1 Objective

Financial instruments include a wide range of assets and liabilities at the United Nations Secretariat reporting entities such as cash, term deposits, investments, contributions receivables and account payables. In addition Cash Pools which represent significant portion of the United Nations assets is within the scope of accounting for financial instrument.

The objective of this chapter is to give a brief overview of the accounting lifecycle and relevant guidance on accounting for financial liabilities within Umoja environment. This chapter on financial instruments includes Accounts Payable module within Umoja environment.

This chapter details how an end user, based on the involved Umoja user profiles, should perform roles and responsibilities related to accounting of financial liabilities.

2 Summary of IPSAS Accounting Policies

2.1 Financial Liabilities

2.1.1 Financial Liabilities - Classification and Measurement

UN Secretariat reporting entities classifies its financial liabilities at fair value through surplus or deficit or other financial liability at initial recognition and re-evaluates the classification at each reporting date.

Currently no financial liabilities are classified under the category of financial liabilities as fair value through surplus or deficit at the UN Secretariat reporting entities, accordingly UN Secretariat reporting entities' financial liabilities are classified as 'other financial liabilities'. They include accounts payable in respect of goods and services, unspent funds held for future refunds, finance lease liability, borrowings and other financial liabilities such as inter-fund balances payable.

Financial liabilities classified as other financial liabilities are initially recognized at fair value, less transaction costs, and subsequently measured at amortized cost using the effective interest method. Financial liabilities with duration of less than 12 months are recognized at their nominal value.

2.1.2 Financial Liabilities - Examples

· Accounts payable and accrued expenses: Accounts payables and accrued expenses arise from the purchase of goods and services that have been received but not paid for as at the reporting date. They are stated at invoice amounts, less payment discounts at the reporting date. Payables are recognized and subsequently measured at their nominal value as they are generally due within 12 months. Accounts payable also includes due to Member States.

· Transfers payable: Transfers payable relates to amounts owed to executing entities/implementing agencies and partners and payables due to funding sources.

· Advance receipt: Advance receipt includes contributions received in advance, member state assessment received in advance

2.2 Identification of Financial Instruments - Liabilities

Table below provides a list of common statement of financial position line items and applies the concepts to determine whether the items meet the definition of a financial instrument. The last two columns of the table establish whether the instruments identified fall within or outside the scope of IPSAS 28: Financial Instruments: Presentation; IPSAS 29: Financial Instruments: Recognition and Measurement, and IPSAS 30: Financial Instruments: Disclosures.

The list is not exhaustive, but an aide to help in identifying financial instruments.

|

Statement of financial position line item |

Financial instrument |

Included within the scope of IPSAS 28 and IPSAS 30 |

Included within the scope of IPSAS 29 |

|

Yes = ✓ |

Yes = ✓ |

Yes = ✓ |

|

|

No = ✗ |

No = ✗ |

No = ✗ |

|

|

Accounts payables |

✓ |

✓ |

✓ |

|

Accruals - goods and services (settlement in cash) |

✓ |

✓ |

✓ |

|

Deferred revenue |

✗ |

n/a |

n/a |

|

Borrowings |

✓ |

✓ |

✓ |

|

Derivative instruments |

✓ |

✓ |

✓ |

|

Retirement benefit obligations |

✓ |

✗ |

✗ |

|

Provisions for constructive obligations (IPSAS 19) |

✗ |

n/a |

n/a |

|

Financial guarantee contracts issued (unless elected to treat them as insurance contracts) |

✓ |

✓ |

✓ |

|

Operating lease |

✗ |

n/a |

n/a |

|

Finance lease obligations |

✓ |

✓ |

✗ |

Items such as deferred revenue are not financial liabilities, because the outflow of economic benefits associated with them is the delivery of goods and services, rather than a contractual obligation to pay cash or another financial asset.

2.3 Reference

For more details on the IPSAS requirements regarding Financial Instruments, refer to:

· The Corporate Guidance on Financial Instruments.

3 Desktop Procedures

3.1 Introduction to Accounts Payable Module

The purpose of the Accounts Payable (AP) module is to manage accounts payable documents and the payment process up to the point where files are handled over to bank signatories. The module records and administers master as well as accounting data for all vendors. It is integrated with other modules such as Supply Relationship Management (SRM), Asset Accounting (AA), General Ledger (GL), Cash Management and Treasury and Travel Management (TM). All postings in AP module are recorded simultaneously in the General Ledger (GL) through reconciliation or control account.

The larger part of accounts payables transactions will be coming from the Purchase to Pay process that is triggered in SRM and describes the overall business process of buying goods and services and paying for them. The Accounts Payable process explains the steps to verify that a vendor or supplier should indeed be paid for goods or services rendered. The Accounts Payable process uses information from a combination of purchasing documents, goods receiving documents, vendor invoice documents, and other business documents such as quality reports (inspection) or troop strength reports.

Accounts payable business processes outlined in this document is within the parameters of creating invoice and subsequent transactions through the use of Business Partner (BP) with vendor role. All advance payments to vendors, non-commercial partners or other entities are processed using the Down Payment request functionality whether or not there is a Purchase Order (PO).

3.1.1 Document Types

In the accounts payable module, document types are used for:

a) writing a story on the vendor's account with enough definition to ensure that someone who was not involved with the recording transaction can readily understand what happened;

b) determining different workflows i.e. the number of workflow steps and the routing can differ by document type; and

c) providing different rules (either for validation or clearing) by document types.

There are four categories of accounts payable document types:

i) Original document

· Documents created manually by AP Users directly into the account payable module.

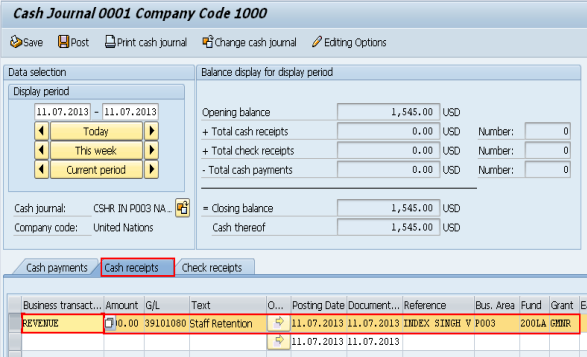

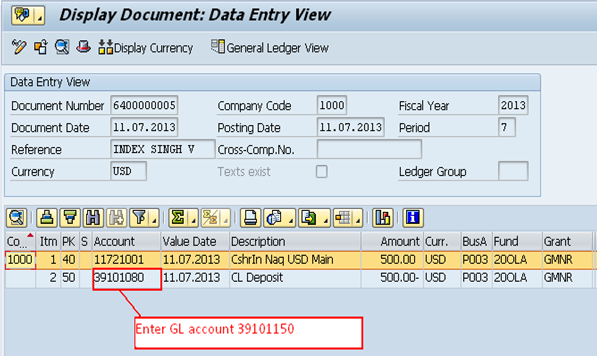

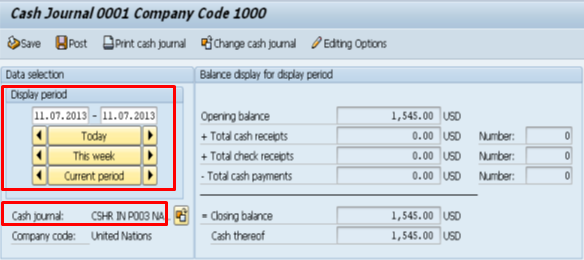

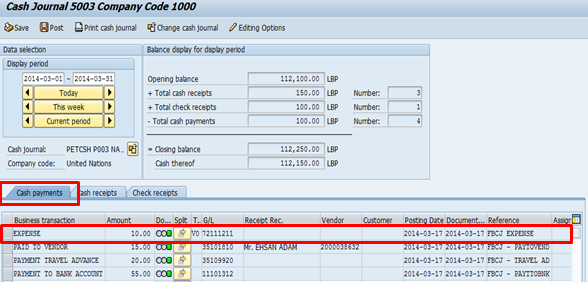

· Downpayment (advance) requests, invoices, credit notes, write offs and incoming payments received by the Cashier and recorded in the cash journal are original documents.

· It is expected that AP Users attached supporting documentation to original documents. Original documents must be approved in workflow, except for cash journal documents which are posted immediately by the cash journal custodian.

ii) Follow on documents

· Documents that are automatically created by the system based on original documents. There cannot be a follow on document without an original document.

· Majority of these follow on documents are payment documents generated by the payment program and clearing documents created by the clearing batch program.

· An example of a follow on document created by the AP User and not automatically by the system is when a downpayment (advance) has been paid in a currency different than the claim. In this case there is no automatic clearing and the AP User must do a manual downpayment clearing prior to recording the claim.

· Follow on documents are posted without workflow approval and no supporting documentation is attached.

iii) Interfaced documents

· With exception of FSS interface travel claims, all accounts payable documents created by an interface are created with status 'posted'.

· For travel claims created in FSS and interfaces to Umoja, same workflow approval applies as if these documents had been created directly in Umoja.

· No supporting document is expected to be attached to interfaced documents.

iv) Converted documents

· All converted documents in accounts payable have the same document type X2. These documents are posted by the conversion program and there is no supporting documents attached.

|

Type |

Name |

Document Number Range |

Description |

Workflow Routing in FI Module |

Typical posting schemes |

|

Original Documents |

|||||

|

KA |

Downpayment Request |

35 |

Downpayment requests created with F-47 are not recorded on the balance sheet as they are 'noted items' in the system's memory until they are disbursed. Upon disbursement, a KZ document is created to record the downpayment paid. |

TEA -> DB1

TEA = Data Entry Agent DB1 = Approving Officer |

Cr Vendor

Noted Items are not balanced documents |

|

KE |

Vendor Inv. with EMF |

31 |

Account payable document recorded against an earmarked fund (EMF). EMF reference is mandatory. |

Cr Vendor Dr Expense |

|

|

KH |

Inv > USD 4,000 no certif |

31 |

Doc type KH is used for invoices without PO and without EMF that do not require certification. |

||

|

KW |

Vendor Write-Off |

37 |

To record a write off. This doc type allows anyone in the organization to subsequently identify a write off taken by another office in the past and initiate recovery procedure if the business partner re-begins to transact with the UN. |

||

|

KG |

Vendor Credit Memo |

32 |

To record a recoverable from vendor |

Dr Vendor Cr Expense |

|

|

KR |

Inv < USD 4,000 w certif |

31 |

Doc type KR is used for invoices without PO and without EMF that require certification. |

TEA -> DA1 -> DB1

DA1 = Certifying Officer DB1 = Approving Officer |

Cr Vendor Dr Expense |

|

RE |

Purch order Invoice |

51 |

Invoice referencing a PO (entered with MIR7) i.e. a logistics invoice |

Cr Vendor Dr GR-IR |

|

|

ZC |

Cashier Incmng_Outgn |

64 |

Incoming payment from vendor received by Cashier. E.g. telephone charge |

No workflow. Posted immediately by Cash Journal custodian. |

Dr Cash Journal Cr. Vendor |

|

ZI |

Imprest Account |

61 |

Incoming payment from vendor received by Imprest custodian. E.g. replenishment. |

||

|

ZP |

Petty Cash |

62 |

Incoming payment from vendor received by petty cash custodian. E.g. replenishment. |

||

|

Type |

Name |

Document Number Range |

Description |

Workflow Routing in FI Module |

Typical posting schemes |

|

Follow on Documents |

|||||

|

KA |

Downpayment Clearing (automatic) |

35 |

Downpayments recorded against a PO prior to goods receipt are cleared by the system at the time of goods receipt or at the time of invoice receipt with a KA document that is automatically created by the system. |

No workflow. Posted immediately by system |

Recording MIGO or MIR7 results in automatic clearing of DP |

|

KA |

Downpayment Clearing (manual) |

35 |

Manual downpayment clearing for the purpose of writing off or for the purpose of netting against a claim in a different payment currency. |

No workflow. Posted immediately by AP User |

AP User uses F-54 |

|

KC |

Vendor Clearing |

34 |

Automatic clearing document KC is created upon disbursement to clear the payable against the payment KZ/KY |

No workflow. Posted immediately by system |

Automatic clearing through: a) F.13 daily clearing batch; or b) F110/FPRL_LIST |

|

KY |

Vendor Clearing F110 |

33 |

Payment document generated by payment program for cash or UNDP payment methods |

No workflow. Posted immediately by system |

Created through payment program F110/FPRL_LIST |

|

KZ |

Vendor Payment |

33 |

Payment document generated by payment program for electronic or cheque payment methods. |

||

|

RT |

Retention Doc |

32 |

When PO has retention indicator, the system automatically creates a separate retention document RT at the time we enter the PO invoice. The RT doc has a due date in the future, as specified when the PO invoice is entered |

No workflow. Posted immediately by system |

System created when PO has retention indicator |

|

Type |

Name |

Document Number Range |

Description |

Workflow Routing in FI Module |

Typical posting schemes |

|

Documents interfaces into accounts payable module |

|||||

|

KT |

Claims FSS Interface |

38 |

Travel claims created in FSS and interfaced to Umoja in status 'Save as Completed'. |

DB1 = Approving Officer |

Cr Vendor Dr Expense Cr Advance Dr Vendor |

|

P1 |

Progen Interface |

70 |

Progen document recording accounts payable against net pay account |

Posted by Progen interface |

Cr Vendor Dr Payroll net pay |

|

P2 |

Progen Clearing |

70 |

Progen document clearing deductions or additional payments against the net pay account |

Dr/Cr Payable/Recoverable Cr/Dr Payroll net pay |

|

|

PY |

HR Payroll |

65 |

Salary downpayment and downpayment clearing (when advance is recovered) |

Posted by HCM interface |

Dr/Cr Vendor Dr/Cr 35501090 HCM Pyr Tech Clrg |

|

TA |

Travel Advance |

35 |

This is a payable document that is automatically created in FI (in real time) when travel request has been approved in travel module. |

Posted by TV interface |

Dr Trav Adv TRM Cr Vendor |

|

TC |

Travel Credit Memo |

32 |

Recovery of travel advance when the travel expense (claim) is submitted in travel |

|

|

|

TG |

Travel Agent Invoice |

31 |

Travel agent invoice recorded and approved in travel module |

Dr Expense Cr Vendor |

|

|

TI |

Travel Invoice |

31 |

Travel expense report recorded and approved in travel module |

Dr Expense Cr Advance Cr Vendor |

|

|

UI |

UNDP SCA invoice |

31 |

Payable document created with UNDP SCA file upload against the EMF or PO transmitted in the Financial Authorization |

|

Dr Expense Cr Vendor |

|

Converted Documents |

|||||

|

X2 |

AP Conversion |

78 |

Doc type X2 is used for all documents converted to the AP sub-ledger. |

Posted by conversion program |

Dr Conversion account Cr Vendor |

3.1.2 Document Status, Workflow Status and Workflow Routing

In Umoja the document status is not linked to the workflow status, thus to know what action is needed to complete a document, a combination of the document status and the workflow status needs to be considered.

Below are document statutes for FI documents, Earmarked Funds documents and FM redeployments:

|

AP Documents Status |

AP Document Type |

Comment |

|

1. Hold |

RE |

· Only the creator of the document can retrieve it |

|

2. Save Parked Document |

RE |

· Document is saved/parked without edit or budget check · No FM document created · Workflow is triggered and document is submitted into workflow · Document is submitted in workflow and cannot be changed outside of workflow |

|

KE, KG, KH, KM, KT, KR |

· Document is saved/parked without edit or budget check · No FM document created · Workflow is not triggered · Any TEA can retrieve and correct/delete/submit the document to workflow. |

|

|

3. Save as Completed |

KE, KG, KH, KM, KT, KR, RE |

· Edit and budget checks are completed · If RE document, then three-way match is checked · If real commitment item is used, an FM document is posted to commit budget · Document is submitted in workflow and cannot be changed outside of workflow |

|

4. Posted |

All AP document types: KA, KC, KE, KG, KH, KM, KT, KR, KY, KZ, RE |

· When a document is reversed, it remains posted. A new document with the same document type is posted to offset the original document. |

The following table illustrates possible combinations for accounts payable documents:

|

Description |

Doc Type* |

Document Status |

Workflow Status |

Comment |

|

Downpayment Requests (DPRs) |

KA |

Posted (payment block D) |

In Progress with DB1 or TEA |

DB1 = Approving Officer TEA = AP User |

|

Posted (no payment block) |

Completed |

Completed |

||

|

Invoices and Credit Memos |

KR |

Parked |

Not submitted in workflow |

Not submitted in workflow |

|

Parked-Save as Completed |

In Progress with DA1, DB1 or TEA |

DA1 = Certifying Officer DB1 = Approving Officer TEA = AP User |

||

|

Posted |

Completed |

Completed |

||

|

KE, KH, KG,KM, KT, KW |

Parked |

Not submitted in workflow |

Not submitted in workflow |

|

|

Parked-Save as Completed |

In Progress with DB1 or TEA |

DB1 = Approving Officer TEA = AP User |

||

|

Posted |

Completed |

Completed |

||

|

RE |

Hold |

Not submitted in workflow |

Not submitted in workflow |

|

|

Parked |

In Progress with DA1, DB1 or TEA |

DA1 = Peer (AP User) DB1 = Approving Officer TEA = AP User |

||

|

Parked-Save as Completed |

In Progress with DA1, DB1 or TEA |

|||

|

Posted |

Completed |

Completed |

* Only document types that have a workflow are included.

From the above table:

1. Downpayment requests (DPRs):

· can only be posted i.e. they cannot be parked. A payment block D is automatically put on the DPR document when it is created and it is removed when the DPR is approved by the DB1. AP Users or Approvers cannot manually remove a payment block D. This prevents payment before the workflow approval is completed.

· are posted on the vendor's account even though they are not yet approved.

2. Document type KR behaves differently than other 'K' document types because KR documents are certified before they are approved.

3. Purchase order invoices (document type RE) have a peer review prior to approval by an Approving Officer.

4. We can have accounts payable documents that are parked in FI with a corresponding document posted in FM. This is meant to be temporary event as parked documents are supposed to be reviewed, approved and posted quickly after submission in the workflow.

Note: All parked accounts payable documents need to be cleared at month end.

· It is the responsibility of the mission/local office to ensure there are no parked documents at month end.

· It is the responsibility of UNHQ to ensure that there are no parked documents on a period before the period is closed.

3.1.3 Business Partner (BP)

An accounts payable module requires a vendor for all transactions. No transaction can be posted in the module without a vendor. A vendor is a business partner that has one of the vendor roles.

3.1.3.1 BP Groups

The BP group defines:

· the number range of the BP;

· the General Ledger control account used to record accounts payable transactions for that BP; and

· the roles the BP can have.

The BP group is the first parameter that is defined on the BP master record and it should not be changed afterwards.

The following table shows the BP groups available in Umoja:

|

BP Group |

BP No |

|

Commercial Vendor UNGM |

1110 |

|

Member States (Permanent Mission) |

1111 |

|

Non Member State (Holy See, etc.) |

1200 |

|

Government and Local Authority |

1300 |

|

UN Agency Fund Programme |

1400 |

|

Intergovernment and NGO |

1500 |

|

Treasury Business Partner (Counterparty) |

1700 |

|

Commercial Customers |

1800 |

|

Vendor non UNGM |

1900 |

|

Individuals externals (Retirees, consultants, independent contractors, survivors, etc.) with Index No |

2000 to 2001 |

|

Staff Members |

2000 to 2001 |

|

Military and Police |

2000 |

|

Ship to |

9000 |

|

Bill to |

9100 |

|

Contact Person |

9200 |

BP numbers are automatically determined by ECC (Enterprise Core Component) in a sequential manner except for:

· Commercial vendor UNGM (1110). The BP number is determined by Supplier Relationship Management (SRM); as such it is considered 'external' to ECC.

· Individuals BP Groups (2000 to 2001 Individual External, Staff Members and Military and Police). The BP number incorporates the individual's index number (6 or 7 digits) preceded by 2 and two or three zeros to fill in the BP number to 10 digits.

3.1.3.2 BP Roles

BP roles defines what transactions can be recorded on the BP. Roles are added to the BP Master record by the Master Data Maintenance (MDM) teams responsible for BPs. Roles can be added at the time of creation or at any time later upon request (via iNeed).

Many roles do not permit the recording of financial transactions in financial accounting (FI). BP roles available in Umoja are as follows:

|

|

Role |

Financial Transactions |

Comment |

|

Z00009 |

UN Low Value Vendor |

Accounts payable |

Can be used in SRM with a low value PO and directly in AP for invoices without PO |

|

Z00010 |

UN FI Vendor |

Accounts payable |

Only invoices without PO |

|

Z00011 |

UN Vendor |

Accounts payable |

Can be used in SRM with POs and directly in AP for invoices without PO |

|

Z00012 |

UN FI Customer |

Accounts receivable |

Only invoices without sales order |

|

Z00013 |

UN Customer |

Accounts receivable |

Can be used in Sales and Distribution for sales order and directly in AR module for invoices without sales order |

|

Z00014 |

UN Tenant (w/o Cust. Acct) |

No |

|

|

Z00015 |

UN Master Tenant |

No |

|

|

Z00016 |

UN Sponsor |

No |

|

|

Z00017 |

UN Counterparty |

No |

|

|

Z00018 |

UN Ship to Partner |

No |

|

|

Z00019 |

UN Bill to Partner |

No |

|

|

Z00020 |

UN Financial Services BP |

No, Treasury only |

|

|

Z00021 |

UN Issuer |

No, Treasury only |

|

|

Z00022 |

UN Global Custodian |

No, Treasury only |

|

|

Z00023 |

UN Depository Bank |

No, Treasury only |

|

|

Z00024 |

UN Bank |

No, Treasury only |

|

|

Z00025 |

UN Paying Bank |

No, Treasury only |

|

|

Z00026 |

UN Landlord w.Vendor Account |

No |

|

|

Z00050 |

UN Lease Processor |

No |

|

|

Z00051 |

UN Contract Approver |

No |

|

|

Z00052 |

UN Facilities Planner |

No |

|

|

Z00053 |

UN Facilities Manager |

No |

|

|

Z00054 |

UN Real Estate Agent |

No |

|

|

Z00055 |

UN Contact Person |

No |

|

Note: Roles in italized font permit the recording of financial transactions. Roles in blue font are relevant to accounts payable.

In practice, many BPs have more than one roles. The number of roles created on the BP master record depends on the BP group. The following shows for each BP group, what roles the UN Secretariat has decided to give to all BPs created in that group and what additional roles can be requested at the time of creation or later on an 'as needed' basis.

|

BP No |

BP Group |

Roles Given to all BPs in the Group |

Additional Roles (as needed) |

|

1110 |

Commercial Vendor UNGM |

Z00011 UN Vendor |

Z00026 UN Landlord w.Vendor Acct Z00054 Real Estate Agent |

|

1111 |

Member States (Permanent Mission) |

Z00011 UN Vendor Z00013 UN Customer Z00016 UN Sponsor |

Z00015 UN Master Tenant Z00026 UN Landlord w.Vendor Acct |

|

1200 |

Non Member State (Holy See, etc.) |

||

|

1300 |

Government and Local Authority |

||

|

1400 |

UN Agency Fund Programme |

||

|

1500 |

Intergovernment and NGO |

||

|

1700 |

Treasury Business Partner (Counterparty) |

Z00020 UN Financial Services BP Z00021 UN Issuer Z00022 UN Global Custodian Z00023 UN Depository Bank Z00024 UN Bank Z00025 UN Paying Bank |

None |

|

1800 |

Commercial Customers |

Z00013 UN Customer |

Z00015 UN Master Tenant |

|

1900 |

Vendor non UNGM |

Z00009 UN Low Value Vendor |

Z00015 UN Master Tenant Z00026 UN Landlord w.Vendor Acct Z00054 Real Estate Agent |

|

2000 to 2001 |

Individuals externals (Retirees, consultants, independent contractors, survivors, etc.) with Index No |

Z00011 UN Vendor |

None |

|

2000 to 2001 |

Staff Members |

Z00010 UN FI Vendor |

Z00050 UN Lease Processor Z00051 UN Contract Approver Z00052 UN Facilities Planner Z00053 UN Facilities Manager |

|

2000 |

Military and Police |

Z00010 UN FI Vendor |

None |

|

9000 |

Ship to |

Z00018 UN Ship to Partner |

None |

|

9100 |

Bill to |

Z00019 UN Bill to Partner |

None |

|

9200 |

Contact Person |

Z00055 UN Contact Person |

None |

Note: Commercial BP groups (1110 Commercial Vendors, 1800 Commercial Customers and 1900 Vendor non UNGM) do not mix vendor and customer roles on the same BP while other BP groups (such as 1111 Member States) combine the same vendor and customer role on the same BP. This is because the BP number for 1110 Commercial Vendor UNGM is not determined in ECC while for commercial customers, the BP number is determined in ECC.

There are two BP groups for commercial vendors:

· Z00009 Low Value Vendor can only be used with low value POs while Z00011 UN Vendor can be used with all other PO types.

· Z00009 Low Value Vendor and Z00011 UN Vendor can be used in SRM and directly in the AP subledger for invoices without POs while Z00010 FI Vendor can only be used in the AP subledger. Z00010 FI Vendor for staff members is created to ensure that SRM is not cluttered with thousands of staff members and that we do not perform procurement activities from staff members.

When a Low Value Vendor becomes an UNGM Vendor, a new BP is created in the Z00011 UN Vendor group and procurement activities are recorded on the new BP. When all balances are cleared on the Low Value Vendor, the BP master record is archived by the MDM team.

When a UNGM Vendor BP no longer has an active contract with the UN (i.e. the contract has expired and has not been renewed) and all balances are cleared, the MDM team will archive the BP (upon receiving a request). It is possible to request a creation of a Low Value Vendor BP to record low value transactions with the commercial entity after the contract has expired.

When a staff member retires from the UN, or when a retiree is retained by the UN as a consultant, the same BP continues to be used since both Staff Member and Individual External BP groups have the same number range. In this case, the BP Roles and/or BP Types may be changed.

3.1.3.3 BP Types

The BP Types provides more definition within a BP group. BP Types are mostly used to distinguish the type of individual. A BP can have only one type at a time; however the BP type can be changed as needed by MDM teams.

The HRM solution does not require BP types, as it uses Employee groups and sub-groups to categorized individuals. However, in the Umoja foundation the Progen payroll system has been retained and BP types are used to categorize individuals for the purpose of the Progen interface.

BP Types available in Umoja are as follows:

|

BP Type |

Description |

|

Z001 |

International Staff |

|

Z002 |

Local Staff |

|

Z003 |

UNVs |

|

Z004 |

Military Staff Officer |

|

Z005 |

Military Observer |

|

Z006 |

UN Police |

|

Z007 |

Correctional Officer |

|

Z020 |

Retirees |

|

Z100 |

Individual Contractor |

|

Z101 |

Consultant |

|

Z900 |

Other Types |

|

Z999 |

HR Active: Not Progen Relevant |

3.1.4 General Ledger (GL) Account used in Accounts Payable

The accounts payable subledger uses reconciliation accounts to record transactions. These accounts can only be accessed through the subledger with the use of a business partner with a vendor role. This ensures that the AP subledger will reconcile with the general ledger.

The GL account structure for accounts payable include three GL accounts for each BP Groups. This structure will allow us to provide analysis or disclosure information by BP Group.

|

GL Account Structure for Accounts Payable |

|

|

Reconciliation account ending in '10' |

· All sub-ledger entries are recorded in this account · Account is determined from the BP master record and SPGL and cannot be selected by AP Users · No JVs allowed in this account · Postings have open or cleared status |

|

Man. Adj. GL account ending in '20' |

· Any manual adjustment done outside the AP subledger with JVs should be recorded in this GL account. Entries posted to this GL accounts do not use a BP · Year end system reclassification batch for net debit balances on vendor's accounts will be posted to Man. Adj. accounts (doc type SA) · No open/cleared status · Note: These accounts cannot be Open Item Managed (OIM) accounts, as system reclassification cannot be posted to OIM accounts |

|

Revaluation GL account ending in '99' |

· Only FI revaluation program posts to this account in accordance with IPSAS (doc type SL) · No open/cleared status · Note: These accounts cannot be Open Item Managed (OIM) accounts, as revaluation program cannot post to OIM accounts |

The following table summarizes the GL accounts that may be classified as 'other financial liabilities':

|

Sr. No. |

Brief Description of payable |

GL range |

|

1 |

Assessed Contributions Reimbursable |

3310XXXX |

|

2 |

Payable to Member Sates |

3320XXXX |

|

3 |

Voluntary Contributions Reimbursable |

3410XXXX |

|

4 |

Accounts Payable |

3510XXXX |

|

5 |

Retention Payable |

3511XXXX |

|

6 |

Investment Purchases Payable |

3530XXXX |

|

7 |

GR-IR Goods Received - Awaiting Invoice |

354010XX |

|

8 |

AP Clearing Accounts |

354011XX |

|

9 |

Transfers Payable |

3570XXXX 4570XXXX |

|

10 |

Borrowings |

3620XXXX 4620XXXX |

|

11 |

Certain GL accounts classified as current liabilities |

3910XXXX |

|

12 |

Unapplied cash |

3920XXXX |

|

13 |

Certain GL accounts classified as non-current liabilities |

4910XXXX |

3.1.4.1 Exchange Payable

The following GL accounts are used to record exchange accounts payable balances:

|

GL Acct |

Long Text |

GL Acct Structure |

|

|

|

|

|||

|

33201010 |

AP Exch Mmbr St |

3 |

320 |

10 |

10 |

|

|

|

|

|

33201020 |

AP Exch Mmbr St Man |

20 |

|

|

|

|

|||

|

33201099 |

AP Exch Mmbr St Reval |

99 |

|

|

|

|

|||

|

33201110 |

AP Exch Govt NonMmbr St |

11 |

10 |

|

|

|

|

||

|

33201120 |

AP Exch Govt NonMmbr St Man |

20 |

|

|

|

|

|||

|

33201199 |

AP Exch Govt NonMmbr St Reval |

99 |

|

|

|

|

|||

|

35101210 |

AP Govt and Local Authority |

510 |

12 |

10 |

3 = Current Liability |

||||

|

35101220 |

AP Govt and Local Authority Man Adj |

20 |

|

|

|

|

|||

|

35101299 |

AP Govt and Local Authority Revaluation |

99 |

|

320 = Exch Accounts Payable Member States |

|||||

|

35101310 |

AP UN Agency Fund Programme |

13 |

10 |

|

|

|

|

||

|

35101320 |

AP UN Agency Fund Programme Man Adj |

20 |

|

510 = Exch Accounts Payable Other |

|||||

|

35101399 |

AP UN Agency Fund Programme Revaluation |

99 |

|

|

|

|

|||

|

35101410 |

AP Intergovernment NGO |

14 |

10 |

|

|

10 to 18 = BP Group |

|||

|

35101420 |

AP Intergovernment NGO Man Adj |

20 |

|

|

|

|

|||

|

35101499 |

AP Intergovernment NGO Revaluation |

99 |

|

|

98 = Accruals (No BP) |

||||

|

35101510 |

AP Commercial Vendor |

15 |

10 |

|

|

|

|

||

|

35101520 |

AP Commercial Vendor Man Adj |

20 |

|

|

99 = Accrued Discount clearing (No BP) |

||||

|

35101599 |

AP Commercial Vendor Revaluation |

99 |

|

|

|

|

|||

|

35101610 |

AP UN Staff Member |

16 |

10 |

|

|

|

10 = reconciliation account on BP Master Record |

||

|

35101620 |

AP UN Staff Member Man Adj |

20 |

|

|

|

|

|||

|

35101699 |

AP UN Staff Member Revaluation |

99 |

|

|

|

20 = Man Adj + System Reclas (No BP) |

|||

|

35101710 |

AP Military and Police |

17 |

10 |

|

|

|

|

||

|

35101720 |

AP Military and Police Man Adj |

20 |

|

|

|

99 = System Reval per IPSAS (No BP) |

|||

|

35101799 |

AP Military and Police Revaluation |

99 |

|

|

|

|

|||

|

35101810 |

AP Individual External |

18 |

10 |

|

|

|

|

||

|

35101820 |

AP Individual External Man Adj |

20 |

|

|

|

|

|||

|

35101899 |

AP Individual External Revaluation |

99 |

|

|

|

|

|||

|

35109810 |

AP Accrued Expense Man |

98 |

10 |

|

|

|

|

||

|

35109899 |

AP Accrued Expense Reval |

99 |

|

|

|

|

|||

|

35109910 |

AP Accrued Discount Clearing |

99 |

10 |

|

|

|

|

||

|

35109919 |

AP Accrued Discount Clearing Reval |

19 |

|

|

|

|

|||

Notes:

· BP groups for Commercial Vendor UNGM and Non-UNGM Vendors have the same reconciliation GL account as we do not disclose balances separately for these groups.

· Current liability GL accounts start with 3.

· 2nd to 4th digits of the GL account number can be thought of as an IPSAS category. These 3 digits reflect the distinction between Member States (320) and other BP Groups (510) to accommodate financial statement presentation on separate lines.

· GL account 3-510-98-10 is to manually record accruals at period end. This GL is not a reconciliation account.

· GL account 3-510-99-10 is used by the system to automatically accrue prompt payment discounts. This is a reconciliation account.

3.1.4.2 Advances Paid and Loans Receivable

The UN financial statement format requires that advances and loans receivable be classified as current assets. In Umoja, these transactions are categorized under accounts payable transactions because in their process it involves payment being issued out of Umoja. Thus the resulting advance or loan receivable is recorded in the accounts payable subledger on a BP with a vendor role. Conversely loans payable are recorded in the accounts receivable subledger on a BP with a customer role.

Because only one reconciliation GL account can be maintained on the BP master record, and we have opted to maintain the Exchange GL account on the BP master record, special GL indicators (SPGL) will need to be used to record advances and loans receivable from entities outside Umoja in different reconciliation accounts. The combination of the reconciliation account on the BP master record with the specific SPGL used on the transaction will determine the alternate reconciliation GL account for advances and loans receivable.

The GL account structure for advances and loans receivable include four GL accounts for each BP Groups as follows:

|

GL Account Structure for Accounts Payable |

|

|

Reconciliation account ending in '10' |

· All sub-ledger entries are recorded in this account · Account is determined from the BP master record and SPGL and cannot be selected by AP Users · No JVs allowed in this account · Postings have open or cleared status |

|

Man. Adj. GL account ending in '14' |

· Any manual adjustment done outside the AP subledger with JVs should be recorded in this GL account. Entries posted to this GL accounts do not use a BP · Year end system reclassification batch for net debit balances on vendor's accounts will be posted to Man. Adj. accounts (doc type SA) · No open/cleared status · Note: These accounts cannot be Open Item Managed (OIM) accounts, as system reclassification cannot be posted to OIM accounts |

|

ADA Man ending in '16' |

· Allowances for Doubtful Accounts (ADA) are recorded outside the AP subledger with JVs in this GL account · Entries should be entered with FBS1 and should reverse the following year · This GL account is an OIM account · Postings have open or cleared status |

|

Revaluation GL account ending in '19' - only for monetary items |

· Only FI revaluation program posts to this account in accordance with IPSAS (doc type SL) · No open/cleared status · Note: These accounts cannot be Open Item Managed (OIM) accounts, as revaluation program cannot post to OIM accounts |

GL accounts used for advances and loans receivable are as follow:

|

GL Acct |

Long Text |

GL Account Structure |

|||

|

Advances to Implementing Partners |

|||||

|

18101210 |

Advance Govt and Local Authority - SPGL Y (PO or EMF) |

1 |

810 |

12 |

10 |

|

18101214 |

Advance Govt and Local Authority Man |

14 |

|||

|

18101216 |

Advance Govt and Local Authority ADA Man |

16 |

|||

|

18101310 |

Advance UN Agency Fund Programme - SPGL Y |

13 |

10 |

||

|

18101314 |

Advance UN Agency Fund Programme Man |

14 |

|||

|

18101316 |

Advance UN Agency Fund Programme ADA Man |

16 |

|||

|

18101410 |

Advance Government NGO - SPGL Y |

14 |

10 |

||

|

18101414 |

Advance Government NGO Man |

14 |

|||

|

18101416 |

Advance Government NGO ADA Man |

16 |

|||

|

GL Acct |

Long Text |

GL Account Structure |

|||

|

Commercial Advances |

|||||

|

19101210 |

Advance to Govt and Local Authority - SPGL A (PO or EMF) |

1 |

910 |

12 |

10 |

|

19101214 |

Advance to Govt and Local Authority Manual |

14 |

|||

|

19101216 |

Advance toGovt and Local Authority AFDA Man |

16 |

|||

|

19101310 |

Advance to UN Agency Fund Programme - SPGL A |

13 |

10 |

||

|

19101314 |

Advance to UN Agency Fund Programme Manual |

14 |

|||

|

19101316 |

Advance toUN Agency Fund Programme AFDA Man |

16 |

|||

|

19101410 |

Advance to Intergovernment NGO - SPGL A |

14 |

10 |

||

|

19101414 |

Advance to Intergovernment NGO Man |

14 |

|||

|

19101416 |

Advance to Intergovernment NGO ADA Man |

16 |

|||

|

19101510 |

Advance to Vendor - SPGL A |

15 |

10 |

||

|

19101514 |

Advance to Vendor Man |

14 |

|||

|

19101516 |

Advance to Vendor ADA Man |

16 |

|||

|

GL Acct |

Long Text |

GL Account Structure |

|||

|

Salary Advances |

|||||

|

19101610 |

Advance to Staff Member Payroll Sal Ben - SPGL S (no EMF) |

1 |

910 |

16 |

10 |

|

19101614 |

Advance to Staff Member Payroll Sal Ben Man |

14 |

|||

|

19101616 |

Advance to Staff Member Payroll Sal Ben AFDA Man |

16 |

|||

|

19101710 |

Advance to Military - SPGL S |

17 |

10 |

||

|

19101714 |

Advance to Military Man |

14 |

|||

|

19101716 |

Advance to Military AFDA Man |

16 |

|||

|

19101810 |

Advance to Individual External - SPGL S |

18 |

10 |

||

|

19101814 |

Advance to Individual External Man |

14 |

|||

|

19101816 |

Advance to Individual External AFDA Man |

16 |

|||

|

GL Acct |

Long Text |

GL Account Structure |

|||

|

Paymaster Advance |

|||||

|

19102010 |

Advance for Cash Payment Paymaster - SPGL K (no EMF) |

1 |

910 |

20 |

10 |

|

19102014 |

Advance for Cash Payment Man OIM |

14 |

|||

|

19102015 |

Advance for Cash Payment Man |

15 |

|||

|

GL Acct |

Long Text |

GL Account Structure |

|||

|

Travel Advance |

|||||

|

19109010 |

Advance Travel - SPGL T with EMF (Foundation) |

1 |

910 |

90 |

10 |

|

19109014 |

Advance Travel Module (no SPGL) (UE1) |

14 |

|||

|

19109015 |

Advance Travel Man |

15 |

|||

|

19109016 |

Advance Travel AFDA Man |

16 |

|||

|

GL Acct |

Long Text |

GL Account Structure |

|||

|

Security Deposits |

|||||

|

19301010 |

Security Deposit - SPGL H (No EMF) |

1 |

930 |

10 |

10 |

|

19301020 |

Security Deposit Man |

20 |

|||

|

GL Acct |

Long Text |

GL Account Structure |

|||

|

Loans Receivable - SPGL X |

|||||

|

16201310 |

Loan Receivable UN Agency Fund Programme - SPGL X (No EMF) |

1 |

620 |

13 |

10 |

|

16201314 |

Loan Receivable UN Agency Fund Programme Manual |

14 |

|||

|

16201316 |

Loan Receivable UN Agency Fund Programme AFDA |

16 |

|||

|

16201318 |

Loan Receivable UN Agency Fund Programme Interfund |

18 |

|||

|

16201319 |

Loan Receivable UN Agency Fund Programme Reval |

19 |

|||

Notes:

· BP groups for Commercial Vendor UNGM and Non-UNGM Vendors have the same reconciliation GL account.

· Current asset GL accounts start with 1.

· 2nd to 4th digits of the GL account number can be thought of as an IPSAS category. These 3 digits reflect the distinction between loans receivable (620), advances to Implementing Partners (810) and other advances such as commercial, salary, travel, paymaster and security deposits (910) to accommodate financial statement presentation on separate lines.

· GL account 1-620-13-18 is to manually record accruals at period end. This GL is not a reconciliation account.

· GL account 1-910-90-14 Advance Travel Module is used to record travel advances approved in the Travel module of Umoja.

3.1.5 Special GL (SPGL) Indicator

The following table shows SPGL indicators available in Umoja and the change in reconciliation account resulting from each SPGL indicator for each BP groups.

|

SPGL Long text |

AP SPGL |

Normal SPGL or Downpayment |

BP Group |

Account Group |

Normal Recon G/L Acct |

SPGL G/L Account |

PO or EMF |

|

Security Deposit |

H |

Downpayment paid |

Z010 |

Commercial Vendor |

35101510 |

19301010 |

No |

|

Z011 |

Member State |

33201010 |

|||||

|

Z012 |

Non Member State |

33201110 |

|||||

|

Z013 |

Government and Local Authority |

35101210 |

|||||

|

Z014 |

UN Agency Fund Programme |

35101310 |

|||||

|

Z015 |

Intergovernment and NGO |

35101410 |

|||||

|

Advance to Implem Partner |

Y |

Downpayment paid |

Z013 |

Government and Local Authority |

35101210 |

18101210 |

PO |

|

Z014 |

UN Agency Fund Programme |

35101310 |

18101310 |

||||

|

Z015 |

Intergovernment and NGO |

35101410 |

18101410 |

||||

|

Commercial Advance |

A, F |

Downpayment paid |

Z010 |

Commercial Vendor |

35101510 |

19101510 |

PO or EMF |

|

Z013 |

Government and Local Authority |

35101210 |

19101210 |

||||

|

Z014 |

UN Agency Fund Programme |

35101310 |

19101310 |

||||

|

Z015 |

Intergovernment and NGO |

35101410 |

19101410 |

||||

|

Z019 |

Commercial Vendor non-UNGM |

35101510 |

19101510 |

||||

|

Retention |

R |

SPGL |

Z010 |

Commercial Vendor |

35101510 |

35111510 |

No |

|

Advance Salary - Foundation |

S |

Downpayment paid |

Z020 |

Staff Member, Ex-Staff Member, Survivors and Dependents, Retirees |

35101610 |

19101610 |

No |

|

Z021 |

Non staff Military and Police |

35101710 |

19101710 |

||||

|

Z016 |

Non Staff with Index |

35101810 |

19101810 |

||||

|

Loan Receivable |

X |

Downpayment paid |

Z014 |

UN Agency Fund Programme |

35101310 |

16201310 |

No |

|

Advance Travel - Foundation |

T |

Downpayment paid |

Z016 |

Non Staff with Index |

35101810 |

19109010 |

EMF |

|

Z020 |

Staff Member, Ex-Staff Member, Survivors and Dependents, Retirees |

35101610 |

|||||

|

Z021 |

Non staff Military and Police |

35101710 |

|||||

|

Cash Advance to Paymaster no EMF |

K |

Downpayment paid |

Z020 |

Staff Member, Ex-Staff Member, Survivors and Dependents, Retirees |

35101610 |

19102010 |

No |

|

Z021 |

Non staff Military and Police |

35101710 |

|||||

|

Z016 |

Non Staff with Index |

35101810 |

|||||

|

Z019 |

Commercial Vendor non-UNGM |

35101510 |

|||||

|

Z010 |

Commercial Vendor |

35101510 |

|||||

|

Z014 |

UN Agency Fund Programme |

35101310 |

|||||

|

Z013 |

Government and Local Authority |

35101210 |

3.1.6 Document Flow - General

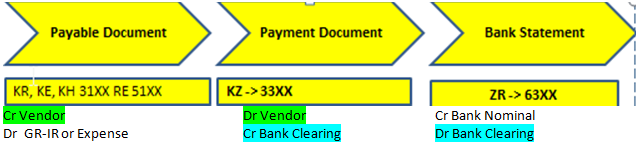

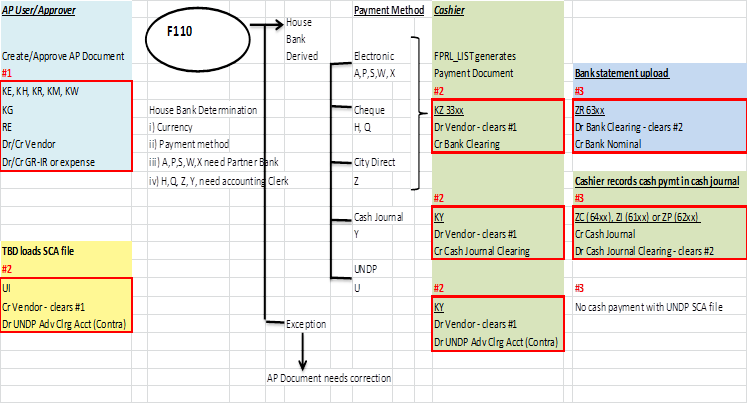

The automation brought by Umoja rests on respecting the natural accounts payable document flow. The natural flow provides for an account payable document cleared by a payment document cleared by a bank statement document.

If the natural flow is not followed, the automatic clearing of bank statement documents (ZR) against payment documents (KZ) is foregone.

The following flowchart illustrates the natural document flow for different payment methods.

|

Accounts payable document |

Document that creates a balance payable or recoverable, an advance or a noted item on the vendor's account |

|

Payment document |

KY, KZ, ZC, ZI or ZP document that indicates that one or more accounts payable documents have been paid. The vast majority of payment documents are generated automatically by the system upon approval of the payment proposal list (KZ, KY). Additionaly, a cash custodian (either petty cash, imprest or cashier's imprest) can also record a payment received on the vendor's account through the cash journal (ZC, ZI or ZP). |

|

Bank statement document |

Document (ZR) created when the bank statement is uploaded in Umoja. |

|

Clearing document |

Automated clearing documents (SC) are generated automatically via an overnight program to clear one or more debit lines with one or more credit lines on a vendor when: · Debits and credits total zero either in Document currency or Local currency; and · Assignment field is identical on all lines; and · Lines are posted to the same GL account

Manual clearing documents (SA) are created before entering a payable document (e.g. travel claim) when the advance and the claims do not have the same document currency. Having different currency prevents the automatic netting of the advance against the claim. In those cases, the AP User creates a KA document with F-54 to credit and clear the advance and debit the vendor for the same amount. |

3.2 Recognition of Accounts Payable

The vendor invoicing process is triggered in one of the following two areas: Logistics Invoice Verification or Finance within Umoja depending upon the type of invoice and ends with processing invoice and payment. As all invoices without purchase order (PO) will need approval, Umoja allows the parking of these documents and a workflow routes these through the approval steps. Final approval triggers the conversion of the parked document to a posted document.

The UN business processes with reference to Accounts Payable include:

· Invoice Processing with PO (Logistics Invoice Processing) - Refer section 3.2.1

· Invoice Processing without PO (FI invoice) - Refer section 3.2.2

· Adjustments for Credit Invoices with Vendors - Refer section 3.2.3

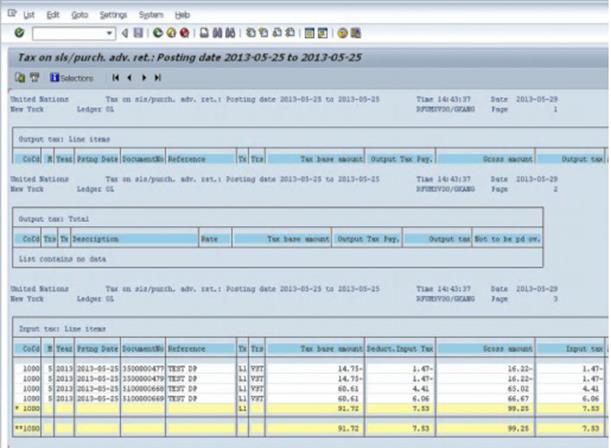

· Tax Accounting - VAT - Refer section 3.2.4

· Document Processing - Inter Agency - Refer section 3.2.5

· Process Local Troops (PCC/TCC) payments - Refer section 3.2.6

· Petty Cash Management - Refer section 3.2.7

3.2.1 Invoice Processing with Purchase Order (PO)

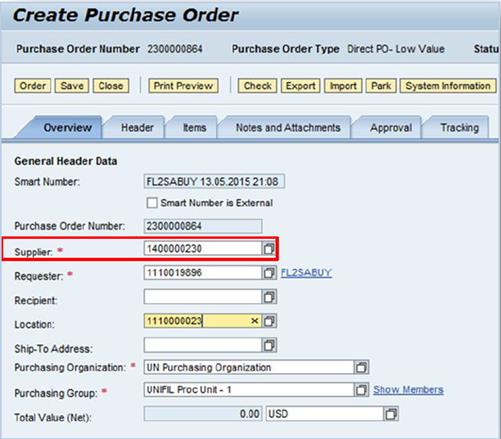

The Umoja solution uses the three way matching process for validating invoices for payment with reference to PO.

The Three Way Match process compares three purchasing documents to verify that a payment should be made to a vendor. The three documents required are: a purchase order, a goods receipt, and a vendor's invoice. The purchase order and goods receipt are entered in the system as logistic steps in the procurement process. When the vendor's invoice is received an electronic record is created in the system. This can be done manually by transcribing data elements from the vendor's invoice into the system. If the vendor references the UN PO number, the person entering the invoice enters the invoice date and the PO number. The invoice date sets the baseline date for ageing the invoice for payment according to the payment terms. From the PO number the system will validate that a PO was approved and that a goods receipt was entered for the items on that PO. Duplicate invoice check is activated to ensure no duplicate invoices are processed during Logistics Invoice Verification (LIV) and paid twice.

Evaluated receipt settlement (ERS) is also applicable with reference to PO specific to external consultants contracted by UN to render professional services. The consultants are paid based on attendance submission. Once the ERS program runs, it will automatically generate the invoice postings based on information provided from PO and service entry sheets made against the PO. The ERS indicator must be flagged in the PO as well as in BP vendor master record of consultants.

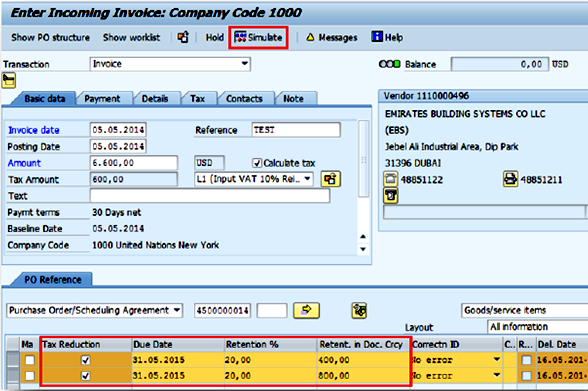

3.2.1.1 Invoice Processing with PO with VAT and with Retention

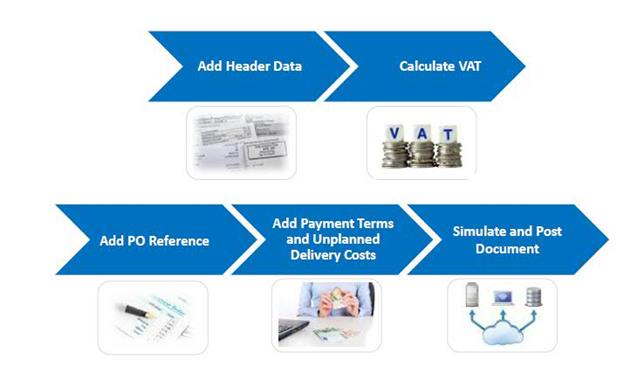

The following are steps to PO invoice processing with VAT and retention:

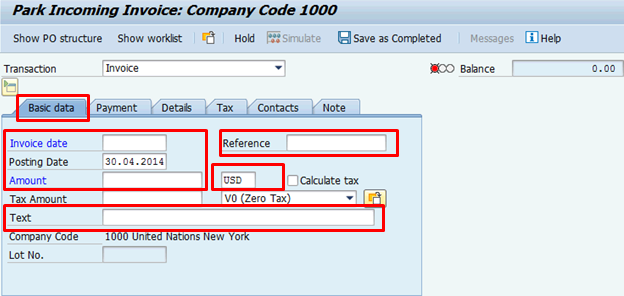

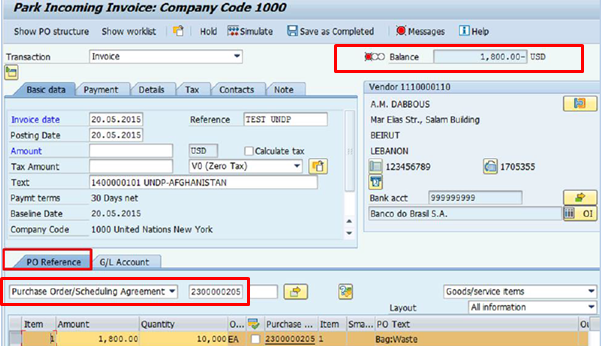

A. Enter parked invoice based on supplier's invoice received / Transaction Code: MIR7

A.1.

Enter MIR7 in the Command field and click the Enter

![]() icon. It

will display the Park Incoming Invoice: Company Code 1000 screen.

icon. It

will display the Park Incoming Invoice: Company Code 1000 screen.

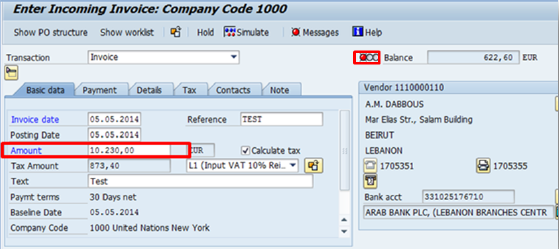

A.2. In the screen, enter the relevant values in the Basic data tab:

· Invoice date: The date on the vendor invoice

· Posting Date: The date on which the invoice is posted

· Reference: The vendor invoice number

· Amount: The total amount on the Invoice, including VAT and all charges

· Currency

· Text: A free text field to convey any particular information about the document

Note: The document type is NOT required to be entered by the end user if processing invoice with reference to PO. The standard document type RE (Purchase Order Invoice) is assigned by the system for invoice processing with reference to PO.

A.3.

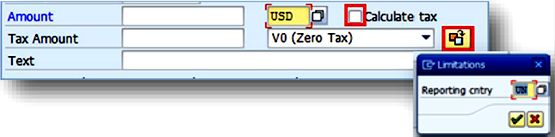

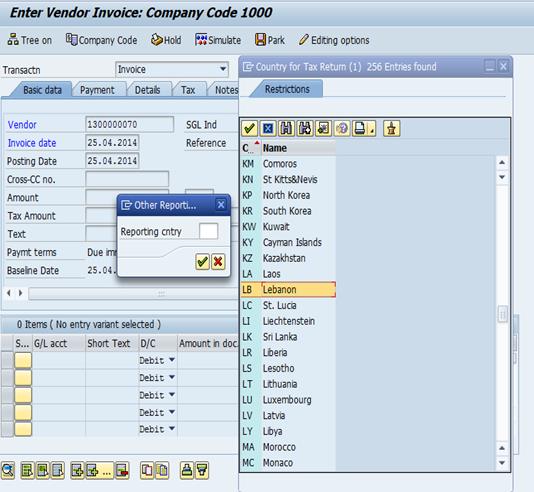

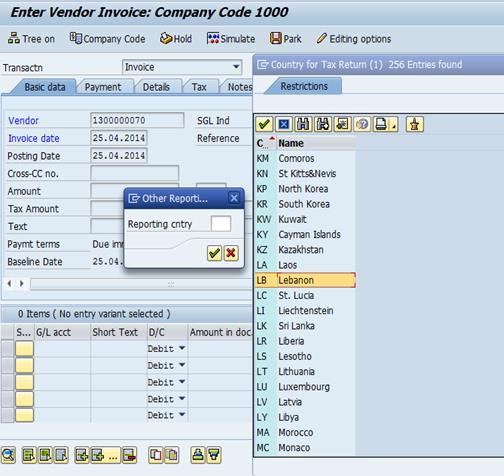

To calculate VAT, tick the Calculate tax box. Then click

the ![]() icon next to the Tax

Amount field. The Limitations pop-up window is displayed. This will

allow you to change the Reporting Country (Reporting cntry).

icon next to the Tax

Amount field. The Limitations pop-up window is displayed. This will

allow you to change the Reporting Country (Reporting cntry).

If you do not know

the country code for your country, click the Matchcode ![]() icon next to

the Reporting cntry field.

icon next to

the Reporting cntry field.

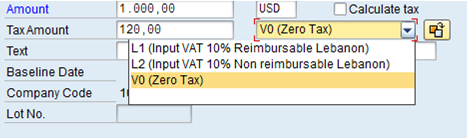

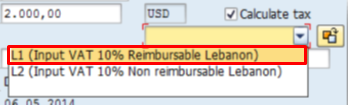

A.4. Click the Tax Code drop down list and select a tax code. The selected Tax Code will allow Umoja to calculate the tax amount and determine in which GL Account to record the VAT.

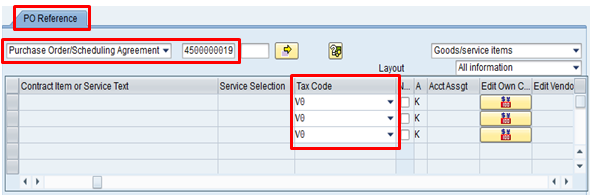

A.5. In the PO Reference tab, enter the PO number referenced in the invoice in the field next to the Purchase Order/Scheduling Agreement drop down menu to pull out the PO details in line item.

A.6. Scroll over to the right until you see the Tax Code field. Select the same Tax Code as the one at the Header level for each line item and press Enter.

A.7. The status in the Balance field at the top should now become green.

A.8. If the PO is subject to retention processing, a system message is issued 'Item is relevant for retention, see message log'. Then click the Continue icon.

A.9. A Due Date is required for payment retention for each line item. In the PO Reference tab, scroll right until you find the Due Date field.

A.10. Tick the boxes in the Tax Reduction field to eliminate tax from retention amount.

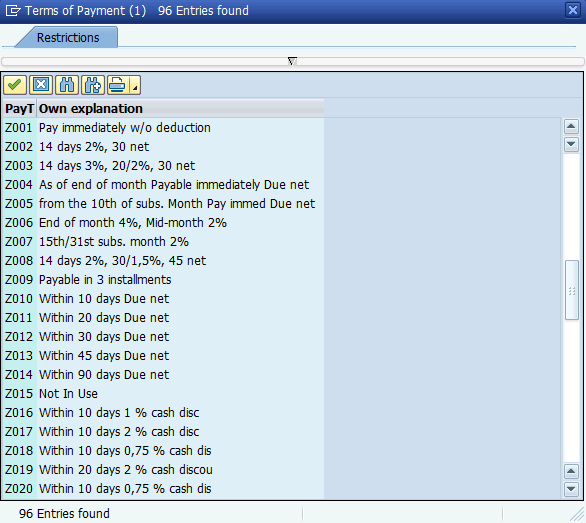

A.11. Add Payment Terms.

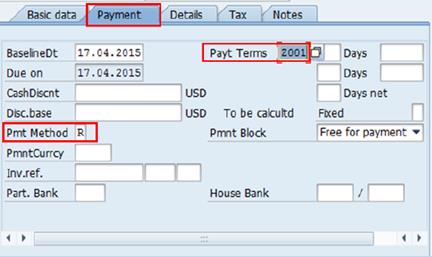

Payment terms are defaulted from the Vendor's Business Partner information. They can be overwritten by editing the information in the Payment tab in MIR7.

Payt Terms: A key that defines what set of payment terms will be used, including discount percentages and payment periods. Example: Z002 = To be paid within 14 days at 2% cash discount or within 30 days due net.

BaselineDt: Date used to track the different payment terms. If the Invoice is received significantly later than the Invoice date listed, you may wish to baseline the payment terms to a different date.

Pmt Method: Specifies the way payment will be made to the vendor. The Vendor Business Partner must be set up to accept this type of payment in order for the payment to be made. If overwriting a default Payment Method, use the BP Transaction to ensure that Payment Method is set up for that Business Partner.

Common Payment Methods are:

· A -Bank Transfer (ACH-CCD): For payee bank in the US

· S -SEPA: (Single Euro Payments Area) For payee bank in Eurozone and currency of payment is Euro

· W -Wire (SWIFT MT103): Used in all other regions

· Y -for payments in cash from Cashier's imprest

· U -UNDP Pay Agent: Used in situations where UNDP is a Pay Agent or is paying a Travel Advance

· R -UNDP Service: Used in situations where UNDP is procuring goods or services on behalf of an Umoja entity

Click here for the link to Payment Method Determination list

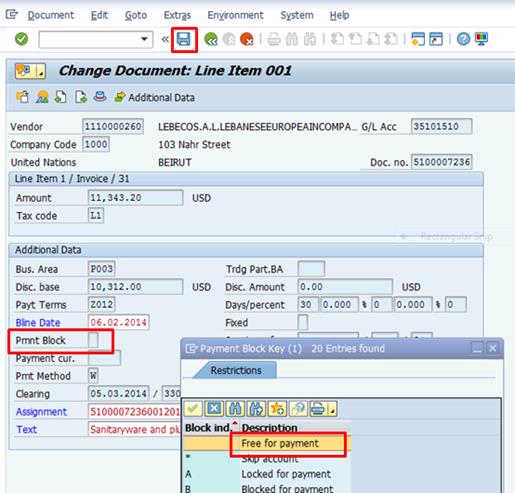

Pmnt Block: Denotes why a payment block is placed on the Invoice. Payment blocks must be manually removed for an Invoice to be paid.

Part. Bank: A vendor may have multiple banks accounts in separate currencies. The partner bank field should be selected to tell the system which payee bank payment should be sent. Also, this must match the Payment Method selected.

Note: Umoja automatically determines the House Bank which will make the payment using one of these is Payment Method. Therefore, make sure the appropriate Payment Method is selected prior to clicking Save as Completed.

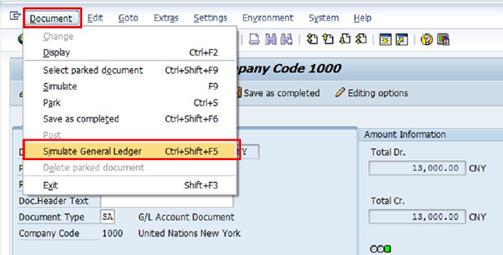

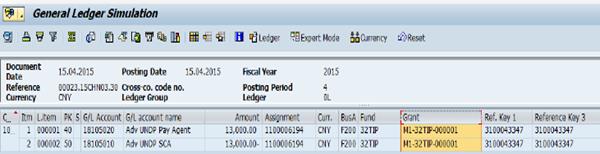

A.12. Go to Documents and select Simulate General Ledger. The simulated document displays the lines for payment and retention.

A.13. Click Save as Completed.

If all checks by the Umoja system are successful, the document is routed through workflow and the system will generate the document number that can be seen at the left bottom side of the screen.

![]()

Process in this section explains the postings for a purchase of document currency USD 50 with 10% retention amount.

|

PK |

GL Acct |

GL Acct Name |

Amount Dr / (Cr) |

Document Currency |

Bus Area |

Cost Center |

Fund |

|

31 |

1110XXXXXX* |

BP with vendor role |

(50) |

USD |

P003 |

|

|

|

86 |

35401010 |

AP Exchange Goods Receipt Payable GRIR |

50 |

USD |

P003 |

10074 |

20OLA |

Another posting document is parked for the retention of a percentage of payable to vendor as defined during PO creation, e.g. 10%. Document type RT (Retention Document) is automatically assigned by the system for retention related transactions.

|

PK |

SPGL |

GL Acct |

GL Acct Name |

Amount Dr / (Cr) |

Document Currency |

Bus Area |

Cost Center |

Fund |

|

21 |

|

1110XXXXXX* |

BP with vendor role |

5 |

USD |

P003 |

|

|

|

39 |

R |

1110XXXXXX** |

BP with vendor role |

(5) |

USD |

P003 |

|

|

* The specific BP account number selected in data entry view determines the AP reconciliation account that will be pulled in accounting entry. In this proforma entry, BP account range 10 will call BP account group Z010 which is Commercial Vendor and derive GL account 35101510 AP Commercial Vendor.

**The special GL indicator R indicates that the related credit posting to BP vendor is posted to an alternative reconciliation account 35111510 AP Commercial Vendor Retention to segregate the payable to vendor arising from retention processing.

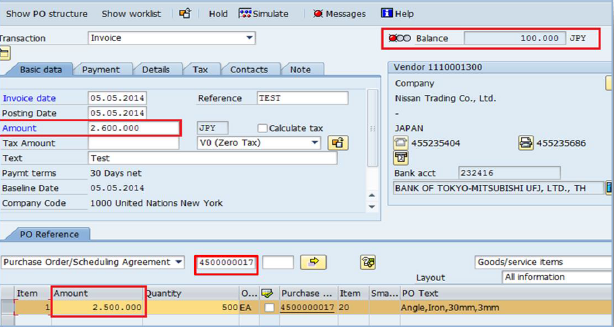

3.2.1.2 Invoice Processing with PO with Invoice Reduction

In cases where the amount in the invoice is more than the amount in the PO, the Invoice Reduction option is used to settle the invoice.

B. Invoice Reductions are entered with the original Invoice in MIR7, only after you have received approval to enter an Invoice Reduction. In addition, they can only be entered if they fall within Invoice Tolerance of USD 4,000 or 10% of PO, whichever is lower.

B.1. Enter the amount in the Amount field under the Basic data tab as it appears on the Invoice along with all other required fields (such as Payment Terms).

B.2. Add the PO Number in the Purchase Order / Scheduling Agreement field under the PO Reference tab

B.3. The status in the Balance field displays in red.

Note: As you can see below, the invoice amount is JPY 100,000 more than the amount on the PO and Goods Received.

B.4. Verify the invoice with the PO and identify line item with the difference. Difference could be for price or quantity (in case of rejection of items).

B.5. In the drop-down menu next to Layout, select Invoice reduction. This will restrict the number of columns to just those that are relevant for Invoice Reductions.

B.6. Scroll to the right until you find the Correctn ID field. For the line item that should be reduced, select the Vendor error: reduce invoice option.

B.7. Under the Invoice Amount Acc. To Vendor field, enter the amount that the Vendor invoiced for this line item. Enter the Invoiced quantity in the Invoice Qty Acc to Vendor field. Press Enter.

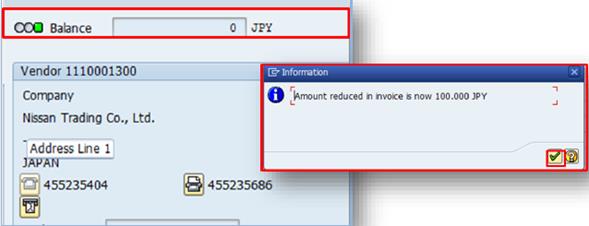

B.8. You will see a pop-up window that shows how much the Invoice was reduced. The balance of the invoice will also be corrected. The invoice can now be simulated.

B.9. Go to Document button and select Simulate General Ledger.

The document type is NOT required to be entered by the end user if processing invoice with reference to PO. The standard document type RE (Purchase Order Invoice) is assigned by the system for invoice processing with reference to PO.

|

PK |

GL Acct |

GL Acct Name |

Amount Dr / (Cr) |

Document Currency |

Bus Area |

Cost Center |

Fund |

|

31 |

1110XXXXXX* |

BP with vendor role |

(2,600,000) |

JPY |

P003 |

|

|

|

86 |

35401010 |

AP Exchange Goods Receipt Payable GRIR |

2,500,000 |

JPY |

P003 |

10074 |

20OLA |

|

40 |

19901010 |

AR Invoice Reduction Clearing |

100,000 |

JPY |

P003 |

|

|

To offset the AR clearing from invoice reduction, another posting document (credit memo) is automatically created in the system. Document type KG (Vendor Credit Memo) is automatically assigned by the system for reduction related transactions.

|

PK |

GL Acct |

GL Acct Name |

Amount Dr / (Cr) |

Document Currency |

Bus Area |

Cost Center |

Fund |

|

21 |

1110XXXXXX* |

BP with vendor role |

100,000 |

JPY |

P003 |

|

|

|

50 |

19901010 |

AR Invoice Reduction Clearing |

(100,00) |

JPY |

P003 |

|

|

* The specific BP account number selected in data entry view determines the AP reconciliation account that will be pulled in accounting entry. In this proforma entry, BP account range 10 will call BP account group Z010 which is Commercial Vendor and derive GL account 35101510 AP Commercial Vendor.

B.10. Click Save as Completed to submit for approval.

3.2.1.3 Invoice Processing with PO with Unplanned Charges

Umoja allows payment of unplanned delivery costs as Unplanned Charges provided these are within the tolerance of 10% of PO or USD 4,000, whichever the lower.

C. Below are the steps if the invoice from supplier include unplanned delivery costs (charges):

C.1. Enter the full amount in the Amount field under the Basic data tab.

Note: When the amount is entered, the document will be unbalanced, as signified by the red light, due to unplanned charges.

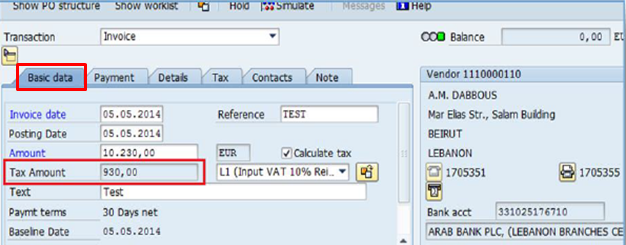

C.2. Go to Details tab. Enter the unplanned charges in the Unpl. Del. Csts field. It will balance the document as signified by the green light.

Note: In the example, the document was unbalanced by Euro 622.60. This is due to unplanned charges for Euro 566 plus 10% tax. Entering the Euro 566 in unplanned charges tab will have the system calculate the tax on this amount which balances the document. It also changes the tax amount under the Basic data tab.

C.3. Go to Documents button and select the Simulate General Ledger.

The simulated document will show that the unplanned charges are debited to the expense account in proportion to the original charges and vendor is paid full amount.

|

PK |

GL Acct |

GL Acct Name |

Amount Dr / (Cr) |

Document Currency |

Bus Area |

Cost Center |

Fund |

|

31 |

1110XXXXXX* |

BP with vendor role |

(10,230) |

EUR |

P003 |

|

|

|

86 |

35401010 |

AP Exchange Goods Receipt Payable GRIR |

8,734 |

EUR |

P003 |

10074 |

20OLA |

|

81 |

7XXXXXXX |

Expense account |

566 |

EUR |

P003 |

|

|

|

40 |

15201020 |

AR VAT Recoverable |

930 |

EUR |

P003 |

|

|

* The specific BP account number selected in data entry view determines the AP reconciliation account that will be pulled in accounting entry. In this proforma entry, BP account range 10 will call BP account group Z010 which is Commercial Vendor and derive GL account 35101510 AP Commercial Vendor.

C.4. Click Save as Completed button.

3.2.1.4 Release Blocked Invoices

The Three-Way Match process in Umoja is triggered to do a triage check against PO, Goods Receipt and invoice.

· If the documents cannot be matched within the invoice tolerance which is 10% or USD 4,000 whichever is lower, the system automatically blocks the payment.

· If the documents do match or are within the invoice tolerance, payments are automatically processed according to payment terms.

For invoices posted by the system but automatically blocked for payment due to quantity and price difference, the AP user or AP approver as duly authorized is expected to reconcile the blocked invoices and release the invoices accordingly to facilitate outgoing payment processing.

D. The following are steps to release block invoices / Transaction Code: MRBR

D.1. Enter MRBR in the Command field.

D.2. Enter the following information in corresponding fields:

· Company code: 1000

· Invoice document: 51xxxxxxxx - 51xxxxxxxx

· Fiscal year:

· Vendor:

· Posting date:

· Due Date:

· Purchasing Group:

· User:

· Release indicator: Release manually or Release automatically

· Blocking procedure: Blocked due to variances, Manual payment block, Stochastically blocked

D.3. Click Execute button

The system will list all blocked invoices based on parameters entered in selection screen.

D.4. Highlight all invoices subject for release and select Release Invoice button

D.5. Select the Save button to save changes made.

3.2.1.5 Processing Down Payments

In Umoja, all advance payments to vendors, non-commercial partners or other entities are known as Down Payments.

Down payments are processed using the Down Payments functionality T-code: F-47 regardless the existing of PO. For down payments made against a PO, a down payment request is made in Umoja ECC. Clearing occurs automatically after goods are received and the invoice is posted.

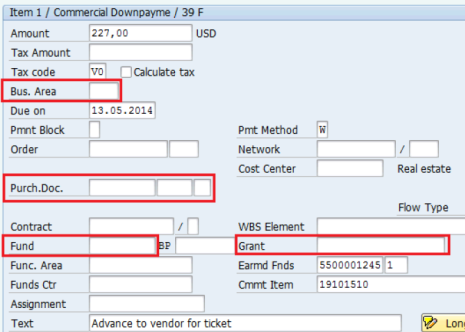

A down payment request is only a noted item and no financial impact. The related coding block from PO or Fund Commitment reference will be derived to populate fields. Document type KA (Down payment) is defaulted by the system for down payment request transactions.

E. Down Payment request / Transaction Code: F-47

E.1. Type in F-47 in the Command field.

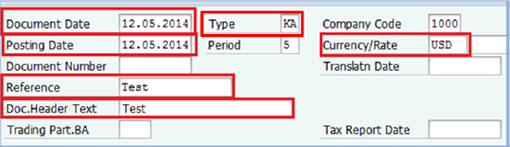

E.2. Enter the following information in the corresponding fields:

· Document Date: enter the Memo date

· Type: KA (for down payment)

· Posting Date:

· Currency/Rate:

· Reference: enter the Memo number

· Doc.Header Text: brief description of the down payment

E.3. Enter the Vendor number in the Account field and select the type of Special GL indicator in the Trg.sp.G/L ind. field.

Note: In the example, Trg.sp.G/L indicator 'A' is used as the vendor is a commercial vendor. A debit will be posted to the Vendor down payment account.

E.4. Click Enter icon.

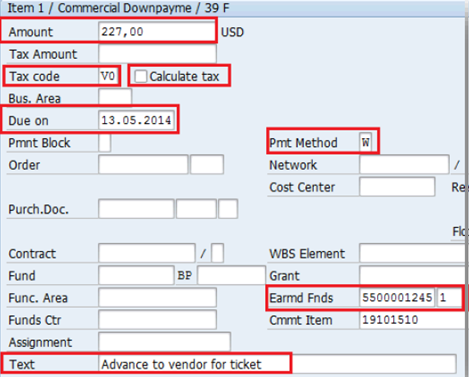

E.5. Enter the following information in the respective fields and press Enter.

· Amount:

· Tax code (mandatory): V0 - no tax on this example transaction

· Calculate tax: tick if applicable

· Due on: for payment schedule

· Pmt Method: used 'Y' for travel advance

· Earmd Fnds: Fund Commitment document number

E.6. When making the down payment against a PO, enter PO number in the Purch.Doc. field.

E.7. When making down payment without a PO or Fund commitment, enter the following fields then press Enter:

· Bus. Area:

· Fund:

· Grant:

E.8.

Click the Save ![]() button

to submit the document for approval.

button

to submit the document for approval.

3.2.1.6 Approve Down Payment Request

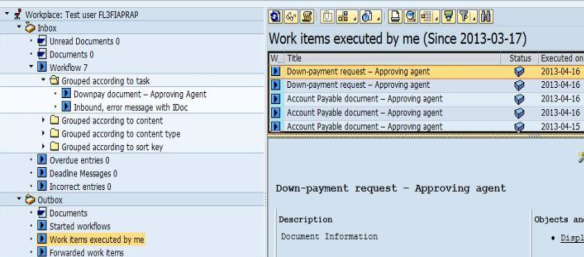

F. After the request has been submitted, it will be routed to the appropriate A/P Approver through a workflow, appearing in their Business Workplace Inbox.

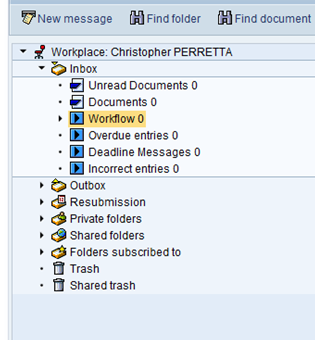

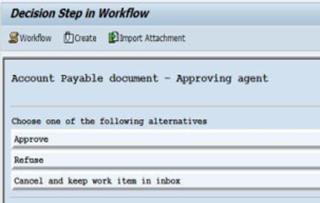

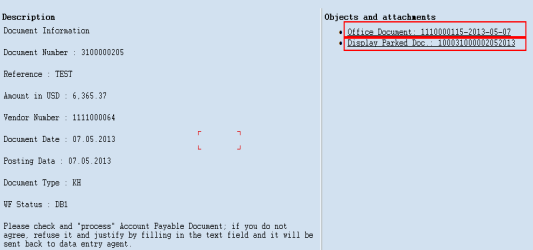

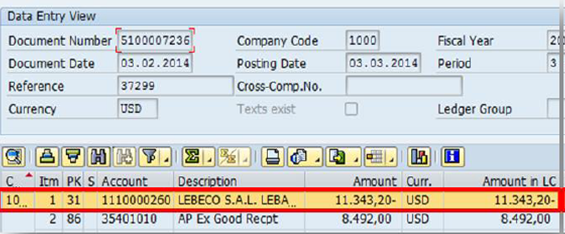

F.1. Workflow to AP Approver / Transaction Code: SBWP

Based on the organizational unit e.g. business area and/ or cost center, enterprise roles assigned, and financial authority delegated to workflow approvers, the parked invoice or credit memo is routed to their inbox for approval or rejection. For more information on workflow refer to section 3.2.2 (H.2).

In this example the down-payment request - approving agent is being approved.

F.2. Clear Down Payments

The down payment request is created in the system. The down payment will be included in payment proposal run subject to payment run approval based on due date using transaction code F110. Transaction code F110 is the automatic payment processing covered in section 3.3.1.1 of Chapter on Cash Management.

When the next invoice against the vendor is entered in Umoja, the system will remind the user about the down payment. The user can apply/clear the down payment against the invoice.

Down payments will be adjusted against the invoice by the system on approval of the document. The system will clear the full down payment even if partial delivery is received.

3.2.1.7 Evaluated Receipt Settlement (ERS)

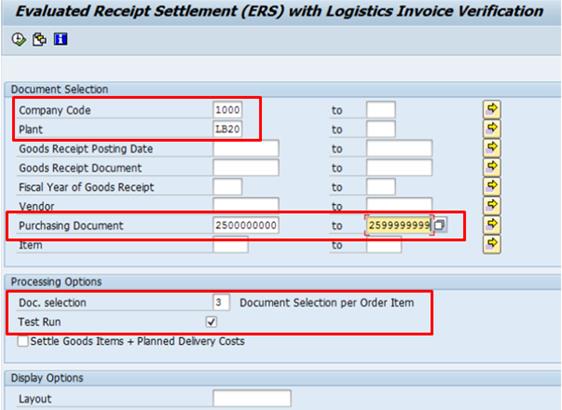

The ERS process is applicable to UN consultants who render professional services for the Organization. Typically a PO is created which is flagged for ERS process settlement. The consultants with BP vendor role are not required to submit vendor invoices to UN. Based on approved PO and service entry sheets (same as goods receipt) created in SRM, the ERS program is run to create invoice postings. The program can be run in test mode, to provide the user an opportunity to review the financial postings before actual run.

G. Following are the steps in performing ERS / Transaction Code: MRRL

G.1. Enter MRRL in the Command field

G.2. Enter data in the following fields:

· Company Code: 1000

· Plant: for location-each mission/office has a unique Plant Code which is used instead of Business Area.

· Purchasing Document: 2500000000 to 2599999999 - a unique range reserved for consultant and individual contractors.

G.3. Under Processing Options section:

· Doc. selection: This brings up separate lines for each Service Entry Sheet.

· Test Run: Ticked

G.4.

Click the Execute ![]() icon

to review the financial postings in test run.

icon

to review the financial postings in test run.

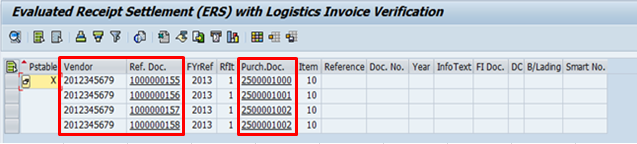

The resulting screen shows the Vendor number, Purchase Document and under Ref. Doc. the Service Entry Sheet number.

G.5.

Click the Back ![]() icon

to go back to the previous screen. Un-tick the box next to Test Run and

execute the transaction again.

icon

to go back to the previous screen. Un-tick the box next to Test Run and

execute the transaction again.

This will post the payable documents in Vendor account and debit the GR/IR (35401010) account.

Note:

· There is no workflow in this transaction.

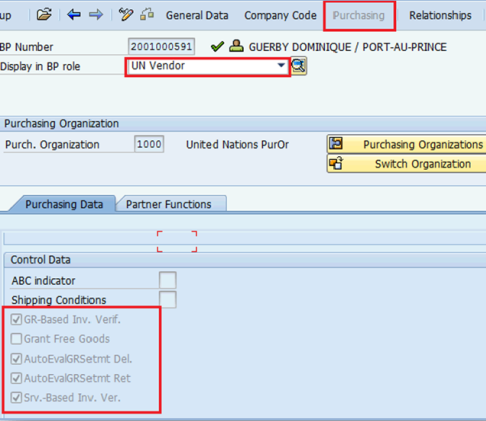

· The Independent Contractor (IC)/Consultant cannot be paid through ERS unless the Auto Evaluation Settlement is checked in the Business Partner (BP) record. This can be seen under Purchasing in UN vendor role.

G.6. Similar with transaction codes MIR7 (parked invoice) or MIRO (Logistics Invoice Verification), ERS will also provide a proforma entry as shown below:

|

PK |

GL Acct |

GL Acct Name |

Amount Dr / (Cr) |

Document Currency |

Bus Area |

Cost Center |

Fund |

|

31 |

1110XXXXXX* |

BP with vendor role |

(100) |

USD |

P003 |

|

|

|

86 |

35401010 |

AP Exchange Goods Receipt Payable GRIR |

100 |

USD |

P003 |

10074 |

20OLA |

* The specific BP account number selected in data entry view determines the AP reconciliation account that will be pulled in accounting entry. In this proforma entry, BP account range 10 will call BP account group Z010 which is Commercial Vendor and derive GL account 35101510 AP Commercial Vendor.

Note: The document type is NOT required to be entered by the end user if processing invoice with reference to PO. The standard document type RE (Purchase Order Invoice) is assigned by the system for invoice processing with reference to PO.

3.2.2 Invoice Processing without PO

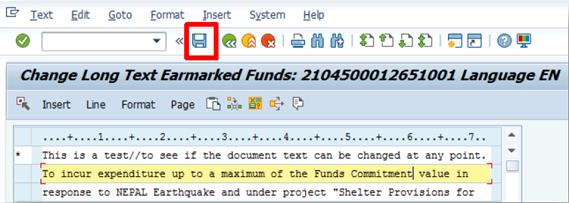

Umoja introduces the concept of creating invoices with reference to a Funds Commitment instead of a PO. This applies in the following scenarios:

· Grants process for implementing partners

· Official Travel

· Entitlement Travel

· Fellowship Study Tour*

· Education Grant*

· Self-Insurance (unless treated as special PO)*

· Appendix D Claims - All Fund Types

· Peacekeeping (PK) Local TCC / PCC payments

· Miscellaneous Obligating Documents

* Requires to be revisited when the Human Capital Management (HCM) solution is deployed in Umoja.

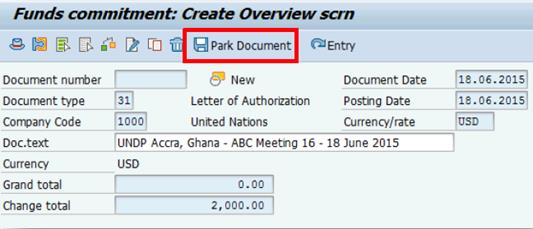

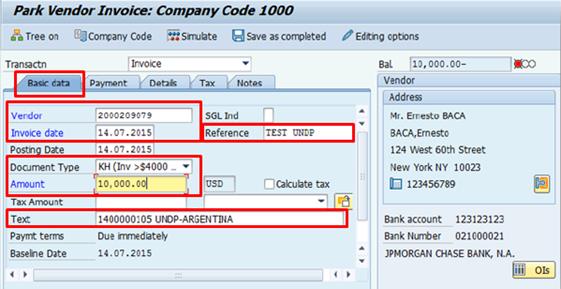

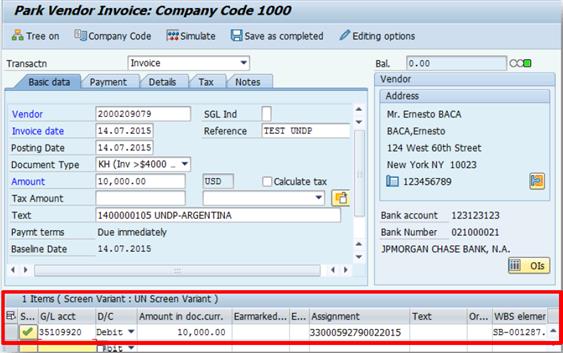

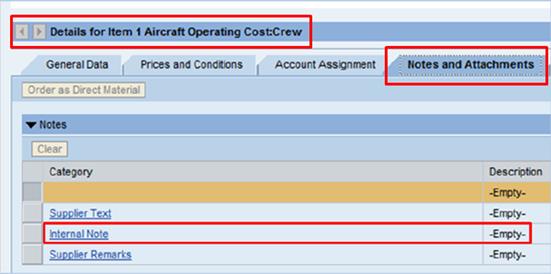

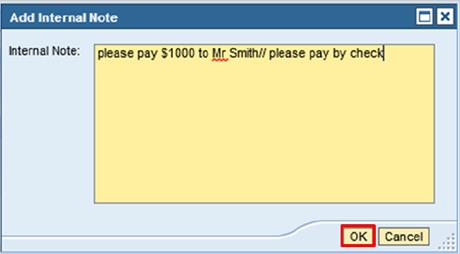

H. The following process steps are applicable to Invoice Processing without PO

H.1. Create parked vendor invoice / Transaction Code: FV60

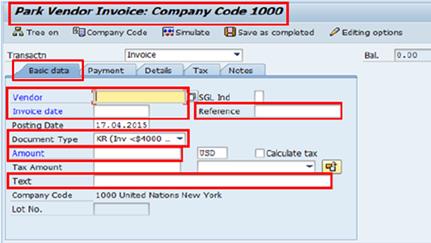

H.1.1.

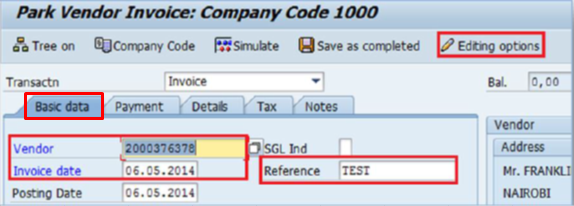

Enter FV60 in the Command field and click the Enter

![]() icon. It

will display the Park Vendor Invoice: Company Code 1000 screen.

icon. It

will display the Park Vendor Invoice: Company Code 1000 screen.

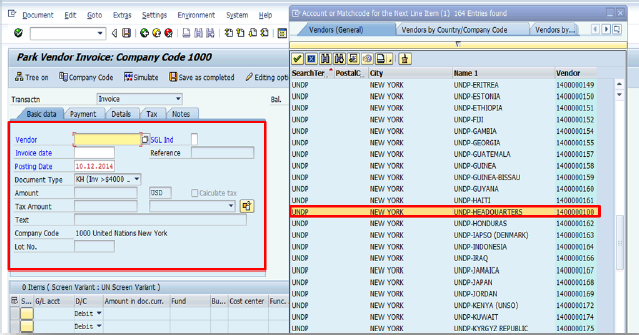

H.1.2. In the screen, enter the relevant values in the Basic data tab:

· Vendor: vendor number

· Invoice date:

· Reference:

H.1.3. Click the Editing options icon.

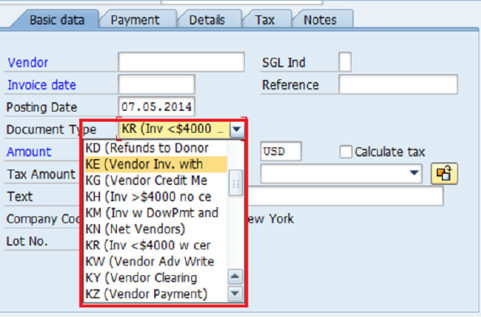

H.1.4. Click the Doc.type option drop down list and select 'Entry with short name'.

H.1.5. Click the Save icon and then the Back button to return to previous screen.

H.1.6. Click Document Type drop down list and select the document type from the listing.

Note:

The document type input is necessary to correctly route the document to workflow as well as for future reporting purposes.

· KE: for charges with Fund Commitments (obligations)

· KR: for direct expenses that require certification. This document type is defaulted by the system for manual invoice transaction.

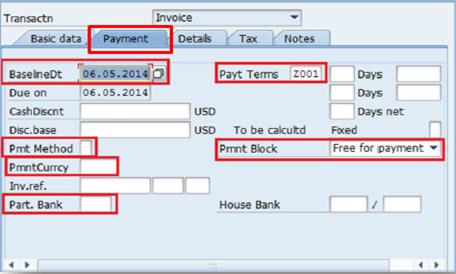

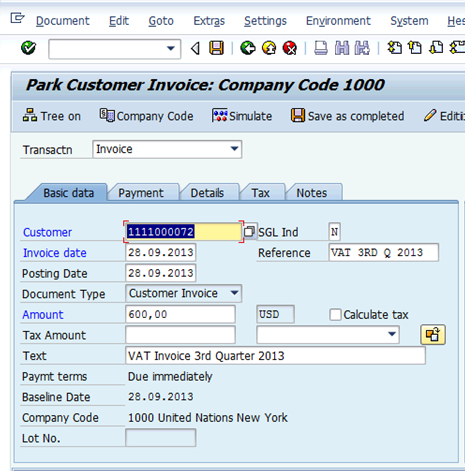

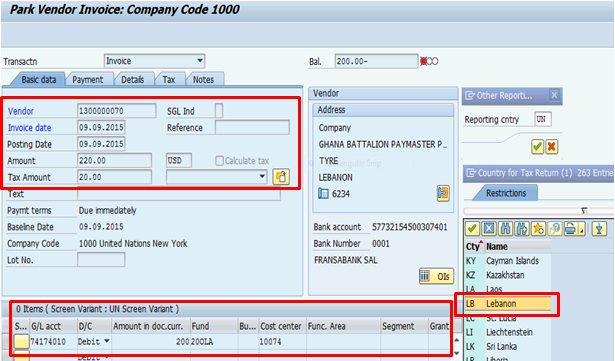

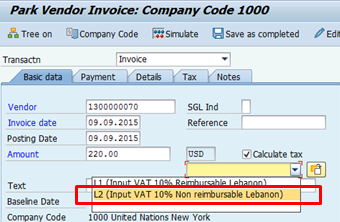

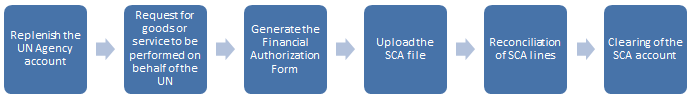

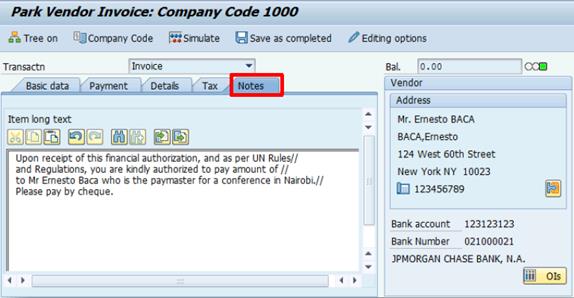

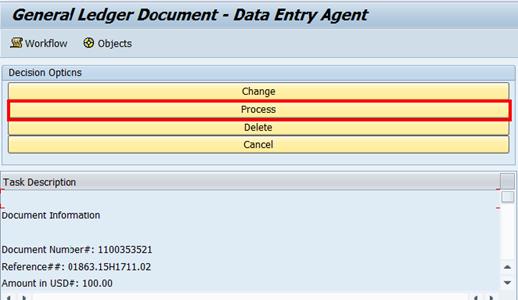

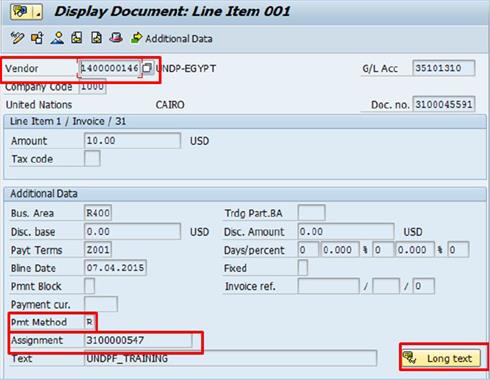

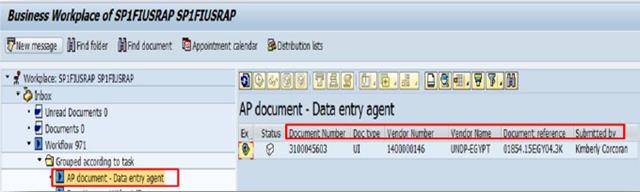

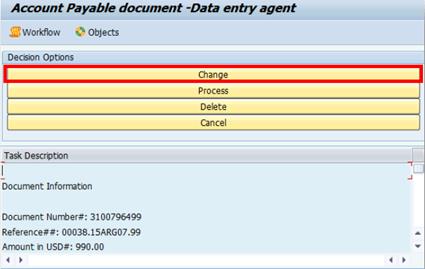

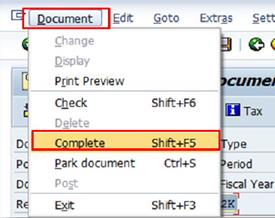

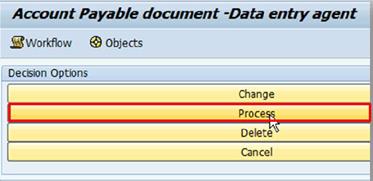

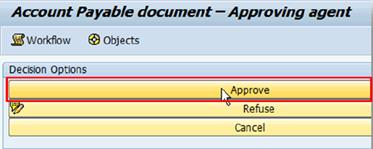

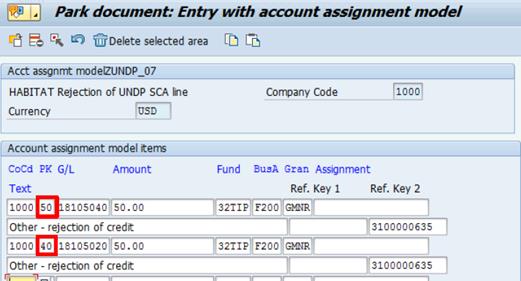

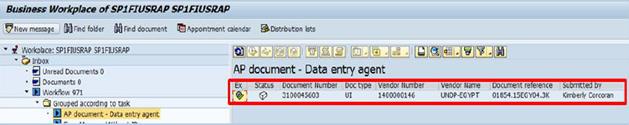

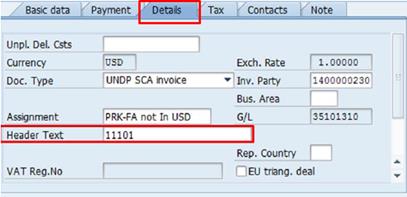

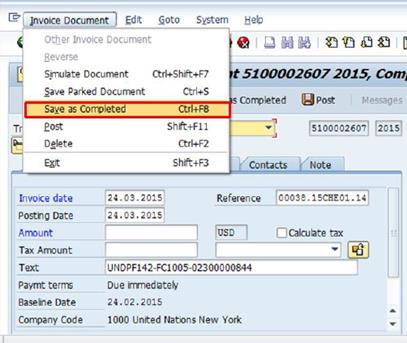

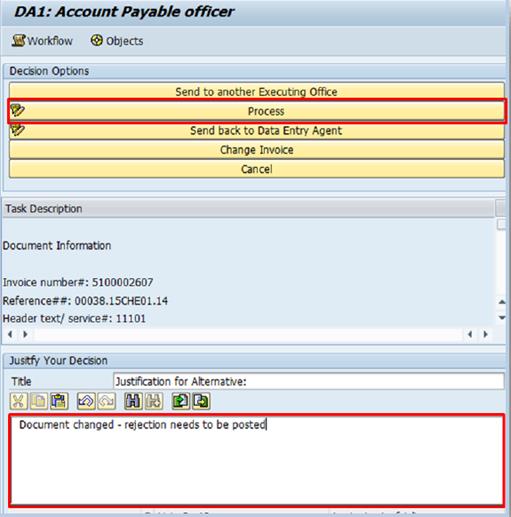

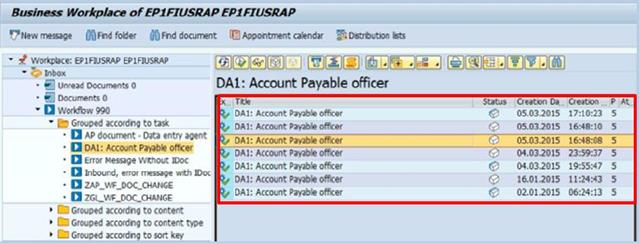

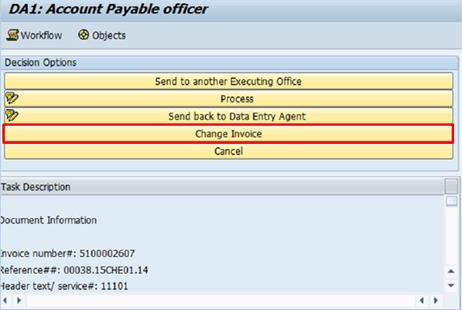

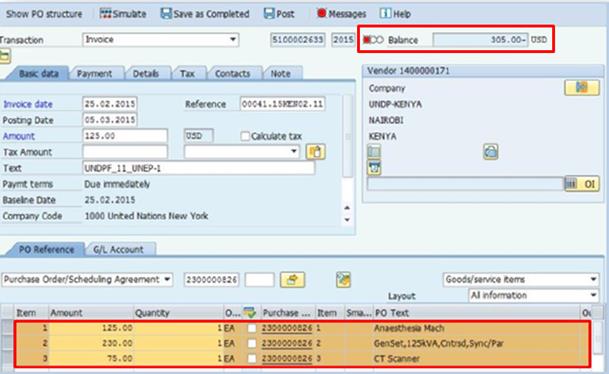

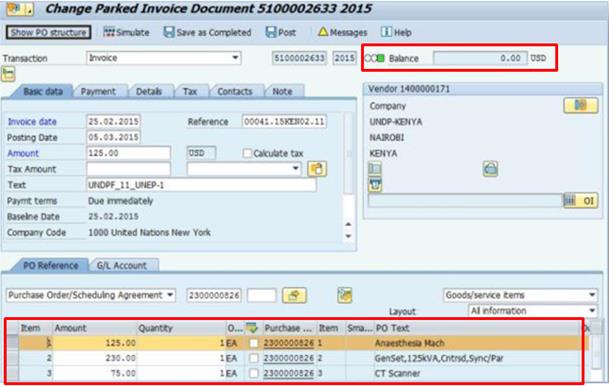

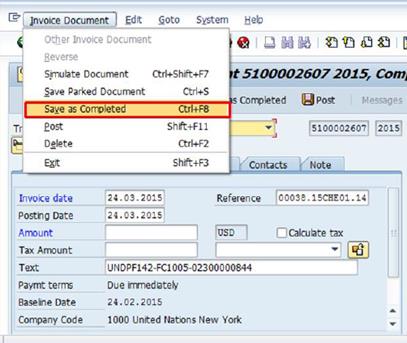

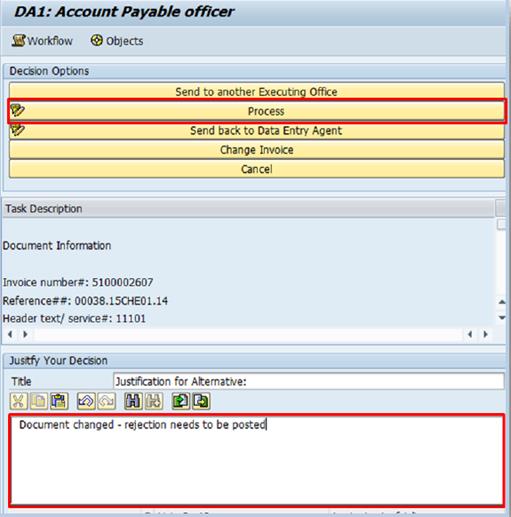

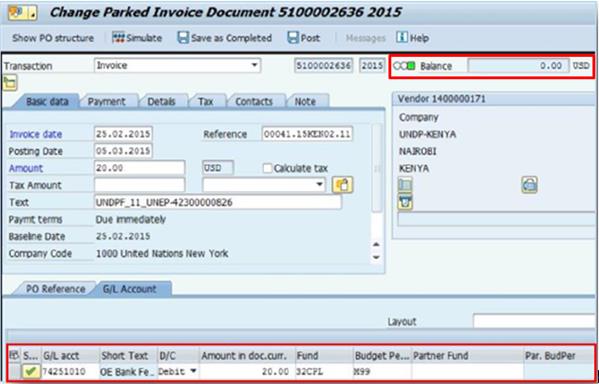

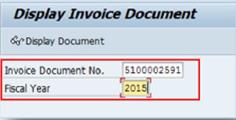

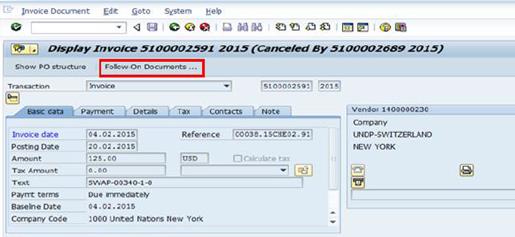

· KH: for charges not requiring certification (i.e. refund of security deposit).