World Economic Situation And Prospects: November 2018 Briefing, No. 120

- Global growth may have reached a peak

- Firms in the United States and Japan are facing capacity constraints

- Manufacturing activity slows in developed and developing economies

English: PDF (198 kb)

Global issues

Global issues

Leading indicators suggest global growth may have peaked

In 2016, the growth rate of world gross product dropped to its lowest level since the global financial crisis, with 49 countries registering a decline in the level of per capita income. Subsequently, the world economy experienced a broad-based upturn and global growth reached 3.1 per cent in 2017—the fastest pace since 2011. The improvement was largely driven by accelerating growth in developed economies, a steady performance in East Asia, and recovery from recession in several developing and transition economies. Investment growth accounted for the bulk of the rebound in 2017, including new investment in some commodity sectors as global commodity prices partially recovered from the steep losses of 2014–2015.

The global growth momentum has been sustained in 2018, buoyed by a strong fiscal expansion in the United States of America, which has largely offset slower growth in some other large economies. The review of global economic indicators presented below suggests that global economic growth has remained steady, exceeding 3 per cent in annualized terms, over the first 6–9 months of 2018. However, expectations over the next 6–12 months point to some softening in economic momentum. These expectations are closely associated with heightened uncertainty, captured both by financial market volatility and global economic policy uncertainty. In October, global financial markets experienced renewed sharp gyrations, resulting in large equity sell-offs in several major countries. These recent developments reinforce expectations that investor sentiments will likely remain highly fragile over the next few months. A protracted period of elevated uncertainty would act as a drag on household and business confidence, with a pass-through to investment and consumer spending decisions. At the same time, several developed economies are facing capacity constraints, which may constrain short-term growth.

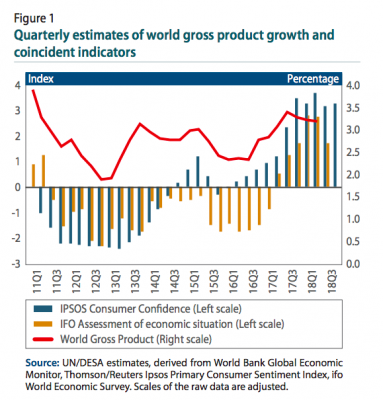

Quarterly estimates of world gross product indicate that the world economy expanded at an annualized rate of 3.4 per cent in the second quarter of 2018. Coincident indicators of global economic output—that is, measures that are closely related to economic activity in the current time period—point to steady, if slightly more moderate, growth in the second half of the year (figure 1). For example, Moody’s Analytics Survey of Business Confidence from 22 October 2018, which is a weekly survey on global business conditions, indicates that “global business sentiment is good and consistent with a global economy that is growing just above its potential. Sales, pricing and hiring are sturdy.” The assessment of the current economic situation in the third quarter of 2018 ifo World Economic Survey, which surveys more than 1,200 experts in 120 countries, deteriorated, but remained at a very high level. The Ipsos Global Consumer Confidence and Investment Indices for October 2018, which surveys more than 17,500 consumers in 24 large economies, remained steady at relatively high levels.

But there are growing signs that global growth may have peaked. Estimates of global industrial production and merchandise trade growth have been tapering since the beginning of 2018, especially in trade-intensive capital and intermediate goods sectors, pointing to weaker investment prospects. The annualized momentum of global industrial production has averaged just 2.2 per cent since January, compared to 3.5 per cent growth in 2017. World merchandise trade growth averaged 3.1 per cent in the 8 months to August, compared to 4.6 per cent growth in 2017.

Leading indicators of economic activity—that is, measures that are indicative of economic developments in forthcoming time periods—suggest that global economic growth is expected to moderate over the coming quarters. The OECD Composite Leading Indicator for the 36 members of the OECD plus 6 large non-member countries (Brazil, China, India, Indonesia, the Russian Federation and South Africa) has drifted down since the end of 2017. This indicator is based on an underlying set of country-specific reference series, selected to correlate with economic activity six to nine months ahead. These include, for example, various measures of economic sentiment and measures related to construction activity, such as the number of permits issued for dwellings; manufacturing indicators, such as new orders or the stock of inventories; financial market indicators, such as share prices, bond yields or interest rate spreads; household consumption indicators, such as car registrations or retail sales; and labour market measures, such as job vacancies or overtime hours worked.

According to Moody’s Analytics Survey of Business Confidence, expectations about business conditions and investment intentions over the next six months have weakened. The expectations measures from both the ifo World Economic Survey and Ipsos Global Consumer Confidence Index likewise point to some softening of economic activity in the coming months.

The recent deterioration in expectations has coincided with a rise in economic uncertainty, both in terms of financial market volatility and global economic policy uncertainty. The steady rise in global economic policy uncertainty over the course of 2018 is driven largely by an increase in uncertainty regarding United States trade policy, reflecting recent tariff hikes and heightened tensions with major trading partners. Together, movements in the Cboe volatility index (VIX) and Global Economic Policy Uncertainty Index can explain nearly half of the shifts in global economic expectations since 2014, as captured by the expectations element of the ifo World Economic Survey.

Developed economies

United States: Capacity constraints emerging

Economic confidence and sentiment indicators in the United States are near recent historical highs, reflecting strong jobs growth, major income and business tax cuts and buoyant economic activity—in the first three-quarters of 2018, gross domestic product (GDP) was 2.8 per cent higher than a year earlier. However, there is growing evidence that firms are facing capacity constraints, which will restrain growth in the coming quarters despite the support of fiscal stimulus measures. Internal freight transportation costs have risen sharply—up 8.3 per cent on the year to September 2018—reflecting labour shortages in the trucking sector and capacity limits in rail transport. Employers also continue to report tight labour markets and difficulties finding other qualified workers, including highly skilled engineers, finance and sales professionals, construction and manufacturing workers, and IT professionals. As capacity constraints tighten, the economy will rely on an expansion of imports to meet demand. Given the upward impact of tariff increases on import prices, this will add to domestic price pressures. Input price pressures are already evident, particularly for construction materials and freight transportation. So far, higher input costs have largely been absorbed by firms, although consumer price inflation has exceeded 2 per cent since November 2017. With persistent capacity constraints, a greater share of the costs can be expected to be passed on to customers, exerting upward pressure on consumer prices.

Japan: Business sentiments remain strong despite moderate deterioration

The latest Tankan survey, an economic survey of Japanese businesses issued by the Bank of Japan, reveals a modest decline in business sentiment, which nonetheless remains generally strong. The diffusion index of business sentiment for the large enterprises edged down to 21 in the third quarter from 22 in the previous quarter. Sentiments with regards to fixed investment, particularly research and development, have been robust, while a vast majority of businesses have reported rising input prices, mainly due to higher oil prices. The Survey also indicates a shortage of labour as well as an extremely high utilization of production equipment. Although the economy is close to capacity, inflationary pressures remain weak. The consumer inflation rate stood at 1.2 per cent in September; but excluding food and energy items, the core inflation rate was sustained at 0.4 per cent, lower than the 2016 average of 0.6 per cent.

Europe: IFO Business Climate Survey indicates strong conditions with possible weakening

Possibly the most-widely watched leading index in Europe is the IFO Business Climate Index for Germany. The index is published monthly by the IFO institute and is based on a survey of about 9,000 companies in manufacturing, services, trade and construction. The overall business climate index is derived from two components: the situation and expectation parts. This means that the surveyed companies are asked to judge the current business situation as “good”, “satisfactory” or “poor”, and to state their expectations for the next 6 months as “more favourable”, “unchanged” or “less favourable”. The overall business climate index and the two component indices are then derived from the balance of responses, meaning the difference between the percentages of the responses “good” and “poor” for the situation part and “more favourable” and “less favourable” for the expectation part. There is a multitude of ways to analyse the index and its components in terms of their levels, changes and combinations with each other, for example matching various constellations with different phases in the business cycle. In a simple assessment, the most recent index data show the situation component at a value of 105.9, while the expectations value stands at 99.8. This indicates that in a very robust current economic situation, marked by capacity constraints in some parts of the region, companies expect a weakening in conditions over the near term. This may be a reflection of a number of factors, including the increase in global trade tensions, the uncertainty stemming from the looming exit of the United Kingdom from the European Union (EU) and controversy over the fiscal situation and policy stance of Italy.

For the countries of Central Europe, forward-looking indicators point to a slowdown toward the end of the year, as trade tensions between the United States and the EU weigh on the outlook for the region’s automotive industry. In September, both the Czech and Polish manufacturing sectors expanded at one of the lowest rates in two years; manufacturing output growth also slowed in Hungary and Slovakia. In the Czech Republic, the level of new manufacturing orders has declined to a two-year low and the headline Purchasing Managers’ Index (PMI) stands at its lowest level since November 2016. In Poland, the PMI also hit a 23-month low of 50.5 points in September, as the number of new orders shrank for the first time since October 2016.

Economies in transition

Commonwealth of Independent States: Some improvement in Russian PMI, but weakening consumer confidence

In the Commonwealth of Independent States (CIS), the Russian manufacturing sector stabilized in September, after four consequent months of contraction. Both output and new orders in the sector returned to growth, with new foreign orders increasing at the fastest rate since April. Meanwhile, activity across the services sector noticeably strengthened, amid robust client demand. However, the unfavourable exchange rate dynamics observed since August fuelled an increase in producer price inflation in September, via higher cost of imported inputs, prompting monetary tightening by the central bank. Industrial output is likely to slow towards the end of the year, as large infrastructure projects, including those related to the FIFA 2018 World Cup, are completed. The stock market, after reaching record highs in September despite the external sanctions environment, has reverted to its medium-term trend. Consumer activity is weakening. Despite unemployment reaching a new low level of 4.5 per cent in September and the continuing increase in real wages, retail trade expanded by only 2.2 per cent. There are indications that the Government’s commitment to a fiscal rule and uncertainties related to the scope of United States’ sanctions have induced an increase in the savings rate of households.

In South-Eastern Europe, Albania’s economy expanded strongly in the first half of 2018, growing at over 4 per cent. However, the economic confidence indicator, while remaining above its long-term average, has been declining in both the second and third quarter, reflecting tapering in both business and consumer confidence. The drop-in business confidence index was widespread, affecting construction, industry and services. Concurrently, the economy is likely to cool down toward the end of the year.

Developing economies

Africa: Largest economies struggling to grow

Africa’s two largest economies are struggling to record modest growth this year and the next. In Nigeria, output has increased gradually since the recession of 2016. Supported by higher oil prices and modest non-oil sector growth, the economy grew 1.5 per cent year-on-year in the second quarter of 2018, slowing from 2 per cent growth in the previous period. Looking ahead, real GDP growth should remain sluggish as the economy remains besieged by structural issues, with a disruptive election season in February 2019. Still, supported by increasing crude oil prices and better access to foreign exchange, growth is projected to rise modestly in 2018–2019. Both manufacturing and services PMIs indicate expanding activity at an increasing rate. Business confidence is at levels similar to those before the crash in commodity prices. Input price inflation has hit a 12-month low and is below the long-run average. The notable slowdown in monthly inflation rates suggests price pressures should ease further over the coming months. Crude oil production has been on the rise since June. However, it remains below the levels seen before the 2014/15 oil price crash, and security challenges to oil production remain a risk. Additionally, uncertainty about the elections may weigh on activity in the near term.

The South African economy contracted by 2.6 per cent in annualized seasonally adjusted terms in the first quarter of 2018 and further by 0.7 per cent in the second quarter of 2018. After two consecutive quarters of negative growth, the economy is considered to be in a “technical recession”. The growth figures have been partly distorted by agriculture and forestry due to unstable weather in the last year; nevertheless, the deterioration in the South African economy is widespread. After improvements in the first half of 2018, the PMI plunged in September to 2017-lows, resuming the downward trend observed since 2010. The South African rand has depreciated by 25 per cent against the dollar in 2018, fuelling inflationary pressures. In October, the Treasury halved its GDP growth projections for 2018 to 0.7 per cent, down from 1.5 per cent in February. Short-term indicators point to weak third quarter activity, while uncertainty regarding the ongoing nationalization of the central bank and proposals for land reform have weighed on business sentiment, suggesting further downgrades to the forecast may be forthcoming.

East Asia: Rising external headwinds likely to dampen region’s trade growth

Amid increasing external headwinds, recent indicators are pointing towards a growth moderation in several of the large East Asian economies. In the third quarter of 2018, China’s GDP growth eased to 6.5 per cent, weighed down by a slower expansion in industrial production and fixed asset investment. While export performance has remained solid, there are signs that the imposition of tariffs may have a more material impact on the Chinese economy in the coming months. In September, China’s manufacturing PMI weakened, as new export orders and business confidence declined. The manufacturing employment index also contracted, indicating that more firms were laying off workers than hiring. Meanwhile, persistently high stock market volatility and uncertainty may dampen sentiments, weighing on consumer spending and investment, although the recent stock market losses are unlikely to generate large negative wealth effects, given that household participation in financial markets is relatively limited.

For several other economies in the region, leading indicators suggest slower trade activity going forward. In September, new export orders contracted in Indonesia, the Republic of Korea, the Philippines, and Taiwan Province of China. A further escalation of trade tensions between the United States and China could significantly disrupt global and regional value networks, with adverse implications on trade in the region.

South Asia: Growth recovery in Sri Lanka is slower than previously anticipated

Sri Lanka’s economy experienced a visible slowdown in 2017, with GDP growth of 3.3 per cent. In 2018, GDP growth is gradually recovering, due to the rebound of the agricultural sector after severe weather-related disruptions in the previous year. Yet, the pace of the recovery has been slower than anticipated, particularly due to the weak performance of investment demand. In 2018, GDP growth is estimated to remain under 4.0 per cent. Several short-term indicators point towards a softer path before the economy can resume its potential growth, above 5.0 per cent. For example, the manufacturing PMI has exhibited a visible downward trend throughout 2018. In September, the index recorded its weakest expansion since last April. In addition, the stock market has also deteriorated steadily. In early October, the Colombo All-Share Index, which tracks all listed companies, dropped to its lowest level in more than four years. In addition, recent political turbulences will likely affect business sentiment even further, while at the same time creating difficulties in the implementation of reforms. Against this backdrop, economic activity in Sri Lanka is projected to remain below its potential in the near term.

Meanwhile, the economic outlook in India remains favourable, underpinned by robust private consumption, a gradually more supportive fiscal stance and benefits from previous reforms. In the second quarter of 2018 the Indian economy expanded by 8.2 per cent year-on year—the highest pace since the first quarter of 2016—after expanding by 7.7 per cent in the first quarter. The recent evolution of short-term leading economic indicators confirms this positive outlook. Since mid-2017, business confidence indices have steadily risen, reaching record highs in the second quarter of 2018. While more volatile, PMI indices have also tended to strengthen throughout 2018. In this context, the Indian economy is projected to continue expanding at an annual rate of about 7.5 per cent, in the near term.

Western Asia: Economic indicators suggest grave challenges ahead

On 15th of October, the Jaber-Nassib border crossing between Jordan and Syria was reopened. Closed since April 2015 due to intensified armed violence, the reopening of the border crossing enables the economies in the region to resume overland trade through Jordan. This has been widely expected to support stronger economic activity in the region. However, financial market reaction to this news has been subdued, reflecting the difficult economic reality. The stock market index of the Damascus Security Exchange (DSE), rose only by 0.5 per cent the next day. The DSE index rose by 93 per cent during the period between September 2017 to March 2018. Since March, however, the DSE index has stayed in a range between 5500 and 6400 with no indication of a further leap. Representative stock market indices for Jordan (Amman Stock Exchange General Index) and for Lebanon (BLOM Stock Index) have continued their recent declining trends. Both Lebanon and Jordan are weighed down by urgently-needed structural fiscal adjustments, which hamper growth prospects amid rising consumer inflation. Moreover, despite having stabilised the exchange rate, the Syrian economy still faces severe foreign exchange constraints. Rising reconstruction activities in Syria may quickly deteriorate the balance-of-payments conditions unless economic sanctions are lifted.

Latin America and the Caribbean: Argentina headed towards deep recession, Brazil facing slower-than-expected recovery

Latin America’s economic recovery has stalled, dragged down by weakening activity in some of the region’s largest countries. The latest data indicate that Argentina is headed towards a deep recession. Industrial production contracted by 5.6 per cent year on year in August, following a 5.7 per cent decline in July. While sales in the domestic market fell sharply, the downturn was somewhat cushioned by an improved performance of export sectors. Exports were supported by a weaker peso and a surge in beef demand from China, which seeks to replace imports from the United States amid the ongoing trade conflict. Business and consumer confidence indicators in Argentina also deteriorated significantly in recent months. As year-on-year inflation reached 40.5 per cent in September, consumer confidence fell to the lowest level in more than four years. Given a marked decline in households’ purchasing power and a severe fiscal austerity program, Argentina is projected to see GDP decline in both 2018 and 2019.

In Brazil, industrial production grew by only 2 per cent in August compared to a year ago. Several leading indicators have declined in recent months and economic uncertainty remains high. In addition, with inflationary pressures starting to build, the central bank hinted at potential interest rate hikes. As a result, Brazil will likely continue to recover only slowly from the deep recession of 2014–16.

In Chile and Peru, the latest data on industrial production and business confidence suggest that economic activity is moderating, following buoyant growth in the first half of 2018. While copper and zinc prices have trended lower in recent months, robust private consumption and investment are projected to support healthy GDP growth in 2019.

Follow Us