World Economic Situation and Prospects Monthly Briefing No. 87

- Commodity price rout dampens regional growth prospects

- China emphasized the need to improve productivity through policies on the supply side of the economy

- Bank of Japan adopts a negative interest rate

Global issues

Commodity price further dampens growth prospects

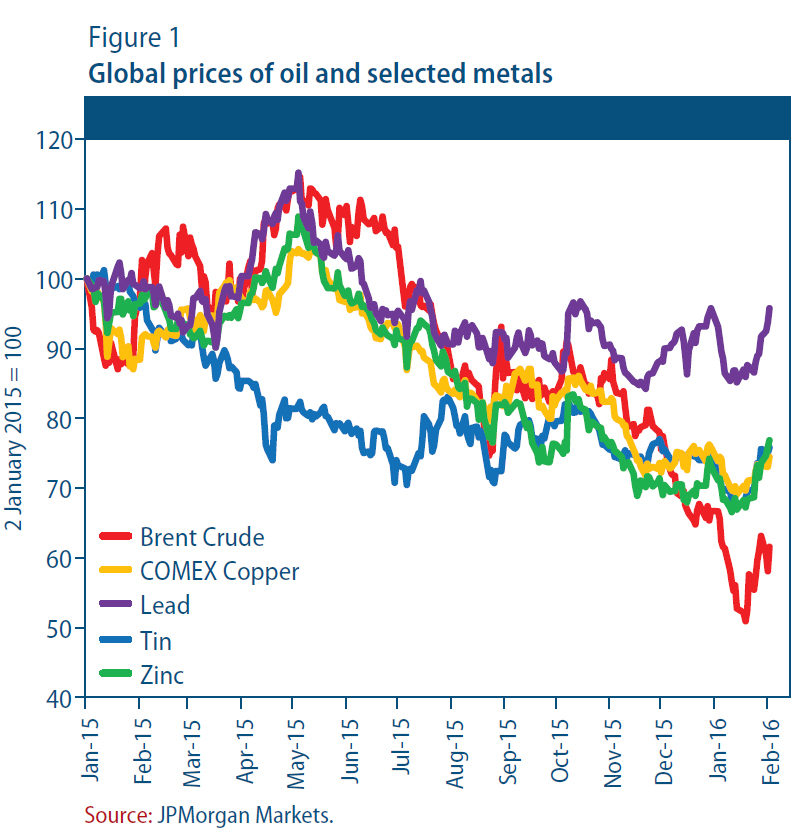

The World Economic Situation and Prospects 2016 (WESP 2016), launched in December 2015, foresaw only tepid growth in the global economy in 2016. A tumultuous start to the year in global commodity and financial markets has deteriorated the outlook further. The price of Brent crude has been below $50 per barrel (pb) since mid-October 2015, and plunged to its lowest level since 2003, at just $27 pb, in mid-January 2016. The price of several industrial metals, notably copper, lead, tin and zinc, have followed a similar trajectory (figure 1). Global stock markets also fell sharply in January, with most major indices dropping below the lowest levels reached in 2015. At the same time, several emerging-market currencies have further depreciated against the dollar since the start of the year, with the steepest falls observed in Brazil, Colombia, Kazakhstan, Mexico, Poland, the Russian Federation and South Africa.

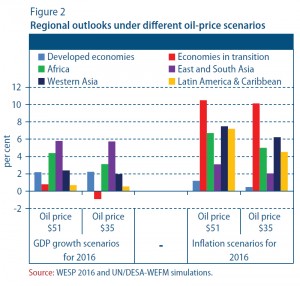

The dramatic decline in the price of oil will clearly change regional economic prospects. The impact on individual economies depends on a wide range of factors, such as the share of national income derived from oil production; the oil intensity of production and consumption; the share of government revenue derived from fuel taxes and the oil sector; the share of government expenditure on energy subsidies; the pass-through of the international oil price to the domestic price level; as well as the cyclical position of the economy before the shock. Regional sensitivities reported in the WESP 2016 suggest that if the oil price remains at an average of $35 pb throughout 2016, the Commonwealth of Independent States (CIS) economies will remain in recession this year, while gross domestic product (GDP) growth in Africa could slow compared to the modest growth of 3.7 per cent achieved in 2015 (figure 2). GDP growth in Western Asia would also slow by at least 0.5 percentage points relative to a scenario with an average oil price of $51 pb. The impacts could be even larger if the loss of oil revenue prompts significant cuts in government spending, as explored in World Employment and Social Outlook: Trends 2016. The impact on fuel-importing economies would be more modest, as the positive effects of low oil prices on real income would at least partially offset lost exports to the fuel-exporting economies.

The 30 per cent drop in oil prices since October 2015 also increases the likelihood of deflation in many countries this year. In general, prices in developed economies tend to be less sensitive to the oil price than in developing economies, largely reflecting the level and structure of taxation on energy usage. Nonetheless, given the low inflation environment already prevailing, average inflation in the developed economies would be expected to fall to close to zero in 2016 if the oil price hovers at about $35 pb throughout the year, exacerbating deflationary expectation. In several East Asian countries, including China, Philippines, Indonesia and Thailand, consumer price sensitivity to the oil price has historically been relatively strong, suggesting that inflation is likely to remain at low levels in the region this year.

China to pursue “supply-side” reform

China's annual high-level Central Economic Work Conference, held at end-December 2015, underscored the need for “supply-side” reforms as a top economic policy priority for 2016. The proposed supply-side reforms aim to improve the quality of supply-side factors—including their productivity and ability to adjust to shifting demand—and to correct their misallocation. In order to achieve these objectives, the

Conference identified five key priorities:

- reduce overcapacity;

- reduce excess property inventories;

- reduce leverage;

- reduce costs for businesses;

- address weak growth areas (see table 1)

Improving overall economic productivity is high on the economic policy agenda, addressing the prevalence of the so-called zombie corporations, i.e. inefficient, persistently loss-making corporations. As these zombie corporations are predominantly state-owned, the effort to strengthen state-owned enterprises (SOE) reform is expected to intensify. There are, however, uncertainties regarding the scope and extent of SOE reforms in the near term. The SOE reform plan introduced in September 2015 included relatively small and incremental changes, such as minority stake sales, stock market listings, and adjustments to the appointment process for senior management.

Fiscal policy will play a bigger role in supporting growth in 2016 relative to previous years, as corporate tax cuts and a gradual increase in the fiscal deficit are envisaged. The authorities maintain that the current prudent monetary policy should remain flexible, so that it will create appropriate monetary conditions for structural reforms and lower financing costs. Some deleveraging is also envisaged to address financial risks, and the Chinese authorities discussed the need to tackle corporate debt, given the steep rise in corporate borrowing since 2008, whereas the Conference in previous years had focused mainly on local government.

The Chinese authorities have indicated that a minimum of 6.5 per cent of annual average growth for 2016-2020 would be needed to achieve the government target of doubling China's GDP and per capita income during 2010-2020. This is consistent with projections reported in the WESP 2016.

Developed economies

United States of America: slower growth due to external factors and stock adjustment

According to the advanced estimate from the United States Bureau of Economic Analysis, the annualized GDP growth in the fourth quarter of 2015 was only 0.7 per cent, a significant slowdown from the 3.9 per cent and 2.0 per cent reached in the second and third quarters, respectively. The declines in net exports and inventory stock-building—both of which subtracted half a percentage point from the growth rate—largely explain the sharp reduction in the fourth-quarter growth. Reduced investment in business structures and equipment also contributed to the slowdown. Private consumption, government expenditure and residential investment remained relatively strong, however, and allowed total domestic final sales to increase by 1.6 per cent.

The housing sector has continued to expand. On average, the number of housing starts has increased by more than 12 per cent per year over the past three years. For 2015 as a whole, residential investment increased by 8.7 per cent and contributed one eighth of total GDP growth. House prices have also recovered steadily from the trough in 2011-2012. According to certain indicators, house prices regained their pre-crisis peak during late 2015.

Japan: central bank adopted negative interest rate amid challenging environment

On 29 January 2016, the Bank of Japan (BoJ) decided to lower its policy rate to -0.1 per cent under a three-tier framework, while maintaining the pace of expansion of the monetary base at 80 trillion yen per year. The BoJ thus joins the European Central Bank (ECB) and the central banks of Denmark, Sweden and Switzerland in adopting a negative interest rate, citing the need to support business confidence and prevent inflation expectations from weakening further as key factors underpinning the decision.

In December 2015, export volumes deviated from an increasing trend and dropped from the previous month by more than three per cent. Correspondingly, industrial production declined again, and for 2015 as a whole, industrial production was about 1 per cent lower than in 2014. Nonetheless, the slowly improving trend in employment has generally endured, and employment increased by 0.4 per cent in 2015.

European Union: turning the page on austerity

During 2010-2014, fiscal policy in the European Union (EU) was characterized by procyclical austerity, as countries struggled to comply with commitments under the Stability and Growth Pact and the harsh economic adjustment programmes imposed on countries that required financial assistance. The pressure to consolidate has now eased significantly in most countries. Portugal's Prime Minister has announced plans to reverse several measures implemented as part of the austerity programme. Ireland squeezed in €1.5 billion (0.8 per cent of GDP) as supplementary fiscal spending in the final weeks of 2015, and has introduced an additional €1.5 billion in stimulus measures for 2016. Budget plans in Spain remain clouded by political uncertainty, but election results point to growing public discontent with austerity. While Greece remains subject to a stringent economic adjustment programme, the net impact of the programme in 2016, in conjunction with targeted funding mobilized by the European Commission to support investment, is expected to be broadly neutral. In aggregate, the fiscal stance in the EU is expected to be marginally expansionary in 2016. However, Croatia, Cyprus, France, Greece, Spain and the United Kingdom of Great Britain and Northern Ireland are expected to remain under Excessive Deficit Procedures this year and face pressure to cut spending. Finland, despite the economy's extended recession, has also elected to pursue a tighter fiscal stance in 2016.

Poland's debt rating downgraded

The downgrading of Poland's sovereign debt rating by Standard and Poor's in mid-January, combined with a negative outlook, has led to a noticeable weakening of the Polish currency. The perceived credibility of monetary policy and the possibility of a large fiscal expansion contributed to the change in rating. This downgrade has led to an increase in the risk premium on Polish debt, although other rating agencies such as Fitch retained their assessment, citing strong economic growth and a stable banking system.

Economies in transition

CIS economies coping with the new realities

Preliminary growth figures for 2015 reflect a slowdown in the CIS area, broadly in line with the estimates incorporated in the WESP 2016. The GDP estimate of the Russian Federation showed a decline of 3.7 per cent, while growth slowed to 1.1 per cent in the energy-exporting economies of Azerbaijan and Kazakhstan as energy revenues contracted. By contrast, Uzbekistan reported 8.0 per cent GDP growth. In South-Eastern Europe, Serbia reported GDP growth of 0.8 per cent in 2015, as an 8.0 per cent increase in industrial production and surge in construction helped to offset the sharp contraction in agricultural output due to drought conditions.

Lower oil prices continue to exert pressure on the CIS currencies, public finances, and the banking sectors (which are exposed to currency mismatches). The inflation outlook for 2016 has been revised upward by a number of central banks, as currency depreciations outweigh the impact of lower commodity prices. The Central Bank of the Russian Federation committed to an inflation target of 4 per cent in 2017, while keeping its policy rate on hold. The Government of the Russian Federation is considering further budget cuts in the range of 5 to 10 per cent of planned expenditure. In parallel, the Government aims to implement an anti-crisis plan worth about $9.8 billion. The Government of Azerbaijan has initiated talks with the International Monetary Fund and the World Bank. In late January, Standard and Poor's rating agency downgraded the country's debt to “junk” status. Thanks to the relatively low public debt level and the assets of the sovereign wealth fund (amounting to about 90 per cent of GDP), Azerbaijan may be able to avoid the assistance of multilateral lenders despite the downgrade. As the currency remains under pressure, the Government introduced partial capital controls in mid-January and closed several banks not meeting the capital adequacy requirements.

Developing economies

Africa: Kenya's economy registers accelerating growth

In Nigeria, foreign direct investment inflows declined by 27 per cent to $3.4 billion in 2015, owing to the decline in oil prices and political uncertainty. Lower revenues from the oil sector make it more difficult for the Government to substitute the decline in private funding with public expenditure, especially to fund infrastructure projects. As a result, the Government has requested an emergency loan of $3.5 billion from the World Bank and the African Development Bank. In Kenya, GDP growth reached 5.8 per cent in the third quarter of 2015, up from 5.0 per cent and 5.6 per cent in the first two quarters. The expansion encompassed all sectors of the economy and was driven in particular by infrastructure investment and the service sector. The only sector with a negative performance was hotels and restaurants, which saw a contraction of 2.3 per cent in light of fewer tourist arrivals. At the same time, inflation in Kenya reached a multi-month high of 8.0 per cent in December on the back of higher food prices and excise duty increases. In Botswana, the economy contracted by 3.5 per cent in the third quarter of 2015, driven by a sharp decline in the production of diamonds, copper and nickel. By contrast, non-mining economic activity held up relatively well, with only a slight decline in growth to 3.6 per cent, thanks to a strong expansion of the government sector.

East Asia: East Asian stock markets slumped in January

Bourses across East Asia slumped in January, along with the sell-off in equity markets worldwide. The Shanghai Stock Exchange lost over 20 per cent of its value during the month—the biggest monthly loss in seven years. The newly introduced “circuit-breaker” mechanism—one that would trigger an automatic trading pause when the CSI 300 Index drops by 5 per cent, or a whole-day halt in the case of a 7 per cent drop—apparently exacerbated the sell-off by investors, rather than limiting it as intended. Investors in the Chinese stock market are predominately retail investors, which also made it more difficult for such a circuit-breaker mechanism to be effective. The mechanism was suspended just days after its introduction.

Stock exchanges in Hong Kong Special Administrative Region of China, Japan, Republic of Korea, Singapore and Taiwan Province of China saw their values decline between 6 to 16 per cent during the first three weeks of January. Towards the end of the month, an overall pattern of recovery emerged across the region's main stock markets, with the exception of the Shanghai and Shenzhen stock exchanges. The upward (if modest) trend has been supported by the expectation of furthering easing by the ECB and the BoJ. Nevertheless, all major stock exchanges in the region closed the month with overall monthly losses.

South Asia: The Islamic Republic of Iran regains access to the global financial and economic system

In mid-January, most economic and financial sanctions against the Islamic Republic of Iran were lifted after the International Atomic Energy Agency found the country in compliance with the terms of the internationally agreed Joint Comprehensive Plan of Action. This will allow the country to regain access to the global financial system. According to the head of the central bank, the Islamic Republic of Iran will receive about $32 billion of unfrozen overseas assets. Companies in developed economies (especially from Europe) have begun to vigorously seek investment and business opportunities in the Islamic Republic of Iran, which has a large and diversified economy, a young population, and is rich in energy and mineral resources. A number of large deals with European companies have already been announced. The Iranian plan to boost oil production by an additional 500,000 barrels per day has further exacerbated the global oil glut, adding to the downward pressure on oil prices.

In a bid to stimulate economic activity, Bangladesh's central bank lowered its main policy rate by 50 basis points to 6.75 per cent. The cut is the first change in almost three years and comes at a time of limited inflationary pressures. Over the past year, consumer price inflation has remained stable, hovering between 6.0 and

6.5 per cent.

Western Asia: negative spillover effects of low oil prices

on the banking sector

Amid current low oil-price environment, banks in the region increasingly face lower profits and rising liquidity constraints. In oil-exporting economies, like Saudi Arabia and the United Arab Emirates, lower bank profits are mostly the result of decreasing government deposits at commercial banks, as the authorities try to repair their public finances. A decline in demand for private loans is also observed, triggered by lower oil prices. Higher interest rates linked to the United States Federal Reserve rate hike in December can also be expected to weigh on bank lending this year. In oil-importing economies, the financial sector also faces some pressures due to spillover effects from the regional outlook. For example, the Lebanese stock market, which is heavily weighted towards bank stocks, declined by 5 per cent in 2015. Slowing remittances from the Gulf countries have reduced non-resident deposits at banks, which are a crucial source of bank funding.

Investment spending is expected to suffer from a weakening banking sector and the announced government spending cuts in the region. To offset oil revenue losses, Governments are increasingly relying on public-private partnerships and foreign funding. The Qatari Government just closed a $5.5 billion five-year syndicated loan with a consortium of mostly foreign banks, in order to lift the fiscal financing burden of local banks.

Latin America and the Caribbean: foreign reserves in Mexico fall sharply

The international reserves in Mexico have fallen noticeably in recent months, as the central bank continued its intervention programme in the foreign-exchange market in an attempt to moderate the depreciation pressures. In January, foreign reserves fell to $174 billion, which is about 11 per cent lower than the level of reserves in January 2015, the largest decline in the last two decades. The central bank initiated its foreign-exchange interventions in early 2015 with dollar auctions of $52 million per day, which was later expanded to $200 million per day. The programme also encompasses an additional $200 million auction in case the peso falls more than 1.0 per cent in a day. However, the central bank's interventions appear to be ineffective so far, as the Mexican peso depreciated by 16 per cent against the dollar in 2015, the highest annual fall since 2008, and it has depreciated about 6 per cent so far in 2016. In January, the peso reached a new record-low of more than 18.0 per dollar. The external economic conditions are playing a key role in fueling the depreciation pressures, including the decline of oil prices, which cast a shadow on investment prospects in the Mexican energy sector, and the recent heightened instabilities in global financial markets. The sharp depreciation of the peso, however, is expected to boost manufacturing exports and to increase the purchasing power of remittances, providing additional support for growth in the Mexican economy through 2016.

Follow Us