1 Objective

The objective of this chapter is to give a brief overview of the accounting life cycle and relevant guidance on the accounting treatment of transactions relating to intangible assets within the Umoja environment. The accounting of transactions pertaining to intangible assets is primarily housed within the Asset Accounting module of Umoja.

This chapter details how an end user, based on the involved Umoja user profiles, should perform roles and responsibilities related to accounting of intangible asset transactions.

This chapter is based on guidance under IPSAS 31: Intangible Assets.

2 Summary of IPSAS Accounting Policies

2.1 Recognition and Measurement

An intangible asset is defined as an identifiable non-monetary asset without physical substance (one cannot literally see or touch it).

An intangible asset is recognized if, and only if, all of the following criteria are met:

• The asset is identifiable, i.e.:

o It is separable which means the asset can be separated or divided from the UN and sold, transferred, licensed, rented, or exchanged individually or in aggregate as part of a contract, regardless of whether the UN intends to do so; or

o If it arises from contractual or other legal rights, regardless of whether the rights are transferable or separable from the UN or from other rights and obligations;

• The UN has control over the asset i.e. the UN has the power to obtain future economic benefits or service potential flowing from the underlying resource and to restrict the access of others to those benefits or that service potential;

• It is probable (more than 50% probability) that the expected future economic benefits or service potential that are attributable to the asset will flow to the UN;

• The cost or fair value (donated intangibles) of the asset can be measured reliably;

• The intangible asset has a useful life of one year or more; and

• An externally acquired intangible asset meets the minimum established threshold of USD 5,000 per unit/user for all reporting entities other than Volumes I and II. For Volume I and II, the threshold for capitalization of an externally acquired asset is USD 20,000 per unit/user. For internally generated intangible assets, the capitalization threshold is USD 100,000 for all UN secretariat reporting entities.

Generally, all intangible assets recognized in the financial statements of the UN should be measured at cost when they are first recognized, except for items donated to the UN. Such goods should be measured at fair value.

Currently, all of the UN's intangible assets have a finite useful life. The following table should be used when assessing an intangible asset's useful life:

|

Asset Class |

Estimated useful life (in years) |

|

Externally acquired software |

Set* (3-10 year range) |

|

Software licenses |

Set* (2-6 year range) |

|

Externally acquired websites |

Set* (short) |

|

Other externally acquired intangible assets |

Set* |

|

Internally generated software |

Set* (3-10 year range) |

|

Publications |

Set* |

|

Internally generated websites |

Set* (short) |

|

Internally generated intangible assets under construction |

No Amortization |

Set* - Specific useful lives and residual values will be applied for high cost and/or specialized items when application of the standard useful lives for the class would result in non-compliance with IPSAS.

2.2 References

For more details on the IPSAS requirements regarding intangible assets, refer to:

• The UN IPSAS Policy Framework;

• The Corporate Guidance on Intangible Assets; and

• The Corporate Guidance on Impairment of non-cash generating assets.

3 Desktop Procedures

3.1 Asset Accounting (AA) Module Overview

In Umoja, the Asset Accounting (AA) module deals with the accounting of PP&E and intangibles, which are classified as non-current assets.

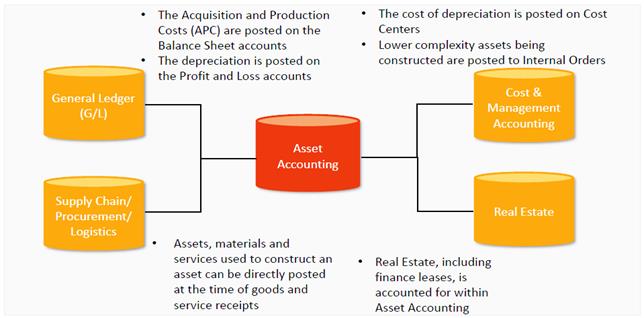

3.1.1 Other Modules Integrated with AA

The Asset Accounting module is integrated with the following modules across Umoja to allow for eased flow of data and communications:

GL accounts that are used for various postings of assets are automatically derived based on backend configuration in Umoja. Such GL accounts are derived based on the 'account determination' IDs that are linked to various asset classes. In other words, each Umoja Asset Class is linked to a unique account determination ID that in turn links to a set of GL accounts pertaining to that asset class. Examples of such sets of GL accounts include asset cost, asset accumulated depreciation/accumulated amortization/accumulated impairment, asset depreciation/amortization/impairment expense and gain/loss on sale of fixed assets.

The Umoja Asset Accounting module maintains both tangible and intangible fixed assets. Since all lifecycle processes for intangible assets are very similar to tangible assets, the Umoja solution for tangible and intangible assets will be the same except for the GL accounts through which the intangible asset accounting is performed.

For a detailed explanation of GL accounts, refer to the General Ledger Chapter of the Finance Manual.

Supply Chain/Procurement/Logistic modules are integrated for the procurement process of fixed assets.

Cost & Management accounting modules are integrated for posting of depreciation / amortization / impairment expenses, loss on sale of fixed assets etc., to applicable cost objects.

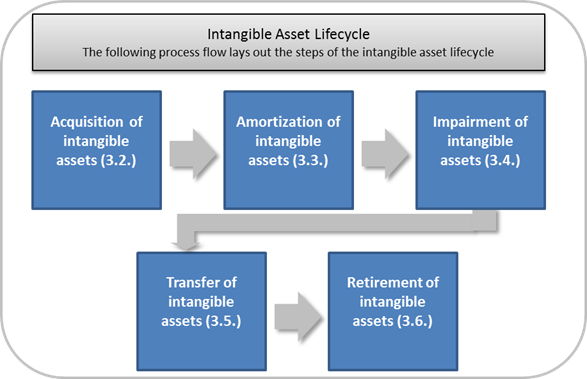

3.1.2 Overview of the Intangible Asset Lifecycle

3.2 Acquisition of Intangible Assets

Initial recognition of intangible assets occurs upon either external acquisition or when an internally generated asset arises from development and meets the criteria of the development phase (refer to the Corporate Guidance on Intangible Assets for a detailed explanation). The accounting process steps are heavily dependent on how the asset was obtained (external acquisition vs. internally generated).

Intangible assets can be acquired in three ways. Umoja steps for each of the three methods of acquisition are similar to that of Property, Plant and Equipment (PP&E) processes and are described in the following three sections:

• 3.2.1. Assets can be purchased from an external source;

• 3.2.2. Assets can be internally developed; or,

• 3.2.3. Assets can be donated.

3.2.1 Standalone (Purchased Externally) Intangible Assets

One potential way for the UN to acquire an intangible asset is through standalone (externally purchased) assets. Standalone assets are those for which no additional costs are anticipated and are capitalized at the time of receipt.

We refer to the Corporate Guidance on Intangible Assets for more details

It must be noted that Umoja master data creation and transaction processing are the same as PP&E. Therefore for details of Umoja specific processes including creating Intangible master data and processing relevant transactions, please refer to section 3.4 and 4.1 in Property, Plant and Equipment Chapter of the Finance Manual.

3.2.2 Assets under Construction (Internally Developed)

Another way for the UN to acquire an intangible asset is by internally developing it. Since it may be difficult to assess whether these internally generated intangible assets meet all the general recognition criteria for an intangible asset, the UN classifies the generation of the asset into a research phase and a development phase.

The costs of internally generated intangibles include total directly attributable costs necessary to create, produce, and prepare the asset to be capable of operating in the manner intended by management.

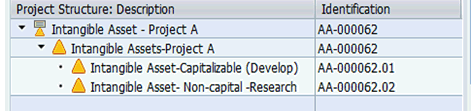

IPSAS requires that for internally developed intangible assets, both non-capitalisable (research) and capitalisable (development) costs should be collected and reported. This can be achieved by creating a cost collector in the form of Work Breakdown Structure (WBS) in Umoja as shown below.

We refer to the Corporate Guidance on Intangible Assets for more details.

It must be noted that the AUC processing for intangible assets in Umoja are the same as PP&E. Therefore for details of Umoja specific processes including creating cost collectors, settlement to asset under construction, Intangible master data and settling the AUC to final assets, please refer to section 4.2 in Property, Plant and Equipment Chapter of the Finance Manual.

3.2.3 Donated Intangible Assets

In some cases, intangible assets can be acquired through non-exchange transactions such as donations. An example of a donated intangible asset would be a situation in which a publication is written by an outside expert and subsequently donated to the UN. In these situations, the item is measured at fair value on the date of acquisition.

It must be noted that Umoja master data creation and transaction processing are the same as PP&E. Therefore for details of Umoja specific processes including creating Intangible master data and processing relevant transactions, section 3.4 and 4.1 in Property, Plant and Equipment Chapter of the Finance Manual.

3.3 Amortization of Intangible Assets

The depreciable amount is defined as the asset's cost less its residual value. The UN decided to apply a residual value of zero for intangible assets.

The depreciable amount of an asset is allocated on a straight line method basis over its useful life.

Amortization begins when the asset is available for use, i.e. when it is in the location and condition necessary for it to be capable of operating in the manner intended by management.

The remaining useful life of an intangible asset with a finite useful life should be reviewed on an annual basis.

In Umoja, both depreciation and amortization are referred to as depreciation. The term 'ordinary depreciation' is used for both depreciation of tangible assets and amortization of intangible assets.

A. The process for amortization is the same as the depreciation process in the Finance Manual Chapter on Property, Plant and Equipment. Refer to section 5.1 of the Property, Plant and Equipment Chapter for detailed steps and screenshots to process amortization. We refer to the following example for guidance on the accounting entries.

Example:

Umoja will be capitalized at each deployment phase (Foundation, Extension 1, and Extension 2) as a sub asset of a parent asset. Development costs during each phase will be captured as 'assets under construction' and will be transferred to 'Internally generated software' as soon as deployment starts and amortization is ready to commence.

Based on the asset number, the depreciation entries will be automatically determined. For example, if the asset number is 710XXXXXXXX, which falls under asset class 710 - Software Internally Developed, then GL accounts for the amortization and accumulated amortization of internally developed software will automatically be utilized based on the asset determination rules.

This will post the accounting entries in the financial accounting ledger as follows:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

XXXX |

77901010 |

Amort Intang Software Internally Developed |

150,000 |

|

|

|

27901010 |

Intang Software Internally Developed Accum Amortiz |

|

150,000 |

3.4 Impairment of Intangible Assets

Irrespective of whether there is any indication of impairment, the UN must test an intangible asset with an indefinite useful life or an intangible asset not available for use for impairment annually by comparing its carrying amount to its recoverable service amount.

Other intangible assets are tested whenever there is an indication that the asset might be impaired.

We refer to the Corporate Guidance on Impairment for the detailed processes for identifying assets requiring an impairment review and performing an impairment test.

Recognizing an impairment loss

Umoja uses the term 'unplanned depreciation' to account for impairments of both tangible and intangible assets.

The process to recognize an impairment loss on an intangible asset is the same as the process to impair Property, Plant and Equipment. Refer to section 5.2 of the Finance Manual Chapter on Property, Plant and Equipment for the detailed Umoja process and screenshots.

We refer to the example below for the detailed accounting entries.

Example:

Software is internally developed for USD 150,000 with an expected useful life of 5 years. After 3 years, an impairment test concludes that the asset is fully impaired.

Terms:

· Original cost: USD 150,000

· Useful life: 5 years

· Carrying value: USD 60,000

· years accumulated depreciation up to date of impairment: USD 90,000 (3* 150,000/5)

· Impairment after 3 years: USD 30,000

The entry to book the impairment would be as follows:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

31 Dec 2015 |

77501010 |

Impai Soft Internal |

30,000 |

|

|

|

27501010 |

IN Softwre Inter Imp |

|

30,000 |

3.5 Transfer of Intangible Assets

The Asset Transfer process involves the transfer of ownership for intangible assets. In UN, transfer of assets involves the following scenarios:

· Transfer of assets from one mission to another mission or one department to another department

· Transfer of assets between grants

· Transfer of assets between Peacekeeping and Regular Budget Projects

The transfer process for all above scenarios is the same except that the new fund/new grant/new business area are specified in the receiving asset. Based on this new information, system will automatically generate additional posting lines for inter-fund, inter-grant, inter-business area postings. However, if the transfer is between two cost centers, this scenario will be considered as a change to the 'Asset Master Data' and should be performed through AS02 - 'Change Asset Master' transaction described later in this chapter.

3.6 Retirement of Intangible Assets

Another step in the lifecycle of an intangible asset is the retirement of the asset. An intangible asset is derecognized upon:

· Disposals, which can occur through sales, financing leases or non-exchange transactions; or

· When no future economic benefits or service potential are expected from its use or disposal.

A gain or loss is determined on the asset de-recognition as the difference between the net disposal proceeds and carrying amount.

The steps to dispose of intangible assets through sales or donations are the same as the steps for PP&E. Refer to section 5.5 of the Finance Manual Chapter on Property, Plant and Equipment for detailed Umoja steps and screenshots.

3.6.1 Donation of an Intangible Asset

This example relates to acquired software with a business specific application. The software has a USD 1.5 million cost, USD 0.4 million accumulated depreciation (amortisation) and therefore USD 1.1 million net book value which for the donated asset is accounted for as debit (i.e. expense) in the Statement of Financial Performance.

|

Date |

GL |

GL short description |

Debit |

Credit |

|

XXXX |

79691010 |

Donation FA Invent |

1,100,000 |

|

|

|

27902020 |

IN Softwr BusSpe Amo |

400,000 |

|

|

|

27202020 |

IN SoftwrAcqBusSpCst |

|

1,500,000 |

3.6.2 Sale of an Intangible Asset

This example relates to acquired software with a business specific application. The software has a USD 1.0 million Cost, USD 0.3 million accumulated depreciation and therefore USD 0.7 million net book value. The software is sold with a sale price of USD 0.5 million giving a loss on disposal of USD 0.2 million which is accounted for as a debit (i.e. expense) in the Statement of Financial Performance.

The entry below is created during the AR invoice posting through Sales and Distribution - Billing Process.

|

Date |

GL |

GL short description |

Debit |

Credit |

|

XXXX |

15101510 |

AR Exch Commercial Customer |

500,000 |

|

|

|

69101020 |

IS2 Sale Asset Clrng |

|

500,000 |

Subsequently, the Asset Accounting Senior User records the reduction of the assets against the suspense account (69101020). Umoja automatically calculates the gains/losses.

|

Date |

GL |

GL short description |

Debit |

Credit |

|

XXXX |

69101020 |

IS2 Sale Asset Clrng |

500,000 |

|

|

|

27902020 |

IN Softwr BusSpe Amo |

300,000 |

|

|

|

79901010 |

Loss on Asset Sale |

200,000 |

|

|

|

27202020 |

IN SoftwrAcqBusSpCst |

|

1,000,000 |

3.7 Ad hoc Transactions

3.7.1 Revision of Useful Life

Certain situations may call for the revision of an assets useful life. A change in useful life could occur from repairs or maintenance, technological obsolescence or a change in the use of an asset.

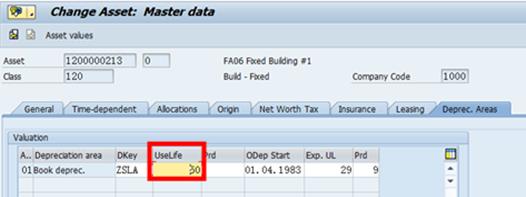

B. Should the useful life require updating, the following Umoja steps shall be followed:

B.1. Revise the useful life / Transaction Code: AS02

B.1.1. Click the Deprec. Areas tab and update the Use Life field.

B.1.2. In order for the useful life change to affect prospectively only, a new interval needs to be created with a start date of the first of the month in which the new useful life should take effect.

B.1.3. In order to create a new interval, double-click the Use Life field. Click the More Intervals button, then the Add Interval button.

B.1.4. Insert the interval start date and new useful life. Note: The remaining useful life doesn't change until the end of the year.

B.2. Review the updated Fixed Asset / Transaction Code: AW01N

If the useful life has been adjusted, use the T-code AW01N to verify that the Ordinary depreciation amount is adjusted based on the change in useful life.

3.7.2 Correction of Amortization Errors

Amortization errors due to incorrect useful life should be corrected as described in the above 3.7.1 - Revision of Useful Lives. This change will have prospective effect.

Any capitalization errors can be corrected in the current month with a retrospective effective date mentioned in the Asset Value Date field. The change in the amortization values will be automatically calculated and posted in the current month.

Depreciation run can be performed with Re-run option for the last month posted. Hence, if there are any corrections that affect last posted month and if they need to be reflected in the last posted month's financials, then the depreciation run can be executed once again for the last posted month with the option- Re-Run.

If the depreciation start date has to be manually adjusted, the Start Date field in Deprec. Areas tab can be changed using AS02-Change Asset transaction.

3.7.3 Changes to Master Data

C. The process to change master data is as follows:

C.1. Change asset master data / Transaction Code: AS02

If the request is for an update of an Asset Master Record, the Master Data Maintenance (MDM) user will update the record as requested as allowed by related policies. Such change of Asset Master could be for change in description, cost center, depreciation key, useful life, scrap value, classification and other reporting parameters stored on the asset master, etc.

C.2. Notify requestor / Manual

If the asset creation request is not in conformity with related policy, the MDM team will notify the requestor with the policy details that are not complied with. If the MDM team was able to change the asset, they will notify the requestor with details of the updated asset.

3.7.4 Consistency of Useful life in Transfer Transactions

To ensure that the correct remaining useful life is maintained in the receiving asset, the user shall verify that the new asset has received the proper remaining useful life after completing the transfer.

3.7.5 Creation and Execution of Reports

Once a report is identified to be executed,

the user needs to select the report from the menu path by double clicking the

report. Then, suitable parameters such as asset class, report date, selection

for 'list assets' (lists all assets) are required to be specified in the

selection screen. If no selection has been made for a particular field, the

system will include all possible options for that field. Selection should be

made only if the user wants to restrict the report values for certain chosen

values. Once the selections are made, the user can press F8 or click Execute

button (clock button ![]() ). Then the system will bring the report values as per the

selections made. Depending on the type of the report, the user will have option

to change the layout of the report to add or exclude certain fields or drill

down further to various other reports or line items. The user can also download

the report to excel using 'export' functionality or by going to System

-> List -> Save -> Local File. The report data can be saved in

excel format. To exit the report screen click Back button.

). Then the system will bring the report values as per the

selections made. Depending on the type of the report, the user will have option

to change the layout of the report to add or exclude certain fields or drill

down further to various other reports or line items. The user can also download

the report to excel using 'export' functionality or by going to System

-> List -> Save -> Local File. The report data can be saved in

excel format. To exit the report screen click Back button.

D. The following reports (asset balances, asset history sheet, ordinary depreciation, unplanned depreciation, asset acquisitions, retirements, transfers and transactions) all relate to the asset accounting module. The section of data chosen for each report can be set in the initial screen.

D.1. Asset Balances / Transaction Code: S_ALR_87011963

This report displays the values of all assets in a depreciation area by different attributes such as by asset number, asset class, business area and cost center.

The user can filter and customize this report based on how he or she would like to view assets.

D.2. Asset History Sheet / Transaction Code: S_ALR_87011990

This report is the most important and most comprehensive asset report for the year-end closing or for interim financial statements. It contains information from opening balances to the end of the year.

D.3. Ordinary Depreciation / Transaction Code: S_ALR_87012006

This report displays the value of ordinary depreciation of assets for a fiscal year.

D.4. Unplanned Depreciation / Transaction Code: S_ALR_87012008

This report displays the value of unplanned depreciation (impairment) of assets for a fiscal year.

D.5. Asset Acquisitions, Retirements, Transfers, Transactions

These reports provide the detail transactions related to acquisitions, transfers and retirements during the fiscal year.

D.5.1. Asset Retirements / Transaction Code: S_ALR_87012052

This report provides the list of assets written off during the period.

D.6. Asset Master Validation / Transaction Code: ZAAVALAS

To view all UN assets in the Umoja ECC system, open the Asset Master Validation Report using the T-code ZAAVALAS. This displays all relevant asset master fields, including linkages to real estate objects for validation.

NOTE: For the detailed Umoja processes on how to generate these reports, please refer to section 6 of the Finance Manual Chapter on Property, Plant and Equipment.

4 Business Partners

The use of Umoja Business Partner functionality is core to the Umoja solution when processing transactions. Each module enables specific processes and requires the creation of a customer, vendor and/or BP. The following Business Partners are relevant to this chapter:

· Z010 Commercial vendors

· Z011 Member States

· Z012 Non Member States

· Z014 UN Agency Funds and Programmes

· Z013 Government

· Z015 Non-Governmental Organizations & Intergovernmental

· Z016 Individual External, Non-Staff (this group is not on Payroll)

· Z018 Commercial Customers

· Z020 Staff Members, Ex-Staff Members, Survivors, Dependents

· Z021 Non Staff Military/Police

Refer to the Umoja Overview Chapter of the Finance Manual for additional details.

5 Asset Master Data

The asset master data record for each asset captures two types of data:

· Asset data: Includes general information such as description, location and asset class.

· Depreciation data: Includes depreciation specific information such as depreciation terms and useful life.

Each asset is part of an asset class, which rolls up to a GL account. Each asset class:

· Classifies assets into logical groups

· Controls the screen layouts of the asset master and depreciation area

· Provides default values to assets that are created under the corresponding asset class

· Determines the numbering ranges of assets

· Determines the GL accounts to be posted to for that class of assets

Intangible asset classes applicable to the Umoja Asset Accounting process are:

|

Asset Class |

Asset Class Description |

|

710 |

Software Internally Developed |

|

720 |

Software Acquired - Enterprise Applications |

|

730 |

Software Acquired - Business Specific Applications |

|

740 |

Software Acquired - Productivity and Utility App |

|

750 |

Software Acquired - Infrastructure Mgt Application |

|

760 |

Software Acquired - Application Development |

|

770 |

License Right |

|

780 |

Copyright |

|

790 |

Software Maint - Enterprise Applications |

|

800 |

Software Maint - Business Specific Applications |

|

810 |

Software Maint - Productivity and Utility Applications |

|

820 |

Software Maint - Infrastructure Mgt Applications |

|

830 |

Software Maint - Application Development |

|

840 |

Asset in Development - IT system |

6 Stages of Assets under Construction

Research phase: Costs arising from the research phase must always be expensed when incurred. These costs do not meet the definition of an intangible asset nor do they meet the recognition criteria because the UN is unable to demonstrate future economic benefits or service potential. This being the case, it is necessary to collect the expense in the cost collector as indicated in section 3.2.2 above.

Development phase: Intangible assets arising from the development phase can be recognized if the UN can demonstrate that all of the following criteria are met:

|

Criteria |

Accounting Treatment |

|

It is technically feasible to complete the intangible asset. |

Capitalize |

|

There is the intention to complete the intangible asset and use it. |

Capitalize |

|

The intangible asset is useable. |

Capitalize |

|

It is probable that the intangible asset will generate future economic benefits or service potential. |

Capitalize |

|

Adequate technical, financial (e.g. approved budget), or other resources are available to complete the development and to use the intangible asset. |

Capitalize |

|

Costs of the asset are able to be measured reliability during the assets development. Adequate processes exist to capture all of the relevant costs. |

Capitalize |

|

Threshold is over USD 100,000. |

Capitalize |

Refer to the Corporate Guidance on Intangible Assets for additional detail.

December, 2016