around $44 billion into equity, in the last two years ending in March 2019. Services received 18 per cent of all equity FDI, with a 37 per cent increase compared to last year. The sector is followed by software and hardware investments with a 9 per cent share. After a 24 per cent fall, around 10 per cent of equity flows remain directed towards various construction activities. While India’s energy needs will continue to offer countless investment opportunities for many years, the power sector received only 3 per cent of recent equity flows with a substantial decline compared to the previous year.

Western Asia: Arab regional partnership seeks leverage for growth and development

On 13 June, the United Nations Secretary-General António Guterres told the Security Council that the cooperation between the United Nations and the League of Arab States (LAS) is ‘pivotal’. Various United Nations activities are underway with the LAS on peace and security challenges and socioeconomic development issues. The LAS is the main regional partnership platform for the Arab region, including a large part of Western Asia. The Arab region includes both high-income countries and least developed countries with varying endowments of natural and human resources. Thus, higher economic growth across the region can be sought by leveraging on existing complementarities between countries. For example, Jordanian and Lebanese workers in the high-income oil exporting countries in the region contributed to the growth of the non-oil sector. In return, the remittance flows to Jordan and Lebanon helped sustain the economic growth of both countries even at the height of the Syrian refugee crisis. For this year, attaining a sufficient level of regional financial inflows became even more critical for both Jordan and Lebanon to implement fiscal reform measures, as public debt has reached alarming levels in both countries. The regional partnership along the LAS can augment the synergies between the countries through closer economic integration. Notably, efforts to create the Arab common market have been progressing in line with the agreements for the Greater Arab Free Trade Area and the Arab Customs Union.

Latin America and the Caribbean: China’s direct investment slows

In 2018, the value of Latin America and the Caribbean’s merchandise trade rose by an estimated 9.7 per cent from the previous year. A main driver behind this increase was a rapid expansion in trade with China, which is the largest export market for several South American economies, including Brazil, Chile, Peru and Uruguay. The value of the region’s total shipments to China is estimated to have grown by 27 per cent in 2018. Raw materials—most notably soybeans, crude oil, iron ore and copper—and natural-resource-based manufactures account for more than 90 per cent of exports to China. Imports from China, on the other hand, which consist almost exclusively of manufactures, increased by about 13 per cent in 2018.

While trade continued to expand, China’s direct investment activity in the region has slowed. The value of both announced greenfield FDI projects and of transactions actually carried out declined notably in 2018. In terms of sector and destination, Chinese FDI in the region has become more diversified in recent years. During the commodity boom of the 2000s, FDI flows to Latin America and the Caribbean were heavily concentrated in the raw material sector. Since then, an increasing share of total investment has gone into manufacturing and services. Argentina and Brazil—the two countries that had historically garnered the largest share of Chinese FDI—have seen inflows decline over the past few years, amid unstable economic and political conditions. By contrast, Chile and Peru have recorded gains. Both are among the 19 Latin American and Caribbean countries that have formally agreed to cooperate with China through the Belt and Road Initiative.

Follow Us