1 Objective

The purpose of this chapter is to explain the General Ledger (GL) process and how other areas interact with the GL process in the Umoja system. It will also describe how General Ledger documents are processed in the Umoja System.

It aims to provide high-level understanding of the assignment of transactions that can be done through the Umoja's GL function to ensure the business transaction is captured accurately in accordance with the UN's classification and reporting requirements.

2 General Ledger (GL) Overview

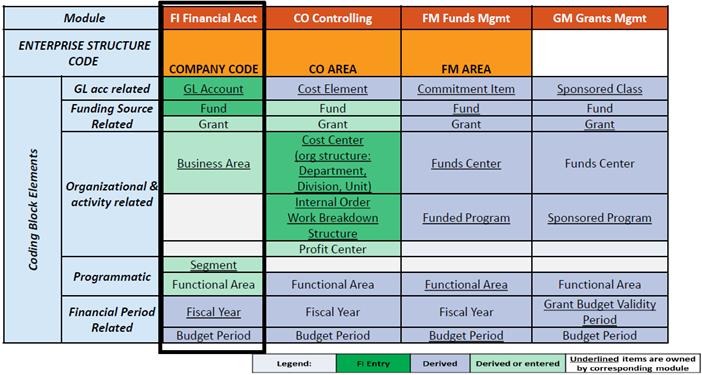

There are four financial ledgers/modules in Umoja that are linked to each other:

· General Ledger (GL), maintained in the Finance (FI) module, to prepare financial statements under IPSAS

· Funds Management (FM) Ledger, maintained in the FM module, to control budget and cash and prepare the performance report

· Grants Management (GM) Ledger, maintained in the GM module, to calculate Indirect Costs (IDC) and prepare donor reporting

· Controlling (CO) Ledger, maintained in the CO module, to calculate cost allocations and record charge backs to entities within Umoja

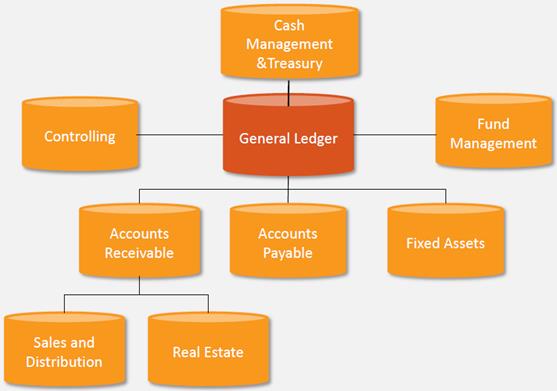

The General Ledger contains the balances of all accounts. Every financial transaction conducted in Umoja has a corresponding posting in the General Ledger.

The General Ledger is the central source of financial records for Umoja. It touches all other process areas and posts entries in other ledgers. This overlap across process areas as highlighted in the diagram below:

General Ledger Accounting is integrated with all components of Umoja and serves as a complete record of all business transactions. The diagram below shows the integration points across Umoja modules, processes and activities.

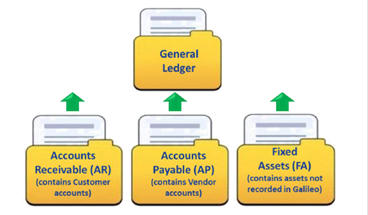

2.1 Subsidiary Ledgers

The subsidiary ledger is a supporting ledger that provides detail information about individual accounts, which are not stored at a detailed level in the General Ledger. Subsidiary ledgers divide financial data into distinct and more manageable categories. The total of all individual account balances in the subsidiary ledger equals the balance of the reconciliation accounts in the General Ledger.

There are three subsidiary ledgers in the Umoja: Accounts Receivable (AR), Accounts Payable (AP) and Fixed Assets (FA).

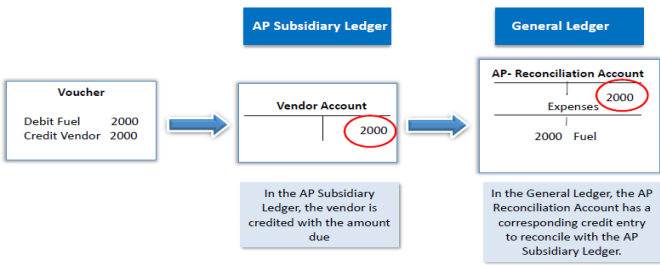

2.2 Reconciliation Accounts

The reconciliation accounts reconcile financial information contained in subsidiary ledgers in real time. The entries in the reconciliation accounts can only come from a subsidiary ledger; direct posting are not allowed in these accounts.

For example:

2.3 General Ledger Entry Source

In addition to subsidiary ledgers, the General Ledger can receive entries from three other sources:

Document Upload

Document upload is also known as a journal voucher upload from an Excel spreadsheet. This entry mode can be used when a specific journal entry has multiple line items.

Manual Entry

Transactions entries made directly to the General Ledgers in Umoja. The Umoja transaction code (T-code) used to execute the manual entry differs depending on the type of transaction executed.

Example of manual entries done in Umoja:

· Journal entry (JV)

· Accrual entry

· Reversal entry

· Recurring entry

2.4 General Ledger Master Data

Every organization like the UN runs on data and a set of processes. As the level of information increases over time, data becomes complex and difficult to manage. If data is not stored and maintained properly, it leads to significant losses in productivity across the organization. Thus, it is extremely critical for the organization to create a centralized data source. In Umoja, this centralized data is called Master Data.

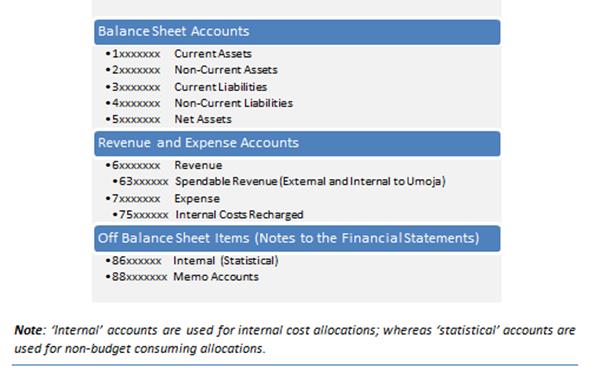

2.4.1 Chart of Accounts

The chart of accounts is a catalogue of all GL accounts established in Umoja. It satisfies necessary IPSAS requirement and will produce IPSAS compliant financial statements.

There is only one chart of accounts used for Peacekeeping, Regular budget and Grants (Trust Funds). Commitment Items used for Budget Control and Performance Reporting are derived from GL accounts. Sponsored Classes used for Grant Budget Control and Donor Reporting are derived from Commitment Items.

In Umoja, General Ledger (GL) accounts are stored and maintained in Chart of Accounts '1000' through transaction code (T-code) FS00.

Click here for the latest chart of accounts.

2.4.2 Accounts Groups

The General Ledger master record contains indicators to determine how GL account will function. GL accounts receive the debit and credit value postings for various transactions and rolls ups to support the account balances in the financial statements.

General Ledger accounts are summarized at a group level and configured with what fields are optional and which fields are required for entries. Account groups that will be used in Umoja are:

Reconciliation accounts

These accounts are associated to subsidiary ledgers and all entries must come from the subsidiary ledgers, therefore no direct entries are permitted to these accounts through journal vouchers (JVs). Umoja has 'Revaluation' and 'Manual adjust' accounts for each reconciliations account to post revaluations and entries can be posted manually to 'manual adjustment' accounts.

For the AR and AP subsidiary ledgers, corresponding debits and credits should be cleared together either by the system or manually. The correct matching of debits and credits provide a reliable and accurate customer and vendor history.

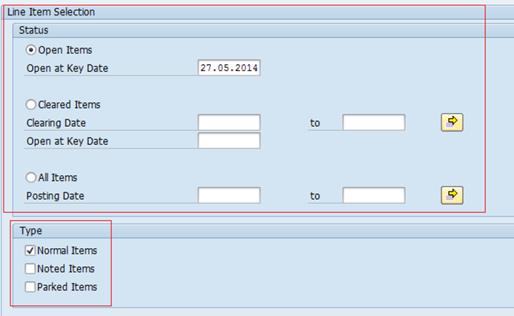

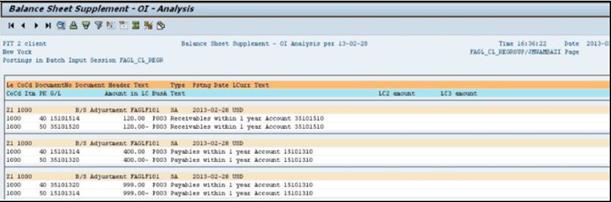

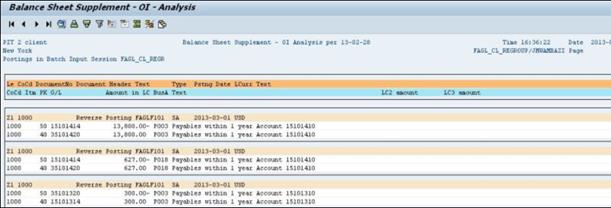

Open Item Managed (OIM) GL account for manual postings

Each document line in the OIM account will be considered either 'open' or 'cleared'. OIM GL accounts require that corresponding debits and credits are matched together. The clearing process creates a link between two (or more) corresponding documents that can be used for drilling back and forth between these documents. The linking of documents allows users to quickly trace the origin of a transaction and every step until its completion.

It is important not to use shortcuts to clear a batch of documents that do not belong together. One clearing document should be used per transaction with the understanding that one transaction may include more than two documents (e.g. creating of IOV for MIP payments received for a month would clear multiple documents in the OIM GL account against one entry in the IOV account).

Clearing OIM documents on a timely basis enables faster system performance and meaningful account listings that show only document lines that make up the ending balance of GL accounts. Umoja executes clearing transaction each week and the plan is to have batch execution done daily. It is the responsibility of the Mission/local office to ensure that all completed transactions have been cleared in OIM GL accounts at month end.

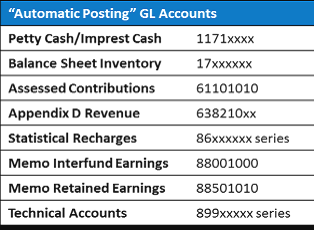

Automatic posting

Post automatically GL accounts do not have a subsidiary ledger; however only system entries may be recorded in these GL accounts. There are no manual entries permitted to this accounts through JVs. In general there is no clearing of debits and credits in these GL accounts with exceptions where the GL account is both Post Automatically and OIM account. In these cases, the system will automatically match the assignment of corresponding debits and credits and the clearing batch will clear items. Users will not be permitted to manually clear items in these GL accounts.

An indicator on the GL master record can be set to prevent any manual posting to a GL account. In Umoja, the following GL accounts are set to 'Post Automatically' which prevents any manual entry:

Retained Earnings Account

The accounts are used to receive the balance carry forward entry at year-end. In Umoja, GL account 51001010 - Net Asset Accumulated Surplus Unrestricted is used to record the balance carry forward. A retained earnings account was created in the Memo account range (88501010) to ensure that revenue in-kind memo entries are not carried forward to the regular retained earnings account. A retained earnings account was created in the Statistical Recharge range (86001009) to ensure that statistical recharges are not carried forward to the regular retained earnings account.

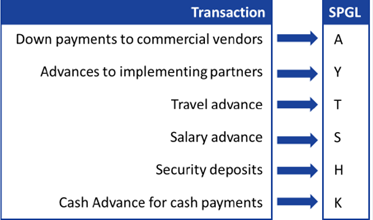

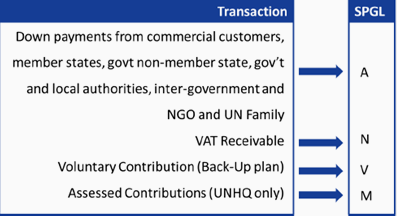

2.4.3 Special GL Indicators (SPGL)

Special GL indicators (SPGL) are used to identify transactions that should be recorded to alternate GL account. In Umoja, every Business Partner (BP) grouping is mapped to a specific GL Reconciliation account.

Special GL indicators are used in Accounts Payable (AP) and Accounts Receivable (AR) subsidiary ledgers and result in different GL accounts in General Ledger. When a SPGL is inserted into a transaction in the AP or AR sub ledger, the corresponding GL entry appears in a different reconciliation GL account as opposed to the mapped GL account.

Example:

When a security deposit is paid to a vendor and a special GL indicator is entered into the document, the GL records the debit paid in the security deposit account rather than the normal AP reconciliation account. This facilitates proper reporting at the year end.

The following are SPGL indicators available in Umoja and the change in reconciliation account resulting from each SPGL indicator for each BP groups.

Accounts Payable (AP)

|

SPGL long text |

AP SPGL |

BP Group |

Account Group |

Normal Recon GL Acct |

SPGL GL Acct |

|

Security Deposit |

H |

Z010 |

Commercial Vendor |

35101510 |

19301010 |

|

Z011 |

Member State |

33201010 |

|||

|

Z012 |

Non Member State |

33201110 |

|||

|

Z013 |

Government and Local Authority |

35101210 |

|||

|

Z014 |

UN Agency Fund Programme |

35101310 |

|||

|

Z015 |

Intergorvernment and NGO |

35101410 |

|||

|

Advance to Implem Partner |

Y |

Z013 |

Government and Local Authority |

35101210 |

18101210 |

|

Z014 |

UN Agency Fund Programme |

35101310 |

18101310 |

||

|

Z015 |

Intergorvernment and NGO |

35101410 |

18101410 |

||

|

Commercial Advance |

A,F |

Z010 |

Commercial Vendor |

35101510 |

19101510 |

|

Z013 |

Government and Local Authority |

35101210 |

19101210 |

||

|

Z014 |

UN Agency Fund Programme |

35101310 |

19101310 |

||

|

Z015 |

Intergorvernment and NGO |

35101410 |

19101510 |

||

|

Z019 |

Commercial Vendor Non-UNGM |

35101510 |

19101510 |

||

|

Retention |

R |

Z010 |

Commercial Vendor |

35101510 |

35111510 |

|

Advance Salary-Foundation |

S |

Z020 |

Staff Member, Ex-Staff Member, Survivors and Dependents, Retirees |

35101610 |

19101610 |

|

Z021 |

Non Staff Military and Police |

35101710 |

19101710 |

||

|

Z016 |

Non Staff with Index |

35101810 |

19101810 |

||

|

Loan Receivable |

X |

Z014 |

UN Agency Fund Programme |

35101310 |

16201310 |

|

Advance Travel-Foundation |

T |

Z020 |

Staff Member, Ex-Staff Member, Survivors and Dependents, Retirees |

35101610 |

19109010 |

|

Z021 |

Non Staff Military and Police |

35101710 |

|||

|

Z016 |

Non Staff with Index |

35101810 |

|||

|

Cash Advance to Paymaster no EMF |

K |

Z020 |

Staff Member, Ex-Staff Member, Survivors and Dependents, Retirees |

35101610 |

19102010 |

|

Z021 |

Non Staff Military and Police |

35101710 |

|||

|

Z016 |

Non Staff with Index |

35101810 |

|||

|

Z019 |

Commercial Vendor Non-UNGM |

35101510 |

|||

|

Z010 |

Commercial Vendor |

35101510 |

|||

|

Z013 |

Government and Local Authority |

35101210 |

|||

|

Z014 |

UN Agency Fund Programme |

35101310 |

Accounts Receivable (AR)

|

SPGL long text |

AR SPGL |

BP Group |

Account Group |

Normal Recon GL Acct |

SPGL GL Acct |

|

AR Assessed Contribution |

M |

Z011 |

Member State |

15101010 |

13101010 |

|

Z012 |

Non Member State |

15101110 |

13101110 |

||

|

AR Volunt Contribution AR |

V |

Z011 |

Member State |

15101010 |

14101010 |

|

Z012 |

Non Member State |

15101110 |

14101110 |

||

|

Z013 |

Government and Local Authority |

15101210 |

14101210 |

||

|

Z014 |

UN Agency Fund Programme |

15101310 |

14101310 |

||

|

Z015 |

Intergorvernment and NGO |

15101410 |

14101410 |

||

|

Z018 |

Commercial Customer |

15101510 |

14101510 |

||

|

AR Volunt Contribution In Kind |

K |

Z011 |

Member State |

15101010 |

14111010 |

|

Z012 |

Non Member State |

15101110 |

14111110 |

||

|

Z013 |

Government and Local Authority |

15101210 |

14111210 |

||

|

Z014 |

UN Agency Fund Programme |

15101310 |

14111310 |

||

|

Z015 |

Intergorvernment and NGO |

15101410 |

14111410 |

||

|

Z018 |

Commercial Customer |

15101510 |

14111510 |

||

|

AR VAT Receivable |

N |

Z011 |

Member State |

15101010 |

15201010 |

|

Z012 |

Non Member State |

15101110 |

|||

|

Z013 |

Government and Local Authority |

15101210 |

|||

|

AP Loan Payable |

L |

Z014 |

UN Agency Fund Programme |

15101310 |

36201310 |

|

Downpayment Received |

A,F |

Z018 |

Commercial Customer |

15101510 |

38501510 |

|

Z011 |

Member State |

15101010 |

38501010 |

||

|

Z012 |

Non Member State |

15101110 |

38501110 |

||

|

Z013 |

Government and Local Authority |

15101210 |

38501210 |

||

|

Z014 |

UN Agency Fund Programme |

15101310 |

38501310 |

||

|

Z015 |

Intergorvernment and NGO |

15101410 |

385011410 |

2.4.4 Posting Keys

The posting key controls the nature of the transaction entered into Umoja and whether the entry is a debit or credit. The nature of each entry can be seen when reviewing the entry.

Example:

Below is the list of posting keys in Umoja:

|

Posting Key |

Account Type |

Debit or Credit |

Posting Key Name |

|

1 |

Customer |

D |

Invoice |

|

2 |

Customer |

D |

Reverse credit memo |

|

3 |

Customer |

D |

Expenses |

|

4 |

Customer |

D |

Other receivables |

|

O |

Customer |

D |

Outgoing payment |

|

6 |

Customer |

D |

Payment difference |

|

7 |

Customer |

D |

Other clearing |

|

8 |

Customer |

D |

Payment clearing |

|

9 |

Customer |

D |

Special GL debit |

|

11 |

Customer |

C |

Credit memo |

|

12 |

Customer |

C |

Reverse invoice |

|

13 |

Customer |

C |

Reverse charges |

|

14 |

Customer |

C |

Other payables |

|

15 |

Customer |

C |

Incoming payment |

|

16 |

Customer |

C |

Payment difference |

|

17 |

Customer |

C |

Other clearing |

|

18 |

Customer |

C |

Payment clearing |

|

19 |

Customer |

C |

Special GL credit |

|

21 |

Vendor |

D |

Credit memo |

|

22 |

Vendor |

D |

Reverse invoice |

|

24 |

Vendor |

D |

Other receivables |

|

25 |

Vendor |

D |

Outgoing payment |

|

26 |

Vendor |

D |

Payment difference |

|

27 |

Vendor |

D |

Clearing |

|

28 |

Vendor |

D |

Payment clearing |

|

29 |

Vendor |

D |

Special GL debit |

|

31 |

Vendor |

C |

Invoice |

|

32 |

Vendor |

C |

Reverse credit memo |

|

34 |

Vendor |

C |

Other payables |

|

35 |

Vendor |

C |

Incoming payment |

|

36 |

Vendor |

C |

Payment difference |

|

37 |

Vendor |

C |

Other clearing |

|

38 |

Vendor |

C |

Payment clearing |

|

39 |

Vendor |

C |

Special GL credit |

|

40 |

GL |

D |

Debit entry |

|

50 |

GL |

C |

Credit entry |

|

70 |

Asset |

D |

Debit asset |

|

75 |

Asset |

C |

Credit asset |

|

80 |

GL |

D |

Stock initial entry |

|

81 |

GL |

D |

Costs |

|

83 |

GL |

D |

Price difference |

|

84 |

GL |

D |

Consumption |

|

85 |

GL |

D |

Change in stock |

|

86 |

GL |

D |

GR/IR debit |

|

90 |

GL |

C |

Stock initial entry |

|

91 |

GL |

C |

Costs |

|

93 |

GL |

C |

Price difference |

|

94 |

GL |

C |

Consumption |

|

95 |

GL |

C |

Change in stock |

|

96 |

GL |

C |

GR/IR credit |

2.4.5 Cost/Funds Center

A Fund Center is an organizational unit within FM ledger that controls budget and is time dependent. In Umoja, there is a one to one relationship between a Fund Center to a Cost Center in which the Fund Center is derived from the Cost Center.

A Cost Center is cost object that collects costs and revenues which identifies the areas of ongoing cost responsibility within an organization's overall organizational structure. The Cost Center master data record includes the corresponding Fund Center. In Umoja, Cost Center can be viewed using transaction code (T-code) KS03.

Internal Order is a temporary cost object established to collect costs and revenues of a specific project that has defined start and end dates. Work Breakdown Structure Element (WBSE) is a temporary cost collector used for high value/complex projects. Every Internal Order/WBSE is assigned to a Cost Center through which it ties to a Fund Center. In Umoja, Internal Order can be viewed using transaction code (T-code) KO03 and CJ13 for WBSE.

Umoja validates the Cost Center to the Business Area and Fund which prevents posting of incorrect Cost Center/Business Area/Fund.

Application in Umoja

· In Finance (FI) module, user enters the Cost Center only and Fund Center is derived.

· User has to input the Fund Center when posting allotment or redeployment.

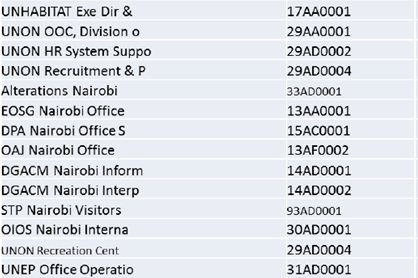

Example: Cost/Funds Center

|

Cost/Funds Center |

Short Text |

Long Text |

|

10999 |

UNHABITAT Exe Dir & |

UNHABITAT Executive Direction & Management |

|

11000 |

UNHABITAT New York O |

UNHABITAT New York Office |

|

11001 |

UNHABITAT Operations |

UNHABITAT Operations Division |

|

11014 |

UNON OOC, Division o |

UNON OOC, Division of Administrative Service |

|

11015 |

UNON Business Contin |

UNON Business Continuity |

|

11016 |

UNON Chief BFMS |

UNON Office of the Chief BFMS |

|

11025 |

UNON HR System Suppo |

UNON HR System Support Unit |

|

11026 |

UNON Staff Administr |

UNON Staff Administration Section |

|

11027 |

UNON Recruitment & P |

UNON Recruitment & Planning Section |

|

11028 |

UNON Chief SSS |

UNON Office of the Chief SSS |

|

11029 |

UNON Facility Manage |

UNON Facility Management & Transportation |

|

11030 |

UNON Building Manage |

UNON Building Management and Transport U |

|

11031 |

Alterations Nairobi |

Alterations & Improvements Nairobi |

|

11032 |

Major Maintenan Nair |

Major Maintenance Nairobi |

|

11033 |

SS Alteration Nairob |

Security and Safety Related Alteration a |

|

11034 |

UNON Commercial Oper |

UNON Commercial Operations Unit |

|

11035 |

UNON Property Manage |

UNON Property Management Unit |

|

11036 |

UNON Travel, Shippin |

UNON Travel, Shipping & Visa Unit |

|

11037 |

UNON Mail, Pouch & A |

UNON Mail, Pouch & Archives Unit |

|

11044 |

EOSG Nairobi Office |

UNON Office of Director-General, UNON |

|

11045 |

DPA Nairobi Office S |

UNON Strengthening UN's Conflict Prevent |

|

11046 |

OAJ Nairobi Office |

OAJ Office of Administration of Justice |

|

11055 |

DGACM Nairobi Inform |

DGACM Nairobi Information Technology Uni |

|

11059 |

DGACM Nairobi Interp |

DGACM Nairobi Interpretation Section |

|

11083 |

STP Nairobi UNIC |

STP Nairobi UNIC |

|

11084 |

STP Nairobi Visitors |

STP Nairobi Visitors' Service Nairobi |

|

11085 |

OIOS Nairobi Interna |

OIOS Nairobi Internal Audit, Nairobi |

2.4.6 Business Area

A Business Area is a classification of UN entities operating in Umoja. It includes: Peacekeeping Missions (P series), Special Political Missions (M series), UN Secretariat (S series) and Funds and Programs (F series).

Business Area is mandatory in every financial transaction executed in Umoja. It can be derived from the Cost Center for postings that have an income statement line. For postings that do not have an income statement line, the Business Area must be entered manually.

Example:

The Business Area for UNHQ is S100; HQ treasury is S101; UNON is S300; OCHA field offices is S200; UNHABITAT is F200; UNEP is F300; UNIFIL is P003; UNTSO is M001.

2.4.7 Functional Area

A Functional Area provides a programmatic view of the UN as well as a budgetary view by Budget Section (Non Peacekeeping) or Component (Peacekeeping); it classifies revenues and expenditures of the organization by component. The Cost Center master record indicates the corresponding Functional Area related.

Example: Functional areas

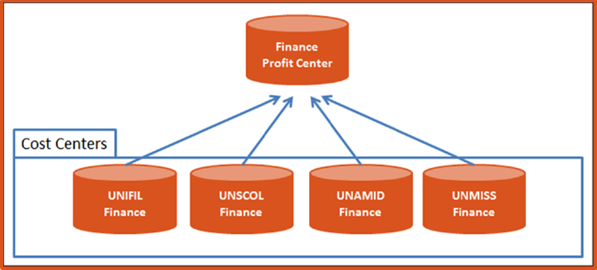

2.4.8 Profit Center

A Profit Center is a business function in Umoja. It represents an attribute to cost objects such as Cost Center, Internal Order and WBSE, that allows reporting of costs by a business function. In areas with revenue producing activities, the Profit Center represents a product or service line.

Profit center can be viewed using transaction code (T-code) KCH3.

Example:

A report of the Profit Center 'Finance' allows the user to selectively view all Cost Centers at the UN that are categorized as a 'Finance' Cost Center. This provides the user with another way to view information.

2.5 Document Types

There are four categories of GL document types:

i) Original documents

· Includes document created manually by GL Users directly into the GL ledger and approved through workflow and system generated documents posted automatically.

· Support documents are to be attached to original GL documents manually created by GL User.

ii) Follow on documents

· Consists of clearing document created manually by GL Users without workflow approval and system generated clearing documents through the schedule F.13 batch.

· No support documents are expected to be attached.

iii) Interfaced documents

· GL documents created by an interface are created with status 'posted'.

· No supporting documents are expected to be attached.

· Documents will come through:

o Grants Management (GM) when indirect support cost (IDC or PSC) is calculated to charge internal Umoja entities;

o Controlling (CO) when cost allocations are done to charge internal Umoja entities.

iv) Converted documents

· Document type is X3.

· Posted by the conversion program.

· No supporting documents attached.

|

Type |

Name |

Document Number Range |

Description |

Workflow Routing in FI Module |

Typical posting schemes |

|

Original Documents |

|||||

|

SA |

GL Acct Document (JV) |

11 |

Journal entry created with FV50 or ZGLDOCLOAD. Clearing documents created with F-03 or F.13. |

TEA -> DB1

TEA = Data Entry Agent DB1 = Approving Officer |

Any GL account that is not Reconciliation or Post Automatically |

|

SF |

19401010 Clearing |

11 |

Journal entry created with FV50 by the Asset Accounting Senior User. |

Dr Donating Exp - Sending Fund Cr Donation Rev - Receiving Fund Dr 19401010 - Receiving Fund Cr 19401010 - Sending Fund |

|

|

SM |

Memo Document |

97 |

Memo documents are posted to a range of GL accounts that are excluded from financial statements. |

Dr 88XX Memo Asset or Liab or Rev Cr 88XX Memo Asset or Liab or Rev Contra |

|

|

SD |

Appendix D |

11 |

Appendix D program calculates and post expense in eligible funds and revenue in Appendix D fund. |

No workflow. Posted immediately by Appendix D program. |

Dr Expense in eligible fund Cr Revenue in Appendix D fund Dr Cash Pool Appendix D fund Cr Cash Pool eligible fund |

|

SL |

Revaluation Doc |

14 |

Revaluation program for GL accounts identified as 'monetary' under IPSAS |

No workflow. Posted immediately by Revaluation program. |

Dr/Cr Reval Accounts (B/S) Dr/Cr 79601010 Unrealized FX gain/loss |

|

SR |

Recurring Doc |

12 |

Recurring document automatically created by F.81. |

No workflow. Posted by Senior FI User with F.81 batch. |

Any GL account that is not Reconciliation or Post Automatically. |

|

SZ |

Accrual |

13 |

To record statistical accruals. |

No workflow if posted with FBS1. If posted with FV50: TEA -> DB1 TEA = Data Entry Agent DB1 = Approving Officer |

Any GL account that is not Reconciliation or Post Automatically. |

|

UJ |

UNDP JV Entry |

11 |

Document generated for inter-agency transactions with UNDP |

TEA -> DB1

TEA = Data Entry Agent DB1 = Approving Officer |

Refer to section 3.2.5 of Chapter on Accounts Payable |

|

S1 |

Special Period 13 |

11 |

For year-end closing purpose |

TEA -> DB1

TEA = Data Entry Agent DB1 = Approving Officer |

Any GL account that is not Reconciliation or Post Automatically. |

|

S2 |

Special Period 14 |

11 |

|||

|

S3 |

Special Period 15 |

11 |

|||

|

S4 |

Special Period 16 |

11 |

|||

|

Follow on Documents |

|||||

|

SC |

GL Acct Document (JV) |

11 |

Clearing documents created with F-03 or F.13. |

No workflow. Posted immediately by GL User or F.13 batch. |

|

|

Documents interfaced into accounts GL module |

|||||

|

AA |

Asset Posting |

41 |

Asset capitalization, asset transfer, asset disposition. |

No workflow. Posted immediately by asset accountant. |

Dr/Cr Asset Dr/Cr Donation Rev/19401010/Sale Rev |

|

AF |

Depreciation Pstngs |

42 |

Asset depreciation and impairment. |

Dr Deprec/Impair Expense Cr Accum Depre/Accum Impair |

|

|

SI |

Grant Indirect Cost |

16 |

IDC program automatically calculates and post IDC (PSC) costs. |

No workflow. Posted immediately by IDC program. |

Dr Expense in eligible fund Cr Revenue in PSC fund Dr Cash Pool PSC fund CR Cash Pool eligible fund |

|

SO |

CO-FI Real Time Doc |

15 |

Cost allocations generated in CO ledger are automatically posted in FI in real time without workflow approval |

No workflow. Poste by CO allocation program. |

Dr Expense - Requesting fund Cr Expense - Providing fund |

|

SS |

CO StatCorrection 86 |

90 |

No workflow. |

Only expense GL accounts |

|

|

ST |

UN Treasury JV entry |

17 |

To record bank transfers. |

No workflow. Posted by Cashier UNHQ. |

Cr Bank clearing 17 - sending bank Dr Bank clearing 17 - receiving bank |

|

ZA |

Average daily balance |

17 |

ADC program automatically calculates and post interest. |

No workflow. |

Cr Revenue - Participant Dr Expense -64VQA |

|

ZZ |

Cash Pool OIM Posting |

17 |

Balancing entry with cash pool lines automatically created by stystem. E.g. FEBAN/F-28 where we Dr Customer in 20OLA and credit bank clearing/unapplied cash in 64VQA. |

No workflow. |

Dr Cash Pool - Fund 1 Cr Cash Pool - Fund 2 |

|

Converted Documents |

|||||

|

X3 |

GL Conversion |

78 |

X3 |

Posted by conversion program. |

Dr/Cr Conversion Account Dr/Cr Any B/S GL Account no recon or post auto |

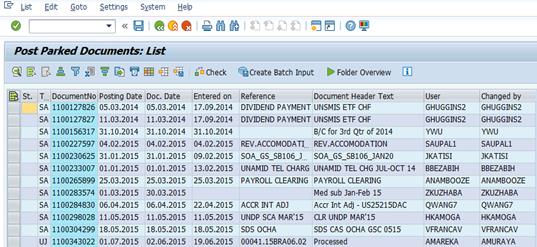

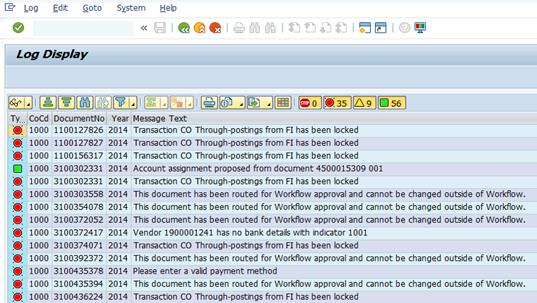

In Umoja the document status is not linked to the workflow status, thus to know what action is needed to complete a document, a combination of the document status and the workflow status needs to be considered.

Below are document statuses for FI documents, Earmarked Funds documents and FM redeployments:

|

GL Documents Status |

GL Document Type |

Comment |

|

1. Save Parked Document |

SA, SF, SM |

· Document is saved/parked without edit or budget check · No FM document created · Workflow is not triggered · Any GL User can retrieve and modify the document |

|

2. Save as Completed |

SA, SF, SM |

· Edit and budget checks are completed · If real commitment item is used, an FM document is posted in FM ledger · Document is submitted in workflow and cannot be changed outside of workflow |

|

3. Posted |

All GL document types |

· When a document is reversed, it remains posted. A new document with the same document type is posted to offset the original document. |

The following illustrates the possible combinations for GL account documents:

|

Description |

Doc Type |

Document Status |

Workflow Status |

Comment |

|

Journal Entries |

SA, SF, SM |

Parked |

Not submitted in workflow |

Not submitted in workflow |

|

Parked-Save as Completed |

In Progress with DB1 or TEA |

DB1 = Approving Officer TEA = AP User |

||

|

Posted |

Completed |

Completed |

Note: All parked documents in FI and FM need to be cleared at month end.

· It is the responsibility of the mission/local office to ensure there are no parked documents at month end.

· It is the responsibility of UNHQ to ensure there are no parked documents in a period before the period is closed.

2.6 Enterprise Roles Involved in General Ledger

|

Enterprise Role |

T-code |

Activity |

|

GL User |

FV50 |

Create journal entries (JVs) |

|

F-03 |

Clearing of OIM GL accounts |

|

|

FBV2 |

Change parked GL documents |

|

|

FBRA |

Reset and reverse GL documents (does not include AR and AP documents) |

|

|

FB08 |

Reverse GL documents (does not includes AR and AP documents) |

|

|

FEBAN |

Bank reconciliation |

|

|

FF.6 |

Display bank statement |

|

|

ZGLDOCLOAD |

Upload file to create multiple AR documents |

|

|

ZAPUNDPSCAUP |

Upload UNDP SCA file |

|

|

GL Approver |

FBRA |

Reset and reverse GL documents (does not include AR and AP documents) |

|

FB08 |

Reverse GL documents (does not includes AR and AP documents) |

|

|

SBWP |

Workflow inbox |

|

|

F-03 |

Clearing of OIM GL accounts |

|

|

FBCJ |

Can display cash journal |

|

|

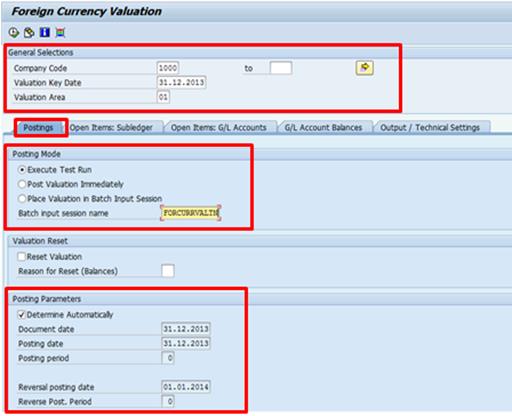

GL Closing User |

FAGL_FC_VAL |

Month end IPSAS revaluation of monetary items |

|

ZGL_APPENDIXD |

Trigger appendix D calculation and postings |

|

|

FAGLF101 |

Month end (or year end) reclassification of AR credit balance and AP debit balances, current to non-current |

|

|

F.81 |

Reversal of accrual documents created with FBS1 |

|

|

F.14 |

Posting of recurring documents |

|

|

F.80 |

Mass reversal of GL documents |

|

|

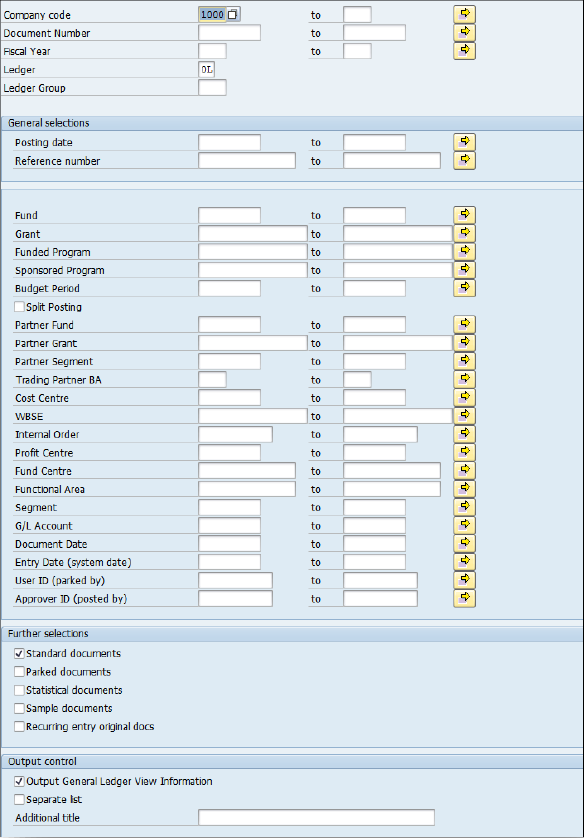

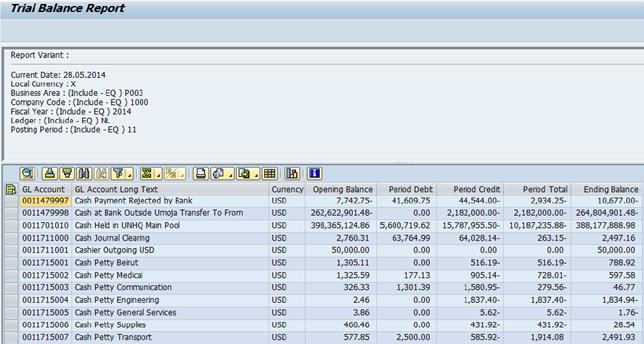

All finance users |

ZGLTRIALBAL |

Custom trial balance by fund, bus area, grant or segment |

|

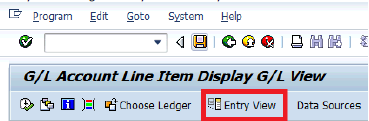

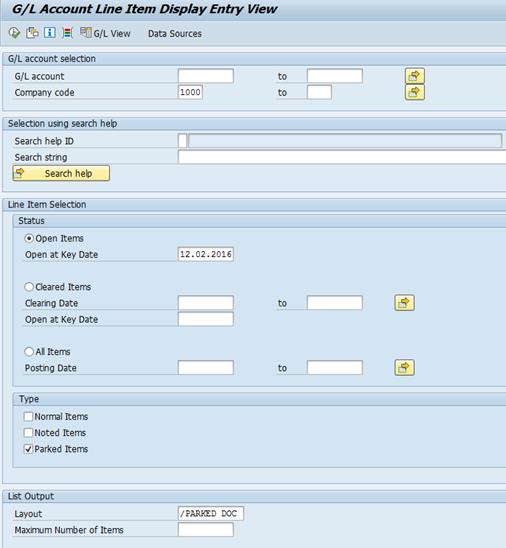

FAGLL03 |

Standard account listing report |

|

|

ZGL_JOURNAL_ENTRY |

Custom report for see full journal entries |

3 General Ledger (GL) Processes

In Umoja, the Financial Accounting (FI) module captures UN's business transactions in a manner that satisfies external reporting requirements. A consolidated list of all Umoja General Ledger accounts is stored in the system's Chart of Accounts. Budget-relevant transactions are recorded in a separate budgetary ledger in the FM module, parallel to the General Ledger.

The General Ledger processes walk through the steps followed to process General Ledger documents from the following originating sources:

1 Document upload

2 Manual Entry

3 Open Item Managed (OIM) GL accounts

Depending on the general ledger accounts affected, the appropriate associated modules, Funds Management (FM), Grants Management (GM) and Controlling (CO) will be updated.

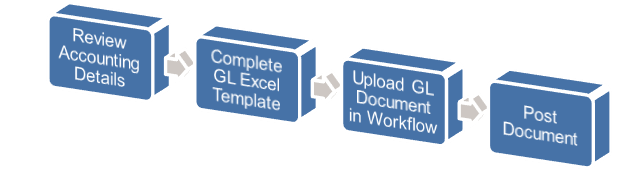

3.1 Document Upload

Where a journal has many lines to be recorded, a journal voucher upload may be used (such as an upload from a spreadsheet). Following steps should be followed by the GL Accounting User to upload a journal voucher:

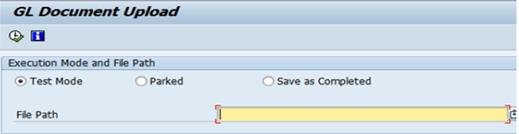

A. Document upload / Transaction Code: ZGLDOCLOAD

A.1. Enter ZGLDOCLOAD in the Command field and press Enter.

A.2. Select the Execution Mode: Test Mode, Parked or Save as Completed.

A.3. Provide the File Path to where the GL upload file is located.

A.4. Click on the Execute button. If the Execution Mode is Save as Completed, it will automatically go through workflow approval process.

3.2 Manual General Journals

The Manual Entry process is used to create journal entries directly in Umoja. However, the process differs depending on the type of transaction executed. A few examples of manual journal documents are accrual entries, reversal entries and recurring entries.

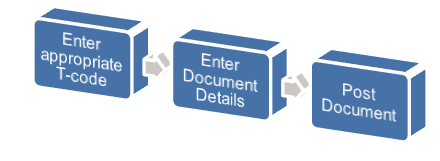

The process followed to execute a manual entry in Umoja is outlined below:

There are four types of manual entry processes that are mainly used:

|

Type |

Transaction Code (T-code) |

Process Reference |

|

One-Time Entry |

FV50 |

|

|

Reversing Entry |

FB08 |

|

|

Accrual Entry |

FBS1 and F.81 |

|

|

Recurring Entry |

FBD1 or F.14 |

3.2.1 One Time Entry

The GL Document workflow represents the two step process (creator/approver) and will be used for submission, review and approval of one-time GL entry documents. This section gives detail to the first step of the workflow process which is creating a journal voucher document up to submitting the document to be reviewed and approved through the workflow.

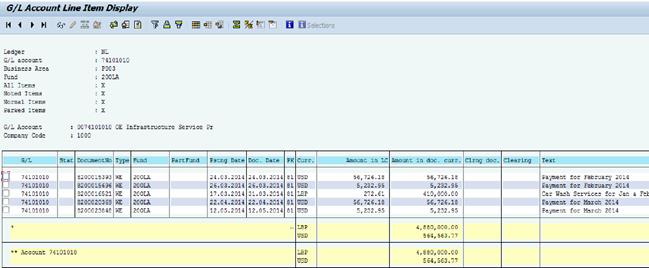

For illustration purpose, below are step by step instructions to reclassify an expense from one GL account (i.e. 74191070) to another GL account (i.e. 74191060).

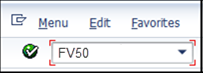

B. Create a parked document (journal voucher) / Transaction Code FV50

B.1. Enter FV50 in the Command field.

B.2. Click the Enter icon à the Park G/L Account Document: Company Code 1000 screen appears.

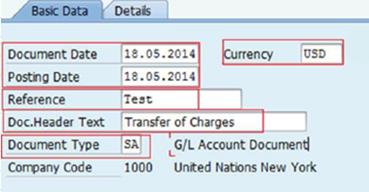

B.3. Enter data in the following fields in the Header section:

· Document Date: date listed on the GL document

· Posting Date: the date that the entry is posted in the GL

· Reference: reference printed on the document received

· Doc.Header Text: entry description

· Currency:

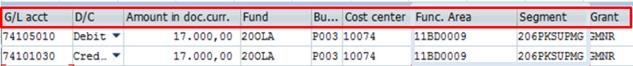

B.4. Enter data for each GL entry in the corresponding column fields.

There are a total of 13 fields that can be populated in the line field of GL Document screen, depending on the type of line item being entered. The following fields are mandatory:

· GL Account

• D/C (Debit/Credit)

• Amount

• Fund

• Business Area

• Cost Center

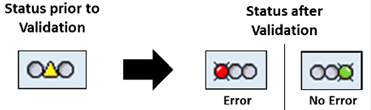

B.5. Click the Enter icon to validate the data added. The status of the GL document will change based on the outcome of the simulation.

B.6. Review the entry for accuracy; update any data that has been identified as incorrect.

B.7.

Click the Simulate ![]() button;

the document view shows the entry as it was entered.

button;

the document view shows the entry as it was entered.

B.8. Click on Document in the navigation bar and select Simulate in General Ledger option. The entry appears as it will post in the General Ledger.

Note: If the above entry is an adjustment entry, GL accounting User is required to enter SU as the document type. In Umoja, this type of document is created to cater all adjustment entries.

B.9.

Click the Save as completed ![]() button.

A document number will be created and the document will be routed to Approving

Officer through Workflow. Refer to section 3.4

for approval process in the workflow.

button.

A document number will be created and the document will be routed to Approving

Officer through Workflow. Refer to section 3.4

for approval process in the workflow.

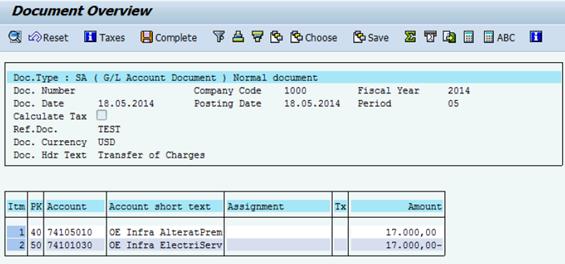

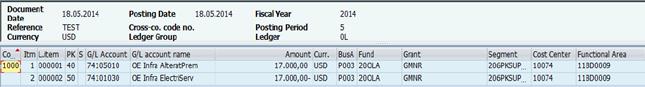

The following is a proforma accounting entry:

|

PK |

GL Acct |

GL Acct Name |

Amout Dr / (Cr) |

Document Currency |

Bus Area |

Fund |

Cost Center |

|

40 |

74105010 |

OE Infra AlteratPrem |

17000 |

USD |

P003 |

20OLA |

10074 |

|

50 |

74101030 |

OE Infra ElectriServ |

(17000) |

USD |

P003 |

20OLA |

10074 |

3.2.2 Reversing Entry

A reversing entry can be performed in Umoja if a journal voucher (JV) was posted erroneously. The following steps are to be followed to reverse a posted GL entry in Umoja. A separate reversal document is created.

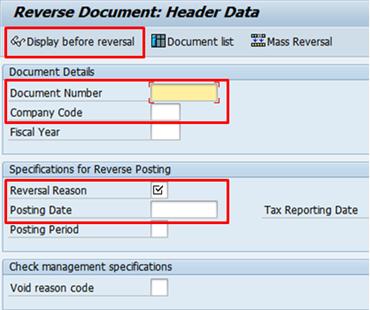

C. Reversal of a posted entry / Transaction Code: FB08

C.1. Enter FB08 in the Command field and press Enter to access the Reversal Document screen

C.2. Enter data in the following fields:

· Document Number: document number to be reversed

· Company Code: 1000

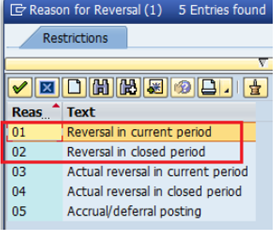

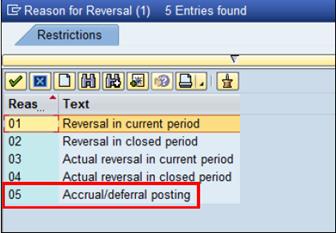

· Reversal Reason:

o Select 01 to reverse the document in the same period as originally posted (January document reversal with January posting date). This will only work only if the original posting period is open

o Select 02 to reverse the document that was posted in a previous period which has been closed in current period (document was posted in January which is closed; the reversal in to be done in current open period)

· Posting Date: as default the system takes current date as posting date

C.3. Click the Display before reversal button to see and confirm original document that is about to be reversed

C.4. Click the Save button to post the reversal document.

C.5. Note the document number generated by the system.

Note:

· Only the Financial Accounting Senior User has the access to execute this transaction. It does not go through a workflow.

· It should be executed after thorough review of the document and circumstances requiring reversal.

· The reversal and original documents should then be amended and text inserted for audit trail.

3.2.3 Accrual Entry

IPSAS requires that all expenses are to be accounted for in the year they are incurred. Accruals serve as a solution as they allow expenses to be posted in the year they are incurred and then reversed once the charges are received in the following period.

The UN records accrual of expenses at year end in order to match costs against revenue in the same financial period. The accruals are recorded when the expenses have been incurred but invoices have yet to be received from the vendors at year end.

Note: This process does not apply to expenses processed through a Purchase Order (PO) which includes processing Service Entry Sheet for services already rendered. When there is a PO, an expense is recognised when goods or a service has been delivered. In recognizing the delivery of goods or services, the system will generate a credit to Account Payable - Goods Receipt GL account.

3.2.3.1 Creating an Accrual Document

Accrual entry does not go through workflow since the entry can only be posted by FI Closing User and FI Senior User.

D.

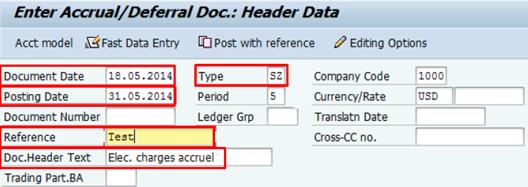

D.1. Note: Using T-code FBS1, GL accounting user is required to enter the document type SZ for accrual entries. In Umoja, this type of document is created to cater all accrual entries.Enter FBS1 in the Command field and lick the Enter icon.

D.2. Enter information in the Enter Accrual/Deferral Doc.: Header Data screen

D.2.1. Header section:

· Document Date: date the document is being processed

· Type: always SZ for accruals.

Note: The SZ document type allows Users to charge expenses in the accrual document without consuming budget.

· Company Code: 1000

· Posting Date: appropriate month end or year-end date

· Period: if necessary

· Currency/Rate

· Reference

· Doc.Header Text: brief description of the accrued expenses

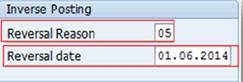

D.2.2. Inverse Posting section:

· Reversal Reason: for accruals, will always be 5

· Reversal date: the first day of the next fiscal period

D.2.3. Line Item section:

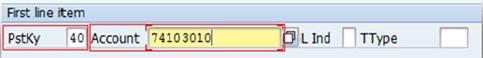

· PstKy (Posting Key): 40 (debit)

· Account: expense GL account

D.2.4. Press Enter key.

D.3. In the Enter Accrual/Deferral Doc. Add G/L account item screen, enter data in the following fields for Item 1.

· Amount

· Business Area

· Cost Center or WBS Element

· Text: description of transaction

D.4.

Click on ![]() button.

button.

D.5. In the pop up window, input:

· Fund

· Grant

D.6. Click Enter to get back to the previous screen.

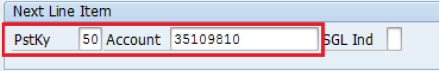

D.7. In Next Line Item section, enter the credit line.

· PstKy: 50 (credit)

· Account: 35109810 (AP - Accrued Expense)

D.8. Click the Enter icon.

D.9. In the Enter Accrual/Deferral Doc. Add G/L account item screen, enter data in the following fields for Item 2.

· Amount

· Fund

· Cost Center, WBSE or Internal Order

· Grant: GMNR if cost object is not WBSE

· Text: description of transaction

D.10. Click

the Overview ![]() button to

display the debit and credit line items.

button to

display the debit and credit line items.

D.11. Once

all entries have been entered, click the Save ![]() button to post

the document. Note the FI document number generated by the system.

button to post

the document. Note the FI document number generated by the system.

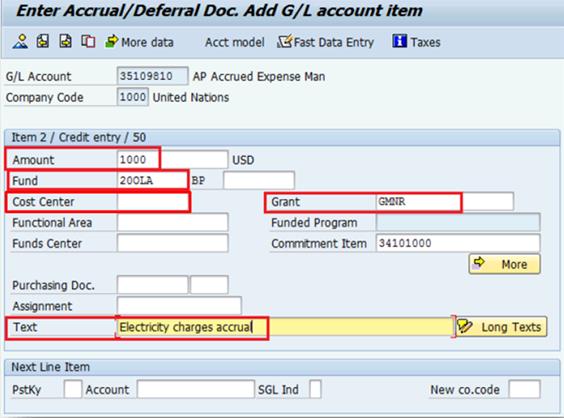

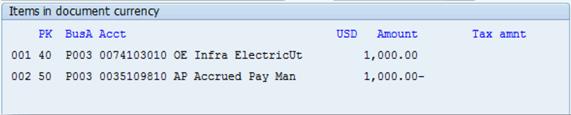

D.12. Following is a proforma accounting entry that will be created:

|

PK |

GL Acct |

GL Acct Name |

Amount Dr / (Cr) |

Document Currency |

Bus Area |

Fund |

Cost Center |

|

40 |

74103010 |

OE Infrastructure Service Utilities Electricity |

1000 |

USD |

P003 |

20OLA |

10062 |

|

50 |

35109810 |

AP Accrued Expense Man |

(1000) |

USD |

P003 |

20OLA |

10062 |

3.2.3.2 Reversing an Accrual Document

Reversal of accrual documents is run centrally through a batch program on the posting date indicated on the Inverse Posting section entered in FBS1 of the individual accrual document. Only authorized User can run the program and unauthorized users are not supposed to process reversals manually.

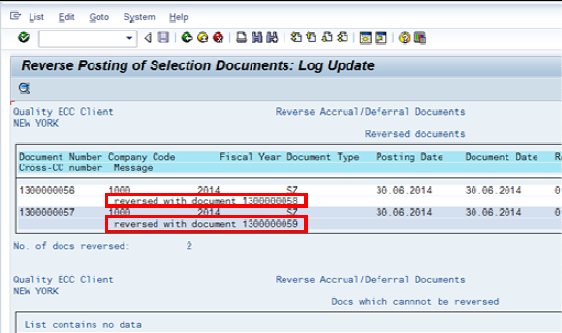

E. Steps to reverse an accrual document using the batch program / Transaction Code: F.81

E.1. Enter F.81 in the Command field and press Enter.

E.2. On the Reverse Accrual/Deferral Documents scree, enter information into the selection criteria:

· Company Code: 1000

· Document Number:

· Document Type:

· Posting Date: original accrual entry posting dates

· Reverse posting date:

· Posting Period:

· Reversal Reason:

E.3. Ensure that the Test Run box in on before clicking on the Execute button.

E.4. Review the log generated. Click the Back icon to exit.

E.5. On the Reverse Accrual/Deferral Documents screen, click the Test Run box to turn off the test mode and hit Execute to initiate the actual run.

E.6. Review the log and noted the document numbers generated for the renewals.

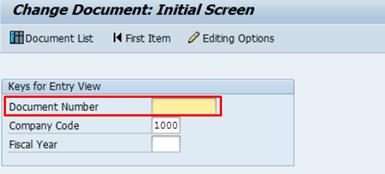

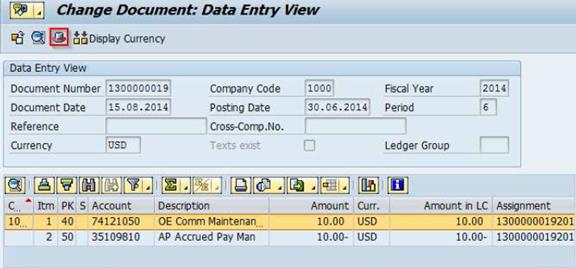

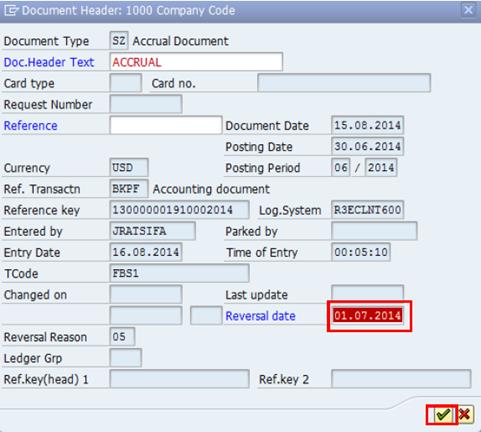

3.2.3.3 Reversing an Incorrectly Posted Accrual Document

F. Steps to reverse an incorrectly posted accrual document / Transaction Code: FB02 and FB08

F.1. Use T-code FB02 to remove the Reversal Date from the original accrual document.

F.2. In the opening screen, enter the accrual document number that posted in error in the Document Number field and press Enter.

F.3. Click on the Display Document Header icon in the Change Document: Data Entry View screen.

F.4. In the open scree, locate the Reversal date field and delete the date.

Note: Reversal Reason cannot be removed.

F.5.

Click on the Continue/Confirm ![]() button à a warning message displays that confirms

the reversal date cancellation. Click the Continue/Confirm button to get

back to the accrual document screen.

button à a warning message displays that confirms

the reversal date cancellation. Click the Continue/Confirm button to get

back to the accrual document screen.

F.6. Save the changes.

F.7. Use T-code FB08 to reverse the amended accrual document. Refer to section 3.2.2 for detailed steps.

3.2.4 Recurring Entry

Recurring entry can be used where identical entries are required to be posted on a periodic basis or on specific future dates (e.g. identical entries can be created for future periods based on the amortization schedule for prepaid items such as education grants). In addition, users will be able to create and save journal entry templates that can used repeatedly to accelerate the processing time and reduce the number of input errors.

The process followed to create a recurring entry is comprised of 2 key steps:

1. Create: First, the entry itself must be created and saved. The saved template will be used to post the information on a recurrent basis without the need to manually re-enter the data into Umoja

2. Post: Once the template has been created and saved, the posting will be executed as a normal part of period end closing for all recurring entries created in the system.

3.2.4.1 Creating a Recurring Document

For illustration purpose, below are step by step instructions to set up a recurring entry debiting GL 74101010 and crediting GL 74101020.

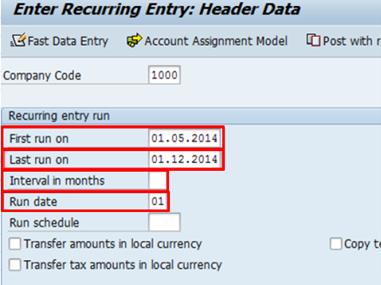

G. Steps to create the recurring entry document / Transaction Code: FBD1

G.1. Enter FBD1 in the Command field and click Enter à the Enter Recurring Entry screen opens.

G.2. In the Recurring entry run section, enter data into the following fields:

· First run on: denotes when the transaction will be executed for first time

· Last run on: date after which transaction should not be executed

· Interval in months: frequency of transaction

· Run date: which date of the month document should post

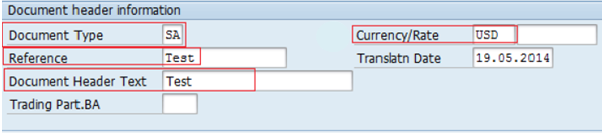

G.3. In the Document header information and First line item sections, enter data into the following fields:

Document header information section:

· Document Type: SA

· Currency/Rate:

· Reference: Recurring entries

· Document Header Text:

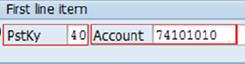

First line item section:

· PstKy: 40 for Debit

· Account: 74101010

Note: For vendor payment, input vendor account in the Account field and Document Type 'KE' (for EMF).

G.4. Click the Enter icon à the Enter Recurring Entry Add G/L account item screen appears

G.5. In the Item 1 section, enter data in the following fields:

· Amount:

· Tax code: if required

· Business Area:

· Cost Center:

· Text:

G.6.

Click on ![]() button

à

In the Coding Block window, enter data in the following fields:

button

à

In the Coding Block window, enter data in the following fields:

· Fund:

· Grant:

· Earmarked Funds: if applicable

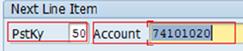

G.7. Hit Enter to go back to previous screen

G.8. In the Next Line Item section, enter:

· PstKy: 50 for Credit

· Account: 74101020

G.9. Hit Enter à the Enter Recurring Entry Add G/L account item screen appears

G.10. Input the relevant data for Item 2 (credit side) and Post the document.

Note: The recurring entry will be posted as part of period end process.

G.11. If the recurring entries are set up correctly, system will give the message: 'Document number 99XXXXXXXX was stored in Company Code 1000'

3.2.4.2 Setting Recurring Entry for Multiple Documents

H. Steps to set recurring entry for multiple documents / Transaction Code: F.14

H.1. Enter F.14 in the Command field and click Enter

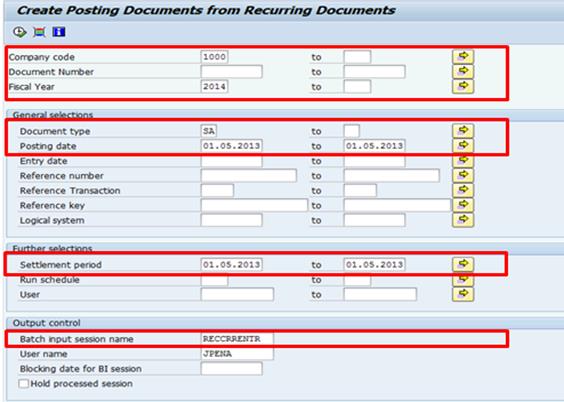

H.2. In the Create Posting Documents from Recurring Documents screen, enter data in the following fields:

• Company Code: 1000

• Document Number: Nil (Considers all recurring entries)

• Fiscal Year:

• Document type: SA

• Settlement period:

• Batch input session name: RECRRENTR

3.2.4.3 Running Recurring Document

I. Steps to process recurring entry session / Transaction Code: SM35

I.1. Enter SM35 in the Command field and press Enter

I.2. Select the Batch input session name

I.3. Choose the Process button

Note: To display the recurring documents posted use T-code: FB03

3.3 Review of Open Item Managed (OIM) GL Accounts

OIM GL accounts require daily monitoring to ensure items are cleared on an ongoing basis and no back log accumulate, as this would create unnecessary distraction at month end and would slow down the closing process.

The following looks at specific OIM GL accounts and how they should be reviewed.

3.3.1 Cash Payment Rejected by Bank - GL 11479997

When the balance of this GL account is not zero, it must represent payments rejected by the bank that have not yet been reissued by the UN. Below are the process steps to follow in clearing the account.

|

11479997 |

Cash Payment Rejected by Bank |

||||||||||

|

|

|

||||||||||

|

Step 1 |

When the bank reconciler sees a rejected payment on the bank statement, records the following through FEBAN: |

||||||||||

|

FEBAN |

DZ |

Dr |

11XXXX1X |

Bank Clearing Account |

64VQA |

S101 |

|||||

|

|

|

Cr |

11479997 |

Cash Payment Rejected by Bank |

Your fund |

Your Bus Area |

|||||

|

|

|

|

|

|

|

|

|||||

|

Step 2 |

When payment is reissued through FV60, we record: |

||||||||||

|

FV60 |

KH |

Dr |

11479997 |

Cash Payment Rejected by Bank - match assignment |

Your fund |

Your Bus Area |

|||||

|

|

|

Cr |

Vendor |

Accounts Payable |

Your fund |

Your Bus Area |

|||||

|

|

|

|

|

|

|

|

|||||

|

Step 3 |

F.13 batch runs and clears the Debit and Credit in 11479997 with the same assignment |

||||||||||

|

F.13 |

|

|

|

|

|

|

|||||

3.3.2 Cash Journal Clearing - GL 11711000

When the balance of this GL account is not zero, it must represent cash in transit no yet received by the cash custodian (petty cash, imprest or cashier's imprest). Below are the steps in cash replenishment process.

|

11711000 |

Cash Journal Clearing |

|||||||||

|

|

|

|

|

|

|

|

||||

|

Step 1 |

When you replenish: |

|||||||||

|

FV60 |

KH 31xx |

Dr |

11711000 |

Cash Journal Clearing |

Your fund |

Your Bus Area |

||||

|

|

|

Cr |

Vendor = Custodian |

Your fund |

Your Bus Area |

|||||

|

|

|

|

|

|

|

|

||||

|

Step 2 |

When Cash custodian receives cash wit Business Transaction Cash Receipt from Bank |

|||||||||

|

FBCJ |

ZC, ZI, ZP |

Dr |

Cash Journal |

|

Your fund |

Your Bus Area |

||||

|

|

|

Cr |

11711000 |

Cash Journal Clearing - match assignment |

Your fund |

Your Bus Area |

||||

|

|

|

|

|

|

|

|

||||

|

Step 3 |

F.13 batch runs and clears the Debit and Credit in 11711000 with the same assignment. |

|||||||||

|

F.13 |

|

|

|

|

|

|

||||

3.3.3 Invoice Reduction Clearing - GL 19901010

The balance in this GL account should be zero at all time since the debit and credit lines are system generated and automatically cleared. No manual entries should be posted to this GL account.

|

19901010 |

Invoice Reduction Clearing |

||||||||||

|

|

|

|

|

|

|

|

|||||

|

Step 1 |

When the invoice has an amount higher than the Goods Receipt, invoice is recorded as part of MIR7 document: |

||||||||||

|

MIR7 |

RE 51xx |

Cr |

Vendor - full invoice amount (overstated amount) |

Your fund |

Your Bus Area |

||||||

|

|

|

Dr |

35401010 |

GR-IR (actual amount received) |

Your fund |

Your Bus Area |

|||||

|

|

|

DR |

19901010 |

Invoice Reduction Clearing |

Your fund |

Your Bus Area |

|||||

|

|

|

|

|

|

|

|

|||||

|

MIR7 |

KG 32xx |

Automatically created at the same time as MIR7 RE document |

|||||||||

|

|

|

Dr |

Vendor - amount of the reduction |

Your fund |

Your Bus Area |

||||||

|

|

|

Cr |

19901010 |

Invoice Reduction Clearing - Automatic Clearing |

Your fund |

Your Bus Area |

|||||

3.3.4 Accrued Expense Man - GL 35109810

Accruals originating from conversion (doc type X3)

These types of accruals are cleared with invoices and journal entries (JVs).

|

35109810 |

Accrued Expense Man |

|||||||||||

|

|

|

|

|

|

|

|

||||||

|

Converted Documents: |

|

|

|

|

|

|||||||

|

Step 1 |

X3 78xx |

Dr |

19991010 |

SAP Conversion Account |

Your fund |

Your Bus Area |

||||||

|

Conversion |

|

Cr |

35109810 |

Accrued Expense Man |

Your fund |

Your Bus Area |

||||||

|

|

|

|

|

|

|

|

||||||

|

Step 2 |

KE, KR, KH |

Dr |

35109810 |

Accrued Expense Man - Matched Assignment |

Your fund |

Your Bus Area |

||||||

|

FV60 |

|

Cr |

Vendor |

|

Your fund |

Your Bus Area |

||||||

|

|

|

|

|

|

|

|

||||||

|

Step 3 |

SA |

Dr |

35109810 |

Accrued Expense Man - Matched Assignment |

Your fund |

Your Bus Area |

||||||

|

FV50 |

|

Cr |

69401010 |

Refund of PY Expenditures |

Your fund |

Your Bus Area |

||||||

|

|

|

|

|

|

|

|

||||||

|

Step 4 |

F.13 batch runs and clears the Debit and Credit in 35109810 with the same assignment. |

|||||||||||

|

F.13 |

|

|

|

|

|

|

||||||

Post conversion accruals

Accruals created with FBS1 are reversed automatically and are automatically cleared upon reversal.

|

35109810 |

Accrued Expense Man |

|||||||||

|

|

|

|

|

|

|

|

||||

|

Accruals Post Conversion: |

|

|

|

|

||||||

|

Step 1 |

SZ 13xx |

Dr |

Expense |

|

Your fund |

Your Bus Area |

||||

|

FBS1 |

|

Cr |

35109810 |

Accrued Expense Man |

Your fund |

Your Bus Area |

||||

|

|

|

|

|

|

|

|

||||

|

Step 2 |

SZ 13xx |

Dr |

35109810 |

Accrued Expense Man - Automatic Clearing |

Your fund |

Your Bus Area |

||||

|

F.81 |

|

Cr |

Expense |

|

Your fund |

Your Bus Area |

||||

|

In the following period |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

Step 3 |

F.13 batch runs and clears the Debit and Credit in 35109810 with the same assignment |

|||||||||

|

F.13 |

|

|

|

|

|

|

||||

3.3.5 Accrued Discount Clearing - GL 35109910

Entries to this GL account are system generated and are cleared automatically. There should be no manual postings to this GL account. If the balance of this GL account is not zero, it must represent discounts available on invoices not yet paid.

|

35109910 |

AP Accrued Discount Clearing |

||||||

|

|

|

|

|

|

|

|

|

|

Step 1 |

RE, KE, KR, KH |

Cr |

Vendor (full invoice amount) |

Your fund |

Your Bus Area |

||

|

MIR7 or FV60 |

|

Dr |

35401010/7xxxxx |

GR-IR or Expense (full amount received) |

Your fund |

Your Bus Area |

|

|

|

|

Dr |

35109910 |

Accrued Discount Clearing |

Your fund |

Your Bus Area |

|

|

|

|

Cr |

Expense |

Amount of discount |

Your fund |

Your Bus Area |

|

|

|

|

|

|

|

|

|

|

|

Step 2 |

KZ |

Dr |

Vendor (full invoice amount) |

Your fund |

Your Bus Area |

||

|

FPRL_LIST |

|

Cr |

Bank clearing (amount net of discount taken) |

64VQA |

S101 |

||

|

|

|

Cr |

35109910 |

Accrued Discount Clearing - Automatic Clearing |

Your fund |

Your Bus Area |

|

|

|

|

Dr |

11701010 |

Cash MAIN Pool |

64VQA |

S101 |

|

|

|

|

Cr |

11701010 |

Cash MAIN Pool |

Your fund |

Your Bus Area |

|

3.3.6 Cash Payment Clearing - GL 35109920

If the balance of this GL account is not zero, it must represents invoices or down payments that are due to be paid in cash by the Cashier. All open items in this GL account should be short term.

|

35109920 |

AP Cash Payment Clrg |

|||||||||

|

|

|

|

|

|

|

|

||||

|

Step 1 |

When you pay an invoice or an advance in cash via the Cash Journal, you MUST select payment method Y and complete F110/FPRL_LIST |

|||||||||

|

FPRL_LIST |

KY 35xx |

Dr |

Vendor with SP GL |

Your fund |

Your Bus Area |

|||||

|

|

|

Cr |

35109920 |

AP Cash Payment Clrg |

Your fund |

Your Bus Area |

||||

|

|

|

|

|

|

|

|

||||

|

Step 2 |

When Cashier/Imprest pay advance with Business Transaction Payment on Clearing Account |

|||||||||

|

FBCJ |

ZC, ZI, ZP |

Dr |

35109920 |

AP Cash Payment Clrg - Matched Assignment |

Your fund |

Your Bus Area |

||||

|

|

|

Cr |

Cash Journal |

Your fund |

Your Bus Area |

|||||

3.3.7 AP Exch Goods Receipts Payable GR-IR - GL 35401010

Open items in this GL account represents either:

a. Goods/services received without an invoice received (credit)

b. Goods/service returned to vendor without a credit memo (debit)

|

35401010 |

AP Exch Goods Receipt Payable GRIR |

|||||||||||

|

|

|

|

|

|

|

|

||||||

|

NORMAL |

|

|

|

|

|

|

||||||

|

Step 1 |

When Goods Receipt is done with Movement Type 101 |

|||||||||||

|

MIGO |

WE 82xx |

Dr |

77XX or 74XX |

Expense is determined by Product Category |

Your fund |

Your Bus Area |

||||||

|

|

|

Cr |

35401010 |

AP Exch Goods Receipt Payable GRIR |

Your fund |

Your Bus Area |

||||||

|

|

|

|

|

|

|

|

||||||

|

Step 2 |

When MIR7 Invoice is recorded |

|||||||||||

|

MIR7 - invoice |

RE 51xx |

Dr |

35401010 |

AP Exch Goods Receipt Payable GRIR |

Your fund |

Your Bus Area |

||||||

|

|

|

Cr |

Vendor = Commercial Vendor |

Your fund |

Your Bus Area |

|||||||

|

|

|

|

|

|

|

|

||||||

|

************************************************************************************************************ |

||||||||||||

|

|

|

|

|

|

|

|

||||||

|

Variant A: |

GOODS RETURNED |

|||||||||||

|

Step 1 |

When Goods Return is done with Movement Type 122 |

|||||||||||

|

MIGO |

WE 82xx |

Cr |

77XX or 74XX |

Expense is determined by Product Category |

Your fund |

Your Bus Area |

||||||

|

|

|

Dr |

35401010 |

AP Exch Goods Receipt Payable GRIR |

Your fund |

Your Bus Area |

||||||

|

|

|

|

|

|

|

|

||||||

|

Step 2 |

MIR7 Credit Note is done for value of Movement Type 122 |

|||||||||||

|

MIR7 - credit memo |

RE 51xx |

Cr |

35401010 |

AP Exch Goods Receipt Payable GRIR |

Your fund |

Your Bus Area |

||||||

|

|

Dr |

Vendor = Commercial Vendor |

Your fund |

Your Bus Area |

||||||||

3.3.8 AP Exch Goods Receipts Payable GR-IR - Conversion - GL 35401014

Converted open items in this GL account represents accrued liabilities for goods/services received prior to conversion for which an invoice was not received before the conversion. When an invoice is received after conversion, the invoice should be processed with FV60 and should debit this GL account with the same assignment as the converted document.

When the invoice has a different amount than the converted document (doc type X3), the difference should be recorded with a journal entry (JV) with the same assignment as the X3 document and with an offset to either Refund of PY Expenditures (for credit) or expense (debit).

|

35401014 |

AP Exch Goods Receipt Payable GRIR - Conversion |

|||||||||||

|

|

|

|

|

|

|

|

||||||

|

Converted Documents: |

||||||||||||

|

|

X3 |

Dr |

19991010 |

SAP Conversion Account |

Your fund |

Your Bus Area |

||||||

|

|

|

Cr |

35401014 |

GR-IR Conversion |

Your fund |

Your Bus Area |

||||||

|

|

|

|

|

|

|

|

||||||

|

Step 1 |

RE, KE, KH, KR |

Dr |

35401014 |

GR-IR Conversion - Matched Assignment |

Your fund |

Your Bus Area |

||||||

|

FV60-Create AP Doc |

|

Cr |

Vendor |

|

Your fund |

Your Bus Area |

||||||

|

|

|

|

|

|

|

|

||||||

|

Step 2 |

SA |

Dr/Cr |

35401014 |

GR-IR Conversion - Matched Assignment |

|

|

||||||

|

FV50-Adj for difference |

|

Cr |

69401010 |

Refund of PY Expenditures OR |

|

|

||||||

|

|

Dr |

7xxxxxxx |

Expense |

|

|

|||||||

3.3.9 Progen Payroll Net Pay Clearing - GL 35591010

The balance of this GL account should be zero at month end.

|

35591010 |

Progen Payroll Net Pay Clearing |

||||||||||

|

|

|

|

|

|

|

|

|||||

|

Progen Interface |

|||||||||||

|

Step 1 |

P1 |

Dr |

35591010 |

Progen Payroll Net Pay Clearing |

Your fund |

Your Bus Area |

|||||

|

Interface |

|

Cr |

Vendor = Staff Member |

Your fund |

Your Bus Area |

||||||

|

|

|

|

|

|

|

|

|||||

|

|

P2 |

Optional - P2 is created to clear a recoverable/payable in addition to payroll |

|||||||||

|

|

|

Dr/Cr |

35591010 |

Progen Payroll Net Pay Clearing (Same Assignment) |

Your fund |

Your Bus Area |

|||||

|

|

|

Dr/Cr |

Vendor |

|

Your fund |

Your Bus Area |

|||||

|

|

|

|

|

|

|

|

|||||

|

|

P3 |

Summarized at coding block level |

|||||||||

|

|

|

Dr |

7xxxxxxx |

SB Expenses |

Your fund |

Your Bus Area |

|||||

|

|

|

Cr |

35591010 |

Progen Payroll Net Pay Clearing (Same Assignment) |

Your fund |

Your Bus Area |

|||||

|

|

|

|

|

|

|

|

|||||

|

Step 2 |

F.13 batch runs and clears the Debit and Credit in 35591010 with the same assignment |

||||||||||

|

F.13 |

|

|

|

|

|

|

|||||

3.3.10 Progen Payroll Various Clearing - GL 355910XX

The balance of these GL accounts should be zero at month end.

|

35591020 to 35591070 |

Progen Payroll Clearing Accounts (Others) |

|||||||||||

|

|

|

|

|

|

|

|

||||||

|

Progen Interface |

||||||||||||

|

Step 1 |

P3 |

Cr |

355910xx |

Progen Payroll Clearing Acct-detailed |

Your fund |

Your Bus Area |

||||||

|

Interface |

|

Dr |

35591010 |

Progen Payroll Net Pay Clrg for Staff portion-detailed |

Your fund |

Your Bus Area |

||||||

|

|

|

Dr |

7xxxxxxx |

Expenses for UN portion |

Your fund |

Your Bus Area |

||||||

|

|

|

|

|

|

|

|

||||||

|

Step 2 |

SA |

Dr |

355910xx |

Progen Payroll Clearing Acct-bulk entry |

Your fund |

Your Bus Area |

||||||

|

FV50 |

|

Cr |

19409910 |

IOV-bulk entry |

Your fund |

Your Bus Area |

||||||

|

|

|

|

|

|

|

|

||||||

|

Step 3 |

SC |

Dr |

355910xx |

Progen Payroll Clearing Acct |

Your fund |

Your Bus Area |

||||||

|

F-03 |

|

Cr |

355910xx |

Progen Payroll Clearing Acct |

Your fund |

Your Bus Area |

||||||

3.3.11 AP Unapplied Cash - GL 39201010

The balance of this GL account should be zero at month end. If the balance is not zero, the balance must reflect cash received at the bank that is not identified and applied to a customer or vendor. Below are the process steps to clear the GL account.

|

39201010 |

AP Unapplied Cash |

|||||||||

|

|

|

|

|

|

|

|

||||

|

Step 1 |

DZ |

Incoming Payment |

||||||||

|

FEBAN |

|

Dr |

11XXXX1X |

Bank Clearing Account - EFT In |

64VQA |

S101 |

||||

|

|

|

Cr |

39201010 |

AP Unapplied Cash |

64VQA or your fund |

S101 or your BA |

||||

|

|

|

|

|

|

|

|

||||

|

Step 2 |

DC 25xx |

Dr |

39201010 |

AP Unapplied Cash - Matched Assignment |

64VQA or your fund |

S101 or your BA |

||||

|

F-44/F-32 |

|

Cr |

Customer/Vendor - Matched Assignment |

Your fund |

Your Bus Area |

|||||

|

Doc#1 |

|

|

|

|

|

|

||||

3.3.12 AP Unapplied Cash Journal - GL 39201020

The balance of this GL account should be zero at month end. If the balance is not zero, the balance must reflect cash received by Cashier in cash or cheque that is not identified and applied to a customer or vendor. Below are the process steps to clear the GL account.

|

39201020 |

AP Unapplied Cash Journal |

||||||||

|

|

|

|

|

|

|

|

|||

|

Step 1 |

ZC, ZI, ZP |

Business Transaction: Revenue |

|||||||

|

FBCJ |

|

Dr |

1171XX1X |

Cash Journal |

Your fund |

Your Bus Area |

|||

|

|

|

Cr |

39201020 |

AP Unapplied Cash Journal |

Your fund |

Your Bus Area |

|||

|

|

|

|

|

|

|

|

|||

|

Step 2 |

|

Dr |

39201020 |

AP Unapplied Cash Journal - Matched Assignment |

Your fund |

Your Bus Area |

|||

|

F-44 or |

KC 34xx |

Cr |

Vendor/Customer - Matched Assignment |

Your fund |

Your Bus Area |

||||

|

F-32 |

DC 25xx |

|

|

|

|

|

|||

3.3.13 AR Due to Due From - GL 19401010

Entries to this GL account are automatically generated by the system as the balancing postings when there is a non-budget relevant (statistical) movement of fixed assets or inventory between two funds or grants. Non-budget relevant transfers are also referred to as an internal donation of assets.

Users define budget relevant or non-budget relevant transactions through the use of Movement Types in the Inventory or Fixed Assets Management module which will affect the GL use in the balancing posting.

Clearance of this account needs to be done by the Senior Asset Accountant role.

|

19401010 |

AR Due to Due From |

||||||

|

|

|

|

|

|

|

|

|

|

Step 1 |

When fixed asset or inventory is being transferred between two funds or grants |

||||||

|

Fixed Asset Module or |

|

Dr |

Fixed Asset / Inventory |

Fund 1 |

Bus Area 1 |

||

|

Inventory Module |

|

Cr |

Fixed Asset / Inventory |

Fund 2 |

Bus Area 2 |

||

|

|

|

Dr |

19401010 |

AR Due To Due From |

Fund 2 |

Bus Area 2 |

|

|

|

|

Cr |

19401010 |

AR Due To Due From |

Fund 1 |

Bus Area 1 |

|

|

|

|

|

|

|

|

|

|

|

Step 2 |

To clear the GL account, document type SF must be selected |

||||||

|

FV50 |

SF |

Dr |

79691020 |

Internal Donation of Fixed Asset/Inventory |

Fund 1 |

Bus Area 1 |

|

|

|

|

Cr |

69101030 |

NSP Internal Donation of Fixed Asset/Inventory |

Fund 2 |

Bus Area 2 |

|

|

|

|

Dr |

19401010 |

AR Due To Due From |

Fund 1 |

Bus Area 1 |

|

|

|

|

Cr |

19401010 |

AR Due To Due From |

Fund 2 |

Bus Area 2 |

|

|

|

|

|

|

|

|

|

|

|

Step 3 |

Clear the documents posted to the 19401010 GL account. |

||||||

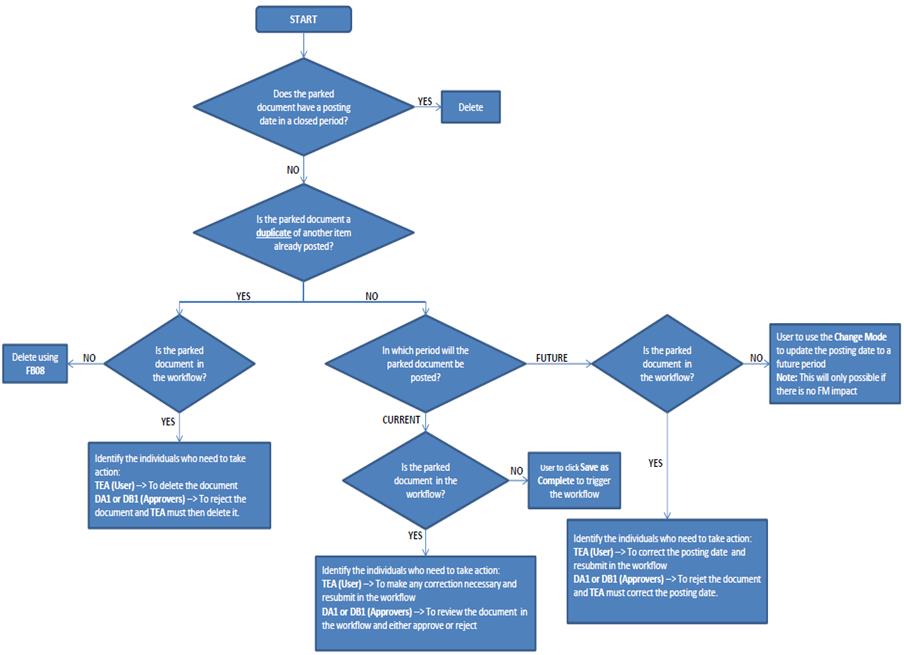

3.4 Workflow Approval

Workflows are used to forward financial documents for review to the appropriate approvers. Documents created by the Financial Accounting User are subject to workflow approval before they can be posted. Whereas Financial Accounting Senior User is able to create GL documents, such as accruals, reversals and recurring entries that are not subject to workflow approval.

3.4.1 Review Document in Workflow

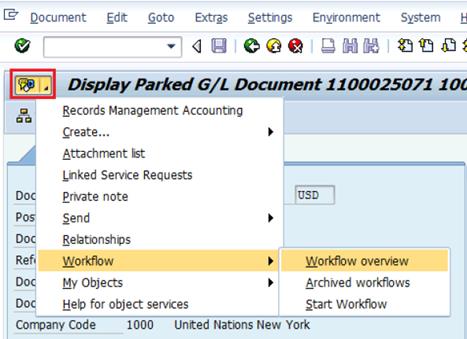

Once the document is in workflow, it cannot be amended until the time Approving Officer has either approved or rejected it. However, workflow for parked documents can be viewed using T-code FB03.

J. Review workflow for parked documents / Transaction Code: FB03

J.1. Enter FB03 in the Command field to bring up Display Document screen.

J.2. Enter the document number and press Enter.

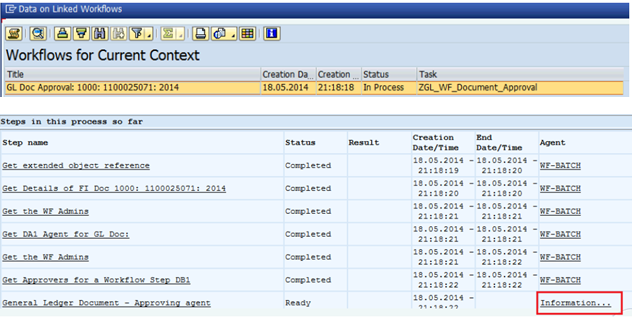

J.3. On the selected document screen, select Workflow overview to see which approving office can approve the document

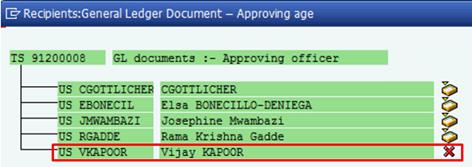

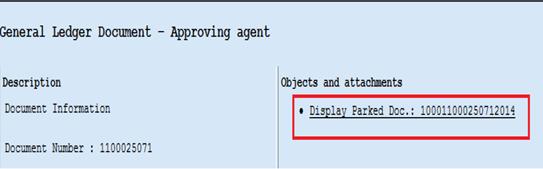

J.4. In the pop up window, click on Information in the General Ledger Document - Approving agent line

J.5. The pop up window will show the names of the Approving Officer who can approve the document. The document will appear in their Workflow Inbox.

Note: The 'X' indicates that the person highlighted was the creator of the parked document. A user cannot approve his/her own created document.

3.4.2 Approving Document in Workflow

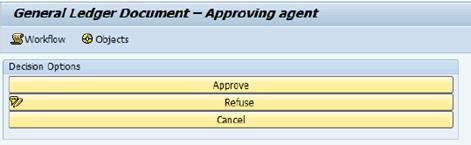

This process is only applicable to the Approving Officer. The Approving Officer can approve the document through Workflow Inbox.

K. Approving document through workflow inbox / Transaction Code: SBWP

K.1. Enter SWBP in the Command field or click on the icon shown in the screenshot.

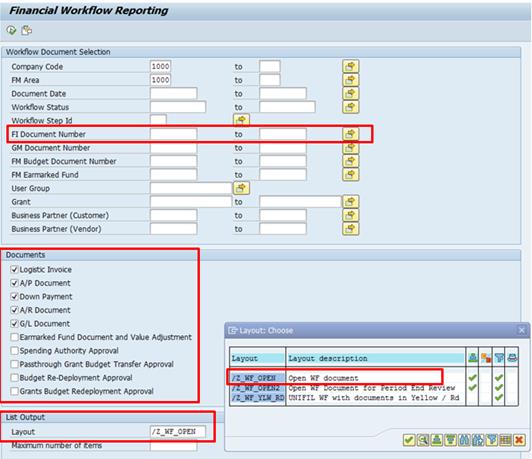

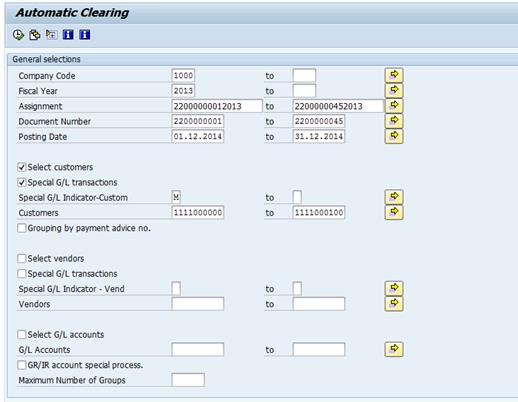

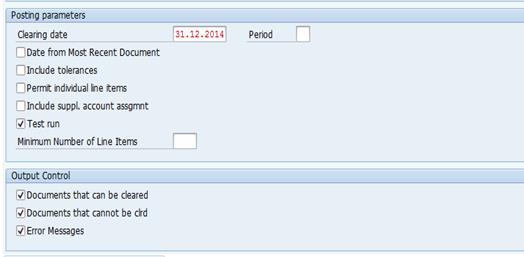

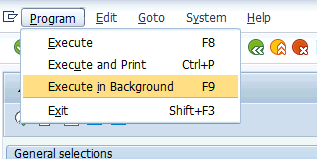

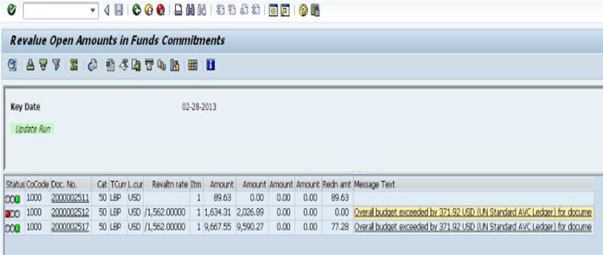

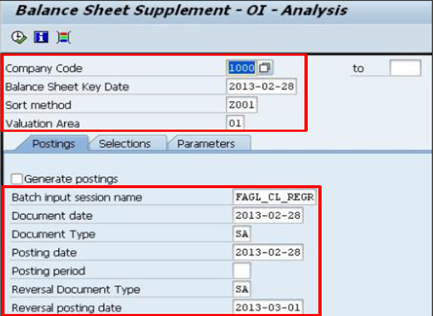

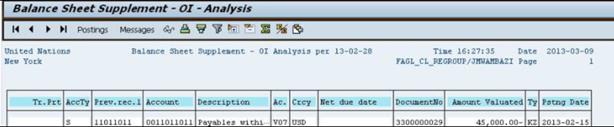

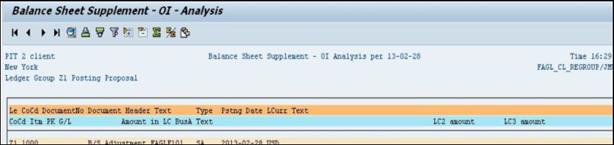

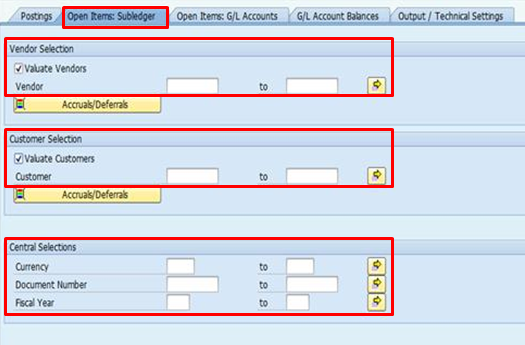

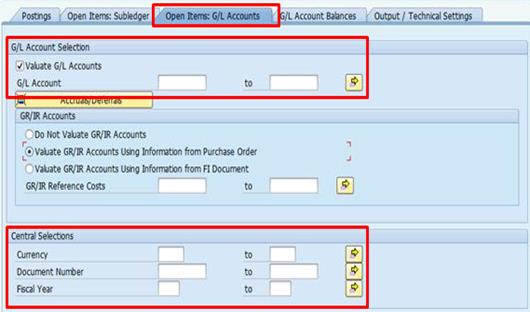

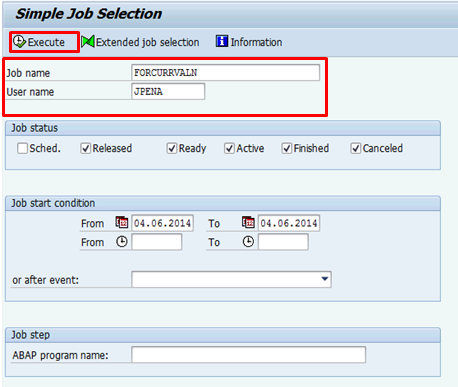

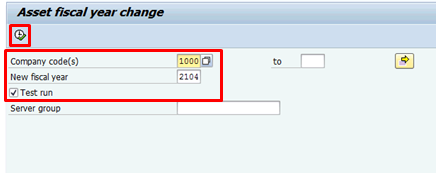

K.2. In the Inbox, select Group according to task folder, then GL documents: - Approving Officer