1 Objective

The objective of this chapter is to give an overview of how the United Nations will account for its leases and donated right-to-use arrangements under IPSAS within the Umoja environment. It details how an end user, based on the involved Umoja user profiles, should perform its roles and responsibilities in the system. The journal accounting entries, based on the Umoja Chart of Accounts, of the lifecycle are included in this chapter. This chapter covers the period end procedures for IPSAS compliant reporting of commercial leases and donated right-to-use arrangements. It also covers the financial statements presentation and disclosure requirements for these arrangements.

2 Summary of IPSAS Accounting Policies

Lease agreements

A lease is a contractual agreement between a lessor and a lessee that gives the lessee the right-to-use an asset for a specific period of time, usually in return of periodic payments.

Under IPSAS, all leases need to be classified, at their inception, as finance or operating. Donated right-to-use arrangements are considered similar to leases, and are to be accounted for as such (and classified as either finance or operating).

The lease is classified as finance lease if it transfers substantially all risks and rewards incidental to ownership of an asset. The UN will classify the lease as a finance lease if one or more of the below indicators is met:

· Ownership is transferred to the lessee by the end of the lease term;

· Lease contains a bargain purchase option;

· Lease term is for the major part (in practice, at least 75%) of the economic life of the asset;

· The present value of the minimum lease payments amounts to at least substantially all (in practice, at least 90%) of the fair value of the leased asset;

· The leased assets are of such a specialized nature that only the lessee can use them without major modifications;

· The leased assets cannot easily be replaced by another asset.

An operating lease is a lease other than a finance lease.

2.1 Where the United Nations acts as a lessee

Lease payments under an operating lease shall be recognized as an expense on a straight-line basis over the lease term. The straight-line basis spreads out the actual cost of lease equally over the lease term.

If the lease is classified as a finance lease, at the commencement of the lease term, the UN shall recognize the assets and the associated lease obligations as liabilities in the statement of financial position. The assets and liabilities shall be recognized at amounts equal to the fair value of the leased property or, if lower, the present value of the minimum lease payments, each determined at the inception of the lease.

A depreciation expense and a finance expense will be recorded in each accounting period for the assets held under a finance lease. If there is no reasonable certainty that the lessee will obtain ownership by the end of the lease term, the asset shall be fully depreciated over the shorter of the lease term or its useful life.

2.2 Where the United Nations acts as a lessor

When the UN leases out under an operating lease, the United Nations will recognize the revenue on a straight-line basis over the lease term, and all costs, including depreciation, incurred in earning the lease revenue are recognized as an expense. The item of PP&E is included in the statement of financial position based on the nature of the asset and the applicable thresholds.

When the UN leases out under a finance lease, the UN needs to recognize the present value of the lease payments as a receivable. The difference between the gross receivable and the present value of the receivable is recognized as unearned finance revenue.

Lease payments relating to the accounting period, excluding costs for services, are applied against the gross investment in the lease to reduce both the principal and the unearned finance revenue. The recognition of finance revenue is based on a constant periodic rate of return on the lessor's net investment in the lease.

2.3 Donated 'right-to-use' arrangements

Donated right-to-use (DRTU) arrangements are those arrangements through which donors give to the United Nations the right to use and occupy an asset and require zero or a nominal (very small) payment in return.

Donated 'right-to-use' arrangements are recognized and measured as follows:

Short-term donated-right-to-use arrangements: The amounts equal to what the United Nations would pay to rent the asset in the marketplace will be recognized as revenue and expenses on the face of financial statements if indicative threshold is met. In other words, the amounts should reflect what the United Nations would otherwise have to pay in the market, in return for the use of similar assets.

Long-term donated-right-to-use arrangements (classified as finance): The United Nations will capitalize (recognize an asset) buildings that it controls (or portion of the building that it jointly controls) at the fair value and credit deferred revenue for a like amount. Capitalized buildings will be depreciated over the lesser of the term of the arrangement or the useful life of the buildings with a maximum of 50 years. At the time the depreciation is recognized, an equal amount should be recognized as revenue by debiting deferred revenue and crediting revenue for the same amount.

Lease transactions with both parties (i.e. lessee and lessor) within the same reporting entity:

Real estate arrangements involving parties within the same reporting entity will be entered in the system on an individual fund basis and then eliminated for consolidated financial statement purposes (e.g. lease agreement between UNAMA and UNOCHA, both part of Volume II financial statements).

2.4 Reference

For more details on the IPSAS requirements regarding leasing, refer to:

· The Corporate Guidance on Leases and Donated Right-to-Use Arrangements;

· ST/AI on Property, Plant & Equipment.

3 Desktop Procedures

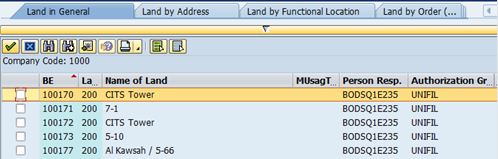

3.1 Real Estate Management

Real estate management is the process by which the UN manages its real estate portfolio and leases, both lease-in and lease-out. The Umoja ECC solution for Real Estate Management is built upon two core components of the Flexible Real Estate (RE-FX) module:

· Portfolio Management

· Lease Contract Administration

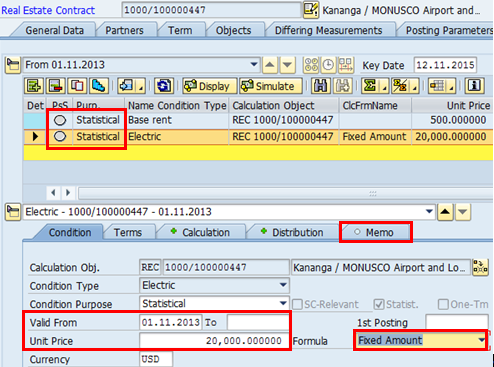

3.2 Portfolio Management

Portfolio Management is the integrated means for managing all types of real estate infrastructure the UN utilizes across the organization. It supports of all phases of the lifecycle of real estate management. This component forms the basis for all object-related information for representing real estate objects in Umoja ECC and is used to define the real estate infrastructure which includes sites, buildings, land, floors etc.

It also provides two different views of real estate portfolios:

· The Architectural View

· The Financial (Usage) View.

The Architectural View provides an architectural structure that represents the physical structure of Land, Infrastructure, a Building or parts of it. The Architectural View is a user-defined hierarchical structure defined according to UN's specific terms for the real estate objects it represents. Example: Site, Land, Buildings, Floors, Rooms, Infrastructure etc.

The Usage View is the financial equivalent of the Architectural View. Objects such as (Business Entity, Building and Land/Property) are created to correspond to the existing Architectural Objects (Site, Building and Land). Measurements from the Architectural Objects are copied automatically to the Usage Objects. However, they can be updated to reflect lease (contract) specifications. It is oriented from the top down with the Business Entity as the top node. Buildings and Land are subordinate objects that are further sub-divided into Rental Objects, which consist of Pooled Spaces and Rental Spaces. All real estate objects that make up this view are financial objects. This means that both costs and revenues can be posted to these real estate objects.

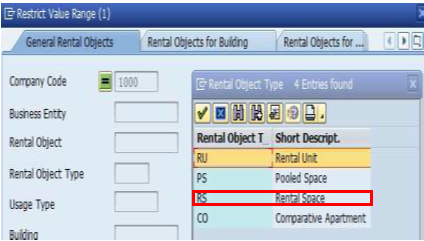

When rental objects are being processed, we first decide which of the following type of rental objects we wish to create:

a) Pooled space - a flexible object that can be divided into several rental spaces.

b) Rental space - a flexible object that refers to the space extracted from a pooled space for the purpose of assigning to a contract and leasing out.

In the case of Rental Spaces, we first have to create a pooled space, but we cannot rent the Pooled Space directly in its entirety. The Pooled Space is a pool from which you can extract Rental Spaces. From system perspective, creating a Pooled Space is a requirement to create and lease out Rental Spaces. You can however assign a Pooled Space to a lease In contract, but never to a Lease Out contract

3.3 Real Estate Lease Contract Administration

Real estate contract accounting is directly integrated with Umoja Finance, Controlling and Fund Management modules. Revenue and expense postings generated from Real Estate module to Finance will automatically generate necessary additional accounting documents in Controlling and FM. The Asset Master Data in Financial Accounting (FI-AA) is linked with the Usage View in the Real Estate module. The following lease types are relevant in Umoja Foundation regarding real estate based on current identified business requirements:

Lease-in types:

· Operating lease arrangements

o Operating commercial

o Operating right-to-use

o Operating nominal

o Operating subsidized

· Finance lease arrangements

o Finance commercial

o Finance right-to-use

o Finance right-to-use-nominal

o Finance subsidized

Lease-out types:

· Lease out internal

· Lease out external

· Lease out external sales based

Lease-in

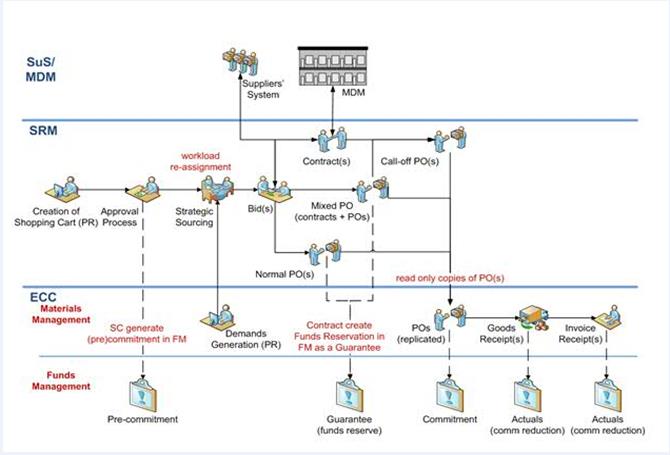

Lease-in contracts are established Where UN is occupying a space that is not owned by the UN and is in the role of a Tenant who leases property from an external commercial or non-commercial Landlord. Lease In contracts are negotiated by the Procurement Office and managed in Supplier Relationship Management (SRM) platform.

For Lease-In contracts, a pre-commitment/commitment of fund is created by the approval of a Purchase Requisition (PR)/ Purchase Order (PO) through Procurement.

Each building owner from whom space is leased-in is created as a UN Landlord Business Partner in the Flexible Real Estate Module (RE-FX). The UN Landlord Business Partner is assigned with a vendor role which creates a corresponding vendor master record in Accounts Payable.

Lease-out contracts

Lease-out contracts may be negotiated by Facilities Management, the Engineering Section or General Service Section and are managed in the Real Estate module. These are leases where the UN is leasing space (owned or not owned by the UN) to a third party who could be internal or external to Umoja

Lease-out internal

These are leases where the space is leased to an entity internal to Umoja, for example, UNEP, UN HABITAT, OCHA. For Lease-out internal, the internal Tenant's coding block is provided to the Landlord and a fund commitment is generated and assigned to the lease-out internal contract. When periodic postings are executed by the Financial Accounting Senior User (FA.05 role), the Tenant's earmarked fund is consumed.

The amounts owed are paid by the Tenant via an internal debit to the Tenants expense and credit to the Landlord's revenue. The internal tenant is created as UN Tenant Business Partners without customer accounts. They will not have a customer record in Accounts Receivable.

Lease-out external

These are leases where the space is leased to an UN agency/affiliate external to Umoja or to any other commercial entity. For example, UNDP, JP Morgan Chase

For lease-out external, the posting parameters for revenue are maintained on the portfolio usage object. When rental income is due, the periodic postings are executed by the Financial Accounting Senior User (FA.05 role), who will also create an invoice and send it to the external tenant, requesting payment.

Each external third-party tenant (to whom space is leased out) is created as a UN Tenant Business Partner with a customer role in RE-FX. The Business Partner assigned with a customer role creates a corresponding customer record in Accounts Receivable.

Lease-out external sales based

These are leases with an external commercial entity where all or a portion of the rent is based on the amount of revenue generated by the tenant. It may also include other tenant charges, for example, Culinart Catering, Hudson News.

For lease-out external sales based, the posting parameters for revenue are maintained on the portfolio usage object. Periodically, the Tenant is required to provide a report on sales made, which is then entered into the contract by the Lease Processor, who will then do a sales based settlement to determine how much in royalties/profits the Tenant should pay to the Landlord. When rental income and sales based profits are due, the periodic postings are executed by the Financial Accounting Senior User (FA.05 role), who will also create an invoice and send it to the external tenant, requesting payment.

Each external third-party tenant (to whom space is leased out) is created as a UN Tenant Business Partner with a customer role in RE-FX. The Business Partner assigned with a customer role creates a corresponding customer record in Accounts Receivable.

3.3.1 Lease-in Lifecycle

At the UN, real estate leases (Lease-ins) are negotiated by the Procurement Office for commercial lease-ins while right-to-use/in kind lease-ins are negotiated generally by the UN Headquarters or by the Head of Mission Office.

Once the need to acquire additional assets/space has been determined, the UN may either purchase a new asset (refer to section 4 of the Property, Plant and Equipment Chapter of the Finance Manual), lease-in the asset under a commercial lease or the UN may be granted the right to use the assets through donated right-to-use arrangements.

After the lease is agreed upon and signed by both parties, the lease is entered into the Umoja system including lease term and conditions.

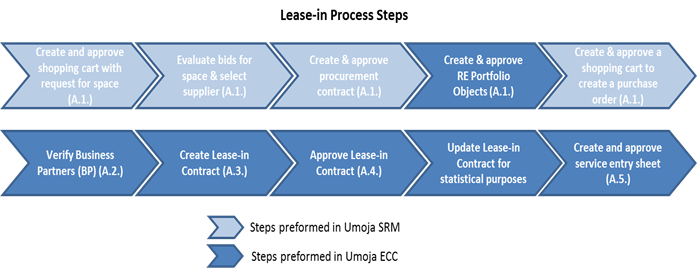

The Lease-in process in Umoja regarding real estate leases is managed in SRM and Real Estate module. The Lease Administration for real estate includes multiple process steps that extend across multiple enterprise roles.

The following sections will describe the Umoja process for all lease-in types for real estate objects i.e. operating commercial leases and donated right-to-use arrangements (operating and finance).

Lease-In High Level Outline

1. Commercial

a. Operating Commercial Lease (3.3.1.1.1)

2. Donated Right-to-use

a. Operating Donated Right-to-use Arrangements (3.3.1.2.1)

b. Finance Donated Right-to-use Arrangements (3.3.1.2.2)

3. Restoration Clause (3.3.1.3)

4. Rent Escalation (3.3.1.4)

3.3.1.1 Commercial (Leases)

The following section will describe the Umoja process for operating commercial leases.

3.3.1.1.1 Operating Commercial Leases

A. The following steps are applicable to process an operating commercial lease in Umoja:

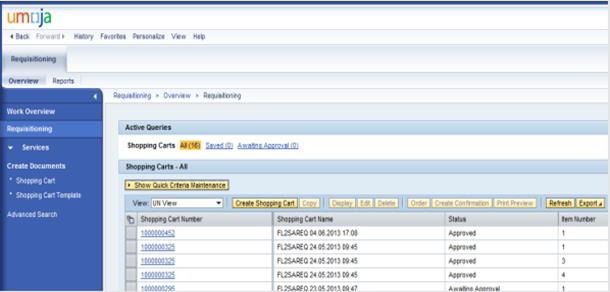

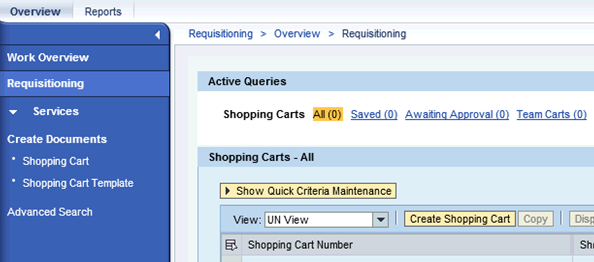

A.1. Create and approve shopping cart and contract / SRM

A.1.1. Whenever there is requirement for space, initially the users will create and approve the unfunded shopping cart with relevant details on the building space needed. Based on such request, bids will be called for and evaluated. Upon selection of the vendor, a procurement contract will be created and approved. After completion of those steps in SRM, for each finalized contract, the related real estate portfolio object will be created and approved in ECC (ERP Central Component) Real Estate module If a procurement contract already exist, to perform a certain type of service, an SRM shopping cart is created and approved (for PO creation) with direct reference to that procurement contract. When such services are completed, they will be confirmed through service entry sheet (ML81N) in ECC.

Note: There is no accounting impact between the two types of shopping carts.

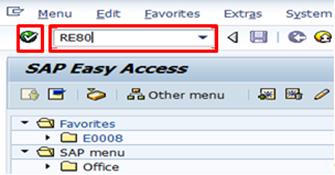

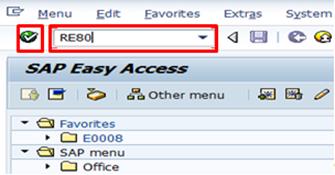

A.2. Check for Landlord Business Partner / Transaction Code: RE80

A.2.1. Enter the t code RE80 in the Command field and click the Enter icon to check if the Business Partner exists in the Umoja system.

A.2.2. The user can also access this transaction using the SAP menu path: Accounting > Flexible Real Estate Management > Master Data >RE Navigator.

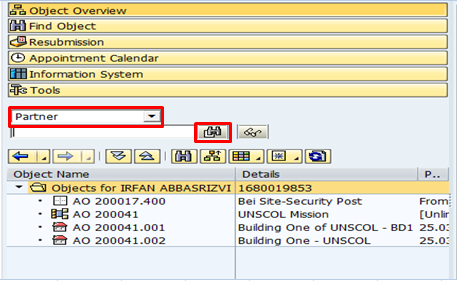

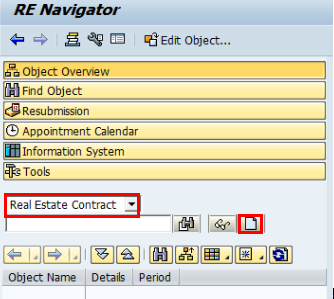

A.2.3. When the RE Navigator screen appears, select Partner from the drop-down.

A.2.4. Click the Find icon to search for a Business Partner.

Note: The drop-down menu provides a way to search for Business Partners while working in the RE Navigator screen.

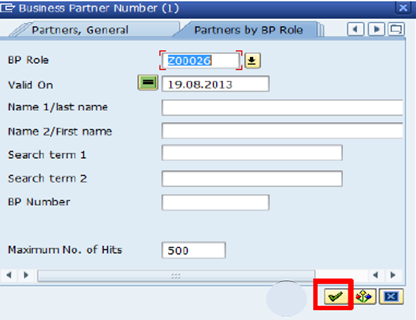

A.2.5. Click the Multiple Selection button next to the BP Role field.

A.2.6. In the BP Role window, select the role you wish to verify and click Enter:

• Z00015 for UN Master Tenant

• Z00026 for UN Landlord w/ Vendor Account

• Z00050 for UN Lease Processor

• Z00051 for UN Contract Approver

A.2.7. Click Enter in the Business Partner Number window.

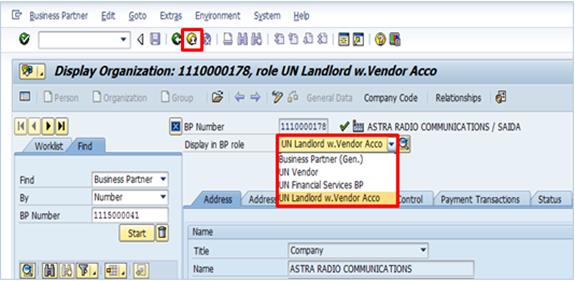

A.2.8. Select the appropriate UN customer and click the Continue icon.

A.2.9. Select the appropriate BP Role from the Display in BP Role drop-down list. Review the tabs and confirm the required information. Click Exit when complete.

A.3. Enter lease contract information / Transaction Code: RE80

For Lease-In, once the lease contract is approved, the lease processor should inform procurement who will perform the following steps:

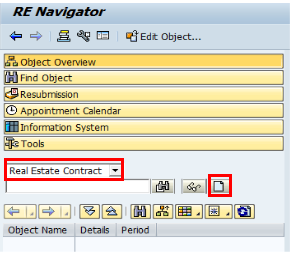

A.3.1. Enter the T-code RE80 in the Command field or click the SAP menu and select the Accounting > Flexible Real Estate Management > Master Data > RE Navigator menu item and click the Enter icon.

A.3.2. When the RE Navigator screen appears, select Real Estate Contract from the drop-down menu of the Navigation area. Click Create icon.

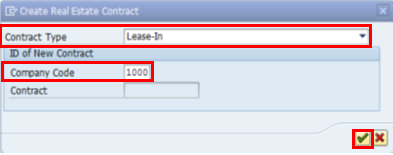

A.3.3. Select Contract Type as Lease-In and type the required data in the Company Code field (1000). Click the Continue icon.

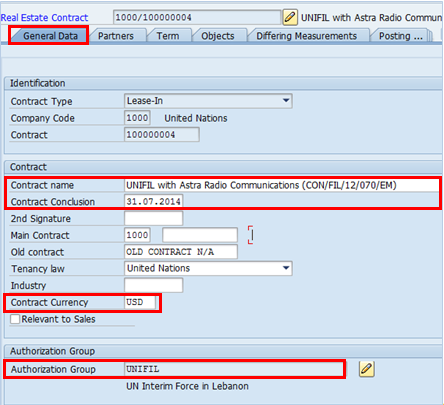

A.3.4. Click the General Data tab and type in following fields:

· Contract Name: The name and the number of the lease contract.

· Contract Conclusion: In Umoja this is the end date of the contract.

· Currency Contract: The currency is set in order to have all subsequent conditions that are added default to that currency and provide a quick glance overview of what currency the lease is managed in. Changing this field does not affect the currency already assigned to an existing condition on the contract. This field does not need to be updated.

· Authorization Group: The security parameter in RE-FX that identifies which group or location maintains an Architectural Object. This does not need to be updated.

A.3.5. Assign Business Partners by selecting the Partners tab and clicking on Assign New Partner.

A.3.5.1. In Lease-ins, the relevant Business Partners that can be assigned are:

· UN Landlord w. Vendor Account: The landlord of the leased space.

· UN Contact Person (if applicable): The individual designated by the landlord as the day-to-day point of contact for any issues related to the leased premise.

· UN Contract Approver: The UN staff member responsible for reviewing and approving the lease contracts.

· UN Lease Processor: The UN staff member responsible for creating and updating the lease contract.

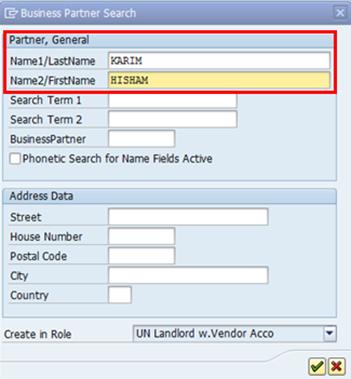

A.3.5.2. The Business Partner Search pop-up window is displayed. Type in the Name 1/LastName and Name 2/FirstName fields. Click the Continue icon.

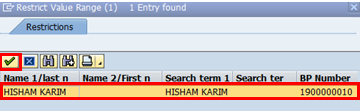

A.3.5.3. Select the Business Partner you wish to assign from the Results list and click the Continue icon. Repeat the steps to add an additional partner.

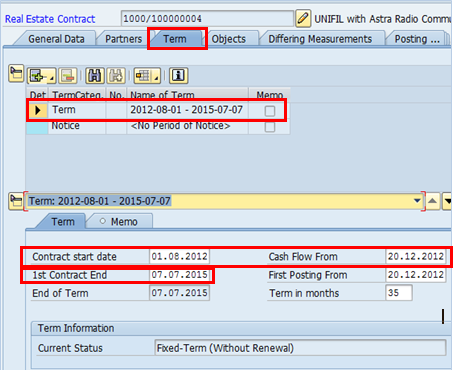

A.3.6. Click the Term tab. Then, select the Term Item on the Term tab and populate the following fields:

· Contract start date: The start date of the first contract entered into by the organization for the leased premises.

· Cash Flow From: The first date on which the landlord will bill for rent and other related costs.

· 1st Contract End: The end date of the first contract.

· Term in months: This will be automatically calculated on the basis of the contract start and end date.

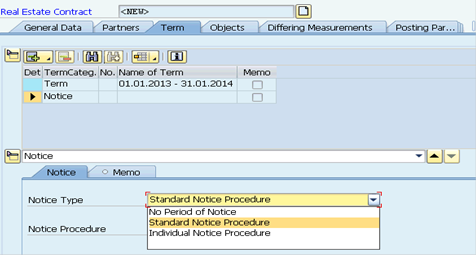

A.3.6.1. If required, click the Notice item on the Term tab.

A.3.6.2. Select either Standard Notice Procedures or Individual Notice Procedures from Notice Type.

![]()

A.3.6.3. Click the Notice Procedure matchbox and select a procedure à click the Enter icon.

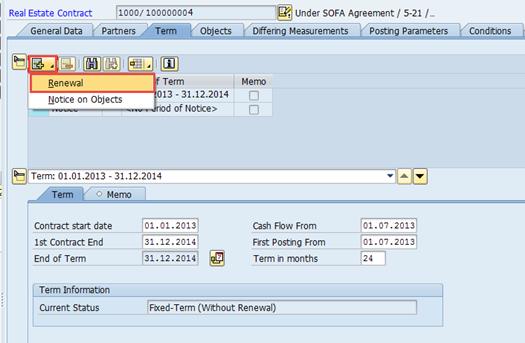

A.3.6.4. To create a Renewal Rule, click the create icon and select Renewal from the drop down list:

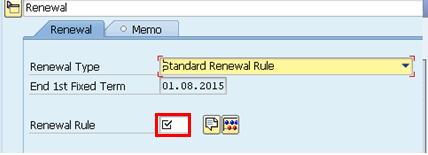

A.3.6.5. In the Renewal tab click the Renewal Type field Select a Renewal Type from the drop down list

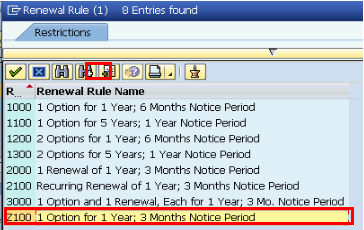

A.3.6.5.1. Click the Renewal Rule matchcode icon.

A.3.6.5.2. Select a Renewal Rule from the drop-down list and click the Enter icon.

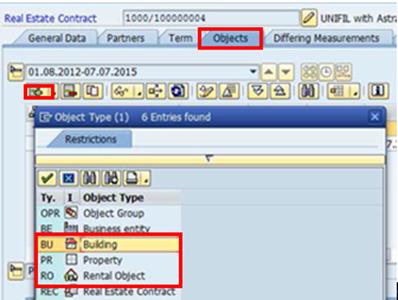

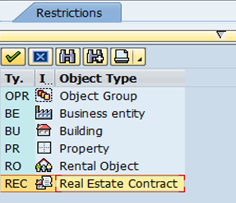

A.3.7. Select the Objects tab and click the Assign icon.

A.3.7.1. Select Building or Property or Rental Object (only Rental Space) depending on the leased space.

Note: A Lease Contract cannot be activated until it is referenced to a leased Real Estate Object.

A.3.7.2. You can search the Object utilizing various criteria (object name, address, utilization and so on). One possibility is searching by Authorization Group:

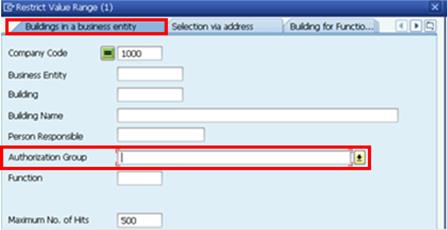

A.3.7.3. In the Search pop-up window, click the Building in the business entity tab.

A.3.7.4. Click the Authorization Group multiple selection button.

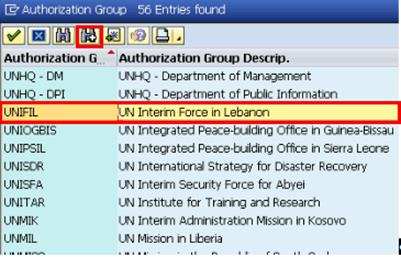

A.3.7.5. In the Restricted Value Range window, click the Start Search icon.

A.3.7.6. Select the Authorization Group from the list and click Copy.

A.3.7.7. Review the generated list to find the relevant Object type. Select the Object Type(s) to assign to the contract (by selecting the check box next on the object number). Click the Continue icon.

A.3.7.8. Repeat the steps to search for any additional Objects to be assigned.

A.3.8. In case the measurement stored in the selected Usage Objects is different from the ones managed within the Lease Contract, click the Differing Measurements tab.

A.3.8.1. Click on Add Measurement icon.

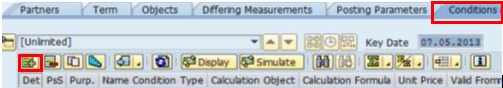

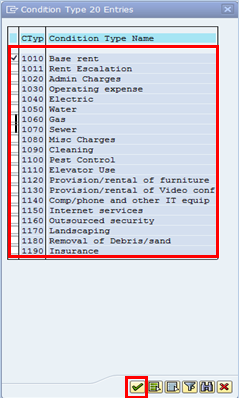

A.3.9. Click the Conditions tab.

A.3.9.1. Click the Insert Condition(s) icon.

A.3.9.2. Select the required condition type to add to the contract and click the Copy icon.

A.3.10. The conditions on Lease-in contracts are always statistical. Confirm that the Condition Purpose is Statistical and the Statist. box is checked.

A.3.10.1. Enter the required details in the Valid From, To and Unit Price fields.

Note: The Conditions on the Lease-In Contract are for information purposes only, and, when added, default to a condition purpose 'Statistical'. This setting should not be changed on Lease-in contracts. The actual conditions owed are recording on the Purchase Order created in the procurement process.

A.3.10.2. Repeat these steps for any additional conditions to be assigned.

A.3.11. If there are documents to attach to the contract, click the Document Management icon.

A.3.11.1. Click on the Create tab in the lower portion of the screen. From here, click on the Standard Doc. Types folder then double click on Attachment.

A.3.11.2. Select the attachment and click the Continue icon.

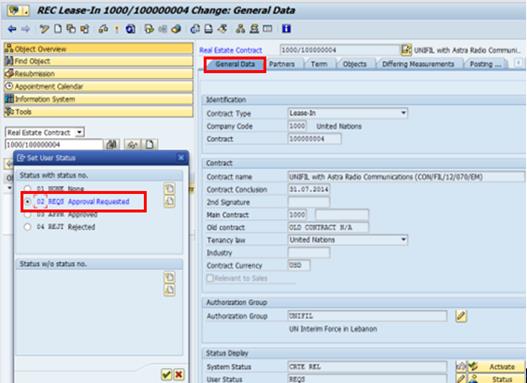

A.3.12. Return to the General Data Tab.

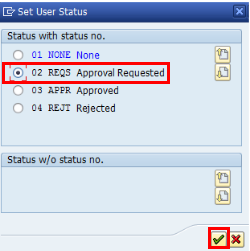

A.3.12.1. Click the Change User Status icon at the bottom of the screen.

A.3.12.2. Select the 02 REQS Approval Requested option. This triggers a workflow approval request message to the UN Facilities Manager assigned on the Partners tab of the contract. The request is sent both via email and to the SAP Inbox when the contract is saved.

A.3.13. Click the Save icon or select Real Estate Contract > Save from menu.

![]()

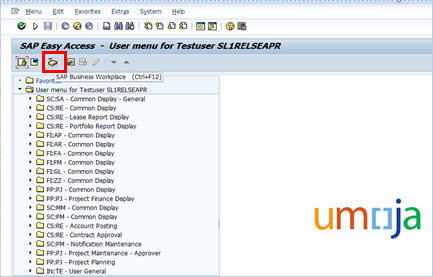

A.4. Approve lease contract / Transaction Code: SBWP

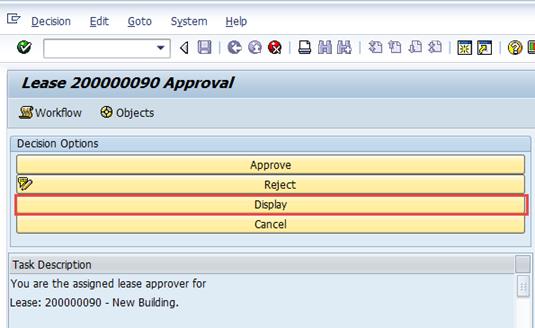

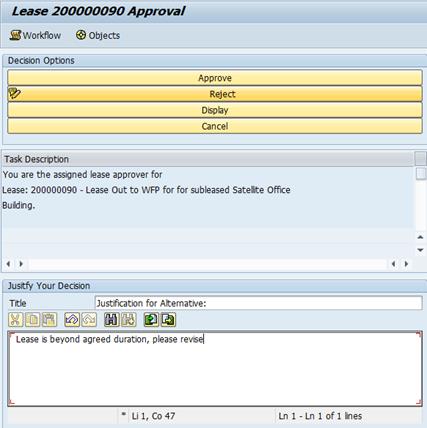

When the lease is saved by the Lease Processor, an email and an Umoja inbox message is sent to the Contract Approver to review and approve the contract. The email contains the links for the following activities:

· Approve

· Reject

· Display the contract

The Lease Processor is notified of the results of the Contract Approver's action by email. The steps to approve the lease contract are as follows:

A.4.1. On the SAP Easy Access screen click the SAP Business Workplace icon or use transaction code SBWP.

A.4.2. Click the Display icon to view the contract information in the inbox message. Then click the Back icon to return to the inbox.

A.4.3. Select the Workflow icon next to the contract that needs to be approved or rejected.

A.4.4. Click the Display button to open the contract.

A.4.5. Navigate through the required tabs and review the contract details.

A.4.6. After the contract is reviewed, click either the Approve or Reject button, as appropriate.

![]()

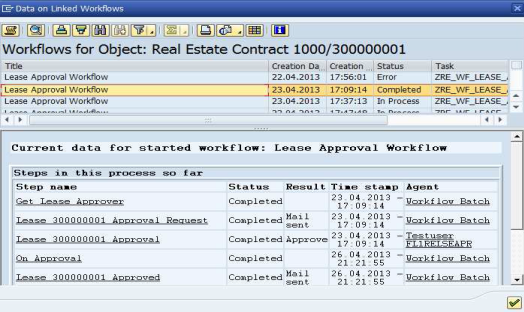

A.4.7. The Lease Processor needs to open the email to confirm receipt of the Contract Approver's actions on the contract that was reviewed. The status of the workflow can be seen on the contract by clicking the Services for Object icon and selecting Workflow > Workflow overview.

A.5. Generate accounting entries / Transaction Code: ML81N

Preforming service receipt is a core supply chain process. It ensures that services acquired through various means conform to the specifications contained in the purchasing document. For services, the process captures the receipt of services using service entry sheets.

The proforma booking is as follows upon service receipt:

|

Account |

Description |

Debit |

Credit |

|

74102010 |

OE Infra Rent Premise |

X |

|

|

35401010 |

AP Ex Good Recpt |

X |

As per IPSAS 31, Lease payments (excluding costs for services such as insurance and maintenance) are recognized as an expense on a straight-line basis, even if the payments are not on that basis. The rent expense should for example be spread on a straight-line basis over the lease term if the lease payments increase (e.g. 2% annual increase) over the lease term ('rent escalation') or in case of a free rent period. We refer to the Corporate Guidance on Leases and Donated Right-to-Use Arrangements for more detailed IPSAS guidance surrounding operating commercial leases. A manual adjustment in Umoja will need to be made to account for this using transaction code: FB50. We refer to Scenario 5, operating commercial lease of equipment, for an illustration of an example including both rent escalation and rent free period, as the process is the same for equipment and real estate.

A.6. Renew Lease / Transaction Code: RE80

If a decision is made to renew the lease, the Lease Processor will renew the lease.

If necessary to update lease contract information, the lease processor will request approval from the contract approver.

A.6.1. Type RE80 in the Command field or click the SAP menu and select Accounting > Flexible Real Estate Management > Master Data > RE Navigator menu icon. Click the Enter icon.

A.6.2. Select the Real Estate Contract from the drop-down list in the Navigation area on the left-hand side of the screen.

A.6.2.1. Type the contract number.

A.6.2.2. Click the Display icon.

A.6.2.3. To make changes to the contract, click the Display <-> Change icon.

A.6.2.4. Navigate to the Term tab and update with the new contract renewal information.

A.6.2.5. Save the changes.

3.3.1.2 Donated Right-to-Use Arrangements

Donated right-to-use arrangements can be classified as operating or finance. The following sections will explain the Umoja processes for each classification, starting with operating.

3.3.1.2.1 Operating Donated Right-to-use Arrangements

Short term donated right-to-use buildings, land, and infrastructure assets are generally classified as operating.

Note:

1. Donated right-to-use land arrangements s are treated as operating lease unless legal title is expected to pass to the UN at the end of the arrangement because land has an indefinite economic life.

2. Peacekeeping missions Status of force agreements (SOFA) and Status of mission agreements (SOMA) are generally classified as operating leases due to the short term nature of the peacekeeping operations.

Accounting treatment: Amounts equal to what the United Nations would pay to rent the asset in the marketplace will be recognized as revenue and expenses on the face of financial statements if indicative threshold is met. In other words, the amounts should reflect what the United Nations would otherwise have to pay in return for use of similar assets in the market.

The following thresholds shall be applied for recognition as revenue in kind / expense in the financial statements:

· Buildings: Yearly rental equivalent equates to USD 20,000 for Volumes I and II and USD 5,000 for other Volumes (per item);

· Land (where title remains with the donor): Yearly rental equivalent equates to USD 20,000 for Volumes I and II and USD 5,000 for other Volumes (per item);

· Infrastructure assets: Yearly rental equivalent equates to USD 20,000 for Volumes I and II and USD 5,000 for other Volumes (per item).

We refer to the Corporate Guidance on Leases and Donated Right-to-Use Arrangements for more detailed IPSAS guidance related to operating DRTU arrangements.

B. The following steps are applicable to process an operating right-to-use arrangement in Umoja:

B.1. Create and approve shopping cart and contract / SRM

B.1.1. Whenever there is requirement for space, the users will initially create and approve the unfunded shopping cart with relevant details on the building space needed. Upon selection of the vendor, a procurement contract will be created and approved. After completion of those steps in SRM, related real estate portfolio objects will be created and approved in ECC for each finalized contract. To perform a certain type of service, whenever required, an SRM shopping cart will be created and approved for creation of a purchase order. When such services are completed, they will be confirmed through service entry sheet (ML81N) in ECC.

Note: The process above relates to creating an unfunded shopping cart (for situations where no procurement contract exists). If a procurement contract already exists, the user can create a shopping cart against the procurement contract. There is no accounting impact between the two types of shopping carts.

B.2. Check for Landlord Business Partner / Transaction Code: RE80

B.3. Enter arrangement contract information / Transaction Code: RE80

B.4. Approve arrangement contract / Transaction Code: SBWP

B.5. Perform service receipt on arrangement of estate assets / Transaction Code: ML81N

B.5.1. Based on the PO created, when the services have been performed, a service entry sheet will be entered in ECC using the transaction code ML81N. The receipt of material and service is a core supply chain process. It ensures that goods and services acquired through various means conform to the specifications contained in the purchasing document. For services, the process captures the receipt of services using service entry sheets. Since these contracts are donated RTU agreements, there will not be any automated accounting entries posted from Service Entry Sheet.

B.6. Enter accounting entries / Transaction Code: FB50

B.6.1. The amounts to be booked are manually calculated and the entry is made through transaction code FB50. We refer to Scenario 1 for the detailed accounting entries.

Scenario 1 - Donated right-to-use arrangement (Building):

Terms

· Asset: Building (Brindisi)

· Lessor: Italian government

· Lease term: 36 months

· Cancellation clause: Cancellable lease

· Shared space: Yes (sub-leases space to WFP)

· Classification: Operating

The agreement indicates that it 'may be terminated by the Parties on a mutually agreed date or by either of the Parties providing thirty-six months written notice to the other Party'. The arrangement is considered as open-ended and the term is therefore 36 months (3 years). The arrangement term (3 years) is below 75% of the economic life of the building and the arrangement is consequently classified as an operating arrangement.

Note: Thresholds for recognition of revenue in kind/expenses in the financial statements is USD 20,000 for buildings in Volumes I and II.

Journal entries

Recognition of donated right-to-use (DRTU) expense and income in 2014:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

31 Dec 2014 |

74102010 |

OE Infra Rent Premise |

Yearly market equivalent rent |

|

|

|

63901010 |

Rev RTU Rent |

|

Yearly market equivalent rent |

The accounting entries in subsequent years are similar to the above accounting entry.

3.3.1.2.2 Finance Donated Right-to-use Arrangements

Donated right-to-use (DRTU) arrangements refer to situations where a donor gives the United Nations the right to use and occupy an asset and requires zero or a nominal payment (very small payment) in return.

Long term) donated right-to-use arrangements, whose term is over 35 years or indefinite, that give the UN exclusive control (or joint control with other United Nations agencies) are classified and treated similarly to finance leases.

DRTU arrangements classified as finance with asset values below the PP&E recognition threshold will be accounted for as operating RTU.

At the commencement of the arrangement term, the UN shall recognize assets acquired under finance arrangements as assets.

C. The following steps are applicable to process a finance donated right-to-use arrangement in Umoja:

C.1. Create and approve shopping cart and contract / SRM

C.2. Check for Landlord Business Partner / Transaction Code: RE80

C.3. Enter arrangement contract information / Transaction Code: RE80

C.4. Approve arrangement contract / Transaction Code: SBWP

C.5. Perform service receipt on arrangement of estate assets / Transaction Code: ML81N

Since these contracts are donated RTU arrangements, there will not be any automated accounting entries posted from Service Entry Sheet.

C.6. Enter accounting entries / Transaction Code: F-90

Finance DRTU arrangements are accounted for as follows:

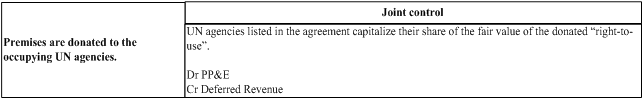

The United Nations will capitalize (recognize an asset) buildings that it controls (or portion of the building that it jointly controls) at the fair value and credit deferred revenue for a like amount. Capitalized buildings will be depreciated over the lesser of the term of the arrangement or the useful life of the buildings with a maximum of 50 years. At the time the depreciation is recognized, an equal amount should be recognized as revenue by debiting deferred revenue and crediting revenue for the same amount.

We refer to the Corporate Guidance on Leases and Donated Right-to-Use Arrangements for more detailed IPSAS guidance related to finance RTU arrangements.

The amounts to be booked are manually calculated and the entry is made through transaction code F-B50. The depreciation of the fixed asset is performed in the Asset Accounting module. The reversal of deferred income (recognizing income) is performed in FI-GL. We refer to Scenario 2 for the detailed accounting entries.

Scenario 2 - Finance donated right-to-use arrangement (building):

Terms

· Asset: Building (VIC, Vienna)

· Lessor: Austrian Government

· Lease term: 98 years 8 months

· Cancellation clause: Considered remote

· Shared space: Yes (UNOV, UNIDO, IAEA, CTBTO share the building)

· Classification: Finance

The terms of the arrangement must be reviewed in order to properly classify an arrangement. In this scenario, a finance classification is triggered by the 1) the 98 year lease term of the arrangement and 2) the fact that the premises are being jointly controlled by the participating agencies.

In addition to the terms mentioned above, other terms of the right-to-use arrangement also need to be analyzed before determining appropriate accounting treatment in this scenario, the building is shared with other agencies; please refer to the common premises section of the Corporate Guidance on Leases and Donated Right-to-Use Arrangements.

The depreciation policy for depreciable leased assets will be consistent with that for depreciable assets that are owned by the UN.

The accounting treatment of finance donated right-to-use arrangements, related to buildings which are jointly controlled with other UN agencies, is outlined in detail in the Corporate Guidance on Leases and Donated Right-to-Use Arrangements:

The fair value of the 'right-to-use' must be determined using the guidelines outlined in the Corporate Guidance on Leases and Donated Right-to-Use Arrangements document

Journal Entries

Commencement of the lease:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

1 Jan 1979 |

2714XXXX |

FA Building donated right-to-use Cost |

Share of fair value of DRTU |

|

|

|

48502010 |

LT Def Inc Right Use (*) |

|

Share of fair value of DRTU Minus Share of fair value of DRTU/ useful life |

|

|

38502010 |

ST Def Inc Right Use (**) |

|

Share of fair value of DRTU/ useful life |

(*) Non-current portion

(**) Current portion

As there is no transfer of legal ownership at the end of the arrangement term, the asset is fully depreciated over the shorter of the arrangement term (98 years and 8 months) or its useful life (limited to 50 years).

Depreciation in 1979:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

31 Dec 1979 |

77842010 |

Depr Bldg Fix |

Share of fair value of DRTU/ useful life |

|

|

|

2784XXXX |

FA Building donated right-to-use Dep |

|

Share of fair value of DRTU/ useful life |

Recognition of donated RTU income in 1979:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

31 Dec 1979 |

38502010 |

ST Def Inc Right Use |

Share of fair value of DRTU/ useful life |

|

|

|

63901010 |

Rev RTU Rent |

|

Share of fair value of DRTU/ useful life |

Transfer from long term to short term liability in 1979:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

31 Dec 1979 |

48502010 |

LT Def Inc Right Use |

Share of fair value of DRTU/ useful life |

|

|

|

38502010 |

ST Def Inc Right Use |

|

Share of fair value of DRTU/ useful life |

The accounting entries in subsequent years are similar to the above accounting entries.

3.3.1.3 Restoration Clause

The estimated costs to restore the leased property in its original condition (e.g. cost to remove leasehold improvements), if required by the contract, is recognized as an item of PP&E (refer to the Corporate Guidance on Property, Plant and Equipment for more detailed guidance related to real estate assets). The obligations for costs accounted for in accordance with IPSAS 17 PP&E are recognized and measured in accordance with IPSAS 19 Provisions, contingent liabilities and contingent assets. For more detailed guidance related to provisions, refer to the Corporate Guidance on Provisions, Contingent Liabilities and Contingent Assets and the Provisions Chapter of the Finance Manual.

Restoration costs are manually calculated and can be determined by internal or external experts or derived from past experience. The costs are capitalized using transaction code F-90.

The initial entry debiting the estimated future cost of restoring the site to its previous condition, which may be based on the UN's historical experience of restoring similar items, and crediting the provision account would generate the following entries:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

07 June 2014 |

27144010 |

FA Lease Fixture Cst |

1,000 |

|

|

|

XXXXXX |

Restorat non-current |

|

1,000 |

The capitalized restoration costs will be depreciated over the term of the lease. The provision will be utilized once the actual restoration takes place.

3.3.1.4 Rent Escalation

In some situations, a contract may call for periodic rent increases (i.e. 2% per year). A detailed example of the accounting treatment of such transactions is discussed in Scenario 5 in section 3.5.1.1 of this document.

3.3.2 Lease-out Lifecycle

A Lease-Out is an agreement where the UN is leasing space (owned or not owned by the UN) to a third party, such as another UN agency, host government, commercial entity, NGO or other organization.

Lease-out contracts are only managed in Real Estate module including the creation and approval of leases and the related cost recovery for spaces rented out

Based on current identified business requirements, operating lease outs and donated right-to-use arrangements are relevant in Umoja Foundation. Operating lease outs include external, internal and sales-based leases, which are described in the next section.

Lease-out High Level Outline

1. Lease Out External (3.3.2.1.1)

2. Lease Out Internal (3.3.2.1.2)

3. Lease Out External Sales Based (3.3.2.1.3)

3.3.2.1 Lease Out Internal and Lease Out External

Lease-out types include external, internal and sales-based. The following processes describe each type, starting with operating external.

3.3.2.1.1 Lease Out External

These are leases where the space is leased to a UN agency external to Umoja or to any other commercial entity (For example UNDP, UNICEF or JP Morgan Chase).

Note: The UN does not generally lease space out under finance leases.

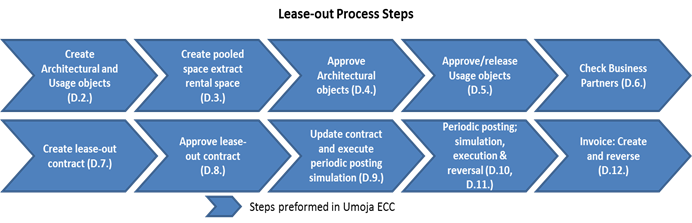

D. The following steps are applicable to process an operating commercial external lease in Umoja:

D.1. Prepare arrangement and obtain signatures from relevant parties.

The Lease Processor prepares the agreement and obtains the relevant signature(s).

D.2. Create architectural and usage objects / Transaction Code: RE80

D.3. Create pooled space and extract rental space / Transaction Code: RE80

D.3.1. The Facilities Planner creates the Usage Object for Pooled Space. After it is created, the Facilities Planner extracts the Rental Spaces. Rental Spaces are used mainly for lease out contracts in order to sublet a building or part of it; however it is possible to use it for lease-in contract as well.

D.4. Approve architectural objects / Transaction Code: RE80

D.5. Approve/release usage objects / Transaction Code: RE80

D.6. Check for Business Partners / Transaction Code: RE80

Refer to the Lease-in section (above) for detailed steps on checking for a business partner, as the processes are the same for lease-in and lease-out.

D.7. Enter lease contract information / Transaction Code: RE80

D.7.1. Type RE80 in the Command field or click the SAP menu and select the Accounting > Flexible Real Estate Management > Master Data > RE Navigator menu item and click the Enter icon.

D.7.2. When the RE Navigator screen appears, click the Type drop-down list and select Real Estate Contract. Click the Create icon.

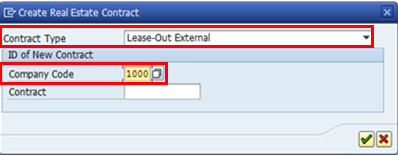

D.7.3. In the Create Real Estate Contract pop-up window, select the Contract Type as Lease-Out External, populate the Company Code and click the Continue icon.

D.7.4. As detailed in the lease-in section, populate the following fields in the tabs outlined below:

D.7.4.1. General Data tab: Enter the Contract name, Contract Conclusion, Contract Currency and Authorization Group.

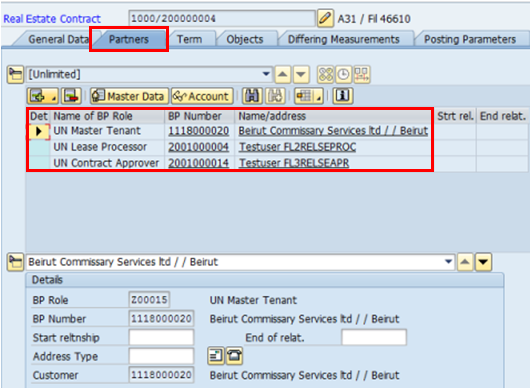

D.7.4.2. Partners tab: To assign Business Partners, select the Partners tab and assign a new partner by clicking the Assign New Partner icon, populate Name1/last name and Name2/first name.

Assign the UN Lease Processor and UN Contract Approver, as well as the UN Master Tenant, the tenant responsible for the rented space. The tenant will have a customer account to track the payments due based on the rent conditions. In addition, assign, if applicable, UN Contact Person who is the individual designated by the tenant as the day-to-day point of contact for any issues related to the leased premise.

D.7.4.3. Term tab: Enter the Contract start date, Cash Flow From, and 1st Contract End Date.

If required, click the Notice item and select either Standard Procedures or Individual Notice Procedures from Notice Type.

D.7.4.4. Objects tab: click the Assign icon and select Rental Object.

It is possible to search for the rental object utilizing different search criteria (Object name, address, use, functional location and so on). If you use the tab, enter 1000 as the Company Code and search for a Rental Object Type.

In this process, the search window shows the following relevant options: Rental Unit or Rental Space.

Click the Continue icon and select the Object Type(s) to assign to the contract:

Repeat the steps above if there are any additional objects to be assigned, and populate accordingly.

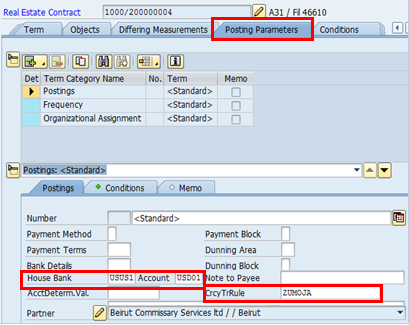

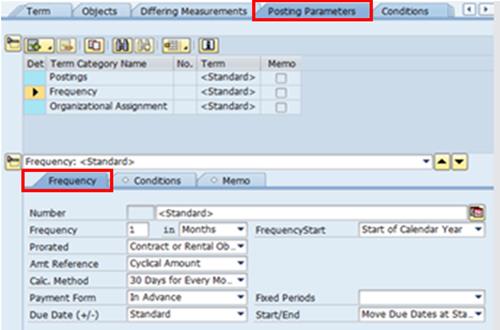

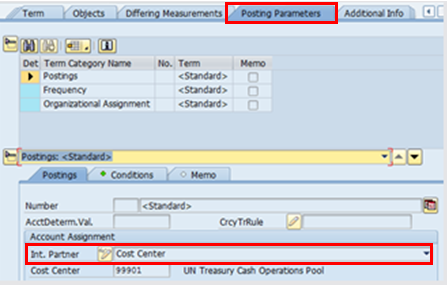

D.7.4.5. Posting Parameters tab: Select the Postings details before selecting the conditions:

For an External Lease-out, populate the Landlord (UN entity) House Bank and Account fields in the Postings tab. These fields are used so that the Tenant may send electronic payments (these are required fields).

Populate the CrcyTrRule field. This field is used to assign the currency translation rule: ZUMOJA. This is a required field when managing a lease that is not in the company code currency.

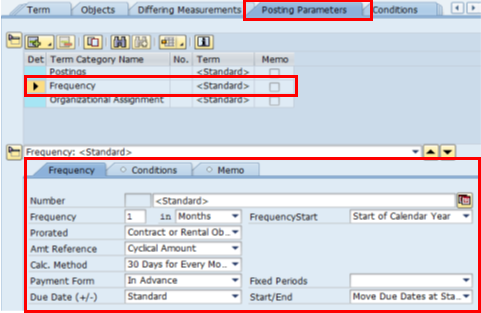

Select the Frequency tab under the Posting Parameters and populate the relevant fields. The frequency allows you to assign various frequencies of payment from the tenant for each condition on the contract (example: monthly, quarterly, and yearly).

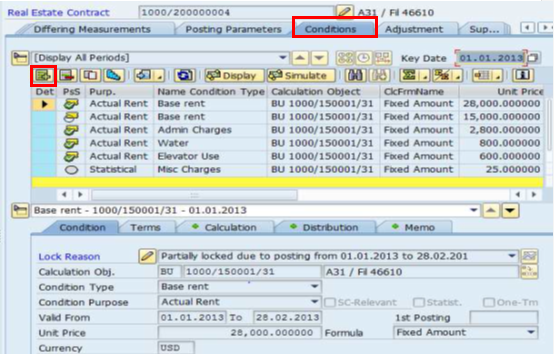

D.7.4.6. Conditions tab: Click the Insert Condition(s) icon. In the case of two or more assigned rental objects, the conditions tab, when adding conditions, will prompt to choose which rental object the condition is applicable to.

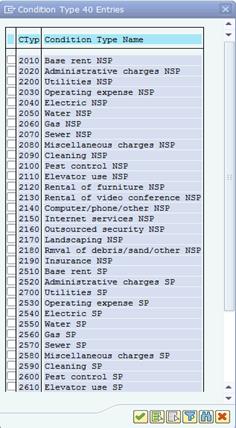

Select the conditions to add from the pop-up window and click the Continue icon. Repeat this step to add all conditions. Depending on the condition selected, the revenue will post to either the income section of the GL account or the spendable income GL account.

· Select conditions with SP next to the Condition Type Name to post to the spendable income GL account

· Select conditions with IS2 next to the Condition Type Name to post financials generated under the Income Section 2 to the income section

· Select conditions with IS3 next to the Condition Type Name to post financials generated under the Income Section 3 to the income section (This is in accordance with IPSAS General Income section 2 and section 3).

Click on the conditions that were added and populate the Unit Price field.

Note: The currency of each condition is defaulted to the Contract Currency assigned on the General Data tab. The condition currency may be updated/changed freely as long as no financial postings have been run in for a particular range of dates (period). If the currency needs to be changed for a range of dates (period) for which postings have been run, this can be done but requires a reversal of the posting(s) already made, update to the currency, and then a new posting. This transaction will be executed by the Senior Finance Accounting User.

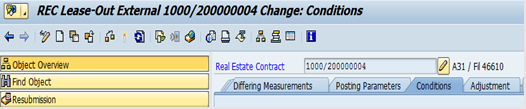

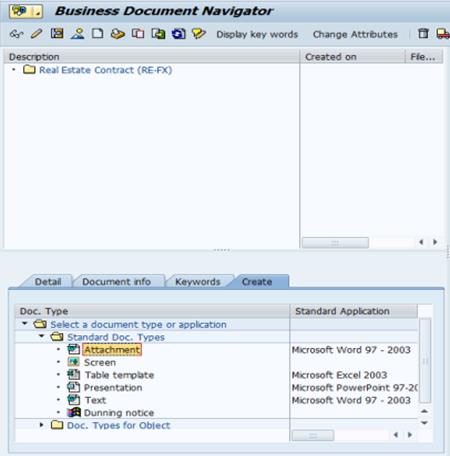

D.7.4.7. If there are documents to attach to the contract, click the Document Management icon.

D.7.4.8. Click on the Create tab in the lower portion of the screen. From here, click on the Standard Doc. Types folder then double click on Attachment.

D.7.4.9. Select the attachment and click the Continue icon.

D.7.4.10. Once complete, return to the General Data tab and change the User Status to REQS Approval Requested. Click the Enter icon.

D.7.5. Approve the lease contract / Transaction Code: SBWP

The Contract approver will approve the lease, following the same approval steps as listed for the lease-in process.

D.8. Update the contract / Transaction Code: RE80

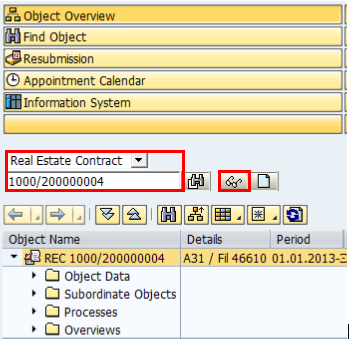

D.8.1. In the Command field, enter RE80 or go to SAP menu -> Accounting -> Flexible Real Estate Management -> Master Data -> RE Navigator.

D.8.2. Select Real Estate Contract in the drop down portion of the Navigation area on the left hand side of the screen.

D.8.3. Enter the Contract Number and click the Display icon to bring up the contract.

D.8.4. Click the Display <-> Change icon to open the object up for changes.

D.8.5. Follow the steps outlined above to access the tabs that contain information that requires updates.

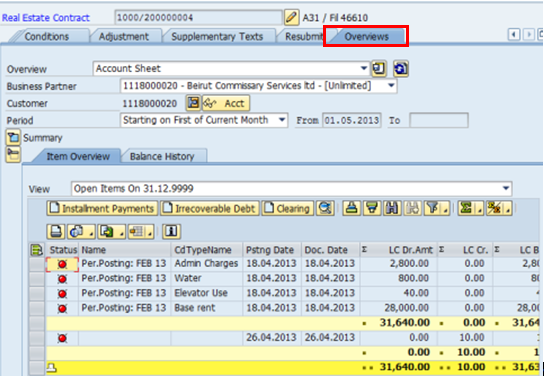

D.8.6. When reviewing the contract, use the Overview tab to review the financial activity on the contract. The most common overview selections are Account Sheet and Invoices.

D.8.7. The Account Sheet provides an overview of the financials of the contract, including payments made and any open items.

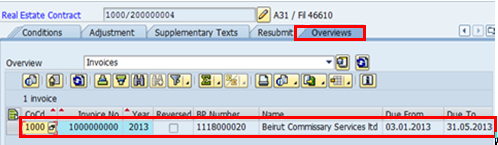

D.8.8. The Invoices selection will allow you to view any invoices created. These can be reissued to the tenant if necessary.

D.8.9. The status of the Workflow can be seen on the contract by clicking the Services for Object icon, and selecting Workflow->Workflow Overview.

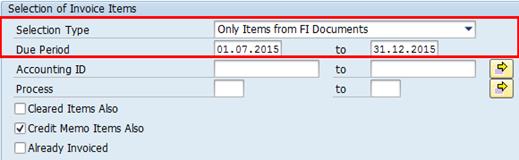

D.9. Simulate rent receivables in test run / Transaction Code: RERAPP

Using the simulation of a periodic posting for the Real Estate Contract function, the accounting entries resulting from the agreed upon conditions are simulated while taking into account the contract type.

D.9.1. Enter RERAPP in the Command field or click the SAP menu and select the Accounting > Flexible Real Estate Management > Accounting > periodic postings > periodic posting: Contracts menu item.

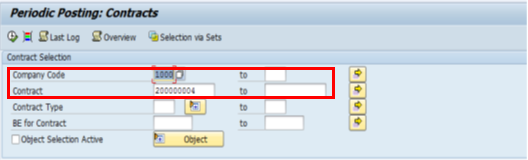

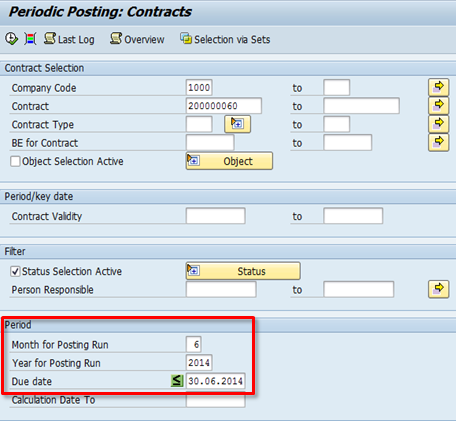

D.9.2. In the Contract Selection section, enter details in the following fields:

D.9.2.1. Company Code: 1000.

D.9.2.2. Contract from and to: This allows you to run the periodic posting for multiple contracts by entering a range of contract numbers.

D.9.3. In the Period section, enter details in the following fields:

· Month for Posting Run: The month the tenant receivables are due.

· Year for Posting Run: The year the tenant receivables are due.

· Due Date: The date less than or equal to the date through which conditions due on the contract will be collected. For example, if the conditions are due in June, this date will be less than or equal to 30 June.

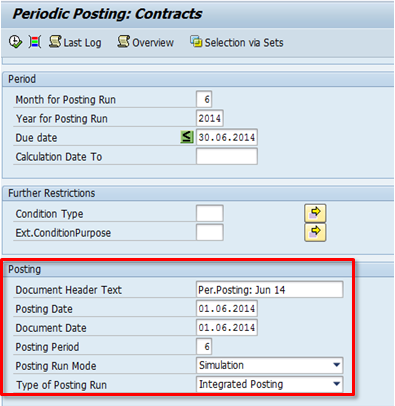

D.9.4. In the Posting section, enter details in the following fields:

· Document Header Text: This is the text displayed at the top of the posting report upon execution. This should be updated as appropriate for Lease-out internal certifications.

· Posting Date: The reference date for when the financial documents will be recognized.

· Document Date: The date the financial documents are created in the system.

· Posting Period: The current open financial period for the financial records.

· Posting Run Mode: During a periodic posting simulation, the Posting Run Mode is always Simulation.

· Type of Posting Run: This is always an Integrated Posting. The integrated posting accrues the revenue due to the tenant, directly to the rental object.

· Confirm the Posting Run mode is set to Simulation and click the Execute icon.

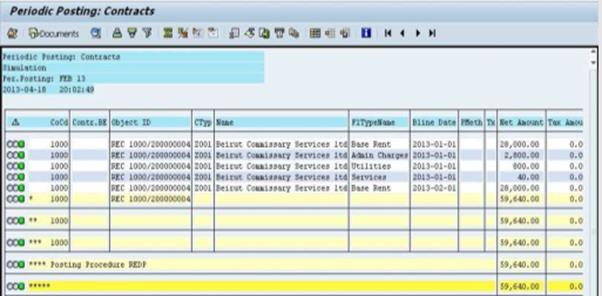

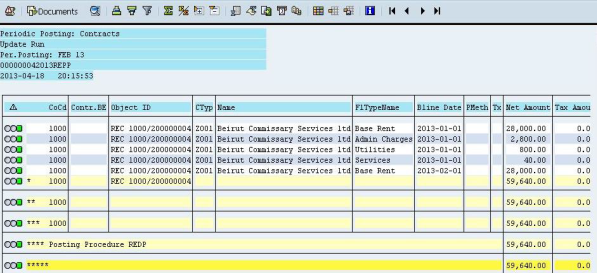

D.9.5. After running the simulation, the first screen displays a summarized listing of the results run. Select the Documents button to view the simulated debits and credits with the complete financial coding block of each.

![]()

For example:

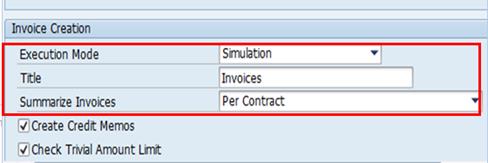

D.10. Execute rent receivables in actual run / Transaction Code: RERAPP

D.10.1. After simulating and reviewing the posting, the Financial Accounting Senior User will execute periodic postings by changing the Posting Run Mode to Update Run.

D.10.2. Click the Execute icon or select to Program -> Execute.

![]()

D.10.3. The first screen to appear will show a summarized listing of the run results. Select the Documents icon which will show a popup from which you can navigate and display the financial documents created.

Lease revenue (excluding receipts for services provided, such as insurance and maintenance) is recognized as revenue on a straight-line basis over the lease term, even if the receipts are not on such a basis. A manual adjustment in Umoja will need to be made to account for straight lining in the case of rent escalation / free rent using transaction code: FB50.

This straight-lining is applicable when rent payments increase periodically. The formula to calculate the monthly rent income when rent payments are not made on a straight-line basis is as follows:

|

Monthly Rent Income = |

Total Rent Receipts Over Lease Term |

|

Number of Month |

Lessor should accrue the rent in addition to the cash over in that accounting period, with a debit to an accrued billings (asset) account and a credit to a rent revenue account.

Refer to Corporate Guidance on Leases and Donated Right-to-Use Arrangements for detailed example on accounting entries for straight-lining.

The proforma bookings are as follows:

|

Account |

Description |

Debit |

Credit |

Explanation |

|

69131010 |

IS2 Rent Basic Exter |

|

X |

Rent income belongs to Income Section 2 (refundable to Member States) |

|

69131020 |

IS2 Rent Escal Exter |

|

X |

|

|

69131050 |

IS2 Rent AdmFeeExter |

|

X |

|

|

69131030 |

IS2 Rent Serv Extern |

|

X |

|

|

69131040 |

IS2 Rent UtilitExter |

|

X |

|

|

63114010 |

Inc SP Ext RentBasic |

|

X |

Rent income belongs to Spendable income (income which can be spent by the UN) |

|

63114020 |

Inc SP Ext RentEscal |

|

X |

|

|

63114050 |

Inc SP Ext RentAdmin |

|

X |

|

|

63114030 |

Inc SP Ext Rent Svc |

|

X |

|

|

63114040 |

Inc SP Ext RentUtili |

|

X |

|

|

Customer account |

Customer Account Name |

X |

|

|

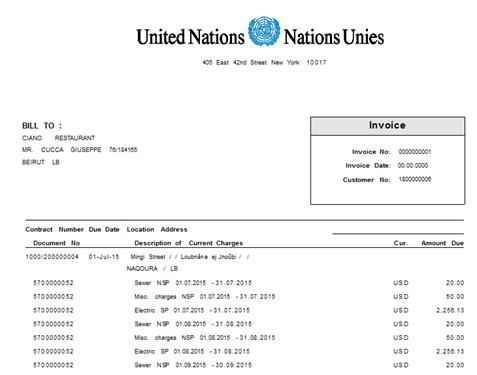

Scenario 3 - Lease-out External building:

Terms

· Asset: Building (Gigiri Complex, Nairobi)

· Landlord: UNON

· Lessee: UNSACCO

· Lease term: 8 years 5 months

· Inception date: 1 January 2005

· Rent: USD 24,437 (market rent)

· Renewal: Both parties agree

· Classification: Operating

· Rent income: Refundable to Member States (IS2 rent income)

Given the lease term is significantly lower than the assets useful life, the classification for this lease is deemed to be operating.

Journal entries

Recognition of lease income in 2005:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

31 Dec 2005 |

15101310 |

AR Ex UN Family |

24,437 |

|

|

|

69131010 |

IS2 Rent Basic Exter |

|

24,437 |

The accounting entries in subsequent years are similar to the accounting entry in 2005.

Scenario 4 - Lease-out External building with rent incentive (ex. 1 year free rent, straight lining):

Terms

· Asset: Building

· Landlord: UN

· Lessee: Commercial entity (external)

· Lease term: 10 years

· Inception date: 1 January Year 1

· Rent: Under a ten year lease agreement, the lessor may give a one year rent-free period followed by a fixed rent of USD 11,000 per annum for 9 years. This is equivalent to 10 years rent of USD 9,900 per annum

· Classification: Operating

· Rent income: Refundable to Member States (IS2 rent income)

Lessors sometimes give their prospective lessees incentives to sign leases. The aggregate cost of incentives (E.g. rent-free rental periods) should be recognised by the lessor as a reduction of the rental income over the lease term on a straight-line basis.

The cost of the incentive should be spread over the lease term on a straight-line basis. Therefore, each year USD 9,900 of rental revenue will be recognized in the statement of financial performance. At the end of the first year, the lessor will recognize accrued rent receivable of USD 9,900, which will be reduced by USD 1,100 each year for the next 9 years.

Journal Entries of Lessor:

Recognition of operating lease revenue in year 1:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

31 Dec Year 1 |

1920XXXX |

ST accrued income |

1,100 |

|

|

|

2920XXXX |

LT accrued income |

8,800 |

|

|

|

69131010 |

IS2 Rent Basic Exter |

|

9,900 |

Recognition of operating lease revenue in year 2:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

31 Dec Year 2 |

15101510 |

AR Ex Customer |

11,000 |

|

|

|

69131010 |

IS2 Rent Basic Exter |

|

9,900 |

|

|

1920XXXX |

ST accrued income |

|

1,100 |

Receive payment from lessee in year 2:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

31 Dec Year 2 |

11011010 |

Csh HQ USD Nominal |

11,000 |

|

|

|

15101510 |

AR Ex Customer |

|

11,000 |

Transfer from long term to short term asset in year 2:

|

Date |

GL |

GL short description |

Debit |

Credit |

|

31 Dec Year 2 |

1920XXXX |

ST accrued income |

1,100 |

|

|

|

2920XXXX |

LT accrued income |

|

1,100 |

The entries in year 3 through 9 are identical to the entries in year 2.

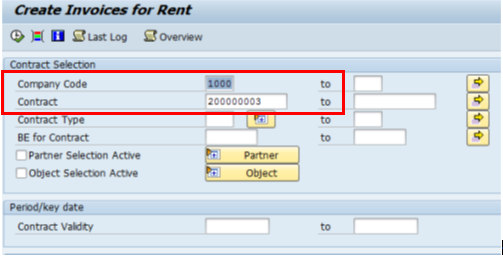

D.11. Create invoice / Transaction Code: RERAIV

D.11.1. Enter RERAIV in the Command field or click the SAP menu and select the Accounting > Flexible Real Estate Management > Accounting > Invoices > Create Invoices menu item.

D.11.2. In the Contract Selection section, enter details in the following fields:

D.11.2.1. Company Code: 1000

D.11.2.2. Contract from and to fields: This allows you to create invoices for multiple contracts by entering a range of contract numbers.

D.11.3. In the Selection of Invoice Terms section, enter details in the following fields:

D.11.3.1. Selection Type: Always select Only Items from FI documents.

D.11.3.2. Due Period From and To: The dates that correspond with the conditions.

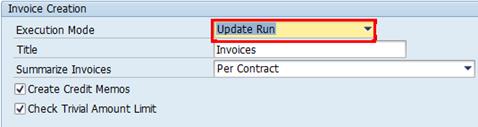

D.11.4. In the Invoice Creation section, enter details in the following fields:

D.11.4.1. Execution Mode: Always select Simulation to review the invoice before executing.

D.11.4.2. Title: The title of the run

D.11.4.3. Summarize: Always select Per Contract.

D.11.5.

Click the Execute ![]() icon.

icon.

D.11.6. Select an invoice and click the Preview button. Review the invoice for accuracy.

D.11.7. Set Execution Mode to Update Run.

D.11.8. Click the Execute icon.

D.11.9. Click Preview icon to display the invoice.

D.11.10. Click on the Send Mail icon to email the invoice to the Tenant (Note: The tenant BP record must have the tenant's email address and StandardComm.Mtd: E-Mail in order for the invoice to be emailed).

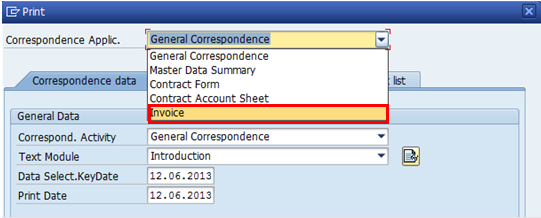

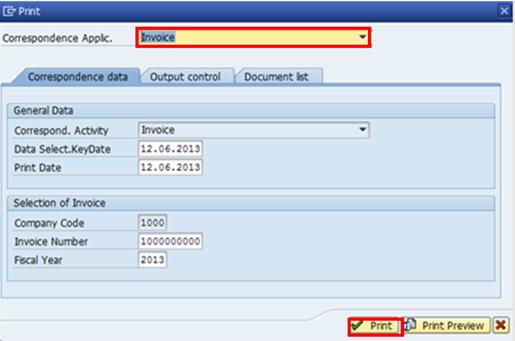

D.11.11. To resend an Invoice, click the Print icon in the transaction toolbar.

D.11.12. Select Invoice in the dropdown menu.

D.11.13. Select the invoice you want to resend.

D.11.14. In the Output control tab, confirm the information in the Additional Output Media section and then press Print.

D.12. To reverse an invoice / Transaction Code: RERAIVRV

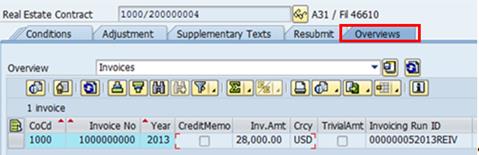

D.12.1. In the Command field, enter RE80 or SAP menu -> Accounting -> Flexible Real Estate Management -> Master Data -> RE Navigator.

D.12.2. Select Real Estate Contract in the drop down portion of the Navigation area on the left hand side of the screen and search for the Contract Number.

D.12.3. Go to the Overview tab, select Invoices and take note of the Invoicing Run ID.

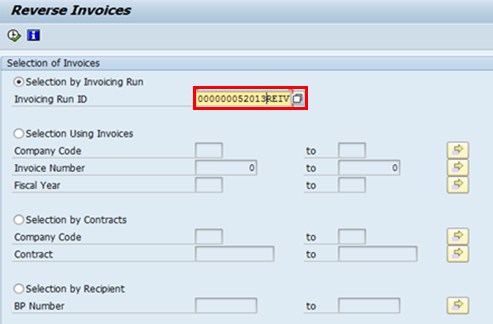

D.12.4. Return to the home screen and enter RERAIVRV.

D.12.5. Confirm Selection by Invoicing Run is selected and enter the Invoicing Run ID, then click the Execute icon.

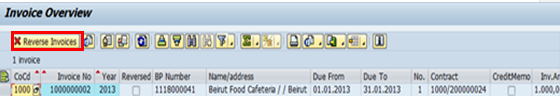

D.12.6. Select the invoice you wish to reverse and click the Reverse Invoices icon.

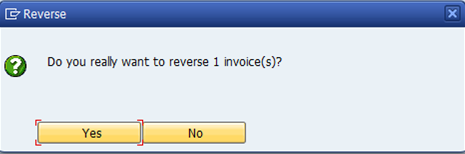

D.12.7. Select Yes when prompted.

D.12.8. The invoice will be reversed.

3.3.2.1.2 Lease Out Internal

These are leases where the space is leased to an entity internal to Umoja, for example, UNEP, UN HABITAT, OCHA. For Lease-out internal, the internal Tenant's coding block is provided to the Landlord and a fund commitment is generated and assigned to the lease-out internal contract. When periodic postings are executed by the Financial Accounting Senior User (FA.05 role), the Tenant's earmarked fund is consumed

The amounts owed are paid by the Tenant via an internal debit to the Tenants expense and credit to the Landlord's revenue. The internal tenant is created as UN Tenant Business Partners without customer accounts. They will not have a customer record in Accounts Receivable.

E. The following steps are applicable to a Lease-out Internal:

E.1. Prepare arrangement and obtain signatures from relevant parties

The Lease Processor prepares the agreement and obtains the relevant signature(s).

E.2. Check for Business Partners / Transaction Code: RE80 or BP

Refer to the Lease-in section (above) for detailed steps on checking for a business partner, as the processes are the same for lease-in and lease-out.

E.3. Enter lease contract information / Transaction Code: RE80

E.3.1. Type RE80 in the Command field or click the SAP menu and select the Accounting > Flexible Real Estate Management > Master Data > RE Navigator menu item. Click the Enter icon.

E.3.2. When the RE Navigator screen appears, click the Type drop-down list and select Real Estate Contract. Click the Create icon.

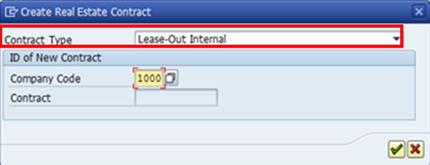

E.3.3. In the Create Real Estate Contract pop-up window, select the Contract Type as Lease-Out Internal.

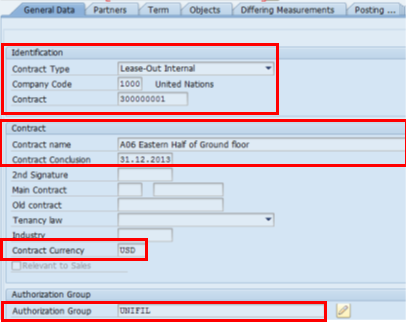

E.3.4. As detailed in the lease-in module, populate the following fields in the tabs outlined below:

E.3.4.1. General Data tab: Enter the Contract name, Contract Conclusion, Contract Currency and Authorization Group.

E.3.4.2. Partners tab: Assign the UN Lease Processor and UN Contract Approver. For Lease-out contracts, assign the UN Tenant that is responsible for the rented space. The tenant will have a customer account to track the payments due based on the rent conditions. In addition, assign, if applicable, a UN Contact Person, who is the point of contact for any issues related to the leased premise.

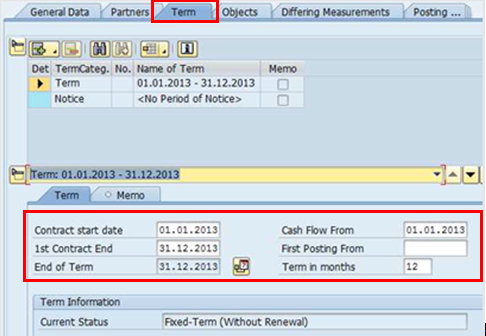

E.3.4.3. Term tab: Enter the Contract start date, Cash Flow From, and 1st Contract End Date.

If required, click the Notice item and select either Standard Procedures or Individual Notice Procedures from Notice Type.

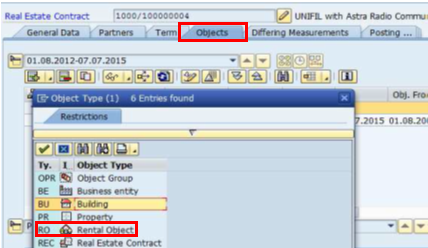

E.3.4.4. Objects tab: Click the Assign icon. Select Rental Object (only Rental Space) depending on the leased space.

E.3.4.5. Posting Parameters tab: Select the Postings details before selecting the conditions:

In the lower window Postings tab, populate the Tenant's Cost Center field to specify the cost center or the WBS for the posting of the Tenant's lease expense. In the case of an Internal Lease-Out (since the tenant is an Umoja entity), there is an internal transfer of funds in which the tenant's account is debited and the landlords revenue account is credited for the contracted lease amount(s).

Note: In a lease contract, 'Posting Parameters' provides the link between the cost center assignments and the funding information, and confirms there is a valid tie. If there is not, an error will occur.

Select the Frequency tab under Posting Parameters and populate the relevant fields. The frequency allows you to assign various frequencies of payment from the tenant for each condition on the contract (example: monthly, quarterly, and yearly).

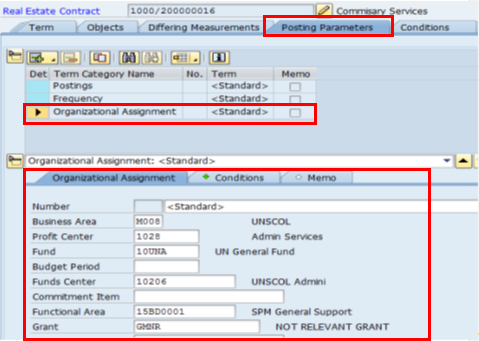

Select the Organizational Assignment Term Category check box and click the Organizational Assignment tab.

Populate the Business Area, Fund, Fund Center, Commitment Item and Functional Area to record the coding block of the Tenant.

Note: To enable the system to process the periodic posting transactions and to recover rental income form the tenant's earmarked fund the posting parameters, as they relate to the internal tenant, need to be specified. Towards this end, we need to specify tenant's fund, fund center, business area, functional area and the commitment item. Once these are specified in this transaction, they are automatically captured in all subsequent postings.

E.3.4.6. Conditions tab: Click the Insert Condition(s) icon and create the desired conditions.

For Internal Lease-outs between two entities in Umoja, the conditions of a contract are configured to process the contract's financial postings as an internal transfer between the Tenant's general ledger expense account to the Landlord's general ledger revenue account.

Depending on the condition selected, the revenue will post to either the income section of the GL account or the spendable income GL account.

• Select conditions with NSP next to the Condition Type Name to post financials to the income (refundable to member states) section.

• Select conditions with SP next to the Condition Type Name to post to the spendable income GL account.

• Click the Continue icon.

• Repeat this step to add all additional conditions.

Note: A Lease Out Internal contract cannot be approved by the Contract Approver until the Earmarked Fund (EMF) has been generated. Once conditions have been created the Lease processor will save the contract which will then automatically generate an EMF and a request for 2 levels of approval will be sent. This is the EMF which the internal tenant will be charged against.

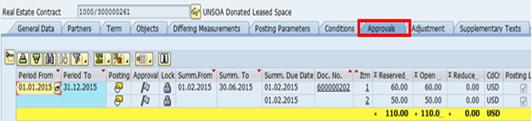

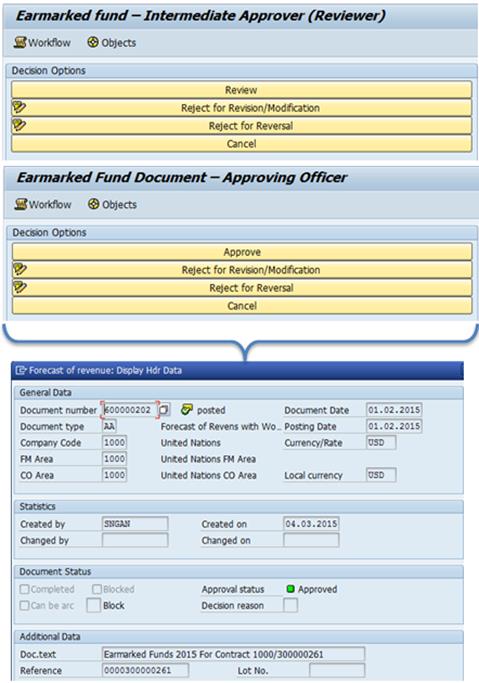

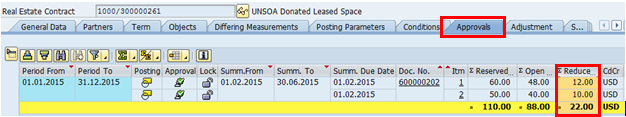

E.3.4.7. On Approvals tab Earmarked Fund (EMF) can be seen with locked lines (2 different G/L accounts in the below example). Once the contract is saved, EMF document is generated and number is assigned. Workflow approval request sent automatically to the first EMF approver:

E.3.5. EMF approved first by Intermediate Approver (FM.07), then by Certifying/Approving Officer (FM.06). Note: ensure that lease processor has exited out of the contract and RE80.

E.3.6. After approval EMF Header shows as approved, and money shows as available in the Overall Amount

E.3.7. Certifying Officer emails the Contract Approver or Lease Processor to notify them the EMF has been approved

E.4. The RE Contract Approver approve and release the lease contract / Transaction Code: SWBP

This simultaneously unlocks the line items on the Approval tab. Contract is now ready for posting:

E.5. The Lease Processor (RE.03) can simulate rent receivables in test run / Transaction Code: RERAPP

The process for simulating rent receivables for a lease-out internal test run is the same as the process for lease-out external. Refer to the lease-out external steps (above) for details on the process.

E.6. The Senior Finance User (FA.05) can execute rent receivables in actual run / Transaction Code: RERAPP

The process for executing rent receivables for a lease-out internal test run is the same as the process for lease-out external. Refer to the lease-out external steps (above) for details on the process.

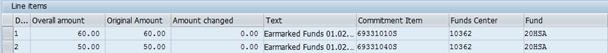

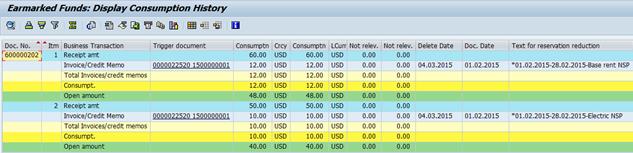

E.7. Once the contract has been posted, the consumed amounts can be seen under the Approvals tab.

Similarly, EMF consumption shows the consumed amounts and the FI Accounting Document they are linked to

The proforma bookings for the Landlord (Lessor) are as follows:

|

Account |

Description |

Debit |

Credit |

Explanation |

|

69331010 |

IS2 IntRent Basic |

|

X |

Rent income belongs to Income Section 2 (refundable to Member States) |

|

69331020 |

IS2 IntRent Escal |

|

X |

|

|

69331050 |

IS2 IntRent AdmFee |

|

X |

|

|

69331030 |

IS2 IntRent Serv |

|

X |

|

|

69331040 |

IS2 IntRent Utilit |

|

X |

|

|

63331010 |

Inc SP Int RentBasic |

|

X |

Rent income belongs to Spendable income (income which can be spent by the UN) |

|

63331020 |

Inc SP Int RentEscal |

|

X |

|

|

63331050 |

Inc SP Int RentAdmin |

|

X |

|

|

63331030 |

Inc SP Int Rent Svc |

|

X |

|

|

63331040 |

Inc SP Int RentUtili |

|

X |

|

|

19401010 |

AR DueTo From |

X |

|

|

The proforma bookings for the Tenant (Lessee) are as follows:

|

Account |

Description |

Debit |

Credit |

|

75331010 |

Int Rent Basic |

X |

|

|

75331020 |

Int Rent Escalation |

X |

|

|

75331050 |

Int Rent Admin Fee |

X |

|

|

75331030 |

Int Rent Serv |

X |

|

|

75331040 |

Int Rent Utility |

X |

|

|

19401010 |

AR DueTo From |

|

X |

E.8. Create invoice / Transaction Code: RERAIV

The steps to create an invoice are the same as the steps for a lease-out external (see section above).

3.3.2.1.3 Sales-based Leases

These are leases where all or a portion of the rent is based on the amount of revenue generated by the Tenant. Rent based on revenue is considered contingent rent in accordance with IPSAS. Contingent rents are booked in income in the period in which they are realized.

The steps to create a Sales-based Lease-out contract, with the addition of sales-based data for determining the amount due from the tenant, based on their sales, are similar to the steps for creating an external lease-out contract. Some of the field selections and entries change based on the lease type. These are listed in this section.

F. The steps to process an operating commercial sales-based lease in Umoja are as follows:

F.1. Create architectural and usage objects / Transaction Code: RE80

F.2. Create pooled space and extract rental space / Transaction Code: RE80

F.2.1. The Facilities Planner creates the Usage Object for Pooled Space. After it is created, the Facilities Planner extracts the Rental Spaces.

F.3. Approve architectural objects / Transaction Code: RE80

F.4. Approve/release usage objects / Transaction Code: RE80

F.5. Check for Business Partners / Transaction Code: RE80

Refer to the Lease-in section (above) for detailed steps on checking for a business partner, as the processes are the same for lease-in and lease-out.

F.6. Enter lease contract information / Transaction Code: RE80

F.6.1. Type RE80 in the Command field or click the SAP menu and select the Accounting > Flexible Real Estate Management > Master Data > RE Navigator menu item and click the Enter icon.

F.6.2. When the RE Navigation screen appears, click the Type drop-down list and select Real Estate Contract. Click the Create icon.

Steps which differ from the External Lease-out are listed below:

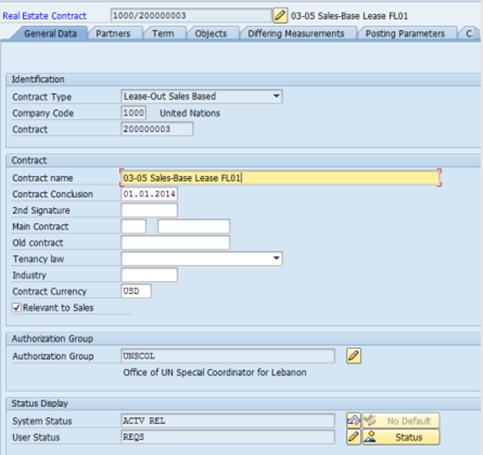

F.6.3. Select the Contract Type as Lease-Out Sales Based on the Create Real Estate Contract pop-up window.

F.6.4. In the General Data tab, enter the required details in the following fields:

F.6.4.1. Contract name, Contract Conclusion and Authorization Group.

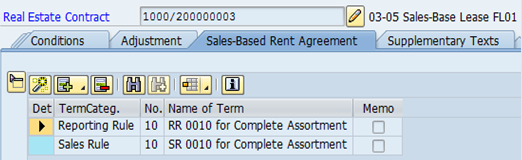

F.6.4.2. For Lease-out Sales-Based contract, select the Relevant to Sales check box. This will enable the Sales-Based Rent Agreement tab for entering the sales and reporting rules for Sales-based Lease-out contracts.

F.6.5. As previously detailed, populate the following fields in the tabs outlined below:

F.6.5.1. Partners tab: To assign Business Partners, select the Partners tab and assign new partners by clicking the Assign New Partner icon.

Add the UN Master Tenant, UN Lease Processor, UN Contract Approver, UN Contact Person (if applicable).

F.6.5.2. Term tab: Enter the Contract start date, Cash Flow From and 1st Contract End Date.

F.6.5.3. Objects tab: Enter required details in the Rental Objects field.

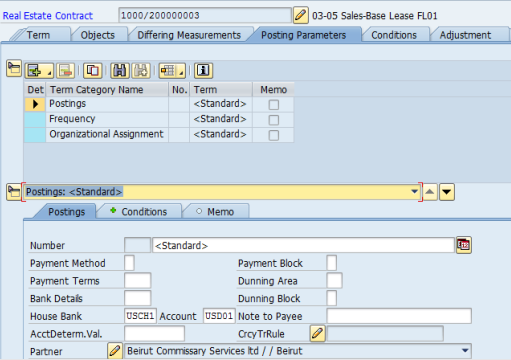

F.6.5.4. Posting Parameters tab: Select the Postings details.

Populate the House Bank, Account (this is the bank were the AR credit is posted) and CrCyTrRule. These fields are for Electronic Fund Transfer (EFT) payment receipt from the tenant.

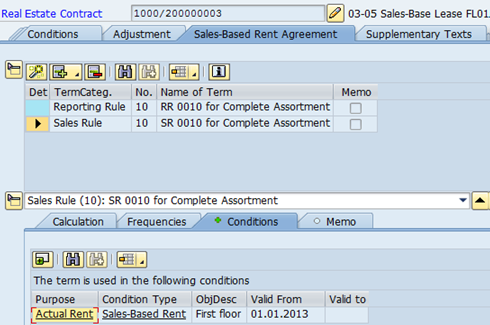

F.6.5.5. Conditions tab: Select the Sales-Based Rent condition. This is required to capture the calculated rent based on the sales reported by the tenant and reporting rules defined in the Sales-Based Rent Agreement tab of the contract.

F.6.5.6. Click the Sales-Based Rent Agreement tab to add and assign Sales and Reporting Rules.

Click the Fast Entry icon and populate the following fields:

• Sales Rule Name: The name of the Sales rule.

• Valid From: The date of the first day that sales-based rent can be collected.

• Type of Sales Rule: This value will default.

• Sales Type: The type of sales on which sales-based rent will be collected.

• Frequency Start: The date on which the sales-based rent can be collected marks the start of the frequency.

• Frequency: It defines how often the sales-based rent will be collected.

• Sales Grading Type: If the Sales Grading Type is No Sales Grading Agreement, then populate the % Rate field.

• % Rate: Defines the percentage of sales on which the sales-based rent will be collected.

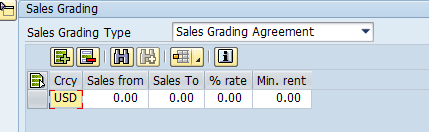

If the Sales Grading Type is Sales Grading Agreement, then populate the following fields:

• Sales from: the value (amount) from which the percentage of sales-based rent can be calculated.

• Sales To: the value (amount) to which the percentage of sales-based rent can be calculated.

• % rate: The percentage of sales on which sales-based rent can be calculated.

• Min. rent: The minimum rent due regardless of the sales.

F.6.5.7. In the Sales-Based Rent Agreement tab, select the Conditions tab and assign the Sales Rule to the rent conditions.

F.6.6. Once complete, return to the General Data tab and change the User Status to REQS Approval Requested.

F.7. Settle sales-based rent agreement / Transaction Code: RESRSE

The Lease Processor simulates a sales-based settlement to calculate the sales-based rent due as per the tenant sales report. The steps to simulate a sales-based settlement are:

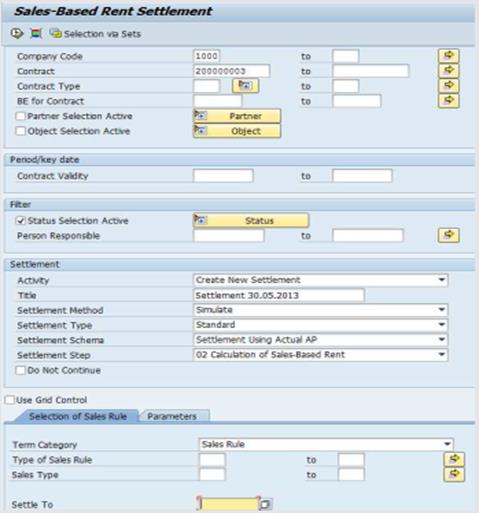

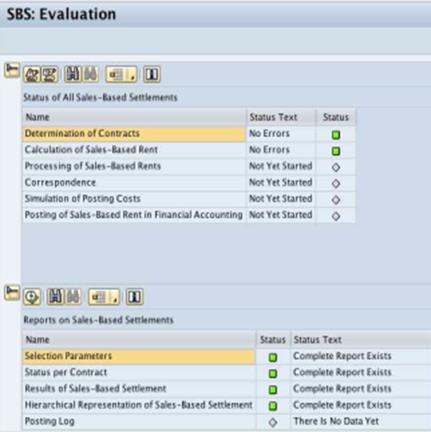

F.7.1. Enter RESRSE in the Command field or click the SAP menu and select the Accounting > Flexible Real Estate Management > Sales-Based Settlement > RESRSE - Execute/Continue Settlement menu item.

F.7.2. Populate the following fields:

• Company Code: 1000

• Contract from and to: This allows you to run the sales-based settlement for multiple contracts by entering a range of contract numbers.

• Activity: Select whether to create a new settlement continue with an existing settlement or reverse a settlement.

• Settlement Method: Always Simulate as the Settlement Method.

• Settlement Type: Always select Standard as the Settlement Type.

• Settlement Schema: Always select Settlement Using Actual AP.

• Settlement Step: Always select 02 Calculation of Sales-Based Rent.

• Settle to: This date is less than or equal to the Sales-Based Rent due date.

F.7.3. Click the Execute icon or select Program > Execute.

Note: The Lease Processor can simulate a Sales-based settlement, but only the Financial Accounting Senior User is able to execute a Sales-based Settlement.

F.7.4. After the execution, a summary of the results will display. The user can select the report they wish to view.

F.8. Simulate the rent receivables in test run / Transaction Code: RERAPP

The steps to simulate the rent receivable are the same as the steps in the external lease-out simulation process (above).

F.9. Execute the sales-based rent periodic posting / Transaction Code: RERAPP

Rent based on revenue is treated as contingent rent in accordance with IPSAS. Contingent rents are booked in income in the period in which they are realized.

The steps to execute a sales-based periodic posting are the same as the steps in the External and Internal Lease-out Periodic Posting process. Refer to the Lease-out External steps (above) for details on the process.

The proforma bookings are as follows:

|

Account |

Description |

Debit |

Credit |

Explanation |

|

69131010 |

IS2 Rent Basic Exter |

|

X |

Rent income belongs to Income Section 2 (refundable to Member States) |

|

69131020 |

IS2 Rent Escal Exter |

|

X |

|

|

69131050 |

IS2 Rent AdmFeeExter |

|

X |

|

|

69131030 |

IS2 Rent Serv Extern |

|

X |

|

|

69131040 |

IS2 Rent UtilitExter |

|

X |

|

|

63114010 |

Inc SP Ext RentBasic |

|

X |

Rent income belongs to Spendable income (income which can be spent by the UN) |

|

63114020 |

Inc SP Ext RentEscal |

|

X |

|

|

63114050 |

Inc SP Ext RentAdmin |

|

X |

|

|

63114030 |

Inc SP Ext Rent Svc |

|

X |

|

|

63114040 |

Inc SP Ext RentUtili |

|

X |

|

|

Customer account |

Customer Account Name |

X |

|

|

3.3.2.2 Subleases

The UN can lease (UN is lessee) a building under an operating commercial lease arrangement and subsequently leases-out (UN is lessor) part of the building under an operating commercial lease arrangement. The UN will receive sublease payments relating to the sublease.