1 Objective

The objective of this chapter is to give an overview of the accounting treatment of changes in accounting policies, changes in accounting estimates and the correction of errors. This chapter also covers the related disclosure requirements.

2 Summary of IPSAS Accounting Policies

|

|

Definitions |

Accounting treatment |

|

Changes in accounting policies |

Accounting policies are the specific principles, bases, conventions, rules, and practices applied by UN in preparing and presenting financial statements. Accounting policies of the UN are stipulated in the IPSAS Policy Framework. |

Prospective/ retrospective* application |

|

Changes in accounting estimates |

A change in accounting estimate is an adjustment of the carrying amount of an asset or a liability, or the amount of the periodic consumption of an asset, that results from the assessment of the present status of, and expected future benefits and obligations associated with, assets and liabilities. |

Prospective application |

|

Errors |

Prior period errors are omissions from, and misstatements in, the UN's financial statements for one or more prior periods arising from a failure to use, or misuse of, reliable information that was available or could reasonably be expected to have been obtained and taken into account in the preparation and presentation of those financial statements. |

Retrospective* restatement |

* Assumes it is practicable to apply it retrospectively. See further for additional guidance.

2.1 Changes in Accounting Policies

The detailed accounting policies of the UN are outlined in the UN IPSAS Policy Framework (ST/IC/2013/36) section 4.2.4. The UN should apply their accounting policies consistently for similar transactions from one period to the next because users of the financial statements need to be able to compare the financial statements over time.

A change in accounting policy should be made by the UN only if:

· The change is required by an IPSAS Standard; or

· If the change will result in the financial statements providing reliable and more relevant information about the effects of transactions on the UN's financial position, financial performance or cash flows.

Changes in accounting policies may be categorized according to the three basic processes applied in the preparation of financial statements, namely, (i) recognition, (ii) measurement bases and (iii) presentation.

Example 1 - Change in accounting policies related to recognition

· Changing from recognizing actuarial gains and losses on defined benefit plans as a separate item directly in full in the statement of net assets/ equity* (current UN accounting policy) to recognize them in the statement of financial performance based on the 'corridor approach';

· Capitalizing directly attributable borrowing costs rather than expense (current UN accounting policy) them.

* We refer to the Corporate Guidance on Employee Benefits for more details.

Example 2 - Change in accounting policies related to measurement

· Changing from measuring a class of PP&E at depreciated historical cost (current UN accounting policy) to a policy of regular revaluation. Note: This is dealt with prospectively as a revaluation rather than retrospectively.

A change in the classification of an item within the balance sheet, income statement or cash flow statement often represents a change in accounting policy related to presentation, except where driven by a change in circumstances.

Example 3 - Change in use of an existing asset (NOT a change in accounting policy because presentation change is driven by a change in circumstances)

A UN entity owns an office building that it has previously used for its own administrative purposes. Accordingly, the building has been classified as property, plant and equipment and carried at depreciated historical cost. During the current year, management moved the workforce to a new building and leased the old building to a third party. Accordingly, the old building was reclassified as investment property and carried at fair value (Suppose fair value is the elected model by the UN for its investment property).

The adoption of an accounting policy for events or transactions that differ in substance from previously occurring events or transactions is not a change in accounting policy. The change represents a change in use of the property and so no restatement of the comparative amounts should be made. The different accounting treatment applied to the same property in the current and prior years is appropriate, because the building was used for different purposes in the two years.

Example 4 - Situations that do NOT result in changes in accounting policies

· The application of an accounting policy for transactions that differ in substance from those previously occurring;

· The application of a new accounting policy for transactions that did not occur previously;

· The application of a new accounting policy for transactions that were immaterial* previously.

* Materiality for each UN Secretariat reporting entity will vary based on facts and circumstances. We refer to the Corporate Guidance on Materiality Framework for more details.

A change in accounting policies should be applied as follows:

· A change in accounting policy that is made on the initial application (including early adoption) of an IPSAS Standard should be accounted for in accordance with the specific transitional provisions (retrospective or prospective application) of that Standard, if any. Specific transitional provisions are often included in new or revised IPSASs to allow prospective, applying new accounting policy to transactions occurring after the date as at which the policy is changed, rather than retrospective (see below) application of the Standard. This is sometimes because it would be impracticable to obtain the information necessary to restate comparatives;

· In the absence of any specific transitional provisions, the change should be accounted for in the same way as other voluntary changes in accounting policies.

Voluntary changes of accounting policy and the adoption of new accounting Standards where there are no specific transitional rules, should be applied retrospectively, except to the extent that it is impracticable to determine either the period-specific effects or the cumulative effect of the change.

Retrospective application (refer to sections 4.2.5, 4.2.6, 4.2.7 and 4.2.8 of the UN IPSAS Policy Framework (ST/IC/2013/36)) implies that comparative amounts should be adjusted to show the results and financial position of prior periods as if the new accounting policy had always been applied. The UN should adjust the opening balance of each affected component of net assets/equity for the earliest period presented, and the other comparative amounts disclosed for each prior period presented as if the new accounting policy had always been applied.

Example 5 - Retrospective application due to voluntary change in accounting policy (hypothetical scenario)

During 20X2, the UN changed its accounting policy for the treatment of borrowing costs that are directly attributable to the acquisition of an asset that is under construction. In previous periods, the UN had capitalized such costs (hypothetical scenario). The UN has now decided to expense, rather than capitalize them. Management judges that the new policy is preferable, because it results in a more transparent treatment of finance costs and is consistent with common practice, making the entity's financial statements more comparable.

The UN capitalized borrowing costs incurred of USD 2,600,000 during 20X1 and USD 5,200,000 in periods prior to 20X1. All borrowing costs incurred in previous years with respect to the acquisition of the asset were capitalized.

The accounting records for 20X2 show surplus before interest of USD 30,000,000; and interest expense of USD 3,000,000 (which relates only to 20X2).

The UN has not recognized any depreciation on the asset because it is not yet in use.

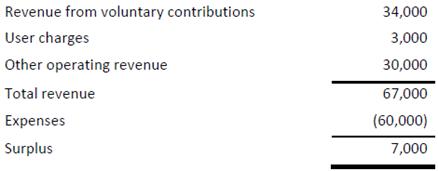

In 20X1, the UN reported (in '000USD):

20X1 opening accumulated surpluses was USD 20,000,000 and closing accumulated surpluses was USD 38,000,000.

The UN had USD 10,000,000 of reserves throughout, and no other components of net assets/equity except for accumulated surplus.

Statement of Financial Performance (in '000 USD)

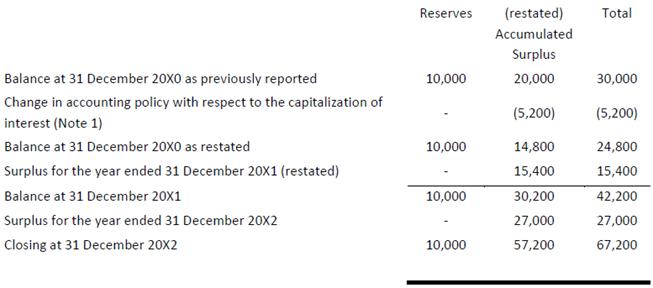

Statement of Changes in Net Assets/Equity (in '000 USD)

2.2 Changes in Accounting Estimates

Owing to the inherent uncertainties in delivering services, preparing financial statements is not an exact science and involves making numerous estimates (refer to section 4.2.9 of the UN IPSAS Policy Framework (ST/IC/2013/36)). Estimates involve judgements based on the latest available, reliable information.

Example 6 - Accounting estimates

Accounting estimates are used amongst others in the following context:

· Allowance for doubtful debts;

· Provisions for slow-moving or obsolete inventory (write-off or write-down of inventory);

· The useful lives of property, plant and equipment and intangible assets;

· Fair values of financial assets and financial liabilities;

· Actuarial assumptions relating to defined benefit pension schemes;

· Depreciation method (straight line, double declined, etc.) of Property, Plant & Equipment;

· Residual value of items of Property, Plant & Equipment;

· Provision for a pending litigation;

· Inventory consumption, i.e. switch from periodic WAP to moving WAP.

The Standard requires the effect of a change in an accounting estimate to be recognized prospectively (that is, from the date of change in estimate) by including it in surplus or deficit in:

· The period of the change, if the change affects that period only; or

· The period of the change and future periods, if the change affects both.

In some circumstances, changes in estimate may impact both assets and liabilities, or relate to a net assets/equity item rather than impacting surplus or deficit. In such circumstances, the change is recognized by adjusting the carrying amount of the related assets and liabilities or the item of net assets/equity in the period of the change.

2.3 Errors

Errors may occur in the recognition, measurement, presentation or disclosure of elements of financial statements. IPSAS 3 states that financial statements do not comply with IPSAS if they contain material errors. Not correcting material prior period errors in accordance with IPSAS 3 might result in a qualified audit opinion. For more details on the materiality concept refer to the Corporate Guidance on Materiality Framework.

Example 7 - Prior period errors

Such prior period errors include the material effects of amongst others:

· Mathematical mistakes;

· Mistakes in applying accounting policies;

· Oversights;

· Misinterpretations of facts;

· Impairment of PP&E has been booked as a provision (liability) instead of deducting it from the carrying amount (asset) of the PP&E;

· Impairment of PP&E which has not been booked;

· Write-off/write-down of inventory which has not been booked;

· Allowance for doubtful debtors (account receivable) which was not booked;

· Income has been recorded on expense accounts instead of on income accounts (presentation issue);

· Income/expense has been recorded in the incorrect reporting entity;

· Accruals have been booked for services/goods ordered but not delivered yet (applying UNSAS concepts which are not IPSAS compliant);

· Accruals regarding services/goods delivered, which were not booked;

· Fraud.

IPSAS 3 requires that adjustments to correct material prior period errors are made retrospectively (except where it is impracticable) by amending comparatives and restating retained earnings at the beginning of the earliest period presented in the first set of financial statements after their discovery as if a prior period error had never occurred.

Immaterial prior period errors are corrected in the first set of financial statements after their discovery without amending comparatives and restating retained earnings, i.e. impacting the current period's surplus or deficit if the correction of the prior period error results in a net result impact.

Example 8 - Material prior period errors

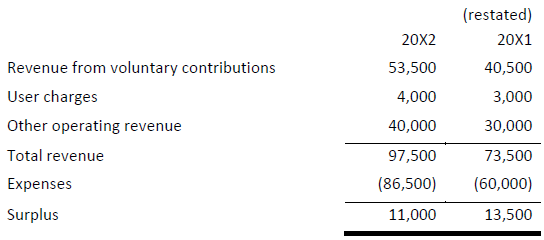

During 20X2, the UN discovered that revenue from voluntary contributions was incorrect. Voluntary contributions of USD 6,500,000, judged to be material by management, that should have been recognized in 20X1 were incorrectly omitted from 20X1 and recognized as revenue in 20X2.

The UN's accounting records for 20X2 show revenue from voluntary contributions of USD 60,000,000 (including the USD 6,500,000 that should have been recognized in opening balances), and expenses of USD 86,500,000.

In 20X1, the UN entity reported (in '000 USD):

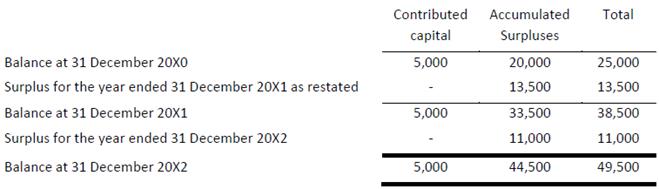

20X1 opening accumulated surplus was USD 20,000,000, and closing accumulated surplus was USD 27,000,000.

The UN entity had no other revenue or expenses.

The entity had USD 5,000,000 of contributed capital throughout, and no other components of net assets/equity except for accumulated surplus.

Statement of Financial Performance (in '000 USD)

Statement of Changes in Equity (in '000 USD)

2.4 Reference

For more details on:

· Accounting policies, changes in accounting estimates and errors refer to the UN IPSAS Policy Framework (ST/IC/2013/36) sections 4.3.1 - 4.4.5.

· Materiality refers to the Corporate Guidance on Materiality Framework.

3 Desktop Procedures

3.1 Changes in Accounting Policies

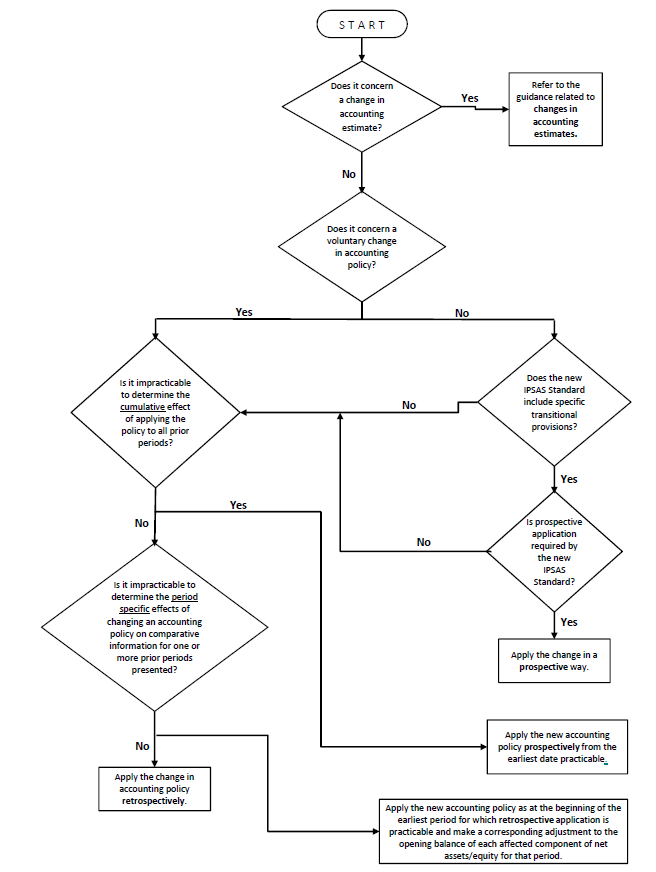

The decisions to be made regarding changes in accounting policies are shown in the below flowchart. Please note that this process is executed at the Central Accounts' division. The Central Accounts division may set up a communication policy to inform the relevant stakeholders of the changes in accounting policies.

It is sometimes difficult to distinguish a change in an accounting estimate from a change in accounting policy. The UN might consider the following questions when determining the nature of the change:

· What was the impetus for the change? Does the change arise as a result of new information, more experience or subsequent developments?

· Did the estimation model change, or just the inputs? Why and when did the inputs change?

· Does the change relate to accounting that includes inherent uncertainty which is subject to estimation?

· Is the accounting result significantly different from the result before the change and why?

In cases where it is still difficult to distinguish a change in an accounting estimate from a change in accounting policy, the change is treated as a change in an accounting estimate (see section 3.2).

A change in accounting policy that is made on the initial application (including early adoption) of an IPSAS Standard (i.e. a non-voluntary change in accounting policy) should be accounted for in accordance with the specific transitional provisions of that Standard, if any. Specific transitional provisions are often included in new or revised IPSASs to allow prospective, rather than retrospective, application of the Standard. This is sometimes because it would be impracticable to obtain the information necessary to restate comparatives.

In the absence of any specific transitional provisions in a new IPSAS Standard, the change should be accounted for in the same way as other voluntary changes in accounting policies.

Voluntary changes of accounting policy and the adoption of new accounting standards where there are no specific transitional rules, should be applied retrospectively. In certain limited circumstances, full retrospective application may not be practicable. To the extent that it is impracticable to determine either the period-specific effects for any reported period or the cumulative effects of changing an accounting policy, full retrospective application of the new policy is not required.

Flowchart 1 - Changes in accounting policy

Applying a requirement is impracticable when the UN cannot apply it after making every reasonable effort to do so. For a particular prior period, it is impracticable to apply a change in an accounting policy retrospectively if:

· The effects of the retrospective application are not determinable. E.g. Data may not have been collected in the prior period in a way that enables retrospective application of a new accounting policy and it may not be practicable to create, or recreate, the information;

· The retrospective application requires assumptions about what management's intent would have been in that period; or

· The retrospective application requires significant estimates of amounts and it is impossible to distinguish objectively information about those estimates that:

o Provides evidence of circumstances that existed on the date(s) as at which those amounts are to be recognized, measured, or disclosed; and

o Would have been available when the financial statements for that prior period were authorized for issue;

from other information. E.g. For some types of estimates, such as an estimate of a fair value measurement that uses significant unobservable inputs, it is not possible to distinguish these different sorts of information. This is presumably because such valuations would be highly subjective and it would be impossible to reliably recreate the subjective considerations that would have been taken into account when making the original estimate in the earlier period.

The IPSAS Standard explains that retrospective application to a particular prior period is not practicable unless the UN can determine the cumulative effect on the amounts in both the opening and closing statements of financial position for that period. This is simply because the effect on the prior period's statement of financial performance will normally be the difference between the cumulative effect at the end and the cumulative effect at the beginning of the period. If one of these is not known the effect on the statement of financial performance (and, therefore, the effect on opening or closing net assets/ equity) of that prior period cannot be determined.

Where it is impracticable to determine the cumulative effect of retrospective application to all prior periods, the UN should adjust the comparative information prospectively from the earliest practicable date. The IPSAS Standard explains that this means that the portion of the cumulative adjustment before that date is disregarded.

Example 9 - Impracticable to determine the cumulative effect (hypothetical scenario solely to illustrate the principle)

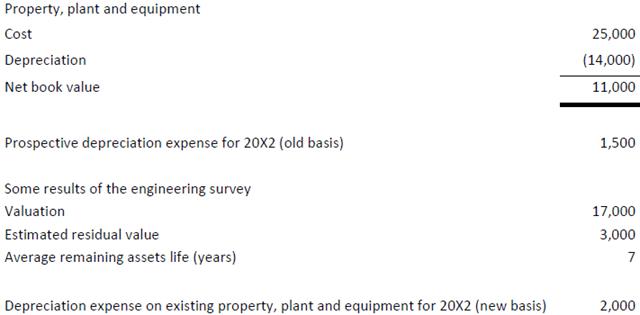

During 20X2, the UN changed its accounting policy for depreciating property, plant, and equipment, so as to apply much more fully a components approach, while at the same time adopting the revaluation model (hypothetical scenario solely to illustrate the principle).

In years before 20X2, the UN's asset records were not sufficiently detailed to apply a components approach fully. At the end of year 20X1, management commissioned an engineering survey, which provided information on the components held and their fair values, useful lives, estimated residual values, and depreciable amounts at the beginning of 20X2. However, the survey did not provide a sufficient basis for reliably estimating the cost of those components that had not previously been accounted for separately, and the existing records before the survey did not permit this information to be reconstructed.

Management considered how to account for each of the two aspects of the accounting change. They determined that it was not practicable to account for the change to a fuller components approach retrospectively, or to account for that change prospectively from any earlier date than the start of 20X2. Also, the change from a cost model to a revaluation model is required to be accounted for prospectively. Therefore, management concluded that it should apply the UN's new policy prospectively from the start of 20X2.

Additional information (in '000 USD):

Extracts from Notes to the Financial Statements*:

From the start of 20X2, the UN changed its accounting policy for depreciating property, plant, and equipment, so as to apply much more fully a components approach, while at the same time adopting the revaluation model. Management takes the view that this policy provides reliable and more relevant information, because it deals more accurately with the components of property, plant, and equipment and is based on up-to-date values. The policy has been applied prospectively from the start of 20X2, because it was not practicable to estimate the effects of applying the policy either retrospectively or prospectively from any earlier date. Accordingly the adopting of the new policy has no effect on prior periods. The effect on the current year is to (a) increase the carrying amount of property, plant, and equipment at the start of the year by USD 6,000,000, (b) create a revaluation reserve at the start of the year of USD 6,000,000, and (c) increase depreciation expense by USD 500,000.

* Refer to 4.1 'Changes in accounting policies' for a detailed discussion regarding disclosure requirements.

Where it is impracticable to determine the period-specific effects of a change on comparative information for one or more periods presented in the financial statement, the new policy is applied retrospectively from the beginning of the earliest reported period for which it is possible to do so (and make a corresponding entry to the opening balance of each affected component of net assets/equity for that period) - this may be the current period.

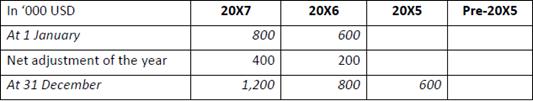

Example 10 - Impracticable to determine the periodic-specific effect (hypothetical scenario solely to illustrate the principle)

The UN changes its accounting policy during 20X7. The change affects net assets/equity and expenses in all periods presented and is assumed to result in financial statements providing reliable and more relevant information. The UN reports current period financial information and comparative information for two prior periods (hypothetical scenario solely to illustrate the principle clearly).

The UN's accounting records do not enable it to determine the adjustments for all the periods being reported. Instead, the UN can determine the increase in net assets/equity at the beginning of the current period (and the end of the previous period) and at the beginning of the previous period, as follows:

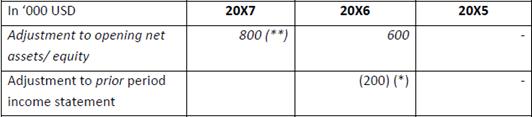

Full retrospective application of the policy to all periods presented is impracticable, because the period-specific effect of the change in 20X5 is not known. In accordance with IPSAS 3, the new policy is applied as at the start of the earliest period for which retrospective application is possible, that is 1 January 20X6. The adjustments made in the financial statements for 31 December 20X7 for the change in accounting policy are as follows:

(*) Decrease of expenses

(**) Increase in net assets/ equity, 800 = 600 + 200

Applicable changes in Umoja environment should be done in an exhaustive way, i.e. throughout the different modules of Umoja.

3.2 Changes in Accounting Estimates

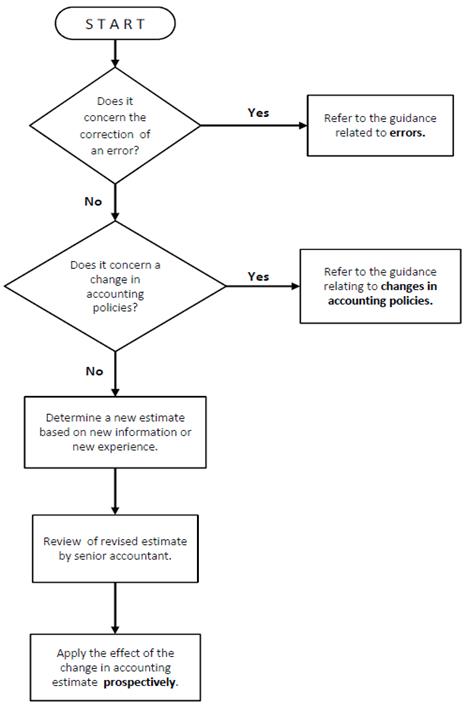

The decisions to be made regarding changes in accounting estimates are shown in the below flowchart.

Flowchart 2 - Changes in accounting estimates

An estimate may need revision as a result of changes in the circumstances on which the estimate was based or because of new information, more experience or subsequent developments. Estimations are necessary because of the inherent uncertainty over the monetary amounts to be attributed to items when applying the UN's accounting policies. As such they represent the result of management's best judgement under the prevailing circumstances and with the latest information.

Errors (see section 3.3), on the other hand, result from the deliberate or accidental misuse of or disregard for information that is available or that should be available. An example of an estimate given in the Standard is a gain or loss recognized on the outcome of a contingency that could not previously be estimated reliably. Such a gain or loss does not constitute the correction of an error.

IPSAS 3 notes that it is sometimes difficult to distinguish a change in an accounting estimate from a change in accounting policy (see section 3.1). The UN might consider the following questions when determining the nature of the change:

· What was the impetus for the change? Does the change arise as a result of new information, more experience or subsequent developments?

· Did the estimation model change, or just the inputs? Why and when did the inputs change?

· Does the change relate to accounting that includes inherent uncertainty which is subject to estimation?

· Is the accounting result significantly different from the result before the change and why?

In cases where it is still difficult to distinguish a change in an accounting estimate from a change in accounting policy, the change is treated as a change in an accounting estimate.

The accounting estimate should reflect the changes in the circumstances on which the estimate was based or because of new information, more experience or subsequent developments.

The revised estimate should subsequently be reviewed by an independent reviewer, i.e. senior accountant.

The effect of the change in accounting estimate should be recognized prospectively in accordance with IPSAS 3 (see section 2.2 for more details).

Applicable changes in Umoja environment should be done in an exhaustive way, i.e. throughout the different modules of Umoja.

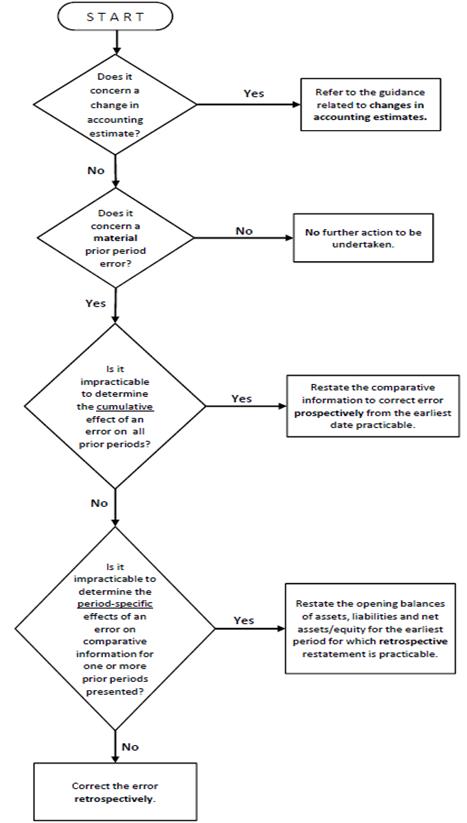

3.3 Errors

The decisions to be made regarding errors are shown in the below flowchart. Please note that this process is executed at the Central Accounts' division. The Central Accounts division may set up a communication policy to inform the relevant stakeholders of identified previous period errors.

The correction of errors should be distinguished from changes in accounting estimates (see section 3.2). As previously noted, accounting estimates are, by their nature, approximations that may need to be revised when additional information becomes available. They are necessary because of the inherent uncertainty over the monetary amounts to be attributed to items when applying the UN's accounting policies. As such they represent the result of management's best judgement under the prevailing circumstances and with the latest information. Errors, on the other hand, result from the deliberate or accidental misuse of or disregard for information that is available or that should be available. An example of an estimate given in the Standard is a gain or loss recognized on the outcome of a contingency that could not previously be estimated reliably. Such a gain or loss does not constitute the correction of an error.

Assessing whether an omission or misstatement could influence decisions of users, and so be material, requires consideration of the characteristics of those users. Users are assumed to have a reasonable knowledge of the public sector and economic activities and accounting and a willingness to study the information with reasonable diligence.

Reasonable knowledge of accounting would include the knowledge that financial statements are normally prepared on a going concern and accruals basis and a basic knowledge of the structure, content and purpose of the statement of financial performance, statement of financial position, cash flow statement and statement of changes in net assets/equity. Therefore, the assessment needs to take into account how users with such attributes could reasonably be expected to be influenced in making and evaluating decisions. Materiality depends on the size (quantity) and nature (quality) of the omission or misstatement judged in the surrounding circumstances. The size or nature of the item, or a combination of both, could be the determining factor.

Arguments that amounts cannot be determined are rarely reasons for considering the effect to be immaterial, because in the absence of quantification it is generally not possible to judge materiality.

Errors should be corrected retrospectively. In certain limited circumstances, full retrospective restatement may not be practicable. To the extent that it is impracticable, e.g. if records necessary to quantify the effect of the error have not been retained and cannot be recreated, to determine either the period-specific effects for any reported period or the cumulative effects of an error, full retrospective restatement of the correction of the prior period error is not required. We refer to section 3.1 for more details.

Flowchart 3 - Errors

Where it is impracticable to determine the cumulative effect of an error, as at the beginning of the current accounting period presented, the UN should adjust the comparative information to correct the error prospectively from the earliest practicable date. It, therefore, disregards the portion of the cumulative restatement of assets, liabilities and net assets/equity arising before that date. The effect on the financial statements where it is impracticable to determine the cumulative effects of a prior period error on all periods presented is treated in a manner similar to a change in accounting policy. This is illustrated in the example 9 in section 3.1 above.

Where it is impracticable to determine the period-specific effects of an error on comparative information for one or more prior periods presented in the financial statements the UN should restate the opening balances of assets, liabilities and net assets/equity for the earliest period for which retrospective restatement is possible. This could, in an extreme case, be the current period if the period-specific effect cannot be determined for earlier periods. The effect on the financial statements where it is impracticable to determine the period-specific effects of a prior period error is treated in a manner similar to a change in accounting policy. This is illustrated in the example 9 in section 3.1 above.

Applicable changes in Umoja environment should be done in an exhaustive way, i.e. throughout the different modules of Umoja.

4 Disclosure Requirements

Information to meet disclosure requirements should be gathered from multiple sources (new or amended IPSAS Standard, OPPBA, Umoja, etc.) and disclosures would not be generated automatically by Umoja.

4.1 Changes in Accounting Policies

For changes in accounting policy on initial application of an IPSAS Standard that has an effect on current or prior periods, or that may have an effect on future periods, the following information should be disclosed. Where it is impracticable to determine the effect on one or more prior periods and, thus, certain of the information cannot be disclosed, the relevant disclosures in the last bullet point below should also be given to explain why that other information is omitted:

· The title of the Standard;

· The nature of the change in policy;

· Where applicable, the fact that the policy has been changed in accordance with the transitional provisions of the Standard;

· A description of those transitional provisions, including, as applicable, those that have an effect on current and prior periods and those that will have an effect on future periods;

· The amount of the adjustments for the current period and for each prior period presented, to the extent that it is practicable. The adjustments to be disclosed are those for each financial statement line item that is affected;

· The amount of the adjustments relating to periods prior to the earliest period presented in the financial statements, to the extent practicable; and

· If retrospective application is required by IPSAS 3, but has not been practicable for a prior period presented in the financial statements, or for earlier periods, details of the circumstances that gave rise to the impracticability and a description of how and from when the change in policy has been applied.

For voluntary changes in accounting policy that have an effect on current or prior periods, or that may have an effect on future periods, the following information should be disclosed. Where it is impracticable to determine the effect on one or more prior periods and, thus, certain of the information cannot be disclosed, the relevant disclosures in the last bullet point below should also be given to explain why that other information is omitted:

· The nature of the change in policy;

· The reason why the new policy gives information that is reliable and more relevant than that given by the previous policy;

· The amount of the adjustments for the current period and for each prior period presented, to the extent that it is practicable. The adjustments to be disclosed are those for each financial statement line item that is affected;

· The amount of the adjustments relating to periods prior to the earliest period presented in the financial statements, to the extent practicable; and

· If retrospective application has not been practicable for a prior period presented in the financial statements, or for earlier periods, details of the circumstances that gave rise to the impracticability and a description of how and from when the change in policy has been applied.

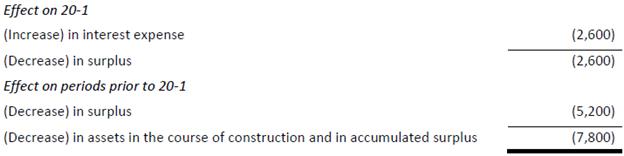

Example 11 - Retrospective application due to voluntary change in accounting policy (hypothetical scenario)

We refer to example 4 for the facts & circumstances.

The notes to the financial statements would be as follows (hypothetical scenario):

During 20X2, the UN changed its accounting policy for the treatment of borrowing costs related to a qualifying asset. Previously, the UN capitalized such costs. They are now written off as expenses as incurred. Management judges that this policy provides reliable and more relevant information, because it results in a more transparent treatment of finance costs and is consistent with common practice, making the UN's financial statements more comparable. This change in accounting policy has been accounted for retrospectively, and the comparative statements for 20X1 have been restated. The effect of the change on 20X1 is tabulated below. Opening accumulated surpluses for 20X1 have been reduced by USD 5,200,000, which is the amount of the adjustment relating to periods prior to 20X1 (in '000 USD):

4.2 Changes in Accounting Estimates

For changes in accounting estimates, the UN should disclose:

· The nature and amount of the change that affects the current period or that is expected to have an effect in future periods. The only exception is where it is impracticable to estimate the effect on future periods; and

· Where the effect on future periods is not disclosed because it is impracticable, that fact should be disclosed.

4.3 Errors

For prior period errors, the following information should be disclosed. Where it is impracticable to determine the effect on one or more prior periods and, thus, certain of the information cannot be disclosed, the relevant disclosures in the last bullet point below should also be given to explain why that other information is omitted.

· The nature of the prior period error;

· The amount of the corrections for each prior period presented, to the extent that it is practicable. The corrections to be disclosed are those for each financial statement line item that is affected;

· The amount of the correction at the beginning of the earliest prior period presented;

· If retrospective restatement is impracticable for a particular prior period, details of the circumstances giving rise to the impracticability and a description of how and from when the error has been corrected.

Example 12 - Retrospective application due to voluntary change in accounting policy (hypothetical scenario)

We refer to example 7 for the facts & circumstances.

The notes to the financial statements would be as follows:

Revenue from voluntary contributions of USD 6,500,000 was incorrectly omitted from the financial statements of 20X1. The financial statements of 20X1 have been restated to correct this error. The effect of the restatement on those financial statements is summarized below (In '000 USD). There is no effect in 20X2.

December, 2016