Development Issues No. 11: The Slowdown in Productivity Growth: A View from International Trade

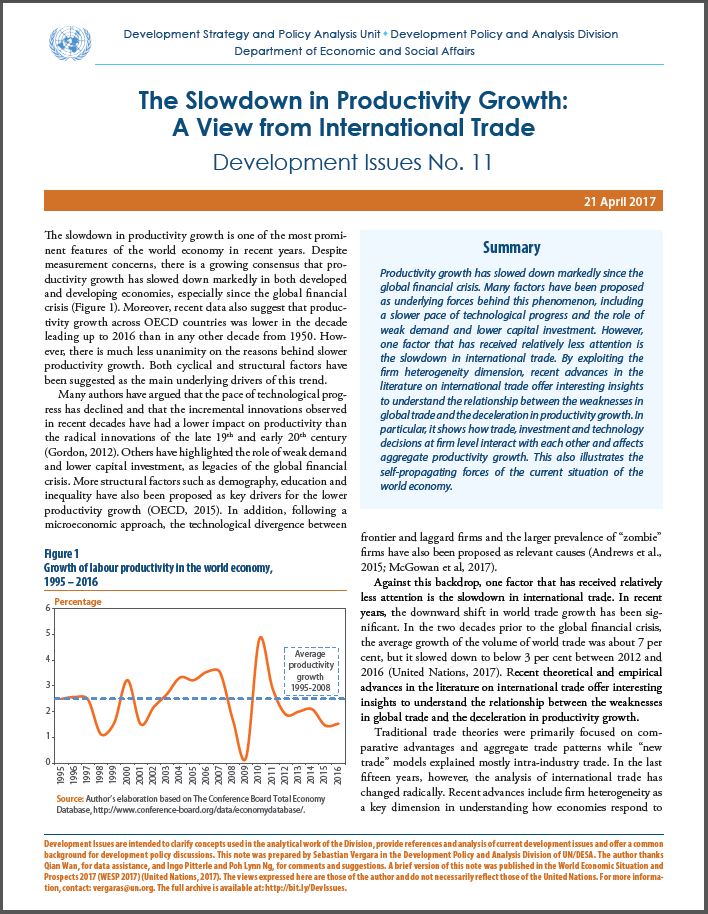

The slowdown in productivity growth is one of the most prominent features of the world economy in recent years. Despite measurement concerns, there is a growing consensus that productivity growth has slowed down markedly in both developed and developing economies, especially since the global financial crisis (Figure 1). Moreover, recent data also suggest that productivity growth across OECD countries was lower in the decade leading up to 2016 than in any other decade from 1950. However, there is much less unanimity on the reasons behind slower productivity growth. Both cyclical and structural factors have been suggested as the main underlying drivers of this trend.

Many authors have argued that the pace of technological progress has declined and that the incremental innovations observed in recent decades have had a lower impact on productivity than the radical innovations of the late 19th and early 20th century (Gordon, 2012). Others have highlighted the role of weak demand and lower capital investment, as legacies of the global financial crisis. More structural factors such as demography, education and inequality have also been proposed as key drivers for the lower productivity growth (OECD, 2015). In addition, following a microeconomic approach, the technological divergence between frontier and laggard firms and the larger prevalence of “zombie” firms have also been proposed as relevant causes (Andrews et al., 2015; McGowan et al, 2017).

Many authors have argued that the pace of technological progress has declined and that the incremental innovations observed in recent decades have had a lower impact on productivity than the radical innovations of the late 19th and early 20th century (Gordon, 2012). Others have highlighted the role of weak demand and lower capital investment, as legacies of the global financial crisis. More structural factors such as demography, education and inequality have also been proposed as key drivers for the lower productivity growth (OECD, 2015). In addition, following a microeconomic approach, the technological divergence between frontier and laggard firms and the larger prevalence of “zombie” firms have also been proposed as relevant causes (Andrews et al., 2015; McGowan et al, 2017).

Against this backdrop, one factor that has received relatively less attention is the slowdown in international trade. In recent years, the downward shift in world trade growth has been significant. In the two decades prior to the global financial crisis, the average growth of the volume of world trade was about 7 per cent, but it slowed down to below 3 per cent between 2012 and 2016 (United Nations, 2017). Recent theoretical and empirical advances in the literature on international trade offer interesting insights to understand the relationship between the weaknesses in global trade and the deceleration in productivity growth.

Traditional trade theories were primarily focused on comparative advantages and aggregate trade patterns while “new trade” models explained mostly intra-industry trade. In the last fifteen years, however, the analysis of international trade has changed radically. Recent advances include firm heterogeneity as a key dimension in understanding how economies respond to international trade, shifting the focus of analysis from country and industry levels towards firm level. A key contribution to this was the seminal model by Melitz (2003), which shows how firm heterogeneity, even within narrowly defined industries, affects aggregate outcomes, including productivity growth, when trade barriers diminish or transportation costs fall. In particular, high-productivity exporting firms survive and expand, while low-productivity non-exporting firms shrink or exit the industry. Along this process, there are significant within-industry productivity gains through different mechanisms. For instance, the increase in firm’s operational scale in foreign markets raises the return to complementary productivity-enhancing investments in technology and innovation. Also, surviving and expanding firms tend to specialize by adjusting the extensive margins of products and destinations (Melitz and Redding, 2015). As a result, this reallocation of resources associated with international trade endogenously raises aggregate productivity.

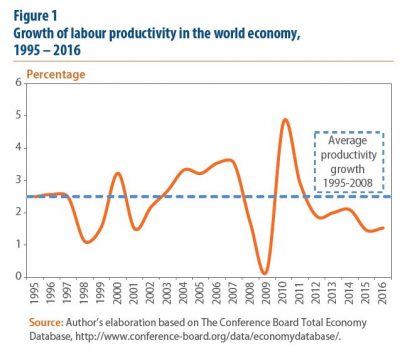

Against this backdrop, the slowdown in international trade flows is constraining productivity growth. In particular, subdued export growth limits the benefits derived from economies of scale and the acquisition of knowledge associated with a closer interaction with international markets. Recent empirical evidence largely supports this causal link in numerous developed and developing country cases (e.g. Lileeva, 2008; De Loecker, 2007). In brief, new exporting firms become more productive once they start exporting, for example through the introduction of new production techniques, inputs and product designs as a result from a learning process.

A simple aggregate analysis at country level illustrates the relationship between exports and productivity growth. Figure 2 displays labour productivity growth and export growth for a sample of developed and emerging economies during 2003-2007 and 2013-2015. The data illustrates a positive correlation between export and labour productivity growth within countries, confirming the literature findings. In addition, the most recent period between 2013 and 2015 is characterized by lower “combinations” of productivity and export growth in most developed countries and emerging economies. For example, labour productivity and export growth in the United States decelerated from an average of 1.9 and 7.2 per cent, respectively, in 2003-2007 to an average of only 0.3 and 2.6 per cent, respectively, in 2013-2015.

In addition, the more protectionist stance in the international trade environment observed recently, including not only a slowing pace of trade liberalization but also rising protectionist measures, also restrains productivity growth. In fact, trade liberalization is associated with productivity gains with different intra-industry channels at work. For instance, mechanisms at play include gains from larger economies of scale, gains from resource reallocation associated with higher competition, and gains from exporters innovating for a larger market. These mechanisms have been identified in many country experiences, such as the Canada-US Free Trade Agreement and other liberalization experiences in developing countries (Melitz and Trefler, 2012, Alvarez and Vergara; 2010, Bustos, 2011, Amiti and Konings, 2007). However, it is important to consider that trade liberalization commonly also entails a significant exit of firms and displacement of workers, and that the reallocation of resources is usually very difficult, as experienced in some Latin American and African countries in the 1980s.

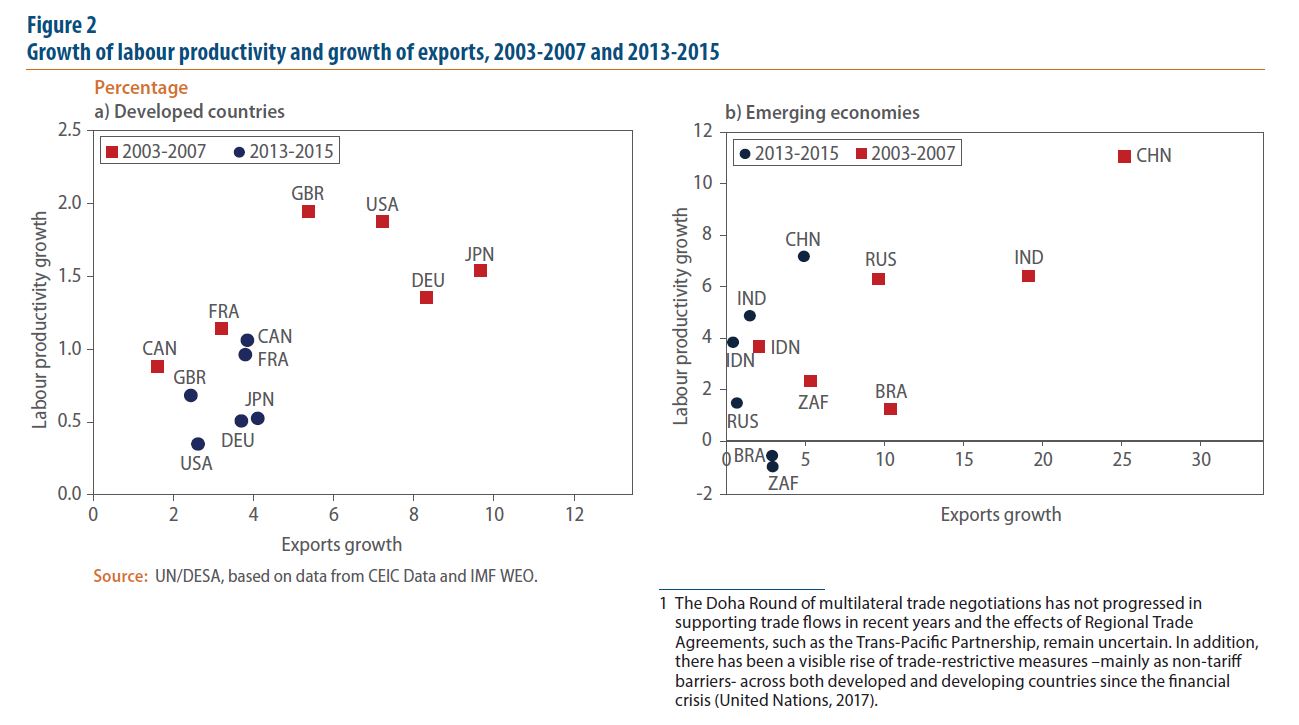

In addition to the previous links between trade and productivity, trade dynamics is also intimately connected to investment behaviour. Hence, taking into account the complementarities between exporting and investment decisions at firm level unveils an additional restraint to productivity growth. In fact, recent research shows that, ultimately, firms take the choice of entering or expanding their operations in foreign markets together with investment, technology adoption, product-mix and R&D and innovation decisions. As a result, firm productivity growth is an endogenous outcome of a number of choices which are taken jointly with trade participation.

For example, Aw and others (2011) shows that productivity growth for electronic producers in Taiwan evolves endogenously to firm’s decisions to export and invest in R&D. Also, the results show that a firm’s export and R&D decisions affect each other and that both decisions affect productivity growth. In the case of Argentina, Bustos (2011) finds that trade integration generates higher revenues and thus stimulates the adoption of new technologies and technology upgrades. Meanwhile, Bloom and others (2011) show that import competition from China has led to increases in R&D, patenting and productivity in more technologically-advanced European firms.

A simple aggregate country-level analysis also illustrates the links between investment and productivity growth. Figure 3 depicts the growth of labour productivity and of private investment for developed countries and emerging economies during 2003-2007 and 2013-2015. Noticeably, there is a positive correlation between labour productivity and private investment growth within countries. In addition, between 2013 and 2015 most developed countries and emerging economies have seen significantly lower growth of productivity and investment than in the period before the financial crisis. For instance, labour productivity and private investment growth in Brazil declined from an average of 1.2 and 6.7 per cent, respectively, in 2003-2007 to an average of minus 0.6 and 3.2 per cent, respectively, in 2013-2015.

In sum, the recent advances in the literature of international trade in the context of heterogeneous firms offer interesting insights to understand the current trends for productivity and trade growth. In particular, it shows how trade, investment and technology decisions interact with each other and affects productivity growth, which also illustrates some of the self-propagating forces of the current situation of the world economy (United Nations, 2017). Looking ahead, the risk of an even more protectionist stance in the international trade environment will exacerbate the challenges in reviving trade flows, investment and, ultimately, productivity growth in the world economy.

In sum, the recent advances in the literature of international trade in the context of heterogeneous firms offer interesting insights to understand the current trends for productivity and trade growth. In particular, it shows how trade, investment and technology decisions interact with each other and affects productivity growth, which also illustrates some of the self-propagating forces of the current situation of the world economy (United Nations, 2017). Looking ahead, the risk of an even more protectionist stance in the international trade environment will exacerbate the challenges in reviving trade flows, investment and, ultimately, productivity growth in the world economy.

References

Alvarez, Roberto and Sebastian Vergara (2010). Exit in Developing Countries: Economic Reforms and Plant Heterogeneity. Economic Development and Cultural Change, Vol. 58(3), pp. 537-561.

Amiti, Mary and Jozef Konings (2007). Trade Liberalization, Intermediate Inputs, and Productivity: Evidence from Indonesia. American Economic Review, Vol. 97, No. 5, pp. 1611-1638.

Andrews, Dan, Criscuolo, Chiara and Peter N. Gal (2015), “The global productivity slowdown, technology divergence and public policy: a firm level perspective”, OECD Productivity Working Papers, No. 2, November.

Aw, Bee Yan, Mark J. Roberts and Daniel Yi Xu (2011). R&D Investment, Exporting, and Productivity Dynamics. American Economic Review, Vol. 101, No. 4, pp. 1312–44.

Bloom, Nicholas, Draca, Mirko and John Van Reenen (2011). Trade Induced Technical Change? The Impact of Chinese Imports on Innovation, IT and Productivity. NBER Working Paper No. 16717, January.

Bustos, Paula (2011). Trade liberalization, exports and technology upgrading: evidence on the impact of MERCOSUR on Argentinean firms. American Economic Review, Vol. 101, No. 1, pp. 304–340.

De Loecker, Jan (2007). Do exports generate higher productivity? Evidence from Slovenia. Journal of International Economics 73, pp. 69–98.

Gordon, Robert (2012). Is U.S. Economic Growth Over? Faltering Innovation Confronts the Six Headwinds. NBER Working Paper No. 18315, August.

Lileeva, Alla (2008), “Trade Evidence and Productivity Dynamics: Evidence from Canada”. Canadian Journal of Economics 41(2): 360–90.

McGowan, Müge Adalet, Andrews, Dan and Valentine Millot (2017). “The Walkind Dead? Zombie Firms and Productivity Performance in OECD Countries”. Economics Department Working Papers No. 1372.

Melitz, Marc J. and Stephen J. Redding (2015). Heterogeneous Firms and Trade. Handbook of International Economics, Vol. 4, Elsevier: North Holland.

Melitz, Marc J. (2003). The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity. Econometrica, Vol. 71, No. 6, pp. 1695-1725.

Melitz, Marc J. and Daniel Trefler (2012). Gains from Trade when Firms Matter. Journal of Economic Perspectives, Vol. 26, No. 2, pp. 91–118.

Organisation for Economic Cooperation and Development (OECD) (2015). The future of Productivity. OECD Publishing, Paris.

United Nations (2017). World Economic Situation and Prospects 2017. Sales No. E.17.II.C.2.

Follow Us