1 Objective

Financial instruments include a wide range of assets and liabilities at the United Nations (UN) Secretariat reporting entities such as cash, term deposits, investments, contributions receivables and account payables. In addition Cash Pools which represent significant portion of the UN assets is within the scope of accounting for financial instrument.

The objective of this chapter is to give a brief overview of the accounting lifecycle and relevant guidance on accounting for financial assets other than Investments and Cash and cash equivalents within Umoja environment. This chapter on financial instruments primarily includes Accounts Receivable module within Umoja environment.

This chapter details how an end user, based on the involved Umoja user profiles, should perform roles and responsibilities related to accounting of financial assets other than Investments and Cash and Cash equivalents.

2 Summary of IPSAS Accounting Policies

UN Secretariat reporting entities classifies certain financial assets like Cash and cash equivalents, receivables non-exchange and exchange transactions, loans to implementing partners, executing agency, staff, certain Investments in term deposits as Loans and receivables.

The classification of financial assets primarily depends on the purpose for which the financial assets are acquired and is re-evaluated at each reporting date.

2.1 Recognition, Derecognition and Measurement of Loans and Receivables

UN Secretariat reporting entities initially recognizes financial assets classified as loans and receivables on the date that they originate, which is the date the reporting entity becomes party to the contractual provisions of the instrument.

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They are initially recorded at fair value plus transaction costs and subsequently reported at amortized cost calculated using the effective interest method. Interest revenue is recognized on a time proportion basis using the effective interest rate method on the respective financial asset. They are included in current assets, except for maturities greater than 12 months after the end of the reporting period.

Loans and receivables are assessed at each reporting date to determine whether there is objective evidence of impairment. Evidence of impairment includes default or delinquency of the counterparty or permanent reduction in value of the asset. Impairment losses are recognized in surplus or deficit in the Statement of Financial Performance in the year they arise.

Loans and receivables are derecognized when the rights to receive cash flows have expired or have been transferred and the UN has transferred substantially all risks and rewards of financial asset.

Financial assets and liabilities are offset and the net amount reported in the Statement of Financial Position when there is a legally enforceable right to offset the recognized amounts and there is an intention to settle on a net basis or release the asset and settle the liability simultaneously.

Cash and Cash Equivalents

Cash and cash equivalents include cash, and short-term, highly liquid investments that are readily convertible to known amounts of cash and are subject to an insignificant risk of changes in value. Financial instruments classified as cash equivalents include investments in term deposits with a maturity of three months or less from the date of acquisition and investments in the cash pools.

Contributions receivable

Contributions receivable includes uncollected revenue from assessed and voluntary contributions committed to UN Secretariat reporting entities by member states, non-member states, donors based on enforceable commitments. These non-exchange receivables are stated at nominal value, unless the impact of discounting future contractual cash flows is material, less impairment for estimated irrecoverable amounts.

Other Receivable

Other receivable primarily includes amounts receivable for goods or services provided to other entities, amount receivable for operating lease arrangements, and loans/advances to staff, Inter fund balance.

Impairment of Financial Assets Classified as Loans and Advances

Estimated irrecoverable amount for financial reporting purpose is computed based on an analysis which is primarily based on specific identification of receivable and the period since the receivable is overdue.

Estimated irrecoverable amount for voluntary contributions receivable, trade receivables and other receivables is 100% when overdue for 3 years and more, 60% when overdue by more than 2 years and 25% when overdue by more than 1 year. Estimated irrecoverable amount for assessed contributions receivables is 100% when past due in excess of 2 years for which Member States have contested the amounts and any balances outstanding for less than 2 years will be disclosed in the notes to the Financial Statements.

2.2 Identification of Financial Instruments - Assets

Table below provides a list of common assets in the statement of financial position line items and applies the concepts to determine whether the items meet the definition of a financial instrument. The last two columns of the table establish whether the instruments identified fall within or outside the scope of IPSAS 28: Financial Instruments: Presentation; IPSAS 29: Financial Instruments: Recognition and Measurement, and IPSAS 30: Financial Instruments: Disclosures. The list is not exhaustive, but provides an aide to help in identifying financial instruments.

|

Statement of financial position line item |

Financial instrument |

Included within the scope of IPSAS 28 and IPSAS 30 |

Included within the scope of IPSAS 29 |

|

|

Yes = ✓ |

Yes = ✓ |

Yes = ✓ |

|

|

No = ✗ |

No = ✗ |

No = ✗ |

|

Intangible assets |

✗ |

n/a |

n/a |

|

Property, plant and equipment |

✗ |

n/a |

n/a |

|

Inter-agency receivable/payable balances |

✓ |

✓ |

✓ |

|

Investments |

✓ |

✓ |

✓ |

|

Inventories |

✗ |

n/a |

n/a |

|

Finance lease receivables |

✓ |

✓ |

✗ |

|

Contribution receivables |

✓ |

✓ |

✓ |

|

Pre-payments - goods and services |

✗ |

n/a |

n/a |

|

Cash and cash equivalents |

✓ |

✓ |

✓ |

Assets (such as pre-paid expenses) for which the future economic benefit is the receipt of goods or services, rather than the right to receive cash or another financial asset, are not financial assets.

2.3 Reference

For more details on the IPSAS requirements regarding financial instruments, refer to:

· The Corporate Guidance on Financial Instruments.

3 Desktop Procedures

3.1 Introduction to Accounts Receivable Module

The Accounts Receivable (AR) area is comprised of all business processes related to recording and tracking receivables from member states, donors, commercial customers, staff members and any other entity that owes money to the UN. The AR module is integrated with other modules/sub module like General Ledge (GL), Sales & Distribution (SD), Travel Management (TM), Flexible Real Estate Management (RE) and Grants Management (GM) which allows simultaneous and online postings to AR.

The Umoja AR solution includes the following processes:

AR process requires the creation of customer as master data elements to execute transactions and maintain source data. These are recorded as Business Partner (BP).

On initial set up, each BP is assigned to a reconciliation account that reflects sub ledger activity in the General ledger. Transactions posted to Business Partner (BP) or customer accounts (invoices, credit memos, payments) are recorded in AR sub ledger and are automatically updated to General Ledger accounting through reconciliation accounts.

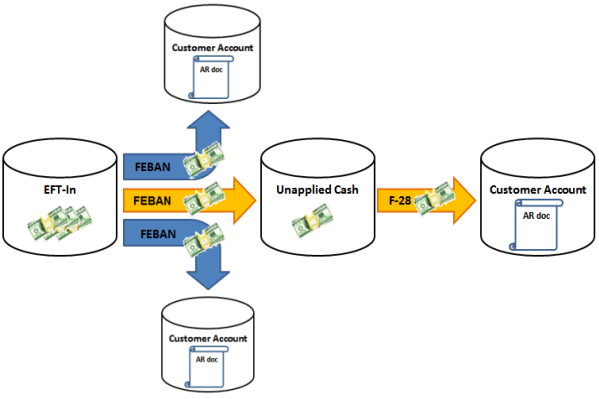

Payments from customers can be received via EFT (electronic fund transfer), bank deposits, and cheques. The incoming payment processing and clearing of invoices can be done manually or automatically and as a whole or partially.

Receivable are tracked to ensure timely payments by customers. In the event of late payments, a Dunning process is implemented that creates reminders automatically in the Umoja system.

Impairment is recorded either by way of write offs (recognized directly to business partners ledger account) or by way of allowance (recognized through the use of an allowance account). Allowance for bad debts is recorded as accrual entry. Accrual entry implies that the entry for the allowance is recorded in one period and then automatically reversed in the next period. Accordingly for each period, the allowance entry will be calculated in total, recorded, and then reversed in the next period.

3.1.1 Document Types

The use of document types is the key to a meaningful classification of transaction on a customer's account.

There are four categories of accounts receivable document types:

i. Original documents

· Documents created manually by AR Users in the accounts receivable module.

· Downpayment (advance) requests, invoices, credit notes, write offs and incoming payment received by the Cashier and recorded in the cash journal are original documents.

· AR Users are expected to attach supporting documentation to original documents.

· Original documents must be approved in workflow, except for cash journal documents which are posted immediately by the cash journal custodian.

ii. Follow on documents

· Documents that are automatically created by the system based on original, interfaced or converted documents.

· Majority of these follow on documents are incoming payment documents generated by the bank reconciliation and clearing documents created by the clearing batch program.

· A manual follow on document is created when the cash received could not be identified by the bank reconciler and was recorder in the Unapplied Cash GL account. In this case, the AR User has to do a manual application of the cash to the customer's account.

· Another manual follow on document is created after a downpayment has been paid by the customer. In this case, the AR User manually clears the downpayment.

· Follow on documents are posted without workflow approval and no supporting documentation is attached.

iii. Interfaced documents

· Documents will come through:

o The Sales and Distribution (SD) interface. Approved Sales Orders in SD will give rise to billing documents in FI.

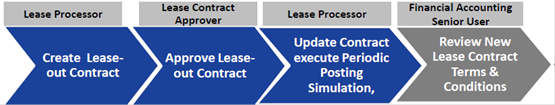

o The Real Estate (RE) interface. Approved lease contract will give rise to billing documents in FI.

o The Grant module via SD where the revenue and receivables for grants with status 'Award'.

· All accounts receivable documents created by an interface are created with status 'posted'.

· No supporting document is expected to be attached to interfaced documents.

iv. Converted documents

· These documents are posted by the conversion program and there is no supporting documents attached. X1 is the document type for all converted documents in accounts receivable.

|

Type |

Name |

Document Number Range |

Description |

Workflow Routing in FI Module |

Typical posting schemes |

|

Original Documents |

|||||

|

DA |

Downpayment Request |

26 |

Downpayment requests created with F-37 or in SD are not recorded on the balance sheet as they are 'noted items' in the system's memory until they are disbursed. Upon receipt, a DZ document is created to record the downpayment received and the corresponding deferred income (liability). |

No workflow. Posted immediately by AR User or interface |

Dr Customer

Noted items are not balanced documents |

|

DR |

Customer Invoice |

22 |

All customer invoices recorded manually with FV70 or ZARDOCLOAD have the same doc type |

TEA à DB1

TEA = Data Entry Agent DB1 = Approving Officer |

Dr Customer Cr Revenue |

|

DW |

Customer Write-Off |

27 |

To record a write off with FV75. This doc type allows anyone in the organization to subsequently identify a write off taken by another office in the past and initiate recovery procedure if the business partner re-begins to transact with the UN. |

Cr Customer Dr Write Off expense |

|

|

DG |

Customer Credit Memo |

23 |

To record a payable to a customer with FV75. |

Cr Customer Dr Revenue |

|

|

ZC |

Cashier Incmng_Outgn |

64 |

Incoming payment from customer received by Cashier. E.g. telephone charge |

No workflow. Posted immediately by Cash Journal custodian |

Dr Cash Journal Cr Customer |

|

ZI |

Imprest Account |

61 |

Incoming payment from customer received by Imprest custodian |

||

|

ZP |

Petty cash |

62 |

Incoming payment from customer received by petty cash custodian |

||

|

Type |

Name |

Document Number Range |

Description |

Workflow Routing in FI Module |

Typical posting schemes |

|

Follow on Documents |

|||||

|

DZ |

Incoming Payment |

24 |

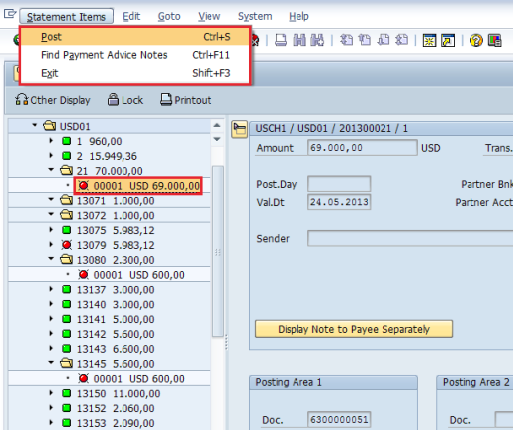

Incoming payments recorded with FEBAN or F-28. |

No workflow. Posted immediately by Bank Reconciler (FEBAN) or AR User (F-28) |

Cr Customer Dr Unapplied Cash (64VQA or your fund) |

|

DA |

Downpayment Clearing (manual) |

26 |

Manual downpayment clearing recorded by the AR User with F-39 after the customer has paid the DP. These DA documents are normal items that appear on the balance sheet (i.e. they are not noted items) |

No workflow. Posted immediately by AR User |

Dr Deferred Income (SPGL A) Cr Customer |

|

KZ |

Outgoing Payment |

33 |

Payment document generated by payment program for electronic or cheque payment method. |

No workflow. Posted by FPRL_LIST |

Dr Customer Cr Bank Clearing |

|

Interfaced Documents |

|||||

|

RV |

Billing Doc.Transfer |

52 |

Billing document generated through the SD interface by the Senior FI User with VF04 based on approved Sales Orders or Grants in Award status. |

No workflow. Grants receivable posted by scheduled interface. Other SD doc posted by VF04 interface. |

Dr Customer Cr Revenue |

|

RL |

Real Estate Billing |

57 |

Billing documents generated through the RE interface by the Senior FI User with RERAIV based on approved Lease Contracts. |

No workflow. Posted by RERAIV interface |

Multiple. |

|

Converted Documents |

|||||

|

X1 |

AR Conversion |

78 |

X1 |

Posted by conversion program |

Dr Customer Cr Conversion accnt |

3.1.2 Document Status, Workflow Status and Workflow Routing

In Umoja the document status is not linked to the workflow status, thus to know what action is needed to complete a document, combination of the document and workflow status needs to be considered.

Below are document statuses for FI documents, Earmark Funds documents and FM redeployment.

|

AR Documents Status |

AR Document Type |

Comment |

|

1. Save Parked Document |

DR, DG, DW |

· Document is saved/parked without edit or budget check · No FM document created · Workflow is not triggered · Any AR User can retrieve and modify the document |

|

2. Save as Completed |

DR, DG, DW |

· Edit and budget checks are completed · If real commitment item is used, an FM document is posted to commit budget · Document is submitted in workflow and cannot be changed outside of workflow |

|

3. Posted |

All AR document types |

· When a document is reversed, it remains posted. A new document with the same document type is posted to offset the original document. |

It is important to remember that all parked accounts receivable documents need to be cleared at end of month.

· It is the responsibility of the mission/local office to ensure that there are no parked documents at month end.

· It is the UNHQ responsibility to ensure that there are no parked documents in a period before the period is closed.

3.1.3 Business Partner (BP)

Accounts receivable module requires a customer for all transactions. No transaction can be posted in the module without a customer. A customer is a business partner that has one of the customer roles.

3.1.3.1 BP Groups

The BP group defines:

i. the number range of the BP;

ii. the General Ledger control account used to record accounts receivable transactions for that BP; and

iii. what roles the BP can have.

The BP group is the first parameter that is defined on the BP master record and it should not be changed afterwards.

The following table shows BP groups available in Umoja:

|

BP Group |

BP No |

|

Commercial Vendor UNGM |

1110 |

|

Member States (Permanent Mission) |

1111 |

|

Non Member States (Holy See, etc.) |

1200 |

|

Government and Local Authority |

1300 |

|

UN Agency Fund Programme |

1400 |

|

Intergovernment and NGO |

1500 |

|

Treasury Business Partner (Counterparty) |

1700 |

|

Commercial Customer |

1800 |

|

Vendor non UNGM |

1900 |

|

Individuals externals (Retirees, consultants, independent contractors, survivors, etc.) with Index No |

2000 to 2001 |

|

Staff Members |

2000 to 2001 |

|

Military and Police |

2000 |

|

Ship to |

9000 |

|

Bill to |

9100 |

|

Contact Person |

9200 |

BP numbers are automatically determined by ECC (Enterprise Core Component) in a sequential manner except for:

· Commercial Vendor UNGM (1110). The BP number is determined by SRM as such that it is considered 'external' to ECC.

· Individuals BP Groups (2000 to 2001 Individual External, Staff Members and Military and Police). The BP number incorporates the individual's index number (6 or 7 digits) preceded by 2 and two or three zeros to fill in the BP number to 10 digits.

3.1.3.2 BP Roles

The BP role defines what transactions can be recorded on the BP. Roles are added to the BP master record by the Master Data Maintenance (MDM) teams responsible for BPs. Roles can be added at the time of creation or at any time later upon request.

The following is the list of the BP roles available in Umoja.

|

|

Role |

Financial Transactions |

Comment |

|

Z00009 |

UN Low Value Vendor |

Accounts payable |

Can be used in SRM with a low value PO and directly in AP for invoices without PO |

|

Z00010 |

UN FI Vendor |

Accounts payable |

Only invoices without PO |

|

Z00011 |

UN Vendor |

Accounts payable |

Can be used in SRM with POs and directly in AP for invoices without PO |

|

Z00012 |

UN FI Customer |

Accounts receivable |

Only invoices without sales order |

|

Z00013 |

UN Customer |

Accounts receivable |

Can be used in Sales and Distribution for sales order and directly in AR module for invoices without sales order |

|

Z00014 |

UN Tenant (w/o Cust. Acct) |

No |

|

|

Z00015 |

UN Master Tenant |

No |

|

|

Z00016 |

UN Sponsor |

No |

|

|

Z00017 |

UN Counterparty |

No |

|

|

Z00018 |

UN Ship to Partner |

No |

|

|

Z00019 |

UN Bill to Partner |

No |

|

|

Z00020 |

UN Financial Services BP |

No, Treasury only |

|

|

Z00021 |

UN Issuer |

No, Treasury only |

|

|

Z00022 |

UN Global Custodian |

No, Treasury only |

|

|

Z00023 |

UN Depository Bank |

No, Treasury only |

|

|

Z00024 |

UN Bank |

No, Treasury only |

|

|

Z00025 |

UN Paying Bank |

No, Treasury only |

|

|

Z00026 |

UN Landlord w.Vendor Account |

No |

|

|

Z00050 |

UN Lease Processor |

No |

|

|

Z00051 |

UN Contract Approver |

No |

|

|

Z00052 |

UN Facilities Planner |

No |

|

|

Z00053 |

UN Facilities Manager |

No |

|

|

Z00054 |

UN Real Estate Agent |

No |

|

|

Z00055 |

UN Contact Person |

No |

|

Note: Roles in italized font permit the recording of financial transactions. Roles in blue font are relevant to accounts receivable.

Many roles do not permit the recording of financial transactions in the financial accounting (FI). For example if we use a BP with only the UN Sponsor role, we will not be able to record accounts receivable or accounts payable in FI or record transactions in GM for that BP.

It is also important to remember that the following Business Partner Groups - Commercial Vendor UNGM, Individuals external with index numbers (Retirees, Consultants, Independent Contractors, Survivors, etc), UN Staff Members, Military and Police - do not have customer roles. They only have vendor roles. Accordingly, any cost recoveries from them e.g. telephone bill, fuel, liberty hours, etc. are done by debiting their vendor accounts through a credit memo in the Accounts Payable sub-ledger. The Accounts Receivable sub-ledger is only used to record receivables from Business Partners who have a customer role in Umoja.

In practice, many BPs has more than one roles. The number of roles created on the BP master record depends on the BP group. The following table shows for each BP group, what roles the UN Secretariat has decided to give to all BPs created in that group and what additional roles can be requested at the time of creation or later on an 'as needed' basis.

|

BP No |

BP Group |

Roles Given to all BPs in the Group |

Additional Roles (as needed) |

|

1110 |

Commercial Vendor UNGM |

Z00011 UN Vendor |

Z00026 Un

Landlord w.Vendor Acct |

|

1111 |

Member States (Permanent Mission) |

Z00011 UN

Vendor |

Z00015 UN

Master Tenant |

|

1200 |

Non Member State (Holy See, etc.) |

||

|

1300 |

Government and Local Authority |

||

|

1400 |

UN Agency Fund Programme |

||

|

1500 |

Intergovernment and NGO |

||

|

1700 |

Treasury Business Partner (Counterparty) |

Z00020 UN

Financial Services BP |

None |

|

1800 |

Commercial Customers |

Z00013 UN Customer |

Z00015 UN Master Tenant |

|

1900 |

Vendor non UNGM |

Z00009 UN Low Value Vendor |

Z00015 UN

Master Tenant |

|

2000 to 2001 |

Individuals externals (Retirees, consultants, independent contractors, survivors, etc.) with Index No |

Z00011UN Vendor |

None |

|

2000 to 2001 |

Staff Members |

Z00010 UN FI Vendor |

Z00050 UN

Lease Processor |

|

2000 |

Military and Police |

Z00010 UN FI Vendor |

None |

|

9000 |

Ship to |

Z00018 UN Ship to Partner |

None |

|

9100 |

Bill to |

Z00019 UN Bill to Partner |

None |

|

9200 |

Contact Person |

Z00055 UN Contact Person |

None |

Note: Commercial BP groups (1110 Commercial Vendor, 1800 Commercial Customers and 1900 Vendor non UNGM) do not mix vendor and costumer roles on the same BP while other BP groups (such as 1111 Member States) combine a vendor and customer role on the same BP. This is because BP number for 1110 Commercial Vendor UNGM is not determined in ECC whereas the BP number for 1800 Commercial Customers is. As a result, two separate BP groups and number ranges had to be created for commercial entities.

3.1.3.3 BP Types

The BP type is a field on the BP master record that provides more definition within a BP group. It is mostly used to distinguish the type of individual. A BP can only have one type at a time; however the BP type can be changed as needed by the MDM teams upon request.

The HRM solution does not require BP types, as it uses Employee groups and sub-groups to categorize individuals. However, in the Umoja foundation the Progen payroll system has been retained and BP types are used to categorize individuals for the purpose of the Progen interface.

The following shows the BP types available in Umoja:

|

BP Type |

Description |

|

Z001 |

International Staff |

|

Z002 |

Local Staff |

|

Z003 |

UNVs |

|

Z004 |

Military Staff Officer |

|

Z005 |

Military Observer |

|

Z006 |

UN Police |

|

Z007 |

Correctional Officer |

|

Z020 |

Retirees |

|

Z100 |

Individual Contractor |

|

Z101 |

Consultant |

|

Z900 |

Other Types |

|

Z999 |

HR active: Not Progen Relevant |

3.1.4 General Ledger (GL) Account Used in Accounts Receivable

The accounts receivable subledger uses reconciliation accounts to record transactions. These accounts can only be accessed through the subledger with the use of a business partner with a customer role. This ensures that the AR subledger will reconcile with the general ledger.

The GL account structure for accounts receivable include four GL accounts for each BP Group. The structure will allow us to provide analysis or disclosure information by BP Group.

|

GL Account Structure for Accounts Receivable |

|

|

Reconciliation account ending in '10' |

· All sub-ledger entries are recorded in this account · Account is determined from the BP master record and SPGL and cannot be selected by AR or SD or RE Users · No JVs allowed in this account · Postings have open or cleared status |

|

Man. Adj. GL account ending in '14' |

· Manual adjustment done outside the AR subledger with JVs should be recorded in this GL account. Entries posted to this GL accounts do not use a BP · Year end system reclassification batch for net debit balances on vendor's accounts will be posted to Man. Adj. accounts (doc type SA) in the current asset man adj accounts · No open/cleared status · Note: These accounts cannot be Open Item Managed (OIM) accounts, as system reclassification cannot be posted to OIM accounts |

|

Allowance for Doubtful Account (ADA or AFDA) ending in '16' |

· IPSAS adjustment for Allowance for Doubtful account is not recorded in subledger (because it is an estimate and it will be reversed) · AFDA are recorded with a JV and reference to BP is included in Text field · These accounts are OIM |

|

Revaluation GL account ending in '19' or '99' |

· Only FI revaluation program posts to this account in accordance with IPSAS (doc type SL) · No open/cleared status · Note: These accounts cannot be Open Item Managed (OIM) accounts, as revaluation program cannot post to OIM accounts |

The following table summarizes the GL accounts used in accounts receivable that may be classified as Loans and receivables:

|

Sr. No. |

Brief Description of receivables |

GL range |

|

1 |

Assessed Contributions Receivable |

13101XXX |

|

2 |

Voluntary Contributions Receivable - Cash |

1410XXXX 2410XXXX |

|

3 |

Exchange Receivable |

1510XXXX 2510XXXX |

|

4 |

Notes Receivable |

1610XXXX |

|

5 |

Loans Receivable |

1620XXXX 2620XXXX |

|

6 |

Advance Transfers to Partners |

1810XXXX 2810XXXX |

|

7 |

Advances (only if future economic benefits expected in cash or another financial asset) |

1910XXXX 2910XXXX |

|

8 |

Security Deposit |

1930XXXX 2930XXXX |

|

9 |

Bonds Receivable |

2940XXXX |

3.1.4.1 Exchange Receivable

The following GL accounts are used to record exchange accounts receivable balances:

|

Exchange GL Accounts |

|||||||||

|

GL Acct |

Long Text |

GL Acct Structure |

|

|

|

|

|||

|

15101010 |

AR Exch Mmbr St |

1 |

510 |

10 |

10 |

|

|

|

|

|

15101014 |

AR Exch Mmbr St Man Adj |

14 |

|

|

|

|

|||

|

15101016 |

AR Exch Mmbr St AFDA Man |

16 |

|

|

|

|

|||

|

15101019 |

AR Exch Mmbr St Revaluation |

19 |

|

|

|

|

|||

|

15101110 |

AR Exch Govt NonMmbr St |

11 |

10 |

|

|

|

|

||

|

15101114 |

AR Exch Govt NonMmbr St Man Adj |

14 |

|

|

|

|

|||

|

15101116 |

AR Exch Govt NonMmbr St AFDA Man |

16 |

|

|

|

|

|||

|

15101119 |

AR Exch Govt NonMmbr St Revaluation |

19 |

|

|

|

|

|||

|

15101210 |

AR Exch Govt and Local Authority |

12 |

10 |

1 = Current Asset |

|||||

|

15101214 |

AR Exch Govt and Local Authority Man Adj |

14 |

|

510 = Exchange Accounts Receivable |

|||||

|

15101216 |

AR Exch Govt and Local Authority AFDA Man |

16 |

|

|

10 = Member States BP Group |

||||

|

15101219 |

AR Exch Govt and Local Authority Revaluation |

19 |

|

|

11 = Govt Non Membr St BP Group |

||||

|

15101310 |

AR Exch UN Agency Fund Programme |

13 |

10 |

|

|

12 = Govt and Local Authority BP Group |

|||

|

15101314 |

AR Exch UN Agency Fund Programme AFDA Man Adj |

14 |

|

|

13 = UN Agency Fund Programme |

||||

|

15101316 |

AR Exch UN Agency Fund Programme AFDA Man |

16 |

|

|

14 = Intergov and NGO |

||||

|

15101319 |

AR Exch UN Agency Fund Programme Revaluation |

19 |

|

|

15 = Commercial |

||||

|

15101410 |

AR Exch Intergovernment NGO |

14 |

10 |

|

|

16 = Staff Members |

|||

|

15101414 |

AR Exch Intergovernment NGO Man Adj |

14 |

|

|

17 = Military and Police |

||||

|

15101416 |

AR Exch Intergovernment NGO AFDA Man |

16 |

|

|

18 = Individual External |

||||

|

15101419 |

AR Exch Intergovernment NGO Revaluation |

19 |

|

|

|

10 = reconciliation account |

|||

|

15101510 |

AR Exch Commercial Customer |

15 |

10 |

|

|

|

14 = Man Adj + System Reclassification |

||

|

15101514 |

AR Exch Commercial Customer Man |

14 |

|

|

|

16 = Allowance for Doubtful Accounts (ADA or AFDA) |

|||

|

15101516 |

AR Exch Commercial Customer AFDA Man |

16 |

|

|

|

19 = System Revaluation per IPSAS |

|||

|

15101519 |

AR Exch Commercial Customer Reval |

19 |

|

|

|

|

|||

|

15101614 |

AR Exch UN Staff Member Man |

16 |

14 |

|

|

|

|

||

|

15101616 |

AR Exch UN Staff Member AFDA Man |

16 |

|

|

|

|

|||

|

15101619 |

AR Exch UN Staff Member Reval |

19 |

|

|

|

|

|||

|

15101714 |

AR Exch Military and Police Man |

17 |

14 |

|

|

|

|

||

|

15101716 |

AR Exch Military and Police AFDA Man |

16 |

|

|

|

|

|||

|

15101719 |

AR Exch Military and Police Reval |

19 |

|

|

|

|

|||

|

15101814 |

AR Exch Individual External on Payroll Man |

18 |

14 |

|

|

|

|

||

|

15101816 |

AR Exch Individual External on Payroll AFDA |

16 |

|

|

|

|

|||

|

15101819 |

AR Exch Individual External on Payroll Reval |

19 |

|

|

|

|

|||

Note: Individuals (Staff and non-staff) do not have a customer role and therefore there is no reconciliation GL account ending in '10'.

3.1.4.2 Non-Exchange Contributions and Loans Payable (Borrowings)

The AR subledger is also used to record loans payable (borrowings) from entities outside Umoja. Even though loans payable (borrowings) are classified as current liabilities in the UN financial statement, these transactions result in cash receipt being recorded in Umoja. Thus loans payable (borrowings) are recorded in the accounts receivable subledger on a BP with a customer role. Conversely, loans receivable are recorded in the accounts payable subledger on a BP with a vendor role.

Because only one reconciliation GL account can be maintained on the BP master record and we have opted to maintain the Exchange GL account on the BP master records, special GL (SPGL) indicators will need to be used to record non-exchange transactions and loans payable in different reconciliation accounts. Combination of the reconciliation account on the BP master record with the specific SPGL used on the transactions will determine the alternate reconciliation GL account for non-exchange transactions and loans payable.

GL accounts used for non-exchange contributions and loans payable are as follows:

|

Assessed Contributions Receivable - SPGL M |

||||||||||||

|

GL Acct |

Long Text |

GL Acct Structure |

|

|

|

|||||||

|

13101010 |

AR Assessed Mmbr St |

1 |

310 |

10 |

10 |

1 = Current Asset |

||||||

|

13101014 |

AR Assessed Mmbr St Man Adj |

14 |

|

310 = Assessed Contributions Receivable |

||||||||

|

13101016 |

AR Assessed Mmbr St AFDA Man |

16 |

|

|

10 = Member States BP Group |

|||||||

|

13101019 |

AR Assessed Mmbr St Revaluation |

19 |

|

|

11 = Govt Non Membr St BP Group |

|||||||

|

13101110 |

AR Assessed Govt NonMmbr St |

11 |

10 |

|

|

|

10 = AR Control Account |

|||||

|

13101114 |

AR Assessed Govt NonMmbr St Man Adj |

14 |

|

|

|

14 = Man Adj + System Reclassification |

||||||

|

13101116 |

AR Assessed Govt NonMmbr St AFDA Man |

16 |

|

|

|

16 = Allowance for Doubtful Accounts (ADA or AFDA) |

||||||

|

13101119 |

AR Assessed Govt NonMmbr St Revaluation |

19 |

|

|

|

19 = System Revaluation per IPSAS |

||||||

|

Voluntary Contributions Receivable - SPGL V |

|

||||||||

|

GL Acct |

Long Text |

GL Acct Structure |

|

|

|

||||

|

14101010 |

AR Volunt Mmbr St |

1 |

410 |

10 |

10 |

1 = Current Asset |

|||

|

14101014 |

AR Volunt Mmbr St Man Adj |

14 |

|

410 = Voluntary Contributions Receivable |

|||||

|

14101016 |

AR Volunt Mmbr St AFDA Man |

16 |

|

|

10 = Member States BP Group |

||||

|

14101019 |

AR Volunt Mmbr St Revaluation |

19 |

|

|

11 = Govt Non Membr St BP Group |

||||

|

14101110 |

AR Volunt Govt NonMmbr St |

11 |

10 |

|

|

12 = Govt and Local Authority BP Group |

|||

|

14101114 |

AR Volunt Govt NonMmbr St Man Adj |

14 |

|

|

13 = UN Agency Fund Programme |

||||

|

14101116 |

AR Volunt Govt NonMmbr St AFDA Man |

16 |

|

|

14 = Intergov and NGO |

||||

|

14101119 |

AR Volunt Govt NonMmbr St Revaluation |

19 |

|

|

15 = Commercial |

||||

|

14101210 |

AR Volunt Govt and Local Authority Govt |

12 |

10 |

|

|

|

10 = AR Control Account |

||

|

14101214 |

AR Volunt Govt and Local Authority Govt Man Adj |

14 |

|

|

|

14 = Man Adj + System Reclassification |

|||

|

14101216 |

AR Volunt Govt and Local Authority Govt AFDA Man |

16 |

|

|

|

16 = Allowance for Doubtful Accounts (ADA or AFDA) |

|||

|

14101219 |

AR Volunt Govt and Local Authority Govt Revaluat |

19 |

|

|

|

19 = System Revaluation per IPSAS |

|||

|

14101310 |

AR Volunt UN Agency Fund Programme |

13 |

10 |

|

|

|

|||

|

14101314 |

AR Volunt UN Agency Fund Programme Man Adj |

14 |

|

|

|

|

|||

|

14101316 |

AR Volunt UN Agency Fund Programme AFDA Man |

16 |

|

|

|

|

|||

|

14101319 |

AR Volunt UN Agency Fund Programme Revaluation |

19 |

|

|

|

|

|||

|

14101410 |

AR Volunt Intergovernment NGO |

14 |

10 |

|

|

|

|

||

|

14101414 |

AR Volunt Intergovernment NGO Man Adj |

14 |

|

|

|

|

|||

|

14101416 |

AR Volunt Intergovernment NGO AFDA Man |

16 |

|

|

|

||||

|

14101419 |

AR Volunt Intergovernment NGO Reval |

19 |

|

|

|

|

|||

|

14101510 |

AR Volunt Commercial Customer |

15 |

10 |

|

|

|

|

||

|

14101514 |

AR Volunt Commercial Customer Man Adj |

14 |

|

|

|

|

|||

|

14101516 |

AR Volunt Commercial Customer AFDA Man |

16 |

|

|

|

|

|||

|

14101519 |

AR Volunt Commercial Customer Reval |

19 |

|

|

|

|

|||

|

Voluntary Contribution Receivable in Kind - SPGL K |

|

||||||||

|

GL Acct |

Long Text |

GL Acct Structure |

|

|

|

||||

|

14111010 |

AR In Kind Volunt Mmbr St |

1 |

411 |

10 |

10 |

1 = Current Asset |

|||

|

14111014 |

AR In Kind Volunt Mmbr St Man Adj |

14 |

|

411 = Voluntary Contributions Receivable in Kind |

|||||

|

14111016 |

AR In Kind Volunt Mmbr St AFDA Man |

16 |

|

|

10 = Member States BP Group |

||||

|

14111019 |

AR In Kind Volunt Mmbr St Revaluation |

19 |

|

|

11 = Govt Non Membr St BP Group |

||||

|

14111110 |

AR In Kind Volunt Govt NonMmbr St |

11 |

10 |

|

|

12 = Govt and Local Authority BP Group |

|||

|

14111114 |

AR In Kind Volunt Govt NonMmbr St Man Adj |

14 |

|

|

13 = UN Agency Fund Programme |

||||

|

14111116 |

AR In Kind Volunt Govt NonMmbr St AFDA Man |

16 |

|

|

14 = Intergov and NGO |

||||

|

14111119 |

AR In Kind Volunt Govt NonMmbr St Revaluation |

19 |

|

|

15 = Commercial |

||||

|

14111210 |

AR In Kind Volunt Govt and Local Authority |

12 |

10 |

|

|

|

10 = AR Control Account |

||

|

14111214 |

AR In Kind Volunt Govt and Local Authority Man |

14 |

|

|

|

14 = Man Adj + System Reclassification |

|||

|

14111216 |

AR In Kind Volunt Govt and Local Authority AFDA |

16 |

|

|

|

16 = Allowance for Doubtful Accounts (ADA or AFDA) |

|||

|

14111219 |

AR In Kind Volunt Govt and Local Authority Reval |

19 |

|

|

|

19 = System Revaluation per IPSAS |

|||

|

14111310 |

AR In Kind Volunt UN Agency Fund Programme |

13 |

10 |

|

|

|

|||

|

14111314 |

AR In Kind Volunt UN Agency Fund Programme ManAdj |

14 |

|

|

|

|

|||

|

14111316 |

AR In Kind Volunt UN Agency Fund Programme ADAMan |

16 |

|

|

|

|

|||

|

14111319 |

AR In Kind Volunt UN Agency Fund Programme Reval |

19 |

|

|

|

|

|||

|

14111410 |

AR In Kind Volunt Intergovernment NGO |

14 |

10 |

|

|

|

|

||

|

14111414 |

AR In Kind Volunt Intergovernment NGO Man Adj |

14 |

|

|

|

|

|||

|

14111416 |

AR In Kind Volunt Intergovernment NGO AFDA Man |

16 |

|

|

|

||||

|

14111419 |

AR In Kind Volunt Intergovernment NGO Reval |

19 |

|

|

|

|

|||

|

14111510 |

AR In Kind Volunt Commercial Customer |

15 |

10 |

|

|

|

|

||

|

14111514 |

AR In Kind Volunt Commercial Customer Man Adj |

14 |

|

|

|

|

|||

|

14111516 |

AR In Kind Volunt Commercial Customer AFDA Man |

16 |

|

|

|

|

|||

|

14111519 |

AR In Kind Volunt Commercial Customer Reval |

19 |

|

|

|

|

|||

|

VAT Receivable and Recoverable - SPGL N |

|

||||||||

|

GL Acct |

Long Text |

GL Acct Structure |

|

1 = Current Asset |

|||||

|

15201010 |

AR VAT Receivable |

1 |

520 |

10 |

10 |

|

|

520 = VAT Receivable |

|

|

15201014 |

AR VAT Recoverable Man Ajd (OIM) |

14 |

|

|

|

10 = AR Control Account |

|||

|

15201015 |

AR VAT Recoverable Man |

15 |

|

|

|

14 = Intermediate GL account |

|||

|

15201020 |

AR VAT Recoverable |

20 |

|

|

|

15 = For use in Grant? |

|||

|

15201099 |

AR VAT Receivable Reval |

99 |

|

|

|

99 = System Revaluation per IPSAS |

|||

|

Loans Payable GL accounts - SPGL L |

|

||||||||

|

GL Acct |

Long Text |

GL Acct Structure |

|||||||

|

36201310 |

Borrowing UN Agency Fund Programme |

3 |

620 |

13 |

10 |

3 = Current Liability |

|||

|

36201320 |

Borrowing UN Agency Fund Programme Manual |

20 |

|

620 = Voluntary Contributions Receivable |

|||||

|

36201327 |

Borrowing UN Agency Fund Programme Interfund(OIM) |

27 |

|

|

13 = UN Agency Fund Programme |

||||

|

36201328 |

Borrowing UN Agency Fund Programme Interfund |

28 |

|

|

|

10 = AR Control Account |

|||

|

36201399 |

Borrowing UN Agency Fund Programme Reval |

99 |

|

|

|

20 = Man Adj + System Reclassification |

|||

|

|

|

|

|

|

|

|

|

|

27 = Interfund loans within Umoja (FV50) |

|

|

|

|

|

|

|

|

|

|

28 = Interfund loans within Umoja |

|

|

|

|

|

|

|

|

|

|

99 = System Revaluation per IPSAS |

3.1.5 Special GL (SPGL) Indicator

The following table shows SPGL indicators available in Umoja for accounts receivable and the change in reconciliation account resulting from each SPGL indicator for each BP groups.

|

SPGL Long text |

AR SPGL indicator |

Normal SPGL or Downpayment |

BP Group |

Account Group |

Normal Recon G/L Acct |

SPGL G/L Account |

|

AR Assessed Contribution |

M |

SPGL |

Z011 |

Member State |

15101010 |

13101010 |

|

Z012 |

Non Member State |

15101110 |

13101110 |

|||

|

AR Volunt Contribution AR |

V |

SPGL |

Z011 |

Member State |

15101010 |

14101010 |

|

Z012 |

Non Member State |

15101110 |

14101110 |

|||

|

Z013 |

Government and Local Authority |

15101210 |

14101210 |

|||

|

Z014 |

UN Agency Fund Programme |

15101310 |

14101310 |

|||

|

Z015 |

Intergovernment and NGO |

15101410 |

14101410 |

|||

|

Z018 |

Commercial Customer |

15101510 |

14101510 |

|||

|

AR Volunt Contribution In Kind |

K |

SPGL |

Z011 |

Member State |

15101010 |

14111010 |

|

Z012 |

Non Member State |

15101110 |

14111110 |

|||

|

Z013 |

Government and Local Authority |

15101210 |

14111210 |

|||

|

Z014 |

UN Agency Fund Programme |

15101310 |

14111310 |

|||

|

Z015 |

Intergovernment and NGO |

15101410 |

14111410 |

|||

|

Z018 |

Commercial Customer |

15101510 |

14111510 |

|||

|

AR VAT Receivable |

N |

SPGL |

Z011 |

Member State |

15101010 |

15201010 |

|

Z012 |

Non Member State |

15101110 |

||||

|

Z013 |

Government and Local Authority |

15101210 |

||||

|

AP Loan Payable |

L |

Downpayment received |

Z014 |

UN Agency Fund Programme |

15101310 |

36201310 |

|

Downpayment Received |

A, F |

Downpayment received |

Z018 |

Commercial Customer |

15101510 |

38501510 |

|

Z011 |

Member State |

15101010 |

38501010 |

|||

|

Z012 |

Non Member State |

15101110 |

38501110 |

|||

|

Z013 |

Government and Local Authority |

15101210 |

38501210 |

|||

|

Z014 |

UN Agency Fund Programme |

15101310 |

38501310 |

|||

|

Z015 |

Intergovernment and NGO |

15101410 |

38501410 |

3.1.6 Document Flow - General

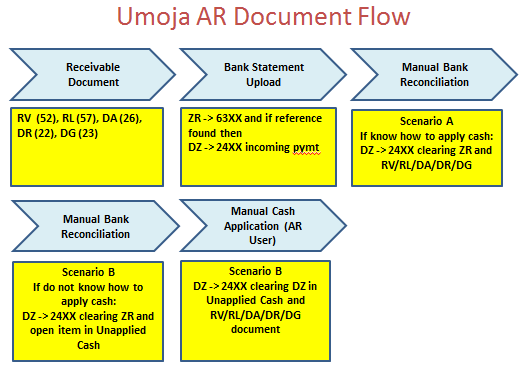

The general flow provides for an accounts receivable document cleared by an incoming payment document which is clearing a bank statement document.

|

Accounts receivable document |

Document that creates a balance receivable or payable, or a noted item on the customer's account |

|

Incoming and Outgoing Payment documents |

DZ, ZC, ZI or ZP document that indicates cash has been received KY, KZ, ZC, ZI or ZP document that indicates that one or more accounts payable documents have been paid. |

|

Bank statement document |

Document (ZR) created when the bank statement is uploaded in Umoja. |

|

Clearing document |

Automated clearing documents (SC) are generated automatically via an overnight program to clear one or more debit lines with one or more credit lines on a vendor when: · Debits and credits total zero either in Document currency or Local currency; and · Assignment field is identical on all lines; and · Lines are posted to the same GL account Manual clearing documents (DA) are created after a downpayment has been received. |

3.1.7 Enterprise Roles Involved in Accounts Receivable

|

Enterprise Role |

T-Code |

Activity |

|

AR User |

FV70 |

Create AR customer invoices and credit memos within the AR Sub-ledger and submit into workflow |

|

FV70 |

Record VAT receivable and submit into workflow |

|

|

FV75 |

Record approved write offs |

|

|

F-37 |

Create downpayment Request - no workflow approval |

|

|

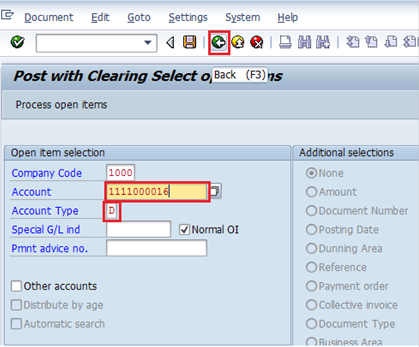

F-28 |

Apply incoming cash to customer's account - no workflow approval |

|

|

F-39 |

Clear downpayment received - no workflow approval |

|

|

F150 |

Dunning for Assessed Contributions |

|

|

ZARDOCLOAD |

Upload file to create multiple AR documents |

|

|

ZARFBL1N |

Responsible for customer history |

|

|

AR Approver |

SBWP |

Approve or reject customer invoices, credit notes and write off documents |

|

F-28 |

Apply incoming cash to customer's account - no workflow approval |

|

|

F-39 |

Clear downpayment received - no workflow approval |

|

|

NA |

Reviews dunning notices prior to distribution |

|

|

FBCJ |

Can display cash journal |

|

|

Senior FI User |

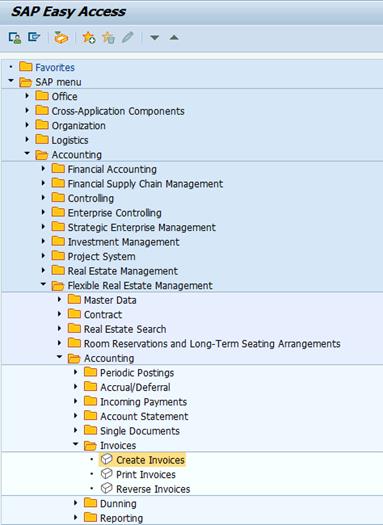

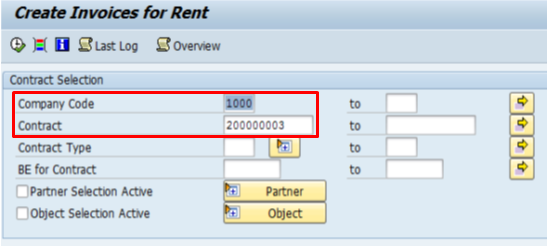

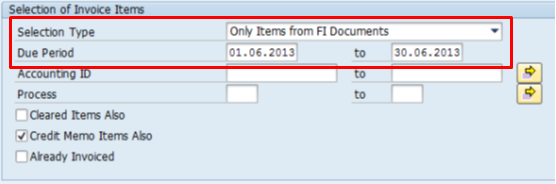

RERAIV |

Trigger interface to create real estate billing documents in FI |

|

VF04 |

Trigger interface to create sales and distribution billing documents in FI (Note: Grants documents are on a separate cheduled interface) |

|

|

F-28 |

Apply incoming cash to customer's account - no workflow approval |

|

|

F-39 |

Clear downpayment received - no workflow approval |

|

|

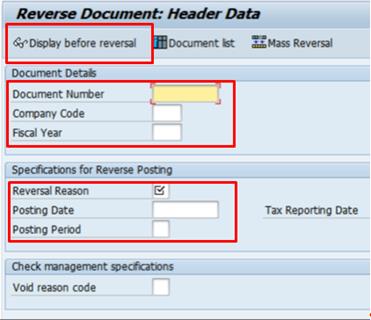

FB08 |

Reverse posted FI documents including AR and AP documents |

|

|

FBRA |

Reset (and reverse) FI documents including AR and AP document |

|

|

GL User |

FV50 |

Records allowance for doubtful accounts in man adj accounts Reclassify VAT recoverable to VAT |

|

GL Approver |

SBWP |

Approves allowance for doubtful accounts documents |

|

FB08 |

Reverse GL documents |

|

|

FBRA |

Reset (and reverse) GL documents |

|

|

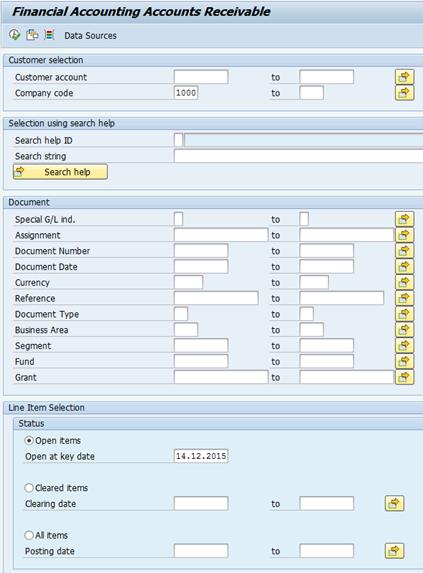

All finance Users |

FBL5N |

Standard customer report (private sector version) |

|

ZARFBL5N |

UN Custom customer report (with fund, bus area and grant) |

|

|

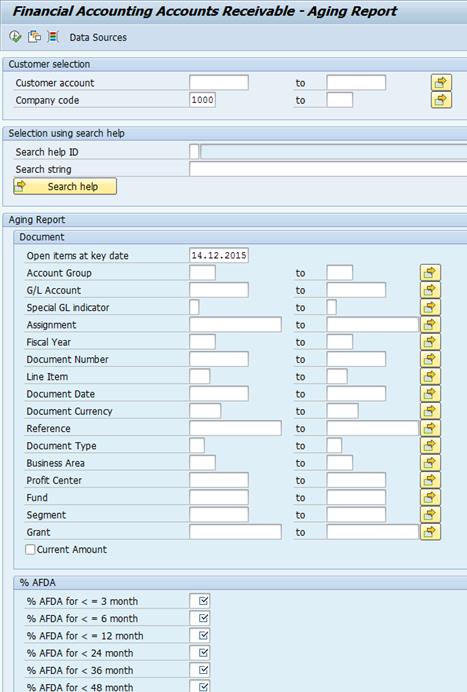

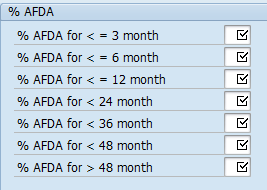

ZARAGING |

UN Custom report to calculate AFDA based on UN IPSAS framework |

3.2 Recognition of Accounts Receivable

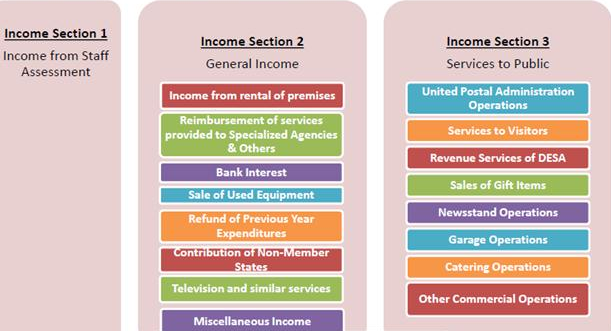

The UN reports its income under three sections. The recording of some of these incomes results in the creation of accounts receivable.

Examples of transactions resulting in accounts receivable include:

· Sale of goods sold and services rendered including Catering Services, Sale of Publications, Guided tours, Sale of audio/visual products etc.

· Recovery of:

o Vehicle repair charges from UN Agencies

o Use of conference facilities

o Advances and other recoveries from staff members

o Advance to organize programs

o Common services used by UN Agencies and NGOs

o VAT from host government

· Sale of assets

· Lease administration for owned and subleased properties

· Grants billing to donors

· Transfer of revenue bearing work/service order management to other UN agencies

It must be noted that all assets and liabilities that result from transactions with in AR module may not be financial assets as per IPSAS. Assets such as pre-paid expenses for which the future economic benefit is the receipt of goods or services, rather than the right to receive cash or another financial asset, are not financial assets.

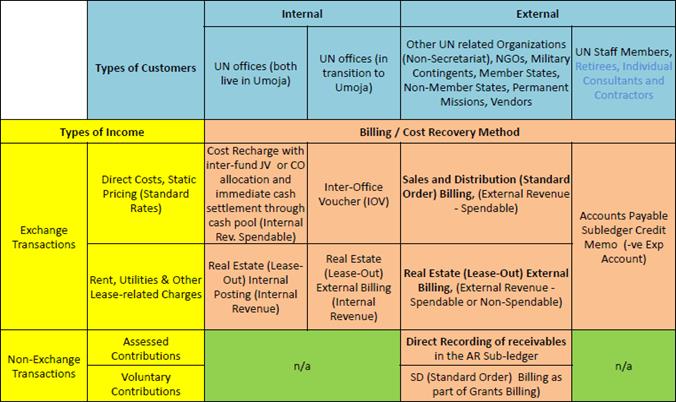

Various methods are used in Umoja to capture revenues (exchange and non-exchange). The choice of which method to use is a function of two factors; type of customer and type of income. The following are methods used in Umoja for billing/cost recovery.

Receivable can be recorded in Umoja through a customer Invoice. A customer invoice can be created in Umoja through:

|

Type of Receivable |

Umoja process |

Refer |

|

Assessed contributions |

Interface from excel spreadsheet |

Section 3.2.1.2 |

|

Receivable from upstream Umoja module like SD, RE, GM, TM |

Refer to relevant upstream process classified under General Income and Services to Public |

Section 3.2.1.3 |

|

Accounts receivables entered directly in Finance - AR Module through manual invoice |

Manual AR Invoice process |

Section 3.2.1.1 |

|

AR posted in GL |

General Ledger Document Processing |

Umoja Overview |

Receivable from Assessed Contributions

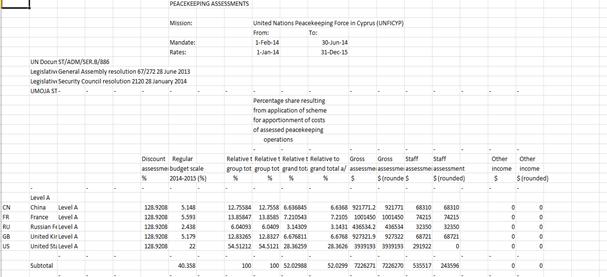

The main objective of this process is to interface with the legacy systems which calculate the Member States' assessments for the Working Capital Fund, Regular Budget (RB), Peacekeeping (PK) Operations, Tribunals and Capital Master Plan (CMP), to record invoices and credit memos and to prepare assessment letters with attachments to member states.

The process will start after the adoption of the RB & PK scales and budgeted amounts for RB, PK, Tribunals and CMP. After the adoption, the appropriated amounts (Gross, Staff assessment credits and Net assessments) are apportioned using the applicable scale of assessments. This is done using Excel spreadsheets. The apportioned amounts (Gross, Staff assessment and Net components) will then be interfaced from the Excel Spreadsheets to Umoja to post the assessments and the credits if any from peacekeeping operations to Member States' accounts.

The accounting policy for revenue recognition is discussed in Revenue from Non-Exchange Transactions. Once the invoices and related credits are approved for posting, the system will also post automatic journal entries by recognizing the revenue and posting relevant entries in the Accounts Receivable (AR) System.

Receivables from Upstream Processes

The creation of most invoices from upstream processes will be automatic. For example, a sale of postal stamps processed in Sales & Distribution (SD) triggers a creation of sales order followed by outbound delivery (post goods issue) which leads to the billing process to record the receivable and related revenue. The resulting accounting entry created from billing process is passed through the backend to Financial Accounting (FI) - AR (sub ledger) and Financial Accounting (FI) - GL modules.

Below is a list of business transactions identified to create receivables coming from different upstream processes:

|

Upstream Module |

Business transactions |

|

Sales & Distribution (SD) |

Commercial activities, third party procurement, cost reimbursement for services provided to parties external to Umoja, Sale or donation of inventory (material) or asset and Advance payment requests to other Agencies |

|

Real Estate Management (RE) |

Rental revenues arising from owned and subleased assets |

|

Grants Management (GM)* |

Receivables from sponsors and/ or implementing partners |

|

Travel Management (TM) |

Advances to staff |

* Currently in GM, receivables can be processed through the SD billing function as well as creation of manual invoice in Finance.

Receivables Managed in Finance (FI) module

In certain cases, invoices will be created manually in the Financial Accounting division. For example, when the UN Secretariat pays insurance or taxes on behalf of other UN entities, a manual invoice will be raised to create the related receivable.

Below is a proforma data entry view to recognize receivable from other UN entities e.g. remittance of taxes on their behalf. UN entities belong to account group Z014, therefore the reconciliation account to be derived for this BP account group is 15101310 AR Ex UN Agency Fund Program.

|

PK |

SPGL |

GL Acct |

GL Acct Name |

Amount Dr / (Cr) |

Document Currency |

Bus Area |

Fund |

Segment |

Funded Program |

Fund Center |

|

01 |

|

14XXXXXXXX |

BP number with customer role |

1000 |

USD |

S001 |

|

|

|

|

|

50 |

|

79151010* |

Reimbursement of Federal Tax |

(1000) |

USD |

S001 |

10UNA |

114STFASMT |

FPNR |

10001 |

* The combination of coding block entered above will automatically derive the business area, functional area, segment, funded program, fund center, and budget period.

3.2.1 Customer Invoice Processing

This section includes the requirements to create invoices from different business areas such as revenue bearing work or service order processed in SD, GM, TM, RE, or FI. The accounts receivable is recognized at BP with customer role level and automatically updates the General Ledger reconciliation account.

In general, there are three sources of customer invoice processing in Umoja:

· Invoice processing through manual entry (refer to section 3.2.1.1)

· Invoice processing through interface (refer to section 3.2.1.2)

· Invoice processing from upstream processes (refer to section 3.2.1.3)

3.2.1.1 Customer Invoice Processing through Manual Entry

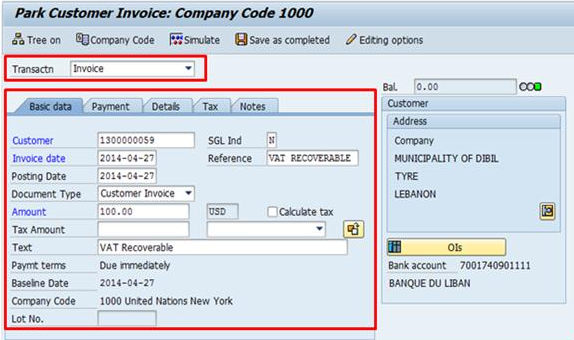

A. Create parked customer invoice or credit memo / Transaction Code: FV70 or FV75

A.1. In Park Customer Invoice or Credit Note entry screen the following values are entered or selected from drop down menus:

Header Data:

Basic data tab:

· Customer: 13XXXXXXXX* (BP with customer role)

· SGL Ind:

· Invoice date:

· Posting Date:

· Document Type: DR Customer Invoice (default value)

· Amount: USD 100

· Document Currency: USD

· Reference:

· Text: freely definable

* The specific BP account number selected in data entry view determines the AR reconciliation account that will be pulled in accounting entry. In this proforma entry, BP account range 13 will call BP account group Z013 which is Government and Local Authority and derive GL account 15101210 AR Ex Govt Local assigned to the BP number.

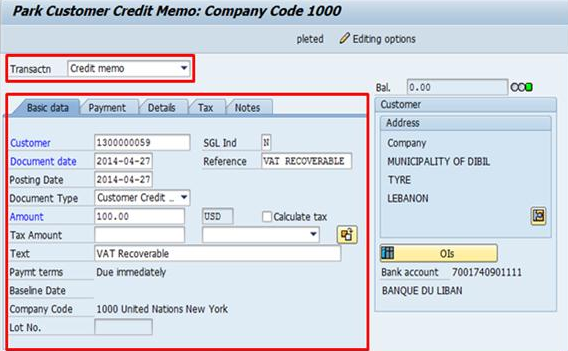

Park Customer Invoice (T-code: FV70)

Park Customer Credit Memo (T-code: FV75)

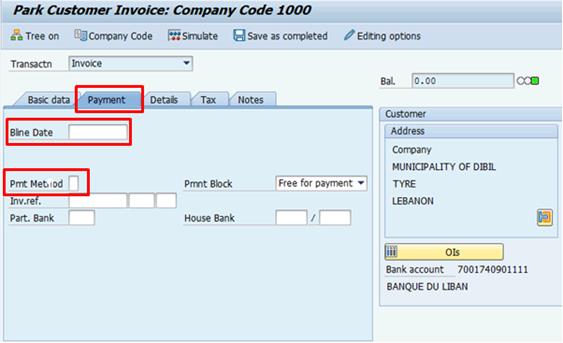

Payment tab:

· Bline Date:

· Payt Terms: Z001 Payable immediately (only applicable in T-code FV75)

· Pmt Method: applicable in T-code FV70

T-code: FV70

T-code: FV75

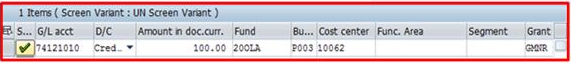

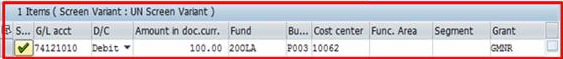

Line Item Data:

· G/L acct: 74121010

· D/C: Credit/Debit

· Amount:

· Fund: 20OLA

· Cost center: 10062

· Grant: GMNR*

* The combination of coding block entered above will automatically derive the business area, functional area, segment, funded program, fund center, and budget period.

T-code: FV70

T-code: FV75

A.2. Press Enter to validate the information entered.

A.3. Click on the Simulate General Ledger to review the proforma entry

|

PK |

SPGL |

GL Acct |

GL Acct Name |

Amount Dr / (Cr) |

Document Currency |

Bus Area |

Fund |

Segment |

Funded Program |

Fund Center |

|

01 |

|

15101210 |

AR Ex Govt Local |

100 |

USD |

P003 |

20OLA |

206PKSUPMG |

FPNR |

10062 |

|

50 |

|

74121010* |

OE Communication Carrier Service |

(100) |

USD |

P003 |

20OLA |

206PKSUPMG |

FPNR |

10062 |

*Represents expense recoverable from Local government where Local government has agreed to share portion of expense incurred by UN.

A.4. Select Save as completed button to release the parked invoice or credit note to workflow. A document number (invoice number) appears at the bottom of the screen to be noted down.

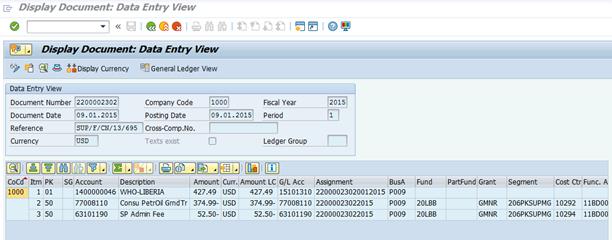

B. Display Manual Invoice/Credit Memo / Transaction Code: FB03

For manual invoice or credit memo, there is no specific form of invoice defined as a business requirement.

B.1. Enter FB03 in the Command field and press Enter.

B.2. Enter:

· Company Code: 1000

· Fiscal Year: 20XX

· Document Number: 22XXXXXXXX

B.3. Select Execute button à Display Document: Data Entry View screen appears.

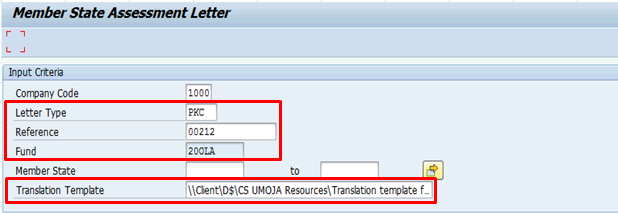

3.2.1.2 Customer Invoice Processing through Interface

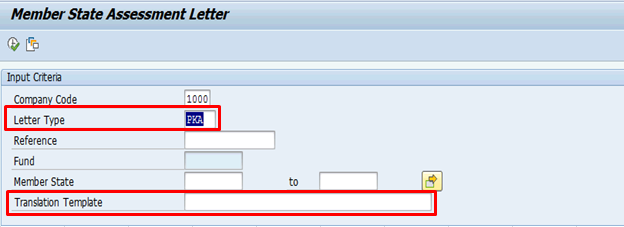

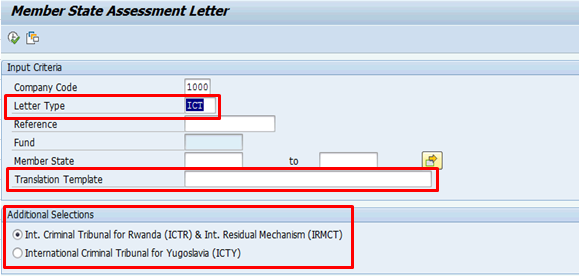

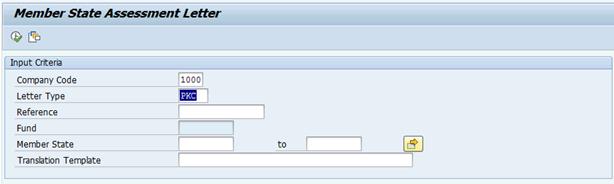

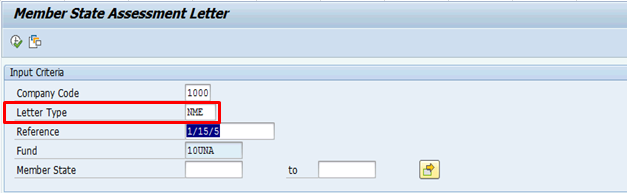

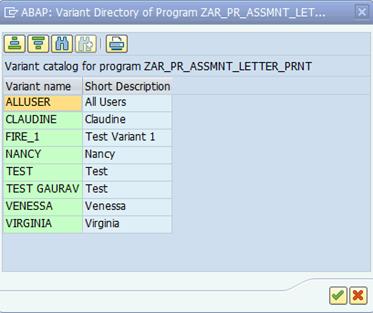

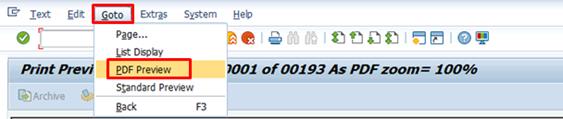

This process is applicable for receivables from assessed contributions that are calculated in the legacy system. The completed assessments worksheet for the regular budget, peacekeeping operations, peacekeeping credits, capital master plan and international tribunals are uploaded to the Member State Assessment Cockpit in Umoja. This process is only carried out by the Contributions Services in New York.

C. Upload of assessment calculation to Umoja / Transaction Code: ZARASSESS

The upload of assessment calculation to Assessment Cockpit will trigger the review and approval to create accounts receivables from or credits (payables) to Member States and Non-Member States.

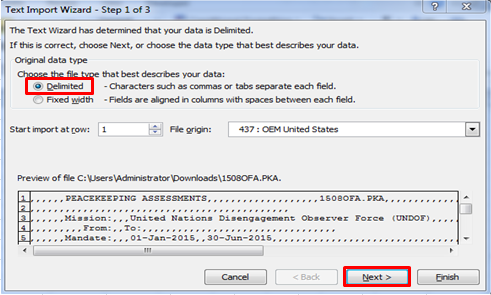

C.1. Export from the Assessed Contributions Management System spreadsheet for upload to the cockpit

C.1.1. All relevant calculations processed through the Assessed Contributions Management System (ACMS) - http://nyvm0428.ptc.un.org/ACMS/Default.aspx

C.1.2. Select assessment to be uploaded. E.g. Type PKA

C.1.3. Click Submit to Umoja

C.1.4. When actions box pops up, click Save document

![]()

C.1.5. Once download is complete, go to excel and open the file from downloads

![]()

C.1.6. Note that the file is downloaded as a PKA file

C.1.7. Once the file has been selected, click Open

C.1.8. Step 1 of Wizard - Select Delimited then click Next

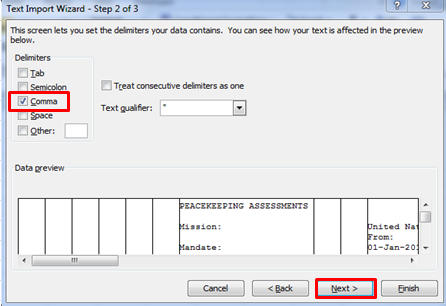

C.1.9. Step 2 of Wizard - Ensure only Comma is selected and click Next

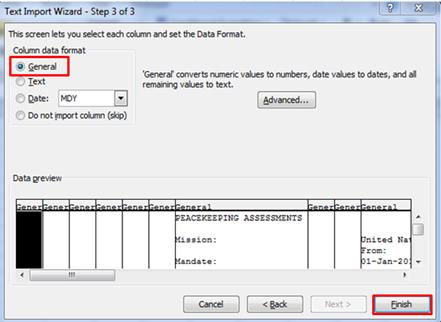

C.1.10. Step 3 of Wizard - Ensure General is selected. Then click Finish

C.1.11. File opens as below

C.1.12. Go to File>Save As

C.1.13. Change name of file to format 'YYMMFFFFF.PKA.CSV' and save type to CSV (Comma delimited) and save to C:\IAIS\data directory. Close file

C.1.14. In files related to additional assessments, the word 'additional' should not be bracketed. Please also note that any word/character entered in this cell will be accepted during the upload. You may also wish to note, there is a validation built into the system. If an attempt is made to load a file with the same name for the same mandate period but the word additional is not included, then the upload will fail as the system will interpret this file as a duplicate file

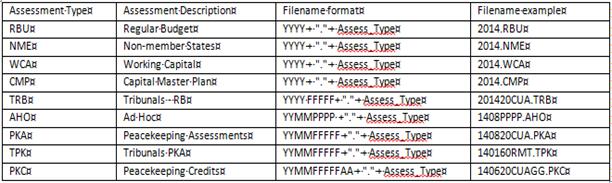

C.1.15. All files which are to be uploaded to the Member Assessment Cockpit must meet requirements related to the file type and name format. The following file types have been configured for use in Umoja

C.2. Upload a document into the assessment cockpit in Umoja (T-code ZARASSESS)

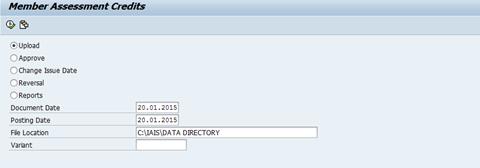

C.2.1. Enter the T-code ZARASSESS in the Command field

![]()

C.2.2.

Click the Enter icon ![]()

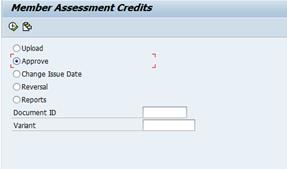

C.2.3. The Member Assessments Credits Screen is displayed

C.2.4. In the Document Date field, enter the date of the document to be uploaded. This can be the same as the current date

C.2.5. The Positing Date field defaults to the current date but may be defined as the date you are posting the assessment to the system

C.2.6.

Click on the File Location field and select the file to be

uploaded by clicking on the icon which resembles two sheets of paper ![]()

C.2.7.

Once file has been selected, click on the Execute button ![]()

C.2.8. The system will review the file to confirm it is acceptable for upload. Should this review process uncover any errors, these errors will be displayed and the file must be corrected and the upload restarted

C.2.9. Once upload has been successful, verify that all entries match the uploaded file, including header information. Issue date can be modified at this stage to match the actual issue date of the assessment

C.2.10.

Once details of the upload have been confirmed, click the Save

button ![]() at the top of

the screen to post the uploaded assessment. Once saved, the system will

generate a Y* document number

at the top of

the screen to post the uploaded assessment. Once saved, the system will

generate a Y* document number

C.3. Approve a document in the assessment cockpit in Umoja

C.3.1.

To approve the upload, click the Back button ![]() and return to Member

Assessment Credits screen

and return to Member

Assessment Credits screen

C.3.2. Select the Approve button and within the Document ID tab, select the document to be approved

C.3.3.

Click Execute ![]()

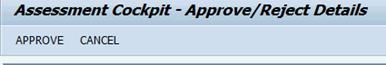

C.3.4. The new screen Assessment cockpit Approve/Reject Details is displayed

C.3.5. At this stage, the document can either be approved (posted) or canceled (deleted)

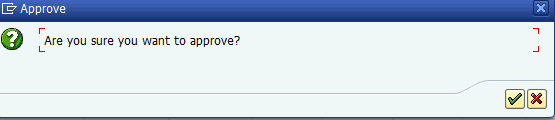

C.3.6. To approve, select Approve (F8) and the system prompts for confirmation that you wish to approve the document

C.3.7.

Click the ![]() for yes and the

for yes and the ![]() for no. The

approval process may take a few minutes. If no is selected, you will need to

click back, return to the selection screen and select the document again

for no. The

approval process may take a few minutes. If no is selected, you will need to

click back, return to the selection screen and select the document again

C.3.8.

PLEASE NOTE: If ![]() is

selected, the system request confirmation if you want to delete the uploaded

records. Click the

is

selected, the system request confirmation if you want to delete the uploaded

records. Click the ![]() for yes and the

for yes and the ![]() for no

for no

C.3.9.

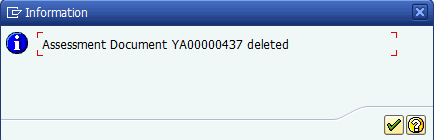

If the ![]() is selected, the

document is deleted and the user receives a message confirmation

is selected, the

document is deleted and the user receives a message confirmation

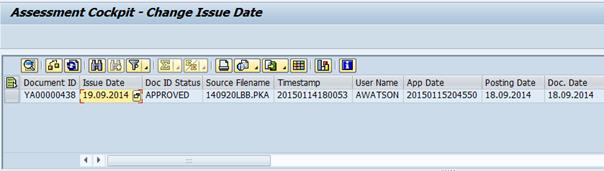

C.4. Change issue date after document has been approved

After a document has been approved, it is possible to change the issue date of the approved document. The act of changing the issue date will impact the aging of the related AR documents.

C.4.1. Select the Change Issue Date radio button

C.4.2.

Then select the correct document by either typing the document

number in or selecting by clicking on the ![]() icon

icon

C.4.3.

Once document has been selected, click on the Execute

button ![]() . The Issue

Date can now be manually changed and the Save button should be

clicked to confirm the change

. The Issue

Date can now be manually changed and the Save button should be

clicked to confirm the change

C.4.4.

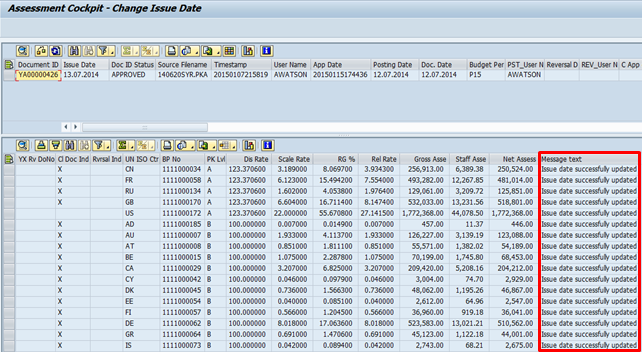

Once the ![]() is selected, an

information box is displayed indicating that a spool has been created and the

message 'Issue date successfully updated' is visible by line item

is selected, an

information box is displayed indicating that a spool has been created and the

message 'Issue date successfully updated' is visible by line item

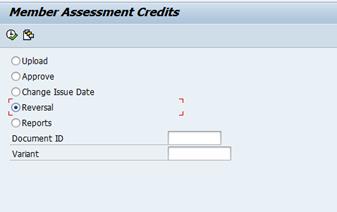

C.5. Reversal of an approved document

If an approved document needs to be reversed, a process exists to reverse documents either in their entirety or not at all.

C.5.1. To reverse a document, go the Member Assessments Credits screen and select the Reversal button

C.5.2. Select the document to be reversed and click Execute

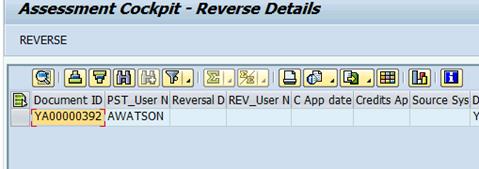

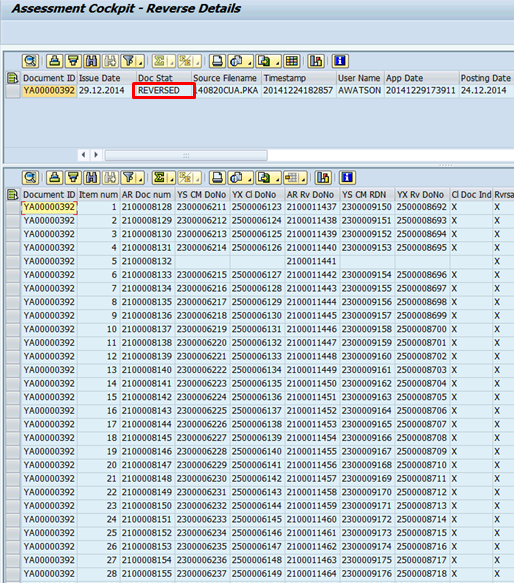

C.5.3. The Assessment Cockpit - Reverse Details screen appears. This screen contains the option to reverse

Please note that if any of the related AR documents have a payment or credit applied against it, this must be undone before the reversal occurs.

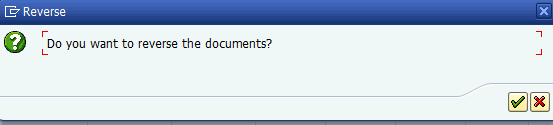

C.5.4. Upon clicking REVERSE, the confirmation box pops up. Clicking the green tick confirms that the reversal should proceed. Please note that the reversal process will take time as it needs to reset and reverse each clearing document, reverse each credit memo and then reverse each AR document

C.5.5. When complete, document status changes to REVERSED and the relevant reversal document numbers are indicated

NOTE: Additional information on the reversal process

The clearing document generated in the cockpit acts as a knot between the credit memo and the account receivable. During the reversal process, this knot must first be undone (reset) before the clearing document can be reversed. This reset and reversal process of the clearing memo is independent of the status of the credit memo and account receivable entry, and cannot be undone once it has begun.

The system is configured as an all or nothing system. Therefore, if for any reason the credit memo or accounts receivable cannot be reversed, the status will not reverse the existing entries until the hindrance is removed.

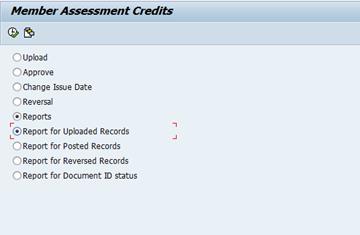

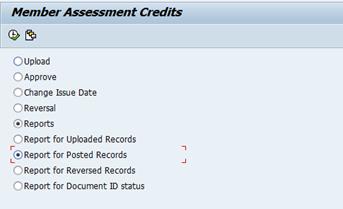

C.6. Reports

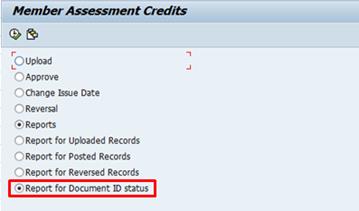

C.6.1. Reports for Uploaded Records (Uploaded but not yet approved)

C.6.1.1. Select the Report for Uploaded Records

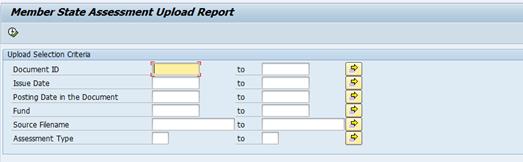

C.6.1.2. Click the Execute button and the upload selection criteria screen opens

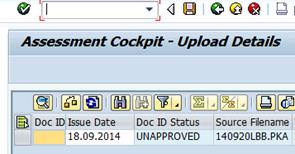

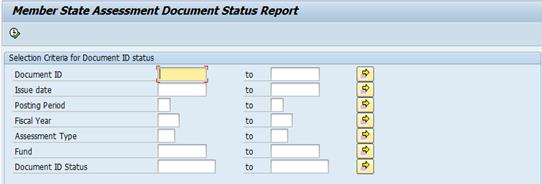

This screen can then be narrowed according to Document ID, Issue Date, Posting Date in the Document, Fund, Source Filename and Assessment Type. It is also possible to do a free search by simply clicking the Execute button without selecting any criteria.

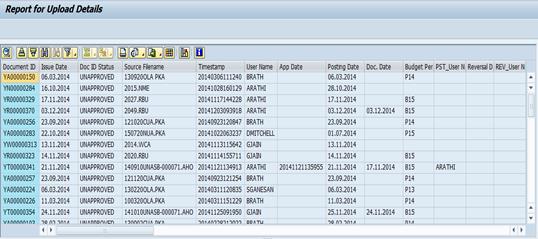

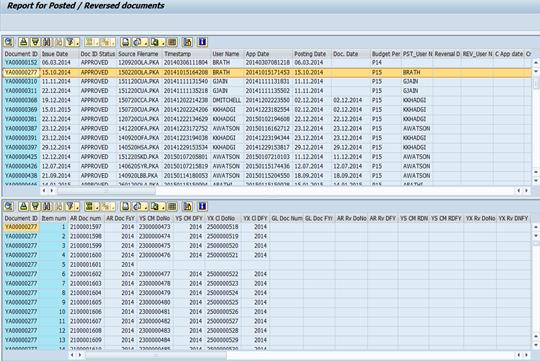

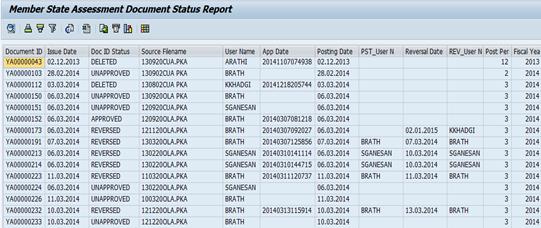

C.6.1.3. Results returned indicate the Document ID, Issue Date, Doc ID Status, Source Filename, Timestamp, User Name, Posting Date, Doc date, Budget Period, etc.

C.6.1.4. If you wish to see the line details related to a particular Document ID, double click on the document ID and the details are displayed in the screen preview below

C.6.1.5. In order to approve the document, you will need to copy or make a note of the Document ID number and then click the Back button in order to select the Approve radio button (please refer to the section on approval)

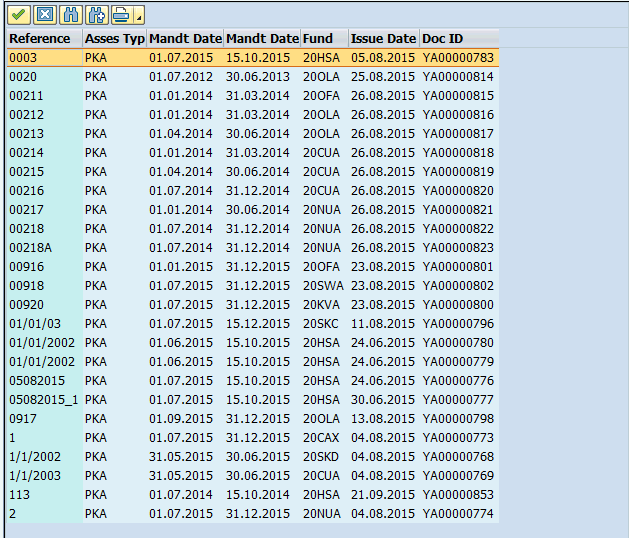

C.6.2. Reports on Posted Records

C.6.2.1. Select the Report for Posted Records

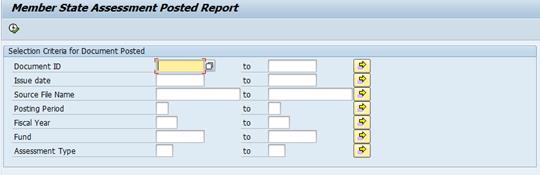

C.6.2.2. Click the Execute button and the posted selection criteria screen opens

This screen can then be narrowed according to Document ID, Issue date, Posting Period, Fiscal Year, Fund, Source Filename and Assessment Type. It is also possible to do a free search by simply clicking the Execute button without selecting any criteria

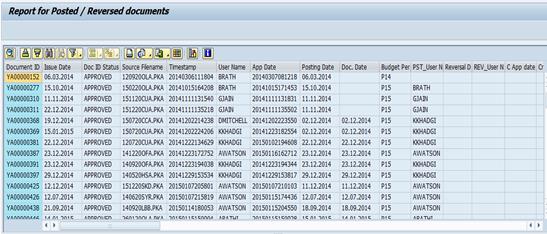

C.6.2.3. Results returned indicate the Document ID, Issue Date, Doc ID Status, Source Filename, Timestamp, User Name, Posting Date, Doc Date, Budget Period, etc.

C.6.2.4. If you wish to see the line details related to a particular Document ID, double click on the document ID and the details are displayed in the screen preview below

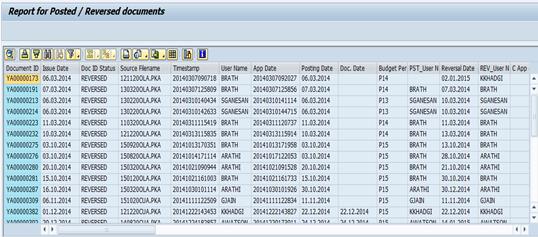

C.6.3. Reports on Reversed Documents

This report can be used to identify all records which have been reversed in the cockpit

C.6.3.1. Select the Report for Reversed Records

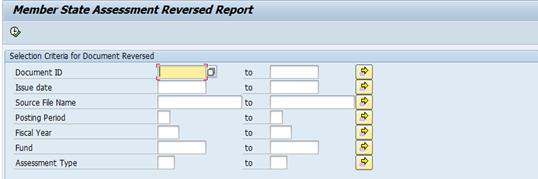

C.6.3.2. Click the Execute button and the reverse selection criteria screen opens

C.6.3.3. The user can either do a free/wide search or can narrow their search criteria according to Document ID, Issue date, Source File Name, Posting Period, Fiscal Year, Fund and Assessment Type

C.6.3.4. Results returned indicate the Document ID, Issue Date, Doc ID Status, Source Filename, Timestamp, User Name, Posting Date, Doc Date, Budget Period, etc.

C.6.4. Report on Document ID Status

This report can be used to identify all records which have been entered into the cockpit and will show the status of the particular document

C.6.4.1. Select the Report for Document ID Status

C.6.4.2. Click the Execute button and the document status selection criteria screen opens

The user can either do a free/wide search or can narrow their search criteria according to Document ID, Issue date, Posting Period, Fiscal Year, Assessment Type, Fund and Document ID Status.

C.6.4.3. Results returned indicate the Document ID, Issue Date, Doc ID Status, Source Filename, Timestamp, User Name, Posting Date, Approval date (if applicable), Posting User, Reversal Date, Reversal User, Posting Period and Fiscal Year

General note on the status of documents

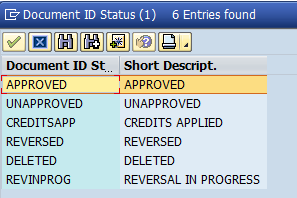

Based on the current design, documents can be in the status of Approved, Unapproved, Creditsapp(Credits Applied), Reversed, Deleted or Revinprogress (reversal in progress)

Definitions:

Unapproved: Assessment worksheet has successfully passed the built in validations for uploading and has been uploaded and saved.

Approved: Document which has been uploaded has passed the validations for approval and has generated the relevant accounting documents (Accounts Receivable, Credit Memo and Clearing Document (for Staff Assessment portion of the assessment).

Creditsapp: Used to indicate that the credits have been applied for the particular fund. Credits are loaded using as a PKC assessment.

Reversed: reversed indicates that all documents generated by the approval process in the cockpit have been reversed. Documents can only be reversed if all subordinate documents can be reversed as no follow-on transactions have been processed against these documents.

Deleted: After a document has been uploaded and saved, it is possible to delete the document prior to approval. In this case, the system maintains a record of the header information related to the document uploaded, but there is no line item view available.

Revinprog: This relates to the reversal process. When the reversal process has begun, the system first reverses the clearing document that has been generated. It then tries to reverse the credit emo against the account receivable document which has been created. If for any reason, the credit memo is unable to be cleared against the receivable document, the reversal process will halt, advise of an error and cannot be restarted until the problem has been resolved.

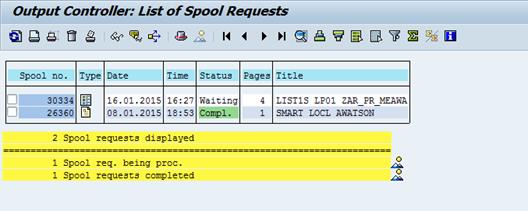

Error Logging

Umoja has a spool report format which maintains a record of all files processed in the cockpit. If an error is generated during the upload, approval, change issue date or reversal process, the system generates a report which is similar to an audit trail. This report can be reviewed and saved to excel (for example).

To view report in detail, click on the

icon in the column Type ![]() for additional

details.

for additional

details.

3.2.1.3 Customer Invoice Processing from Upstream Processes

The transactions are initiated in upstream processes such SD, RE, GM, and TM. They are posted in Sub-ledger using the BP accounts with customer role and automatically updated in General Ledger (GL).

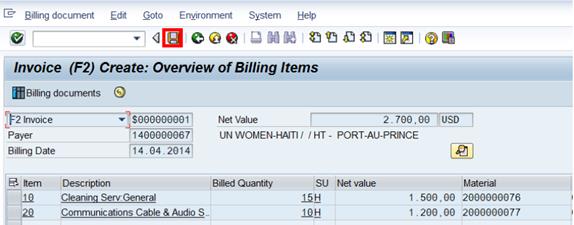

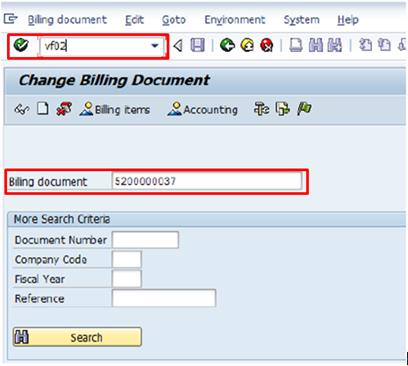

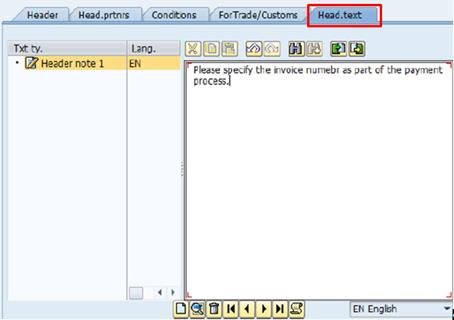

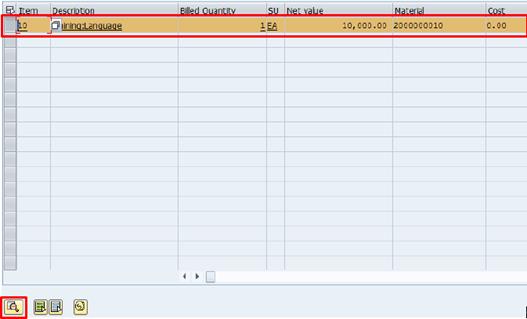

D. Invoice processing of posted document coming from Sales & Distribution (SD)

The followings are steps for the Financial Accounting Senior User to follow in order to process customer invoice from standard order generated and approved by Sales and Distribution (SD) User and Approver.

D.1. Display and review list of Standard Orders / Transaction Code: VA05

The Sales and Distribution user or approver must communicate the list of approved standard order to the FI Senior User as currently there is no Umoja workflow or automated notification to the FI Senior User after the approval of a sales order.

D.1.1. Enter VA05 in the Command field and press Enter.

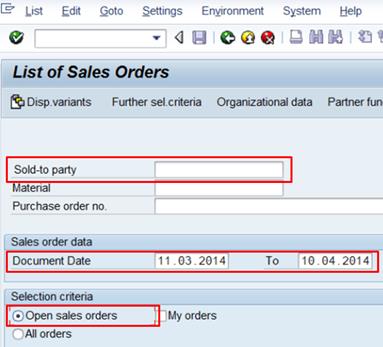

D.1.2. Enter the following values and press Enter:

· Sold-to party: customer number

· Document Date

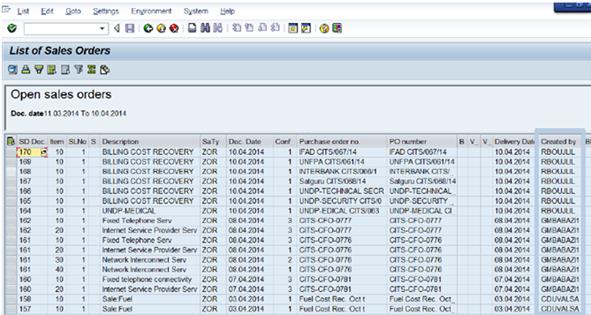

· Checked Open sales orders button in Selection criteria section to obtain list of standard orders for which invoices have not been issued.

D.1.3. Double click the specific sales order from the list to review the details in the sales order screen that appears.

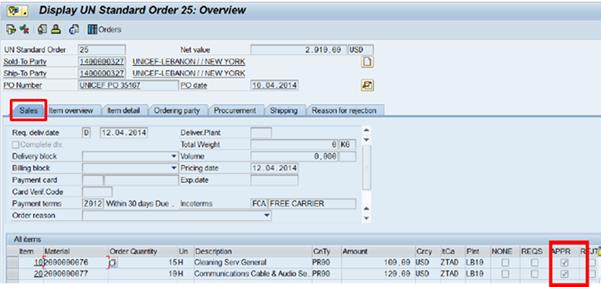

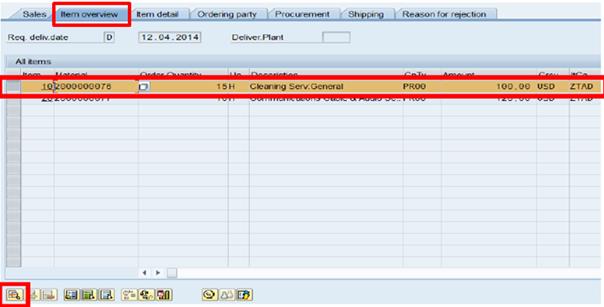

D.1.4. At the Sales tab, check and ensure that the status of each item is Approved.

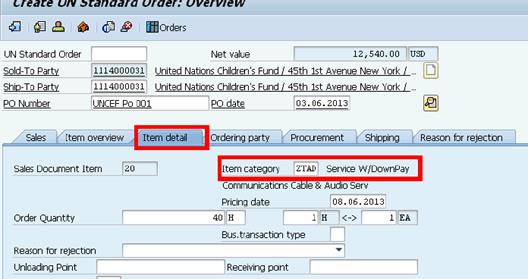

D.1.5. Click the Item detail tab and review the Item category.

Described below are the available Item categories and their functionalities:

|

Item Category |

Description |

Comments |

|

TAD |

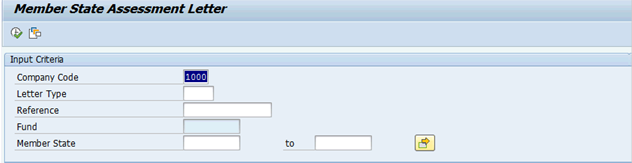

Service |