1 Objective

Financial instruments include a wide range of assets and liabilities at the UN Secretariat reporting entities such as cash, term deposits, investments, contributions receivables and account payables. UN Treasury invests the funds pooled from the UN Secretariat and other participating UN system organizations. These pooled funds are referred to as Cash Pools which represent significant portion of the United Nations (UN) assets is within the scope of accounting for financial instruments.

The objective of this chapter is to give a brief overview of the accounting lifecycle and relevant guidance on accounting for Cash Pools Investments within Umoja environment. This chapter on financial instruments includes Treasury module within Umoja environment.

This chapter details how an end user, based on the relevant Umoja user profiles, should perform roles and responsibilities related to accounting for financial instruments. Additionally this chapter provides guidance on IPSAS 30: Financial Instruments: Disclosures, which prescribes disclosures that enable the users of financial statements to evaluate the significance of financial instruments to an entity, the nature and extent of their risks, and how the entity manages those risks.

2 Summary of IPSAS Accounting Policies

2.1 Recognition, Derecognition and Measurement of FVTSD

Cash pool investments classified as Fair Value through Surplus or Deficit (FVTSD) are recognized initially on the trade date, the date the reporting entity becomes party to the contractual provisions of the instrument.

Cash pool investments in this category are classified as current assets if expected to be settled within twelve months, otherwise they are classified as non-current. They are initially recognized at fair value, and transaction costs such as custody fees are expensed in the statement of financial performance by netting them against investment income. Gains or losses arising from changes in the fair value are presented in the Statement of Financial Performance in the period in which they arise.

Cash pool investments are derecognized when the rights to receive cash flows have expired or have been transferred and the UN has transferred substantially all risks and rewards of financial asset.

Cash pool investments and liabilities are offset and the net amount reported in the Statement of Financial Position when there is a legally enforceable right to offset the recognized amounts and there is an intention to settle on a net basis or release the asset and settle the liability simultaneously.

2.2 Cash Pools Investments

UN Treasury invests the funds pooled from the UN Secretariat and other participating UN system organizations. These pooled funds are referred to as Cash Pools. Participation in the Cash Pool implies sharing the risk and returns on investments with the other participants. Since the funds are commingled and invested on a pool basis, each participant is exposed to the overall risk of the investments portfolio of its share of the Cash Pools. The commingled funds from the participants are primarily invested in fixed income securities in accordance with the Investment Management Guidelines.

Cash Pools' investments will be classified as FVTSD because the UN Treasury monitors and reports its investments on a fair value basis and the information is periodically reviewed by the management team.

2.3 IPSAS Reference

For more details on the IPSAS requirements regarding Financial Instruments, refer to:

· The Corporate Guidance on Financial Instruments

3 Treasury (Investments) Module

The UN uses SAP Treasury and Risk Management Module to achieve the goal of providing an optimal return on excess UN funds while maintaining safety of principal and adequate liquidity to meet UN operational needs. The SAP Treasury and Risk Management Module is used for recording, settling and accounting of these investments. It is also used to manage foreign exchange risks and liquidity.

The UN Treasury manages unutilized cash in three separate cash pools (portfolios) to optimize investment returns while maintaining liquidity. The three cash pools are as follows:

· Main Pool, investments are currently denominated in USD (US dollar)

· Euro Pool, investments are currently denominated in EUR (Euro)

· UNSMIS Pool, investments are currently denominated in CHF (Swiss Franc)

3.1 Treasury and Risk Management Lifecycle

The investment management objective is to preserve capital and ensure sufficient liquidity to meet operating cash while earning a competitive market rate of return on each investment pool. Investment quality, safety and liquidity are emphasized over the market rate of return component of the investment management objective. The portfolio management process at the UN aims to optimize the investment for excess funds by maximizing the risk adjusted returns.

3.1.1 Transaction Execution - Investment

UN Treasury uses the partially integrated cash management and treasury management functionality within SAP to assess the liquidity needs of the entire cash pool managed by the UN Treasury based on the cash position and liquidity planning forecasts for short term and medium term liquidity needs, and taking into consideration the market conditions.

UN Treasury front office (Investment Section within Treasury) executes the redemptions and purchases/sales with investment bank/broker/custodian.

Once the trade is complete, UN Treasury uses the back office (Investment Accounting Unit) functionality within the transaction manager (where the transaction is created within the system) to settle the trade and conclude the transaction by either receiving or making a payment.

UN also reconciles the treasury transactions with the custodian by processing an interface file relating to the trading activity provided by the custodian. The matched deals are cleared based on the pre-determined criteria and unmatched deals will be posted / reversed manually after performing investigation.

Umoja is designed to reinforce compliance with IPSAS through the parameters of fair value through surplus or deficit and adherence to trade date over settlement date accounting.

UN portfolio normally includes following instruments:

|

Issuer Type |

Security Type |

Umoja Product Type |

|

US Treasury |

UST Bils |

CPS |

|

UST Notes |

FIB |

|

|

US Agencies |

Discount Notes |

CPS |

|

Bonds |

FIB/VRB |

|

|

Non US Sovereigns |

Discount Notes |

CPS |

|

Bonds |

FIB/VRB |

|

|

Non US Agencies |

Comerical Paper |

CPS |

|

Bonds |

FIB/VRB |

|

|

Super Sovereigns |

Discount Notes |

CPS |

|

Bonds |

FIB/VRB |

|

|

Corporates/Banks |

Commercial Paper |

CPS |

|

Bonds |

FIB/VRB |

|

|

Certificate of Deposit |

CD |

|

|

Term Deposti |

FTD |

Umoja process steps applicable to Time deposits (Fixed Term deposits and Money Market investments) are explained in section 3.1.1 part A and Umoja process steps applicable to Fixed Income Securities (All security type other than Term deposit) are explained in section 3.1.1 part B.

A. Transaction Execution - Investment - Fixed Term Deposits

The following process steps are applicable to executing a time deposit transaction. For fixed term deposits with maturities of less than three months, they are classified as cash and cash equivalents.

A.1. Front Office (Investment Section within Treasury)

A.1.1. Place Fixed Term Deposits with Counterparty either on Bloomberg Aim or over the phone. The business process step is performed outside of Umoja system.

A.1.2. Review and check trade transactions / Manual

A second Investment Trader (Front office user) reviews and checks transaction details to ensure compliance with investment guidelines, and reasonableness of the transaction in respect to daily cash flows and liquidity requirements. This review is also performed outside of the Umoja.

Once reviewed, the investment details are loaded to Umoja through an interface. Currently in Umoja Foundation, this interface is not yet realized thus the investment has to be recorded manually in Umoja following process step A.1.3.

A.1.3. Enter investment transactions in Umoja / Transaction Code: FTR_CREATE

Investment transactions are manually entered in Umoja system. However, it is envisioned that the transaction details will be imported into Umoja via an electronic interface from Bloomberg Aim that will be in real-time. The system immediately calculates all related cash flows associated with the security. Umoja updates liquidity forecast and related cash flow information to ensure proper cash positioning and planning.

The process followed to enter an investment transaction in Umoja differs depending on the type of financial instrument being traded. The Treasury Front Office (Investment Section within Treasury) enters the trade information in Umoja via the following steps:

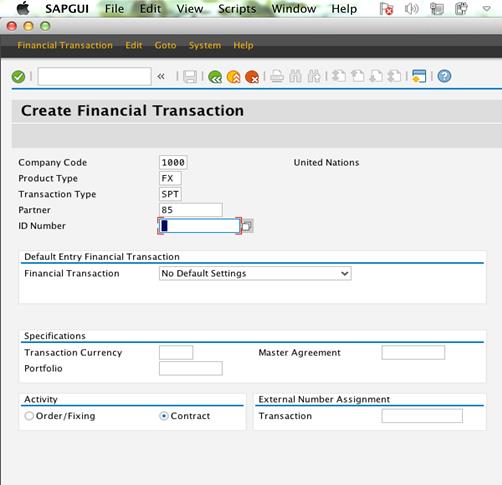

A.1.3.1. Type FTR_CREATE in the Command window and click the Enter icon

A.1.3.2. The Create Financial Transaction screen appears. The information entered in the Header section of this screen defines the product being traded.

A.1.3.3. Enter the required transaction data in the following fields: Company Code (always 1000), Product Type, Transaction Type, Partner, Transaction Currency, Portfolio.

Note: For Fixed Income transactions, security ID Number also needs to be provided.

A.1.3.4. The Create Security Transaction: Structure screen appears containing detailed information on the transaction being created across a series of tabs.

A.1.3.5. The Structure tab contains information that defines the terms of the transaction, including transaction nominal and payment amounts, valuation class, payment/value/posting dates, market price and accrued interest.

A.1.3.6. Enter the required information in the following fields in the Structure tab: Securities Acct, Pos. Value Date, Nominal Amount, check Incl. box

A.1.3.7. After populating the data, click the Enter icon.

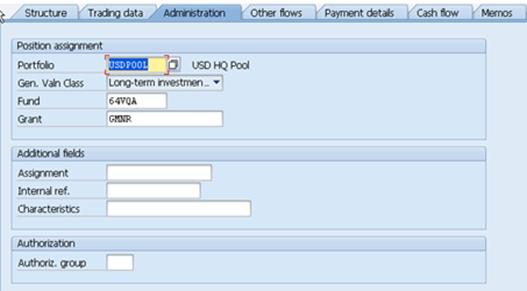

A.1.3.8. The Administration tab contains information that identifies the location from which the trading funds will be pulled, required authorizations and investment type.

A.1.3.8.1. Enter the following information in the Administration tab: Portfolio, Fund, Grant (always GMNR).

A.1.3.8.2. After populating the data, click the Enter icon.

A.1.3.9. The Other flows tab contains information on interest, costs and charges that will be factored into the transaction total. Examples include accrued interest and processing charges. Confirm that the accrued interest amount displayed in the other flows table is correct.

A.1.3.10. The Payment details tab displays specific information on where payment funds are being pulled from and whether or not a payment will be submitted with the trade settlement. The House Bank Account from which the funds are being pulled is auto populated based on the information entered earlier in the process.

A.1.3.10.1. Confirm that Umoja generated flows match the amount confirmed with the counter party.

A.1.4. Sends to the back office (Investment Accounting Unit).

A.2. Back Office (Investment Accounting Unit)

A.2.1. Approving an investment transaction in Umoja - Confirm and settle the investment / Transaction Code: FTR_EDIT

Compare the investment entry against MT-320 or call the counter party to confirm that the transaction specifications, i.e. Principal, Interest Rate, Maturity, and Settlement Instructions, including bank routing information are correct. Once the settlement information on Umoja is correct and confirmed, the Settlement Approver proceeds to settle and confirm the transaction in Umoja.

A.2.1.1. Enter FTR_EDIT in the Command field and click the Enter icon -> the Edit Financial Transaction screen appears next.

A.2.1.2. Enter 1000 in the Company Code field.

A.2.1.3. Enter the transaction number in the Transaction field.

A.2.1.4. Verify the accuracy of transaction by reviewing each of the tabs on the screen and confirming the information with the counterparty. Confirm that the Payment Required box is checked for Term Deposit investments and Fixed Income purchases.

A.2.1.5. For Fixed Income transactions, make sure to select the clearing agent (exchange) used to settle the trade in the Trading Data tab.

A.2.1.6. Click the Save icon - this puts the transaction in 'settlement mode'.

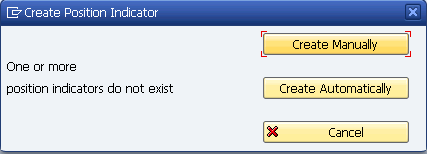

A.2.1.7. For Fixed Income transactions, select 'Create Automatically' in the Create Position Indicator window.

A.2.2. If the investment is a Term Deposit, create and send MT-320 message to counter party.

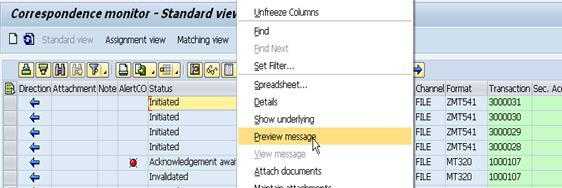

A.2.2.1. Launch FTR_COMONI and preview the MT-320 message corresponding to the transaction number.

A.2.2.2. If there are no errors, request the Cashier's Office to release the MT-320 (to Counterparty).

A.2.3. If the settlement is for a Fixed Income instrument then send MT-541 / MT-543 message to the custodian.

A.2.3.1. Launch FTR_COMONI and preview the MT-541 (for purchase) or MT-543 (for sale) corresponding to the transaction number.

A.2.3.2. If there are no errors, request the Cashier's Office to release the MT-541 / MT-543 message to the custodian.

A.2.4. Post Flows / Transaction Code: TBB1

TBB1 posts the accounting entries for the trade.

The steps are as follows:

A.2.4.1. Enter TBB1 in SAP Command window and click the Enter icon -> the Treasury: Post Flows screen appears.

A.2.4.2. For Term Deposits, check the Money Market box and enter the following information in the General selections section:

• Company Code: 1000

• Transaction: Transaction Number - do not run with this field empty!

• Up To And Including Due Date: Value Date

• Up to and Incl. Posting Date: NA

• Posting date: Trade Date

A.2.4.3. Select the Test Run check box.

A.2.4.4. Click the Execute icon.

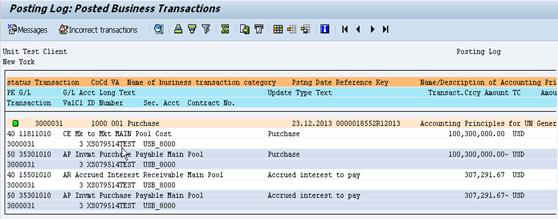

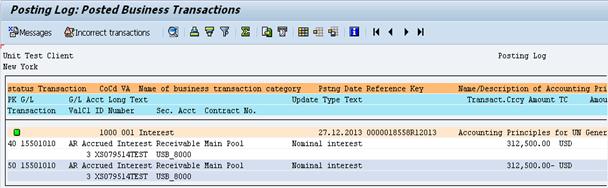

A.2.4.5. Posted Business Transactions screen appears displaying the accounting flows for the transaction as they will appear in the General Ledger (GL). After confirming that the posting is correct, the flows must be posted (remember, this posting was run in test mode).

A.2.4.6. Click the Back icon.

A.2.4.7. Clear the Test Mode checkbox.

A.2.4.8. Click the Execute icon.

A.2.4.9. For Fixed Income transactions, check the Securities box and enter the following information in the General selections section:

· Company Code: 1000

· Transaction: Transaction Number - do not run with this field empty!

· Up To And Including Due Date: Value Date

· Up to and Incl. Posting Date: NA

· Posting date: Trade Date

A.2.4.10. Select the Test Run check box.

A.2.4.11. Click the Execute icon.

A.2.4.12. Posted Business Transactions screen appears displaying the accounting flows for the transaction as they will appear in the General Ledger (GL). After confirming that the posting is correct, the flows must be posted (remember, this posting was run in test mode).

A.2.4.13. Click the Back icon.

A.2.4.14. Clear the Test Mode checkbox.

A.2.4.15. Click the Execute icon.

A.2.4.16. To display payment request. Note down the 'Key Number' and request the Cashier's Office to run F-111 for that key number to create the MT-202 message using transaction code: F8BT

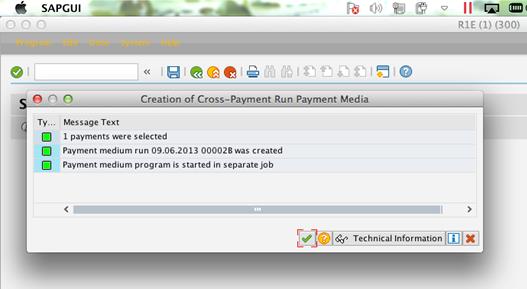

A.2.4.17. The payment request is then batched by Cashier's group using transaction code FBPM1 and Approved by two bank signatories in T-code BNK_APP. Only after the second signatory has Approved, the format of the payment file is available for review.

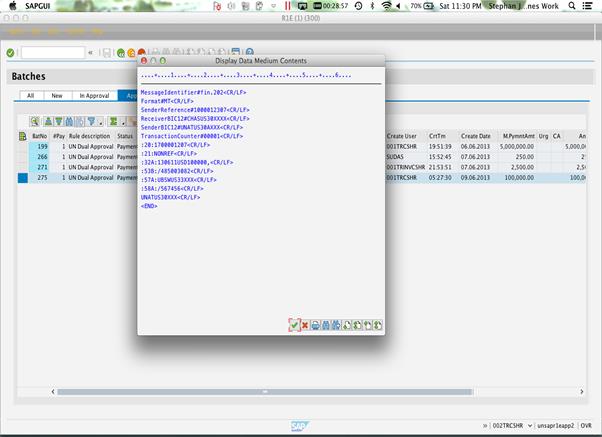

A.2.4.18. Run BNK_MONI to review the MT-202 message generated by Umoja before asking Cashier's office to release. Select the below options:

A.2.4.19. Paying Company Code: 1000

A.2.4.20. House Bank: USCH2 (until further review)

A.2.4.21. Review the MT-202 messages and request the Cashier's office to send the payment instruction to bank.

Note: At maturity, counterparty will send back principal and interest to the bank account.

B. Transaction Execution - Investment - Fixed Income Securities

The following process steps are applicable to executing a fixed income security transaction.

B.1. Front Office (Investment Section within Treasury)

B.1.1. Execute trade in Bloomberg / Bloomberg AIM.

B.1.2. If the transaction is a purchase of a new fixed income issue, then provide issue details to the back office (Investment Accounting Unit).

B.1.3. If the transaction involves a new issuer (not just a new issue of an issuer already existing in the system) then the issuer is created in the system by UN Treasury, based on the details provided by Front office/ Investment Section.

B.1.4. Create security master / Transaction Code: FWZZ

If the transaction involves an existing security master then skip to step B.1.5.

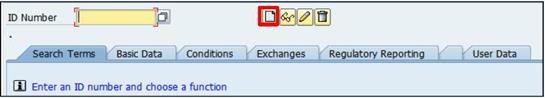

B.1.4.1. Enter FWZZ in the SAP Command window and click the Enter icon.

B.1.4.2. Click the Create icon -> this launches a new Create Class window.

B.1.4.3. Enter the Security ID number in the ID number field, the produSecurity Master details must exist in Umoja before a fixed income transaction can be recorded. Typically, security master would be automatically loaded from Bloomberg. However, until the Bloomberg to Umoja interface is in place, the information would be maintained manually by the investments accounting unit, which means the Security Master will be entered in Umoja directly

B.1.4.4. Type in the Prod. type field, the short name of the security in the Shrt field, the long name of the security in the Long field.

B.1.4.5. Unless an exact replica of an existing security is to be created, select the Without reference radio button.

B.1.4.6. Click the Create icon.

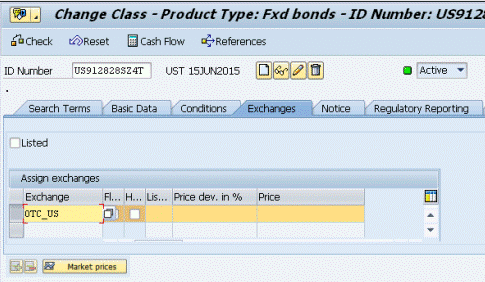

B.1.4.7. The Display Class - Product Type screen re-appears with the security's information populated across the following seven tabs: Search Terms, Basic Data, Conditions, Exchanges, Notice, Regulatory Reporting, User Data.

B.1.4.8. Fill in the required fields located in the Basic Data tab: Issuer, Issue currency, Issue start, End of term.

B.1.4.9. Click the Enter icon to validate the inputs before moving to the next tab.

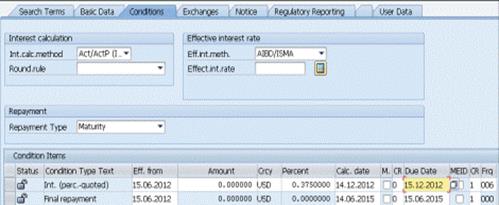

B.1.4.10. Click the Conditions tab - The Conditions tab contains all the information related to coupon and final payment, such as interest rates, calculation method, interest payment frequency and schedule.

B.1.4.11. Enter the following information: Percent, Frequency.

Note: Information should be modified in Int. (per-quoted) only. Final repayment should not be modified.

B.1.4.12. Click the Enter icon to populate the Calc. date and Due Date.

B.1.4.13. Double-click the Int. (per quoted) row to view the condition details -> the Condition Details window appears.

B.1.4.14. Select the appropriate Int.calc.method (specifies the coupon calculation method).

Note: The due date listed must match the first payment date of the security (Eff. from date). If the dates do not match, modify the due date manually.

B.1.4.15. The Exchanges tab specifies the initial price (normally price at first purchase). Click the Insert Row icon to open the Assign Exchanges window.

B.1.4.16. Select OTC_US and click the Save icon.

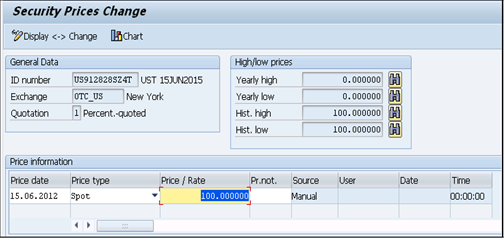

B.1.4.17. Highlight the OTC_US row and click the Market prices button -> the Security Prices Change screen appears.

B.1.4.18. Click the Display <-> Change icon.

B.1.5. If the transaction is a purchase of an existing issue or a sale, enter the transactions in Umoja and provide details to the back office (Investment Accounting Unit) using transaction code: FTR_CREATE.

B.1.6. If the transaction involves a new issuer (not just a new issue of an issuer already existing in the system) then the issuer is created in the system by UN Treasury, based on the details provided by Front office/ Investment Section.

Note: Refer above in the section on time deposits for detailed information on FTR_CREATE (A.1.3).

B.1.7. The Front Office (Investment Section within Treasury) sends the details to the back office (Investment Accounting Unit).

B.2. Investment Accounting Unit - Back Office

B.2.1. Confirm the trade with the counter party over the phone / Manual

B.2.2. Settle the trade in Umoja / Transaction Code: FTR_EDIT

Refer above in the section on transaction execution for time deposits for the steps related to FTR_EDIT (A.2.1).

B.2.3. Send MT-541 (purchases) or MT-543 (sales) to the custodian / Transaction Code: FTR_COMONI

B.2.3.1. Execute FTR_COMONI with just the Company Code 1000.

B.2.3.2. Right click on the transaction and select Preview Message.

B.2.3.3. If the message does not have any errors then select Create Message and Send.

B.2.3.4. Request Treasury to release the message.

B.2.4. Posting Derived Flows / Transaction Code: TBB1

Refer above in the section on transaction execution for time deposits for the steps related to TBB1 (A.2.4).

Journal Entries

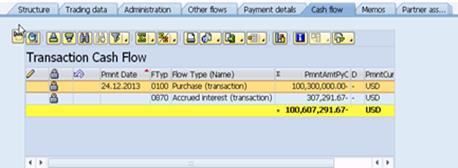

· Purchase of a fixed income bond at USD 100,300,000.

In this example, the purchase went through AP because it is purchased for a future date, so trade date is different from the settlement date, which then creates an AP component in the entry below. If a security is purchased today for tomorrow, it already has accrued interest. When you purchase the bond, there is additional accrued interest. The only time there is not accrued interest is if you are purchasing a zero coupon bond or if the coupon date is the same as the settlement date. This example only represents bonds.

Note: The entries below represent two journal entries. The first two lines are for the additional accrued interest of the bond and the second two lines is based on the clean price.

|

GL Acct |

GL Acct Name |

Amount |

Document Currency |

Portfolio |

Update Type |

ID Number |

Journal Entry Type |

|

15501010 |

AR Accrued Interest Receivable Main Pool |

307,291.67 |

USD |

USDPOOL |

SE8702 |

XS079514TEST |

Additional accrued interest |

|

35301010 |

AP Invmt Purchase Payable Main Pool |

(307,291.67) |

USD |

USDPOOL |

SE8702 |

XS079514TEST |

|

|

11811010 |

CE Mk to Mkt MAIN Pool Cost |

100,300,000 |

USD |

USDPOOL |

SE1000 |

XS079514TEST |

Actual cost of the bond |

|

35301010 |

AP Invmt Purchase Payable Main Pool |

(100,300,000) |

USD |

USDPOOL |

SE1000 |

XS079514TEST |

· Sale of fixed income security at USD 100,400,000

|

GL Acct |

GL Acct Name |

Amount |

Document Currency |

Portfolio |

Update Type |

ID Number |

Journal Entry Type |

|

11012917 |

Cash Philadelphi USBank USD Secur Proceeds Investm |

10,416.67 |

USD |

USDPOOL |

SE8701 |

XS079514TEST |

The accrued interest portion of the bond at the time of sale |

|

15501010 |

AR Accrued Interest Receivable Main Pool |

(10,416.67) |

USD |

USDPOOL |

SE8701 |

XS079514TEST |

|

|

11012917 |

Cash Philadelphi USBank USD Secur Proceeds Investm |

100,400,000.00 |

USD |

USDPOOL |

SE2000 |

XS079514TEST |

Based only on the price of the bond |

|

11811010 |

CE Mk to Mkt MAIN Pool Cost |

(100,400,000.00) |

USD |

USDPOOL |

SE2000 |

XS079514TEST |

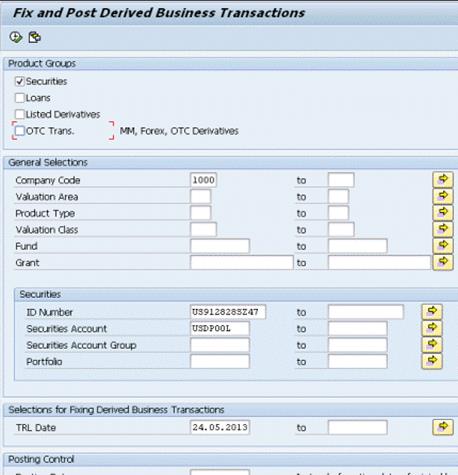

B.2.5. Account for Premiums and Discounts / Transaction Code: TPM18

All premiums and/or discounts applicable to the approved transaction must be accounted for. This transaction should also be run in test mode, first to review and then to confirm the information generated.

The steps to post account premium/discount are as follows:

B.2.5.1. Click the Enter icon -> the Fix and Post Derived Business Transactions screen appears next.

B.2.5.2. Select the Securities check box.

B.2.5.3. Enter details in the following fields:

· Company Code

· ID Number

· Securities Account

· TRL Date (must match posting date)

B.2.5.4. Click the Execute icon -> a table containing the positions with derived business transactions to be fixed appears on the screen

B.2.5.5. Confirm that the information is correct

B.2.5.6. Click the Fix button to post the flows -> The premium/discount flows are posted

Journal Entries

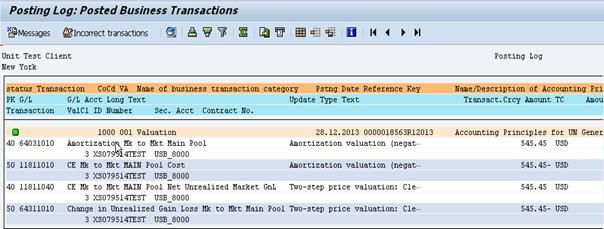

As a result of the amortization automatic entry, the system takes the amortization amount and nets it so that accrued interest is zero. Four compounding entries are then created. Umoja cleans up open entries and creates a compound entry. It clears all of the derived flows so that at the end of a position there are no outstanding items except for revenue and cash.

|

GL Acct |

GL Acct Name |

Amount |

Document Currency |

Portfolio |

Update Type |

ID Number |

|

11811010 |

CE Mk to Mkt MAIN Pool Cost |

20,545.45 |

USD |

USDPOOL |

DBT_B001 |

XS079514TEST |

|

64611010 |

Market Gain Loss on Sale Mk to Mkt Main Pool |

(20,545.45) |

USD |

USDPOOL |

DBT_B001 |

XS079514TEST |

|

11811010 |

CE Mk to Mkt MAIN Pool Cost |

84,909.05 |

USD |

USDPOOL |

DBT_E003 |

XS079514TEST |

|

11811040 |

CE Mk to Mkt MAIN Pool Net Unrealized Market GnL |

(84,909.05) |

USD |

USDPOOL |

DBT_E003 |

XS079514TEST |

|

64311010 |

Change in Unrealized Gain Loss Mk to Mkt Main Pool |

84,909.05 |

USD |

USDPOOL |

DBT_E025 |

XS079514TEST |

|

64611010 |

Market Gain Loss on Sale Mk to Mkt Main Pool |

(84,909.05) |

USD |

USDPOOL |

DBT_E025 |

XS079514TEST |

|

64031010 |

Amortization Mk to Mkt Main Pool |

545.45 |

USD |

USDPOOL |

DBT_C004 |

XS079514TEST |

|

11811010 |

CE Mk to Mkt MAIN Pool Cost |

(545.45) |

USD |

USDPOOL |

DBT_C004 |

XS079514TEST |

C. Modifying and reversals

C.1. Investment Transactions / Transaction Code: FTR_EDIT

If a transaction is in 'Settlement' state then it has to be brought back to 'Contract' state before it can be modified. Differentiating between modifying and reversing investment transactions is important because the process followed to modify an investment transaction varies, depending on where in the entry process of the transactions is.

· If the investment transaction is in contract state (i.e. it has not been settled yet), then the transaction can be modified.

· If the investment transaction has settled, then Reverse the transaction to contract state first before it can be modified.

· If the investment transaction has settled and the derived flows have been posted (TBB1 and TPM18), then Reverse the transaction to contract state and run TPM10 to reverse the accounting posted by TBB1 and TPM18, before the transaction can be modified.

· If accruals (TPM44) and amortization (TPM1) postings have been made then reverse those postings by running TPM45 and TPM2 respectively, Reverse the transaction to contract state and run TPM10 to reverse the postings which took place in TBB1 and TPM18, before the transaction can be modified.

Note: To delete the transaction from Umoja entirely, reverse the transaction one more time from contract state - i.e.it has to be reversed twice.

C.2. If a transaction is to be reversed or modified after the entry date (date it is entered into Umoja), that is, if amortization (TPM1) and accrued interest (TPM44) have already been run, then those postings have to be reversed first using TPM2 and TPM45 respectively before the transaction can be reversed.

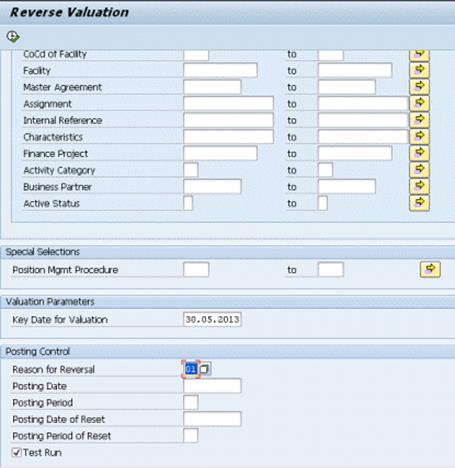

C.2.1. Reversal of amortization / Transaction Code: TPM2

C.2.1.1. Enter TPM2 in the Command field and click the Enter icon -> the Reverse Valuation screen appears. First, confirm whether the Key Date for Valuation is correct.

C.2.1.2. Select the appropriate Reason for Reversal.

C.2.1.3. Select the Test Run checkbox so that data can be verified before actual execution.

C.2.1.4. Click the Execute icon.

Note: Reversals of amortization can only be done one day at a time - from the last day to the first.

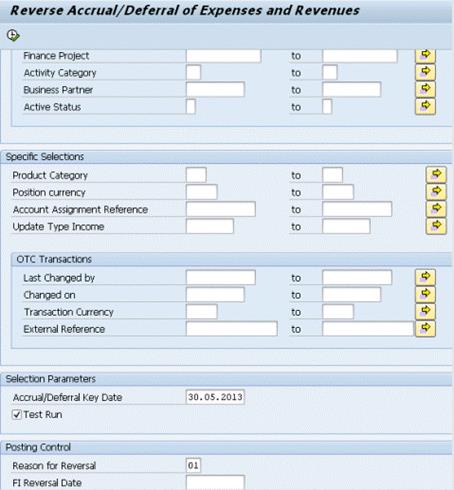

C.2.2. Reversal of Accrued Interest / Transaction Code: TPM45

C.2.2.1. Enter TPM45 in the Command field.

C.2.2.2. Click the Enter icon.

C.2.2.3. Confirm that the Accrual/Deferral Key Date is accurate.

C.2.2.4. Select the appropriate Reason for Reversal.

C.2.2.5. Select the Test Run checkbox so that data can be verified before actual execution.

C.2.2.6. Click the Execute icon.

C.3. If no amortization or accrued interest has been posted for the transaction then reverse the transaction to bring it to 'contract' state.

C.3.1. Type FTR_EDIT on SAP Command window click the Enter icon -> the Edit Financial Transaction screen appears next.

C.3.2. Enter 1000 in the Company Code field.

C.3.3. Enter the transaction number to be modified or reversed in the Transaction field and click on REVERSE.

C.3.4. In the new window select the Reversal Reason from the drop down window and SAVE.

C.3.5. TBB1 and / or TPM18 has been run, then the derived flows have to be reversed as well from TPM10.

· Enter TPM10 in the Command window and click the Enter icon -> the Fix, Post or Reverse Transactions screen appears.

· Enter the Transaction Number and Reversal Reason and EXECUTE.

C.4. At this point the transaction is in 'contract' state. From FTR_EDIT the transaction can either be modified by clicking on the Change button or reversed completely by clicking on the Reverse button (a second time). If the transaction is to be modified, then follow the steps above to settle and post the derived flows.

3.1.2 Transaction Execution - Foreign Exchange

The UN Treasury makes disbursements in 49 currencies and manages the foreign currency risks and liquidity for all these currencies. The UN's functional and presentational currency is USD. The UN uses the Cash Position Report and Liquidity Planner within cash management to analyze the foreign currency liquidity needs over the short term and medium term and perform FX trade in the Spot or Forward market, depending on the requirement. Spot and Forward FX transactions are performed in FXAll, the FX trading platform used by UNHQ Treasury. Once the FX trade is performed, the trade details are entered in Umoja for settlement and accounting purposes.

Once the trade is complete, Treasury uses the back office (Investment Accounting Unit) functionality within the transaction manager to perform the settlement of the trade and conclude the transaction by either receiving or making a payment. At each stage relevant to financial accounting, the treasury transaction manager (where the transaction is created within the system) updates financial management and financial accounting. UN also reconciles the treasury transactions with the custodian by processing an interface file relating to the FOREX activity provided by the dealer. The matched deals are cleared based on the pre-determined criteria and unmatched deals are posted / reversed manually after performing investigation. The UN needs to perform valuation for foreign currency. The UN uses the foreign currency valuation within SAP Treasury Risk and Management Module for this process.

UN Treasury has one centralized view of FOREX Exposures within Umoja which provides more comprehensive information to facilitate hedging and FX funding decisions.

Spot transactions are executed to address immediate non-USD Funding. Additionally, Forward transactions are sometimes executed to address future FOREX exposures. The majority of the FOREX transactions are processed through a third party trading platform (the existing front-end user application interface is FXAll). All trades are currently imported manually from FXAll into SAP, until a full integration of SAP is completed.

Note: FX transactions are limited to purchases of foreign currencies for operational purposes.

D. The following process steps are applicable to Transaction Execution - Foreign Exchange:

D.1. FX Trader reviews FX Exposure report to identify FX exposures / Transaction Code: FTR_CREATE

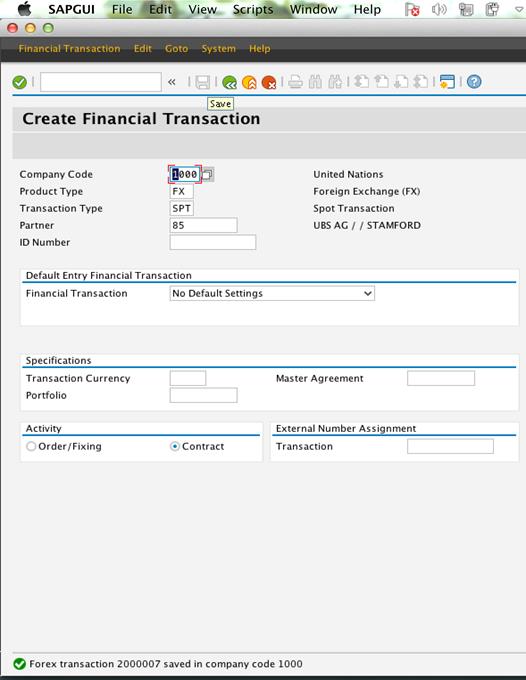

D.1.1. Type in FTR_CREATE

D.1.2. Enter FX, SPT, and Counterparty.

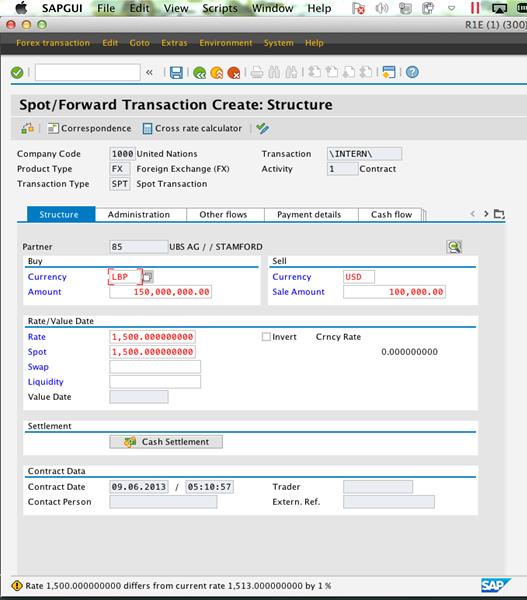

D.1.3. Press Enter -> Spot/Forward Transaction Create: Structure.

D.1.4. Enter FX amount and Rate or USD used.

D.1.5. Press Enter -> go to tab Administration.

D.1.6. Enter in Portfolio (mostly USDPOOL), Fund (64VQA for USDPOOL), and Grant (GMNR).

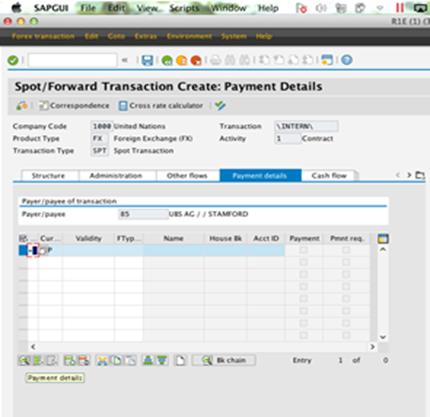

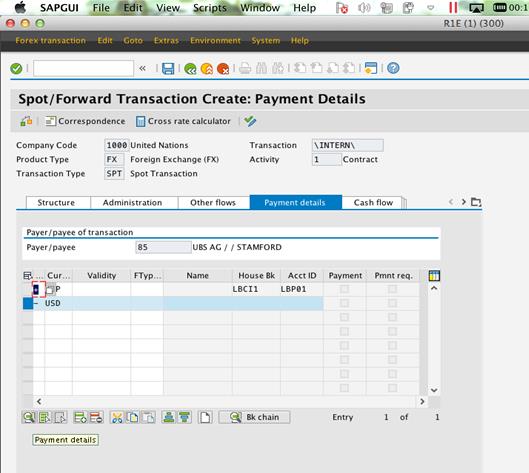

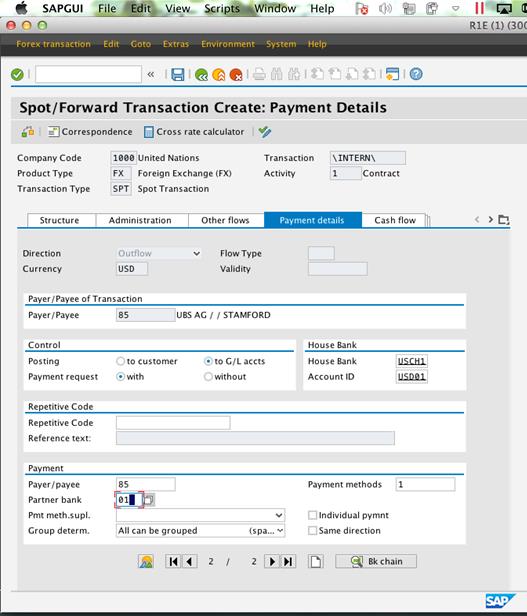

D.1.7. Go to tab Payment details and enter: +, FX Currency.

D.1.8. Mark the first line and click on Payment details (button on bottom left) and enter corresponding fx House Bank for inflow and corresponding account (can be picked up).

D.1.9. Go back to Overview (Overview icon on bottom left) and enter: USD.

D.1.10. Mark the line and click on Payment details.

D.1.11. Enter:

· outflow House Bank

· corresponding account

· select 'with' Payment request

· enter Payment methods '1' or '2'

· enter the counterparty id as payee

· and pick the account

D.1.12. Go back to Overview.

D.1.13. Check the deal (with the icon just below the screen heading, left to 'correspondence').

The FX Trader prepares an FX trade request to hedge or buy/sell currencies.

D.2. Another FX Trader reviews and approves the FX trade request to hedge or buy/sell currencies / Manual

D.3. Execute FX Trade in FX Trading Platform / Manual

FX Trader 'A' executes FX trades using the Third Party Trading Platform based on identified FX exposures and the prepared trade request. Depending on the decision taken, a spot or a FX Derivative transaction may be undertaken.

D.4. Trade Details Exported from FXAll into Umoja / Automated

Trade details from the third party trading platform (e.g. FXAll) are currently manually exported to Umoja until a full FXAll and SAP integration. In the event a trade is executed outside of the Third Party Trading Platform, an Investment Trader manually enters trade details into Umoja.

Umoja attaches standard settlement instructions as defined in the Master Data, based on currency and Business Partner. Umoja processes the trade and immediately calculate all related cash flows associated with incoming/outgoing USD and foreign currency on the respective dates. Umoja updates liquidity forecast and related cash flow information to ensure proper cash positioning and planning.

D.5. Reconcile Trade Details in Umoja with Supporting Documentation / Manual

The FX Settlement Approver compares trade details as recorded in Umoja system with supporting documentation from the Treasury Front Office (Investment Section within Treasury). If Umoja trade details agree with supporting documentation, the FX Settlement Approver reviews Settlement Instructions and ensures the accuracy of such instructions.

D.6. Send Confirmation to Counterparty / Automated

The Umoja system is supposed to electronically transmit trade confirmations to the counterparty (through FXAll using SWIFT compliant messaging and SWIFT transmission protocol) when full integration is complete.

D.7. Receive Confirmation from Counterparty / Automated

The counterparty (through FXAll using SWIFT compliant messaging and SWIFT transmission protocol) is supposed to electronically transmit a confirmation back to Umoja when full integration is complete.

D.8. Review Trade and Settlement Instructions / Manual

The FX Settlement Approver reviews trade and settlement instructions details - Umoja and third party confirmations. The FX Settlement Approver determines if Umoja trade and settlement instruction details agree.

Perform Required FX Transactions - Once the FX transaction requirements have been determined, the Investment Officer may perform the FX trade in the Spot or Forward market, depending on the requirement. Both Spot and Forward FX transactions are performed in FXAll, the FX trading platform used by UNHQ Treasury. Once the FX trade is performed, the trade details are re-entered in Umoja for settlement and accounting purposes.

D.9. Settle and Confirm FX Trade / Transaction Code: FTR_EDIT

If the Trade information on Umoja is correct, the FX Settlement Approver proceeds to settle and confirm the trade in the system. The FX Settlement Approver and the FX Trader determines if the trade should be routed for modification or reversal, depending upon the materiality and type of error.

D.9.1. Verify the transaction number and click on Settle.

D.9.2. Verify that the transaction has been saved successfully.

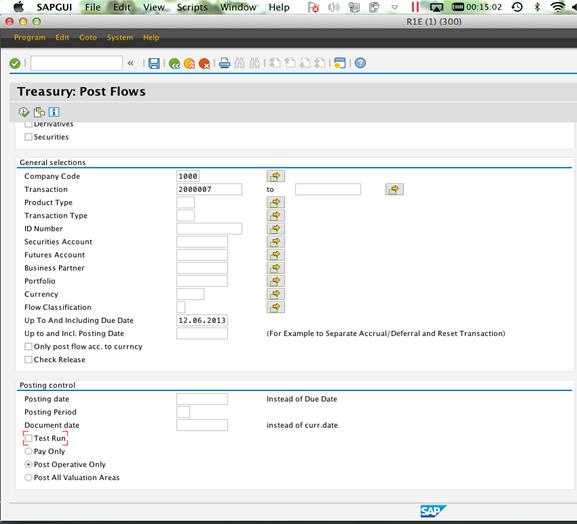

D.10. Post FX Trade / Transaction Code: TBB1

If the Trade Data in the Umoja is correct, the FX Settlement Approver proceeds to settle and post the FX trade. This in turn generates a Payment Request to facilitate the Cash Settlement. A Payment Proposal is then generated to facilitate the Cash Settlement. In addition, trade details updates Cash Position and Liquidity Forecast data within Umoja.

D.10.1. Enter the following inputs:

· Transaction number (from before)

· Up To And Including Due Date (two business days from deal date = standard settlement)

· Remove Test Run for the actual posting - it is recommended to do a test run prior to posting

· Select Post Operative Only.

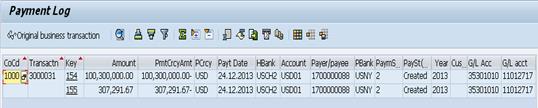

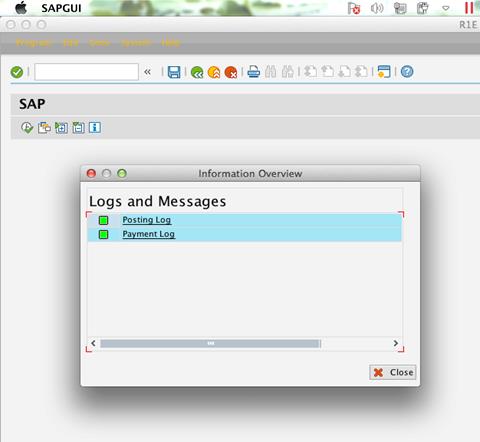

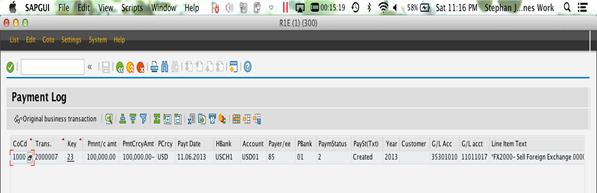

D.10.2. Verify the Posting and Payment Log.

Remark: take note of the deal number in 'Key' (i.e. 23 in this case).

D.10.3. After the transaction has been entered in Umoja by the trader, the Settlement Officer must perform the following steps to complete the trade:

D.10.3.1. Process the transaction and calculate the required cash flows.

D.10.3.2. Confirm the trade with counterparty. If there are discrepancies then send the trade back to the investment officer.

D.10.3.3. Review the standard settlement instruction for the counterparty and generate SWIFT message for payment to the counterparty.

D.10.4. Post the trade, which updates the liquidity forecast and related cash flow information.

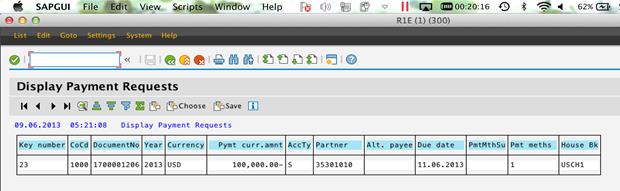

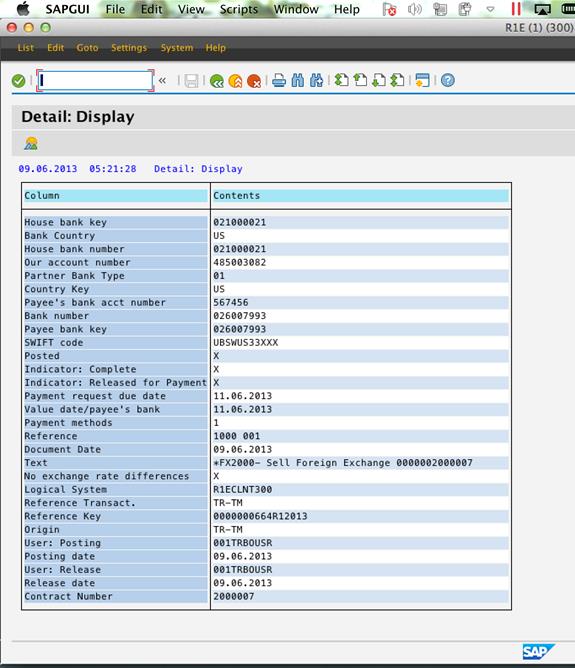

D.11. Display Payment Request / Transaction Code: F8BT

D.11.1. Verify that the payment request has been successfully created prior to running. Note: Use the key number obtained in the previous step.

D.12. Authenticate payment request / Transaction Code: F111

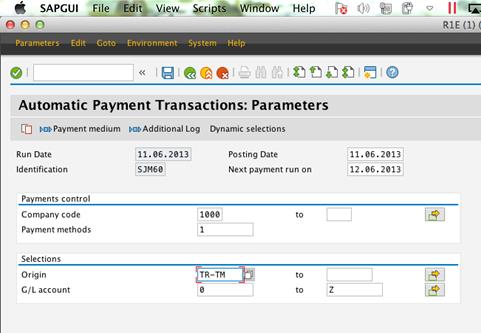

D.12.1. Enter the settlement date. (The system has been improved so that the actual Run Date can be input, and it can be different from the settlement date).

D.12.2. Enter Identification unique for the run date.

D.12.3. Click on Parameters and enter:

· Date of Next payment run on: next business day.

· Origin: TR-TM.

· G/L account: can be left blank.

· Payment methods: '1' or '2'

Note: if you only want to run for one payment, you can optionally enter the Key number in Dynamic selections (see number noted above).

D.12.4. Optional: add the relevant ranges in Additional Log.

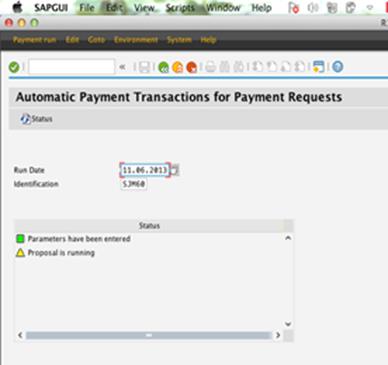

D.12.5. Click on Proposal and start immediately.

D.12.6. Additional Log:

· Tick line items

· Due date check

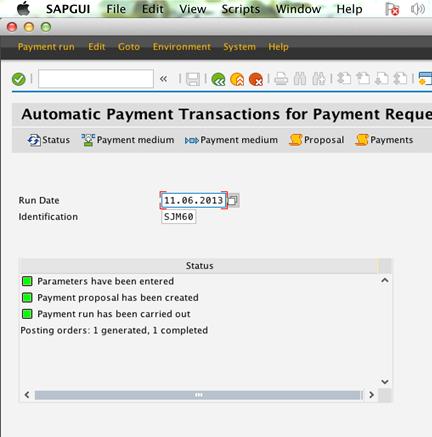

D.12.7. Verify the proposal (either by checking the log or edit proposal - all items shall be green).

D.12.8. Select Pmnt run and start immediately.

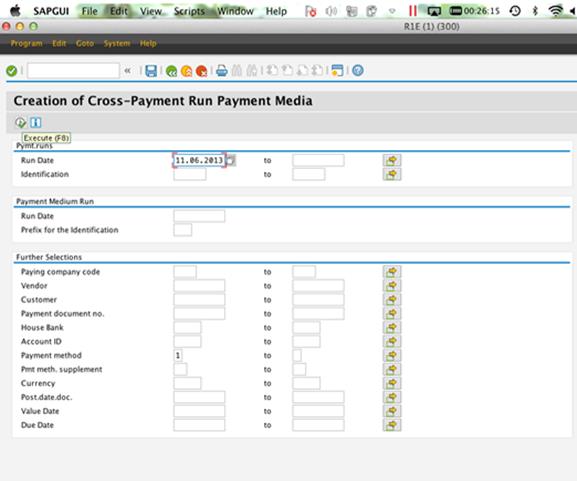

D.13. Payment Merge / Transaction Code: FBPM1

D.13.1. Enter:

· Run Date (same as proposal date)

· Payment method: '1' or '2'

· Eventually narrow down by House Bank

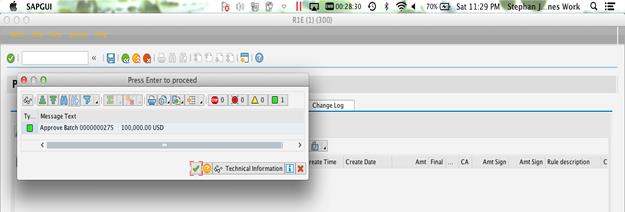

D.14. Bank Approval / Transaction Code: BNK_APP

D.14.1. Two signatories need to approve (two different users).

D.14.2. The second signatory will approve the batches in the second tab.

D.15. Bank Monitor / Transaction Code: BNK_MONI

D.15.1. Bank monitor allows for tracking the status of a batch.

· New = no signatory has signed yet.

· In approval = second signatory still has to sign.

· Approved

· Sent to bank = a SWIFT ACK (for MT messages) has been received.

· Complete = a MT-940 statement has been received and the payment has been successfully identified and reconciled. (Note that the automatic reconciliation is not happening yet).

· Exception = i.e. NACK, SAP system issues.

3.1.3 Investment Accounting - Daily Process

Umoja records both the trade date and the value date of the position to provide a full audit trail of the transaction. Under IPSAS, trade date accounting is used. This means that a journal entry will be posted on the trade date (posting date in Umoja = trade date; value date in Umoja = settlement date). Note: This is not in place for Forward trades, for which both Trade and Settlement dates are recorded in the same month, even if they are more than a month apart

The IPSAS accounting policy is that all non-cash and cash equivalents Cash Pool assets are categorized as 'Financial Assets at Fair Value through Surplus or Deficit'. Accordingly, Umoja is configured to record purchases of investments at fair value on the trade date and, expense transaction costs immediately, if any.

The Investment Accounting - Daily process starts with the fixing of variable interest rates, updates for corporate actions and processing of purchases, sales and maturities for the day.

Then, cash flows and liquidity forecasts are updated based on the daily transactions and accounting entries are created, reviewed and posted to the General Ledger. Umoja trade positions are reconciled with the Custodian positions and Bloomberg positions maintained by UN Investment Traders.

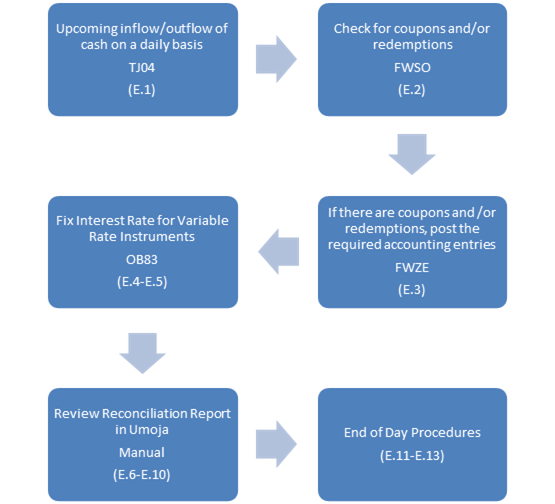

E. Flow of Daily Process

The following process steps are applicable to Investment Account - Daily Process:

E.1. Upcoming inflow/outflow of cash on a daily basis / Transaction Code: TJ04

Run TJ04 with the following options to check for incoming and outgoing cash:

· Product Group: Security and OTC

· Company Code: 1000

· Payment Period: Current date to some date in the future

E.2. Check for coupons and/or redemptions / Transaction Code: FWSO

E.2.1. Enter FWSO in the Command window and click the Enter icon.

E.2.2. Populate the appropriate details in the following fields: Company Code, Product Type, ID Number*, Securities Account*, Up to and including pos. date*, Document Date*.

Note: Fields marked with a * are automatically populated based on the information entered when the coupon was recognized.

E.2.3. Click the Execute icon.

Journal Entries

Coupon Payment Entry - Periodic coupon redemption, it may be received for a semi-annual security would be received every 6 months but for a quarterly security would be received every 3 months. It depends on the nature of the security. The impact of this entry is zero.

|

GL Acct |

GL Acct Name |

Amount |

Document Currency |

Portfolio |

Update Type |

ID Number |

|

15501010 |

AR Accrued Interest Receivable Main Pool |

312,500 |

USD |

USDPOOL |

SAM5000 |

XS079514TEST |

|

15501010 |

AR Accrued Interest Receivable Main Pool |

(312,500) |

USD |

USDPOOL |

SAM5000 |

XS079514TEST |

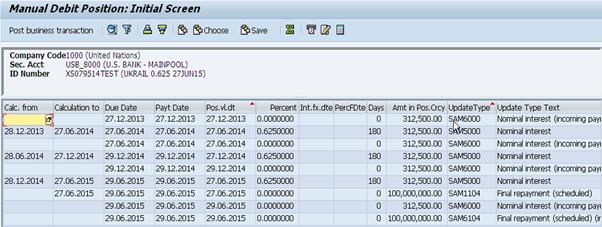

E.3. If there are coupons and /or redemptions, post the required accounting entries / Transaction Code: FWZE

E.3.1. Enter transaction code FWZE.

E.3.2. Click the Enter icon. The Manual Debit Position screen is displayed.

E.3.3. Populate the appropriate details in the following fields: Company Code, ID Number, Sec. Acct, Settlement Currency, and then hit Enter.

E.3.4. Review the data generated and modify as needed.

E.3.5. Click the Post business transaction button.

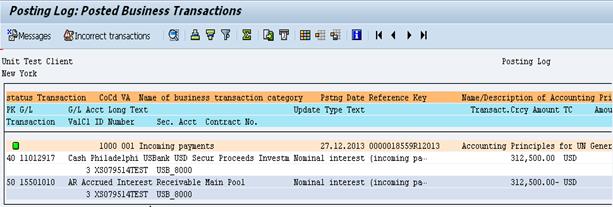

Journal Entries

Coupon Payment Entry

The actual posting referenced for transaction code FWSO is being posted as part of transaction code FWZE for the accrued interest. This is where the coupon entry is posted to cash.

|

GL Acct |

GL Acct Name |

Amount |

Document Currency |

Portfolio |

Update Type |

ID Number |

|

11012917 |

Cash Philadelphi USBank USD Secur Proceeds Investm |

312,500 |

USD |

USDPOOL |

SAM6000 |

XS079514TEST |

|

15501010 |

AR Accrued Interest Receivable Main Pool |

(312,500) |

USD |

USDPOOL |

SAM6000 |

XS079514TEST |

E.4. Fix Interest Rate for Variable Rate Instruments / Transaction Code: OB83

The system fixes interest rates for variable rate instruments already recorded in Umoja. When the core specifications of the contract are entered in Umoja, the system automatically projects Interest Fixing Schedule. At the interest fixing date, it then automatically imports the applicable Reference Interest Rate for fixing.

E.4.1. Click the Enter icon. The Change View Reference Interest Rate Values: Overview screen is displayed.

E.4.2. The rates should be entered on rate fixing dates, which are normally two days before the value date. If there is a market data feed to Umoja, then the rates would be updated automatically as needed.

E.4.3. Click the New Entries button à the New Entries: Overview of Added Entries screen appears.

E.4.4. Populate appropriate details in the following fields:

• Reference;

• Desc.;

• Valid From (fixing date); and

• Int. Rate

E.4.5. Click the Save icon.

E.5. Fix Variable Rates / Transaction Code: OB83

Exceptions are electronically notified to the Investment Accounting unit. The Back Office Treasury user fixes interest rates for variable rate instruments not fixed by the system.

E.6. Post Corporate Actions / Transaction Code: FWER

If there are any corporate actions to be managed, Front Office (Investment Section within Treasury) will provide the information to bank office and they will record the information using FWER.

E.7. Import Daily Investment Portfolio from Custodian / Automated

A daily investment portfolio file (securities account statement, by security account) is received electronically from the custodian, and imported directly into Umoja.

The system generates a reconciliation report with the investment portfolio data imported from the custodian and the Umoja portfolio data and identifies items with differences. Items compared includes: quantity, CUSIP, par value, cost, amortized cost, purchase date, maturity date, accrued income receivable, etc.

E.8. Review Reconciliation Report in Umoja / Manual

The Back Office Treasury user reviews the reconciliation report on RECON2 monitor that identifies any discrepancies between Umoja and data received from the custodian. The Investment Accountant resolved the discrepancies with the Custodian immediately. Once resolved, the Custodian electronically transmits another file to Umoja.

E.9. Import Investment Portfolio into Umoja from Trading Platform / Automated

A daily investment portfolio file is received electronically from the Trading Platform at the end of each business day, and imported directly into Umoja.

The system reviews the investment portfolio data imported from the Trading Platform and compares each and every security position within the security account statement to the security positions maintained in Umoja.

Note: this process is not yet in place as of this manual, but it is part of the Umoja Solution.

E.10. Review Reconciliation Report in Umoja / Manual

A reconciliation report is then generated by the system, identifying any discrepancies between the Umoja system and data received from the Trading Platform. The Investment Accountant investigates discrepancies and resolves them.

Note: this process is not yet in place as of this manual, but it is part of the Umoja Solution.

E.11. End of Day Procedures:

E.11.1. Post flows for upcoming Coupons and Final Repayments (maturities) / Transaction Code: FWSO

E.11.2. Account for maturing Time Deposits. Remember to exclude the rollover deal if it has not been done for that day / Transaction Code: TBB1.

· Application: Money Market only

· Company Code: 1000

· Up To And Including Due Date: Current date

E.11.3. Post daily interest accruals. Run the program with the following options (Variant 'UN DAILY ACCRUAL') / Transaction Code: TPM44

· Product Group: Securities and OTC Transaction

· Company Code: 1000

· Product Type: EXCLUDE FX

· Accrual / Deferral Key Date: Current date

Daily Interest Accrual Journal Entry

This represents the daily accrued interest for the security as part of end of day procedures.

|

GL Acct |

GL Acct Name |

Amount |

Document Currency |

Portfolio |

Update Type |

ID Number |

|

15501010 |

AR Accrued Interest Receivable Main Pool |

1,736.11 |

USD |

USDPOOL |

AD1004 |

XS079514TEST |

|

64021010 |

Interest on Securities Mk to Mkt Main Pool |

(1,736.11) |

USD |

USDPOOL |

AD1004 |

XS079514TEST |

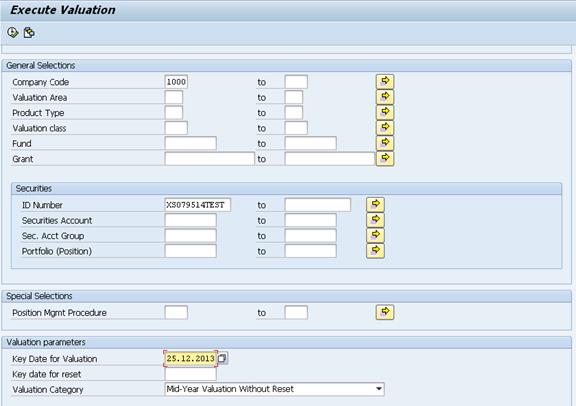

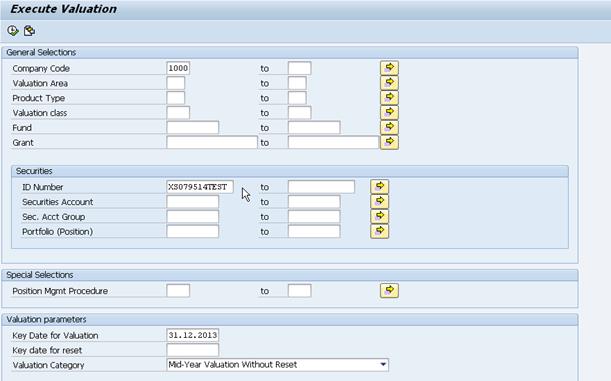

E.11.4. Post daily amortizations for securities. Run the program with the following options (Variant 'UN_VALUATION') / Transaction Code: TPM1

· Product Group: Securities Only

· Company Code: 1000

· Key Date for Valuation: Current date

· Valuation Category: Mid-Year Valuation Without Reset

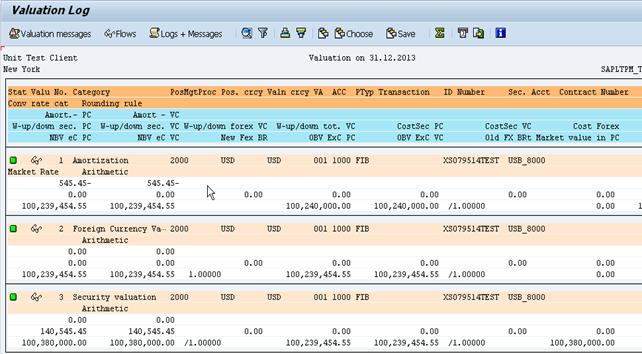

Journal Entries

The following journal entry is recorded at the end of the process for the daily amortization:

In order to amortize daily the security must recognize the amortization of the value and if a security is purchased at a premium or a discount, there will be an unrealized gain/loss.

|

GL Acct |

GL Acct Name |

Amount |

Document Currency |

Portfolio |

Update Type |

ID Number |

Type of Entry |

|

11811040 |

CE Mk to Mkt MAIN Pool Net Unrealized Market GnL |

545.45 |

USD |

USDPOOL |

V251 |

XS079514TEST |

Entry for the unrealized gain/loss |

|

64311010 |

Change in Unrealized Gain Loss Mk to Mkt Main Pool |

(545.45) |

USD |

USDPOOL |

V251 |

XS079514TEST |

Entry for the unrealized gain/loss |

|

64031010 |

Amortization Mk to Mkt Main Pool |

545.45 |

USD |

USDPOOL |

V301 |

XS079514TEST |

Entry for the amortization |

|

11811010 |

CE Mk to Mkt MAIN Pool Cost |

(545.45) |

USD |

USDPOOL |

V301 |

XS079514TEST |

Entry for the amortization |

E.12. Post Net Revenue Allocation to Funds

The net revenue allocation is posted to each fund daily. These daily updates to the General Ledger enable fund managers to determine that available cash, as cash sufficiency tests are met prior to releasing disbursements. The General Ledger module in Umoja is then updated for the posted allocation to each respective fund.

Note: This is completed as part of the end of day procedures, however it is only done on a monthly basis. Refer to section 3.1.4, period end process for more details.

E.13. Investment Portfolio Reconciliations

The asset reconciliation process is automated in Umoja. MT-535 from the custodian would be uploaded into Umoja to compare the asset position in Umoja that recognized by the custodian. After the comparison is run, a status e-mail is sent to the Back Office staff nightly. If there are any failures, action must be taken immediately. Similarly, when Bloomberg to Umoja interface is in place, positions in the two systems are also to be reconciled.

Note: This is completed as part of the end of day procedures, however it is only done on a monthly basis. Refer to section 3.1.4, period end process for more details.

3.1.4 Investment Accounting - Period End Process

Umoja provides comprehensive functions to record Mark-to-Market procedures using Currency and Price as the two key denominators in computing and processing Mark-to-Market procedures.

Umoja supports IPSAS policy of recording investments at market value (fair value) and recording the unrealized gains and losses in surplus or deficit, is supported by Umoja. The current policy requires mark to market valuation twice a year, at 30 June and 31 December, to accommodate the Financial Statements preparation for reporting entities with years ending 30 June and 31 December.

The UN Treasury pulls the market data into Umoja to facilitate various calculations and reports. Currently, the process consists of pulling rates from Bloomberg which is the market data provider. In cases where such data is not available through the market data provider, for example inactive foreign currencies, the field office analyzes previous month market data, determines the rate for the month, and transmits that rate to headquarters. The rates that are pulled from Bloomberg or entered manually are used for the purposes of foreign currency valuation and accounting for gains and losses on currency and investment holdings.

F. Process steps - Period end process

High level process steps are as follows:

i. Load market prices into Umoja

1. Enter TBEX in the Command field

2. Click the Enter icon

3. Click the Spreadsheet tab

4. Click the new box

5. Copy and paste the rates as below

ii. Confirm UNORE Rates (Refer to section 3.1.5 for explanation of UNORE)

iii. Mark to Market

iv. Confirm that all daily processes have been successfully run

v. Calculate Unrealized Gains/Losses

vi. Calculate Realized Foreign Exchange Gains and Losses

The following process steps are applicable to Investment Accounting - Period End Process:

Note: During period end, the following steps (upload market prices and confirm UNORE) need to be completed before end of day process can occur

F.1. Upload Market Prices / Transaction Code: TBEX

Verify the availability of market prices. The Back Office Treasury user would then verify if relevant Security Prices are available in the system.

F.1.1. Update the following fields in the TR_DataFeed file and save on your desktop.

· Class: 02

· Key 1: Security ID Number

· Key 2: OTC_US

· Cat: 01

· Date: 12.31.3013

· Time: 9PM

· Val.: Price (in 100s)

· Currency: CCY

F.1.2. Use transaction code TBEX, load the above file and securities radio button

F.1.3. Go to the Spreadsheet tab.

F.1.4. Click on the Change button to view the data.

F.1.5. Click on the Import Market Data button.

F.1.6. Once the upload completes, check column M (within TBEX) to check for errors.

F.2. Confirm UNORE Rates

The Back Office Treasury user would then verify if UNORE is available in the system.

F.3. Mark to Market / Transaction Code: TPM1

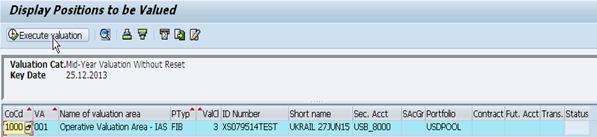

This process begins similar to the daily process by posting daily amortizations for securities, but at period end adds in the mark to market computations. Back Office Treasury user evaluates the Umoja's mark-to-market computations and proposed accounting entries. Umoja presents the mark-to-market computations, and the proposed journal entries. The Investment Processor reviews these entries to ensure computations and entries appear correct. Mark-to-market computation rules and the accounting entries are pre-defined in the system. Hence, exceptions are rare.

Journal Entries

Example: Period End Mark to Market

Note: Three entries are created, the mark to market entry (first two lines listed below). The mark to market entry only occurs at period end. The rest of the entries are part of the transaction code TPM1 during the daily process, discussed above in section 3.1.3.

|

GL Acct |

GL Acct Name |

Amount |

Document Currency |

Portfolio |

Update Type |

ID Number |

Journal Entry Type |

|

11811040 |

CE Mk to Mkt MAIN Pool Net Unrealized Market GnL |

83,818.15 |

USD |

USDPOOL |

V200_OCI |

XS079514TEST |

The entry for Mark to Market (additional unrealized gain/loss for the period end) |

|

64311010 |

Change in Unrealized Gain Loss Mk to Mkt Main Pool |

(83,818.15) |

USD |

USDPOOL |

V200_OCI |

XS079514TEST |

The entry for Mark to Market (additional unrealized gain/loss for the period end) |

|

11811040 |

CE Mk to Mkt MAIN Pool Net Unrealized Market GnL |

56,727.30 |

USD |

USDPOOL |

V251 |

XS079514TEST |

This represents the daily unrealized gain or loss |

|

64311010 |

Change in Unrealized Gain Loss Mk to Mkt Main Pool |

(56,727.30) |

USD |

USDPOOL |

V251 |

XS079514TEST |

This represents the daily unrealized gain or loss |

|

64031010 |

Amortization Mk to Mkt Main Pool |

545.45 |

USD |

USDPOOL |

V301 |

XS079514TEST |

This represents the amortization |

|

11811010 |

CE Mk to Mkt MAIN Pool Cost |

(545.45) |

USD |

USDPOOL |

V301 |

XS079514TEST |

This represents the amortization |

F.4. Distribute realized revenue (gains and losses)

Distribution of investment income is performed every six months on 30 June and 31 December to pool participants. The distribution is done manually following this schema:

Main Pool:

Dr 74001010 Instrst Dist Main Pool 64VQA

Cr 64001010 Intrst Inc Pool Main Participating fund, e.g. 10UNA

Euro Pool:

Dr 74001210 Instrst Dist Main Pool 64VQE

Cr 64001210 Intrst Inc Pool Main Participating fund, e.g. 10UNA

CHF Pool:

Dr 74001410 Instrst Dist Main Pool 64VQE

Cr 64001410 Intrst Inc Pool Main Participating fund, e.g. 10UNA

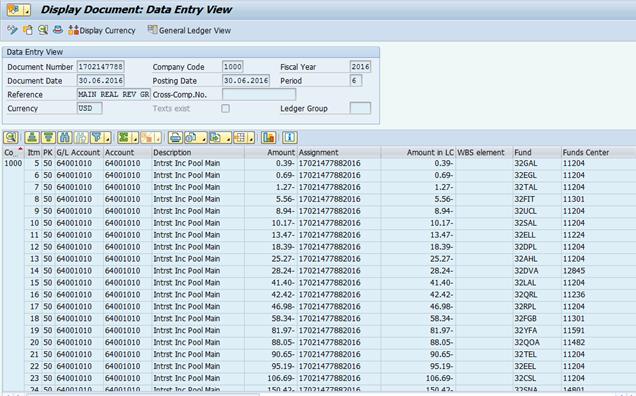

Entering the transaction is performed using FV50 and using the coding block assigned to each fund. For recording interest Income the necessary fields are G/L Account, Amount, Fund, Funds Center, Business Area, Grant (only for grant relevant funds), Currency and Text. The below screenshot shows a sample JV used to record income to the Main Pool.

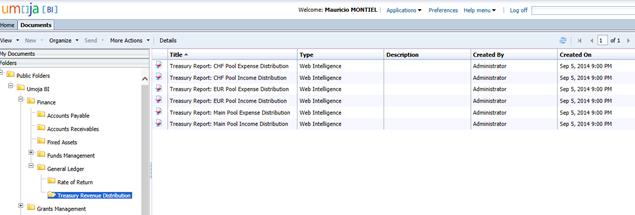

F.5. In order to get the information regarding the calculation of the income run the BI report 'Treasury Report: Main Pool Income Distribution' (see below) and take the figures assigned to each fund for 30 June or 31 December to fill out the JV described above. For the Euro pool and CHF Pool run the respective income reports.

3.1.5 Master Data Maintenance - Exchange Rates

The following explanations are taken from the relevant parts of the UN Treasury's Working Guidelines for the UN Operational Rates of Exchanges:

Effective Date

UNORE are effective on the 1st of each month except for July and January where rates are effective on the 30th June and 31st of December, i.e. on the closing dates of financial periods. UNORE are established two business days prior to the effective dates according to the New York Headquarters calendar. (Paragraph 2)

Data Source

UNORE are determined using the current market rates from a recognized financial data source and, if appropriate, supplementary information from UNDP, UNICEF, Specialized Agencies, Regional Economic Commissions, Peace-Keeping Missions, and other relevant sources. (Paragraph 3)

When currencies are not actively traded in foreign exchange markets, UNDP country offices, UNICEF country offices, Specialized Agencies, regional economic commissions, peace-keeping missions and others offices reports to the UN Treasury the actual rates legally obtained on conversion either in the local market or at a local bank. (Paragraph 7)

Type of Rates

The market rates used as reference to determine UNORE of major currencies are the average of the buying and selling spot rates (spot-mid-rate). Currencies other than major currencies are quoted in the buying rate (spot bid rate). (Paragraph 5)

For currencies that are not actively traded in foreign exchange markets, UNDP country offices reports to the UN Treasury the actual rates legally obtained on conversion either in the local market or at a local bank. (Paragraph 7)

Currency Type - Major Currencies

UN defined major currencies are Euro (EUR), Australian Dollar (AUD), Canadian Dollar (CAD), Swiss Franc (CHF), Danish Krone (DKK), British Pound (GBP), Japanese Yen (JPY), Norwegian Krone (NOK), New Zealand Dollar (NZD), Swedish Krona (SEK), Singapore Dollar (SGD), and South African Rand (ZAR), (Paragraph 7a)

Currency Type - Major UN Duty Station Currencies

The major duty station currencies are Chilean Peso (CLP), Kenyan Shilling (KES), Mexican Peso (MXN), and Thai Baht (THB) (Paragraph 7b).

Mid-Month Rate Revision

Mid-month revisions are made if the market rate has changed significantly since the beginning of the month, based on the market rates between the hours of 9:00 am and 10:00 am Eastern Standard Time (EST) on the establishment day, i.e. two business days prior to the effective date. The mid-month revision is effective the 15th of each month. (If the 15th falls on a weekend or holiday as defined by the New York Headquarters calendar, the mid-month revision is effective the previous working day.)

The significant change means:

· for major currencies : 3.0% or more fluctuation from UNORE

· for major duty station currencies: 6.0% or more fluctuation from UNORE

· for other currencies : 10.0% or more fluctuation from UNORE

End-Month - Rate Establishment

The operational Rates are set between 9:00 am and 10:00 am Eastern Standard Time (EST) on the establishment day. The establishment day is two business days prior to the effective dates. When there is an important announcement of economic data that may impact the Operational Rates on the establishment day, the rate establishment may be delayed but should not pass 1:00 pm EST.

G. Process steps - Exchange rate master data maintenance

The following process steps are applicable to Master Data Maintenance Exchange Rates including UNORE:

G.1. Recommend FX rates for non-traded currencies

The Rate Analyst in the UNDP/OAH Country offices periodically sends UN Treasury recommendations of the exchange rates of their respective currencies. These mainly relate to the exchange rates of exotic currencies.

G.2. Upload the recommended rates in Umoja / Transaction Code: ZTRUNORE

The Rate Processor uploads or manually enters to Umoja the rates recommended by various field offices, assigning a unique rate type (i.e. UNDP rates).

G.3. Import daily from the 3rd Party Market Data Provider the FX rates for traded currencies

Daily rates for liquid currencies are pulled automatically from service providers on a pre-established schedule. In addition to UNORE, multiple market rates could be maintained in Umoja for analysis. Each source of FX rates can be assigned with a unique rate type indicator (i.e. rates from Bloomberg have a Bloomberg indicator as the rate type while rates selected for UNORE have a distinct 'UNORE' rate type).

G.4. Rates unavailable from Market Data Service or field offices are entered manually in Umoja / Transaction Code: OB08

G.4.1. Click new entries button.

G.4.2. Enter the following values:

• Exchange rate type: M

• Valid from: 17.02.2014

• Indirect Quoted Exchange Rate: XXXXXX

• From: Currency other than USD

• To: USD

G.4.3. Select Check button to continue.

G.4.4. Select Save button.

G.4.5. Enter another exchange rate by repeating steps G.4.1 to G.4.4.

The Rate Processor enters UNORE manually in isolated cases where the rates cannot be obtained from the available market/recommended rates.

G.5. Review FX rate report to flag deviation

A customized report is developed to show daily rates vs. the latest UNORE for review by Rate Processors. In current Umoja Foundation release, the custom report is not yet available.

Note: The customized report is available to any other interested party.

G.6. Review if the FX rate deviation is significant

The Rate Reviewer determines if the FX rate deviation is significant. If not the establishment date, rates will not be revised. If establishment date, a determination is made whether or not it is mid-month. If it is mid-month, a determination is made if the rate deviation is significant or not. If it is not a Mid-Month date, (i.e. month end) in accordance to the UN Guidelines, the UNORE rates are updated. If the rate deviation is significant, rates are revised. Otherwise, rates are not revised mid-month.

G.7. Establish the applicable rate as UNORE

The Rate Reviewer proposes the new rates and presents them for approval to the Rate Approver.

Note: In Umoja Foundation, this will not take place within Umoja, but will remain 'as-is' until Umoja Extension.

G.8. Approval

The Rate Approver approves or rejects the new rates proposed by the Rate Reviewer with the correct effective date. If the Rate Approver approves the proposed rates, the UNORE rate is established from the effective date. If the rates are rejected, the Rate Reviewer is expected to correct the rate and re-submit them to the Rate Approver.

G.9. Upload and Publish / Transaction Code: ZTRUNORE

The Rate Processor uploads the approved UNORE rates to Umoja for use throughout the organization. Note: Full review and approval is in Umoja as part of Umoja Extension only. In Umoja Foundation, all FX rates are stored in Umoja. However, review and approval is outside of Umoja, and UNORE are uploaded from the UN Treasury UNORE website. UN Treasury website users are able to review the approved UNORE rates on designated websites. This process excludes any other form of notifications, such as current email notifications.

3.1.6 Master Data Maintenance - Reference Interest Rates and Security Prices

The UN Treasury Investment portfolio contains Financial Instruments which:

a. Are subject to changes in daily market prices i.e. market values

b. Are pegged to Variable Interest Rates (e.g. 3 month LIBOR)

The entire Investment Portfolio is maintained in Umoja. In order to automate the maintenance of the full-life cycle of these instruments from Treasury Portfolio Position Management, Valuation and Accounting, it is essential that market interest rates and security prices used in calculating investment income and valuing the securities held by the UN are maintained in Umoja.

At present in Umoja Foundation release, market data is uploaded to Umoja, using transaction code TBEX. The detailed process steps are outlined in section 3.1.4 Investment Accounting - Period End Process. While the management of reference interest rates are done using transaction code OB83 in section 3.1.3 Investment Accounting - Daily Process.

The Treasury Administrator reviews the composition of the portfolio to identify new securities. For each new security identified, the Treasury Administrator updates the Market Data Request File. This file specifies the required Rates and Security Market Values (referred to as Security Prices in Umoja) and the frequency of the updates needed from the market data provider used by UN Treasury (Custodian and/or Bloomberg). The daily transmission of the Market Data Request File to the Third Party Market Data Provider is done automatically by Umoja via interface and can be scheduled or triggered manually by the Analyst as often as needed. In the case of the reference interest rates, the fixing might occur as frequently as daily; therefore, the values are interfaced with the Umoja daily. In the case of security prices, the mark-to-market valuation likely occurs on monthly or quarterly basis, requiring less frequent interfaces with Umoja.

Based on the specifications, the Third Party Market Data Provider securely transmits the required data to the Umoja. Once the market data tables are updated in Umoja, and have the necessary information to carry out activities such as interest rate fixing for variable interest rate instruments, and mark-to-market valuations for securities and other financial instruments.

Product types are listed below:

· CPS - Commercial Papers and Discounted Securities

· FIB - Fixed Interest Bonds

· VIB - Variable Interest Bonds

· FTD - Fixed Term Deposits

Transaction types available:

· PUR - purchase (Bonds)

· SAL - sale (Bonds)

· INV - investments (FTD)

H. Process Flow to update the request specifications and transmit an updated request file as the makeup of the Financial Instrument Portfolio evolves, the Market Data Analyst is required to update the request specifications and transmit an updated request file.

H.1. Specify the market data required.

Based on the composition of the Treasury Portfolio, the Treasury Administrator specifies, on a front user interface in Umoja: a) the securities for which Security Prices are required, and b) the interest rates that are required for fixing. If the Treasury Portfolio changes over time, the additional data sets needed to obtain prices of additional Securities or Interest Rates needs to be determined. The Treasury Administrator updates the Data Request Specifications. The question that must be considered: Are the interest rates and security prices loaded automatically from a Third Party provider (e.g. Bloomberg/Custodian), or will rate information be obtained from other sources and input manually? If data is obtained manually, information can be entered into the system directly by the Treasury Administrator. For reference to the process, refer to Investment Accounting - daily process (section 3.1.3).

H.2. Required File Created.

Based on the market data specifications provided, the Umoja generates and transmit a file to the Third Party Service Provider requesting interest rates and market prices. This step is scheduled daily. Additionally, it could be triggered manually by the Treasury Administrator at any time.

H.3. Market Data Obtained from Third Party.

Based on the request received, the Third Party Service Provider instantaneously transmits the required data to Umoja through an interface.

H.4. Update security prices and reference interest rates in Umoja.

Once the data is received from the Third Party Service Provider, the Security Prices table and Interest Rates Table within Umoja is updated automatically.

H.5. Review Market Data in Umoja for accuracy and completeness.

The Market Data Analyst reviews updated Market Data in Umoja to ensure data has been transmitted accurately and completely to calculate the correct market values.

4 Business Partners

As a result of the wide scope of the UN treasury operations, the UN Treasury conducts regular business with multiple trading partners. In order to process any type of transaction with external trading partners in Umoja, the UN creates these trading partners as business partners. The Business Partners contain all settlement information as well as other trading partner attributes. It contains payment instructions and information required for transaction access. Since the volume of trade and the amount of cash in treasury transactions are significant, a proper review and control environment is critical at the time of setting up the business partner master data.

Business Partner Role

A Business Partner Processor in the Treasury Master Data Team receives a request to create a Treasury Business Partner. The main requester of the Business Partner Master record is the Master Data Management team.

When creating a Business Partner, the Business Partner Processor first assigns one or multiple roles to the new Business Partner. Standard Business Partner Roles for a typical Treasury operation include:

· Counterparty -> broker/bank

· Depository Bank -> custodian

· Issuer -> entity who issued the security

The information entered into a Business Partner record is divided into different tabs. Assignment of the role determines what tabs are available for activation, which in turn determine the input fields available for the Business Partner record.

These are required information for Business Partners created with Counterparty role:

· Transaction Authorization - to assign permitted financial transactions for a given Business Partner (e.g. fixed-term deposit, call account, foreign exchange, securities, derivatives)

· Details of the House Bank and House Bank Account to be used for settlement (i.e. our UN bank)

· Business Partners' bank account information/details

· Standing instructions for correspondence with the Business Partner for Treasury Deal/Contracts, (e.g. SWIFT MT-320(fixed-term deposits), SWIFT MT-300(FX), email)

· Derived flows - derivation procedures to calculate automatically the charges such as commissions or withholding tax

For more details Business Partner functionality and maintenance please refer to Chapter on Umoja Overview.

December, 2016