1 Objective

The objective of this chapter is to provide guidance on the accounting processes of property, plant and equipment (PP&E) transactions within the Umoja environment in line with IPSAS requirement. This chapter details how an end user, based on the involved Umoja user profiles, should perform roles and responsibilities related to accounting of PP&E transactions.

This chapter is based on guidance under IPSAS 17: Property, Plant, and Equipment.

2 Summary of IPSAS Accounting Policies

2.1 Recognition and Measurement

Property, plant and equipment (PP&E) are tangible assets held by the organization provided they meet the following recognition criteria:

· Controlled by the organization i.e. benefit and risk consideration accrue and born by the organization.

· Probable that future economic benefit or service potential flow to the UN for more than a year

· Cost or fair value is measured reliably.

· Amounts meet the minimum established threshold

2.1.1 Valuation

PP&E is stated at historical cost less accumulated depreciation and accumulated impairment losses. Historical cost comprises the purchase price and any costs directly attributable to bringing the asset to its location and condition including associated costs. For PP&E acquired at nil or nominal cost (including donated assets), the cost will be measured at the fair value of the asset. Refer to the Corporate Guidance on Property, Plant and Equipment for detailed guidance on establishing the fair value of an asset.

Once identified as an asset based on recognition criteria, the asset is recorded as an item of PP&E. We refer to the Corporate Guidance on Property, Plant and Equipment for additional detail.

Asset under construction costs will be capitalized if they are directly identifiable exclusively to the construction of the particular assets or group of assets and meet the required thresholds.

A gain or loss resulting from the disposal of PP&E arises where proceeds from disposal differ from its carrying amount. Those gains or losses are recognized in the statement of financial performance.

2.1.2 Leasehold Improvements

Leasehold improvement should be viewed from a project perspective. If the improvement relates to one project to be completed in stages, the threshold should be evaluated based on the aggregate value of the stages over the life of the improvement. If the leasehold improvement relates to projects that are planned for and budgeted independent of each other, then the threshold should be evaluated based on the individual amounts.

2.1.3 Subsequent Recognition

Costs incurred subsequent to initial acquisition are capitalized only when it is probable that future economic benefits or service potential associated with the item will flow to the UN and the cost exceeds the established threshold for initial recognition. Repairs and maintenance (day-to-day servicing) are charged to surplus or deficit in the statement of financial performance in the year in which they are incurred.

2.1.4 Subsequent Measurement

The organization has elected the cost model to measure PP&E after initial recognition. PP&E is depreciated over their estimated useful life using the straight-line method except for land and assets under construction, which are not subject to depreciation. For non-peacekeeping operations, significant components of real estate assets with different useful life are depreciated using components approach. Given the expected pattern of usage of the item of PP&E, the residual value is nil unless residual value is likely to be significant.

2.1.5 PP&E Thresholds and Useful Lives

|

Asset Class |

Sub class |

Threshold (USD) |

Estimated Useful life (In years) |

|

Buildings |

Fixed |

100,000 |

20-50 |

|

Temporary and mobile* |

5,000 |

7 |

|

|

Commercial finance lease |

100,000 |

Shorter of term of arrangement or useful life of buildings |

|

|

Donated RTU |

100,000 |

Shorter of term of arrangement or useful life of buildings |

|

|

Land |

|

No threshold |

Unlimited |

|

Leasehold improvements |

Fixtures and fittings |

100,000 |

5 |

|

Minor construction works |

|||

|

Infrastructure Assets |

All types of Infrastructure Assets |

100,000 |

Set** (up to 50 years) |

|

Assets Under Construction |

Buildings Under Construction |

100,000

|

No depreciation |

|

Infrastructure Assets Under Construction |

|||

|

Other assets under construction |

|||

|

Furniture and fixtures |

Office Equipment |

20,000 |

4 |

|

Furniture |

20,000 |

10 |

|

|

Library Reference Material (incl. books) |

20,000 |

3 |

|

|

Fixtures and fittings |

20,000 |

7 |

|

|

Machinery and Equipment |

Light engineering and construction equipment |

20,000 |

5 |

|

Heavy engineering and construction equipment |

20,000*** |

12 |

|

|

Printing and publishing equipment |

20,000 |

20 |

|

|

Water treatment and fuel distribution |

20,000 |

7 |

|

|

Equipment |

20,000 |

5 |

|

|

Medical equipment |

20,000 |

7 |

|

|

Transportation equipment |

20,000 |

7 |

|

|

Security and safety equipment |

20,000 |

5 |

|

|

Vehicles |

Light wheeled vehicles |

5,000 |

6 |

|

Heavy wheeled vehicles and engineering |

5,000 |

12 |

|

|

Support vehicles |

5,000 |

12 |

|

|

Specialized vehicles, trailers and attachments |

5,000 |

Set**** (6-12 year range) |

|

|

Communication and IT equipment |

IT equipment |

20,000***** |

4 |

|

Communications equipment |

20,000****** |

7 |

|

|

Audio visual equipment |

20,000 |

7 |

* Temporary & mobile buildings are included in Galileo where they are referred to as prefab buildings for Peacekeeping.

** Specific useful lives and residual values will be applied for high cost and/or specialized items of PP&E when application of the standard useful life for the class would result in non-compliance with IPSAS.

*** Heavy engineering and construction equipment includes generators with a threshold of USD 5,000.

**** IT equipment includes network equipment with a threshold of USD 5,000.

***** Communication equipment includes satellite communication systems with a threshold of USD 5,000.

Note: Major upgrades to land and buildings are recognized as assets on the basis of the threshold of USD 100,000.

2.2 References

For more details on the IPSAS requirements regarding PP&E, refer to:

• The UN IPSAS Policy Framework;

• The Corporate Guidance on Infrastructure Assets;

• The Corporate Guidance on Property, Plant and Equipment (excluding infrastructure assets);

• The Corporate Guidance on Impairment of non-cash generating assets.

3 Desktop Procedures

3.1 Asset Accounting (AA) Module Overview

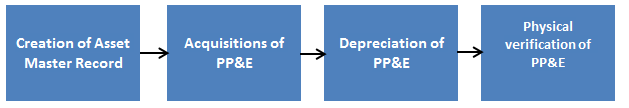

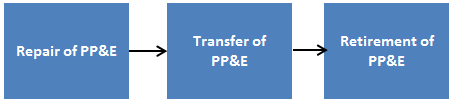

In Umoja, the Asset Accounting (AA) module deals with the accounting of PP&E, which are classified as non-current assets in the Statement of Financial Position. The AA module manages the complete lifecycle of an asset starting from the creation of the master data of the asset, acquisition of the asset and its capitalization, transfers between entities and retirement when the asset is no more useable. During this time, the system calculates appropriate depreciation values and impairment losses.

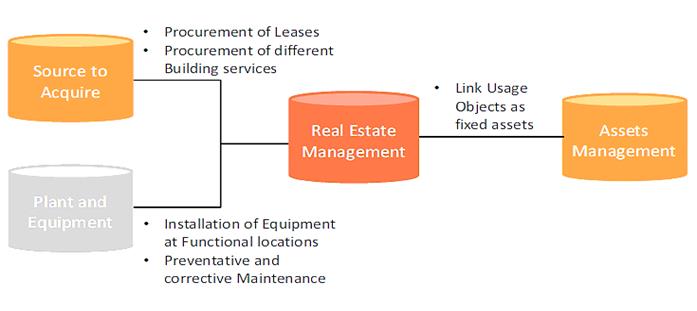

3.2 Other Modules Integrated with AA

The asset accounting module is integrated with the following modules across Umoja to allow for eased flow of data and communications:

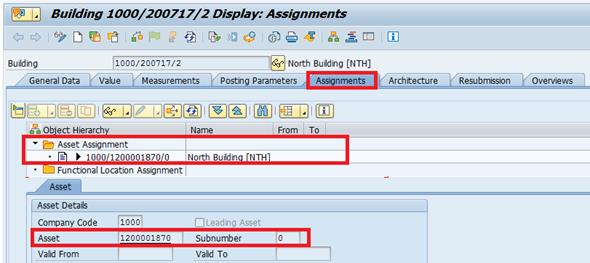

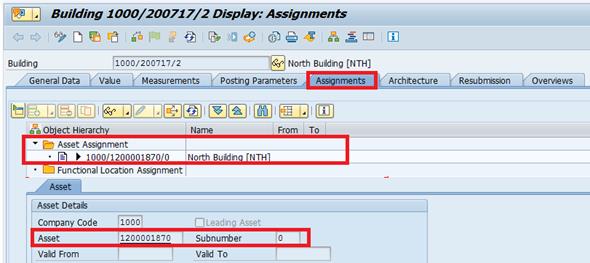

The real estate asset will be created as a real estate object in the real estate module. When the asset master record is created in the AA module, it will be linked to the information stored in the real estate module via the field 'Real Estate Object'. The related real estate record stores further information such as land and building physical/operational parameters, building floors, spaces and lease details, if any.

In the case of plant and equipment, the equipment master is created automatically upon goods receipt. All maintenance and related logistical information will be maintained on the equipment master in the Plant Maintenance module. Fixed asset and equipment master records are linked to each other through a cross reference field in the respective master data records.

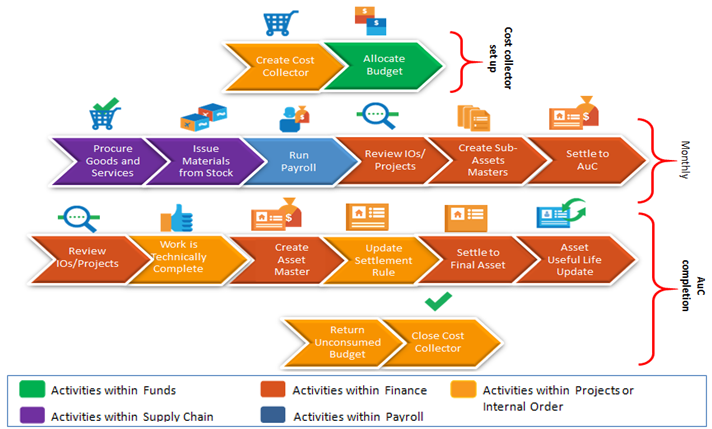

3.3 Overview of the PP&E Lifecycle

3.4 Creation of Asset Master Record

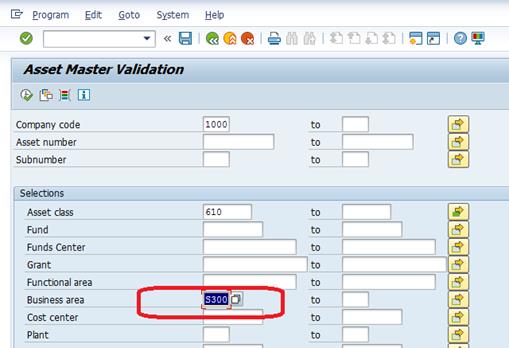

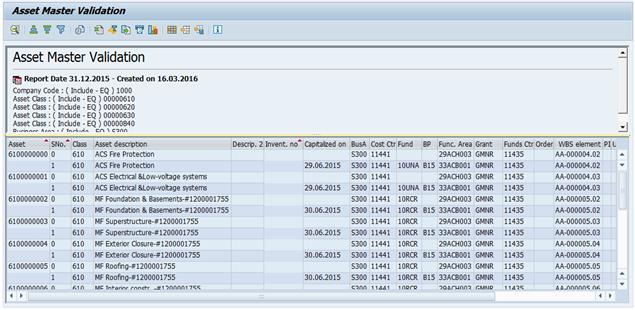

The asset shall containing the primary parameters such as cost center, fund, business area etc. should be created before processing any transactions related to that asset. The asset shall is the basis to create the complete asset master record. The asset master record is created in Umoja in two methods:

3.4.1 Automatic Creation of Assets Master Record

This is the process whereby the asset shell is created when the procurement of the asset is carried out from the material master called ZSAST or by selecting the account assignment 'A' during the source to acquire (procurement) processes. When a Requisitioner selects the asset from the ZSAST material master and creates the shopping cart, the asset shall is automatically created based on backend configuration. The asset shall is subsequently updated during the follow-on purchase order and goods receipt transactions and becomes asset master record completed for all the required parameters for the downstream management of the asset.

3.4.2 Manual Creation of Asset Master Record - Current Year Acquisitions

When an asset is not acquired from ZSAST material master through the source-to-acquire processes (Requisitioning àPurchase Order àGoods Receipt) i.e. when an asset related to current year acquisitions is donated, self-constructed, found through physical verification or incorrect material number was used and no asset master was created (i.e. the item was expensed), such asset is manually created using T-code AS01 as follows:

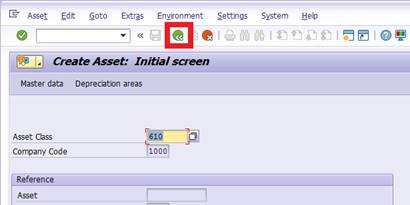

A. Steps to manually create asset master record in current year /Transaction Code: AS01

This step to be performed by users with role: FA.15 - Financial_Accounting: Asset_Accounting_User

A.1. Log in to Umoja ECC.

A.2. Execute transaction code AS01.

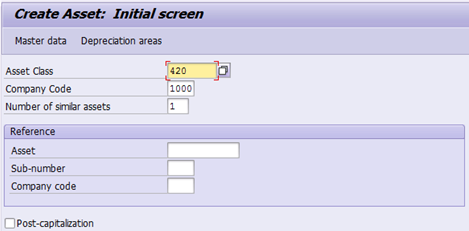

A.3. On the Create Asset: Initial screen:

· Asset Class: Enter the Asset Class of the asset you are creating.

· Company Code: Always equal to 1000

· Number of similar assets: If you are creating many similar assets, you can specify how many here up front.

· Reference: You may fill in the Asset, Sub-number, and Company code of a similar asset as a template that you would like to copy.

· Post-capitalization: This should not be checked (it is not used for current year acquisitions)

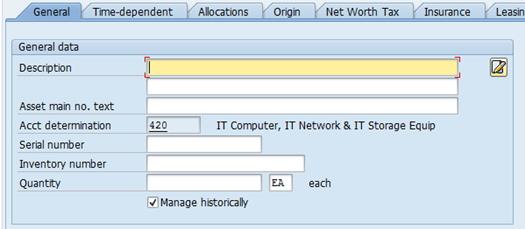

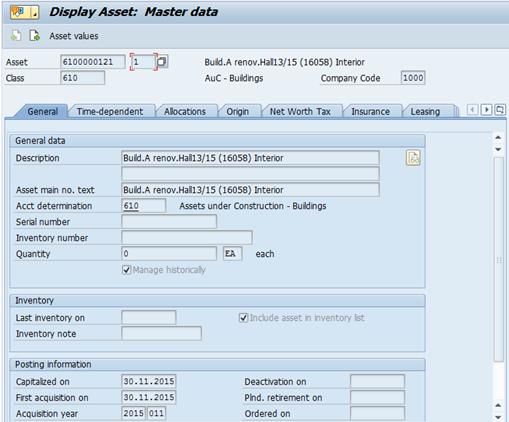

A.4. When you have made all of your selections, press Enter on your keyboard. You will be taken to the Create Asset: Master data screen. There are several tabs on the screen that you will need to go through and fill out data.

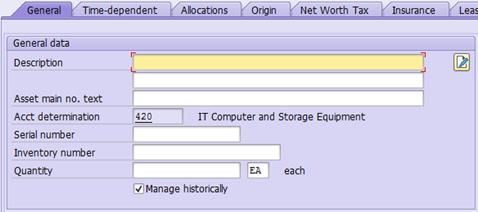

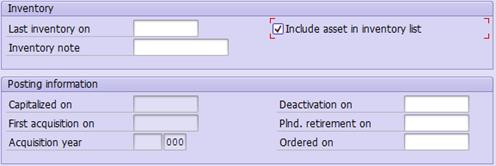

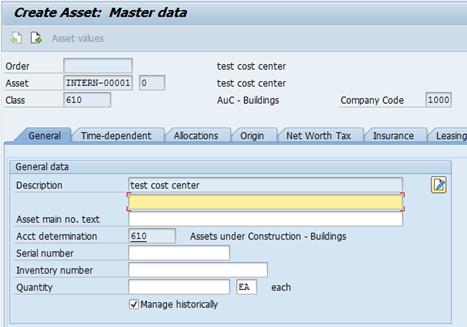

A.4.1. General tab:

· Description: Use an appropriate description, i.e. Server, vehicle etc.

· Asset main no. text: This is inherited from the Main Asset for sub-assets.

· Serial number: This field is not used, it is maintained in the equipment master.

· Inventory number: This is only used during conversion and ramp up, in these cases it should be equal to the 'Technical ID' in the Equipment Master record.

· Quantity: Always leave blank. The quantity is entered during the acquisition of the asset.

· Manage historically: Keep this checked

· Include asset in inventory list: Keep this checked

The rest of the fields on the General tab do not need to be filled out at this time, or are automatically populated later on.

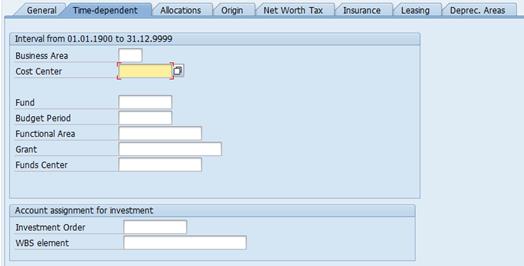

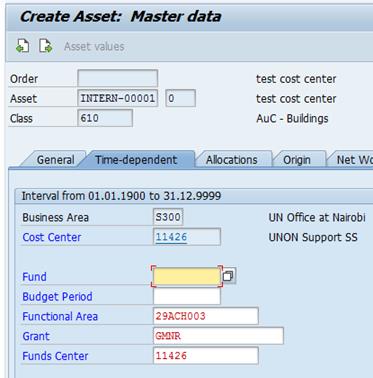

A.4.2. Time-dependent tab:

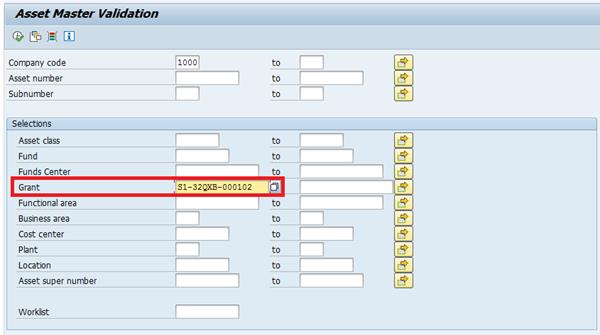

In the 'Interval from…' section you should fill in the Cost Center, Fund, and (if applicable) Grant. After filling these in you can press Enter to have the system derive the rest of the fields.

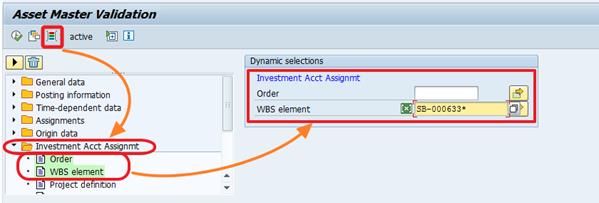

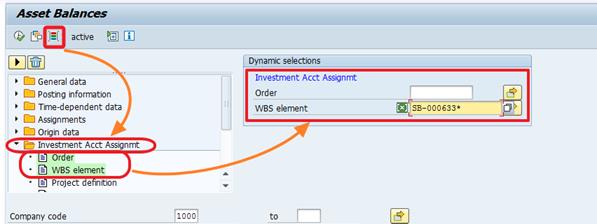

Fill in the following fields if this asset is related to an Investment Order or Project:

· Investment Order: If applicable, enter an investment order (internal order) here.

· WBS element: If this asset is project-funded, enter the WBS Element here.

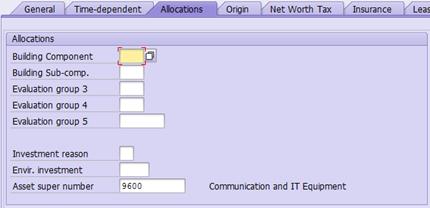

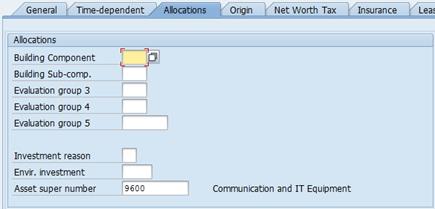

A.4.3. Allocations tab:

· Building Component: Only used for building components. If applicable, select one from the list.

· Building Sub-comp.: Only used for building components. If applicable, select one from the list.

· Asset super number: This corresponds to the IPSAS asset class, and should be derived automatically already from the Umoja asset class you entered earlier.

The rest of the fields on the Allocations tab do not need to be filled out at this time, some are automatically populated later on.

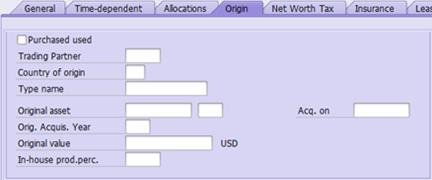

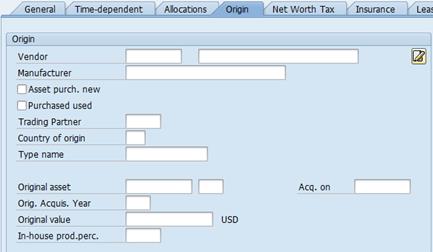

A.4.4. Origin tab:

The fields on the Origin tab do not need to be filled out at this time, some are automatically populated later on during acquisition, transfer etc. processes.

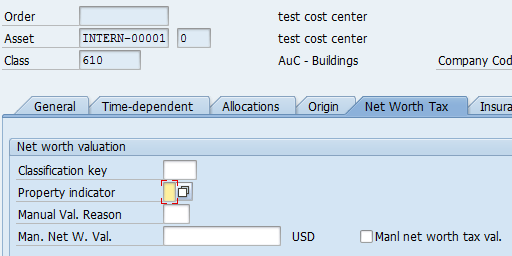

A.4.5. Net Worth Tax tab:

· Property indicator: Select a value from the selection box regarding the ownership/lease-situation of this asset.

The rest of the fields on the Net Worth Tax tab do not need to be filled out at this time, or are automatically populated later on.

A.4.6. Insurance tab - Not applicable at this time.

A.4.7. Leasing tab - Not applicable at this time.

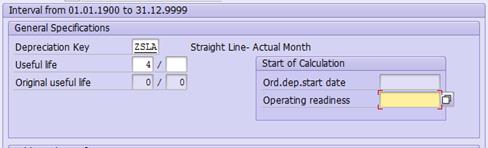

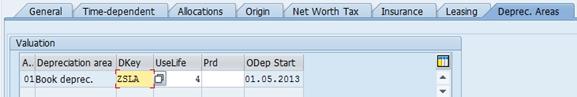

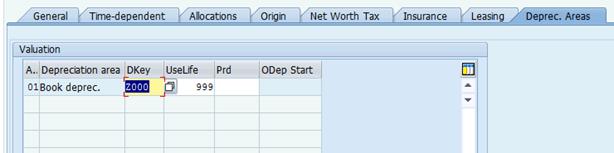

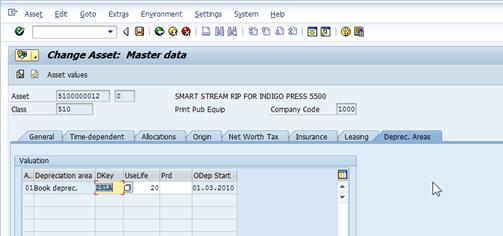

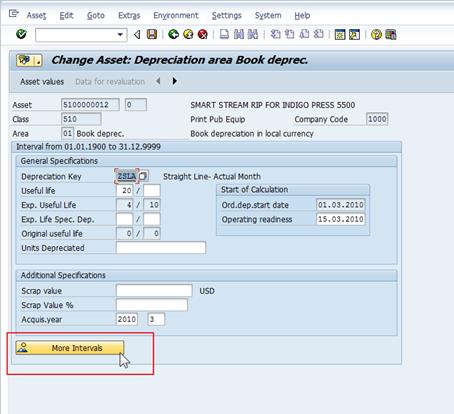

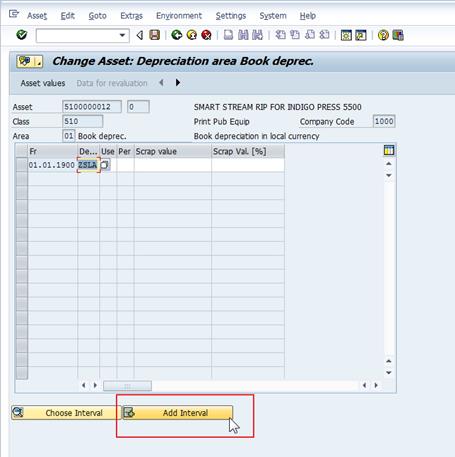

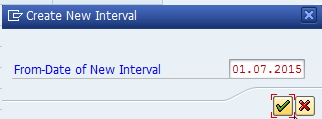

A.4.8. Deprec. Areas tab:

All values should normally be defaulted based on the Asset Class. For certain Real Estate Fixed Assets (e.g., Buildings in Asset Class 120), default UseLife will be set to 999. For such Fixed Assets, you should adjust the UseLife to 20, 25, 40 or 50 years, as per IPSAS.

You can also add the Date of Operating Readiness by double clicking on the line item and entering a value in the Operating readiness field (shown below).

Click the ![]() Back button after adding this date to

return to the Create Asset: Master data screen.

Back button after adding this date to

return to the Create Asset: Master data screen.

A.5. When you have entered data in all of the tabs, click on the Save icon at the top of the screen to create the Asset Master record.

A.6. Make sure to write down the Asset Number displayed in the status bar at the bottom of the window.

![]()

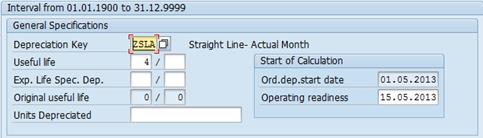

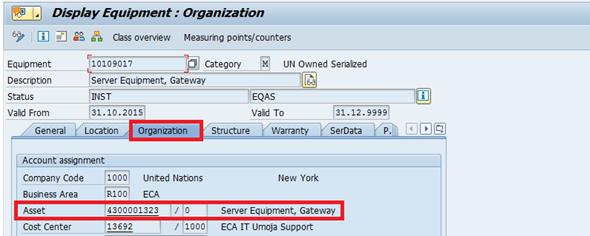

The new Fixed Asset must be linked to an operational object. Follow the instructions below based on the type of Fixed Asset.

1. Equipment Asset: Share the new Asset Number with the Property Custodian responsible for the Equipment (Role SD10). They must link the Fixed Asset to the associated Equipment. A review of the cost centre should also be undertaken to ensure it aligns to the asset record.

The Property Custodian can reference the Services Delivery job aid titled Equipment Creation Post Go-Live.

2. Real Estate Asset: Share the new Asset Number with the Facilities Planner responsible for the Real Estate Usage Object. They must link the newly created Fixed Asset to the associated Real Estate Usage Object.

The Facilities Planner can reference instructions in the Real Estate Portfolio Management training materials.

3. Intangible Asset: No operational object exists to represent intangible assets in Umoja. No link is required in Umoja.

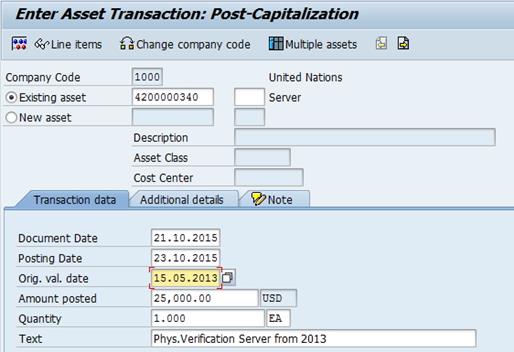

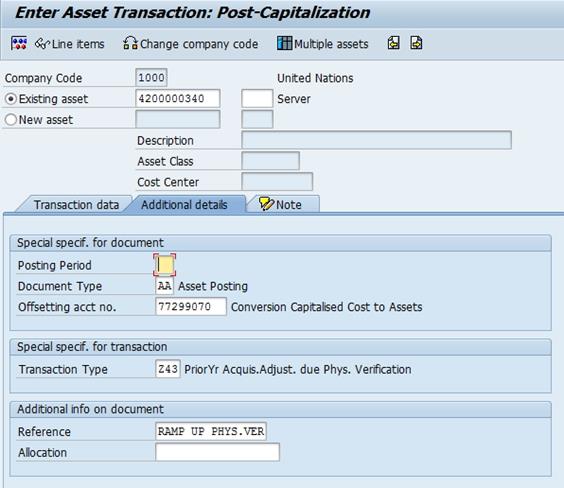

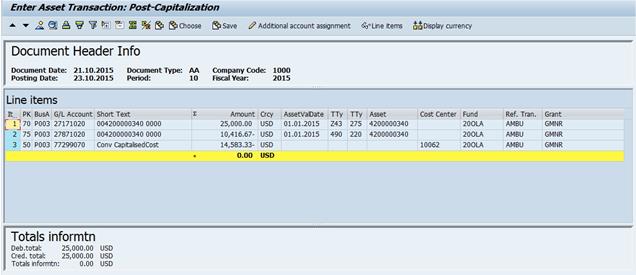

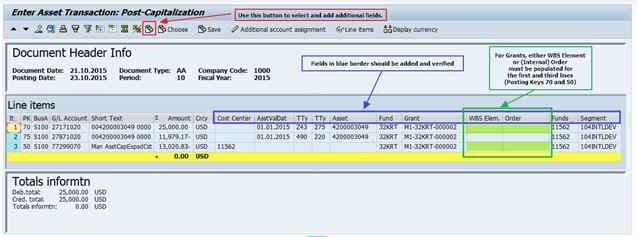

3.4.3 Manual Creation of Asset Master Record - Prior Year Acquisitions

When an asset is not acquired from ZSAST material master through the source-to-acquire processes (Requisitioning à Purchase Order à Goods Receipt) i.e. when an asset related to current year acquisitions is donated, self-constructed, found through physical verification or incorrect material number was used and no asset master was created (i.e. the item was expensed), such asset is manually created using T-code AS01 as follows:

B. Steps to manually create asset acquired in prior year /Transaction Code: AS01

B.1. Log in to Umoja ECC.

B.2. Execute transaction code AS01.

B.3. On the Create Asset: Initial screen:

· Asset Class: Enter the Asset Class of the asset you are creating.

· Company Code: Always equal to 1000

· Number of similar assets: If you are creating many similar assets, you can specify how many here up front.

· Reference: You may fill in the Asset, Sub-number, and Company code of a similar asset as a template that you would like to copy.

· Post-capitalization: This MUST be checked (it is used to enable capitalisation in prior years)

B.4. When you have made all of your selections, press Enter on your keyboard. You will be taken to the Create Asset: Master data screen. There are several tabs on the screen that you will need to go through and fill out data.

B.4.1. General tab:

· Description: This description is inherited from the Material Name during the normal procurement process. For ramp up purposes, please use an appropriate description, i.e. Server, vehicle etc.

· Asset main no. text: This is inherited from the Main Asset for sub-assets.

· Serial number: This field is not used, it is maintained in the equipment master.

· Inventory number: This is only used during conversion and ramp up, in these cases it should be equal to the 'Technical ID' in the Equipment Master record.

· Quantity: Always leave blank. The quantity is entered during the acquisition of the asset.

· Manage historically: Keep this checked

· Include asset in inventory list: Keep this checked

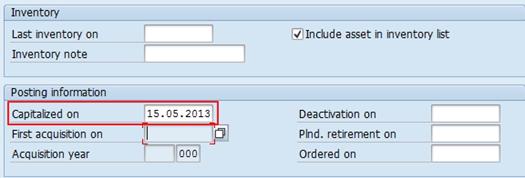

· Capitalized on: Set actual capitalisation date for this asset, from any prior year.

The rest of the fields on the General tab do not need to be filled out at this time, or are automatically populated later on.

B.4.2. Time-dependent tab:

Fill in the Cost Center, Fund, and (if applicable) Grant. After filling these in you can press Enter to have the system derive the rest of the fields.

Fill in the following fields if this asset is related to an Investment Order or Project:

· Investment Order: If applicable, enter an investment order (internal order) here.

· WBS element: If this asset is project-funded, enter the WBS Element here.

B.4.3. Allocations tab:

· Building Component: Only used for building components. If applicable, select one from the list.

· Building Sub-comp.: Only used for building components. If applicable, select one from the list.

· Asset super number: This corresponds to the IPSAS asset class, and should be derived automatically already from the Umoja asset class you entered earlier.

The rest of the fields on the Allocations tab do not need to be filled out at this time, some are automatically populated later on.

B.4.4. Origin tab:

The fields on this tab do not need to be filled out at this time, or are automatically populated later on.

B.4.5. Net Worth Tax tab:

· Property indicator: Select a value from the selection box regarding the ownership/lease-situation of this asset.

The rest of the fields do not need to be filled out at this time, or are automatically populated later on.

B.4.6. Insurance tab - Not applicable at this time.

B.4.7. Leasing tab - Not applicable at this time.

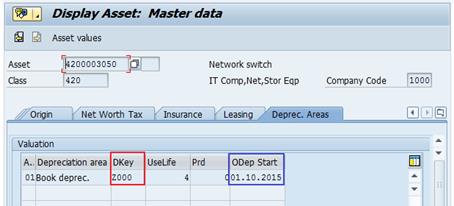

B.4.8. Deprec. Areas tab:

All values should normally be defaulted based on the Asset Class. For certain Real Estate Fixed Assets (e.g., Buildings in Asset Class 120), default UseLife will be set to 999. For such Fixed Assets, you should adjust the UseLife to 20, 25, 40 or 50 years, as per IPSAS.

You can also add the Date of Operating Readiness by double clicking on the line item and entering a value in the Operating readiness field (shown below).

Click the ![]() Back button after adding this date to

return to the Create Asset: Master data screen.

Back button after adding this date to

return to the Create Asset: Master data screen.

Note: The Ordinary Depreciation Start field (ODep Start in Deprec. Areas tab, and also Ord.dep.start date in the detail window that opens on double‑click) will already be populated with the first day of the month when we are capitalizing this asset (derived from the Capitalized on value in General tab). This is specific and expected for post-capitalization procedure.

B.5. When you have entered data in all of the tabs, click on the Save icon at the top of the screen to create the Asset Master record.

B.6. Make sure to write down the Asset Number displayed in the status bar at the bottom of the window.

![]()

The new Fixed Asset must be linked to an operational object. Follow the instructions below based on the type of Fixed Asset.

1. Equipment Asset: Share the new Asset Number with the Property Custodian responsible for the Equipment (Role SD10). They must link the Fixed Asset to the associated Equipment. A review of the cost centre should also be undertaken to ensure it aligns to the asset record.

The Property Custodian can reference the Services Delivery job aid titled Equipment Creation Post Go-Live.

2. Real Estate Asset: Share the new Asset Number with the Facilities Planner responsible for the Real Estate Usage Object. They must link the newly created Fixed Asset to the associated Real Estate Usage Object.

The Facilities Planner can reference instructions in the Real Estate Portfolio Management training materials.

3. Intangible Asset: No operational object exists to represent intangible assets in Umoja. No link is required in Umoja.

4 Acquisition of Assets

The first step in the PP&E lifecycle is acquisition of the asset. Assets can be acquired in following ways; as a standalone (purchased) asset, asset under construction or through donation. The following sections describe the Umoja processes for each acquisition method, starting with the process for standalone purchased of assets.

4.1 Standalone (Purchased) Assets

One potential means for the UN to acquire asset is through direct purchase of completed assets through the source to acquire process in the SRM module of Umoja. Standalone assets are those for which no additional costs are anticipated and are capitalized at the time of receipt. A standalone asset is recognized by the UN when the risks and rewards of the asset have passed to the UN based on the underlying contract and control criteria.

Standalone (purchased) assets are recorded at cost. When referring to the 'cost' of an asset, the following cost components are included:

• Its purchase price, including import duties and non-refundable purchase taxes, after deducting trade discounts and rebates;

• Any directly attributable costs to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management (associated costs);

• The initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located.

We refer to the Corporate Guidance on Infrastructure Assets and the Corporate Guidance on Property, Plant and Equipment (excluding infrastructure assets) for more details on cost components of an asset.

4.1.1 Asset Requisitioning and Creating Process

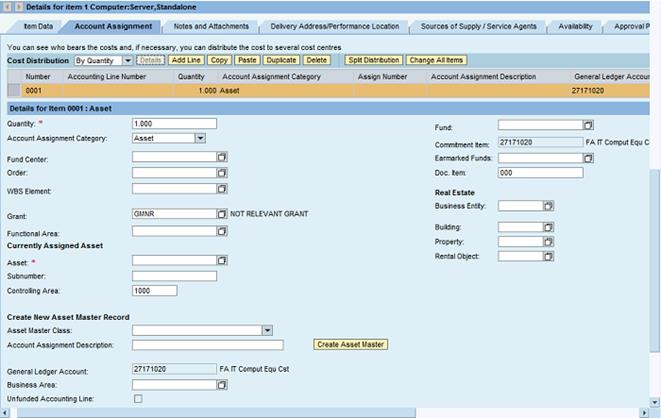

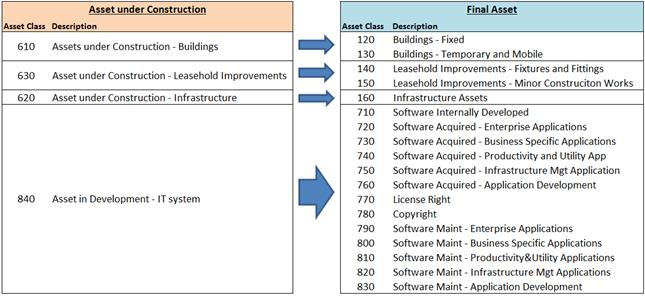

When acquiring a standalone asset, the Requisitioner initiates the purchasing via creating the shopping cart by picking product ID starts with 21 (Material Master called ZSAST) or select the A (Asset) in the Account Assignment tab . When the shopping cart is saved, the asset shall be automatically created with the basic parameters necessary for the follow-on transaction processing of placing a purchase order and generating goods receipt.

Items should be added to the Shopping Cart based on the description. The Requisitioner must verify if a product is considered to be an Asset in accordance with the IPSAS guidelines i.e. it is valued at equal to or more than USD 20,000 (or equal to or more than USD 5,000 for specified smaller entities) or for certain items (i.e. vehicles) valued at equal to or more than USD 5,000.

Product IDs for Assets valued at USD 20,000 or more typically start with 21 i.e. the Product ID for a Computer, Server, Standalone (Asset) is 2100001083. Product IDs are created by the UN's Master Data Maintenance Team in consultation with the Business. However, smaller offices that have the lower IPSAS Asset threshold of USD 5,000 may have Assets with product IDs not starting with 21 in which case the user has to choose the account assignment 'Asset' and capitalize the purchase.

1. If an item with a Product ID beginning with 21 is selected, the Account Assignment Category automatically defaults to Asset as shown in the screen shot below and the appropriate General Ledger Account is also defaulted.

2. If the item is deemed an Asset in accordance with IPSAS and the Account Assignment Category field is not already populated with Asset, click the icon beside the Account Assignment category field and click to view the drop-down menu options. Double click on Asset select. Each Asset will require an individual, unique Asset Master Record number. Click the icon beside the Asset Master Class field and click on the defaulted description to select. Click Create Asset Master.

3. The asset is capitalized and reflected in the financial statements when the goods are received with the resulting accounting entry of:

Dr. Asset GL 27****** with asset subledger (Asset Master Record)

Cr. Goods Receipt Payable GRIR

For the detail Umoja process of raising a shopping cart from the ZSAST material master, creating the purchase order and goods receiving, refer to Finance Manual Chapter on Expenses, sections 3.2.4: Requisitioning Process for Goods and 3.2.6: Inbound Goods - Receiving and Receipting.

4.2 Assets under Construction (AuC)

Another means of acquiring an item of PP&E is through assets under construction. The stage of completion of the construction works should be reflected in the statement of financial position as AuC for the amount of costs incurred to date. If the asset under construction is completed and is available for use, then it should be moved from the AuC to final asset under the appropriate asset class and start depreciating. 'Available for use' is determined to be when the physical construction of the asset is complete even though routine administrative work might still continue.

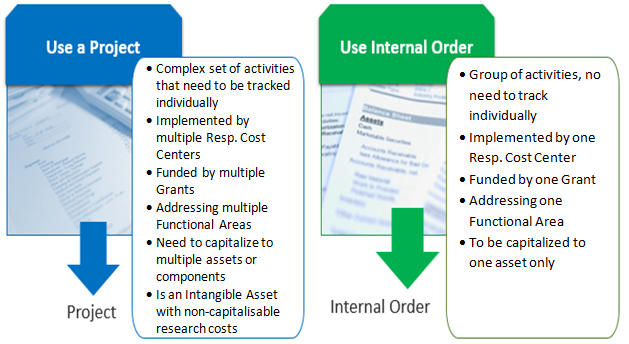

Most of the organization's real estate assets are acquired through AuC. The AuC is set up for the following asset classes:

· Building

· Infrastructure

· Leasehold improvements

· Intangibles

For information regarding IPSAS requirements related to AuC, please refer to www.ipsas.un.org/

4.2.1 Cost Collectors

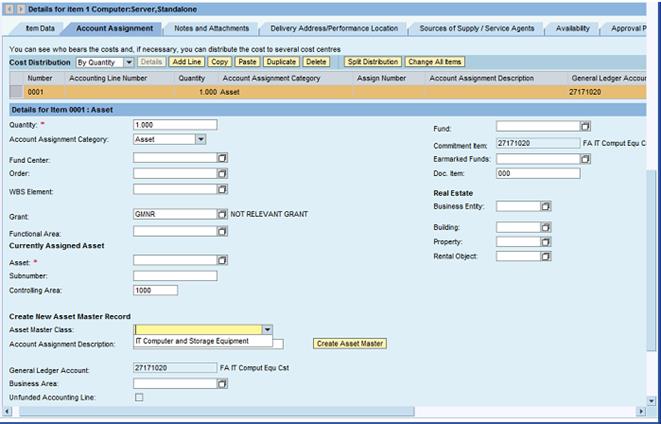

Under IPSAS the organization is required to capitalize costs related to AuC that are expected to exceed the USD 100,000 capitalization threshold. In order to collect the costs associated to the construction, a cost collector in the form of either Internal Order of Work Breakdown Structure Element (WBSE). The use of a cost collector in Umoja allows the organization to easily capture costs related to AuC and also ensure these costs are settled to the respective AuC and capitalized on monthly basis.

Before creating an Asset under Construction, ask the following questions:

· What type of funding? Assessed funds or grants? How many?

· At what level of detail do you need to record costs? How many cost centers / functional areas?

· What type of asset will this be? New Building, Leasehold Improvement, Major Alteration, Infrastructure, or Intangible Asset?

· Do you want to collect costs on a Project with WBS Elements or on an Internal Order?

· How will services and materials be procured? Is a Service Order going to be used for services?

· Should you create a project or an internal order?

Note that users with the following access rights will be able to create and make changes to the cost collector.

PP.01 Programme_Project: Project_Management_Approver

PP.02 Programme_Project: Project_Management_User

FA.15 Financial_Accounting: Asset_Accounting_User

FA.16 Financial_Accounting: Asset_Accounting_Senior_User

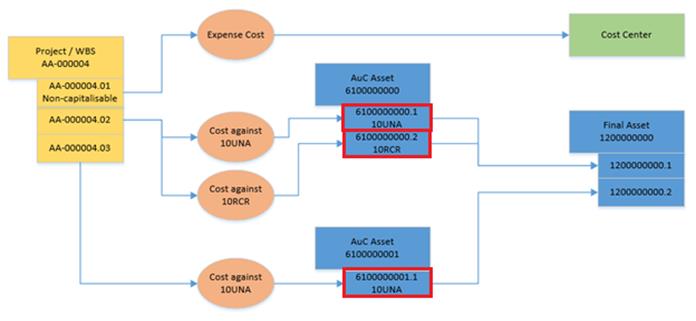

Assets under Construction can be used to create Final Assets within the following Asset Classes. The tables below show which AuC Asset Class is associated with each Final Asset Class.

4.2.1.1 Set Up an AuC as a Project with WBS Elements

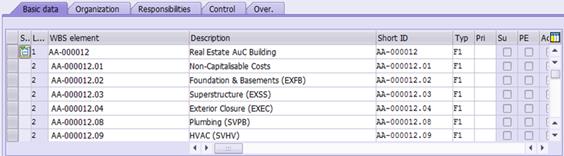

In line with IPSAS requirements, a typical major building shall be reported in line with the following components and subcomponents and cost collectors should be set up based on this structure.

A standard project template which follows the typical componentization of a Building AuC (where the final assets are the sub-components) exists in the system. To use this as a starting point for your AuC, follow the instructions directly below, otherwise look at the section on creating a project from scratch.

4.2.1.2 Creating a Project from a Standard Project Definition Template

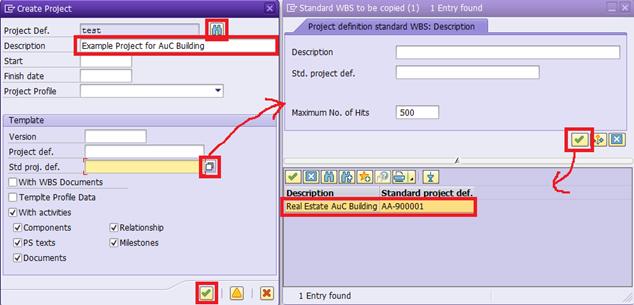

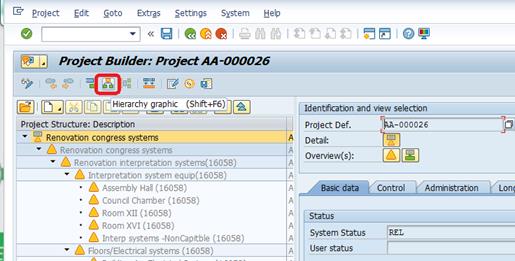

C. The steps to create a new Project and its WBSEs for an AuC / Transaction Code: CJ20N

C.1. Login to Umoja ECC.

You must have the FA.16, PP.01, or PP.02 security authorizations to create a project.

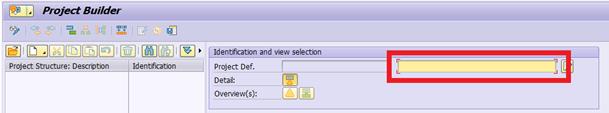

C.2. Execute transaction code CJ20N or navigate to the following path in the SAP Menu: Accounting à Project System à Project à Project Builder

C.3. Click on the Create icon and then select Copy project. This will open the Create Project window.

C.4. Fill out the form as instructed below:

·

Project Def.:

Click on the binoculars ![]() icon next to the Project Def. field. A value should appear

in this field. It is ok if it says 'test', a new project definition ID

will be generated later.

icon next to the Project Def. field. A value should appear

in this field. It is ok if it says 'test', a new project definition ID

will be generated later.

· Description: Fill in a description of this AuC.

·

Std proj. def.:

Click on the entry field for Std proj. def. and then click on the ![]() icon to bring up a search help window. Click on the green checkbox

to display the list of standard projects. Select the one you want by

double-clicking on it.

icon to bring up a search help window. Click on the green checkbox

to display the list of standard projects. Select the one you want by

double-clicking on it.

C.5. When done making the selections, click on the green check at the bottom of the Create Project window to proceed à you will see an Error message. Ignore it and click on the green check to continue.

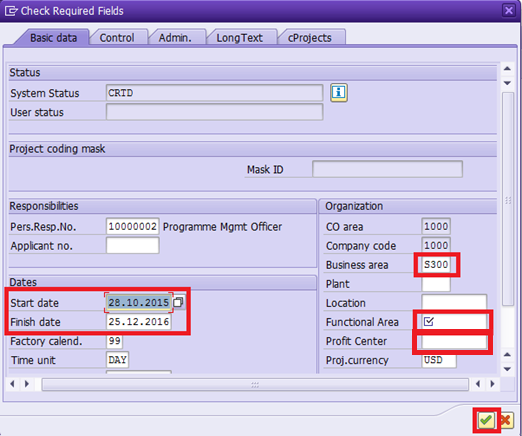

C.6. In the Check Required Fields screen, fill out the following fields:

· Start date and Finish date: Fill in planned dates here. These can be changed later, if necessary.

· Business Area: This should be changed to your local business area code.

· Functional Area: Select an appropriate functional area for this project. This field is mandatory at this time and will be defaulted into each WBS Element, though it is the WBS Element's functional area that is ultimately responsible for budget and postings. Note that this default value may not apply to all WBS Elements, so care should be taken to review when later defining each WBS Element.

· Profit Center: Enter the default profit center 9999.

C.7. Click on the green check at the bottom when ready to continue. The other tabs at the top Control, Admin, LongText, and cProjects do not need to be filled out at this time.

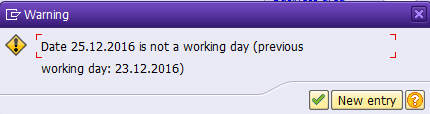

C.8. You may receive a warning message similar to this if either of your dates falls on a non-working day (e.g. weekend). You may go back and manually adjust the date by selecting New entry, or you can accept the suggested previous working day by clicking on the green check.

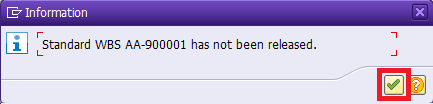

C.9. Click on the green check when you see this message. This is expected.

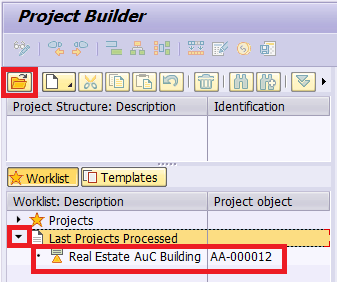

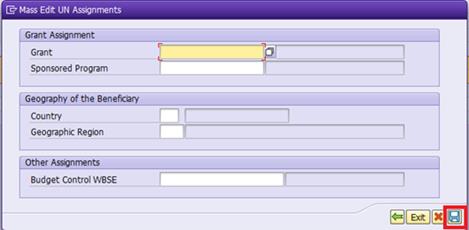

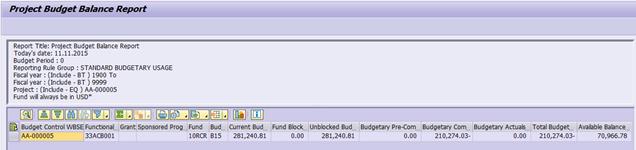

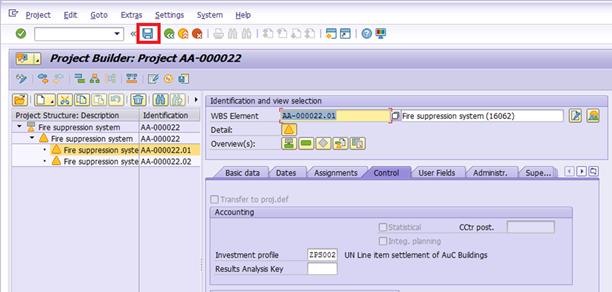

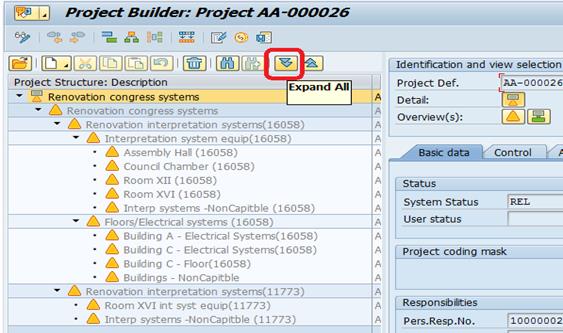

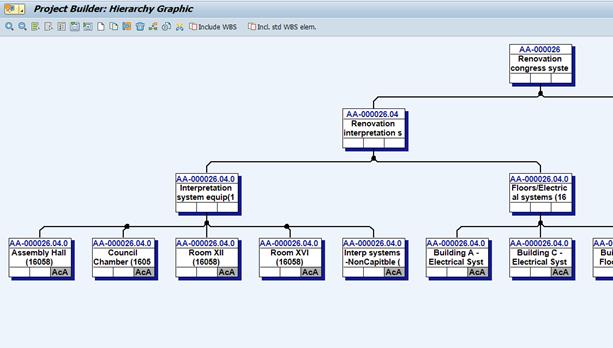

C.10. You will now be greeted with the Project Builder interface.

· The Worklist and Templates area contains recently viewed projects in the Worklist section and various elements that can be added to the project in the Templates section.

· The Project Structure Tree contains the Project Definition and all of the WBS Elements beneath it. Clicking on any of them will open them in the Work Area for display or editing.

· The Project Definition has been prepared already from the standard project definition and any values entered during step C.6.

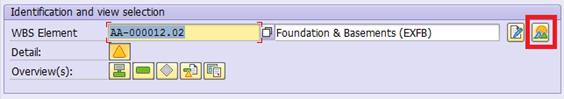

C.11. Now the WBS Elements need to be customized for this project à select the top (Level 1) WBS Element by clicking on it in the Project Tree.

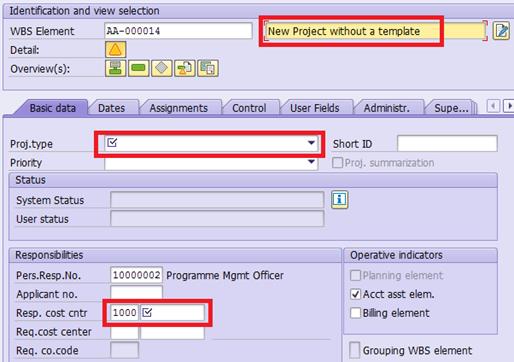

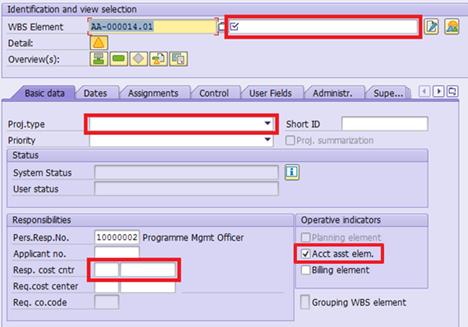

C.12. Update the Level 1 WBS Element.

Start by updating the WBS Element Description to match the description you gave to the Project Definition. This is a standard convention that the Project Definition and Level 1 WBS Element share the same description.

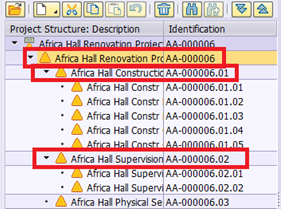

C.12.1. Basic Data tab:

· Resp. cost cntr: Enter company code 1000 and the Cost Center for this WBSE.

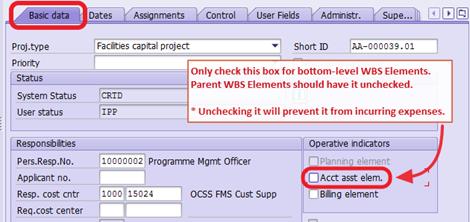

· For all WBSE elements that should not be used to charge costs the box Acct asst elem. should be unchecked. This will mean that users of the shopping carts etc. cannot use these lines to charge costs to. This will be the case for all level 1 WBSE.

*Reminder: Only leave the Account assignment element checked where you want to collect costs at this level.

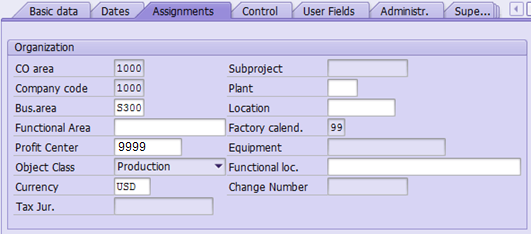

C.12.2. Assignments tab:

· Functional Area: Enter the Functional Area associated with the Responsible cost center defined on the Basic Data tab. This will NOT be automatically derived from the cost center, so it is important that care is taken to make sure they align. Use transaction KS03-Display Cost Center to confirm that the functional area relates to the cost center entered.

· Profit Center: Enter 9999

C.12.3. Control tab:

Review the Investment profile as that will determine whether or not this WBS Element will create an AuC asset. Typically, the Level 1 WBS Element will not have an investment profile.

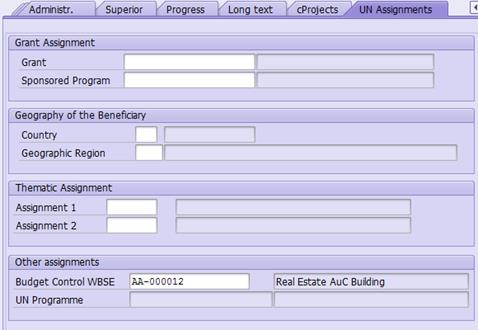

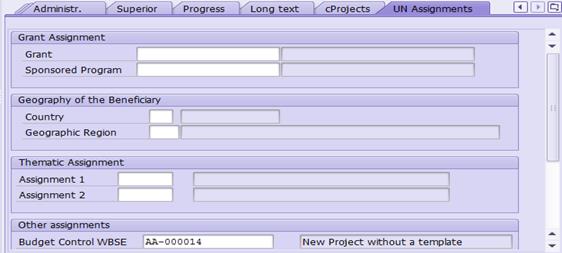

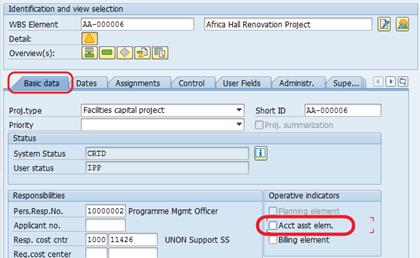

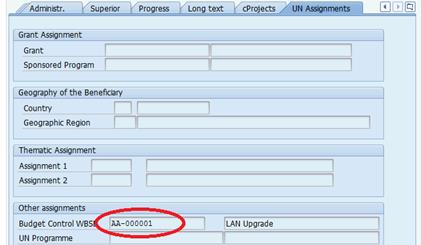

C.12.4. UN Assignments tab:

· Grant Assignment: Fill in the Grant and Sponsored Program that funds this WBSE.

· Geography of Beneficiary: Fill in the Country or Geographic Region if a Grant is assigned.

· Thematic Assignment: Fill in thematic assignments, if necessary.

· Budget Control WBSE: This is the WBSE from which this WBSE receives its budget. This can be the WBSE or a parent WBSE, and allows multiple WBSE elements to share the same budget address.

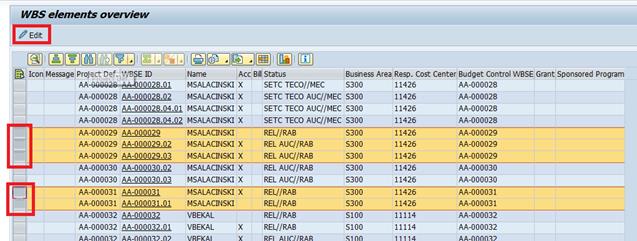

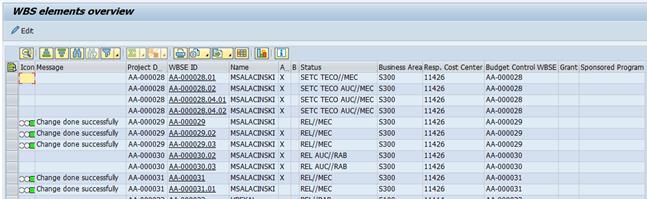

C.13. For the Level 2 WBS Elements. The procedure is the same as in the previous step.

You may edit many WBS Elements at once in a tabular format by switching to the WBS Element Overview. This may be a more efficient way of viewing and managing the different properties of each WBS Element. The exception to this is the attributes found on the UN Assignments tab will not be shown in the Overview table, otherwise everything else is available in this overview.

Here you can see and edit all of the WBS Elements and most of their attributes.

Note: Ensure that the Functional Area (Organization tab) correctly matches that of the Cost Center (Responsibilities tab) for each WBSE. If the functional area is not correctly aligned with the cost center at the WBSE level then the entity will receive budget exceeded messages. You can confirm the Functional Area assigned to each Cost Center with transaction KS03.

C.14. Fill out the necessary fields for all remaining WBS Elements.

** Only bottom-level WBS Elements should collect expenses, and therefore all 'parent' WBS Elements should have their Acct assn elem. Indicator unchecked on the Basic Data tab.

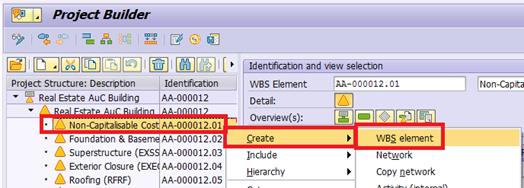

C.15. If you need to add a new WBS Element:

C.15.1. Determine which WBS Element you'd like to insert the new one beneath. If you want to add a Level 2 WBSE, choose the Level 1 WBSE. In the example screenshot below, we are creating a Level 3 WBSE beneath the 'Non-Capitalisable Costs' Level 2 WBSE.

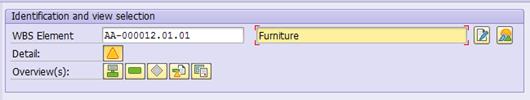

C.15.2. Create a new WBS Element by right-clicking on an existing WBS Element and selecting Create à WBS element.

C.15.3. Fill in a description for this WBS Element and any other necessary fields as with any other WBSE.

C.15.4. The new WBSE should be visible in the tree view after pressing enter.

C.16. If you expect to have capitalisable charges that will be distributed across multiple final assets (i.e. building subcomponents) when the project is completed, AND you cannot define a % split when the shopping cart/Purchase order is set up, you can add an extra WBS Element to collect these costs during construction/development, calling this WBSE 'Other Capitalisable Costs'. At final project settlement, you settle these charges to multiple final assets on a percentage basis. It is recommended that you keep charges to this WBSE to a minimum to avoid a lengthy review process of expenses charged to this WBSE when the AuC is finalized.

Note: Non-capitalisable costs should NOT be charged to this WBSE, if part of the costs are capitalisable and part not capitalisable this split must be done at the time of the financial commitment.

Follow the instructions in the previous step to add the WBS Element. Be sure to give it a description that communicates its intended use, such as 'Other Capitalisable Costs'.

For example:

If your project will have service charges that will be capitalized across many of the building's subcomponents (Foundation, Superstructure, Roof, Interior construction, etc.), you could charge the 'Other Capitalisable Costs' WBS Element. At the final settlement, the entity would need to review the charges to this WBSE and define multiple settlement rules (on a percentage basis) for this WBS Element to the final assets of each of the subcomponents.

C.17.

If you want to remove an existing WBS Element,

select it in the tree view and then click on the Delete ![]() button and confirm that you want to delete the WBS Element.

button and confirm that you want to delete the WBS Element.

C.18.

When you have added, removed, and updated all of

the WBS Elements, save the project by clicking on the Save ![]() icon at the top of the screen.

icon at the top of the screen.

C.19. You should see a message in the status bar similar to this, and the project will be closed.

![]()

C.20. After initial creation, you will want to update the status of your project. In order to release the project. You will have to take 3 steps:

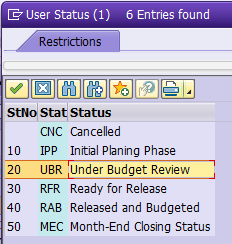

1. First step: Update the User Status of each WBS Element from 10: IPP to 20: UBR

2. Second step: Update the User Status of each WBS Element from 20: UBR to 30: RFR

3. Third step: Update the System Status of the Project Definition to Released.

Instructions on changing the User Status and System Status are covered in section 4.2.1.4 - Updating the Project/WBSE Status.

4.2.1.3 Creating a Project from Scratch

D. The steps to create a new Project and its WBS Elements for an AuC / Transaction Code: CJ20N

D.1. Login to Umoja ECC.

You must have the FA.16, PP.01, or PP.02 security authorizations to create a project.

D.2. Execute transaction code CJ20N or navigate to the following path in the SAP Menu: Accounting à Project System à Project à Project Builder

D.3. Click on the Create icon and then click Project.

D.4. Give the project a description

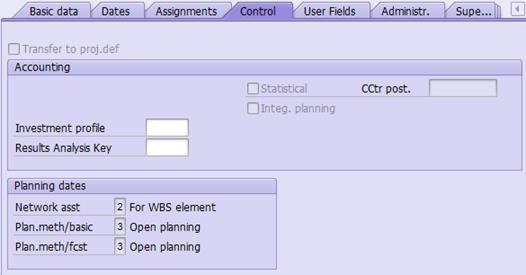

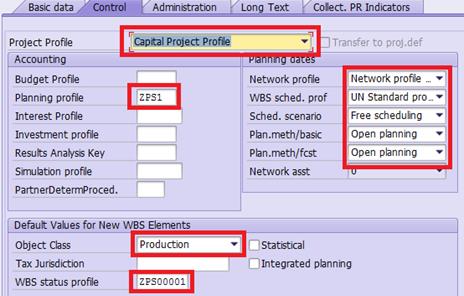

D.5. Fill in the following details in the Control tab:

· Project Profile: Capital Project Profile

· Planning profile: ZPS1

· Network profile: Network profile w/ activity acct. assignment

· WBS sched. prof: UN Standard profile - time scheduling

· Sched. scenario: Free scheduling

· Plan.meth/basic -- and - Plan.meth/fcst: Open planning

· Object Class: Production

· WBS status profile: ZPS00001

D.6. Fill out the following details on the Basic tab, and then press Enter.

· Pers.Resp.No.: The role responsible for this project. This will usually be 10000002 - Programme Mgmt Officer.

· Start date and Finish date: Estimated (and adjustable) dates for projects start/finish.

· Factory calend.: Most should use calendar 99

· Business area and Functional Area: Select as appropriate for this project.

· Profit Center: Enter the default profit center 9999.

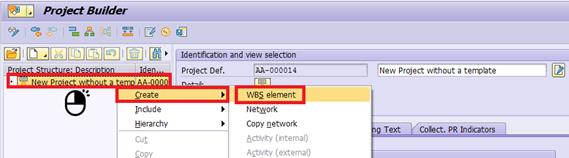

D.7. Create the first WBS Element. Right-click on the Project Definition from the Project Structure Tree and then select Create à WBS element.

D.8. Enter the description of the WBS Element. It should have the same description as the Project Definition that you created in steps D.4 through D.6. Next, fill out the following fields on the Basic tab.

· Proj.type: Select either Facilities, ICT, or Substantive Capital Projects.

· Resp. cost cntr: Enter the company code (1000) and Cost Center for this WBS Element.

D.9. In practice, the Level 1 WBS Element you just created will not be charged to. It will be the parent element for Level 2, and possibly Level 3, WBS Elements that will be charged to. Generally, if a WBSE has a child WBSE then it should not be charged to. The parent nodes are used for reporting and budgetary purposes only.

D.10. Continue adding WBS Elements. Right-click the parent WBSE that you wish to add the next one under and select Create à WBS element. You can also use the icon.

D.11. Give the new WBSE a description that conveys what type of expenses should be charged to it (or to its children). It is also good practice to indicate in the description whether or not the expenses incurred under this WBSE will be capitalized or not, especially if there are multiple non-capitalisable WBSEs within the project.

D.12. After describing it, fill out the following fields on the Basic tab.

· Proj.type: Select either Facilities, ICT, or Substantive Capital Projects.

· Resp. cost cntr: Enter the company code (1000) and Cost Center for this WBS Element.

· Acct asst elem.: Uncheck this for parent WBS Elements where you do not want to incur expenses.

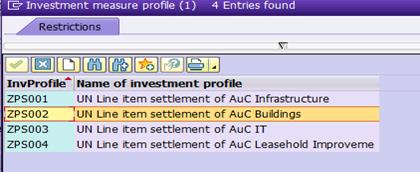

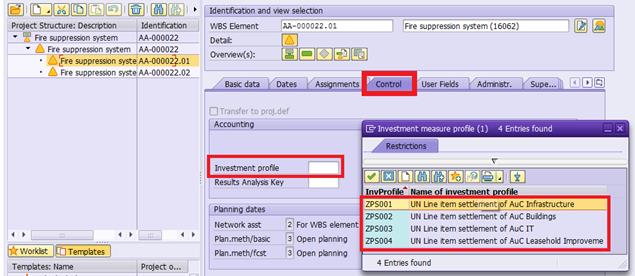

D.13. Go to the Control tab.

IMPORTANT: If this WBSE is to be used to collect information regarding capitalisable costs, select an Investment profile. Otherwise, leave that field empty.

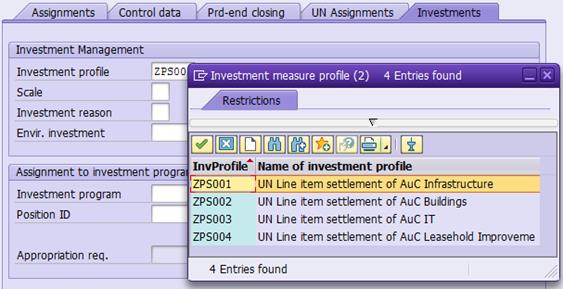

The investment profiles available are as follows:

D.14. Review the last tab UN Assignments and fill in a Grant / Sponsored Program if this WBS Element is Grant-funded.

D.15. Repeat steps D.10 - D.13 for all other required WBS Elements.

Note: As mentioned in the earlier section, if you expect to have capitalisable charges that will be distributed across multiple final assets or subcomponents when the project is completed and you cannot define a % split when the shopping cart/Purchase order is set up, you can add an extra WBS Element to collect these costs during construction/development, calling this WBSE 'Other Capitalisable Costs'. At final project settlement, you settle these charges to multiple final assets on a percentage basis. It is recommended that you keep charges to this WBSE to a minimum to avoid a lengthy review process of expenses charged to this WBSE when the AuC is finalized.

D.16. When you have added all required WBS Elements, save the project by

clicking on the Save ![]() icon at the top of the screen.

icon at the top of the screen.

D.17. You should see a message in the status bar similar to this, and the Project Builder screen will be closed.

![]()

D.18. After initial creation, you will want to update the status of your project. In order to release the project, you will have to take 3 steps:

1. First step: Update the User Status of each WBS Element from 10: IPP to 20: UBR

2. Second step: Update the User Status of each WBS Element from 20: UBR to 30: RFR

3. Third step: Update the System Status of the Project Definition to Released.

Instructions on changing the User Status and System Status are covered in the next section.

4.2.1.4 Updating the Project/WBSE Status

There are two types of status in Umoja, System Status and User Status. A project goes through several statuses before it can be used. Each WBS Element, and the Project Definition, has its own status.

|

System Status |

User Status |

State of the Project / Actions |

|

CRTD - Created |

IPP - Initial Project Planning |

Initial Status of Project / WBS Elements. |

|

CRTD - Created |

UBR - Under Budget Review |

All WBS Elements have been defined and the project is ready to have budget allotted. |

|

CRTD - Created |

RFR - Ready for Release |

Budget has been allotted. It is

ready to be released. |

|

REL - Released |

RFR - Ready for Release |

The project has been released. Individual WBS Elements can now have their User Status set to Ready for Release. |

|

REL - Released |

RAB - Released and Budgeted |

The project is Released and Budgeted. Goods and services can now be procured against these WBS Elements. |

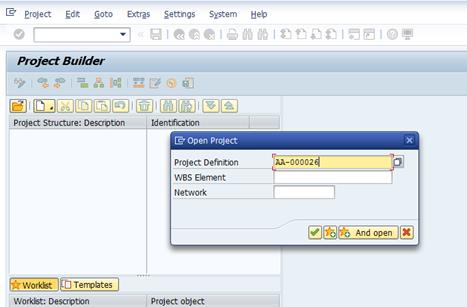

E. The steps to update a project's User Status / Transaction Code: CJ20N

E.1. Execute transaction code CJ20N or navigate to the following path in the SAP Menu: Accounting à Project System à Project à Project Builder

E.2.

Reopen the project you created earlier by either

clicking on the Open ![]() icon and entering the project definition number, or by clicking on

the dropdown arrow (

icon and entering the project definition number, or by clicking on

the dropdown arrow (![]() ) next to Last Projects Processed and double-clicking your

new project.

) next to Last Projects Processed and double-clicking your

new project.

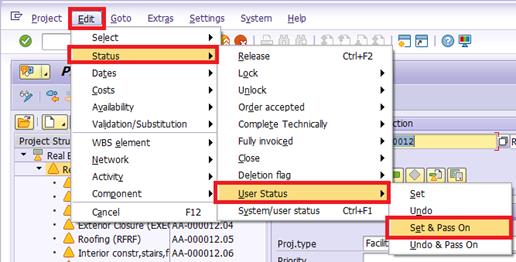

E.3. To change the User Status for all WBS Elements, select the Level 1 WBS Element in the Project Tree and then select Edit à Status à User Status à Set & Pass On from the top menu bar.

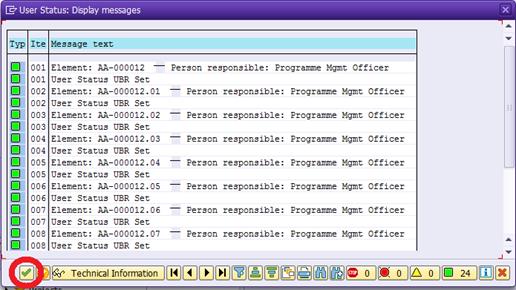

E.4.

Double click on the new User Status you

want to change to. Review the messages that are displayed in a new window and

click on the green check to continue. Save ![]() the project.

the project.

F. The steps to update a project's System Status to Released / Transaction Code: CJ20N

F.1. Execute transaction code CJ20N or navigate to the following path in the SAP Menu: Accounting à Project System à Project à Project Builder

F.2. Reopen the project you created earlier. All WBS Elements should be in status RFR (Ready for Release) in order to release the project.

F.3. Select the Project Definition (the top line in the Project Structure Tree) and then select Edit à Status à Release from the top menu bar.

F.4.

Save ![]() the Project.

the Project.

F.5. Before posting to any of the WBS Elements, the User Status must be updated once again to RAB (Released and Budgeted). This should not be done, however, until budget has been allocated by FM or GM colleagues.

4.2.1.5 Updating the Budget Control WBSE Field for FM/GM Users

A special transaction code exists for determining where each WBS Element derives its budget from. This enables FM and GM Users access to allocate budget to projects without giving them access to change any other project fields. You may have already defined this for your project in the UN Assignments tab of each WBSE, but this is an alternative specifically for FM and GM Users. Asset and Project Management Users cannot use this transaction without having the appropriate FM or GM authorizations.

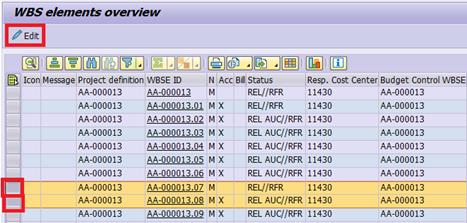

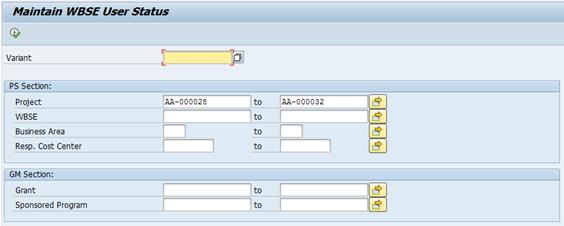

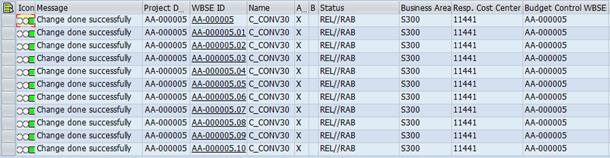

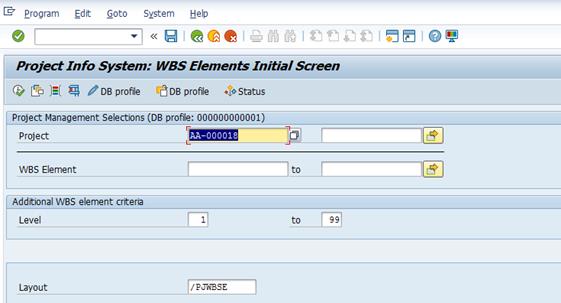

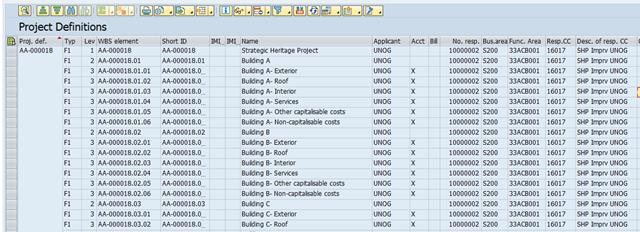

G. Steps to update the budget control for FM/GM Users / Transaction Code: ZPJWBS

G.1.

Enter transaction code ZPJWBS and then enter selection

criteria (usually just the project you wish to modify) and click on ![]() Execute.

Execute.

G.2. Select the WBS elements you wish to modify by clicking on the button to the left of their rows, and then click the Edit button in the toolbar.

G.3.

Fill out the window that opens and click on the Save ![]() icon

to update the WBS Elements.

icon

to update the WBS Elements.

4.2.1.6 Ensure that Higher-Level WBS Elements Cannot Incur Expenses

It is good practice to only collect costs at the lowest level WBS Elements within the structure. If a WBS Element has 'children', then it probably should not be charged to. Charging to these 'parent' WBS Elements can be prevented by ensuring the Acct asst elem. indicator is not checked (expenditure will then not be able to be charged to this WBSE, however budget can still be assigned).

H. The steps to review and change WBS Elements so that they cannot be charged to / Transaction Code: CJ20N

H.1. Enter transaction code CJ20N.

You must have the FA.16, PP.01, or PP.02 security authorizations to make this change.

H.2.

Open the project you created earlier by clicking on the Open

![]() icon

and entering the project definition number, or by opening it from the Worklist

à Last Projects Processed

section.

icon

and entering the project definition number, or by opening it from the Worklist

à Last Projects Processed

section.

H.3. From the project structure tree on the left, find each of the WBS Elements that should not be able to incur expenses.

In this example screenshot, we have 3 'parent' WBSEs that should have the Acct asst elem. Indicator unchecked.

H.4. Select each 'parent' WBSE and then confirm whether or not the Acct asst elem. Indicator checkbox is checked. Uncheck it if necessary.

H.5.

Repeat steps H.3 and H.4 for all parent WBSEs and Save ![]() the

project.

the

project.

NOTE: The Acct asst elem. Indicator becomes unchangeable once the project or WBSE's System Status is set to Released. Be sure to confirm the appropriate checkbox status before releasing.

4.2.1.7 Review that Budget has been Assigned to the Project

All projects will have one or more 'Budget Control WBSEs'. These are WBSEs within the project that receive budget allocations. The other WBSEs on the project will reference these Budget Control WBSEs in the UN Assignments tab and derive/share their budget from it.

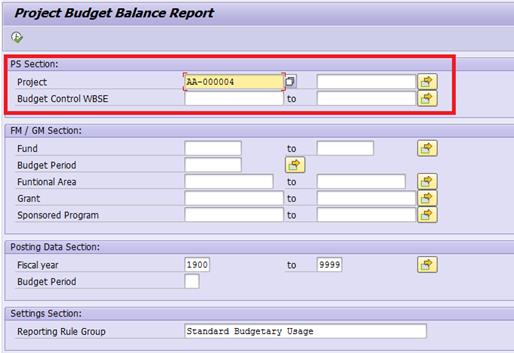

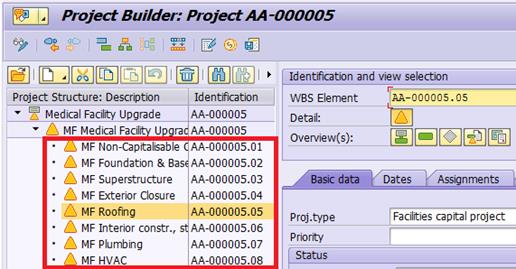

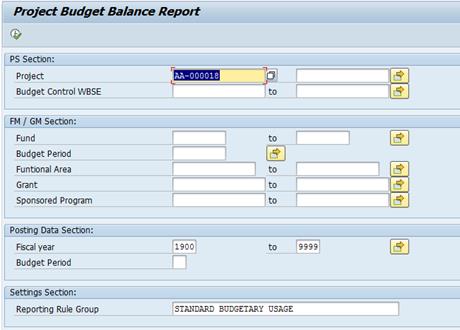

I. The steps to review the budget for a project / Transaction Code: ZPJPRJBUDBAL

I.1. Enter transaction code ZPJPRJBUDBAL.

Any Fixed Asset or Project Management Users can access this transaction.

I.2.

Enter the project or WBSEs that you wish to review and click on ![]() Execute.

Execute.

I.3. You will see a report similar to the below summarizing the status of each Budget Control WBSE.

Note: Take care to ensure that the Functional Area aligns correctly with the Cost Center. WBS Elements inherit the Functional Area from that of the Project Definition, so if the Cost Center has a different Functional Area then the Functional Area would need to be manually corrected. Use KS03 to review which Functional Area belongs to which Cost Center.

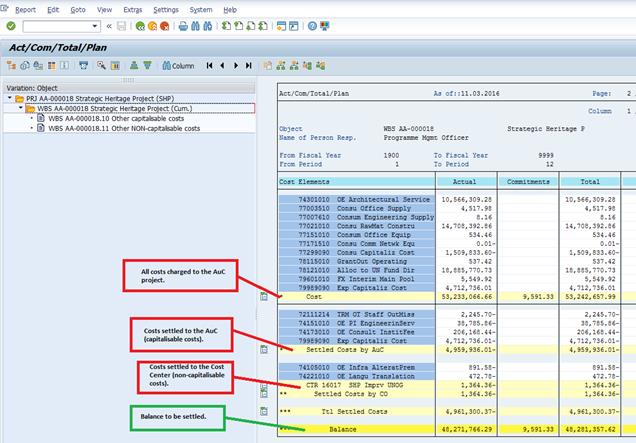

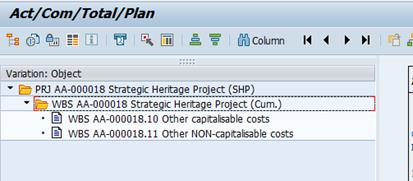

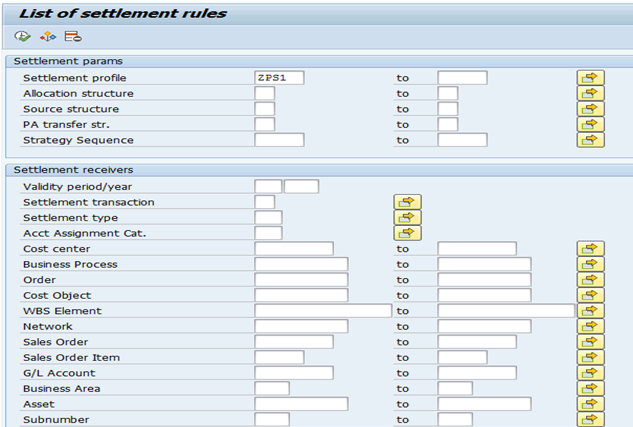

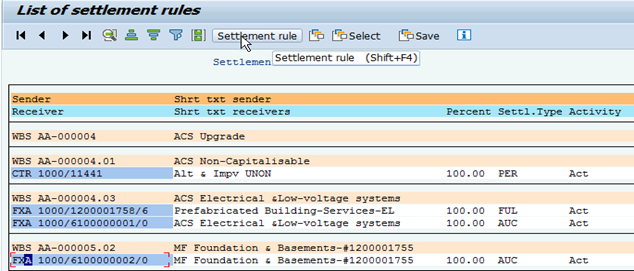

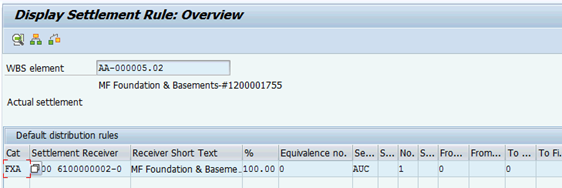

4.2.1.8 Create Settlement Rules for Non-Capitalisable WBS Elements

Settlement rules must be created for each WBS element that will be settled to a cost center (non-capitalisable AuC costs). This is not required for WBS elements that are settling to an AuC asset because those settlement rules are automatically generated during settlement (it will need to be done later however when you are settling to the final asset).

Notes:

· Settlement Rules must be maintained for the lowest level WBS elements where the expenditures have been incurred.

· If a service order is used, the expenditures incurred for the service order must first be settled to the project and then to the AuC.

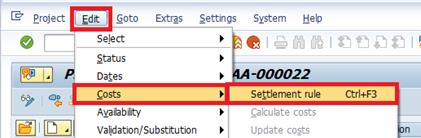

J. The steps to update Settlement Rules for WBS Elements / Transaction Code: CJ20N

J.1. Enter transaction code CJ20N.

You must have the FA.16, PP.01, or PP.02 security authorizations to create settlement rules.

J.2.

Open the project you created earlier by either clicking on the Open

![]() icon

and entering the project definition number, or by double clicking on it in the Worklist

à Last Projects Processed

section.

icon

and entering the project definition number, or by double clicking on it in the Worklist

à Last Projects Processed

section.

J.3. From the project structure tree on the left, select the WBS Elements for which settlement rules need to be created. You will have to create them one WBS Element at a time (repeat steps J.4 and J.5 for each one).

J.4. Select the WBS Element and go to Edit > Costs > Settlement Rule from the top menu bar.

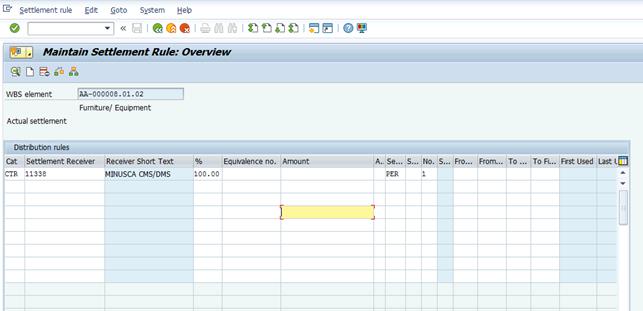

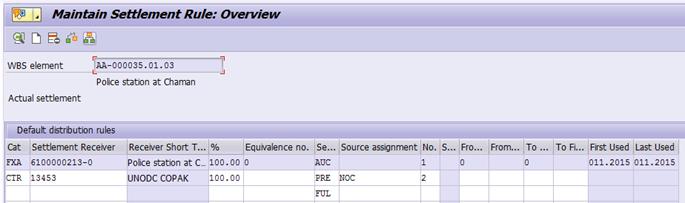

J.5. The Maintain Settlement Rule: Overview screen opens up for the selected WBS Element. Populate the following fields:

· Category: CTR - This defines the settlement receiver type to be a cost center.

· Settlement Receiver: Enter the appropriate Cost Center (this is often the Responsible Cost Center of the WBSE).

· Settlement Percentage: 100%

If there is split settlement you may adjust the percentage here by adding multiple lines that sum to 100%.

· Settlement Type: PER (periodic settlement, the rule used for month end).

J.6.

Press the Enter key on your keyboard, and then click the Save

![]() icon

in the initial screen (the project builder).

icon

in the initial screen (the project builder).

NOTE: For all WBS Elements with a selected Investment profile, a Settlement Rule to the corresponding AuC will be generated automatically.

4.2.1.9 Define Investment Profile and Create AuC Asset after Project is Already Released

If your AuC project has already been released, but you need to add an Investment profile to it, there are a few additional steps to complete compared to adding an Investment profile to an unreleased project.

K. Steps to add Investment profile to a released AuC / Transaction Code: CJ20N

K.1. Execute Transaction code CJ20N and open the project.

K.2. Select the WBS Element you wish to create an Investment profile for. Go to the Control tab.

K.3. From the Control tab, select the appropriate Investment profile for this WBS Element.

![]()

K.4. After selecting the investment profile, press the Enter key on your keyboard.

K.5. You should receive a warning message similar to the following. Press the Enter key again to dismiss this message.

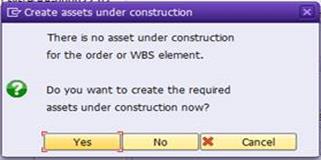

![]()

K.6. On the next prompt, click Yes to create an asset under construction for this WBS element.

K.7.

On the next screen (Create Asset: Initial

screen), just click on the Back ![]() button before going any further. If you instead hit Enter at

this screen or go further into to Master data, then you will be forced

to enter a Fund and Budget Period for this AuC Asset before

clicking the Back button (adding a fund at this stage is not necessary).

button before going any further. If you instead hit Enter at

this screen or go further into to Master data, then you will be forced

to enter a Fund and Budget Period for this AuC Asset before

clicking the Back button (adding a fund at this stage is not necessary).

K.8. After this the asset has been created in the background and the system has accepted the investment profile you entered. Don't forget to Save the project after this.

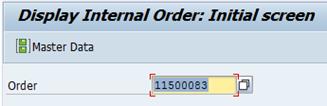

4.2.2 Set up an AuC as an Internal Order

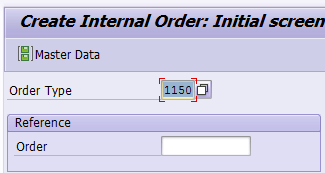

L. The steps to create a new Internal Order for an AuC / Transaction Code: KO01

L.1. Login to Umoja ECC.

You must have the FA.16 (Senior User) security authorization to create an Internal Order.

L.2. Execute transaction code KO01 or navigate to the following path in the SAP Menu: Accounting à Controlling à Cost Element Accounting à Master Data à Accrual Order à Create

L.3. Select Order Type 1150 - Capital Activities (AuC) and press the Enter key. If you know of a similar Internal Order that you wish to copy, you can enter its # in the Reference section

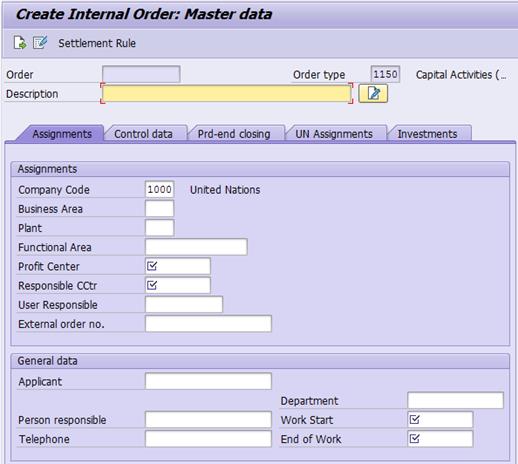

L.4. On the Create Internal Order screen, fill in the following fields on the Assignments tab:

· Description: Fill in a description of this AuC.

· Profit Center: Enter the default profit center 9999

· Responsible CCtr: Enter the responsible Cost Center. This will derive the business area and functional area.

· Work Start and End of Work: Fill in planned dates here. These can be changed later, if necessary.

·

User Responsible:

Enter an Umoja User ID of the person responsible for this AuC. You can use the ![]() icon to search for someone by their name if you do not know their

user id.

icon to search for someone by their name if you do not know their

user id.

· External order no.: If this AuC should reference a specific order number outside of Umoja, you can enter it here.

· Person responsible: Enter the name of the person responsible for this AuC.

· Telephone: Enter the telephone number of the Person responsible.

· Department: Enter the department responsible for this AuC.

L.5. You can skip the Control data and Prd-end closing tabs.

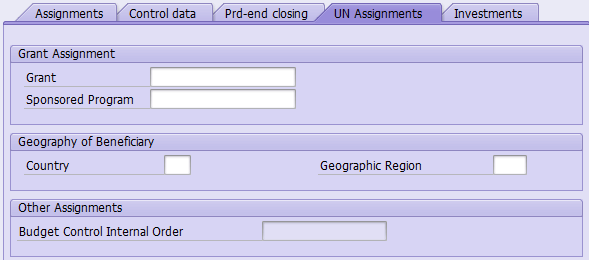

L.6. On the UN Assignments tab, fill in Grant and Sponsored Program if this AuC is grant-funded.

L.7. On the Investments tab, select an appropriate Investment profile from the list depending on if the Asset under Construction is an Infrastructure, a Building, an IT / Intangible asset, or a Leasehold Improvement.

L.8.

When you're done, click on the Save ![]() icon. You should see the following informational message. Press the

Enter key to proceed.

icon. You should see the following informational message. Press the

Enter key to proceed.

![]()

L.9. You will then see this prompt. Choose Yes to create the AuC asset master now.

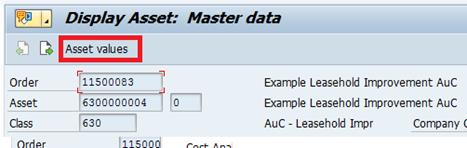

L.10. The system will bring you to the Asset Master creation screen, with the correct Asset Class for the AuC you are creating as determined by the Investment profile specified on the Investments tab.

L.11. Press the Enter key to proceed and select the green check to continue.

L.12. Most fields on the asset master should have been automatically filled out based on information provided in the Internal Order earlier. Go to the Time-dependent tab.

L.13. On the Time-dependent tab, enter the Fund and the other fields should derive from the Cost Center and Fund.

NOTE: The Cost Center came from the responsible cost center on the Internal Order.

L.14. On the Net Worth Tax tab, fill in the Property indicator, this will often be 2 - Owned Constructed.

L.15.

Click on the Back ![]() icon at the top of the screen to complete the AuC asset master.

icon at the top of the screen to complete the AuC asset master.

L.16.

Click on the Save ![]() icon to save your internal order and Asset under Construction. You

should see a message at the bottom of the screen showing your Internal Order

number.

icon to save your internal order and Asset under Construction. You

should see a message at the bottom of the screen showing your Internal Order

number.

![]()

Note: You do not need to create a settlement rule for an AuC Internal Order for its periodic settlements to the AuC asset. It will be automatically created during your first periodic settlement. For the final settlement, you will create one rule to settle to the final asset, this is covered in the Job Aid 3.3: Asset under Construction - Final Settlement.

4.2.3 Review of AuC and Monthly Settlements

4.2.3.1 Review of Project Structures

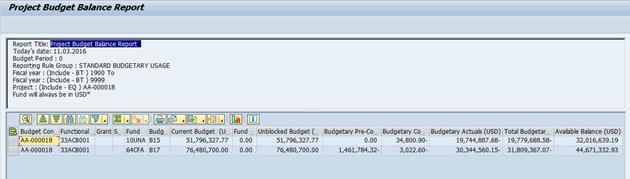

M. Steps to review project structures / Transaction Code: CN41

M.1. Log in to Umoja ECC.

M.2. Execute Transaction code CN41. All FA and Project users have access.

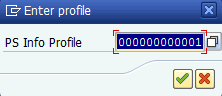

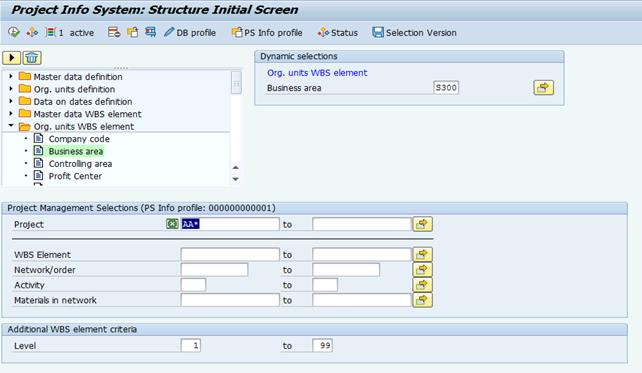

M.3. Select 000000000001 - std profile: structure overview description.

M.4. Enter AA* in the Project field and select the corresponding Business area from the dynamic extract all AuC projects for that particular business area.

M.5. Review the list of projects and WBS elements to ensure completeness.

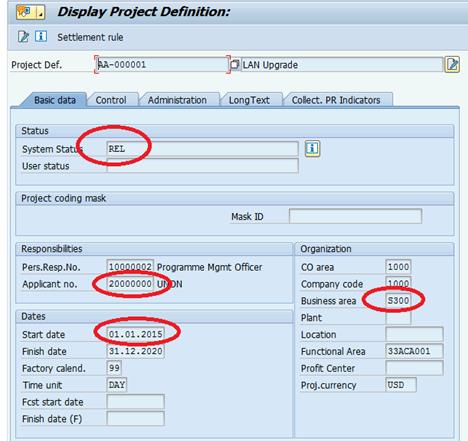

M.6. Double-click all project definitions (marked in ) to ensure that System Status is REL (Released) and that the Applicant no., Start date, Business area and Functional Area are correct.

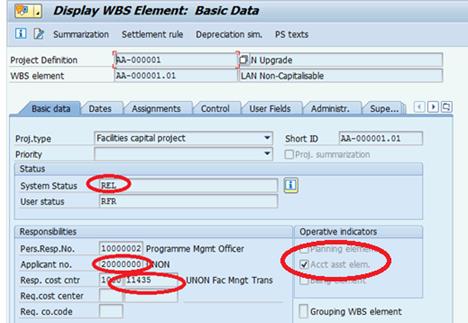

M.7. Double click all WBS elements to ensure that System Status is REL and that the Applicant no., Responsible Cost Center, Business Area, Functional Area are correct. For each WBSE that is not at the lowest level, expenditures should not be posted. To prevent this, the Acct asst elem. indicator should not be checked.

4.2.3.2 Review Project Expenditure Postings

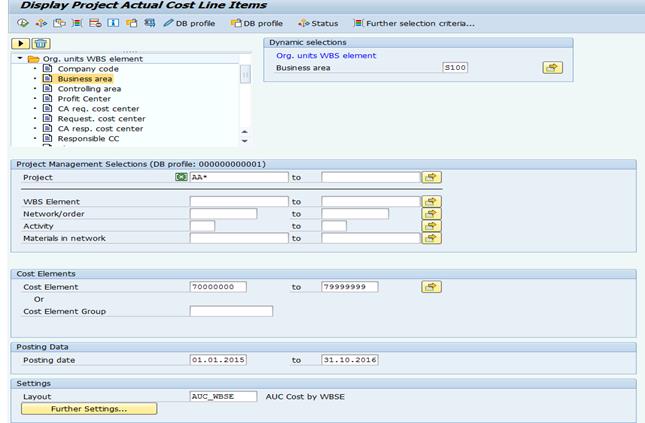

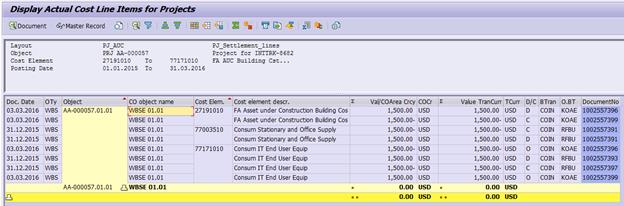

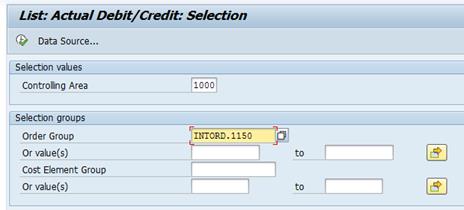

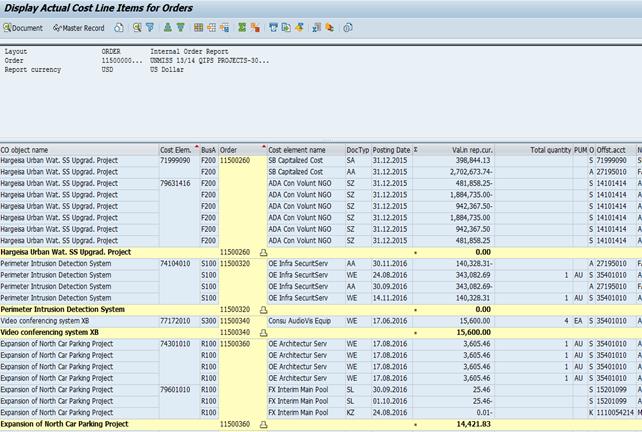

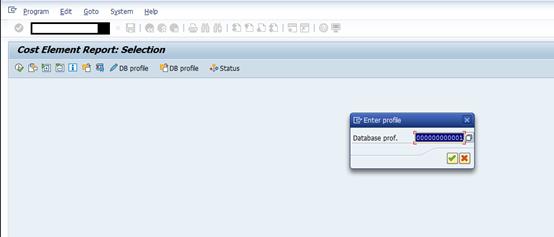

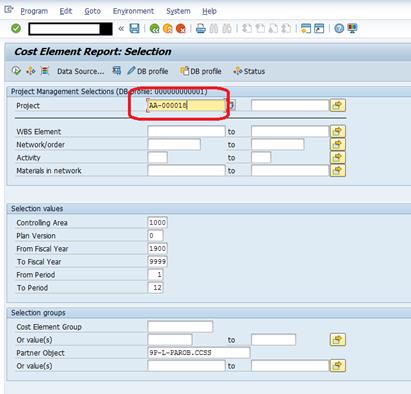

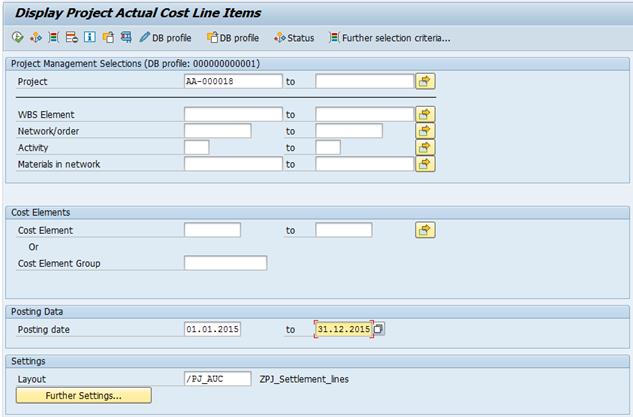

N. Steps to review project expenditure / Transaction Code: CJI3

N.1. Log in to Umoja ECC.

N.2. Execute transaction code CJI3. All FA and Project Users have access.

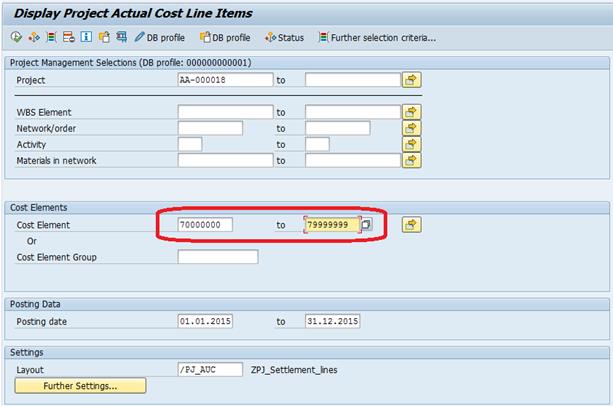

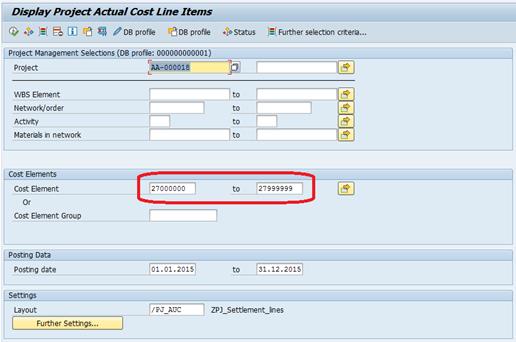

N.3. Enter the Projects or WBSEs being reviewed in the Project field, the Cost Element from 70000000-79999999 and ensure the Posting dates reflect the period you are interested in.

N.4.

Execute ![]() the

report.

the

report.

N.5. Review the postings. Double-click on any line to see more details.

4.2.3.3 Create Sub-Assets for AuC

The Asset Accounting Senior User identifies that the construction project has costs to be capitalized at the end of the month. Initially, sub-assets need to be created for each distinct fund that is charged to a WBS Element. After initial creation, sub-assets usually do not need to be recreated in each accounting period (month). Exception to this is if a new fund is used during the month, when new sub-assets would need to be created for such fund.

Structure below is an example showing where sub-assets fit in.

O. Steps to create sub-asset / Transaction Code: AS11_FMIM

O.1. Log in to Umoja ECC.

You must have the FA.16 (Senior User) security authorization to create sub-assets for AuCs.

O.2. Execute transaction code AS11_FMIM.

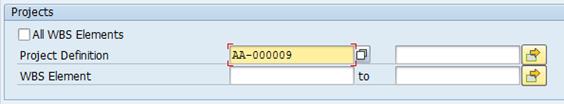

O.3. Fill out the following fields as instructed:

· Controlling Area: Always set to 1000

· Company Code: Always set to 1000

· All fields in the Orders region should be empty and unchecked.

· All WBS Elements: Unchecked

· Project Definition: Enter the Project Definition number here.

· WBS Element: If you entered a Project Definition above, you may leave this blank, but it would allow you to only create sub-assets for specific WBSE's within the project.

· Clear any values in the Further Selections region.

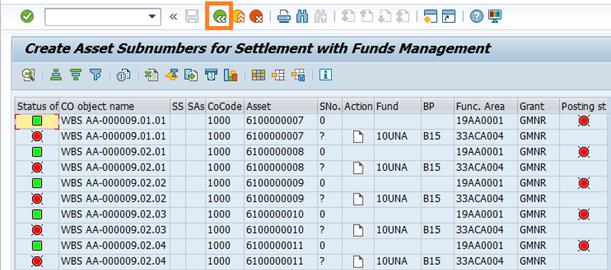

· List existing assets - and - Test Run: Both should be checked.

O.4.

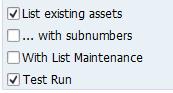

Press the Execute button ![]() at the top of the screen. You should see a screen similar to the

one below for your review.

at the top of the screen. You should see a screen similar to the

one below for your review.

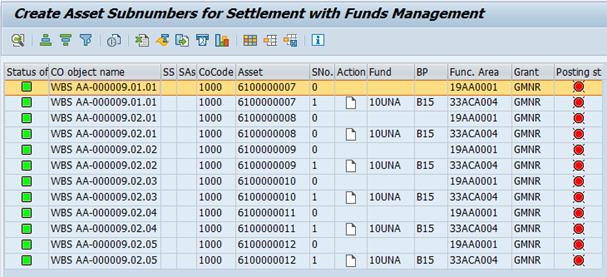

NOTE:

Each line with a Create Asset icon ![]() in the Action column shows new sub-asset(s) that will be

created if you uncheck the Test Run option and re-execute this

transaction. It is normal for these rows to have a red circle in the Status

of asset column.

in the Action column shows new sub-asset(s) that will be

created if you uncheck the Test Run option and re-execute this

transaction. It is normal for these rows to have a red circle in the Status

of asset column.

O.5.

Press the Back button ![]() to return to the previous screen. If prompted to 'Leave list' then

click Yes.

to return to the previous screen. If prompted to 'Leave list' then

click Yes.

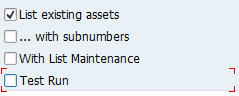

O.6.

Uncheck the Test Run button and then

press the Execute button ![]() again.

again.

O.7. The rows that previously had a red circle in the Status of asset column should now have green squares and an assigned sub-number indicating that the sub-assets have been created. You may close the transaction now.

4.2.3.4 Update User Status to MEC

Before performing any settlement, the User Status must be updated to MEC - Month End Closing to indicate that expenditures are ready to be settled to the AuCs. To update the user status, use T-code ZPJ_WBS_US to quickly change the User Status of one or more projects.

You must have the FA.16 security authorization to update the User Status using this transaction.

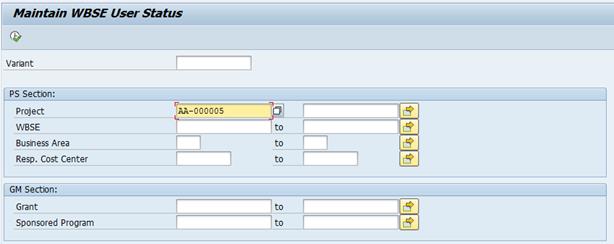

P. The steps to update user status / Transaction Code: ZPJ_WBS_US

P.1. Enter transaction ZPJ_WBS_US

P.2. Fill in selection criteria so that you will select all of the WBS Elements for which you need to change the status.

NOTE: WBS Elements that have not been Released will not be selected.

The example in the screenshot shows the selection of all WBS Elements from 5 projects.

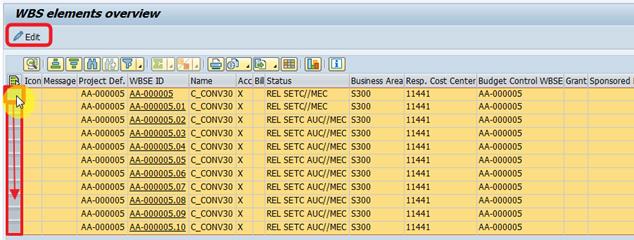

P.3.

Click the Execute ![]() icon

to proceed to the next screen, listing out each WBS Element selected from the

criteria on the last screen. Select all of the WBS Elements you wish to change

by clicking on the squares to the left of each row and dragging. You can make

multiple selections (as shown in the screenshot below) by holding the CTRL key

on your keyboard.

icon

to proceed to the next screen, listing out each WBS Element selected from the

criteria on the last screen. Select all of the WBS Elements you wish to change

by clicking on the squares to the left of each row and dragging. You can make

multiple selections (as shown in the screenshot below) by holding the CTRL key

on your keyboard.

P.4.

When you have selected all of the WBS Elements, click on ![]() button

to change the User Status.

button

to change the User Status.

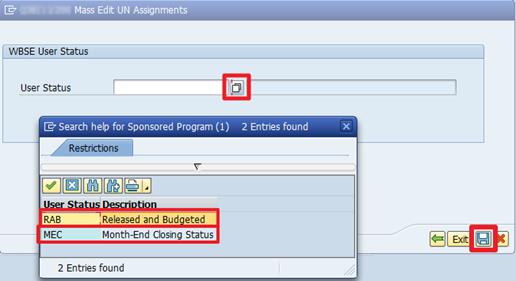

P.5.

In the Mass Edit screen, enter the User Status MEC

directly into the field, or select it from the selection list. Click on the Save

![]() icon

to make and save the change to all selected WBS Elements.

icon

to make and save the change to all selected WBS Elements.

P.6. If the change succeeds, the table will update to show the changes made. The changes are saved immediately, so there is no further action required.

![]()

NOTE: Users can also use CJ20N and simply select edit user status, then set and pass on to change to MEC, it should be noted the system may produce warning messages, as a result of the missing account assignment elements, these should be ignored.

Keep in mind that only WBS Elements currently in User Status RAB can be set to new User Status MEC.

4.2.3.5 Special Note for Capitalisable WBSEs with Grant-Funding

AuC Projects that are funded by a Grant need to settle the non-capitalisable Indirect Costs (IDC) or Program Support Costs (PSC) charged to their WBS Elements.

Because these IDC / PSC charges are NOT capitalisable, you must define an extra settlement rule to each capitalisable WBSE in the project so that these non-capitalisable charges will automatically settle to a cost center instead of an AuC. This new settlement rule will have an additional dimension is called Source assignment and the value to be selected is NOC which stands for 'not for capitalisation'.

For example:

The first line is the automatically generated settlement rule for settling capitalisable costs to the AuC.

The second line is the non-capitalisable settlement rule described above.

Q. To define the IDC settlement rules / Transaction Code: CJ20N

IMPORTANT: This settlement rule must be created AFTER the first settlement. This is because the system will automatically generate the AuC Asset settlement rule upon first settlement. This IDC settlement rule must be defined below the AuC Asset settlement rule.

Q.1. Enter transaction code CJ20N and open the project you are creating settlement rules for.

Q.2. From the project structure tree, select the WBSE for which costs will be settled one at a time.

Q.3. Go to the task bar and select Edit > Costs > Settlement rule

Q.4. Add a new line with the following dimensions (It should look similar to the screenshot above):

· Category: CTR (Cost Center)

· Settlement Receiver: The responsible cost center for this WBS Element

· Settlement Percentage: 100%

· Settlement Type: PRE (Preliminary)

· Source Assignment: NOC (Not to be capitalized)

Q.5.

Click on the Back button ![]() to

go back to the project builder screen.

to

go back to the project builder screen.

Q.6. Repeat steps Q.1 - Q.4 for all remaining WBS Elements.

Q.7.

Click on the Save icon ![]() to

save changes.

to

save changes.

4.2.3.6 Run Cost Settlement

After you have reviewed the costs against the project and have ensured that sub-assets exist for the AuCs, you can run cost-settlement to capitalize costs to the AuC sub-assets.

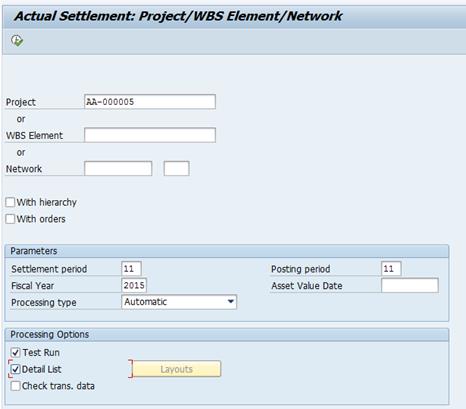

R. The steps to run Cost Settlement / Transaction Code: CJ88

R.1. Execute transaction code CJ88.

You must have the FA.16 (Senior User) security authorization to run project settlement.

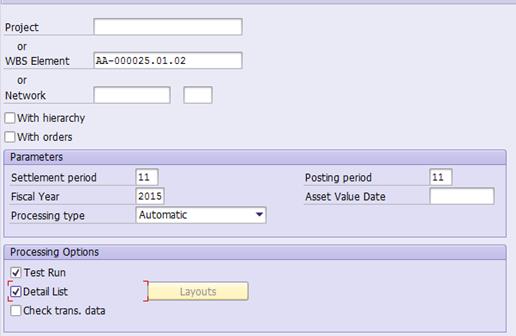

R.2. Define the Project/WBS Element to be settled by entering the following fields:

· 'Project' or 'WBS Element': Enter the Project ID, or the ID of a single WBS Element you wish to settle. If you enter it at the Project level, it will attempt to settle for all WBS Elements that are in the MEC - Month End Closing User Status.

· With hierarchy: Check this if you entered a WBS Element (instead of a Project) and wish to also settle all subordinate WBS Elements structured beneath it.

· Settlement period: Current month (should match posting period).

· Posting period: Current month.

· Fiscal Year: Current year.

· Asset Value Date: Usually today's date, or the last day of the month.

· Processing type: Automatic

· Test Run: Checked

· Detail List: Checked

R.3.

Select the Execute icon ![]() .

.

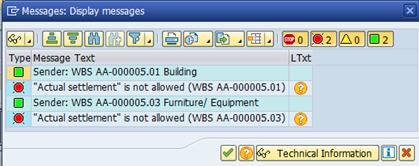

NOTE: If

there are any errors, warnings, or informational messages, there will be a

messages icon ![]() in

the Menu bar. Click on that icon to review and validate the messages. Any error

messages (red icon) will need to be fixed before a settlement will process.

in

the Menu bar. Click on that icon to review and validate the messages. Any error

messages (red icon) will need to be fixed before a settlement will process.

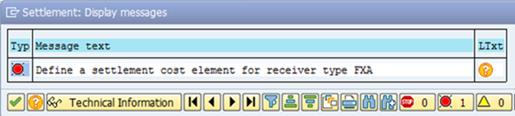

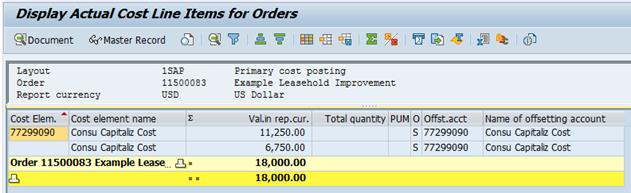

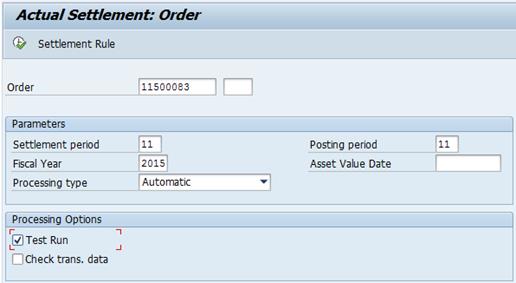

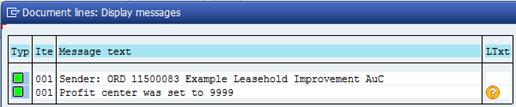

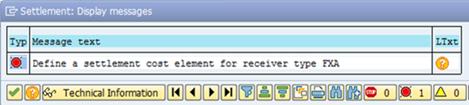

If you encounter an error stating 'Define a settlement cost element for receiver type FXA', this is likely because your project is Grant-funded and had IDC postings to this WBS Element.

If there are no

error messages, go Back ![]() to

the selection screen.

to

the selection screen.

R.4.

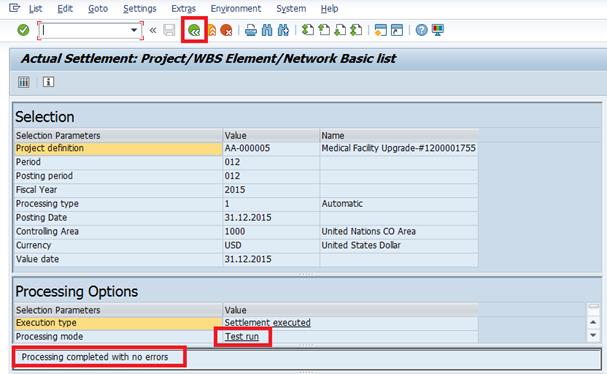

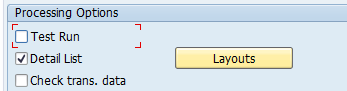

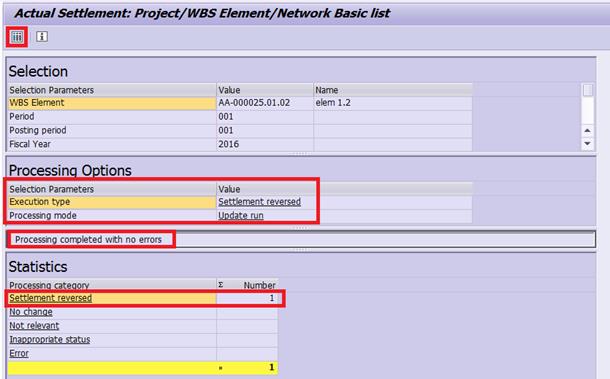

Return to the Actual Settlement: Project/WBS Element/Network

Basic list screen, unselect the Test Run checkbox. Then click on the

Execute icon ![]() in

the Menu bar.

in

the Menu bar.

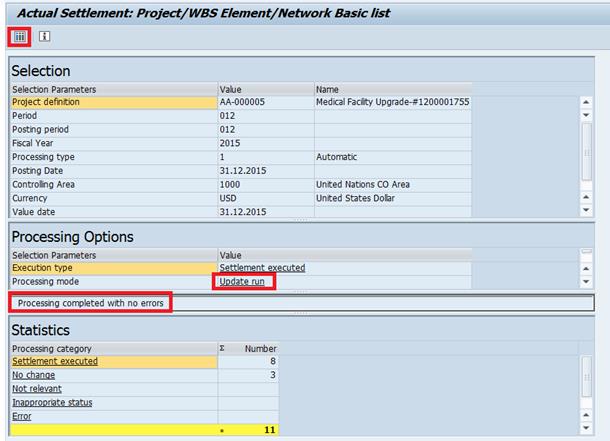

R.5. Review the results of the actual run.

R.6.

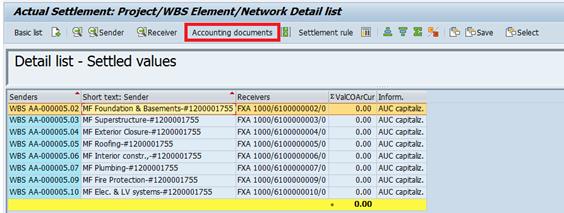

On the Actual Settlement: Project/WBS Element/Network Basic

list screen, select the Detail lists ![]() button.

Each line in this view represents one WBS Element that was settled. Review the

postings for each by selecting the line and then clicking on Accounting

documents.

button.

Each line in this view represents one WBS Element that was settled. Review the

postings for each by selecting the line and then clicking on Accounting

documents.

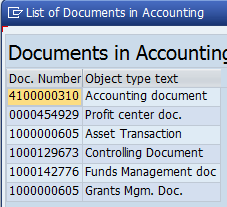

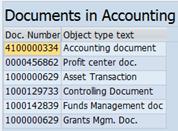

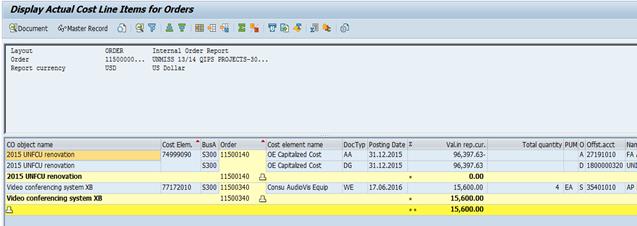

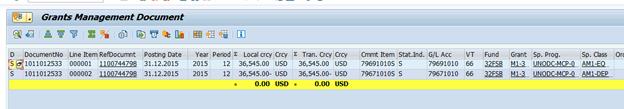

R.7. From the pop-up window, double-click the document to be reviewed and validate the entries in the FI, CO, FM and GM documents.

R.8.

Click the Back icon ![]() and

repeat the process for each document to be reviewed.

and

repeat the process for each document to be reviewed.

R.9. Next, review the settlement line items before updating the WBS User Status back to RAB.

NOTE: If you do not change the User Status back to RAB, no new commitments can be raised against this WBS Element.

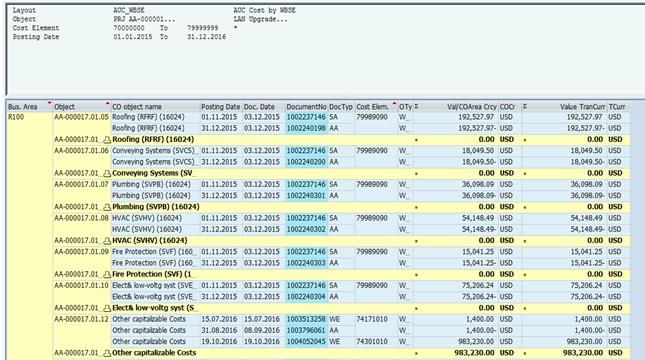

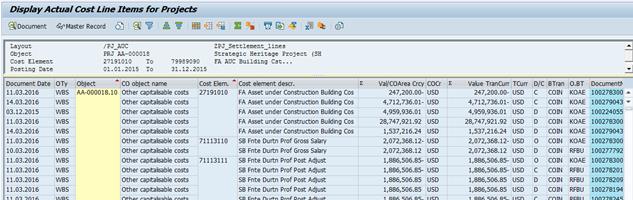

4.2.3.7 Run Line Item Report to Review Settlement

To validate that all expenses were settled to the AuC or Cost Center, run the line item report again.

S. The steps to run the Line Item Report / Transaction Code: CJI3

S.1. Execute transaction code CJI3.

S.2. In the Project Actual Cost Line Item screen define the project for which the line item report should be run. If needed, narrow the report down to a specific WBS Element or a range of WBS Elements.

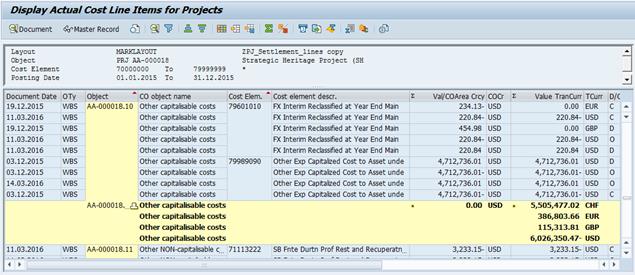

S.3. Provide Cost element ranges as 70000000-79999999

S.4. Adjust the Posting date range to cover only the period just settled.

S.5.

Click the Execute icon ![]() .

.

S.6. Confirm that the balance is as expected after settlement. All postings that can be settled should have been settled and the balance for each project is zero.

S.7. You may also review the settlement documents again by double-clicking the individual settlement line items.

From the Settlement Documents screen, select each row and click on Accounting documents to see all accounting documents associated with this settlement item. From the pop-up window double click the document to be reviewed and validate the entries in the documents related to the settlement posting.

S.8.

Click the Back icon ![]() and

repeat the process for each document to be reviewed.

and

repeat the process for each document to be reviewed.

S.9. After settlement is completed and reviewed, you will need to change the User Status of the project WBS Elements from MEC to RAB.

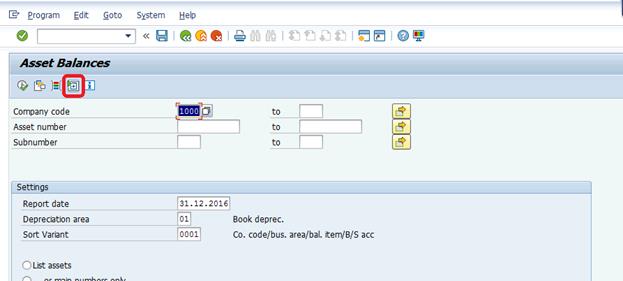

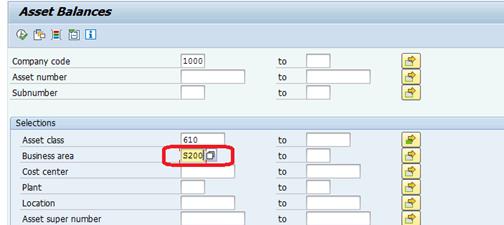

4.2.3.8 Review Fixed Asset Transaction Documents

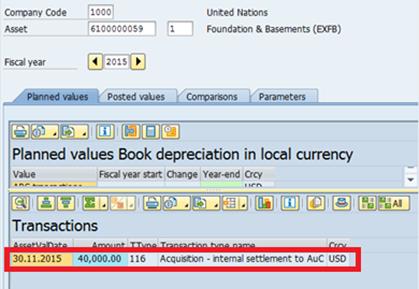

T. The steps to review Fixed Asset Transaction Documents / Transaction Code: AW01N

T.1. Enter transaction code AW01N. All FA and Project Users have access.

T.2. Populate data in the following fields:

· Company Code: 1000

· Asset Number: Asset (AuC) number generated in transaction AS11_FMIM

· Asset Sub-number: Usually '1', but if there are multiple costs with different funds, then there can be multiple sub-assets to review with sub-numbers 2, 3, 4, etc.

· Fiscal year: Current year.

T.3. Click the Enter icon.

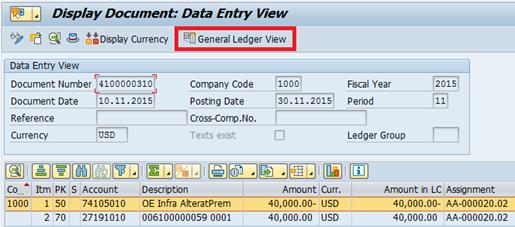

T.4. Double-click the asset transaction to be reviewed

T.5. Click the General Ledger View icon.

NOTE: Review each line and ensure the amounts and account assignments are correct according to the transaction posted.

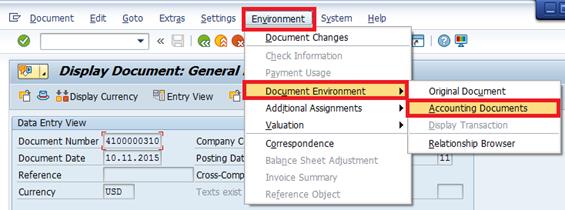

T.6. Select the Environment > Document Environment > Accounting Documents from the Menu bar.

T.7. From the pop-up window, double-click the document to be reviewed.

T.8.

Click the Back button ![]() and

repeat the previous steps for each document to be reviewed.

and

repeat the previous steps for each document to be reviewed.

4.2.3.9 Revert User Status to RAB after Settlement

The user status must be changed back to RAB - Released and Budgeted after settlement is completed, otherwise new expenditure will not be able to be charged to the WBSE.

U. The steps to update user status / Transaction Code: ZPJ_WBS_US

U.1. Enter transaction ZPJ_WBS_US

You must have the FA.16 security authorization to use this transaction.

U.2. Fill in selection criteria so that you will select all of the WBS Elements for which you need to change the status back to RAB.

The example in the screenshot shows the selection of all WBS Elements from 1 project.

U.3.

Click the Execute ![]() icon

to proceed to the next screen, listing out each WBS Element selected from the

criteria on the last screen. Select all of the WBS Elements you wish to change

by clicking on the squares to the left of each row and dragging. Or if you only

want to update for selected WBSE then hold CTRL and Left Click

each square. When you have selected all of the WBS Elements click on

icon

to proceed to the next screen, listing out each WBS Element selected from the

criteria on the last screen. Select all of the WBS Elements you wish to change

by clicking on the squares to the left of each row and dragging. Or if you only

want to update for selected WBSE then hold CTRL and Left Click

each square. When you have selected all of the WBS Elements click on ![]() button

to change the User Status.

button

to change the User Status.

U.4.

In the Mass Edit screen, enter the User Status RAB

directly into the field, or select it from the selection list. Click on the Save

![]() icon

to make and save the change to all selected WBS Elements.

icon

to make and save the change to all selected WBS Elements.

U.5. If the change succeeds, the table will update to show the changes made. The changes are saved immediately, so there is no further action required. The project can now receive new expenditures.

![]()

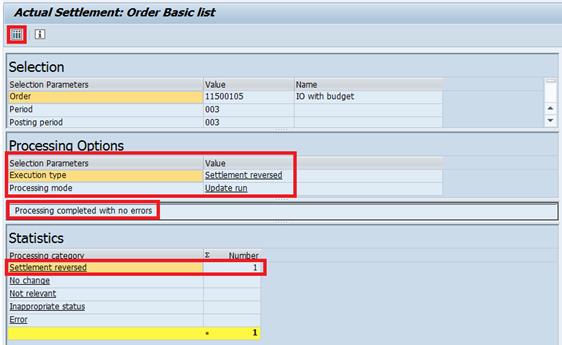

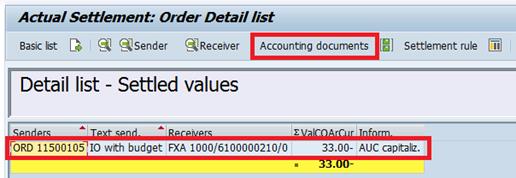

4.2.3.10 Reversing a Cost Settlement

V. The steps to reverse the settlement of a Project / WBS Element(s) / Transaction Code: CJ88

· Confirm the period that you wish to reverse. If you must reverse an older period, you must first reverse the more recent settlements. So if you need to reverse the settlement for January, but you have already settled February, then you must first reverse February before reversing January. Keep in mind that earlier posting periods may also not be open for posting anymore.

· Confirm that the User Status of the WBS Elements is set to MEC.

V.1. Execute transaction code CJ88.

You must have the FA.16 (Senior User) security authorization to reverse a settlement.

V.2. Define the Project/WBS Element to be reversed by entering the following fields:

· Project or WBS Element: Enter the Project ID, or the ID of a single WBS Element you wish to reverse. If you enter it at the Project level, it will attempt to reverse all WBS Elements that are in the MEC - Month End Closing User Status.

· With hierarchy: Check this if you entered a WBS Element and wish to reverse all subordinate WBS Elements structured beneath it.

· Settlement period: The month/period that you wish to reverse settlement of.

· Posting period: Should be the same as settlement period.

· Fiscal Year: The fiscal year of the period to be reversed.

· Asset Value Date: Leave this blank, it is not required for reversal.

· Processing type: Automatic.

· Test Run: Checked

· Detail List: Checked

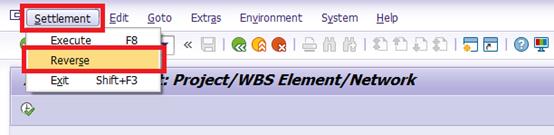

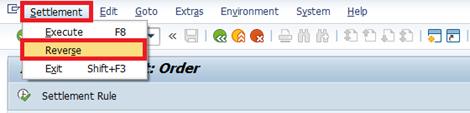

V.3. From the menu bar at the top of the screen, click on Settlement à Reverse

V.4.

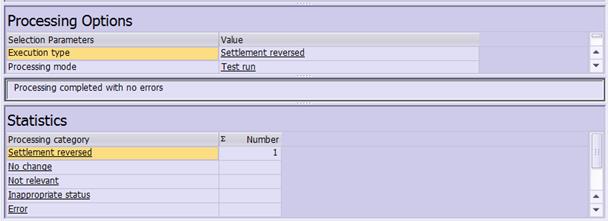

Review the results and any messages from the reversal Test Run.

Click on the Back button ![]() .

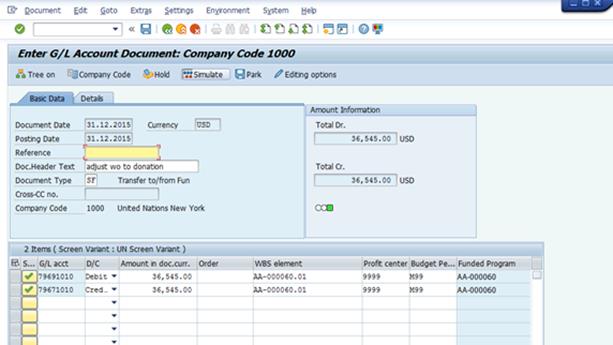

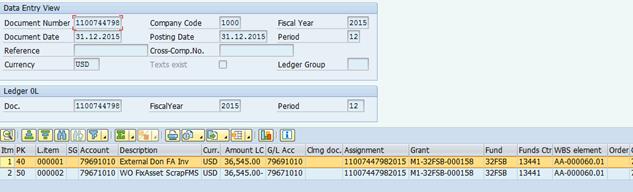

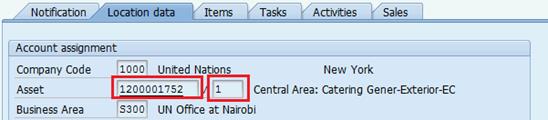

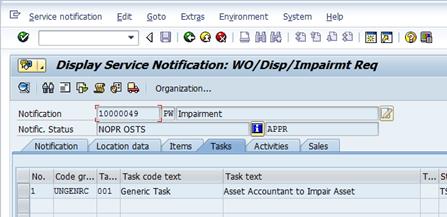

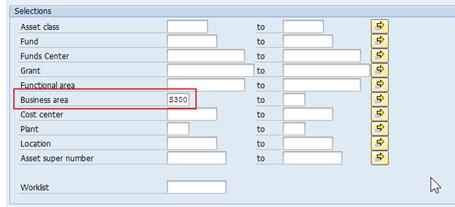

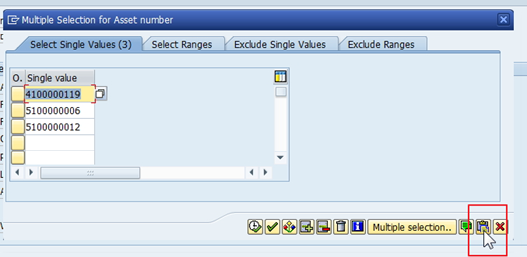

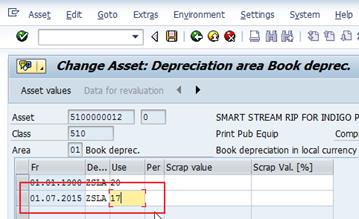

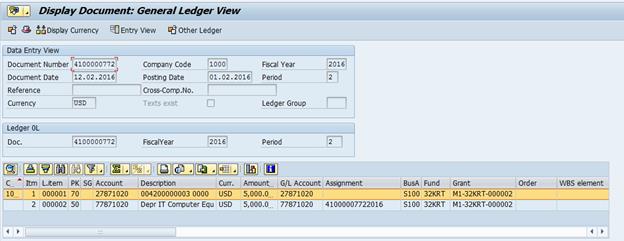

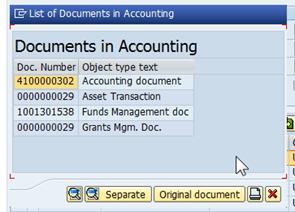

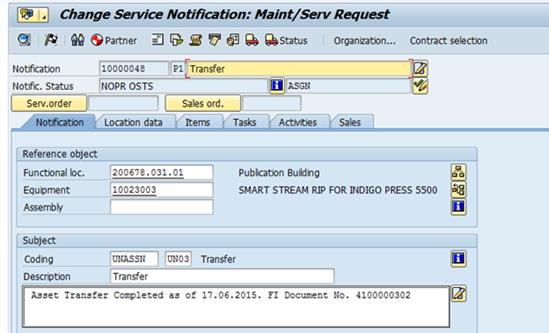

.