1 Objective

The objective of this chapter is to give an overview of the accounting lifecycle for employee benefits recognized by the UN within the Umoja environment. It details how an end user, based on the involved Umoja user profiles, should perform its roles and responsibilities related to accounting of employee benefits.

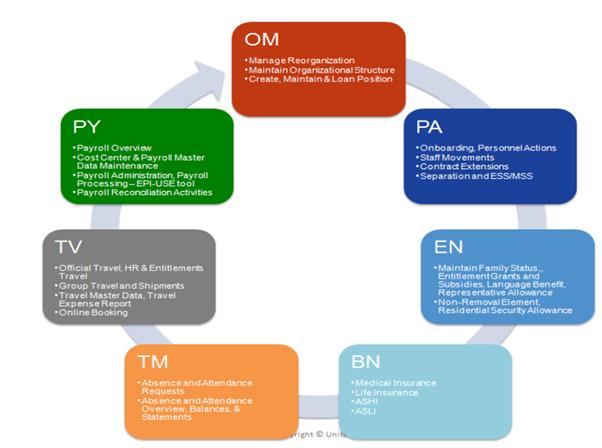

1.1 Overview of the Human Capital Management solution in Umoja

The Human Capital Management (HCM) solution in Umoja follows the following process flow:-

Staff data is centrally stored and Staff members assume a higher responsibility/accountability for their own data. Using the Employee Self Service (ESS) portal, end-users are provided access to update their personal information, request services and view their own data. End users with manager roles can login to the Umoja Self Service Portal and access information, through dedicated areas, as well as perform tasks that will automatically trigger workflows to other parties such as HR Partners, update records in the ERP Central Component (ECC) system or send notifications (for example time approvals).

1.2 The Employee Self-Service Portal

The ESS portal allows staff and managers to:-

· View and update their Employee profile

· Initiate and track requests for benefits & entitlements (benefits such as enrollment for health Insurance; entitlements such as Home Leave for International Staff)

· Certify online their monthly and annual time statements

· View pay statements and simulate payroll

· Upload documents for themselves and dependents

· Make travel requests directly and submit claims electronically (See section 3.3 on HR related Travel and entitlement travel)

· Manager can view their team calendar and approve leave requests

Therefore, the process of recording and accounting for transactions related to certain employee benefits is automated within Umoja. Section 3 details the desktop procedures that are involved in the origination, processing and recording of transactions related to employee benefits.

1.3 Payroll

Processing of payroll has recently moved from Progen-based to Umoja-based. At the time of publishing this manual, some payroll processes remained undocumented therefore the payroll processes will be updated in the next published version of this manual.

1.4 Year-end processes

The processing of actuarially valued employee benefit liabilities as at the reporting date is a year-end process with entries made directly in Umoja using manual journal vouchers (JVs). Furthermore, in order to comply with accrual based accounting required by IPSAS, adjustments are made at year end that serve to apportion other employee-benefit related expenses to the relevant reporting period (see section 3.4 on year-end processes).

2 Summary of IPSAS Accounting Policies

Employees are considered to be individuals providing services to a reporting entity on a full-time, part-time, permanent, casual or temporary basis.

Employees include staff members, within the meaning of Article 97 of the Charter of the UN, whose employment and contractual relationship is defined by a letter of appointment subject to regulations promulgated by the General Assembly pursuant to Article 101, paragraph 1, of the Charter and UN Volunteers. Refer to IPSAS policy framework for further guidance.

2.1 Recognition and measurement of short-term benefits

Expenses for short-term employee benefits are recognized in the statement of financial performance when incurred. The statement of financial position is only affected when there is a timing difference between when the expense is incurred and when payment for these benefits is made.

2.2 Recognition and measurement of post-employment benefits

All of the UN's post-employment benefits reviewed in this chapter are classified as defined benefit plans and accounted for as such, with the exception of UNJSPF, which is accounted for as if it were a defined contribution plan.

2.2.1 Defined Benefit Plans

The net position in the statement of financial position for defined benefit plans is determined as follows:

· The present value (i.e. adjusted for the time value of money) of the defined benefit obligation at the reporting date;

· Minus the fair value at the reporting date of plan assets (if any) out of which the obligations are to be settled directly.

All of the UN's post-employment schemes (ASHI and repatriation grant) are unfunded plans (i.e. no plan assets as defined by IPSAS 25 Employee Benefits exist) and consequently, the position in the statement of financial position reflects the present value of the defined benefit obligation.

The cash received for each scheme, whether in the form of contributions or budgetary allocations, should be accounted for as a financial instrument (see Corporate Guidance on Financial Instruments for further information).

The UN's employee benefit obligations for ASHI and repatriation grant are determined by consulting actuaries. The valuation provided by the consulting actuaries forms the basis of the UN's accounting entries to reflect its liabilities in the financial statements.

The consulting actuaries' report details the defined benefit obligation movements for the period:

1. Current service costs;

2. Interest costs;

3. Past service costs;

4. The effect of any curtailments and settlements;

5. Actuarial gains and losses; and

6. Benefit payments.

Items (1) to (4) are recognized in the Statement of Financial Performance and actuarial gains and losses (5) are recognized through net assets in the Statement of Financial Position. Benefit payments (6) only affect the Statement of Financial Position as the disbursement credit to cash is offset by the reduction in the obligation.

This approach is followed consistently for all of the UN's defined benefit liabilities.

Accounting for defined benefit plans is a complex accounting area and detailed guidance is provided in the Corporate Guidance on Employee Benefits.

2.2.2 Defined Contribution Schemes

As mentioned above, the UNJSPF is considered to be a multi-employer plan for accounting purposes and is accounted for on a defined contribution basis.

2.3 Recognition and measurement of other long-term benefits

The accounting for other-long term benefits generally follows the defined benefit plan accounting method summarized above, i.e. the present value of the entity's defined benefit obligation is calculated by actuaries and the report provided forms the basis of the UN's accounting entries related to other long-term benefits:

· The measurement of the other long-term benefits follows the same principles as the measurement of the defined benefit obligation for post-employment benefits.

· The UN requests an actuarial assessment for its annual leave benefit liability, which is used to include the UN's liability in the statement of financial position.

2.4 Recognition and measurement of termination benefits

The UN recognizes termination benefits when it has communicated its plan of terminating employment contracts to those affected.

The UN recognizes a liability and expense for termination benefits only if it can reliably measure the full extent of the obligation. If no reliable amount can be established (in rare cases); the circumstances and details of the termination benefit should be disclosed.

2.5 Other Specific Benefits

The overview below summarizes specific employee benefits available to UN employees, and overall accounting treatment for each:

|

Scheme |

Employee benefit? |

IPSAS 25 classification |

|

Self-insured health insurance |

Yes - with regards to employer contributions |

Short-term benefit |

|

Life insurance - before retirement |

Yes - with regards to top-up premiums |

Short-term benefit |

|

Life insurance - after retirement |

Yes |

Post-employment benefit (defined benefit) |

|

Commercial insurance (MAIP) |

Yes |

Short-term benefit |

|

Appendix D workers' compensation (illness and long-term disability benefit) |

Yes |

Post-employment benefit (defined benefit) |

Details of specific accounting policies for these employee benefits may be found in Corporate Guidance on Employee Benefits.

2.6 Reference

For further information on accounting policies relating to the above topics, refer to:

· The Corporate Guidance on Employee Benefits; and

· IPSAS 25: Employee Benefits

3 Desktop Procedures

3.1 Overview

As noted above, accounting for employee benefits within Umoja Foundation is automated for some employee benefits (i.e. payroll, travel entitlements) while a manual process through Journal Voucher (JV) entries is required for actuarially valued employee benefits liabilities as well as processing of year-end accrued.

The table below summarizes the common processes which are used to perform accounting entries within Umoja for each of the employee benefits:

|

Employee Benefit |

Accounting Entry |

Employee Benefit |

Accounting Entry |

|

|

Assignment grant |

|

Rest and recuperation Travel |

Travel Process |

|

|

Initial shipment (if other country) |

|

Reimbursement of taxes |

|

|

|

Travel to new post |

Travel Process |

Maternity leave |

|

|

|

Rental agent / broker's fee |

|

Adoption leave |

|

|

|

Salary and post adjustment |

Payroll |

Night differential |

|

|

|

Organization contributions to medical insurance plans |

|

Residential security allowance |

|

|

|

Mobility allowance |

Payroll |

Paternity leave |

|

|

|

Non-removal allowance |

Payroll |

Compensatory time off for overtime (non-accumulating compensated absences) |

|

|

|

Hardship allowance |

Payroll |

Sick leave (accumulating compensated absences) |

|

|

|

Daily subsistence allowance |

|

Sabbatical leave |

|

|

|

Certain travel costs for non-resident judges |

|

Malicious Act Insurance Plan Premiums |

|

|

|

Special operations living allowance |

Payroll |

Low (or no) interest advances and loans |

|

|

|

Special allowances for higher post |

Payroll |

Home leave travel |

Travel process |

|

|

Special allowance for interpreters |

Payroll |

Death benefit |

|

|

|

Rental subsidy |

Payroll |

Pension |

|

|

|

Danger pay (Hazard Pay??) |

Payroll |

Repatriation benefits |

Manual JV following actuarial valuation |

|

|

Language allowance |

Payroll |

Compensation for death attributable to performance of duties |

|

|

|

Spouse dependency allowance |

Payroll |

After-service health insurance (ASHI) |

Manual JV following actuarial valuation |

|

|

Dependent children allowances |

Payroll |

Annual leave (Unused & Commuted to Cash) |

Manual JV following actuarial valuation |

|

|

Overtime |

Payroll |

Compensation for injury attributable to performance of duties |

|

|

|

Secondary dependent allowances |

Payroll |

Termination indemnity |

Manual JV following actuarial valuation |

|

|

Education grant (Tuition) |

Payroll |

Coverage for health expenses of staff members from UN Staff Mutual Insurance Society against sickness and accident (UNSMIS) |

|

|

|

Education Grant (Travel) |

Travel Process |

Payment in lieu of notice |

||

|

Safe driving bonus payments |

Payroll |

|

|

|

|

Family visit Travel |

Travel process |

|

|

3.2 Umoja Payroll Processes

[This section will be covered in detail in the next version of the manual.]

3.3 Travel Process

UN staff undertake official business travel or and non-official business travel. Travel requests for both official and non-official travel are processed in Umoja via the Travel Management Module.

In Umoja, there are four types of travel associated with the travel process namely:

|

· Official travel |

· Entitlement Travel |

|

· HR Travel |

· Uniformed Personnel Travel |

This chapter covers employee-benefit related travel i.e. HR Travel and Entitlement Travel.

Examples of employee-benefit related travel include the following:-

· Travel to new post i.e. appointment, temporary assignment, transfer/reassignment, secondment (HR Travel)

· Separation/Repatriation (HR Travel)

· Education grant travel (Entitlement Travel)

· Reverse Education Grant (Entitlement Travel)

· Family visit (Entitlement Travel)

· Reverse Family Visit (Entitlement Travel)

· Home leave travel (either taken in cycles of every 12 months or every 24 months) (Entitlement Travel)

· Rest and Recuperation (Entitlement Travel)

· Certain travel costs for non-resident judges

The list above is not exhaustive.

3.3.1 Overview of the Travel Process - ESS

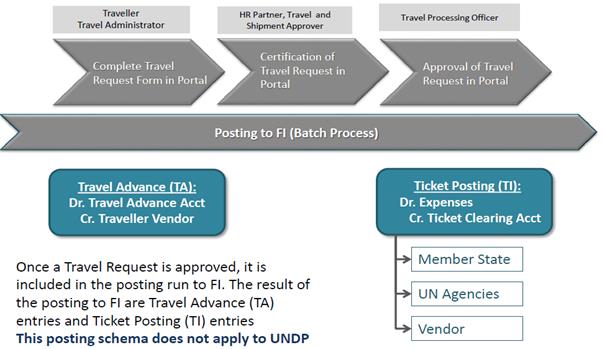

For a detailed overview of travel processes, refer to section 3.4.1 of Chapter on Expenses of the Finance manual. The only difference between entitlement or HR travel related travel requests and other types of travel requests is that entitlement or HR related travel requests involve the role of the HR Partner who has to approve the request in line with the Traveller's entitlement or benefit. Therefore, the overview for entitlement travel or HR related Travel Process will be as shown in the figure below:

The Entitlement Travel Request Process Overview looks as follows:

3.3.1.1 Creating Travel Request and Approval

A travel process in Umoja is initiated by the Traveller who creates and submits a Travel request Form in ESS.

The travel request is approved by an HR Partner who is responsible for approving staff movements and Entitlement Travel as well as Shipment Requests.

The Travel and Shipment Approver approves all travel and shipment requests as well as expense reports from all categories of personnel.

The Travel Processing Officer receives, review and process travel requests from all categories of personnel; Reject and return travel requests, along with the reason (mandatory); Forward travel request to another Travel Processing Office for reasons of efficiency and effectiveness.

The completion of the Travel Request approval triggers a payroll process for allowances or lump sum.

3.3.1.2 Travel Advances

Travel Advances are provided to Travellers to cover expenses of their trip and may include Subsistence Allowance and Terminal Expenses.

Lump sum payments for Entitlement Travel will be processed as advances through Umoja ESS. They will follow the same guidelines and recovery process as travel advances. Lump sum payments are released eight weeks before Entitlement Travel.

The following payment options are available:

|

Role |

What options are available |

Remarks -ECC |

|

Travel and Shipment Approver (TSA) |

· Cheque Payment Option · Cash Payment Option · UN Cashiers · Bank Counter · UNDP · The TSA cannot change the EFT bank account selected by the traveller and will return the Travel Request to the traveller to be updated if necessary |

· If cheque is selected, it will be posted with Payment Block B, and H as Payment Method · If Cash-UN Cashier, it will be posted with Payment Block B, and Y as Payment Method · If Cash-Bank Counter, it will be posted with Payment Block B, and Z as Payment Method |

|

Travel Processing Officer |

None Travel Unit cannot make any changes to the payment options selected and certified by the TSA |

|

3.3.1.3 Payment Options for Travel Advances

|

Payment Option |

Payment Option |

Payment Option |

|

EFT |

TA |

· No Payment Block · Payment currency is the BP Bank Account currency if different from USD · FI partner bank of the selected bank account's ID |

|

Cheque |

TA |

•Payment Block B •Payment Method H •Payment Currency blank |

|

Cash(UN Cashiers) |

TA |

•Payment Block B •Payment Method Y •Payment Currency blank |

|

Cash (Bank Counter) |

TA |

•Payment Block B •Payment Method Z •Payment Currency blank |

Key Issues to note:

· Once a Travel Request is approved, it is not possible to request or issue additional advances through Umoja ESS.

· An additional travel advance can ONLY be requested when a travel request has been approved and the claim process has not been initiated. This is typical of situations where travel is extended beyond the original travel date.

· Once a request for additional advance is initiated and needs to be processed, the Finance Officer mapped to the Travel Claim Processor role will be able to process the advance.

· The Finance Officer mapped to the Travel Claim Processor role will be able to issue additional advances, as well as reduce advances.

3.3.1.4 Submission and Settlement of Travel Expense Report

The Travel Expense Report will be used by the Traveller to submit any reimbursement of travel expenses related to Official Business Travel or Entitlement Travel such as Home Leave.

Travellers are required to submit in ESS an expense report 14 calendar days following the return of the trip to avoid potential recovery of travel advances from their payroll.

Once completed by the Traveller, the Travel Expense Report is routed for certification to the delegated Travel and Shipment Approver based on the fund and fund center in the cost assignment field of the report.

If there are multiple fund and fund centers, the Expense Report is routed to the Travel and Shipment Approver that has the requisite delegation.

Once the certification is complete, the Travel expense Report is submitted for review by the Travel Claims Processor who approves (or reject if necessary) the expense report for batch processing and posting to FI as the final stage of the Travel Management Process.

3.3.2 The Travel Process - Posting to FI

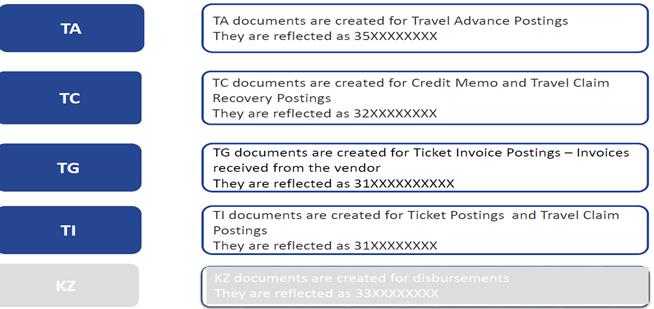

The following document types are created in the Travel process:

Automated postings to FI are made in the following instances during the Travel Management Process:

3.3.2.1 Posting after travel request has been approved

3.3.2.2 Posting after Expense Report has been approved

3.3.3 Travel Processes - Travel Advances

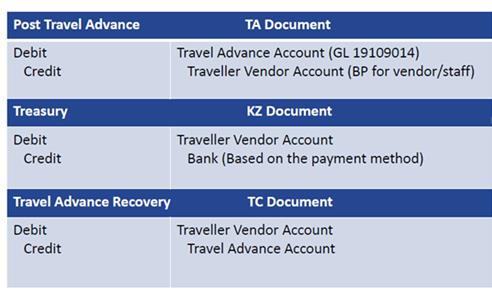

3.3.3.1 Posting Schema

The posting schema for Travel Advances is as presented below:

(See Travel Claim Posting Schema - with Travel Advance in section 3.3.5.1)

3.3.3.2 Review FI Postings for Travel Advances

All travel transactions related to the Travel Requests and Travel Expense Reports are posted to finance once the batch is executed

After the batch jobs have run and travel expense transactions are posted, Finance Officers may view financial entries

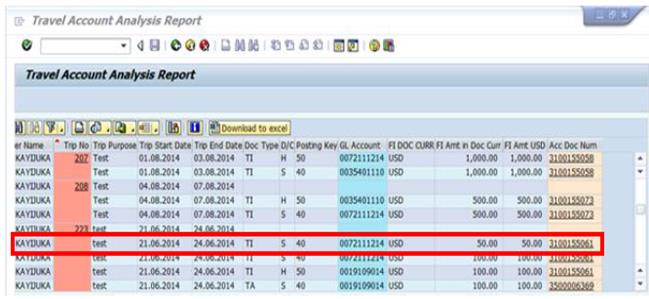

A. To view FI postings for Travel Advance, use the T-code ZTV_TRAVELACC

A.1. Enter ZTV_TRAVELACC in the Command field.

A.2.

Click ![]() to continue

to continue

A.3. The Travel Account Analysis Report is displayed.

A.4. Enter Date Range of transactions you wish to view in Posting Date and enter the Personnel No.

The search can be narrowed by inputting specific details like the Trip Number and fund.

A.5. Use /TRAVEL_FI as Layout.

A.6. Check Show Posting Documents. This will ensure that the report displays the relevant financial documents only.

A.7.

Click ![]() to generate the

report.

to generate the

report.

A.8. To view Travel Advance postings, click on the FI document with the TA document type.

3.3.3.3 Adjustments for Travel Advances

Instances may arise where additional advances may need to be created or where travel advances may need to be reduced.

Where a recovery of a Travel Advance is necessary following a Traveller's failure to submit a Travel claim within 60 days following his/her return, a Travel Advance recovery is initiated automatically through payroll (refer to section 3.3.8)

The following steps are either carried out (by Travel Claims Processor) where manual reviews and adjustments to Travel Advance are required.

3.3.3.3.1 Creating additional advances

B. Steps to create additional travel advances are:

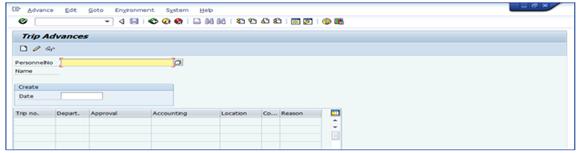

B.1. Enter PR03 in the Command field.

B.2.

Click ![]() to continue.

to continue.

B.3. The Trip Advances screen is displayed. All travel Requests will be displayed in this transaction. You can add additional advance amounts.

B.4. Enter Personnel No. for whom you will create a Travel Advance. Press Enter in your keyboard. All the travel requests will be listed.

B.5. Select the Trip No. against which the advance is to be paid.

B.6. Click ![]() to

edit advance details.

to

edit advance details.

B.7. Input the Amount of additional advance based on Traveller's entitlements.

** Press Enter on your keyboard. ** If you do not press enter, the data will not validate correctly.

B.8.

Uncheck the flag ![]() under Cash

column. This will ensure that the advance is correctly posted for payment.

under Cash

column. This will ensure that the advance is correctly posted for payment.

B.9.

Click ![]() to save additional advance.

This will be part of the next batch process. Once the posting run executes, the

advance amount is posted to FI.

to save additional advance.

This will be part of the next batch process. Once the posting run executes, the

advance amount is posted to FI.

3.3.3.3.2 Reducing Advances

C. Steps to reduce advance are as those for creating additional advance up except for step seven where the amount is reduced instead of being increased:

C.1. Enter PR03 in the Command field.

C.2.

Click ![]() to continue

to continue

C.3. The Trip Advances screen is displayed. All Travel Requests will be displayed in this transaction.

C.4. Enter Personnel Number for whom you will reduce a Travel Advance. Press Enter in your keyboard. All the travel requests will be listed.

C.5. Select Trip No. against which the advance is to be reduced.

C.6.

Click ![]() to edit advance

details.

to edit advance

details.

C.7. Input a negative Amount based on the reduction of the Traveller's entitlements.

** Press Enter on your keyboard.**

C.8.

Uncheck the flag ![]() under Cash

column. This will ensure that the reduction to the advance is correctly posted.

under Cash

column. This will ensure that the reduction to the advance is correctly posted.

C.9.

Click ![]() to save reduction

of the travel advance. This will be part of the next batch process. Once the

posting run executes, the reduction of the advance amount is posted to FI.

to save reduction

of the travel advance. This will be part of the next batch process. Once the

posting run executes, the reduction of the advance amount is posted to FI.

3.3.4 Travel Processes - Ticket Option

3.3.4.1 Posting Schema

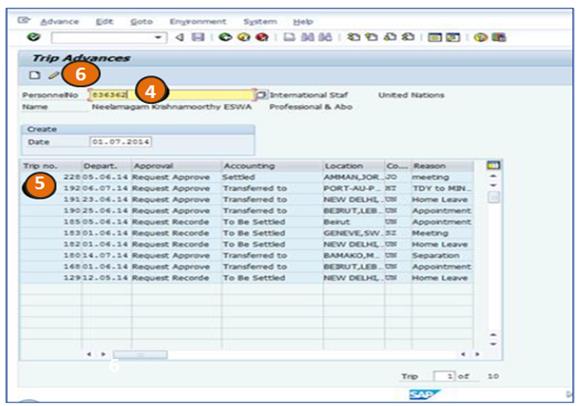

The posting schema for the Ticket Option is as presented below:

3.3.4.2 Review FI Postings for Ticket option

D. To view FI postings for Travel Advance, use the T-code ZTV_TRAVELACC

D.1. Enter ZTV_TRAVELACC in the Command field.

D.2.

Click ![]() to continue

to continue

D.3. The Travel Account Analysis Report is displayed.

D.4. To view Ticket postings, click on the FI document with the TI document type and select the line where the GL Account is 35401110 (Ticket Clearing Account). FI documents with Document Type TG are Ticket Invoices.

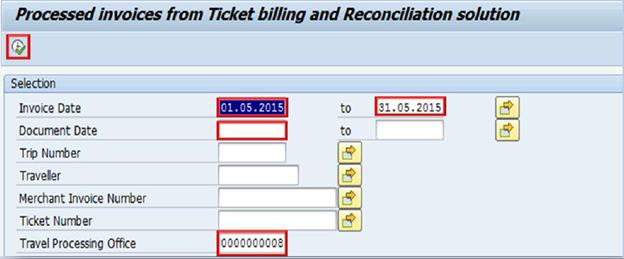

3.3.4.3 Ticket Billing Solution

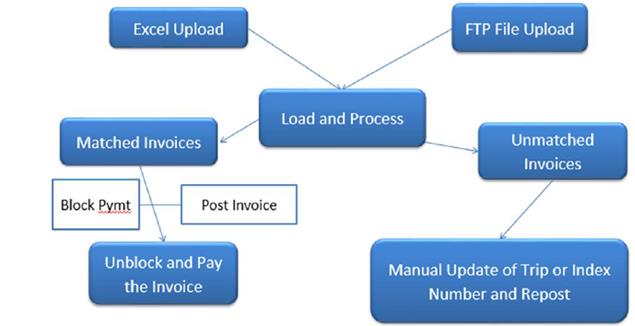

The ticket billing solution enables the upload of electronic invoices received from the ticket billing agent as a result of the selection in the Estimated Cost Grid of the ESS Portal. The two ways to upload invoices in ECC are the Excel Upload and Interface feed from the travel agent vendor.

The invoices are uploaded in the system and automatically processed if matched, or parked if not matched.

The three components required for the Ticket Billing Solution are the File Upload, Matching View and Ticket Billing Portal.

3.3.4.3.1 Estimated Cost Section

The commercial ticket vendor must be selected in the Services Provider field in the Estimated costs section of the Estimated Cost Field in the Travel Portal.

The important elements for the ticket invoices are the currency, ticket costs, index number, service provider, itinerary and the ticket transaction fees if applicable.

3.3.4.3.2 Commercial Ticket Vendor Billing Program

3.3.4.3.2.1 Upload

The commercial ticket billing process will enable the electronic invoice upload of the file through:

· Manual Excel Upload Feature

· Automatic FTP file upload

The parameters required for file upload are the Travel Processing Office and the Vendor

3.3.4.3.2.2 Match Criteria

Invoices received with corresponding trips and the three matching criteria, which are Trip Number, Personnel Number and Billed Ticket amount less or equal to the booked amount plus tolerance, will be automatically posted with a payment block

Credits: the Trip Number and Personnel Number will be used to determine the automatic posting of the credits or refunds

3.3.4.3.2.3 Ticket Invoice Posting: Commercial Vendor

Financial postings are made at key points in the Travel Request Workflow process as follows:

3.3.4.3.3 Ticket Billing Solution & Match Desk

3.3.4.3.3.1 Upload File Process

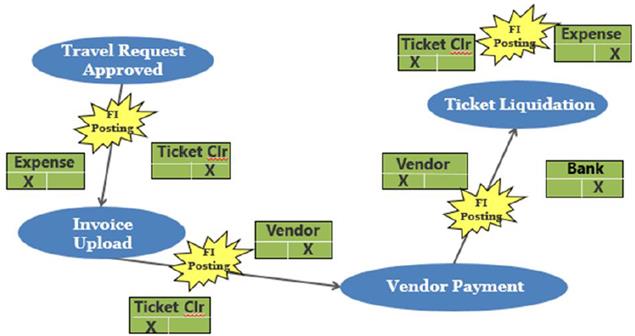

E. To enable the electronic invoice upload of the file through Manual Excel Upload Feature, follow the steps below:-

E.1. Enter ZTV_TICKET_INTERFACE in the Command field and click the Enter icon

E.2. The Ticket Invoice Upload Interface screen is displayed

E.3. Populate the following fields:

· Travel Processing Office

· Vendor

· G/L Account

E.4. In the Load Ticket Billing Invoice section, click the Load Invoice From File radio button

E.5. Upload the file from the Input file field

E.6. Select the Test Run check box and click the Execute icon

E.7. The Ticket Invoice Upload Interface screen is displayed

E.8. Click the Back icon to go to the previous screen

E.9. Clear the Test Run check box and click the Execute icon

E.10. The Ticket Invoice Upload Interface screen is displayed

3.3.4.3.3.2 Matching View Process

All invoices matched from the invoice file by the trip number, personnel number with ticket amounts that are less than booked amounts are posted in FI with a payment block [R].

The Posting Entries are:

Dr. Clearing Account (35401110)

Cr. Vendor Account

When in this tab, review the invoice and click the unblock invoice button. This will remove the payment block and change the baseline due date to today's date for immediate payment release. It will also automatically clear the invoice.

F. To Carry out the Matching View process, follow the steps below:-

F.1. Enter ZTV_TICKET_MATCHDESK in the Command field and click the Enter icon

F.2. The Travel Ticket Matching Desk screen is displayed

F.3. Populate the following fields:

· G/L Account

· Open at key date

· Vendor

· Travel Processing Office

F.4. Click the Execute icon

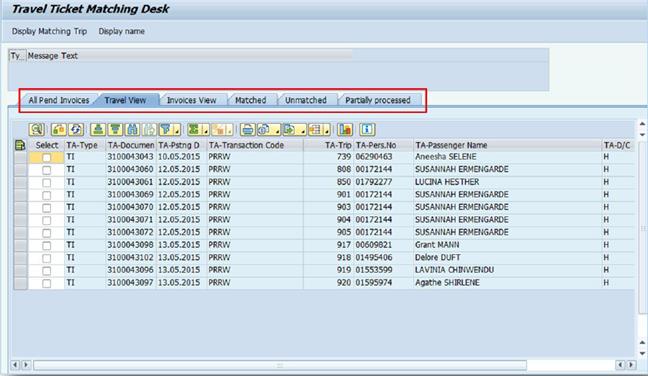

F.5. The following six tabs of the Travel Ticket Matching Desk are displayed:

· All Pend Invoices: This tab contains all of the invoices in the Matchdesk

· Travel View: This tab contains the tickets posted and linked to the commercial vendor (TI)

· Invoices View: This tab contains invoices uploaded from the commercial vendor (TG)

· Matched: This tab contains the invoices that are matched and ready for payment

· Unmatched: This tab contains the unmatched invoices

· Partially processed: This tab contains invoices that should be either rejected or reprocessed

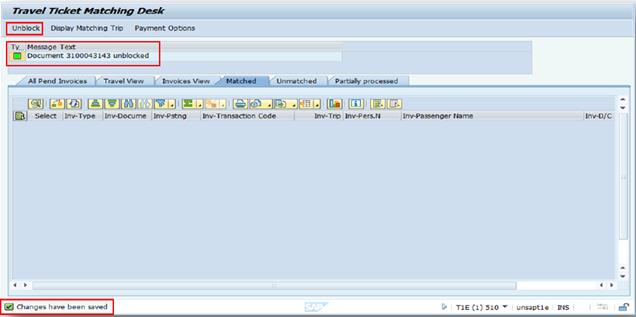

F.6. Click the Matched tab

F.7. Select the invoices that are uploaded with a corresponding trip number and click the Display Matching Trip button. It will launch the Travel Request

F.8. Select the invoices that are matched to the correct trips and click the Payment Options button

F.9. The Additional data before unblocking screen is displayed.

F.10. Select the bank displayed and click the Continue icon

F.11. The following message will be displayed. Click the Continue icon

F.12. Click the Save button and select the matched invoices

F.13. Click the Unblock button. The messages indicating that the Document 31XXXXXXXXXX unblocked and Changes have been saved will be displayed

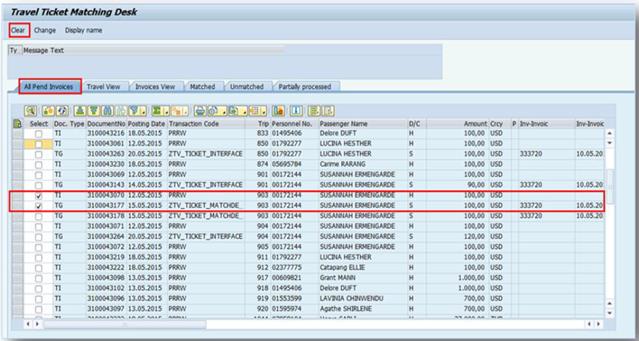

F.14. Click the All Pend Invoices tab

F.15. Select all the invoices related to the trip (TI and TG). In this example, we have used Trip 903

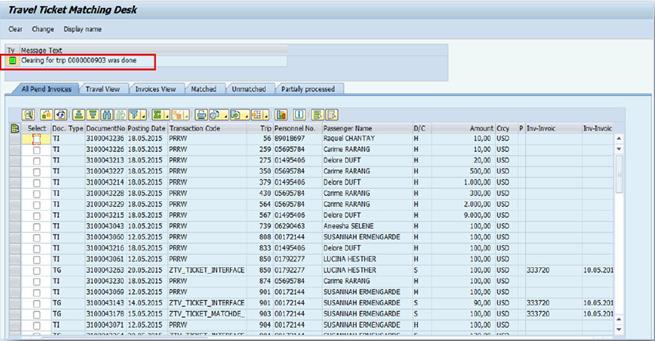

F.16. Click the Clear button to clear the travel postings and invoices for the trip

F.17. The message Clearing for trip 0000000XXX was done will be reflected. In this example the message, Clearing for trip 0000000903 was done is displayed

3.3.4.3.3.3 Unmatched Ticket Scenarios

Some of the possible unmatched ticket scenarios are as follows:

Case 1: The billed amount is higher than the obligated amount plus the tolerance amount defined for the Vendor/TPO

Action Item: Travel Processing Office amends the Travel Request to increase the ticket cost

Case 2: The Trip Number or Index Number does not match the existing travel authorization

Action Items:

· Request the Travel Agent to resend the rejected records and new file upload using the same unique reference record

· The Ticket Billing Processor investigates and updates the correct trip number and/or Index Number internally and reprocesses the invoices

Case 3: System related issues

Action Item: Raise an iNeed ticket to be escalated to the Umoja Team for analysis

3.3.4.3.3.4 Commercial Ticket Vendor Billing Program - Debit/Credit Invoice

The process flow for the commercial ticket vendor billing program - debit invoice is as follows:

The process flow for the commercial ticket vendor billing program - credit invoice is as follows:

3.3.4.4 Ticket Liquidation

3.3.4.4.1 Carry out a ticket liquidation

G. To carry out a Ticket Liquidation, follow the steps below:

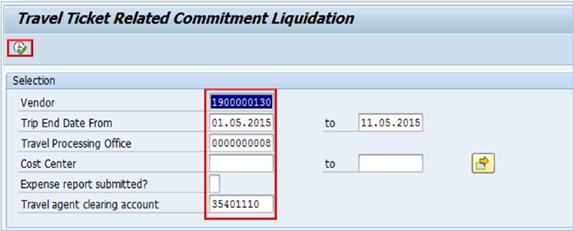

G.1. Enter ZTV_TICKET_LIQUIDAT in the Command field

G.2. Click the Enter icon

G.3. The Travel Ticket Related Commitment Liquidation screen displays. Populate the following fields:

· Vendor

· Travel End Date Range

· Travel Processing Office Vendor

· Travel End Date

G.4. Data in the Travel agent clearing account appears by default

G.5. Click the Execute icon

G.6. The Travel Ticket Related Commitment Liquidation output displays the following columns:

· Select Check Box

· Trip Number

· Personnel Number

· Cost Center

· Amount posted from the Travel Request

· Amount posted from the commercial invoices

· Difference between the amount posted from the Travel Request and the commercial invoice

· Currency

· The Expense Report submission status

G.7. Choose a trip by clicking the Select check box

G.8. Click the Process commit. Adjustment button

G.9. The message Trip XXXXXXXXX liquidation done will be displayed and the Difference will be liquidated

Note: In the example below, we have used trip 912

3.3.4.4.2 View Processed Tickets

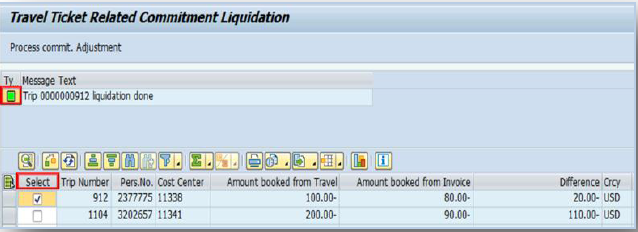

H. To view paid invoices, follow these steps:

H.1. Enter ZTV_TICKET_PROCESSED in the Command field and click the Enter icon

H.2. The Processed Invoices from Ticket billing and Reconciliation solution screen is displayed

H.3. This report will show paid invoices

H.4. This report is used to identify individual or multiple invoices

H.5. The report will only display paid invoices

H.6. The mandatory input parameters are Invoice Date or the Document Date and Travel Processing Office

H.7. Click the Execute icon

The record displayed below is split into two screenshots to provide a complete picture of the processed invoices:

3.3.4.4.3 View Open Items

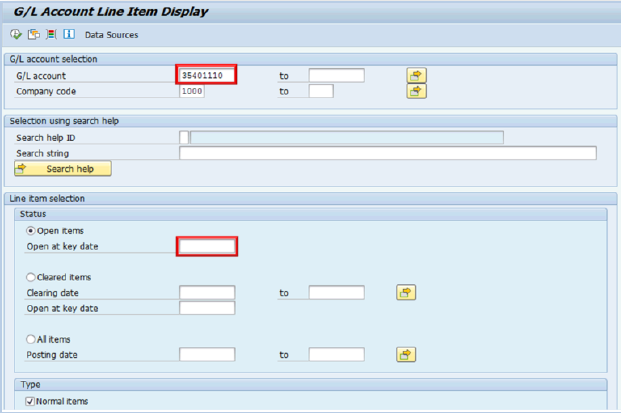

I. Follow the steps below to view open items (unpaid invoices):

I.1. Enter FBL3N in the Command field and click the Enter icon

I.2. The G/L Account Line Item Display screen is displayed

I.3. Populate the G/L account field

I.4. Under the Line Item Selection section, ensure that the Open at key date field is blank and click the Execute icon

The report is displayed

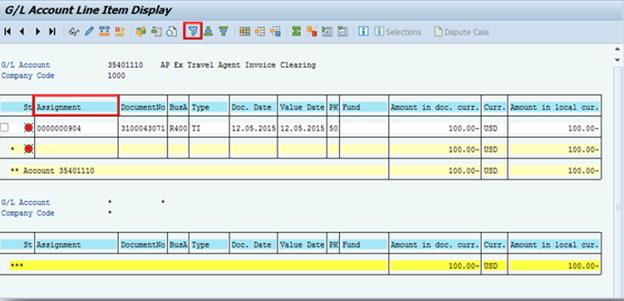

3.3.4.4.4 View Cleared Items for a Particular Trip

J. To view cleared items for specific trip, follow these steps:

J.1. Select the Assignment field

J.2. Click the Filter icon

J.3. Enter the trip number using wildcards (*) before and after the trip number to view the items in the clearing account related to the invoice. The trip number used in this case is 904

Key Transactions

|

Transactions |

T-code |

|

File Upload |

ZTV_TICKET_INTERFACE |

|

Matching View Process |

ZTV_TICKET_MATCHDESK |

|

Ticket Liquidation |

ZTV_TICKET_LIQUIDAT |

|

Ticket Processing |

ZTV_TICKET_PROCESSED |

|

Display Open items |

FBL3N |

3.3.5 Reviewing Travel Claim Posting

Once a Traveller submits an Expense Report upon return and it is reviewed by the approving agents, it is posted to FI following approval by Finance and the successful batch execution.

K. To review Travel Claim postings, follow the steps below:-

K.1. Enter ZTV_TRAVELACC in the Command field.

K.2.

Click ![]() to continue.

to continue.

K.3. The Travel Account Analysis Report is displayed.

K.4. To view Travel Claim postings, click on the FI document with TI document type.

· The Travel Expense Report is debited to the derived GL account and credited to the Travel Advance Account if it is not recovered. The posting would either debit the Traveller Vendor if there is an overpayment or credit the Traveller Vendor if a net payable is due.

· Net payables of less than USD 200 are paid through payroll by creation of an IT0015 entry. Otherwise, they are paid by Accounts Payable based on the payment modalities selected in the travel claim.

3.3.5.1 Travel Claim Posting Schema - with Travel Advance

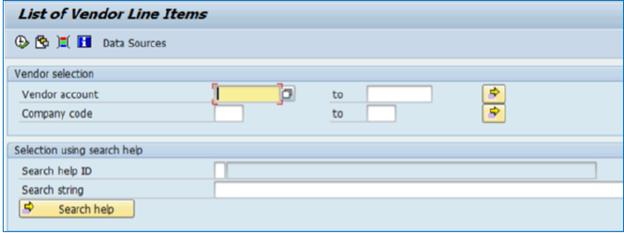

3.3.6 Review Items Blocked for Payment

L. The steps to generate a list of Items Blocked For Payment are:

L.1. Enter S_ALR_87012103 in the Command field.

L.2.

Click ![]() to continue

to continue

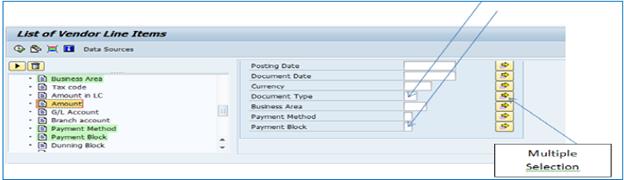

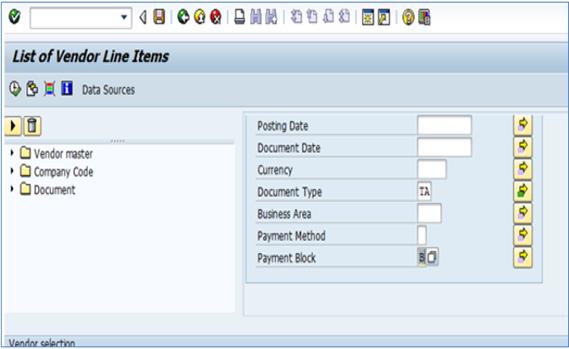

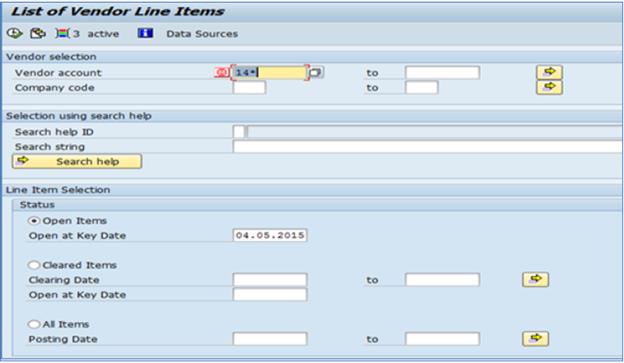

L.3. The List of Vendor Line Items screen is displayed.

L.4. Click on the Dynamic Selection Icon

L.5. Additional selection fields will be displayed.

L.6. To locate the Payment Block field, click on the Vendor Master folder until the Document folder opens. The Payment Block field is a part of document table.

L.7. Scroll down and double click on the Payment Block field. The fields which are already in the dynamic selection are highlighted in green.

L.8. Scroll down on the right side pane to ensure that the Payment Block field is displayed. Click on the arrow for the Multiple Selection at the right of the Document Type field.

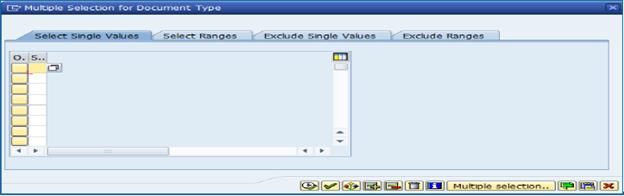

L.9. The Multiple Selection for Document Type screen will be displayed. Click on the Select Single Values tab.

L.10. Enter all of the required Document Types from travel postings. Examples of document types are TA, TI, TC, and TT in the Document Type field. Click on the Clock icon to execute.

L.11. Select B in the Payment Block field and click on the Clock icon to execute the report.

L.12. The report is generated.

L.13. Use T-code FB02 to remove the B blocks

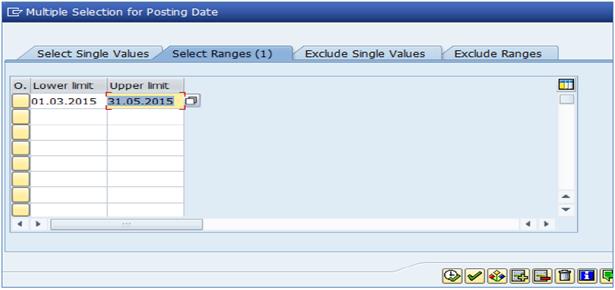

L.14. To generate the report faster, click on the Multiple Selection arrow at the right side of the Posting Date field in the List of Vendor Line Items screen. The Multiple Selection for Posting Date screen will be displayed. Click on the Select Ranges tab and specify the date range in the Lower limit and Upper limit fields. Selecting the Open Items button also produces faster results.

L.15. Use the additional filter 14* in the Vendor account field to exclude UNDP postings from the report.

L.16. A revised report will be displayed.

3.3.7 Creating Travel related Shipment Commitments

M. The steps to generate a report of commitments created by the Travel Shipment Solution are:

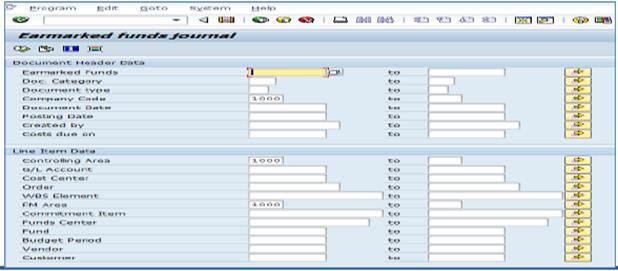

M.1. Enter S_P99_41000147 in the Command field.

![]()

M.2.

Click ![]() to continue

to continue

M.3. The Earmarked funds journal screen is displayed.

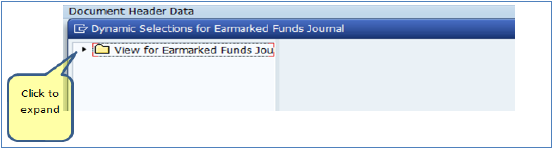

M.4. Remove any default values from the fields in the journal and click on the Dynamic Selection Icon to display additional selection fields.

M.5. In the Dynamic Selections for Earmarked funds journal screen expand the View for Earmarked Funds Journal folder.

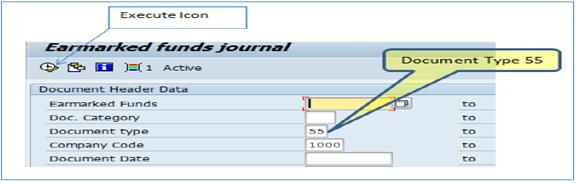

M.6. Double-click on Document Header Text to obtain the Dynamic selections option displayed on right

M.7. Input Funds Commitment for Shipment Request*in the Document Header Text field and press Enter on the keyboard. The string search is enabled.

M.8. Click on the Applied Selected Items so that the selection is applied, then click on the Save icon

M.9. Input 55 in the Document type field and 1000 in the Company Code field. Click on the Execute Icon to run the report. 55 is the Funds Commitment document created by the Travel and Shipment Solution

M.10. The report results are displayed below. The Shipment Request number is the Trip number

3.3.8 Travel and Payroll Integration

If a Traveller does not submit a Travel Claim within 60 days following his/her return date, a Travel Advance recovery is initiated automatically.

A batch program is scheduled prior to the payroll batch to identify travel advances raised against travel authorizations. The program will identify claims which have not been submitted 60 days following the return date and reclassify the receivable from the balance sheet account to the vendor account.

The batch program posts the below entries:

Dr. Traveller Vendor Account

Cr. Travel Advance

The batch program posts a payment block [W] if the advance is to be recovered through payroll for personnel active on payroll.

The payment block field is blank for non-staff members.

Once a recovery has been initiated against a traveller, any future payments for that trip will be paid through payroll.

Travel Advances with payment block [W] will be recovered through payroll via the automatic creation of IT0045.

The payroll posting will create a credit against the Traveller that will clear automatically.

If the final travel claim settlement results in a travel advance overpayment, the recovery of the residual balance will be made through payroll

At the time of the claim posting, a debit balance is posted against the Traveller vendor account with a payment block [W]

IT0045 is created automatically when the payroll recovery batch runs prior to the upcoming payroll cycle.

An email notification will be sent to the traveler when the IT0045 is created.

3.4 Year-end Processes

The year-end processes for recording of employee benefits comprise of two key areas:

(a) Recording of actuarially valued employee benefit liabilities as at the reporting date is a year-end process with entries made directly in Umoja using manual journal vouchers (JVs). Actuarially valued employee benefits liabilities comprise:-

· liabilities for after-service health insurance (ASHI);

· repatriation benefits;

· annual leave; and

· workers' compensations (Appendix D).

Section 3.4.3 explains in detail the processes involved in the recording of actuarially valued employee benefits.

(b) Accruing for employee benefits that are affected by timing differences such as those that have been earned but not yet paid (e.g. salaries and allowances, home leave travel, family visit travel, rest and recuperation) or paid but not yet fully earned, in which case adjustments are made that serve to apportion employee benefit related expenses to the relevant reporting period (e.g. pro-ration of education grants between expenditure for the accounting period and advances carried forward to the next accounting period).

3.4.1 Umoja Manual Journal Voucher Entry

The posting of year-end accruals uses T-code FBS1 and Document Type SZ. The posting of year-end accruals are normally reversed in the following year. The reversal process can either be automated at the point of posting the original entry by updating the Inverse Posting section or done manually in the following year. Detailed guidance on the process of raising of accrual manual JVs can be found in section 3.2.3 of Chapter on General Ledger of the Finance Manual.

3.4.2 Accruing for Employee Benefits Affected by Time Differences

At the year-end, accrued liabilities for employee benefits such as home leave travel, family visit travel and rest and recuperation, which have been earned since the last time taken till the reporting date should be updated and recorded. The changes from the previous balances should be recorded in the respective accrued liabilities and expense accounts.

Section 5 below provides templates for calculating the amounts to be accrued in respect of home leave travel, family visit travel, rest and recuperation and education grant. For travel requests that have already been initiated using the Travel process in ESS, year-end processes will be processed through the same travel process. Refer to section 3.4.4 of Chapter on Expenses of the Finance Manual for year-end work-around for the Ticket billing solution.

Accruals must also be made for all other staff benefits that have been earned but not paid such as salaries and allowances; as well as entitlements as at the reporting date for new staff appointments (assignment grant, initial shipment, travel to new post), staff transfers, retirement and separation of staff.

Note: Accruals for the previous accounting period are normally reversed in the following year. However, if no reversal was made, accruals for the next reporting period must be adjusted to take account of the amount brought forward i.e. only accrue for the difference.

The accounting entries for these accruals will be:

Dr Expense Account (Statement of Financial Performance)

Cr Accrued liability account (Statement of Financial Position)

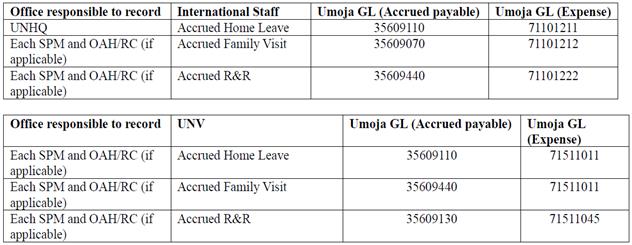

Example of GL for recording accruals for Rest and recuperation, Home leave travel and Family visit Travel:

3.4.3 Accruing for Actuarially Valued Employee Benefits

For actuarially valued employee benefits, the UN maintains within Umoja (Note: Some information is still maintained in IMIS and will eventually be phased out) the underlying information that is provided to expert actuaries to process these records and provide informed values for processing accounting entries in Umoja. Obtaining actuarial reports for the various UN reporting entities is usually done centrally i.e. using the same expert to provide the individual actuarial valuation reports for each UN reporting entity. However, the recording of the actuarially valued employee benefits liabilities is done separately for each reporting entity.

N. The sources of data for the census file provided to actuaries for UN Volume 1 are as follows:-

N.1. Active Staff

· Extract from the IMIS databases in eight locations (i.e., UNHQ, UNOG(Includes staff of ECE, UNCTAD and OHCHR), UNOV, UNON, ECA, ECLAC, ESCAP and ESCWA). This covers the international and local staff administered in those eight IMIS locations (Data for staff of ITC, UNCC, UNCDD, UNFCCC, UNODC, UNEP and UN-Habitat contained in extracts from UNOG, UNOV and UNON are reported under separate census files.)

· Excel files provided by DFS for local staff in the various peacekeeping and special political missions

· Extract from Umoja database for MINUSTAH international and local staff members who have been administered in that system since July 2014 (This census file not included in Volume I valuations for 2015 which was limited to RB, XB and UUA only due to incomplete data for local peacekeeping staff at time of preparation of valuation).

· Extract from UNDP Atlas system for any UN staff members administered by UNDP country offices.

Data from the IMIS extracts that belong to other reporting entities (e.g., ITC, UNCC, UNEP, UN-Habitat, etc.) are excluded from the UN file. The exclusion of data intended for other entities' files uses the fund code of the staff member's post

N.2. Retirees

· Extract from the UNHQ IMIS database which covers all retirees administered by UN Headquarters.

· Extract from UNOG from UNSMIS database for all retirees enrolled in the UNSMIS plan and administered by UNOG (excluding organizations that are not part of the join UN valuation like UNHCR)

· Excel file from UNOV for retirees administered by Vienna

Data from the UNHQ IMIS and UNOG extracts that belong to other reporting entities (e.g., UNDP, UNICEF, ITC, UNCC, UNEP, UN-Habitat, etc.) are excluded from the UN file.

O. The information contained in the census file includes:

|

Active File |

Retirees File |

|

· Employee Date of birth |

· Retiree Date of birth |

|

· Entry on Duty |

· Date of retirement |

|

· Employee Index numbers (reviewed to endure no duplication) |

· Employee numbers (reviewed to ensure no duplications within the file) |

|

· Contract types per agreed values |

· Gender - per agreed value only |

|

· Monthly accrual rates for annual leave (i.e., temporary appointments have 1.5; all others have 2.5) |

· Spouse's date of birth |

|

· Annual leave balance (no. of days) |

· Medical plan codes per agreed values |

|

· Gender |

· Medical coverage codes per agreed values |

|

· Medical plan codes per agreed values |

· Dental coverage codes per agreed values and only for those with a US-based medical plan or no medical plan |

|

· Medical coverage codes per agreed values |

· Medical contribution and Medical subsidy amounts - reported for those with medical coverage |

|

· Dental coverage codes per agreed values and only for those with a US-based medical plan or no medical plan |

· Dental contribution and Dental subsidy amounts are reported for those with dental coverage (none for MIP) |

|

· Country of duty station |

· Subsidy effective date is 31/12/2014 or later |

|

· Country of nationality |

· Medicare eligibility status reported only for those on US-based plans |

|

· Repatriation grant accrual rate are reported for internationally-recruited staff with an international indicator date, on a non-temporary appointment and has country of duty station different than country to nationality |

· Medicare enrolment status is reported if Medicare eligibility status is 'Yes' |

|

· Repatriation grant weeks are reported for those with repatriation accrual rates hired before 1 Jan 2015 |

· Medicare subsidy amount is reported if Medicare enrolment status is not blank |

|

· Average repatriation travel shipment amount is reported for those with repatriation accrual rate and weeks reported |

· Location code is reported as much as possible |

|

· International Indicator Date |

· |

|

· Key Personnel indicator reported for KMP |

· Primary division is marked 'Prorate' (in accordance with 77% -15%- 8% ratios for RB, PK and XB, respectively) |

|

· Category Overall per agreed values ('G' and 'P' only) |

· Secondary division is reported to track office administering the ASHI benefit |

|

· Staff category per agreed values and is appropriate for the Category Overall value |

|

|

· Grade and Step per agreed values |

|

|

· Monthly Gross Salary amounts that are reasonable for category/grade of staff |

|

|

· Staff Assessment amounts (are reasonable for category/grade of staff and are all reported as negative amounts) |

|

|

· Post Adjustment amounts (reported for internationally-recruited staff only) |

|

|

· Language Allowance amounts, when available, (reported for GS and FS staff only) |

|

|

· Primary subdivision values are per agreed reporting segments and in accordance with fund of post |

|

|

· Secondary subdivision values per agreed reporting segments (especially for XB division) |

|

|

· Death Benefit Rate per agreed values ('S' and 'D') |

|

P. Process for raising manual JVs from actuarial reports:

P.1. Actuaries are consulted for the four employee benefits listed in section 3.4(a) above, and should provide a timely report on the valuation and movements of such obligations.

P.2. Such reports should contain as a minimum (for years N, N-1 and N+1 and including the current/non-current split where relevant):

· Service cost.

· Interest on obligation.

· Prior service cost.

· Benefits paid in year.

· Actuarial gains / losses.

· Fair value of plan assets.

· Present value of unfunded obligations.

· Present value of funded obligations.

· Amounts recognized in net assets / equity.

· Discount Rate Sensitivity to End of Year Liability

· Effect of change in Assumed Health Care Cost Trend Rates.

· Main Assumptions.

P.3. The format of actuarial reports may vary depending on who the contracted actuary is. Usually, one actuary will be used to provide valuation for several UN reporting entities.

P.4. Detailed guidance on the process of raising of manual JVs can be found in the General Ledger Chapter of the Finance Manual (section 3.2).

Example - End of year recording for Actuarially Valued Employee Benefits

The opening balances for the actuarially valued employee benefit obligations for the UN in the year 2015 are as follows:

|

|

ASHI |

REPATRIATION GRANT |

ANNUAL LEAVE |

|

Current liabilities |

USD 86,193,000 |

USD 20,203,000 |

USD 19,044,000 |

|

Non-current liabilities |

USD 4,207,342,000 |

USD 235,364,000 |

USD 239,447,000 |

|

Total Liability |

USD 4,293,535,000 |

USD 255,567,000 |

USD 258,491,000 |

The actuarial valuation obtained by the UN in 2015 for ASHI, Repatriation Grant and Annual Leave provided the following values for:

|

|

ASHI |

REPATRIATION GRANT |

ANNUAL LEAVE |

|

Service Costs |

USD 147,350,000 |

USD 14,798,000 |

USD 12,279,000 |

|

Interest Costs |

USD 139,608,000 |

USD 6,485,000 |

USD 6,486,000 |

|

Actuarial (gains)/losses |

(USD 820,956,000) |

USD 13,539,000 |

(USD 44,989,000) |

|

Benefits paid (Net of participants' contributions) |

(USD 89,026,000) |

(USD 17,288,000) |

(USD 15,660,000) |

Together with any payments made, these amounts explain the movement in the liability since the previous valuation.

The Service costs, Interest costs and prior service costs are booked in the statement of financial performance.

In line with UN IPSAS Policy, actuarial gains/losses are booked directly to the Statement of Changes in Net Assets.

The following tables indicate the GLs to which the actuarially valued costs are booked for each type of actuarially valued employee benefits liability:-

ASHI

|

Date |

GL |

GL short description |

Debit (USD) |

Credit (USD) |

|

Based on actuarial valuation report |

79701010 |

SvcCst ASH |

147,350,000 |

|

|

79701011 |

IntCst ASHI |

139,608,000 |

|

|

|

51001050 |

NA Adj ASHI Act G/L |

|

820,956,000 |

|

|

Net movement in obligation (excluding benefits paid) |

35609330 |

AP Ac ASHI Liab |

3,196,000 |

|

|

45609330 |

LT AP Ac ASHI Liab |

530,802,000 |

|

ASHI benefits paid by the UN during the year will be recorded as follows:

|

Date |

GL |

GL short description |

Debit (USD) |

Credit (USD) |

|

|

45609330 |

LT AP Ac ASHI Liab |

89,026,000 |

|

|

|

11011010 |

Csh HQ USD Nominal |

|

89,026,000 |

REPATRIATION GRANT

|

Date |

GL |

GL short description |

Debit (USD) |

Credit (USD) |

|

Based on actuarial valuation report |

79701012 |

SvcCst Repat Grant |

20,658,000 |

|

|

79701013 |

IntCst Repat Grant |

8,225,000 |

|

|

|

51001051 |

NA Adj Repat Act G/L |

18,748,000 |

|

|

|

Net movement in obligation (excluding benefits paid) |

35609130 |

AP Ac Repat Grant |

|

12,644,000 |

|

45609130 |

LT AP Ac Repat Grant |

|

34,987,000 |

Repatriation grant benefits paid by the UN during the year will be recorded as follows:

|

Date |

GL |

GL short description |

Debit (USD) |

Credit (USD) |

|

|

45609130 |

LT AP Ac Repat Grant |

20,880,000 |

|

|

|

11011010 |

Csh HQ USD Nominal |

|

20,880,000 |

ANNUAL LEAVE

|

Date |

GL |

GL short description |

Debit (USD) |

Credit (USD) |

|

Based on actuarial valuation report |

79701014 |

SvcCst Annual Leave |

18,806,000 |

|

|

79701015 |

IntCst Annual Leave |

8,757,000 |

|

|

|

51001051 |

NA Adj Leave Act G/L |

|

73,580,000 |

|

|

Net movement in obligation (excluding benefits paid) |

35609030 |

AP Ac Annual leave |

|

3,302,000 |

|

45609030 |

LT AP Ac AnnualLeave |

49,319,000 |

|

Annual leave benefits paid by the UN during the year will be recorded as follows:

|

Date |

GL |

GL short description |

Debit (USD) |

Credit (USD) |

|

|

45609030 |

LT AP Ac Annual Leave |

28,361,000 |

|

|

|

11011010 |

Csh HQ USD Nominal |

|

28,361,000 |

For illustrative purposes, an overview of the movement in the obligation from 2014 to 2015 is as follows:

|

|

ASHI |

REPATRIATION GRANT |

ANNUAL LEAVE |

|

Obligation at the end of 2014 |

USD 4,293,535,000 |

USD 255,567,000 |

USD 258,491,000 |

|

Service costs |

USD 147,350,000 |

USD 20,658,000 |

USD 18,806,000 |

|

Interest costs |

USD 139,608,000 |

USD 8,225,000 |

USD 8,757,000 |

|

Actuarial (gains)/losses |

(USD 820,956,000) |

USD 18,748,000 |

(USD 73,580,000) |

|

Benefits paid (net of participant contributions) |

(USD 89,026,000) |

(USD 20,880,000) |

(USD 19,715,000) |

|

Obligation at the end of 2015: |

|

|

|

|

Current liabilities |

USD 82,997,000 |

USD 32,847,000 |

USD 22,346,000 |

|

Non-current liabilities |

USD 3,587,514,000 |

USD 249,471,000 |

USD 170,413,000 |

|

Total Obligation at year end (2015) |

USD 3,670,511,000 |

USD 282,318,000 |

USD 192,759,000 |

4 Business Partners

All Personnel are setup and maintained as Business Partners with UN Vendor Role in Umoja AP Master Data in Groupings:

· Z016 - Individuals, Externals, Independent Contractors, Consultants, etc. (Non-Staff not on payroll)

· Z020 - Staff Member, Ex-Staff Member, Retirees, Survivors.

· Z021 - Non Staff Military and Police.

· Z022 - Non Staff on Payroll.

Personnel Types are further identified by the following BP Types in Business Partners Master Data:

· Z001 - International Staff.

· Z002 - Local Staff.

· Z003 - UNVs.

· Z004 - Military Staff Officer.

· Z005 - Military Observer.

· Z006 - UN Police.

· Z007 - Correction Officer.

· Z008 - Consultant

· Z009 - Retirees.

· Z010 - Other types.

· Z020 - Retirees.

· Z100 - Individual Contractor.

· Z101 - Consultant.

· Z900 - Other types.

5 Templates for Employee Benefit Liability Data Reporting

Note: The templates included in this section are based on those used in year-end instructions applicable to SPMs and may be subject to change.

Accrued Liabilities for Family Visit Travel - International Staff

|

Mission |

||||||||||||

|

Accrued liabilities for family visit travel - International staff |

||||||||||||

|

As at 31 December 2016 |

||||||||||||

|

(US dollars) |

||||||||||||

|

Name |

Index |

Duty |

FV cycle (12 or 24 months) |

Last taken, or entry into duty station of new staff |

Next entitlement due |

Family visit destination country |

No. of family members entitled for FV |

Travel cost per person a/ |

Accrued liabilities b/ |

|||

|

No. of months to December 2016 |

Percentage of entitlement earned |

Amount |

||||||||||

|

|

|

|

(A) |

|

|

|

(B) |

(C ) |

(D) |

(E)=(D/A) |

(1+B)*C*E |

|

|

Jack Smith |

xxxx |

xx |

12 |

1-Jan-16 |

1-Jan-17 |

xx |

2 |

10,000 |

11.97 |

99.73% |

29,917.81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liability |

29,917.81 |

|||||||||||

|

Note: Data in the shaded columns from Nucleus report. |

||||||||||||

|

a/ Estimated lump-sum or last actual total expense utilizing travel services database ( AMADEUS, Worldspan, Sabre, etc.) b/ This section is calculated with the data in the preceding columns. |

||||||||||||

Accrued Liabilities for Rest and Recuperation Travel Allowance - International Staff

|

Mission |

|||||||||

|

Accrued liabilities for rest and recuperation travel allowance -International staff |

|||||||||

|

As at 31 December 2016 |

|||||||||

|

(US dollars) |

|||||||||

|

Name |

Index |

Duty |

ORB cycle in weeks |

Last taken, or entry into duty station of new staff |

Designated R&R location |

Travel cost |

Accrued liabilities a/ |

||

|

No. of weeks to 31 December 2016 |

Percentage of entitlement earned |

Amount |

|||||||

|

|

|

|

(A) |

|

|

(B) |

(C ) |

(D)=(C/A) |

(B*D) |

|

John Doe |

xxxx |

xx |

6 |

30-Nov-16 |

xx |

1,500 |

4.42 |

73.61% |

1,104.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liability |

1,104.11 |

||||||||

|

Note: Data in the shaded columns from Nucleus reports. |

|||||||||

|

a/ This section is calculated with the data in the preceding columns. |

|||||||||

Accrued Liabilities for Home Leave Travel - UNV

|

Mission |

|||||||||||

|

Accrued liabilities for home leave travel -UNV |

|||||||||||

|

As at 31 December 2016 |

|||||||||||

|

(US dollars) |

|||||||||||

|

Name |

Index |

Duty |

HL cycle (24 months) |

Last taken, or entry into duty station of new staff |

Next entitlement due |

Home leave destination country |

No. of family members entitled for HL a/ |

Travel cost per person b/ |

Accrued liabilities c/ |

||

|

No. of months to December 2016 |

Percentage of entitlement earned |

Amount |

|||||||||

|

|

|

|

(A) |

|

|

|

(B) |

(C) |

(D) |

(E)=(D/A) |

(1+B)*C*E |

|

John Smith |

xxxx |

xx |

24 |

1-Jan-16 |

1-Jan-18 |

xx |

4 |

10,000 |

11.97 |

49.86% |

24,931.51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liability |

24,931.51 |

||||||||||

|

a/ Maximum four, not including UNV, in family duty stations. |

|||||||||||

|

b/ Estimated lump-sum or last actual total expense utilizing travel services database ( AMADEUS, Worldspan, Sabre, etc.) |

|||||||||||

|

c/ This section is calculated with the data in the preceding columns. |

|||||||||||

Accrued Liabilities for Rest and Recuperation Travel Allowance - UNV

|

Mission |

|||||||||

|

Accrued liabilities for rest and recuperation travel allowance -UNV |

|||||||||

|

As at 31 December 2016 |

|||||||||

|

(US dollars) |

|||||||||

|

|

|||||||||

|

Name |

Index |

Duty |

ORB cycle in weeks |

Last taken, or entry into duty station of new staff |

Designated R&R location |

Travel cost |

Accrued liabilities a/ |

||

|

No. of weeks to 31 December 2016 |

Percentage of entitlement earned |

Amount |

|||||||

|

|

|

|

(A) |

|

|

(B) |

(C ) |

(D)=(C/A) |

(B*D) |

|

John Doe |

xxxx |

xx |

6 |

30-Nov-16 |

xx |

1,500 |

4.42 |

73.61% |

1,104.11 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liability |

1,104.11 |

||||||||

|

a/ This section is calculated with the data in the preceding columns. |

|||||||||

Accrued Liabilities for Resettlement Allowance - UNV

|

Mission |

||||||

|

Accrued liabilities for resettlement allowance -UNV |

||||||

|

As at 31 December 2016 |

||||||

|

(US dollars) |

||||||

|

|

||||||

|

Name |

Index |

Duty |

Entry onto duty stations-date (month/year) |

Resettlement allowance rate per month |

Accrued liabilities a/ |

|

|

No. of months to 31 December 2016 |

Amount |

|||||

|

|

|

|

(A) |

(B) |

(C ) |

(B*C) |

|

John Doe |

xxxx |

xx |

1-Jan-15 |

150 |

23.97 |

3,595.07 |

|

… |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a/ This section is calculated with the data in the preceding columns. |

Total liability |

3,595.07 |

||||

December, 2016