World Economic Situation And Prospects: June 2019 Briefing, No. 127

- Trade tensions and policy uncertainty are damaging global growth prospects

- Several countries continue to experience setbacks in their fight against poverty

- Carbon pricing a key element in combating climate change

English: PDF (168 kb)

Global issues

Trade tensions and policy uncertainty continue to damage global growth prospects

The World Economic Situation and Prospects (WESP) as of mid-2019, launched on 21 May, stresses that high trade tensions and policy uncertainty continue to damage prospects for economic growth. The report also downgraded growth forecasts for many countries. When the WESP 2019 was launched last January, a softening in global economic activity was already evident. In recent months, some of the risks to the outlook that were previously highlighted have materialized, and the slowdown in momentum has in many cases been more pronounced than expected. Trade tensions have escalated; Brexit uncertainty has persisted longer than expected; geopolitical tensions and domestic political uncertainties have intensified in some areas; and weather-related shocks such as cyclone Idai have had severe localized impacts. On top of these setbacks, the global slowdown also reflects the waning effects of fiscal stimulus measures in the United States, disruptions to the automobile sector in Europe, and factors such as power shortages in South Africa, and oil production cuts by OPEC and other oil producers.

Following an expansion of 3.0 per cent in 2018, world gross product growth is now projected to moderate to 2.7 per cent in 2019 and 2.9 per cent in 2020. Some recent headline data releases, such as first quarter GDP growth for the United States and Japan, appear unexpectedly strong on the surface. But the underlying dynamics reveal weaker household spending and business investment, and a sharp drop in imports, weighing on prospects for the rest of the world.

The current backdrop to the world economy, of high trade tensions, international policy uncertainty, a build-up of financial risks and the increasing frequency and intensity of natural disasters, make the task of meeting development goals all the more challenging. Weak income growth poses an enormous challenge as countries strive to eradicate poverty and hunger, develop essential infrastructure such as bridges and tunnels, create decent jobs and ensure access to affordable and clean energy.

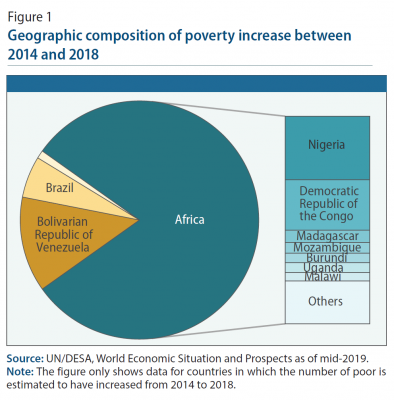

In recent years, several countries have experienced setbacks in their fight against poverty. This includes, for example, several sub-Saharan African economies, where poverty rates are already among the highest in the world (figure 1). Reversing the observed rise in poverty levels will require a combination of stronger GDP growth, and committed policy actions to reduce inequalities, address rural poverty and tap into the development potential of ongoing urbanization processes.

Amid elevated downside risks, many countries today have limited macroeconomic policy space to mitigate the effects of an adverse shock. Tackling the current slowdown and placing the world economy on a more robust and sustainable growth path requires a comprehensive policy response, including a combination of monetary, fiscal and development-oriented measures. It is clearly not sufficient to focus exclusively on policies to stimulate economic growth in the short-term. In tandem with an urgent and coordinated approach to global climate policy, well-targeted policy measures are needed, for example, to improve fiscal management, channel available finance into productive investment, boost agricultural productivity, build resilient infrastructure, and strengthen education and health services.

Amid elevated downside risks, many countries today have limited macroeconomic policy space to mitigate the effects of an adverse shock. Tackling the current slowdown and placing the world economy on a more robust and sustainable growth path requires a comprehensive policy response, including a combination of monetary, fiscal and development-oriented measures. It is clearly not sufficient to focus exclusively on policies to stimulate economic growth in the short-term. In tandem with an urgent and coordinated approach to global climate policy, well-targeted policy measures are needed, for example, to improve fiscal management, channel available finance into productive investment, boost agricultural productivity, build resilient infrastructure, and strengthen education and health services.

Persistently high trade tensions pose a threat to global growth

Last year saw a significant rise in global trade tensions and disputes raised at the World Trade Organization. Many of these disputes remain unresolved and tensions have continued to escalate. Bilateral trade between the United States and China has dropped by more than 15 per cent since September 2018, when the second round of tariffs were introduced. This has also impacted global value chains in East Asia and other trading partners. World trade growth is forecast to slow to 2.7 per cent this year, from 3.6 per cent in 2018.

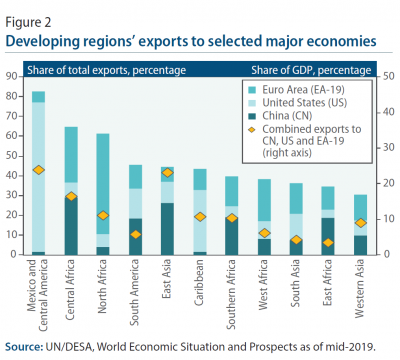

The WESP as of mid-2019 report warns that a spiral of additional tariffs and retaliations could have significant spillovers on developing countries, particularly in regions with a high export exposure to China and the United States (figure 2).

The slowdown in world trade growth has also impacted investment in trade-oriented sectors. Given the strong interlinkages between trade, investment and productivity, this, in turn, dampens medium-term prospects for growth. Failure to resolve these disputes and reinvigorate the multilateral trading system will inevitably reduce the opportunity for developing countries to accelerate their development.

Carbon pricing is a key element in combating climate change

The increasing frequency and intensity of natural disasters highlights the rising threats posed by climate change, particularly for the most vulnerable countries, which include many least developed countries and small island developing States. Transitioning towards sustainable global production and consumption requires a fundamental shift in the way the world powers economic growth. To accelerate this process, governments have several policy options. These include increasing subsidies for clean energy and carbon removal technology, eliminating fossil fuel subsidies, regulating the sources of carbon emissions, implementing stringent energy-efficiency standards, and campaigning to change public opinion and behaviour towards conservation of energy and carbon-rich land cover. However, these policy measures are likely to fall short unless they are supported by a coordinated, multilateral approach to global climate policy, including a price on carbon.

A price on carbon compels economic decisionmakers to internalize some of the environmental costs of their consumption and production. To date, carbon pricing tools have been introduced on a very limited and fragmented basis. As initiatives advance along piecemeal, country-by-country or even firm-level approaches, there is a risk of carbon leakage, in the form of the relocation of carbon intensive industries to jurisdictions with more lax regulation, potentially even increasing global emission levels. The potential for carbon leakage highlights the risks of fragmented policy frameworks and the need for a coordinated approach to carbon pricing. Unified principles and standards would also facilitate aligning carbon pricing with other major policy areas such as trade and international finance.

Developed economies

North America: Imports into the United States drop sharply amid trade tensions

In the first quarter of 2019, GDP in the United States expanded by 3.2 per cent on an annualized basis, up from 2.2 per cent in the previous quarter. This stronger-than-expected headline figure masks a slowdown in both household consumption and private investment growth, and is driven primarily by a sharp drop in import volumes. For 2019 as a whole, the WESP as of mid-2019 projects GDP growth of 2.3 per cent—down from 2.9 per cent in 2018—as the effects of fiscal stimulus measures wane and trade growth is hampered by ongoing disputes. In 2020, GDP growth in the United States is expected to moderate further to 2.1 per cent.

In Canada, GDP is forecast to grow by 1.8 per cent in 2019 and 2.0 per cent in 2020. Oil production cuts in Alberta, the impact of higher interest rates on the housing and automobile sectors, and tariffs on the exports of steel and aluminium to the United States all restrained activity in the first months of 2019.

Developed Asia: Forecasts revised down as externaldemand weakens

Japan’s growth forecast for 2019 has been revised down from 1.4 per cent to 0.8 per cent. The revision reflects weakening external demand. On a year-on-year basis, exports declined in the first months of 2019, notably to China. This has significantly hampered intentions for capacity-enhancing investments in the manufacturing sector. Amid stubbornly weak wage growth, private consumption is expected to remain sluggish.

The forecasts for Australia and New Zealand are also revised down slightly. Australia’s economy slowed in the fourth quarter of 2018 due to a sharp decline in private investment. Despite fiscal stimulus measures, a further slowdown is expected in line with the stagnating housing sector. New Zealand also faces decelerating domestic and external demand. The Reserve Bank of New Zealand has hinted at monetary easing in 2019. Both Australia and New Zealand are expected to be influenced by weaker demand from their major trading partners, particularly China and the European Union (EU) countries.

Europe: Trade related risks materialize

The European Union (EU) is projected to expand by 1.5 per cent in 2019 and 1.8 per cent in 2020. This constitutes a downward revision compared to the previous forecast, as the trade-related downside risks attached to the last baseline forecast have started to materialize. By contrast, private consumption remains relatively robust. Solid labour market conditions underpin upward wage pressure, which together with subdued inflation rates supports household purchasing power and private consumption spending. In addition, the European Central Bank has postponed any withdrawal of its accommodative policy stance, which has supported investment and the construction sector in various countries.

The postponement of the United Kingdom’s exit from the EU without clarification as to the way forward has increased the risk of a disorderly separation. This could have severe negative consequences in the form of a disruption or even breakdown in trade flows to and from the United Kingdom.

Economies in transition

CIS: Aggregate growth expected to moderate

For the economies of the Commonwealth of Independent States (CIS), external conditions, including non-oil commodity prices, may be less supportive in 2019. Growth is expected to moderate slightly, especially as fiscal policies are largely growth-neutral, and several countries have tightened monetary conditions. In the Russian Federation, GDP growth for 2018, at 2.3 per cent, exceeded forecasts. Such performance is unlikely in 2019, as the increase in the VAT rate in January 2019 added to inflationary pressures, curbing consumer spending and impeding monetary easing. In the first quarter, the economy expanded by just 0.5 per cent relative to a year earlier, hampered by insufficient business lending and weak investment; any additional economic sanctions would undermine the business environment. The implementation of the social and economic development programmes should nevertheless modestly add to growth in the medium term. Among other CIS energy-exporters, Azerbaijan should benefit from higher natural gas output in 2019, and fiscal spending and investment promotion should support the expansion in Kazakhstan.

Among the CIS energy-importers, the economy of Ukraine is facing risks from lower steel prices and the possible downscaling of the Russian natural gas transit. The country faces around $25 billion of external debt repayments in 2019–2020. Belarus is also confronted with external debt repayments and may see less favourable terms for oil imports, eroding economic activity. The strong expansion recorded in 2018 in a number of smaller CIS economies may not be sustainable. However, growth in Central Asia should exceed the CIS average and the implementation of the "Belt and Road Initiative" should facilitate infrastructure upgrading and better market access. Aggregate GDP of the CIS and Georgia is expected to increase by 1.9 and 2.3 per cent in 2019 and 2020, respectively.

In South-Eastern Europe, the region’s aggregate GDP is expected to expand by 3.4 per cent in 2019 and 3.2 per cent in 2020, supported by investment in the energy sector and exports; however, the incidents of political instability pose risks to the outlook.

Developing economies

Africa: Growth remains insufficient to make visible progress towards the 2030 Agenda

The economic outlook in Africa remains challenging. While growth is estimated to strengthen, the region is facing difficulties to resume a robust growth trajectory amid a global slowdown, tepid commodity prices and fragilities in commodity exporters. GDP growth is projected at 3.2 per cent in 2019 and 3.7 per cent in 2020, after an expansion of only 2.7 per cent in 2018. These growth rates are insufficient to absorb a fast-growing labour force. The creation of decent jobs represents a crucial challenge to make further progress in poverty reduction. The risks to the short-term outlook are tilted to the downside. They include weather-related shocks, political uncertainty and security concerns on the domestic front; and lower-than-expected commodity prices and an escalation of trade tensions on the external front. The recent upsurge in external sovereign bond issuances has also raised debt sustainability concerns in several economies.

In North Africa, general sentiment has weakened in tandem with European economies, the subregion’s largest trading partner. Yet, growth is vigorous in Egypt and Libya, supported by stable balance-of-payment conditions. East Africa continues to be the fastest-growing sub-region, and the outlook is positive in Ethiopia, Kenya and United Republic of Tanzania. West Africa’s economic bloc is expected to continue to expand at a relatively fast pace. Meanwhile, Nigeria’s economy is slowly recovering, due to stronger household consumption and fixed investment, gradually rising oil prices and production and reduced policy uncertainty. In Central Africa, the recovery remains feeble, amid unstable political, social and security conditions. Yet, reforms should contribute to the gradual pick-up in non-oil sectors, for example in Central African Republic and Cameroon. Likewise, growth in Southern Africa continues to be below potential, for example in South Africa and Angola. Notably, cyclone Idai has caused a major humanitarian crisis, with visible economic impacts as well, mostly in Mozambique.

East Asia: Trade tensions continue to cast a cloud ongrowth outlook

In the East Asia region, domestic demand is expected to remain resilient, supported by accommodative policies in most economies. However, export performance will soften, in tandem with a more moderate expansion of global demand and a weakening of the global electronics cycle. Trade tensions also continue to cast a cloud on the region’s trade outlook. Against this backdrop, regional GDP growth is projected to moderate from 5.8 per cent in 2018 to 5.5 per cent in both 2019 and 2020.

Growth in China is projected to moderate from 6.6 per cent in 2018 to 6.3 per cent in 2019 and 6.2 per cent in 2020. Recent monetary and fiscal stimulus measures are expected to bolster domestic demand, partially offsetting the adverse impact of trade tariffs on overall growth. Nevertheless, these measures could also exacerbate domestic financial imbalances, raising the risk of a disorderly deleveraging process in the future.

For most other East Asian economies, private consumption will be supported by healthy job creation, rising incomes, and moderate inflationary pressures. In Indonesia, the Republic of Korea, and Malaysia, the expansion of social welfare programmes will provide additional impetus to consumer spending. Growth in many countries, including the Philippines and Thailand, will also be supported by public investment, amid the continued implementation of large infrastructure projects.

Downside risks to East Asia’s growth outlook remain elevated. A renewed intensification of trade frictions could severely disrupt the region’s extensive production networks. Furthermore, protracted uncertainty in the trade policy environment could prompt businesses to delay investment decisions, thus hampering medium-term productivity growth. On the domestic front, financial sector vulnerabilities, in particular high corporate and household debt, will continue to weigh on growth prospects in several countries.

South Asia: Strong average growth despite somedownward revisions

South Asia remains on a strong growth path, even as forecasts have been revised downward. Following an expansion of 5.7 per cent in 2018, GDP is forecast to grow by 5.0 per cent in 2019 and 5.8 per cent in 2020. Across the region, output continues to be constrained by infrastructure bottlenecks. The Indian economy, which generates two-thirds of regional output, expanded by 7.2 per cent in 2018. Strong domestic consumption and investment will continue to support growth, which is projected at 7.0 per cent in 2019 and 7.1 per cent in 2020. The economy of Bangladesh is forecast to grow by 7.1 per cent in 2019 and 2020. By contrast, growth in Pakistan is expected to slow from 5.4 per cent in 2018 to about 4 per cent in 2019 and 2020 amid fiscal, inflationary and domestic demand challenges. In the Islamic Republic of Iran, the 0.8 per cent GDP contraction in 2018—largely reflecting external political factors—is expected to be followed by a further 2.0 per cent decline in 2019. In Bangladesh, the growth slowdown in the EU entails risks to the outlook. The EU accounts for around two-thirds of its total exports, with a quarter of exports concentrated in Germany and the United Kingdom. India’s exports remain more robust, as around half of exports are destined for faster-growing Asian markets. Geopolitical risks continue to confront Afghanistan and the Islamic Republic of Iran.

Western Asia: Tighter external conditions sloweconomic growth

Western Asia’s growth forecast for 2019 has been revised down from 2.4 per cent to 1.7 per cent, reflecting forecast downgrades for Saudi Arabia and Turkey. In Saudi Arabia, the oil sector’s output is lower, as the country has complied with new OPEC-led crude oil production cuts. In Turkey, a sharp decline in industrial production, following the steep depreciation of the Turkish lira in August 2018, indicates that the export sector will only slowly benefit from improved price competitiveness. Despite a recovery in oil prices during the first quarter of 2019, domestic demand growth remained sluggish in the region’s major oil exporters. Weak domestic demand has dampened inflationary pressures, with Qatar, Saudi Arabia and the United Arab Emirates facing deflation. The outlook for Jordan and Lebanon remains subdued, as both countries struggle to reduce public debt. Particularly in Lebanon, the growing level of public debt is increasingly exerting pressure on the banking system. The Iraqi economy is forecast to recover steadily as the domestic demand expansion continues. Additional refinery facilities, which were damaged by armed conflict in 2014, have resumed operations, improving the availability of fuel products. Syria’s economy is supported by reconstruction activities. However, economic sanctions have stoked inflationary pressures. While in Yemen the humanitarian crisis continues, the economy is forecast to grow on the back of expanding oil and gas production. The Israeli economy’s robust growth is forecast to continue despite weaker external demand from Europe.

Latin America and the Caribbean: Regional growth outlook downgraded further

Amid slowing external demand, ongoing global policy uncertainty and country-specific factors, the economic recovery in Latin America and the Caribbean has lost momentum. Economic activity in late 2018 and early 2019 was weaker than expected, particularly in some of the region’s largest countries. This has prompted a downward revision of the short-term growth outlook. Regional GDP is projected to expand by 1.1 per cent in 2019, following estimated growth of 0.9 per cent in 2018. Growth is forecast to accelerate to 2.0 per cent in 2020 as economic conditions in Argentina and Brazil improve gradually. The risks to the outlook remain tilted to the downside. Sharper-than-expected slowdowns in the region’s main trading partners—China, United States and the EU—or renewed financial volatility could further weaken the recovery. In view of significant downside risks, limited inflationary pressures and constrained fiscal space, most central banks are likely to maintain accommodative monetary policies to support growth.

The region continues to be characterized by stark differences in growth prospects across countries. GDP is expected to contract in 2019 in the Bolivarian Republic of Venezuela and Nicaragua in the wake of socio-political crises. Economic activity is also expected to decline in Argentina, which has entered a large-scale financial assistance programme with the IMF. The short-term outlook for Brazil and Mexico is weaker than previously expected—with growth projected to be below 2 per cent in 2019—owing to sluggish investment and industrial production. The Northern Countries of Central America—El Salvador, Guatemala and Honduras—are expected to see subdued growth in the range of 2.0 to 3.5 per cent. On the other hand, growth prospects remain favourable in several other economies, most notably Bolivia, the Dominican Republic, Panama and Peru. In these countries, strong domestic demand, including buoyant infrastructure spending, will support economic activity. In the Caribbean, regional growth is projected to strengthen in 2020, partly due to the expected onset of commercial oil production in Guyana.

Follow Us