1 Objective

Revenues received by the United Nations Secretariat arise both from exchange and non-exchange transactions. A significant portion of the United Nations (UN) operations is financed from non-exchange transactions, including assessed contributions from Member States and voluntary contributions in cash and in kind from Member States, business organizations or the community at large.

The UN also provides funds to an intermediary implementing partner or to an end beneficiary in the process of achieving its aims of facilitating cooperation in international law, international security, economic development, social progress, human rights, and achievement of world peace.

The arrangements of receiving funds (grants in) are referred to as donor agreements, while providing funds to implementing partners or end beneficiaries (grants out) are generally referred to as funding agreements. The objective of this chapter is to give a brief overview of the accounting lifecycle and relevant guidance on the accounting treatment of these arrangements. It details how an end user, based on the involved Umoja user profiles, should perform roles and responsibilities related to accounting of these arrangements.

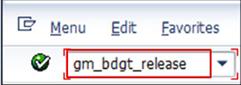

Accounting of revenue from assessed contributions is primarily performed within the Accounts Receivable module of Umoja and accounting of revenue from voluntary contributions and related costs is primarily performed within the Grants Management module of Umoja.

This chapter is based on guidance under IPSAS 23: Revenue from non-exchange transactions (Taxes and Transfers), which deals with issues that need to be considered in recognizing, measuring and presenting revenue from non-exchange transactions.

2 Summary of IPSAS Accounting Policy

2.1 Grants in - Revenue

A non-exchange transaction is a transaction that is not an exchange transaction. In a non-exchange transaction, the UN either receives value from another entity without directly giving approximately equal value in exchange, or gives value to another entity without directly receiving approximately equal value in exchange.

Revenue recognition is based on an assessment of whether an asset or a liability has been created.

An inflow of resources from a non-exchange transaction that is recognized as an asset should be recognized as revenue, except to the extent that a liability is also recognized in respect of the same inflow. If the transaction has stipulations that amount to conditions attached, then a liability for these conditions is recognized.

Revenue = Asset - Liability

2.1.1 Assessed Contributions

For the regular budget and the international tribunals, contributions are assessed for the related biennial budgets over a two consecutive year budget period, beginning with an even-numbered year. Following the approval of the biennial budget, the amount of these contributions is apportioned between the two years for invoicing and payment. Assessed contributions are recognized as revenue at the beginning of the apportioned year in the relevant two year budget period.

For peacekeeping operations, contributions are assessed for each operation for the annual period (1 July - 30 June), or for the portion of the annual period for which the operation has a valid mandate. Following legislative action on appropriations and mandates, assessed contributions are recognized as revenue at the beginning of the apportioned period.

2.1.2 Voluntary Contributions

Voluntary contributions and other transfers, which are supported by legally enforceable agreements, are recognized as revenue at the time the agreement becomes binding, which is the point when the UN is deemed to acquire control of the asset, unless where resources provided are subject to specific conditions if above the threshold of USD 50,000 or when contributions are explicitly given for a specific year such as under the framework agreements for Junior Professional Officer services. Recognition of revenue is deferred until the start of those services or until those conditions have been satisfied.

Voluntary pledges and other promised donations that are not supported by legally enforceable agreements, with offer and acceptance conditions, are recognized as revenue when the arrangement becomes binding (upon acceptance of contribution letter, upon receipt of cash together with the contribution letter). Pledges and promised donations, as well as agreements not yet formalized by acceptance, are to be disclosed in the notes to the financial statements. Revenue is also recognized for voluntary contributions where cash receipt is formalized by acceptance or where cash disbursement is authorized for proceeds of fundraising activity conducted by another party over which the UN does not have control. In such cases, any outstanding balances will be disclosed in the notes to the financial statements.

Stipulations imposed by donors on the use of contributions are classified as either conditions or restrictions. For a stipulation to be a condition, it must include both a performance obligation to use the donation in a specified manner and an enforceable return obligation, by legal or administrative means, to return the donation if it is not used in the specified manner.

2.1.2.1 Return of Unused Funds

Return of unused funds to the donor is presented net of revenue in current period regardless of the period in which the funds were initially recognized.

2.1.2.2 Goods and Services In-Kind

In-kind contributions of goods, above recognition threshold of USD 20,000 for Volumes I & II (USD 5,000 for other UN Secretariat entities) per discrete contribution, are recognized as assets and revenue once it is probable that future economic benefits or service potential will flow to the UN and the fair value of those assets can be measured reliably.

In-kind contributions of service, above recognition threshold of USD 20,000 for Volumes I & II (USD 5,000 for other UN Secretariat entities) per discrete contribution, are not recognized however disclosed in the notes to the financial statements.

Contributions in kind are initially measured at their fair value at the date of receipt determined by reference to observable market values or by independent appraisals.

2.1.3 Disclosure of Voluntary Contributions

An item that possesses the essential characteristics of an asset but fails to satisfy the criteria for recognition may warrant disclosure in the notes as a contingent asset.

Voluntary contribution arrangements which are not binding (offer and acceptance) at the reporting date should be disclosed in the notes to the financial statements if measurable and probable. These may include:

· Agreements in the process of negotiation at the year-end;

· Agreements not signed by both parties;

· A pledge letter from donor received but not accepted by the UN;

· Verbal pledges at pledge conference supported by minutes; or

· The remaining outstanding balances of fundraising activities, which the UN has no control over (such as the United Nations Foundation contributions to the United Nations Fund for International Partnerships).

2.1.4 Programme Support Cost (PSC)

The UN refers to the charge that it collects on trust fund (or 'extra-budgetary'') expenditure as Programme Support Cost (PSC). This charge is intended to ensure that the additional costs of supporting activities financed from extra-budgetary contributions are not borne by assessed funds and /or other core resources that are central to the budget process at the UN Secretariat. The PSC charge agreed with the donor is included as part of voluntary contributions. It is expressed as a percentage of direct costs (actual expenditure and unliquidated obligations).

2.2 Grants out - Expenses

Certain program activities are implemented by executing entities/implementing partners. Executing entities/implementing partners typically include Governments, NGO's and the UN agencies. The UN advances funds to these implementing partners based on cash projections. Advances to implementing partners that are not expensed during the year (remain outstanding at the end of the year), are reported as an asset in the statement of financial position (except for Volume I where all advances to implementing partners where control is no longer with the UN are expensed upfront at the time of disbursement of the funds).

Executing entities/implementing partners provide the UN with certified expense reports documenting their use of resources, which are the basis for recording releasing the asset in the statement of financial position and recording program/project expenses in the statement of financial performance.

Where a transfer of funds is deemed to be an outright grant i.e. quick-impact projects, an expense is recognized at the point when the UN has a binding obligation to pay, which is generally upon signature/confirmation of the arrangement.

2.3 References

For more details on the IPSAS requirements regarding revenue from non-exchange transactions, refer to:

· The UN IPSAS Policy Framework

· The UN IPSAS Corporate Guidance - Funding Arrangements

· IPSAS 23 - Revenue from Non-Exchange Transactions (Taxes and Transfers)

3 Assessed Contributions

Assessed contributions refer to the appropriations, voted by the General Assembly to cover activities that are approved for funding from the main fund (also known as the regular budget), for peacekeeping operations, the international tribunals and the capital master plan.

3.1 Recognition Principle for Assessed Contributions

Revenue from non-exchange transactions is recognized by the UN to the extent that the transaction creates an asset without a corresponding liability.

Since there is no specific condition (liability) attached to assessed contributions it must be determined when assessed contributions meet the criteria for recognition of an asset, i.e. at the beginning of the period when the UN has right to claim the assessed contributions and it is probable that the UN will receive funds.

3.2 Umoja Overview

Assessments to Member States are included in the AR process area which is comprised of all business processes related to recording and tracking receivables. In Umoja, sub-ledger functionality is used for AR transactions arising from assessments to the Member States. It means AR transactions are posted to Business Partner (BP) accounts of the Member States first and the equivalent GL reconciliation accounts are automatically updated. All assessment contribution transactions are assigned with special GL indicator 'M' and configured to be defaulted at all BP (customer) line items to segregate the transactions from other AR transactions. The special GL indicator 'M' will call and update alternate reconciliation accounts; AR Assessed Member State 13101010 for Member States and AR Assessed Gov't Non Member State 13101110 for non-member States.

In Umoja Foundation, the assessment to Member States starts with interface of uploaded file which summarizes the calculation of the Member States assessments for a) the working capital fund, b) the regular budget (RB), c) the peacekeeping operations (PK), d) the international tribunals and e) the capital master plan (CMP), to record invoices and credit memos and to prepare assessment letters with attachments to the Member States.

The assessment process starts after the adoption of the RB & PK scales and budgeted amounts for RB, PK, Tribunals and CMP. After the adoption, the appropriated amounts (gross, staff assessment credits and net assessments) are apportioned using the applicable scale of assessments. The apportioned amounts (gross, staff assessment and net components) will be interfaced from the excel spreadsheets processed through the Assessed Contributions Management System to Umoja to post the assessments and the credits from peacekeeping operations to Member States AR accounts.

An assessment cockpit was custom developed to enable recognition of all transactions related to assessed contributions. For this development object, the assessment cockpit is designed to provide the capability to upload, approve, reverse, apply credits, generate reports and issue letter of assessments.

The preparation of assessment letters to Member States is governed by the financial rules and regulations of the UN. Once the invoices and related credits are approved for posting, the system will also post automatic entries by recognizing the revenue and receivables or credits in the FI - AR module.

The assessments are classified into different assessment types, and each of them is represented as a three character field with specific Umoja document type assigned:

|

Umoja Document Type |

Assessment Type |

Description |

|

YR |

RBU |

Regular Budget |

|

YA |

PKA |

Peacekeeping Assessments |

|

YT |

TPK |

Tribunals - Peacekeeping Assessments |

|

YP |

PKC |

Peacekeeping Credits |

|

YM |

CMP |

Capital Master Plan |

|

YB |

TRB |

Tribunals - Regular Budget |

|

YN |

NME |

Non-member States |

|

YW |

WCA |

Working Capital |

|

YH |

AHO* |

Ad Hoc |

*AHO Assessment Type is typically used for one-time type of assessment and cannot be classified under the established assessment types.

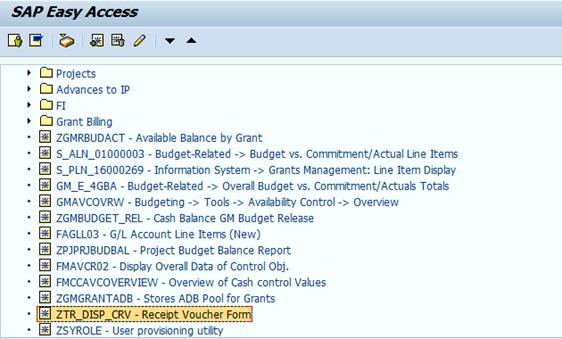

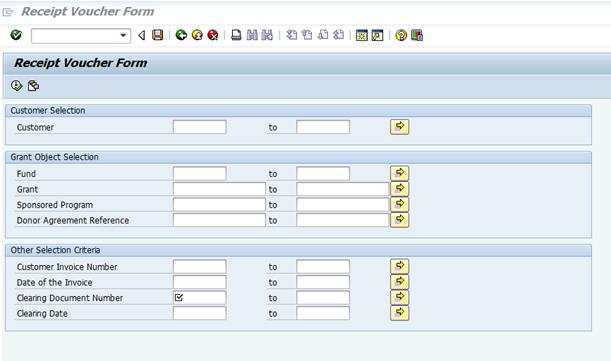

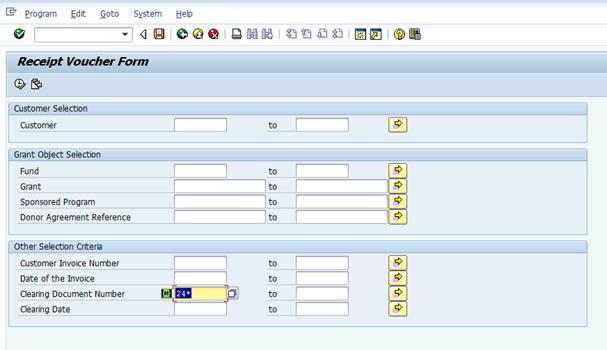

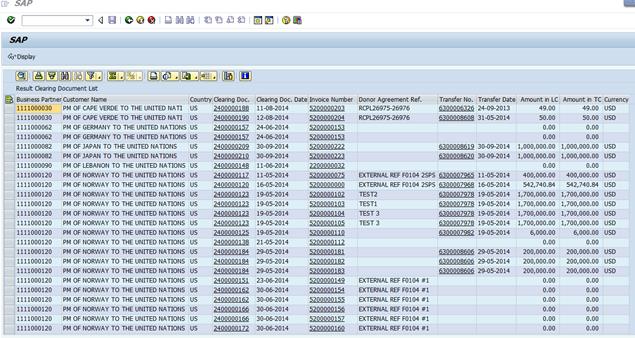

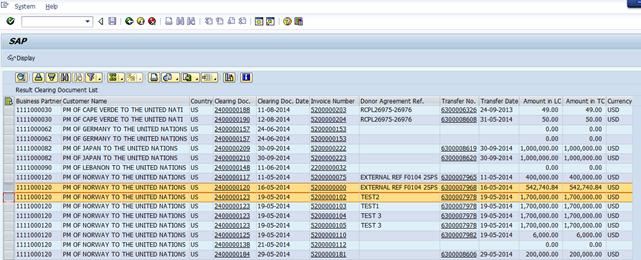

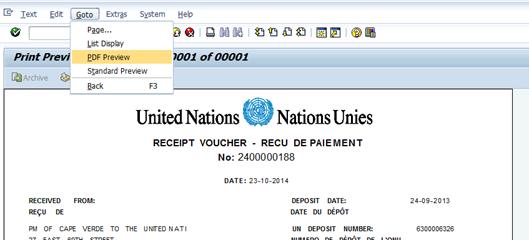

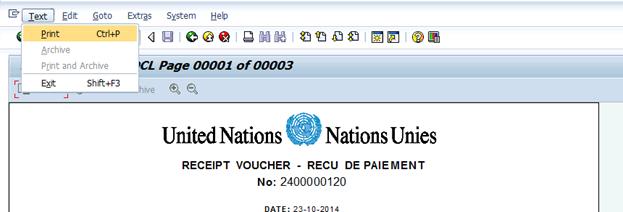

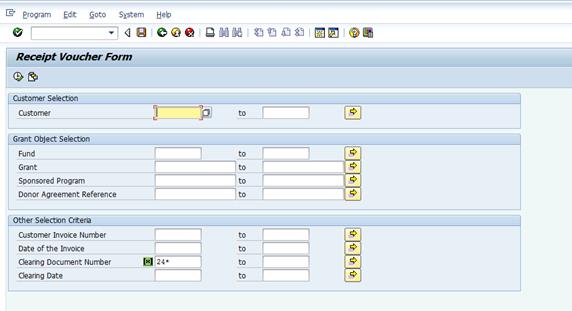

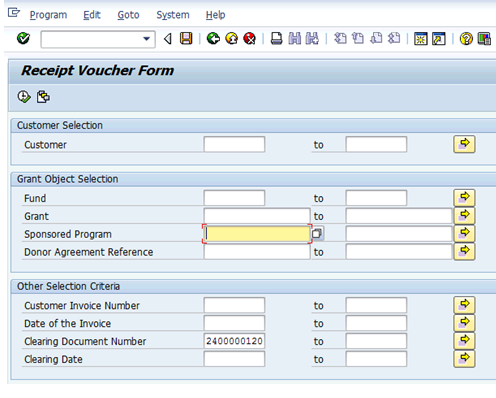

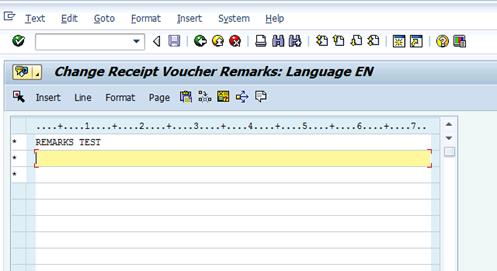

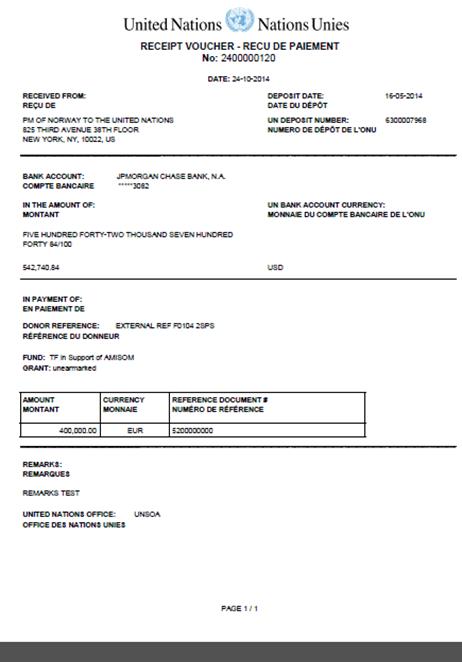

For incoming receipts from Member States, official receipt vouchers will be issued acknowledging the receipt and detailing the application of the cash to various invoices due for payment.

In the event of late payments, a dunning process creates reminders or notices automatically in Umoja. The dunning process involves review of AR open items and the periodical preparation of the dunning proposal, analysis of the dunning proposal with the purpose of selecting the Member States to whom the dunning letters will be sent, and creating and sending dunning letters to those customers (BP).

3.3 Umoja Process

This section explains the Umoja process steps applicable to recognition of revenue from assessed contributions, followed by an example with screenshots of accounting records generated from assessed contributions upload program in Umoja for regular budget.

A. The following process steps are applicable to recognition of revenue from assessed contributions.

The assessment to Member States starts with interface of uploaded file summarizing the calculation of the Member States assessments from the Assessed Contributions Management System (ACMS) to the Member States Assessment Cockpit.

A.1. Upload a document

A.1.1. Export the assessments worksheet from the Assessed Contributions Management System (ACMS) for upload to the Member States Assessment Cockpit.

Go to ACMS and select assessment to be uploaded, e.g. Type PKA.

A.1.2. Click Submit to Umoja.

A.1.3. When actions box pops up, click Save document.

![]()

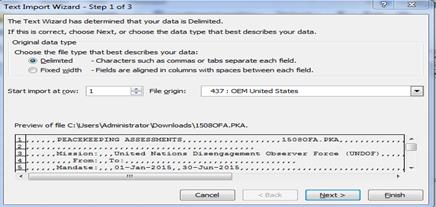

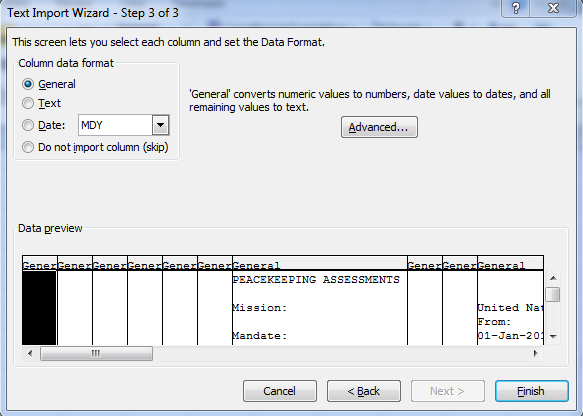

A.1.4. Once download is complete, go to excel and open the file from downloads.

![]()

Note: The file is downloaded as a PKA file.

A.1.5. Once the file has been selected, click Open.

A.1.6. Select Delimited of Wizard then click Next.

A.1.7. Ensure only Comma is selected and click Next.

A.1.8. Ensure General is selected. Then click Finish.

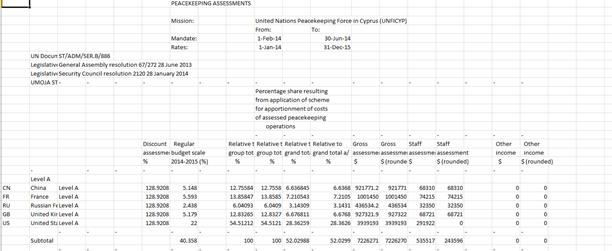

A.1.9. File opens as below.

In Cell B10, add the word 'Reference'. In Cell C10, add the reference to be included with the assessment in the format 1/YY/XX where YY is the year and the XX refers to the # of the assessment. Insert ISO code, e.g. WS for Samoa and TL for Timor Leste. Remove the value that is in A263.

ISO codes for assessments:

A.1.10. Go to File > click Save As. Change name of file to format 'YYMMFFFFF.PKA.CSV', save type to CSV (Comma delimited) and save to C:\IAIS\data directory. Close file.

In files related to additional assessments, the word 'additional' should not be bracketed.

Note: Any word/character entered in this cell will be accepted during the upload. Besides, there is a validation built into the system. If an attempt is made to load a file with the same name for the same mandate period but the word additional is not included, then the upload will fail as the system will interpret this file as a duplicate file.

A.1.11. All files which are to be uploaded to the Member States Assessment Cockpit must meet requirements related to the file type and name format.

The following file types have been configures for use in Umoja.

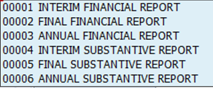

|

Assessment Type |

Assessment Description |

Filename format |

Filename example |

|

RBU |

Regular Budget |

YYYY + '.' + Assess_Type |

2014.RBU |

|

NME |

Non-member States |

YYYY + '.' + Assess_Type |

2014.NME |

|

WCA |

Working Capital |

YYYY + '.' + Assess_Type |

2014.WCA |

|

CMP |

Capital Master Plan |

YYYY + '.' + Assess_Type |

2014.CMP |

|

TRB |

Tribunals - RB |

YYYY FFFFF+ '.' + Assess_Type |

201420CUA.TRB |

|

AHO |

Ad Hoc |

YYMMPPPP +'.' + Assess_Type |

1408PPPP.AHO |

|

PKA |

Peacekeeping Assessments |

YYMMFFFFF +'.' + Assess_Type |

140820CUA.PKA |

|

TPK |

Tribunals PKA |

YYMMFFFFF +'.' + Assess_Type |

140160RMT.TPK |

|

PKC |

Peacekeeping Credits |

YYMMFFFFFAA + '.' + Assess_Type |

140620CUAGG.PKC |

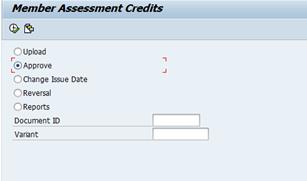

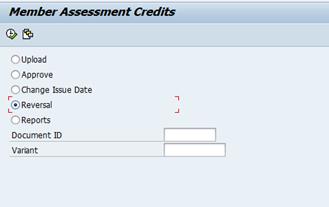

A.1.12. Go to Assessment Cockpit - the T-code to access the Member States Assessment Cockpit is ZARASSESS to upload, approve, reverse as indicated below.

Enter the T-code is ZARASSESS in the Command Field.

![]()

Click the Enter icon ![]() . The Member Assessment Credits screen is

displayed.

. The Member Assessment Credits screen is

displayed.

The AR processor will select Upload to upload interface file.

A.1.13. Enter the selection criteria

The AR processor will enter values in selection screen:

· Document Date - enter the date of the document to be uploaded. This can be the same as the current date.

· Posting Date - defaults to the current date, but may be defined as the date the assessment is posted to the system.

·

File Location - the file to be uploaded is selected by clicking on the

icon ![]() .

.

· Variant

Once file has been selected, click the Execute button

![]() .

.

A.1.14. Run in test mode

The system performs the business validations e.g. no duplicate file is uploaded twice. The AR processor reviews error messages provided and/or the line items from upload file.

Once upload has been successful, all entries should be verified to match the uploaded file, including header information. Issue date can be modified at this stage to match the actual issue date of the assessment.

A.1.15. Save the upload in Assessment Cockpit

Once details of the upload have been confirmed, click the

save button at the top of the screen to post the uploaded assessment ![]() .

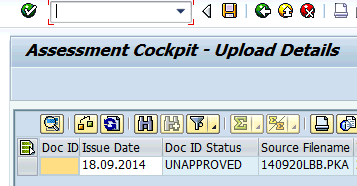

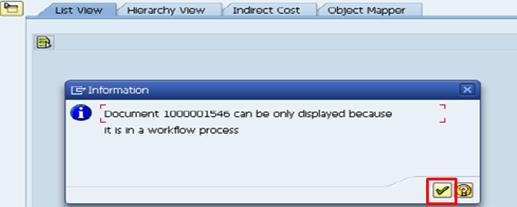

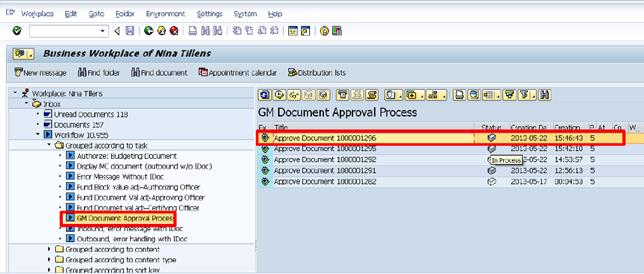

Once saved, the system will generate a Y* document number .The system sends

notification message to the AR Approver based on workflow table.

.

Once saved, the system will generate a Y* document number .The system sends

notification message to the AR Approver based on workflow table.

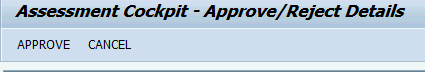

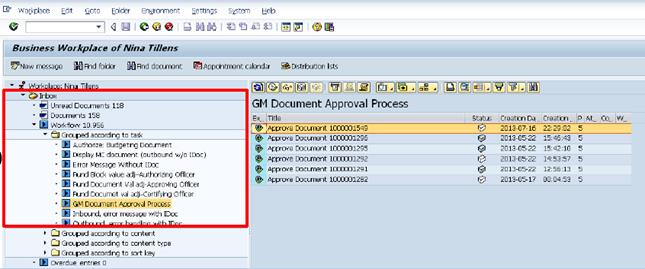

A.2. Approving uploaded documents

A.2.1. Go to Assessment Cockpit - T-code ZARASSESS.

The AR Approver will go to Assessment Cockpit and select Approve to review the uploaded file.

Within the Document ID tab, select

the document to be approved. Click Execute![]() .

.

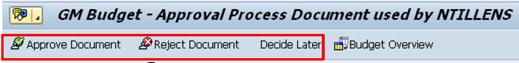

A.2.2. The new screen Assessment Cockpit-Approve/Reject Details is displayed. At this stage, the document can either be approved (posted) or canceled (deleted).

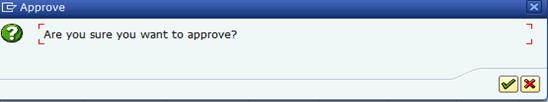

A.2.2.1. To approve, select Approve (F8) and the system prompts for confirmation to confirm the approval of the document.

Click the ![]() for yes and the

for yes and the ![]() for no. The approval process may take a few minutes. If no is

selected, the system returns to the selection screen and the document needs to

be selected again.

for no. The approval process may take a few minutes. If no is

selected, the system returns to the selection screen and the document needs to

be selected again.

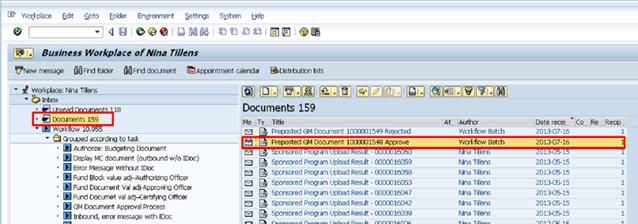

If approved, documents will be posted in Umoja and Assessment tables will be updated.

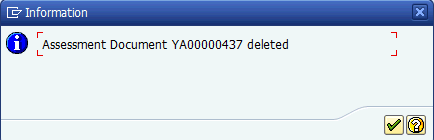

A.2.2.2. If Cancel is selected, the system requests confirmation if the uploaded records are to be deleted.

Click the ![]() for yes and the

for yes and the ![]() for no. If the

for no. If the ![]() is selected, the document is deleted and the user receives a

message confirmation.

is selected, the document is deleted and the user receives a

message confirmation.

If rejected, a notification message will be sent to the AR processor to make the necessary corrections and repeat the process steps.

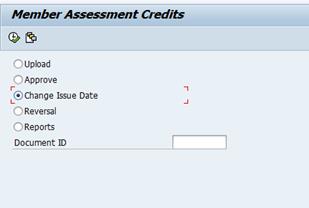

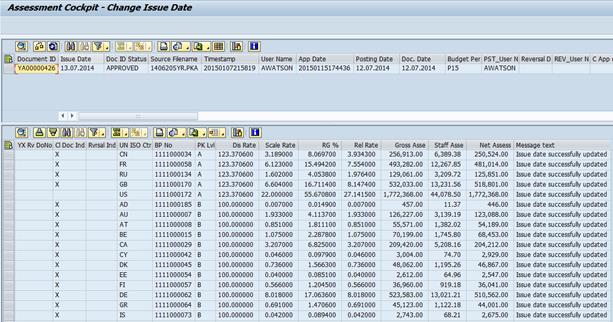

A.3. Change issue date after document has been approved

After a document has been approved, it is possible to change the issue date of the approved documents. This will have an impact on the ageing of the related AR document.

A.3.1. Go to Assessment Cockpit - T-code ZARASSESS.

The AR Approver will go to Assessment Cockpit and select Change Issue Date to review the upload file.

The correct document is selected either

by typing the document number in or by clicking the icon ![]() to

select the document.

to

select the document.

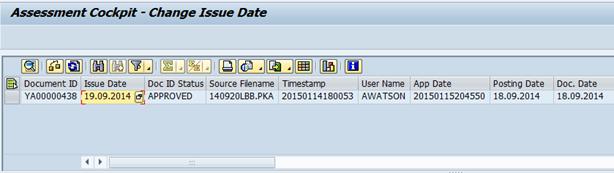

A.3.2.

Once the document has been selected, click the Execute

button ![]() .

The issue date can now be manually changed and the save button should be

clicked to confirm the change.

.

The issue date can now be manually changed and the save button should be

clicked to confirm the change.

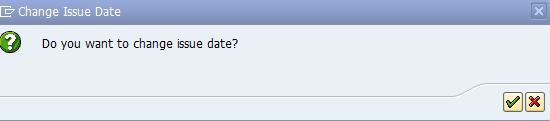

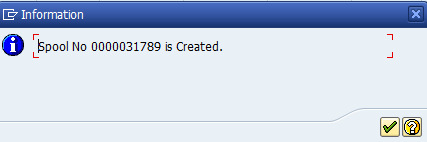

A.3.3.

Once the ![]() is

selected, an information box is displayed indicating that a spool has been

created and the message 'Issue date has been updated' is visible by line item.

is

selected, an information box is displayed indicating that a spool has been

created and the message 'Issue date has been updated' is visible by line item.

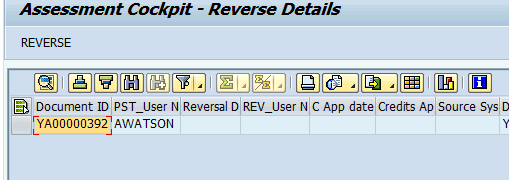

A.4. Reversal

If an approved document needs to be reversed, a process exists to reverse documents either in their entirety or not at all.

A.4.1. Go to Assessment Cockpit - T-code ZARASSESS.

The AR Approver will go to Assessment Cockpit and select Reversal to reverse all posted documents per upload file.

Select the document to be reversed and

click the Execute button ![]() .

.

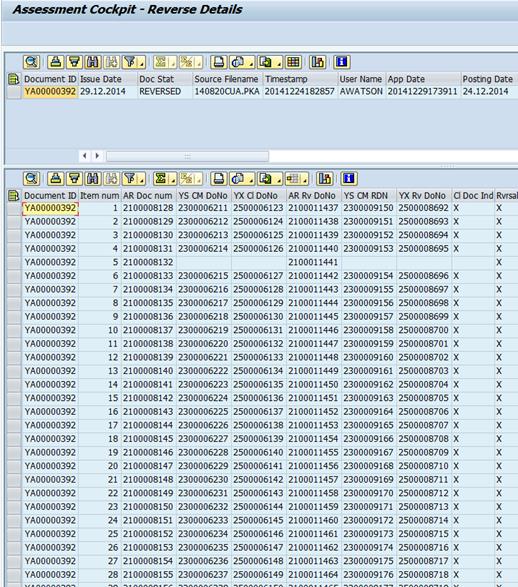

A.4.2. The Assessment Cockpit - Reverse Details screen appears. The screen contains the option to reverse.

A.4.3. Enter the selection criteria

The AR Approver will enter values in selection screen.

A.4.4. Run in test mode

The system triggers business validations e.g. reversal is not allowed for open items with incoming payments applied. If any if the related AR documents have a payment or credit applied against it, this must be undone before the reversal occurs. The AR Approver reviews any error messages provided and/or the line items subject for reversal.

A.4.5. Run in actual mode

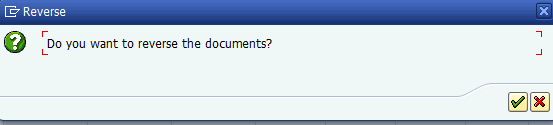

Upon clicking reverse, the confirmation box pops up. Clicking the green tick confirms that the reversal should proceed.

Note: the reversal process takes time as it needs to reset and reverse each clearing document, reverse each credit memo and then reverse each AR document.

The system reverses all documents originally posted from upload process and creates reversal documents. Umoja and Assessment tables are updated.

A.4.6. Generate the log report

When complete, document status changes to Reversed and the relevant reversal document numbers are indicated.

Additional information on the reversal process:

The clearing document generated in the cockpit acts as a knot between the credit memo and the account receivable. During the reversal process, this knot must first be undone (reset) before the clearing document can be reversed. This reset and reversal process of the clearing memo is independent of the status of the credit memo and account receivable entry, and cannot be undone once it has begun.

The system is configured as an all or nothing system. Therefore, if for any reason the credit memo or accounts receivable cannot be reversed, the status will not reverse the existing entries until the hindrance is removed.

A.5. Generate Reports

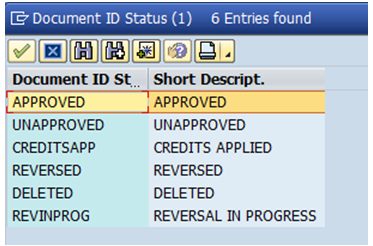

Based on the current design, documents can be in the status of Approved, Unapproved, Creditsapp (Credits Applied), Reversed, Deleted or Revinprog (reversal in progress).

Approved: Document which has been uploaded has passed the validations for approval and has generated the relevant accounting documents - Accounts Receivable, Credit Memo and Clearing Document (for Staff Assessment portion of the assessment).

Unapproved: Assessment worksheet has successfully passed the built in validations for uploading and has been uploaded and saved.

Creditsapp: Used to indicate that the credits have been applied for the particular fund. Credits are loaded using as a PKC assessment.

Reversed: Indicates that all documents generated by the approval process in the cockpit have been reversed. Documents can only be reversed if all subordinate documents can be reversed as no follow-on transactions have been processed against these documents.

Deleted: After a document has been uploaded and saved, it is possible to delete the document prior to approval. In this case, the system maintains a record of the header information related to the document uploaded, but there is no line item view available.

Revinprog: This relates to the reversal process. When the reversal process has begun, the system first reverses the clearing document that has been generated. It then tries to reverse the credit memo against the account receivable document which has been created. If for any reason, the credit memo is unable to be cleared against the receivable document, the reversal process will halt, advise of an error and cannot be restarted until the problem has been resolved.

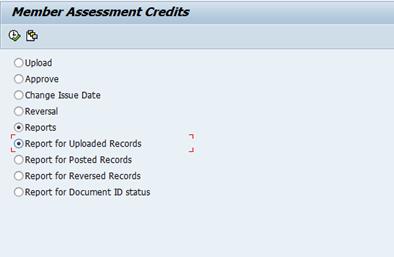

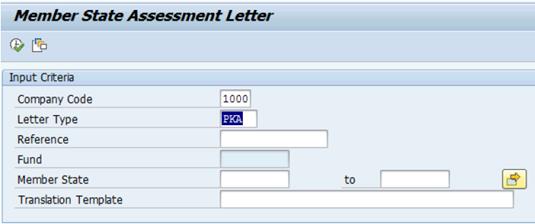

A.5.1. Go to Assessment Cockpit - T-code ZARASSESS

The AR processor will go to Assessment Cockpit and select Reports available for uploaded records, posted records, reversed records and by document ID status.

A.5.2.

Click the Execute button ![]() and

the selection criteria screen opens.

and

the selection criteria screen opens.

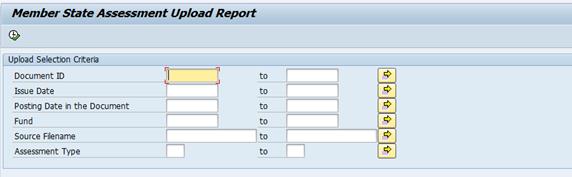

The AR Processor will enter values in selection screen, and this screen can be narrowed according to the selected criteria:

· Document ID

· Issue Date

· Posting Date in the Document

· Fund

· Source Filename

· Assessment Type

It is also possible to do a free search by simply clicking the Execute button without selecting any criteria.

A.5.3. Run in test mode

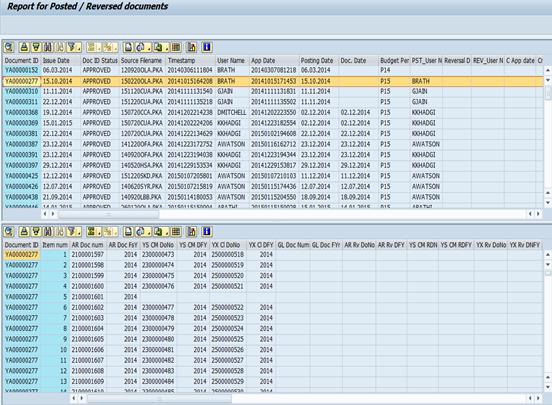

A.5.3.1. The system triggers business validations. The AR processor reviews the line items in report. Results returned indicate the following fields:

· Document ID

· Issue Date

· Document ID Status

· Source Filename

· Timestamp

· User Name

· Approval Date (if applicable)

· Posting Date

· Posting User

· Reversal User (if applicable)

· Posting Period

· Fiscal Year

A.5.3.2. In order to see the line details related to a particular document ID, double click on the document ID and the details are displayed in the screen preview below.

A.5.3.3. In order to approve the document, the document ID number should be copied /noted. Click the Back button in order to go back to Approval section.

A.5.4. Run in actual mode

The AR processor generates a report. Umoja has a spool report format which maintains a record of all files processed in the cockpit. If an error is generated during the upload, approval, change issue date or reversal process, the system generates a report which is similar to an audit trail. This report can be reviewed and saved to excel (for example).

To view the report in detail, click on the icon in the column Type for additional details.

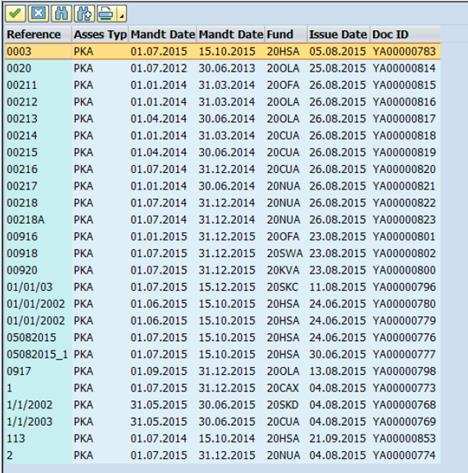

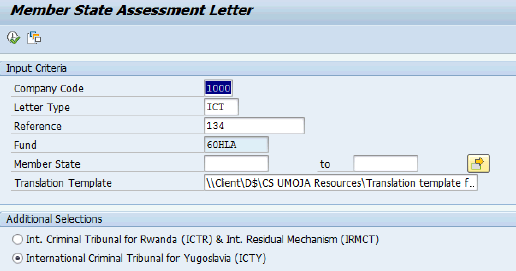

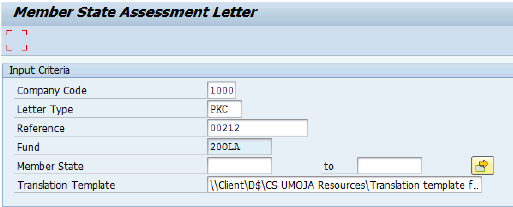

A.6. Issue assessment letter

The AR processor generates assessment letters in Umoja for the regular budget, peacekeeping operations, the international tribunals, peacekeeping credits for inactive funds and non-member states.

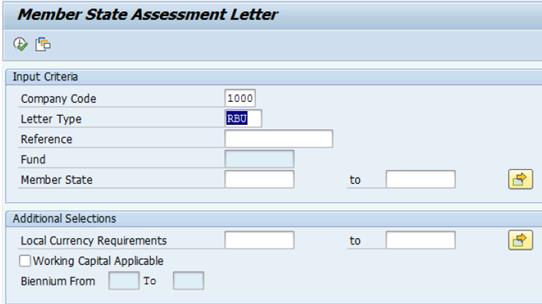

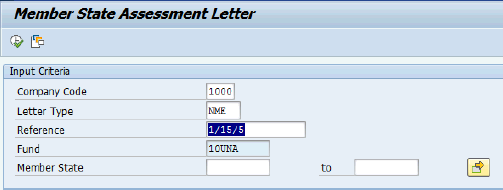

The T-code to access the Custom Assessment Letter Print Program is ZARASSESSLTR.

A.6.1. Assess the Custom Assessment Letter Print Program - enter the T-code ZARASSESSLTR in the Command Field.

![]()

A.6.2.

Click the Enter icon ![]() .

The Custom Assessment Letter Print Program is displayed.

.

The Custom Assessment Letter Print Program is displayed.

A.6.3.

In the Letter Type field, enter the letter type to the assessment

which needs to be prepared. Current options are shown below and can be accessed

by clicking the icon ![]() .

.

Note: All three tribunals (ICTY, ICTR and IRMCT) are available using the ICT letter type.

A.6.4. Enter the selection criteria. Once letter type has been selected, hit Enter.

The AR Processor will enter values in selection screen:

· Letter type

· Reference - reference field is what ties different assessments together e.g. the regular budget and adjustment to working capital. The reference is determined outside of the system and must be communicated prior to the preparation of the assessment letters. Within the reference selection, Umoja will provide a list of all uploaded files which relate to the assessment type chosen.

· Fund - should populate and this should be validated against the assessment being printed.

· Member State

There are enhancements by the letter type chosen.

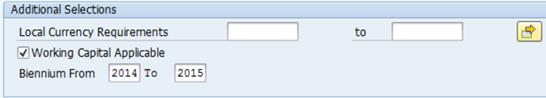

A.6.4.1. Letter type RBU

If RBU is chosen, the screen changes to allow for local currency requirements and the working capital if applicable.

In the case of the regular budget assessment letter to be issued, once the RBU letter type is selected, hit the Enter button. An additional selection screen pops up with local currency requirements and working capital applicable.

The local currency requirements should be used for those Member States who are allowed to make their contributions to the regular budget in their local currency. These member states can be selected as a single value or multiple values.

In the year where there is an adjustment for the working capital, the check box next to Working Capital Applicable must be selected and the biennium years must be filled in. e.g. 2016 to 2017.

If there is no working capital adjustment, this box does not need to be checked.

A.6.4.2. Letter type PKA

In the case of the peacekeeping assessment letter to be issued, once the PKA letter type is selected, hit the Enter button. An additional selection is displayed for the translation template.

The fields to be modified are:

· Language

· Reference - the unique identifier which links the related assessment schedules together

· Legislative Basis - updated based on the assessment being issued

· Security Council Resolution - updated based on the assessment being issued

· Mandate Beginning - Mandate End - updated based on the assessment being issued

· Additional - the logic in Umoja takes this word from the uploaded document. Therefore, this must not be modified or removed from the translation template.

Once the template has been finalized, select all from the word Language - across and down, copy, open Notepad and paste to notepad. Save the file and close.

Return to Umoja, and in the translation template field, click on the translation template field, then select and search for the location of the .txt file. Choose the file and then click on the Execute button.

A.6.4.3. Letter type ICT

In the case of the international tribunals, the ICT assessment letter type is to be used.

As of September 2015, there are three criminal tribunals - the International Criminal Tribunal for Yugoslavia (ICTY), the International Criminal Tribunal for Rwanda (ICTR) and the International Residual Mechanisms Criminal Tribunal (IRMCT).

Once the ICT letter type is selected, hit the Enter button. An additional selection is displayed for the translation template and the type of tribunal.

Due to the option of the Member States to pay their contributions to the ICTY in Euros to a Euro-currency denominated account, there is a separate letter version used for ICTY.

A.6.4.4. Letter type PKC

Letter type PKC is used when credits are being returned to the Member States related to inactive/closed operations and when there is no accompanying assessment. Once the letter type is selected, hit Enter.

Follow the steps above to select the reference and validate the fund. Upload translation template and execute.

A.6.4.5. Letter type NME

The letter type NME is to be used for letters related to non-member state assessments for the regular budget.

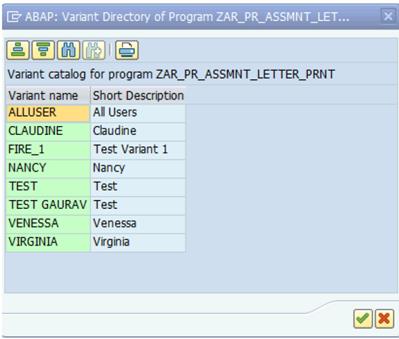

A.6.4.6. Variants

The Member State Assessment Letter screen also allows the issuer to issue letters for a specific Member State or group of Member States. There is also a variant which is customized according to the areas of responsibility of the Contributions Service User.

This level of specification will generate letters only for those under the specified area of responsibility.

A.6.5.

Once all parameters have been included, click the Execute

button ![]() .

.

Depending on the number of assessment letters being generated, it may take a few moments. Once the letters are generated, enter 'pdf!' in the Command bar to obtain a pdf view of the letters generated.

A.6.6. Review assessment letter/Inquire Member State account balances.

Review letters to confirm outstanding balance match accounting records.

Note: The balance shown will include the new assessment and all credits. If verifying by column, review member state account balance and include/exclude new assessment as appropriate.

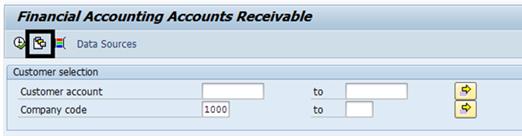

A.6.7. Assess the Custom Assessment Letter Print Program - enter the T-code ZARFBL5N in the Command Field.

![]()

A.6.8.

Click the Enter icon ![]() .

The Selection Parameter screen is displayed.

.

The Selection Parameter screen is displayed.

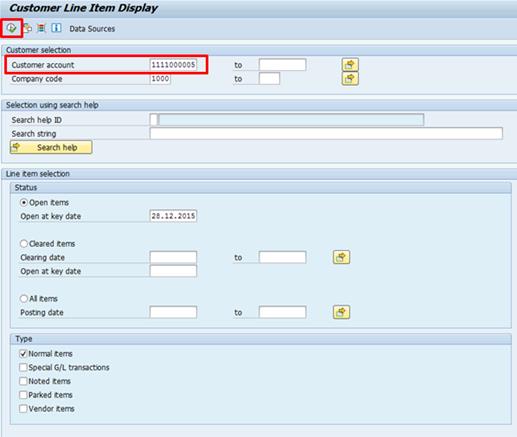

A.6.9. Enter the selection criteria:

· Customer Account - enter the customer account number (BP number) enquired. If running for all Member States, either should be left blank or the range 1111000000 to 1111000194 (and 1200000000 for the Holy See) is entered.

· Special G/L indicator

· Fund

· Line Item Selection - select Open Items and remove the Open at key date if it automatically gets populated. If the status as of a particular date is enquired, the date is included as the system defaults to the current date.

·

Type - ensure that Special G/L Transactions is

checked. The icon ![]() allows

the user to enter multiple selections in any of the fields.

allows

the user to enter multiple selections in any of the fields.

A.6.10.

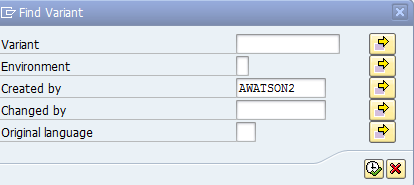

Variant - to access the variant, when the T-code opens,

click the icon ![]() .

.

A.6.11. The new screen Find Variant is displayed.

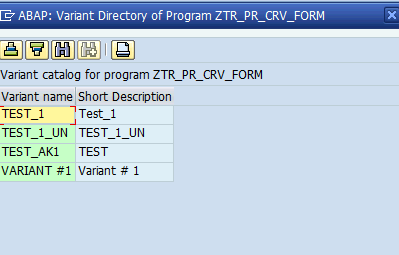

If the user has more than one variant, double click on the one that has the variant name enquired. The variant can be pulled up by typing the variant name in the Variant filed and executing.

A.6.12. Save / Print assessment letter.

If all information is accurate, pdf-files are saved in shared location and letters are printed for signing.

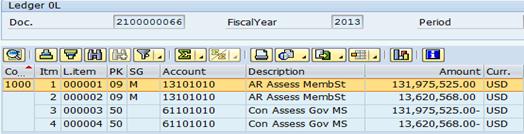

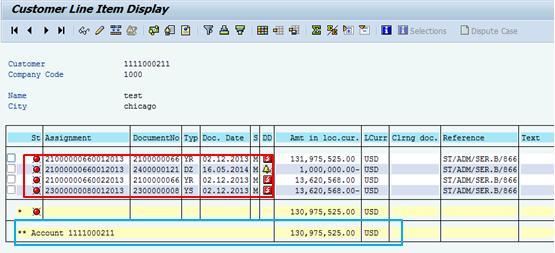

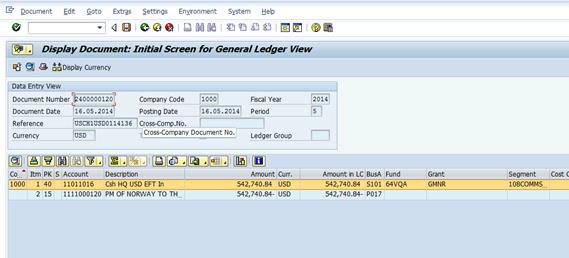

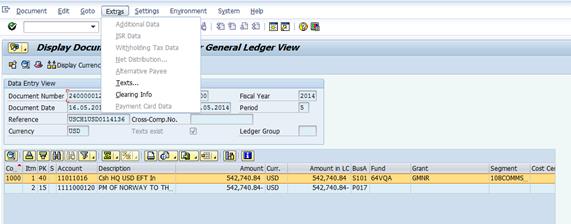

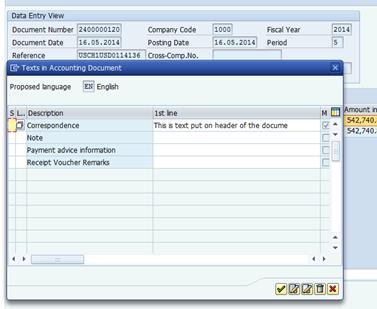

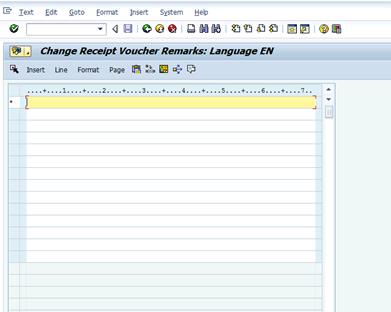

Example: Revenue recognition for assessed contributions

On 27 December 2014 under the General Assembly resolution, assessed contribution of XYZ (Member State with staff assessment) was determined. Additional facts:

· The UN has a right to receive USD 131,975,525 from country XYZ and Staff assessment credit amounted to USD 13,620,568.

· The UN receives first installment of USD 1,000,000 from country XYZ.

· Country XYZ has historically transferred agreed upon funds to the UN without default.

Accounting entry on recognition of revenue:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

1 Jan 2015 |

1111XXXXXX* |

AR Assess MembSt |

131,975,525 |

|

|

|

79161010 |

TEA Credit Given to Member State Regular Budget |

13,620,568 |

|

|

|

61101010** |

Con Assess Gov MS |

|

145,596,093 |

* This is a reconciliation account. Using the sub-ledger functionality, postings will go directly to BP (customer) #.

** Assessed contributions from non-member States will be presented as part of Assessed Contributions Receivable on the statement of financial position and the scheme of accounting entry will be similar to above, however GL code for statement of financial performance should be 69241110.

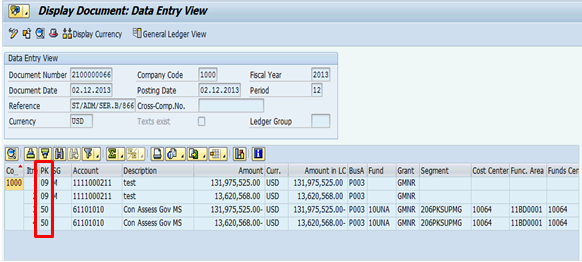

· AR document type YR is for Regular Budget.

o Special GL indicator M is assigned to customer line items.

o Data entry view requires the BP customer account number which calls the alternate reconciliation account 13101010 for Member States.

o Assessed contributions are recorded at Gross; Assessment (line1) + Staff assessment credits (line 2) for Member States with assessments.

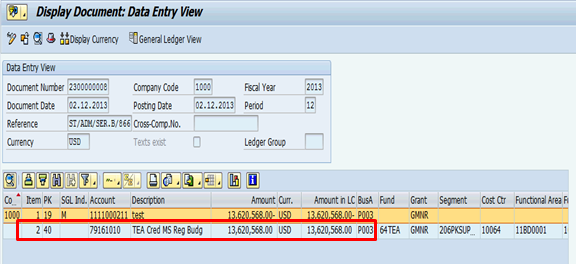

· Credit Memo document type YC is automatically created from interface program to reduce the AR balance by staff assessment credit component.

o Staff assessment credit is charged to Tax Equalization Account (TEA) account 79161010 for regular budget.

o Net assessed contributions receivable from Member State is USD 131,975,525 while total revenue from assessed contributions is USD 145,596,093 as summarized in GL account Contribution Assessed Gov't 61101010. The GL account is maintained as auto posting only, it means it is only through the upload program that the account can be posted.

Accounting entry on receipt of funds from Member State:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

Date of receipt |

11011010 |

Csh HQ USD Nominal |

1,000,000 |

|

|

|

1111XXXXXX* |

AR Assess MembSt |

|

1,000,000 |

* This is a reconciliation account. Using the sub-ledger functionality, postings will go directly to BP (customer) #.

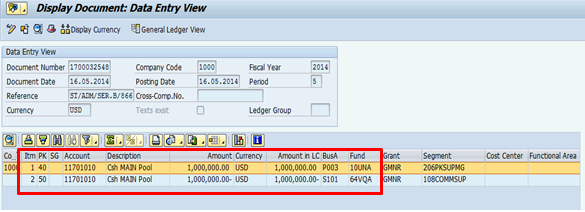

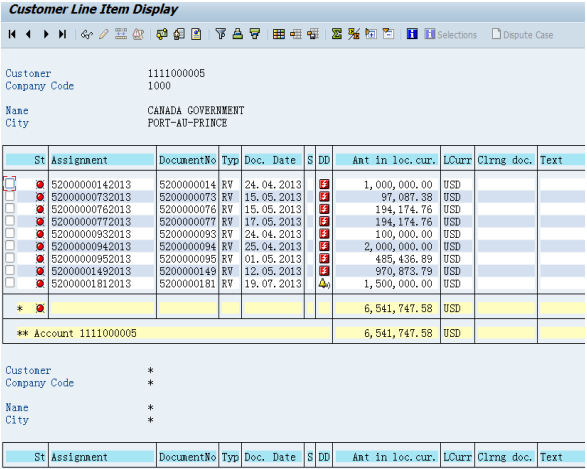

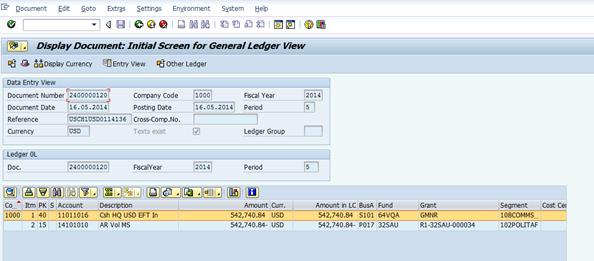

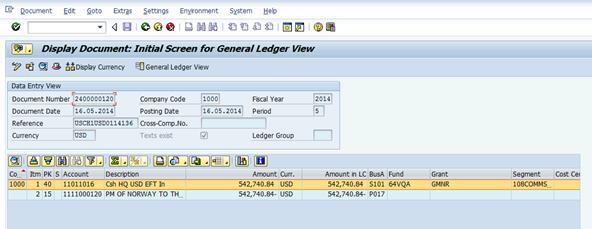

· Incoming Payment received against document type YR document is processed through automatic upload of bank statements. Refer to section 3.3.2 of Chapter on Cash Management for further guidance on incoming payments.

o Outstanding receivable from the Member State is reduced by incoming payment received of USD 1,000,000.

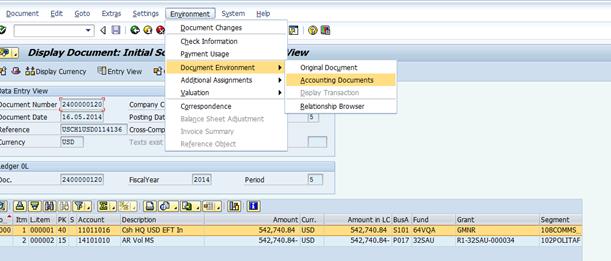

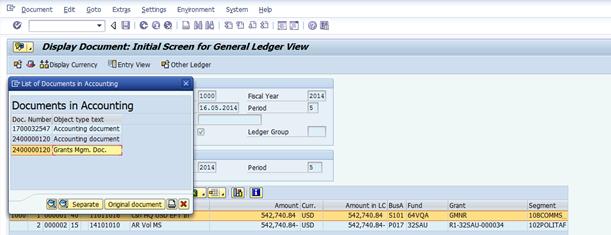

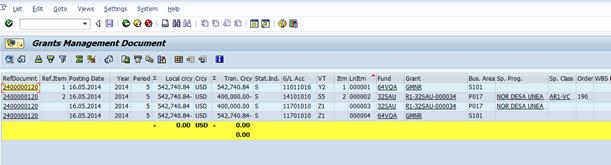

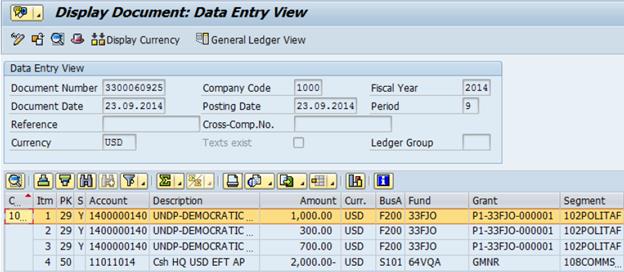

o The receipt of incoming payment will go to Treasury Fund 64VQA, the transaction will cross business areas that will trigger creation of another accounting document (document # 1700032548) to balance the funds at both business areas and funds.

· Display Sub-ledger account details of Member State using transaction code FBL5N or ZARFBL5N. For detailed steps refer to section 3.2.3 of Chapter on Accounts Receivable.

o Partial incoming payment of USD 1,000,000 from document type DZ was posted. Staff assessment credit from document type YR is offset against credit memo from document type YS.

o Net outstanding receivable from Member State is USD 130,975,525.

For guidance on allowances for estimated irrecoverable receivables refer to section 3.3 of Chapter on Accounts Receivable.

4 Voluntary Contributions

In addition to the program work financed from assessed contributions (regular budget, peacekeeping, tribunals), additional activities are carried out by the UN in connection with those areas of work that are financed from voluntary contributions. These are extra budgetary resources that generally support or supplement the substantive work program of the UN, provide humanitarian and/or other relief assistance, and provide technical assistance to developing countries either through multilateral arrangements or through the UN System.

4.1 Recognition Principle for Voluntary Contributions

The basic revenue recognition principle remains the same as explained above. Revenue recognition is based on asset recognition, when the United Nations gains control over an asset, unless there are corresponding conditions that would require the recognition of a liability if above the threshold of USD 50,000.

Compared to assessed contributions, where the UN has control over the manner in which the funds are managed, voluntary contributions usually have certain stipulations with regard to the usage of the funds / transferred assets.

From an accounting perspective, it is very critical that all the stipulations are identified and further assessed to determine whether the stipulation is a condition or restriction on the transferred asset. This is critical because a liability should be recorded for all conditions on the transferred assets above the threshold of USD 50,000, but not for restrictions on the transferred assets.

Restrictions are stipulations that limit or direct the purposes for which a transferred asset may be used, but do not specify that future economic benefits or service potential is required to be returned to the transferor if not deployed as specified. For a stipulation to be a condition, it must include both a performance obligation to use the donation in a specified manner and an enforceable return obligation, by legal or administrative means, to return the donation if it is not used in the specified manner.

For fundraising activities conducted by another party over which the United Nations does not have control (such as the United Nations Foundation contributions to the United Nations Fund for International Partnerships), revenue is recognized at the time of receipt of the Cash Disbursement Authorization, which indicates exactly the amount to be contributed. The remaining portion of the funding will be disclosed in the notes to the financial statement.

4.1.1 Voluntary Contributions - Non-Conditional

Similar to assessed contributions, there is no specific condition (liability) attached to non-conditional voluntary contributions, it must be determined when non-conditional voluntary contributions meet the criteria for recognition of an asset.

4.1.2 Voluntary Contributions - Conditional

Initial recognition

The following is recognized for conditional funding agreements at initial recognition:

a) An asset measured at its fair value as at the date of acquisition;

b) A liability for the conditions attached to the agreement measured at the best estimate of the amount required to settle the obligation at the reporting date. In most arrangements at the UN where conditions exist, the liability will approximate to the fair value of the corresponding asset at initial recognition; and

c) Revenue to the extent that a liability is not recognized.

Revenue is recognized for all conditional arrangements up to the threshold of USD 50,000.

Subsequent recognition

As the UN satisfies an obligation recognized as a liability (i.e. as the condition is satisfied) in respect of a conditional funding agreement, there will be a reduction in the carrying amount of the liability and recognition of revenue equal to the amount of reduction in liability.

The timing of subsequent revenue recognition is determined by the nature of the conditions and their settlement. For example, if a liability was initially recognized for a condition that specifies that the UN is to provide specific goods or services to third parties, then revenue is recognized as those specific goods or services are provided.

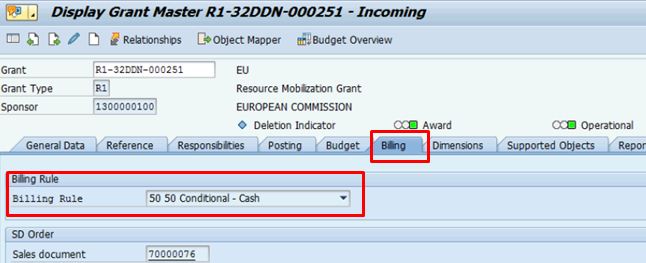

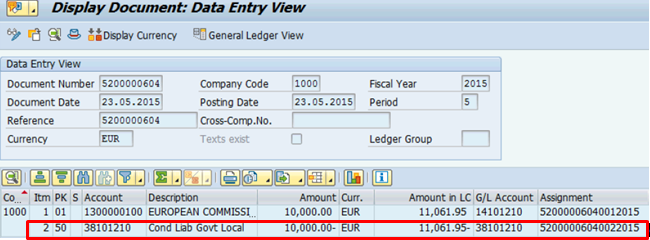

All European Commission (EC) agreements under the Financial and Administrative Framework Agreement are examples of conditional arrangement because the EC has requested refunds in the past where the funds were not used in accordance with the agreement.

4.1.3 Multi-Year Voluntary Contributions

Multi‐year voluntary contributions include arrangements in which the undertaking to provide funding is spread across more than one accounting period. Revenue is recognized upfront only if funding is not linked / earmarked to a specific year such as under the framework agreements for Junior Professional Officer services and there are no conditions in the arrangement. For more guidance on accounting for multi-year voluntary contributions refer to Corporate Guidance on Funding Arrangements.

4.1.4 In-Kind Voluntary Contributions

IPSAS 23 provides the following guidance for the classification of 'goods in kind' and 'services in kind':

· Goods in kind are tangible assets transferred to the organization in a non-exchange transaction.

· Services in kind are services provided to the organization in a non-exchange transaction.

Further IPSAS 31 provides examples of certain assets to be classified as 'Intangible assets' and IPSAS 23 covers assets received under donated 'right-to-use' arrangement, i.e. through non-exchange transaction.

Since IPSAS guidance is very generic, professional judgment should be applied to determine how the gift or donation should be classified. For more guidance on accounting treatment of Revenue from non-exchange transactions refer to Corporate Guidance on Funding Arrangements.

4.1.4.1 Recognition and Measurement of Goods In-Kind

The principle of recognizing revenue for 'goods in-kind' is consistent with guidance for non-exchange transactions. The assets acquired through non-exchange transactions should be measured at their fair value as at the date of acquisition.

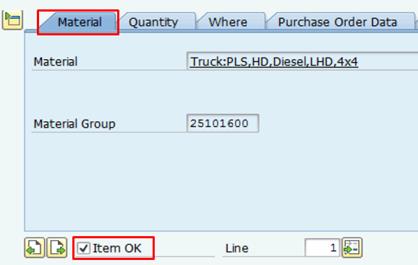

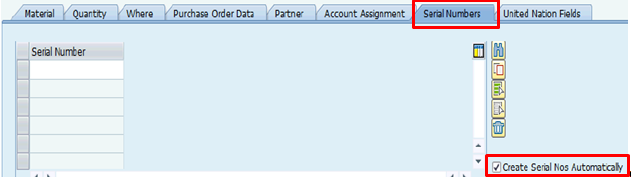

A threshold of USD 20,000 for Volumes I and II (USD 5,000 for other UN reporting entities) per discrete contribution is in place regarding the recognition of goods in kind, except for the following commodity groups for which the lower threshold of USD 5,000 is applicable: a) Vehicles; b) Prefabricated buildings; c) Satellite communication systems; d) Generators; and e) Network equipment.

Refer to section 4.3.5.4 for processing goods in kind in Umoja.

4.1.4.2 Disclosure for Services In-Kind

The UN does not recognize services in-kind. However, the disclosure of the nature and type of services in kind received during the reporting period is required if they are material. The disclosure in the notes to the financial statements should include information about services in-kind with a value above USD 20,000 for Volume I and II (USD 5,000 for other UN reporting entities), per discrete contribution, measured at fair value.

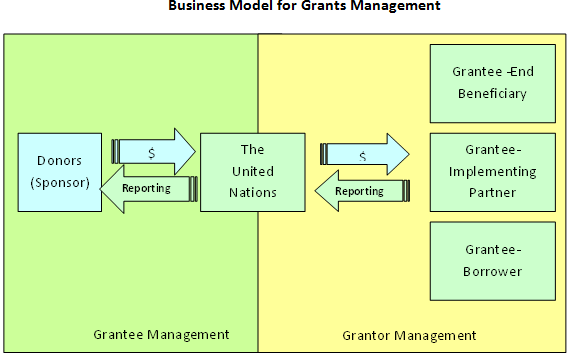

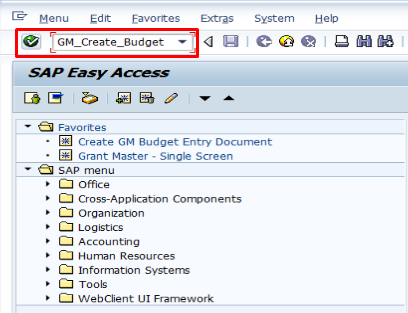

4.2 Grants Management Module Overview

Voluntary contributions are managed and recorded in Umoja Grants Management (GM) module.

The Business Model consists of two parts:

· Grantee Management to cover the management of the contributions (both monetary and contributions in kind) from the Donors (Sponsors). In Grantee Management, the UN acts as a Grantee and its Donors play a Grantor role.

· Grantor Management to cover the part of the business where resources, both monetary and in kind, are provided by the UN to its Grantees. In this case, the UN acts as a Grantor.

With regard to the means of financing, Grantee Management covers only voluntary contributions. Grantor Management covers the distribution of funds not only received through voluntary contributions but also through assessed contributions.

The above end-to-end Grantee and Grantor Management business model consists of following process:

· Signing Donor Agreements;

· Funding Program and Project Activities;

· Release Spending Authority;

· Grant execution;

· Grant closure.

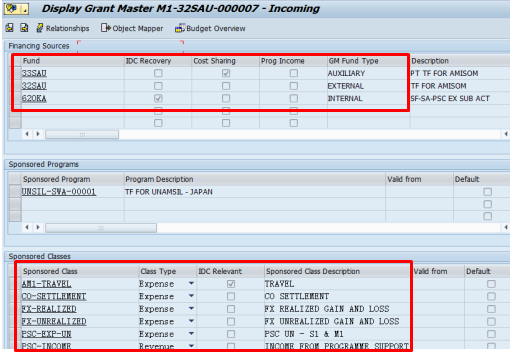

4.2.1 GM Module - Key Terms

· Fund is a separate and distinct accounting object containing a self-balancing set of accounts used to identify the source and use of funding from voluntary contributions. It is established for the purpose of financing wholly or in part the cost of program and project activities consistent with the UN's aims and policies.

· Grant is an object that is used to maintain the terms and conditions of the Grantor's contributions.

o In cases where the UN is a Grantee, that is the UN receives contributions from Donors, the Grant or a group of grants represent the Donor's Agreement. A Sponsor (a donor), is a government, institution or individual that provides funding to the UN.

o In cases where the UN is a Grantor, that is the UN gives money to an Implementing Partner, the Grant or a group of grants represent the Funding Agreement.

o Grants can be grouped for reporting purposes.

Grant is a 'central' element of the Grants Management process which ties together all the Grants Management Master Data objects, e.g. Fund, Sponsor, Sponsored Program, Sponsored Classes, Grant Budget Rules.

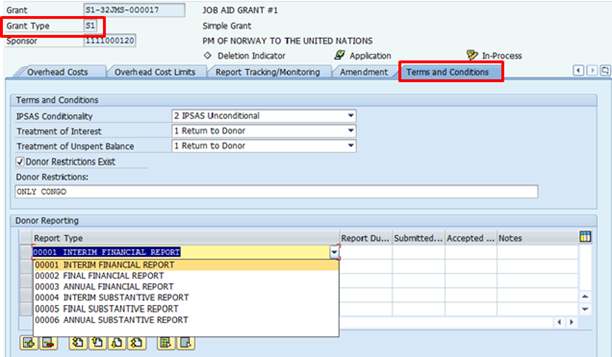

The Grant Type is a key master data element that allows management of Grants to meet both the donor's requirements and the financial recording and reporting requirements of the UN. Grant type is used to define Grant's controls and behavior. Once the Grant is saved, the Grant Type cannot be changed.

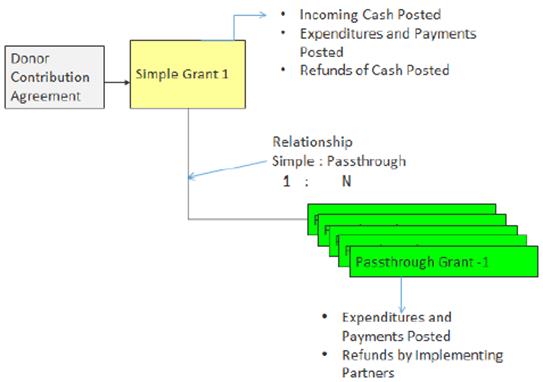

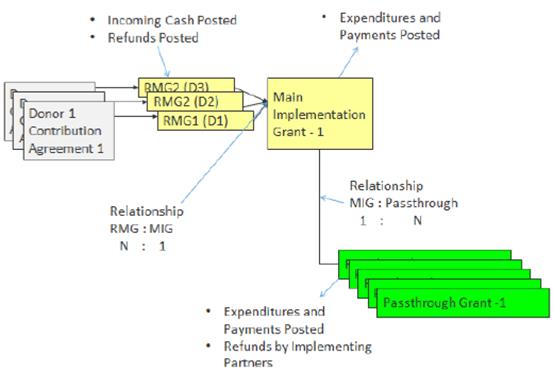

The four grant types that exist in Umoja are as follows:

· A Simple (S1) grant is used when a single donor contributes and the UN is required to report on the specific donor contribution, no comingling of expenditures with other donor's contributions.

· A Resource Mobilization (RM / R1) grant is used when a donor contributes to a funding pool. The R1 grant will only record revenue and not expenditures.

· A Main Implementation (MIG / M1) grant is created to provide funding to program and project activities within the UN. The M1 grant will be logically linked to multiple R1 grants which collect revenues while the M1 grant will be used to record pooled expenditures.

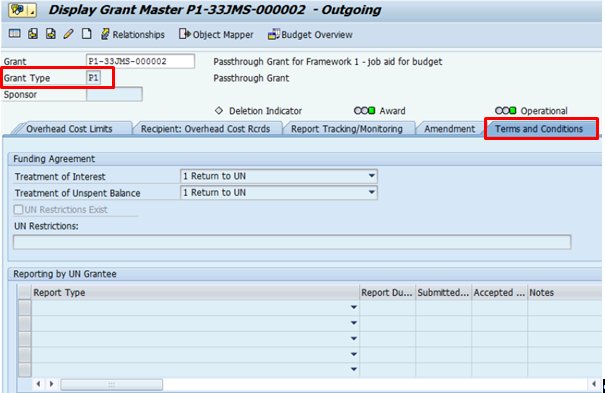

· A Passthrough (P1) grant is created to support activities where the UN has a responsibility to report both the UN and non-UN related expenditures to the donor. The grant represents Funding Agreement between the UN and a UN Grantee (i.e. Implementing Partner) and is used to record the UN Grantee's expenditure.

· Business Partner is an organization or an individual that has a business interest with the UN. A Business Partner can be a sponsor who provides voluntary contribution to the UN.

· Sponsored Program identifies a program of the Sponsor. It identifies the purpose of the Sponsor's contribution. Sponsored Programs are defined by the organization to reflect the reporting structure required by the donor as well as to reflect and enforce any restrictions imposed on the funds by the donor. Sponsored Program is a GM Master Data Object that is derived and cannot be manually entered. Sponsored Program can be created for a specific project, an activity on the project, a group of projects, non-project related activity, material, service, program/subprogram objective, associated experts and so on, according to the specific donor requirements.

· Sponsored Class is a GM Master Data object that summarizes the GL accounts of the organization, facilitating reporting to the donor and enforcing donor restrictions. It represents the view that the sponsor wants reported back to them. It also represents the level at which the sponsor requires the processes to be controlled.

Although sponsored program and sponsored class do not have any accounting implications they are important from the perspective of donor reporting.

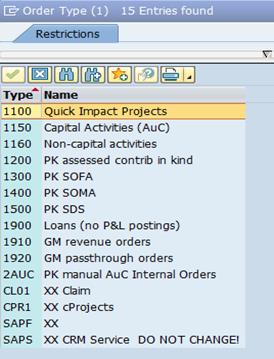

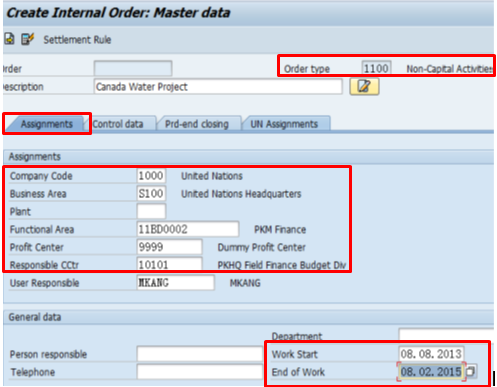

· Internal Order is a GM Master object that collects costs and revenues of a specific event or simple project that has defined start and end dates. It is usually temporary (unique) in nature and the costs are segregated from other events or on-going operations to enable more detailed monitoring.

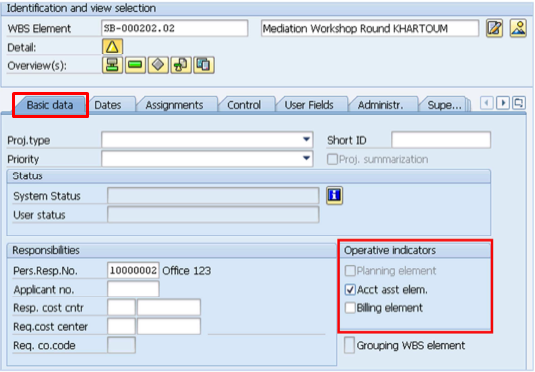

· Work Breakdown Structure Element (WBSE) is a GM Master object that represents a project with its structure.

4.2.2 Grants Frameworks

Important in the Grants Management process is choosing the framework that would be applicable to the Grant creation based on the facts of the grant which is primarily driven by donor requirements.

There are two frameworks in the UN Grants Management environment based on the requirements for donor reporting:

Framework 1: Donor requires UN to report specifically on its contribution.

The donor (Donor Agreement) is represented by one grant which is typically a Simple (S1) grant. A Passthrough (P1) grant is used to represent the Funding Agreement while a Sponsored Program will represent the purpose of the contribution in which it might be shared with other grants.

In this framework, Programme Support Cost (PSC) is unique to the Donor Agreement. Return of Interest and unspent balance may be a requirement by the donor and budget is created against the S1 grant. USD is the expected currency for S1 grant and associated P1 grants. Nevertheless, R1 and M1 grants can be used in Framework 1 when the contribution currency (S1) and the currency of grant expenditures (P1) are different.

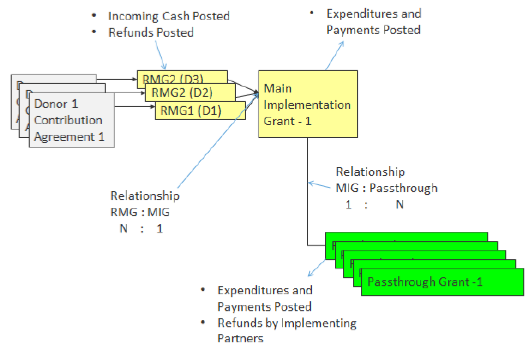

The layout of a typical Framework 1 grant is displayed in the diagram below:

Framework 2: Donor requires UN to report on 'pooled' expenditures.

Each donor (Donor Agreement) is represented by a separate R1 grant. These R1 grants represent donors' total contributions to the grant's fund. The R1 grants are linked through a relationship to the M1 grant that represents the 'pooled' expenditures. A Passthrough (P1) grant represents the Funding Agreement while a Sponsored Program represents the purpose of the contribution, which is the same for all donors participating in the 'pool' and can be shared with other grants.

In this type of framework, Programme Support Cost rates should be consistent for all participating donors with budget set against the M1 grant. While the donors (represented by R1 grants) can provide funding in multiple currencies, the currency of M1 grant and associated P1 grants must always be USD.

The layout of a typical Framework 2 is displayed in the diagram below:

Exception

By Umoja design, cases where the reporting requirements of the donor fall within the Framework 1, and the Donor Agreement is signed in a currency other than USD currency, the Framework 2 has to be used. In this case there will be a one-to-one relationship between the R1 and M1 grants. The Resource Mobilization grant and Main Implementation grant will both have the same donor.

4.3 Grants Management Process

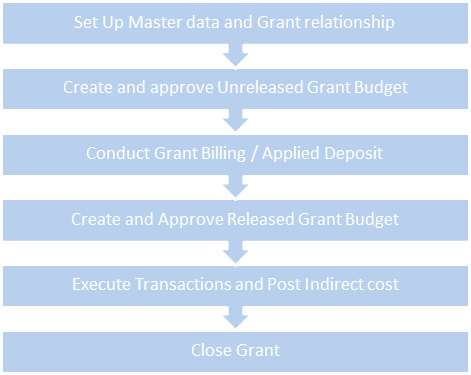

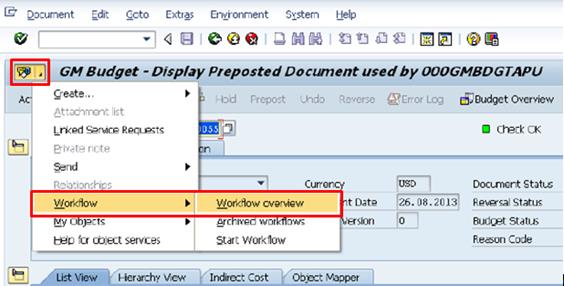

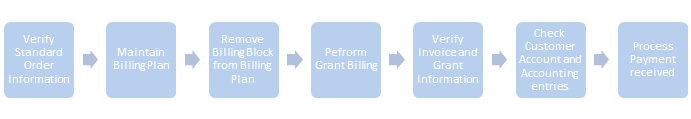

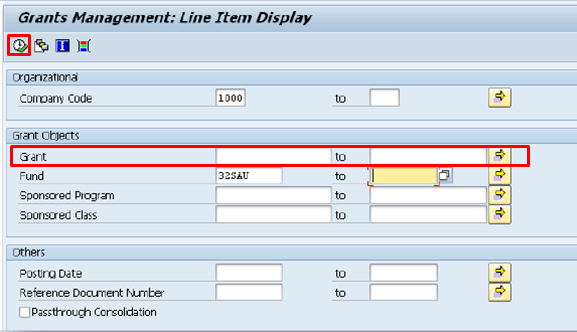

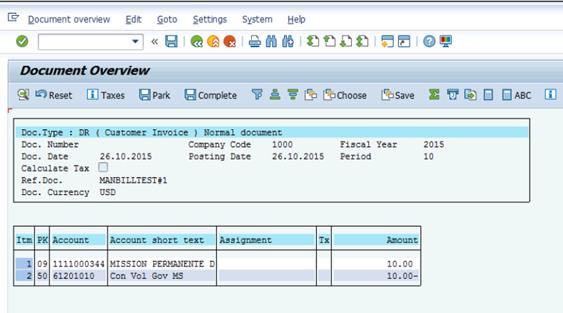

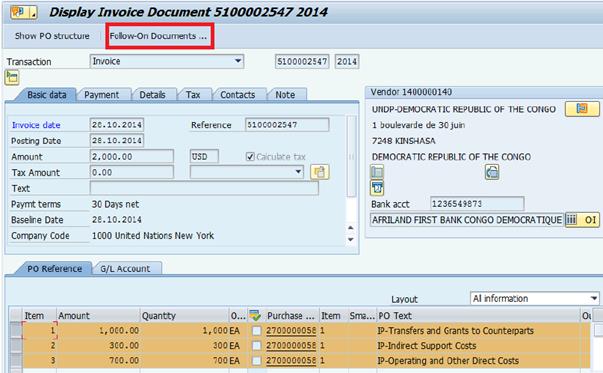

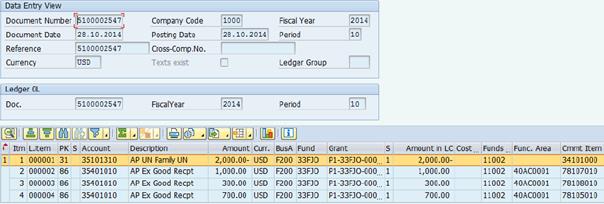

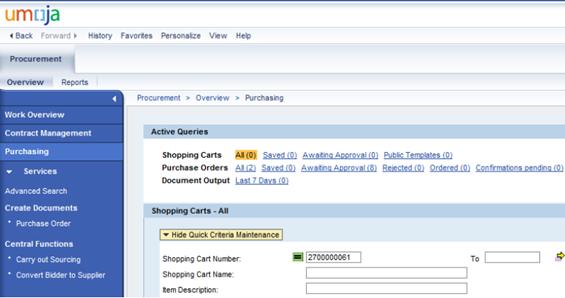

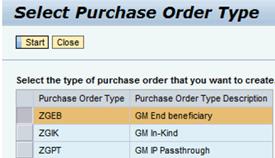

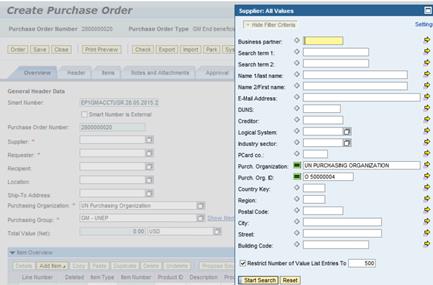

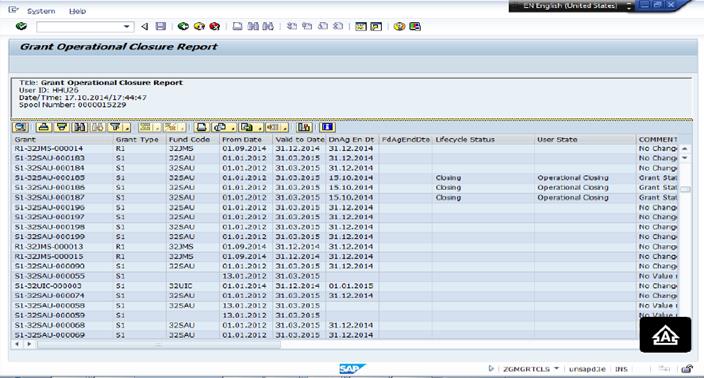

The following flow chart depicts high-level overview of Grantee Management process within GM module of Umoja.

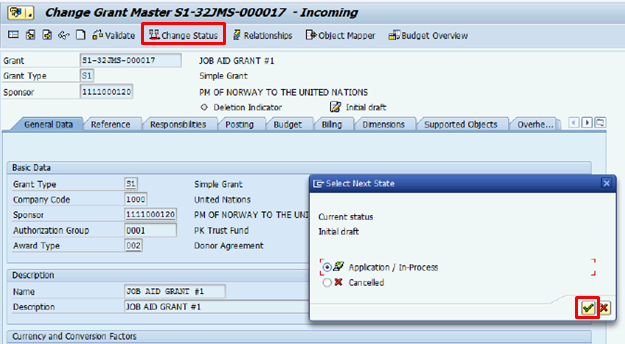

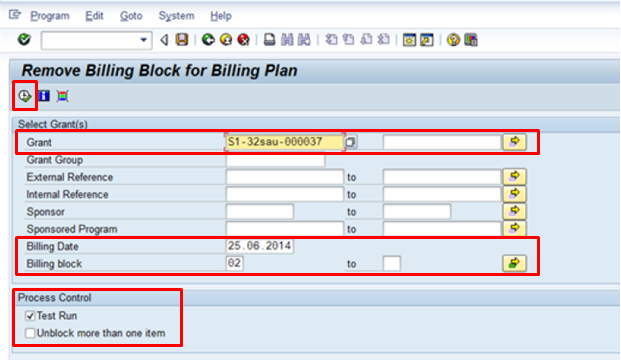

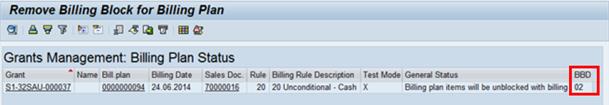

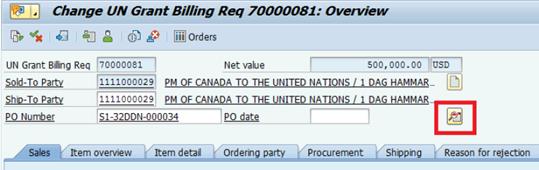

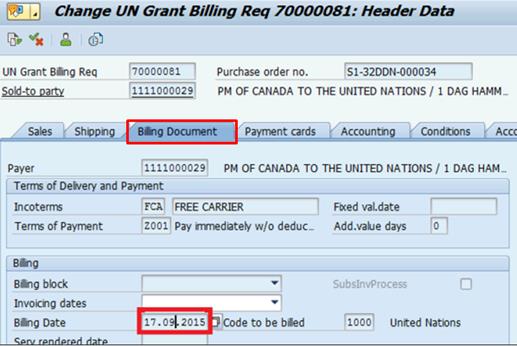

Grants Framework 1 process steps:

1. Display/Maintain grant-related Master data

· Verify Business Partner Data

· Create Sponsored Program

2. Create Simple grant

· Create S1 grant master data

· Change Status of grant to 'Approved by UN'

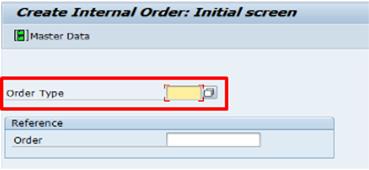

3. Create Revenue Internal Order

4. Link Revenue Internal Order to grant

5. Change Status of grant to 'Award/Operational'

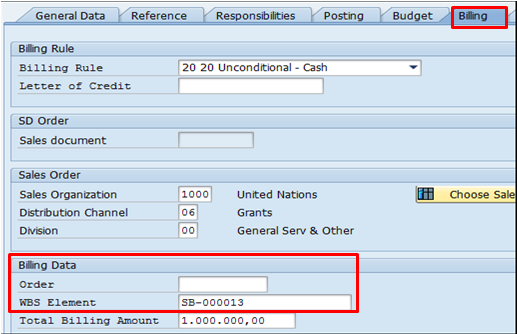

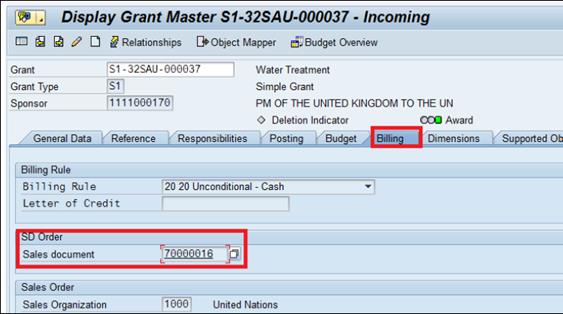

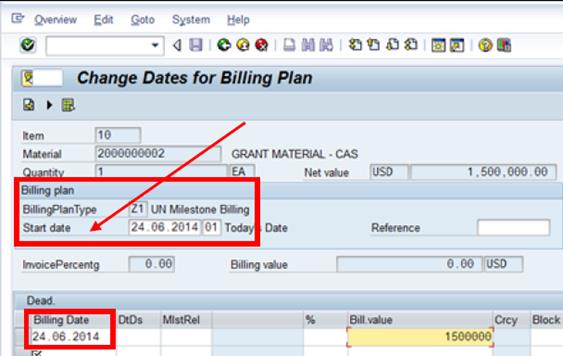

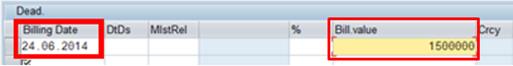

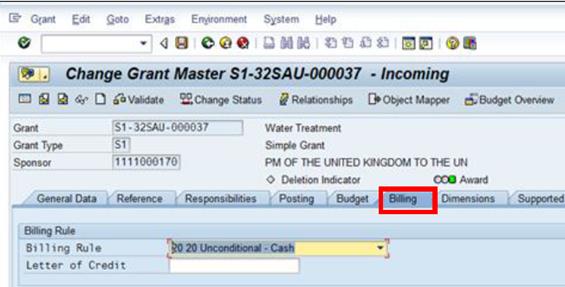

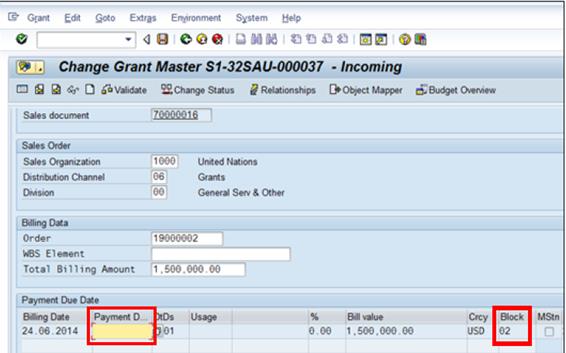

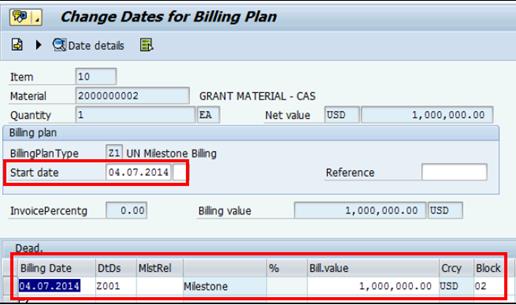

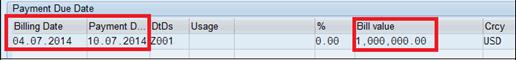

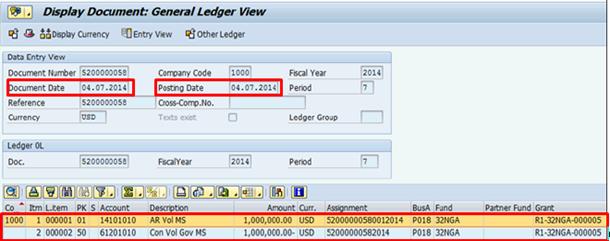

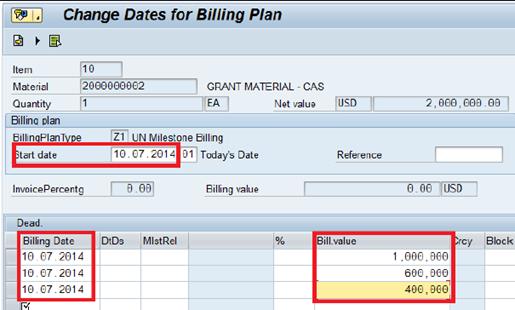

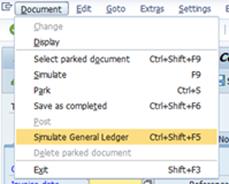

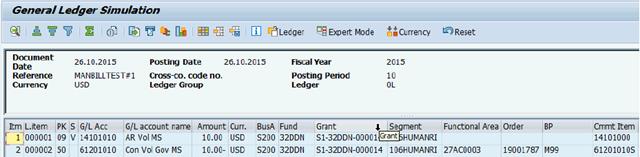

6. Perform Billing

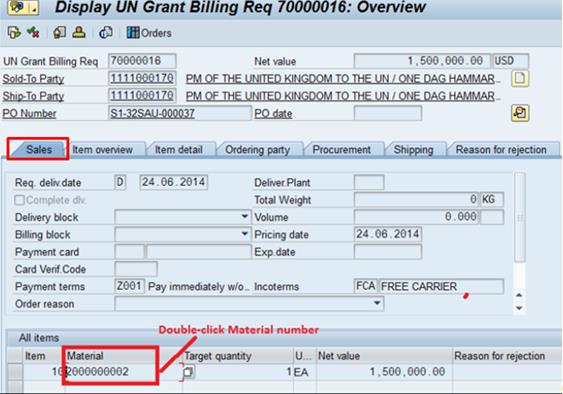

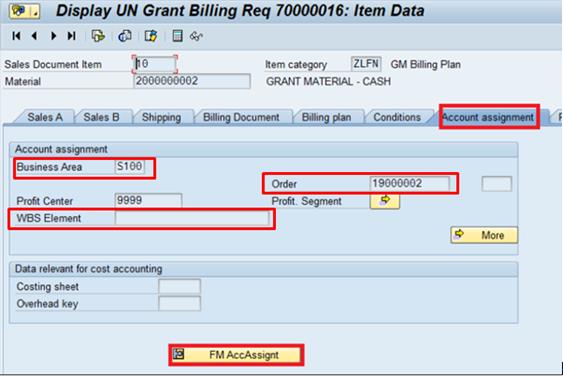

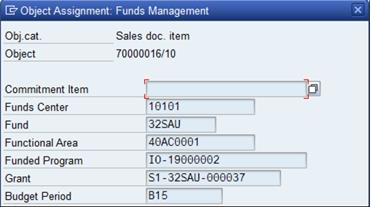

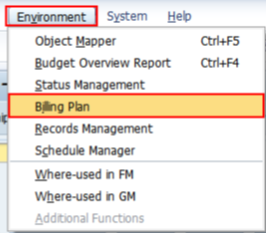

· Maintain Billing

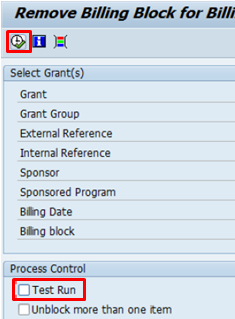

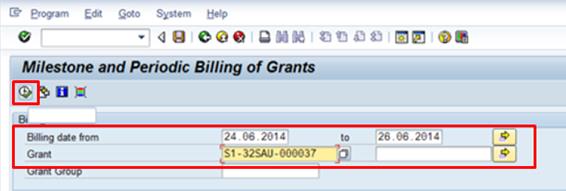

· Verify sales order

· Remove Billing Block from Billing Plan

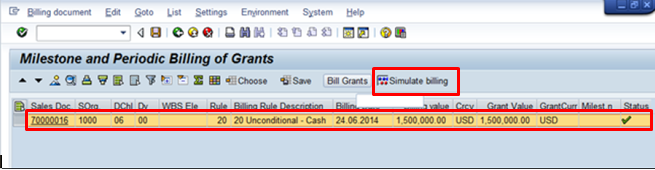

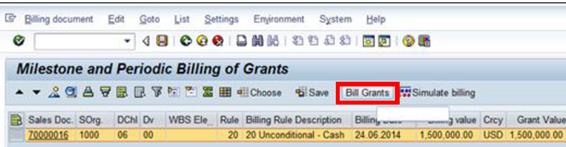

· Simulate and Bill grant

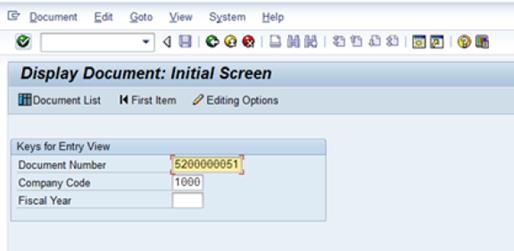

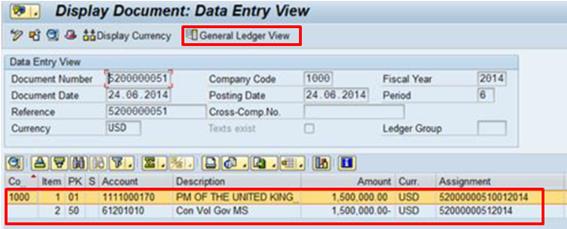

· Display FI document

7. Create Unreleased Budget

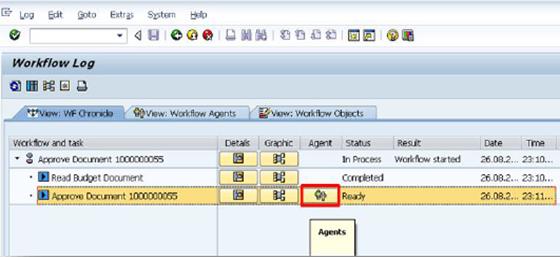

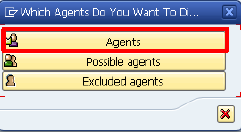

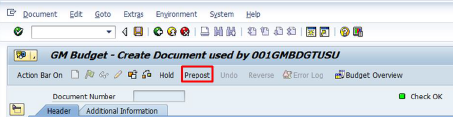

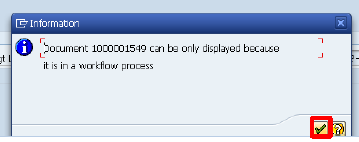

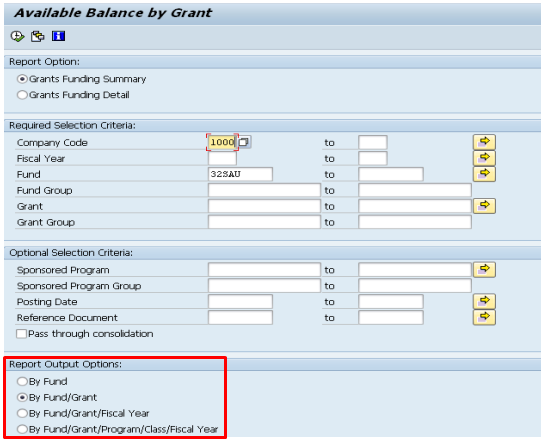

8. Approve Unreleased Budget via Workflow

9. Create Project/Internal Order for expenses

10. Update Sponsored Program

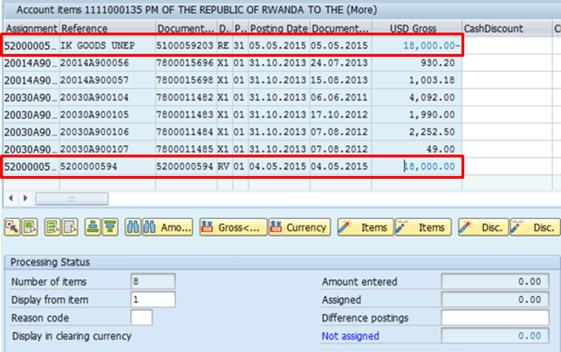

11. Receipt of Funds/Clearing of Receivables

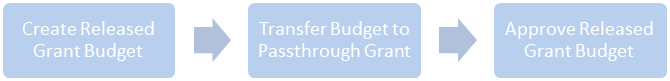

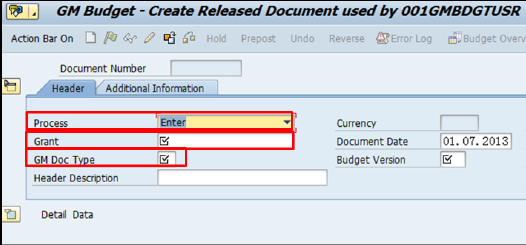

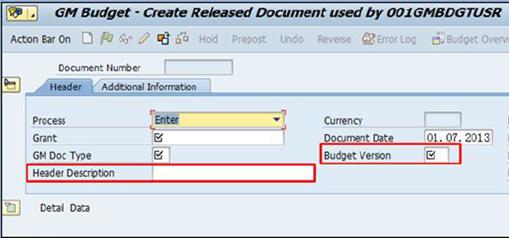

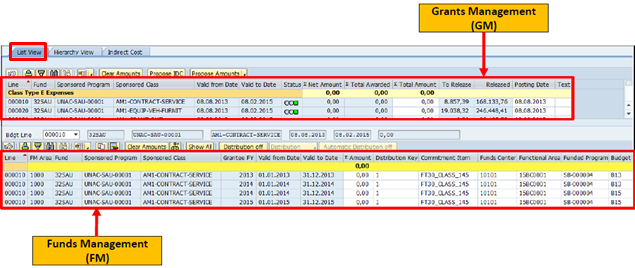

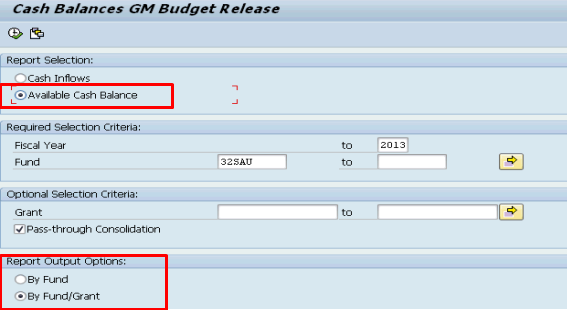

12. Create Released Budget

13. Approve Released Budget via Workflow

14. Post Indirect Costs

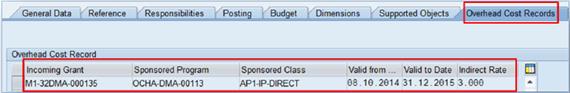

15. Close grant

Grants Framework 2 process steps:

1. Display/Maintain Master data

· Verify Business Partner Data

· Create Sponsored Program

2. Create Resource Mobilization Grant

· Create R1 grant master data

· Change Status of grant to 'Approved by UN'

3. Create Revenue Internal Order

4. Link Revenue Internal Order to grant

5. Change Status of grant to 'Award/Operational'

6. Perform Billing

· Maintain Billing

· Verify sales order

· Remove Billing Block from Billing Plan

· Simulate and Bill grant

· Display FI document

7. Create Implementation Grant

· Create M1 grant master data

· Change Status of Grant (to Award/Operational)

· Link R1 grant to M1 grant

8. Create Unreleased Budget (M1 grant)

9. Approve Unreleased Budget (M1 grant) via Workflow

10. Create Project/Internal Order for expenses

11. Update Sponsored Program

12. Receipt of Funds/Clearing of Receivables

13. Create Released Budget (M1 grant)

14. Approve Released Budget (M1 grant)

15. Create Passthrough Grant

· Create P1 grant master data

· Change Status of Grant (to Award/Operational)

· Link P1 grant to M1 grant

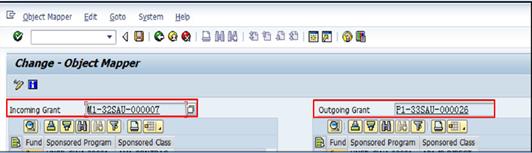

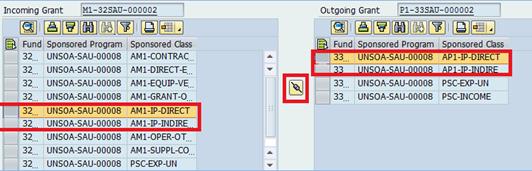

· Map objects from M1 to P1 grant

· Transfer Budget to Passthrough grant (P1 grant)

16. Approve Released Passthrough Grant Budget (P1 grant) via workflow

17. Post indirect costs

18. Close grant

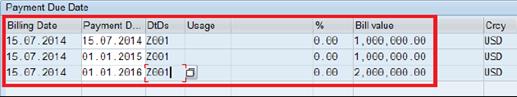

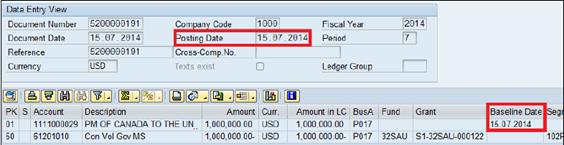

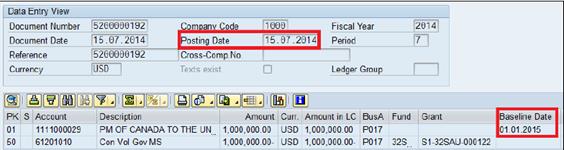

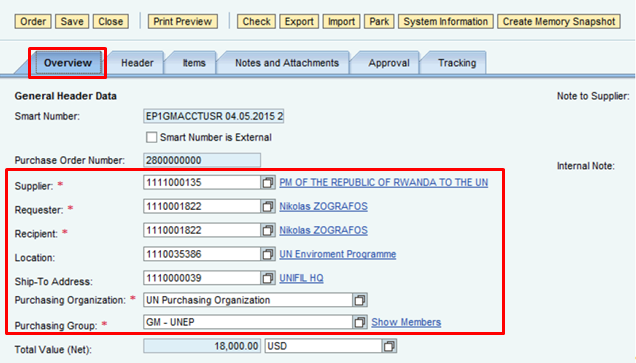

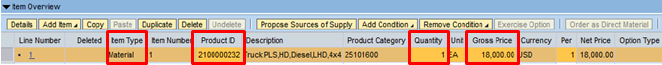

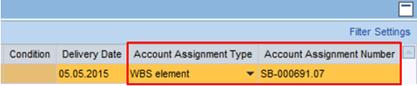

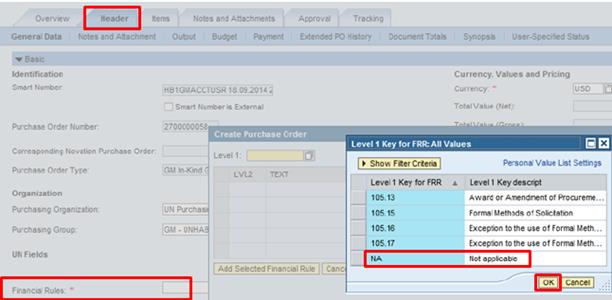

The following example has been used to explain the steps to navigate the entire Grants management process along with the accounting entries generated within each step.

Example - Unconditional grant

A project is funded by three unconditional donor agreements. Two donor Member States contribute USD 1 million in funding and one NGO donor contributes USD 2 million, allotted upfront, inclusive of 13% IDC (the UN portion on expenditure incurred by the UN) on M1 grant, 7% IDC (Implementing Partners portion on expenditure incurred by Implementing Partners), and 6% (the UN portion on expenditure incurred by Implementing Partners) on Passthrough grant. The Passthrough grant to Implementing Partner is USD 1.5 million. Final financial and substantive reports are provided to the donors at the end of the project. Interest earned if any on the unused funds should be returned back to donors in proportion of their contributions.

Donor agreements were signed on 1 July 2014. Cash was received from Donors 1 and 2 on 1 July 2014 and on 2 July 2014 from Donor 3. Advance to Implementing Partner was paid on 15 July 2014. All the direct expenses were incurred and paid prior to completion of project on 30 November 2014. The UN earned interest revenue of USD 12,000 by investing unused donor funds. Balance amount was refunded to donors on 15 December 2014. Expenditure pertaining to the grant is as follows:

|

The UN (USD) |

Implementing Partner (USD) |

Total (USD) |

|

|

Direct expenditure |

|||

|

Employee cost |

750,000 |

500,000 |

1,250,000 |

|

Travel |

200,000 |

100,000 |

300,000 |

|

Equipment |

60,000 |

- |

60,000 |

|

Supplies |

1,202,389 |

672,727 |

1,875,116 |

|

Indirect expenses |

|||

|

PSC - 13% |

287,611 |

- |

287,611 |

|

PSC - 7% |

- |

89,091 |

89,091 |

|

PSC - 6% |

- |

76,364 |

76,364 |

|

Total |

2,500,000 |

1,438,182 |

3,938,182 |

4.3.1 Set Up Master Data and Grant Relationship

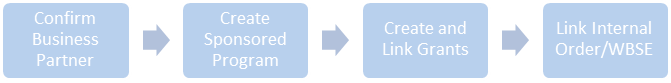

Setting up master data and grant relationships include the following steps:

While completion of these steps do not trigger any accounting entries, it is important to realize that inputs while setting up master data and grant relationships will be the basis for accounting entries posted during the life-cycle of GM. Further it is important to contemporaneously set up master data and grant even if the agreement is not signed by both parties, so that the data can be used for contingent asset disclosure as per section 2.1.3.

Umoja processes

|

Process |

Umoja Role |

Explanation |

For steps refer |

|

Confirm Business Partner |

GM Account User |

Confirm whether the donors and Implementing Partners are Business Partners. If not then Business Partners should be created before the user moves on to the next step |

|

|

Create Sponsored Program |

GM Account User / GM Grant Creator |

Sponsored Program needs to be created so that the donor can be provided with a view of Grant data that they are expecting. |

|

|

Create Grant |

GM Account User / GM Grant Creator |

Since donors require reporting on pooled basis; framework 2 type of a set up will be required. This will involve creating · 3 Resource Mobilization grants representing 3 donors · 1 Main Implementation grant to report entire project on pooled basis · 1 Passthrough grant representing Implementing Partner |

|

|

Link Internal Order / WBSE |

GM Account User / GM Grant Creator |

Since grant activities are executed through Internal Order / project WBSE, it is necessary to link grants and related Sponsored Programs to corresponding Internal Orders / WBS Elements. |

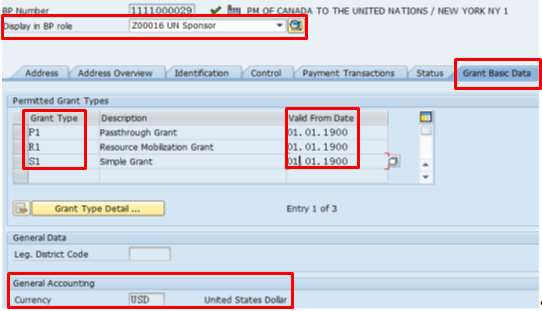

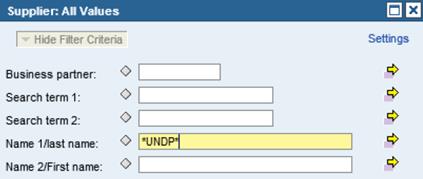

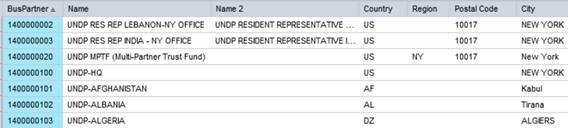

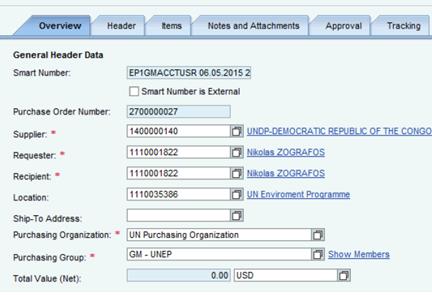

4.3.1.1 Confirm Business Partner

Business Partners are set up in Umoja by the Central Master Data (CMDT) team. As a result, a Grants User will only be responsible for viewing the sponsor's business partner profile to confirm that the sponsor has been entered in the system correctly.

B. Steps to confirm the business partner / Transaction Code: BP

B.1. Enter BP in the Command field and click the Enter icon.

B.2. Search for the sponsor using the BP Number, click Start. Review the general role information.

B.3. Select UN Sponsor from the Display in BP role drop-down list.

B.4. Click the Grant Basic Data tab. Review sponsor-specific information:

· Grant Type: The grant type that can be used for this sponsor. M1 for MIG grant, P1 for Passthrough Grant, R1 for RM grant and S1 for Simple grant.

· Valid From Date: The day the grant is valid.

· Currency: The currency associated with the BP.

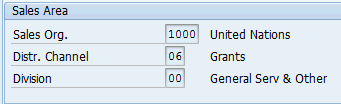

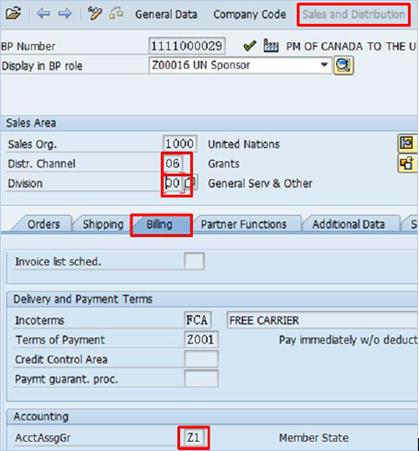

B.5. Click the Sales and Distribution menu bar button and check that the following details in the Sales Area section have already been entered:

· Distribution Channel field is 06.

· Division field is 00.

B.6. Click the Billing tab. Scroll down to Accounting.

Review the details in the AcctAssgGr field for the type of sponsor:

|

Account Group |

Sponsor Type |

|

Z1 |

Govt Member St |

|

Z2 |

Govt Non Member St |

|

Z3 |

Inter and Local Gov |

|

Z4 |

NGO and Public |

|

Z5 |

UN Agency FuProg |

|

Z6 |

Commercial Customer |

Check appropriate classification of sponsor (Z1 for Member State).

B.7. Exit using the Back button.

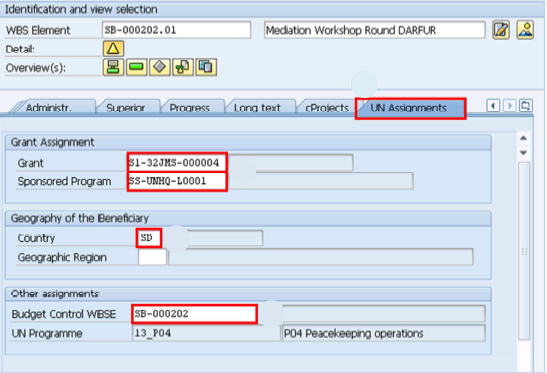

4.3.1.2 Create Sponsored Program

As soon as negotiation with the donor starts, the initial Master Data elements need to be set up in Umoja. If a Sponsored Program has not been set up, it needs to be done at this time. The Sponsored Program identifies a specific program for which the sponsor has contributed money and links to a Work Breakdown Structure Element (WBSE) through the funded program.

A Sponsored Program can be assigned individually to a grant, or it could be assigned to many grants depending on the agreement. For example, it can have one to many relationships with grants if the purpose of the agreements with many donors is the same.

The Sponsored Program can specify the level of earmarking of funds. There should be at least one level of earmarking on the Sponsored Program. Some examples are:

· The purpose of the Voluntary Contribution Fund and/or Fund Group (example: purpose of the program or sub-program).

· The purpose of the Functional Area and/or Functional Area Group.

· The purpose of the Project or Internal Order.

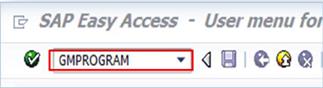

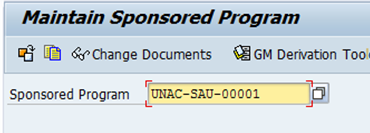

C. Steps to create a new Sponsored Program / Transaction Code: GMPROGRAM

C.1. Enter GMPROGRAM in the Command field.

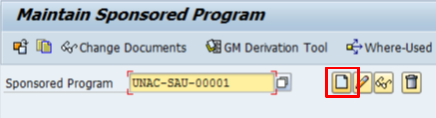

C.2. Click the Enter icon à the Maintain Sponsored Program screen displays.

C.3. Enter name of the Sponsored Program (e.g UNAC-SAU-00001) in the Sponsored Program field and press Enter.

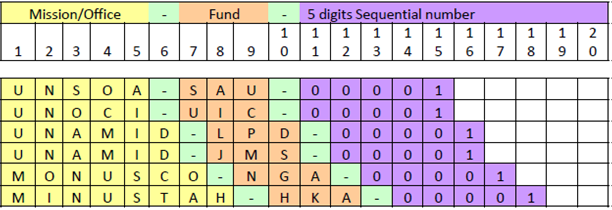

C.4. The following Sponsored Program naming convention should be followed:

· First 1 to 10: Name of Mission/Office (max 10 characters)

· Next: Dash

· Next: Fund Code (3 alpha characters)

· Next: Dash

· Next: 5 digit sequential number 00001 to 99999

Note: The Sponsored Program name should be entered manually by the user as per the naming convention explained above.

C.5. Click the Create icon.

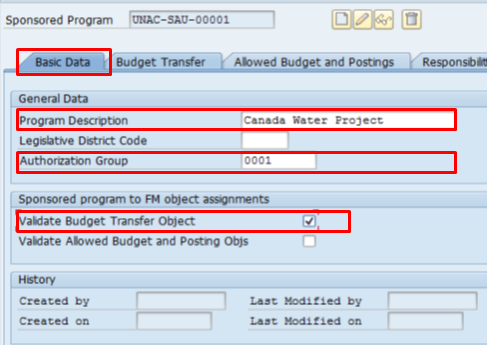

C.6. Click the Basic Data tab.

C.7. Enter the details in the following fields:

· Program Description field.

This field can define the purpose of the contribution.

· If the donor is contributing to a specific project, the description field can contain the name of the project.

· If the donor contributes to a group of projects, for example a 'cluster', the description can be the same as the name of the 'cluster'.

· If the donor contribution is in support of on-going activities, the description should reflect this. For example, 'in support of DPA activities'.

· Authorization Group field: PK missions will use 0001. SPMs will use 0002.

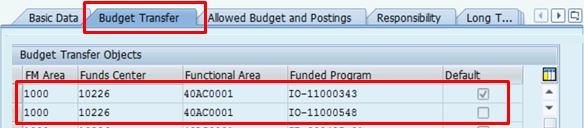

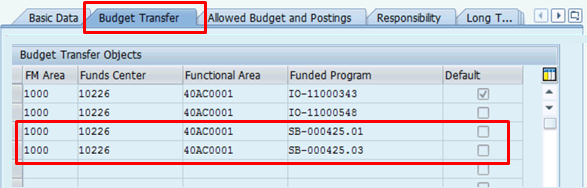

C.8. Select the Validate Budget Transfer Object check box.

This verifies that the FM budget transfer objects used in budgeting exists in the FM objects list maintained in the Sponsored Program Master Data.

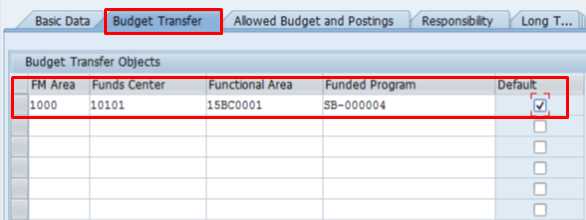

C.9. Click the Budget Transfer tab.

To be able to transfer or to release budget from GM to FM, populate the following fields:

· Enter 1000 in the FM Area field.

· Enter the funds center in the Funds Center field.

· Enter the functional area in the Functional Area field.

· Enter the Funded Program field.

· Select the Default check box. If there are multiple lines, the user can check multiple lines. This identifies all FM objects to be considered as default entries at the time the GM budget document is created.

C.10. Click the Additional Data tab.

Enter the details in the following fields:

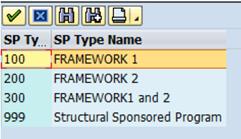

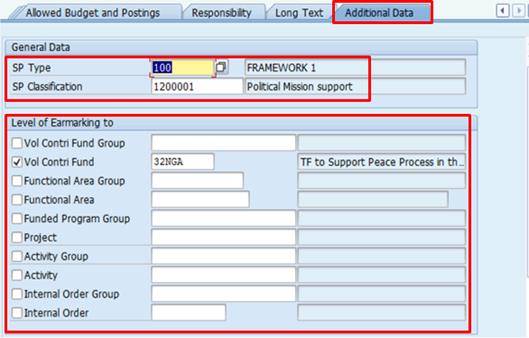

C.10.1. SP Type (Sponsored Program Type): identifies either the Grants Management Framework(s) associated with the Sponsored Program or whether it is a Structural Sponsored Program that is used across the board on all Grants.

There are four main Sponsored Program types:

· 100 - Programmatic Sponsored Program used only in Grants Framework 1

· 200 - Programmatic Sponsored Program used only in Grants Framework 2

· 300 - Programmatic Sponsored Program used in both Grants Framework 1 and 2

· 999 - Structural Sponsored Program; required to support postings in FI.

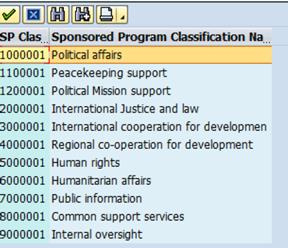

C.10.2. SP Classification (Sponsored Program Classification): provides the major programmatic areas fir which the donor provides funding.

C.10.3. Select the relevant check boxes from the Level of Earmarking to area in accordance to the Donor Agreement. At least one level of earmarking has to be checked otherwise Sponsored Program cannot be saved.

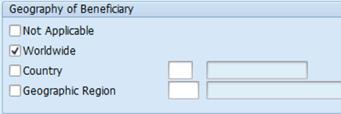

C.10.4. Select the relevant check box from the Geography of Beneficiary area. If Country or Geographic Region check box is checked, choose specific Country or Region.

C.10.5. If applicable, select the relevant check box from the Other Donor Earmarking.

C.11. Click the Save icon.

4.3.1.3 Create, Link and Change Grant Status

This section explains the Umoja process steps to create grant, link grant to the appropriate grant to insure that all applicable funding is allocated to the correct program and subsequently map different object classes between S1 or M1 grant and P1 grants as well as the process steps to change grant status.

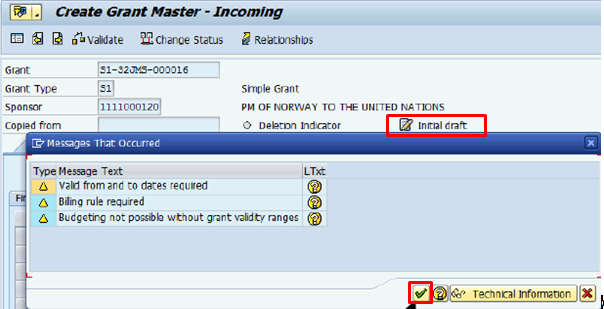

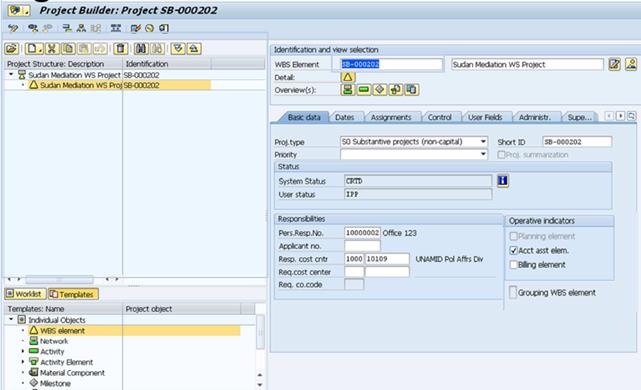

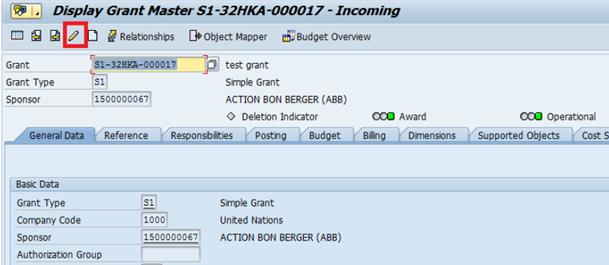

4.3.1.3.1 Create Grant

Grants are created at the negotiation stage and tracked in the system until expiry date. The creation of grant is similar for all types of grants. However, the type of grant defines grant layout and therefore there are difference in a number of tabs and fields on the grant's screen depending on the grant type.

Note: If a single contribution is both monetary and in kind, two grants will need to be created in Umoja - one grant for the monetary portion of the contribution and one grant for the in-kind portion of the contribution.

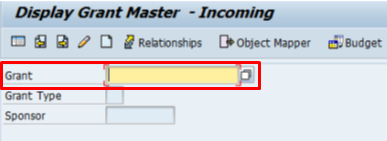

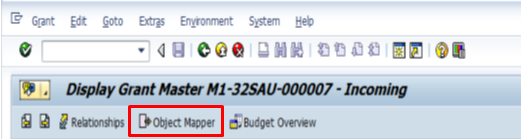

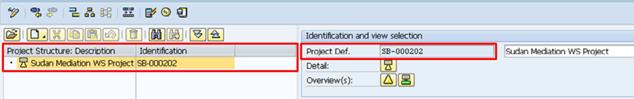

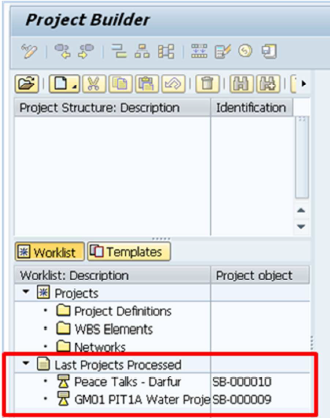

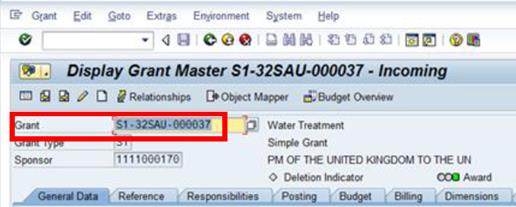

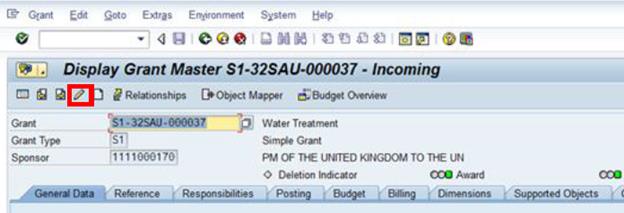

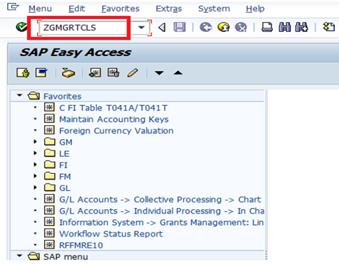

D. Steps to create grant (S1, R1, M1 and P1) / Transaction Code: GMGRANT

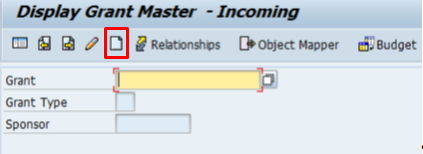

D.1. Enter GMGRANT in the Command field.

D.2. Click the Enter icon à The Display Grant Master screen is displayed.

D.3. Click the Create icon.

D.4. Populate data in the following fields:

|

Grant |

Grant ID comprises of the Grant Type and the Fund to which the Grant is linked. Example: R1-32SAU- , M1-32SAU-, S1-32SAU |

|

Grant Type |

The grant type describes a grant and controls its behavior. R1 / M1 / S1 / P1 |

|

Sponsor |

· Not applicable for P1. · For S1, R1 and M1 (in Framework 1): BP in BP role Z00016 (UN Sponsor). · For M1 (in Framework 2): enter group sponsor number (a dummy group number) or sponsor for Exception as per section 4.2.2 |

|

Copied from |

To copy all the information from an existing grant. Enter the grant number here. |

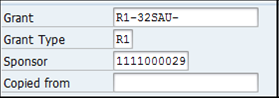

D.5. Press the Enter key on the keyboard.

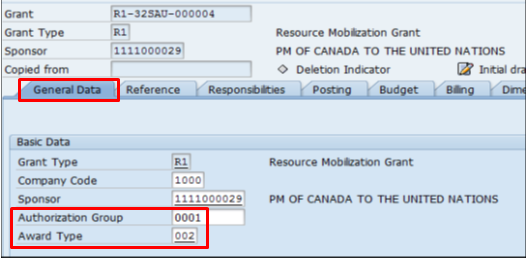

D.6. Click the General Data tab, available in all grant types:

D.6.1. In the Basic Data section, enter the required details in the following fields:

|

Company Code |

This value is defaulted to 1000 |

||||||||

|

Authorization Group |

Authorization groups for grants are a means of grouping Grants objects together for the purpose of authorization checking for security. Only users with appropriate roles assigned to a particular authorization group will be able to create or change grants for this authorization group. Example: PK missions will use 0001 and SPMs will use 0002. |

||||||||

|

Award Type |

Indicates how the grant is originated. For S1, R1 and M1 grants, award type is a type of legal framework for business relationship between Sponsor (Donor) and the United Nations, which is used for classification and reporting purpose.

For P1 grants, award type is a type of legal framework for business relationship between Grantor (the UN) and Grantee (Implementing Partner), which is used for classification and reporting purposes. |

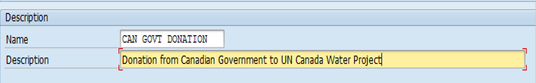

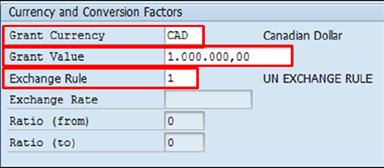

D.6.2. In the Description section, enter details to the following fields:

|

Name |

Short description of the grant. The 20-character short description of the grant is text used by various reports to identify the grant. Use capital letter for consistency. |

|

Description |

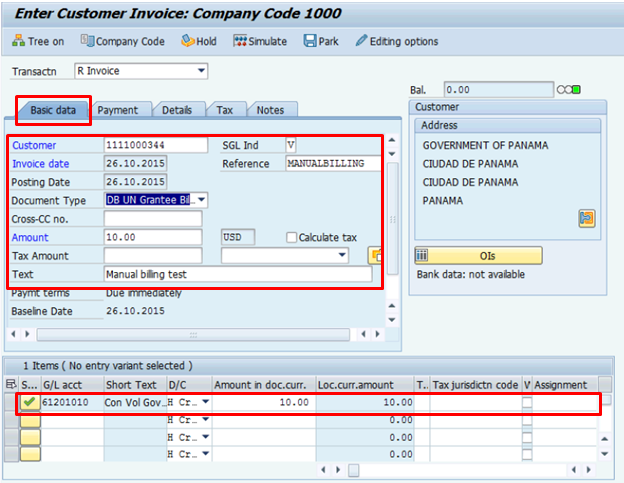

80-character long text description of the grant (not case-sensitive). This description will be printed on the Receipt Voucher. Use capital letter for consistency. Example: Grant by Denmark to support Demining activity in North Afganistan |

D.6.3. Populate the required details in the Currency and Conversion Factors section:

|

Grant Currency |

Currency as stated in the agreement. Valid Grant currency must be input depending on the Grant type: · R1 can be in any currency. · S1 M1 and P1 must be in USD. |

|

Grant Value |

The total value of the grant in the currency defined in Grant Currency as per Donor Agreement, including both direct and indirect costs. Note: The total of the M1 grant will continue to change as additional R1 grants are linked to it. The value of the grant must always represent the current consolidated value of the R grants linked to the M grant. |

|

Grant Value in USD |

· For R1 Grant: USD equivalent of the donor agreement at the UN exchange rate on the date of signing the agreement. · For S1 and P1 Grants: Equals Grant value as expressed in USD on General Data Tab. · For M1 Grant: USD equivalent of all donor agreements represented by corresponding Resource Mobilization Grants at the UN exchange |

|

Exchange Rule |

The exchange rule field will always be 1 which represents UN Exchange rule. |

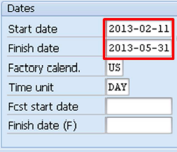

D.6.4. Populate the required details in the Grant Validity section:

|

Valid from Date |

Represents Grant start date, start of negotiations for the grant. Starting on this date, use of the grant by any transactions is allowed in Umoja. Format: DD/MM/YYYY |

|

Valid to Date |

The end date of the grant is the financial closing date. After this date no transactions is allowed using this Grant. Format: DD/MM/YYYY |

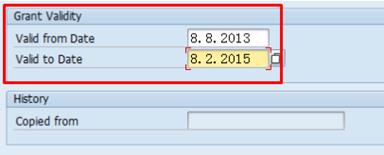

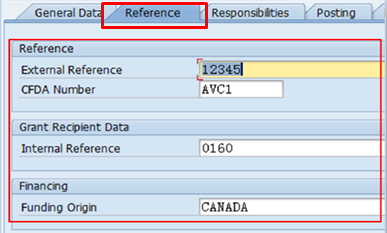

D.7. Click the Reference tab, available in all grant types:

D.7.1. In the Reference section, enter the required details in the following fields:

|

External Reference |

· For S1 and R1: Donor Agreement ID assigned by the donor, reports sent to the donor include this number · For P1: Funding Agreement ID assigned by the grantee · For M1: Not applicable |

||||||||||||

|

CFDA Number |

· Only applicable for S1 and M1. · Defines the level of GM budgetary control. If the budget is to be controlled at Fund and Grant level without Sponsored Class and time slice, choose AVC4 which is the most relaxed budgetary control. If the budget is to be controlled at each grant element, choose AVC1 which is the strictest budgetary control.

|

D.7.2. In the Grant Recipient Data section, in the Internal Reference field enter:

· For S1 and R1: Donor Agreement ID assigned by the UN

· For P1: Funding Agreement ID assigned by the UN

· For M1: Not applicable

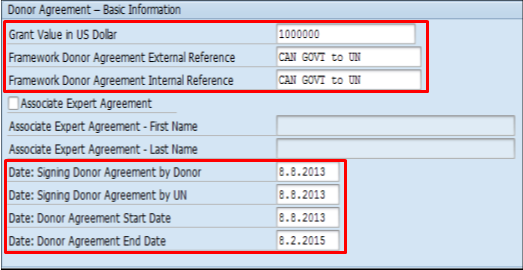

D.7.3. In the Donor Agreement - Basic Information section, populate the following fields:

|

Grant Value in US Dollar |

· For S1, R1 and P1: USD equivalent at UN Exchange Rate on the date of signing of the agreement · For M1: USD equivalent of all donor agreements at the UN Exchange rate on the date of signing each Donor Agreement. |

|

Framework Donor Agreement External Reference |

· Framework Donor Agreement ID assigned by the donor · Only applicable for S1 and R1 |

|

Framework Donor Agreement Internal Reference |

· Framework Donor Agreement ID assigned by the UN · Only applicable for S1 and R1 |

|

Associate Expert (check box) |

· Has to be checked at any times whether or not the agreement relates to an Associate Expert. · Not applicable for P1 |

|

Associate Expert Agreement - First Name |

If the Donor Agreement is not for Associate Experts, input 'NA'. |

|

Associate Expert Agreement - Last Name |

If the Donor Agreement is not for Associate Experts, input 'NA'. |

|

Date: Signing Donor Agreement by Donor |

· For S1 and R1: Signature date of the agreement by donor · For M1: First date the Donor Agreement is signed by one of the donors · For P1: Not applicable |

|

Date: Signing Donor Agreement by UN |

· For S1 and R1: Signature date of the agreement by the UN · For M1: First date the Donor Agreement is signed by the UN · For P1: Not applicable |

|

Date: Donor Agreement Start Date |

· For S1 and R1: Operational start date when the UN can start incurring expenditures against the grant. Note: If not specified, enter the date of signing agreement by Donor or by the UN, whichever the later. · For M1: The earliest operational start date when the UN can start incurring expenditures against the grant. Note: If multiple R1 grants fund an M1 grant, enter the earliest date reflected on the related R1 grants. · For P1: Not applicable |

|

Date: Donor Agreement End Date |

· For S1 and R1: Operational end date in which as of this date the UN cannot create new obligations against the grant. · For M1: The operational end date as indicated in the related R1 grant(s) in which the UN cannot incur expenditures against the grant. Note: If multiple R1 grants fund an M1 grant, enter the latest end date reflected on the related R1 grants. · For P1: Not applicable |

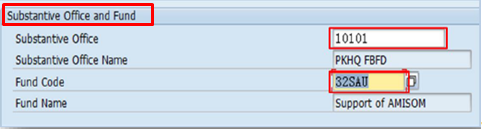

D.7.4. In the Substantive Office and Fund section, enter the required details in the following fields:

|

Substantive Office |

Cost Center / Fund Center which manages the grant |

|

Fund Code |

This should be the same as the ID of the Fund incorporated in the ID/name of the grant. Example: The Fund Code for grant S1-32JMS-000013 should be 32JMS |

D.7.5. In the Funding Agreement - Basic Information section, applicable only to P1 grant, populate the following fields:

|

UN Grantee |

Choose the UN Grantee (Implementing Partner) from list of vendors |

|

Funding Framework Agreement External Reference |

Funding Framework Agreement ID assigned by the Implementing Partner

|

|

Funding Framework Agreement Internal Reference |

Funding Framework Agreement ID assigned by the UN

|

|

Date: Signing Funding Agreement by UN Grantee |

Date of signing Funding Agreement by Implementing Partner |

|

Date: Signing Funding Agreement by UN |

Date of signing Funding Agreement by the UN |

|

Date: Funding Agreement Start Date |

Operational start date of the agreement when the UN starts transferring funds to the Implementing Partner. Note: If not specified, enter the date of signing agreement by Implementing Partner or by the UN, whichever is later. |

|

Date: Funding Agreement End Date |

Operational end date when no new commitments or obligations can be created against the grant. |

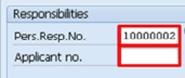

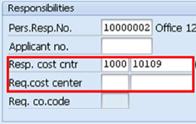

D.8. Click the Responsibilities tab, available in all grant types.

The enterprise roles that have access for the grant are listed. This includes the user's role and ID. The information is defaulted by the system for values 0005 - Budget Approver Unreleased and 0007 - Budget Approver Released. These two values are necessary to support Grants Management Budget workflows for unreleased and released budgets.

Completion of this tab is not required however, adding user information to this table will assist other users in identifying who to contact in the event that questions regarding the grant arise.

D.9. Click the Posting tab, available in all grant types.

|

Block All Postings (check box) |

Block all posting on the grant. Note: Ensure that the box in unchecked prior to Billing process. |

|

Allow Pre-Award Postings |

Not used by Umoja. |

|

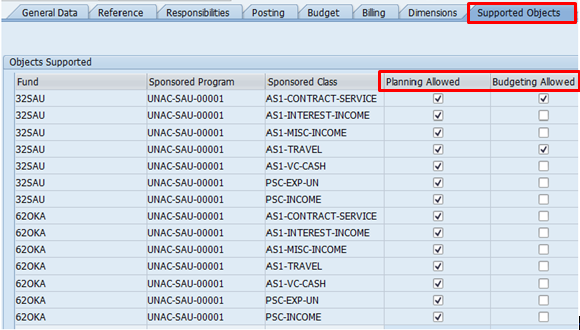

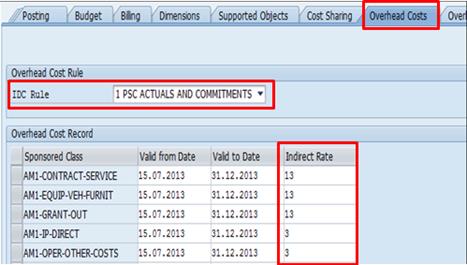

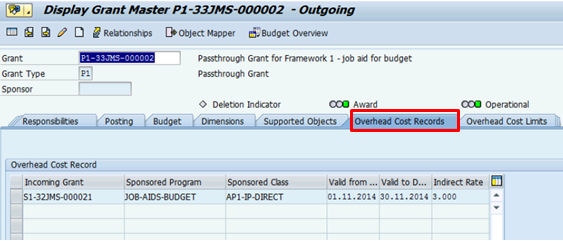

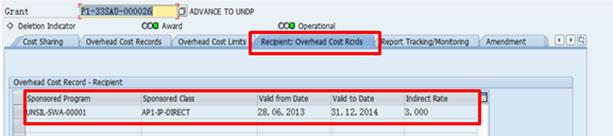

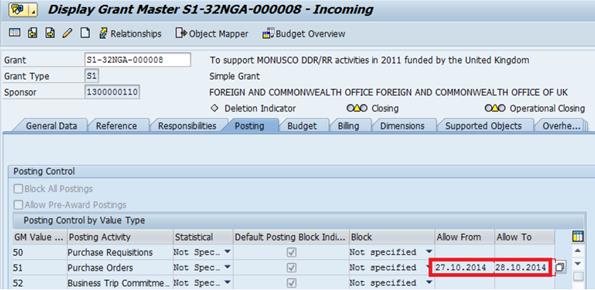

Allow in and Allow to |

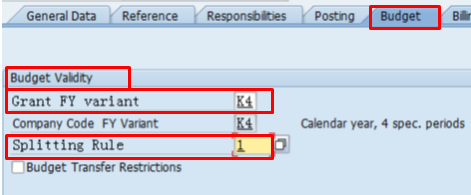

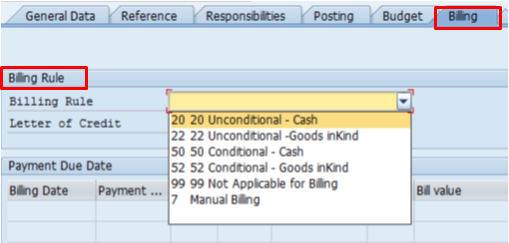

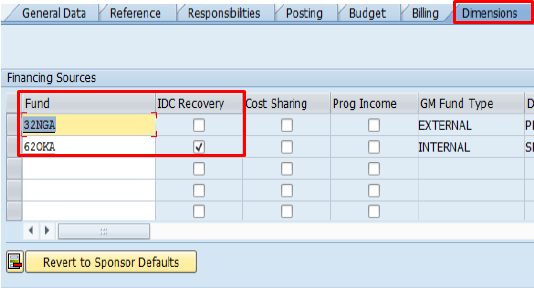

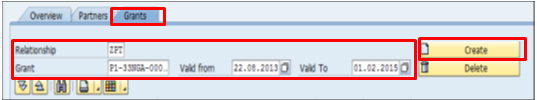

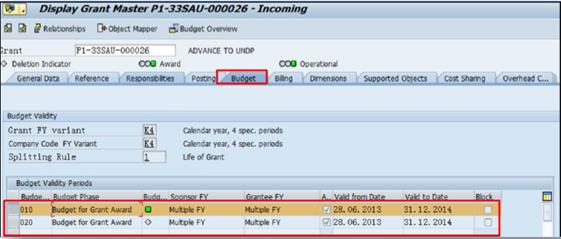

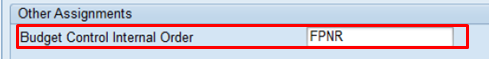

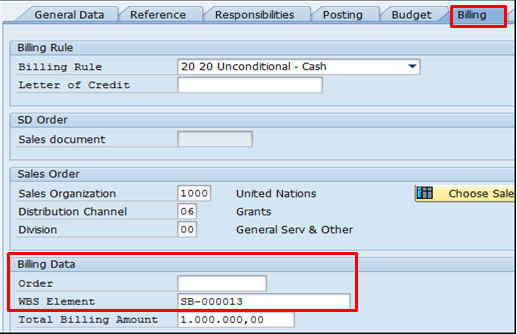

Used during closure if the grant to allow processing of required transaction. |