World Economic Situation and Prospects: July 2023 Briefing, No. 173

Supply chains for microchips

Supply chains for microchips

Increasing use of microchips in daily life

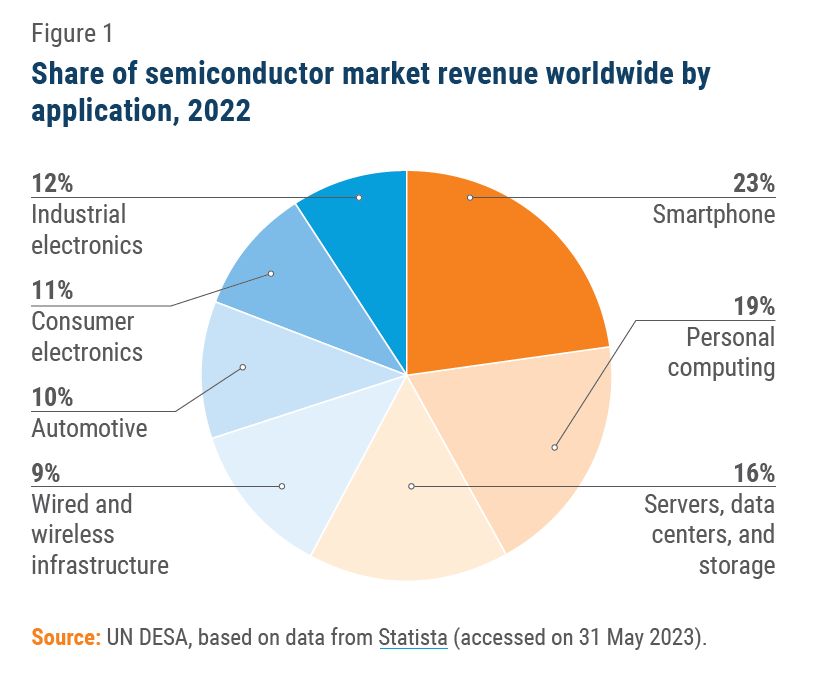

Microchips, sometimes also referred to as semiconductors, are central to modern electronics. They are virtually ubiquitous in people’s daily lives, being present in smartphones and other consumer products, industrial machines and military systems (figure 1). Leibovici and Dunn (2021), based on industrial information in the United States, estimate that about 25 per cent of 226 manufacturing industries use semiconductors as a direct input; these industries represent 39 per cent of all manufacturing output. These rates are expected to increase quickly over time. More importantly, microchips are essential for countries to transit to a green economy. They are used in a wide range of renewable energy technologies, including solar panels and wind turbines. They can be also used in a variety of other applications that contribute to the green transition, such as energy-efficient lighting, smart homes and buildings, and electric vehicles. Microchips are even more critical to enable technologies of the future, including artificial intelligence, quantum computing and advanced wireless networks.

Microchip supply shortages: recent trends and impacts

Microchip supply shortages: recent trends and impacts

Microchip supply shortages have become a major challenge to the world economy in recent years. Researchers have estimated that 169 industries faced a microchip supply crunch, including automobiles, computers, medical equipment and other electronic devices (Howley, 2021). The shortages reflected the continued supply and demand imbalances. During the pandemic, demand for electronic goods surged with increases in telework and home schooling. The supply of microchips, however, lagged amid worldwide shutdowns of factories and staff shortages. In 2022, the war in Ukraine further threatened the supply of a few materials for microchip manufacturing. For instance, only a handful of companies in Ukraine supply neon, a critical gas in the lithography process of microchip manufacturing. Extreme weather events also caused temporary supply disruptions. For instance, in 2021, Taiwan Province of China – home to the majority of global chip production – experienced its worst drought in the past half century, which affected its microchip exports, as large amounts of water are needed to cool manufacturing equipment.

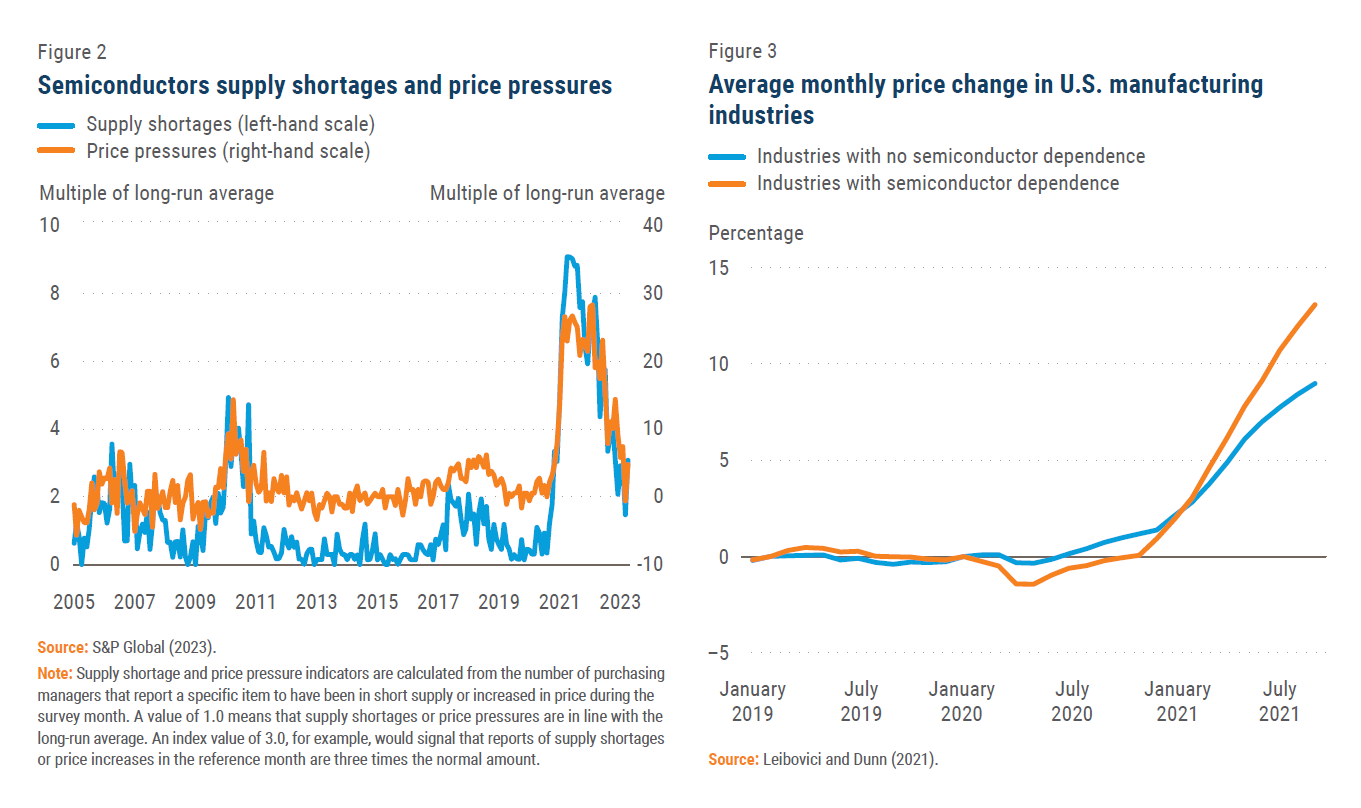

Microchip shortages can have macroeconomic implications, for example, through potentially slowing growth and fuelling inflation. During 2021 and 2022, the number of purchasing managers that reported price increases of semiconductors was 20 to 30 times higher than the normal trend (figure 2). In the United States, while the gap in average monthly price changes between semiconductor-dependent and non-semiconductor-dependent industries had remained close to zero through 2019, it rose to about 4 percentage points by September 2021 (Leibovici and Dunn, 2021) (figure 3). In 2021, consumers needed to pay 4 per cent more on average for a new car worldwide compared with a year ago, reflecting higher chip prices.

The microchip shortage also separately affected production and revenue of related industries. As microchips are widely used in manufactured goods, shortages delayed the production of cars, home appliances, consumer electronics and so on. The average lead time for equipment manufacturers increased from 3-4 months to 10-12 months in 2022 (Kaur, 2022). The automotive sector was particularly hard hit during the pandemic, as people’s increased preference for individual mobility led to a faster-than-expected recovery in the demand for cars while chip shortages forced automakers to cut production. The automotive industry is estimated to have lost more than $200 billion in 2021 due to microchip shortages (Ramachandran, 2022).

Global microchips supply began to improve in 2022 and the improvement has continued into 2023. In April 2023, reports of semiconductor shortages were three times the normal amount, much lower than the peak of about nine times in mid-2021 (figure 2). A recent survey suggests that the chip industry could be shifting from a constrained environment, where it was difficult to get products, to one of abundance driven by excess inventory and weakened demand in 2023 amid global economic weakness (KPMG and GSA, 2023).

However, the stabilization of the global chip supply has happened unevenly across use-sectors. Industrial products, smartphones and other consumer electronics have seen relief from chip shortages, thanks to increased production capacity and easing demand. Nevertheless, advanced computing products, such as those used in 5G and electric and autonomous vehicles, could continue facing difficulties in getting the chips they need (Hoecker and others, 2022; Shein, 2023).

Microchip supply chain and its structural weaknesses

The demand for microchips is expected to grow given the continuing digital transformation of every aspect of life. Tools such as ChatGPT fuels demand for chips with stronger computing power. Demand for artificial intelligence chips is forecast to double from 2020 to 2025 (Statista, 2023). Growth of supply, however, may not be able to keep up. Rapp and Möbert (2022) estimate that global microchip supply shortages could exceed $200 billion in market value by 2030.

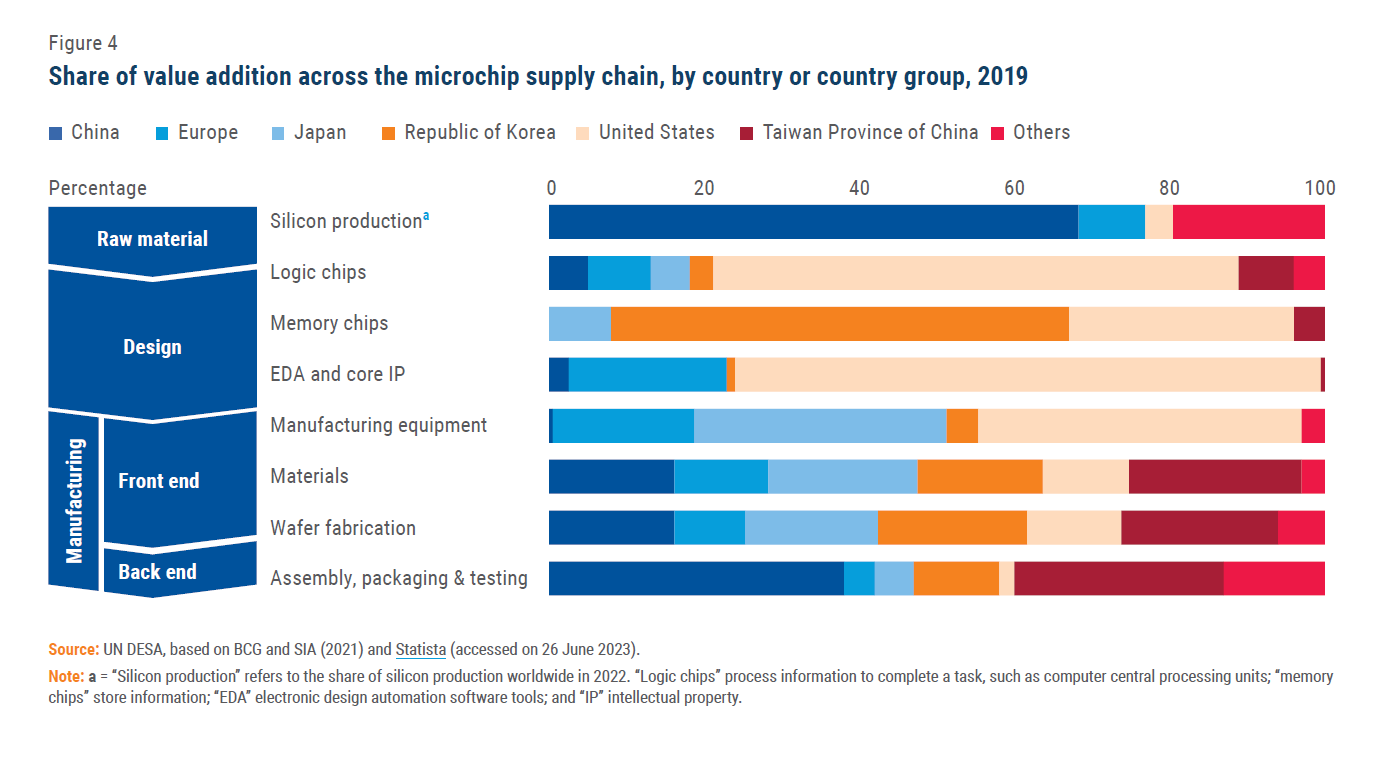

More importantly, the microchip supply chain is subject to structural weaknesses. Figure 4 illustrates in a simplified way the exceptional degree of global interconnectedness of the microchip supply chain. In particular, the United States enjoys a clear advantage in intellectual property and chip design. The European Union and Japan play major roles in providing equipment and materials for manufacturing. The Republic of Korea has advantages in memory chip design, manufacturing, assembly and testing. China is a major exporter of silicon (the raw material to produce chips), one of the major manufacturers of mature microchips, and a leader in assembly, packaging and testing. Taiwan Province of China accounts for a substantive share of chip manufacturing. Each of these supply chain components is critical and most are highly concentrated in a few places. Such a high geographical concentration means acute events, such as COVID-19 lockdowns and extreme weather events in a few critical places, could easily disrupt the entire supply chain. Moreover, the chip industry is at the forefront of geopolitical competition. The supply chain has become vulnerable to geopolitical fragmentation and tensions between countries.

Policy responses: developed countries

The strategic importance of microchips to economic competitiveness and even national security has prompted countries worldwide to focus on the resilience of their supply chain. Many developed countries have planned to increase investments and build partnerships to diversify and re-shore the microchip supply chain, particularly microchips manufacturing. The United States, for instance, introduced the CHIPS and Science Act 2022, which will direct $280 billion over the next 10 years into microchip research and development (R&D), manufacturing and human resources, as well as into tax credit incentives for firms. The European Parliament and the EU Member States agreed on the European Chips Act in April 2023 aiming to contribute public investments of €43 billion (about $47 billion) in the sector and double its global market share to 20 per cent by 2030. In May 2023, the United Kingdom announced a new 20-year plan (the “National Semiconductor Strategy”) – including government investment of up to £1 billion (approximately $1.24 billion) in the next decade – to improve access to infrastructure, power more R&D and facilitate greater international cooperation.

Developed countries in Asia, such as Japan and the Republic of Korea, have also adopted national strategies and increased fiscal spending to improve national capacity across the microchip supply chain. Japan’s “Strategy for Semiconductors and the Digital Industry” in 2021, which is set to be updated in 2023, aims to strengthen semiconductor design and technological development and secure domestic production with next-generation manufacturing. The Republic of Korea’s “K-Semiconductor Strategy”, announced in May 2021, and “Special Act to Protect and Foster National High-Tech Strategic Industry”, that went into effect in August 2022, provide microchip firms with investments, tax benefits, regulatory concessions, and other preferential treatment to spur more R&D and increase production output.

At the same time, developed economies are strengthening collaboration with strategic partners. The United States proposed the “Chip 4 Alliance” initiative in March 2022, as part of wider plans to enhance the security and resilience of semiconductor supply chains. The initiative includes Japan, Republic of Korea and Taiwan Province of China, all of which excel in certain segments of the global microchip supply chain. In March 2023, the United States and India signed a memorandum of understanding (MoU) to establish a semiconductor supply chain and innovation partnership. Japan and the United Kingdom announced in May 2023 to establish a semiconductor partnership to deliver new R&D cooperation, skills exchange, and improve the resilience of the semiconductor supply chain for both countries.

Policy responses: developing countries

Developing countries that are heavily engaged in the microchip global supply chain have also been reassessing their positions across the supply chain. Many have introduced new national industrial policies and increased investment to enhance R&D and manufacturing capacity within their borders. In China, for instance, the development of the semiconductor industry has long been a priority. As part of the “Made in China 2025” national strategy, issued in 2015, China aimed to improve capacity across the semiconductor supply chain. The supply chain improvement gained renewed urgency over the past years because of trade tensions with the United States and the COVID-19 pandemic. In 2020, China issued 40 policy measures to provide preferential tax, investment and financing support as well as talent recruitment support for firms that focus on integrated circuit design, software design, material supplies, and microchips manufacturing, assembly and testing. The country’s 14th Five-Year (2021-2025) Plan highlighted “self-controllable, secure and highly efficient” supply chains, and identified semiconductors and integrated circuits as key areas for technological breakthroughs.

Southeast Asian countries, home to chip production since the 1970s, have been also taking actions to move up the value chain in recent years. For instance, Malaysia’s most recent five-year plan, which ends in 2025, expects the chip industry to contribute to about 8 per cent of the country’s GDP as it shifts its focus to higher-value products and attracts investment in design and research. In 2021, Thailand introduced incentives, including tax exemptions, to draw investment, as well as R&D, to its semiconductor and electronics industries. Indonesia has identified the semiconductor sector as a priority industry that is generally eligible for tax incentives and investment facilities (Ernst & Young, 2022).

India is also now seeking to expand microchip manufacturing, despite having focused earlier on software related know-how. In December 2021, the Government announced support of $30 billion to develop the semiconductor industry in the country and encourage investments across the semiconductor value chain.

Developing countries outside of Asia – despite their more limited role in the global microchip supply chains – are looking for opportunities to enhance their participation, especially as developed countries are reshaping the supply chains. Brazil and Mexico, for instance, could benefit from the U.S. reshoring plans due to their geographic proximity. In 2021, Brazil extended credit incentives for microchip manufacturers in the “Program to Support Technological Development of the Semiconductor Industry”. Several African countries are also taking actions. For instance, Kenya launched the country’s first semiconductor production unit in December 2022, aiming to strengthen its position as a manufacturing hub in East Africa and lead the continent’s technological development (Mwangi and Wamutitu, 2022).

Potential impacts of recent policies and persistent challenges

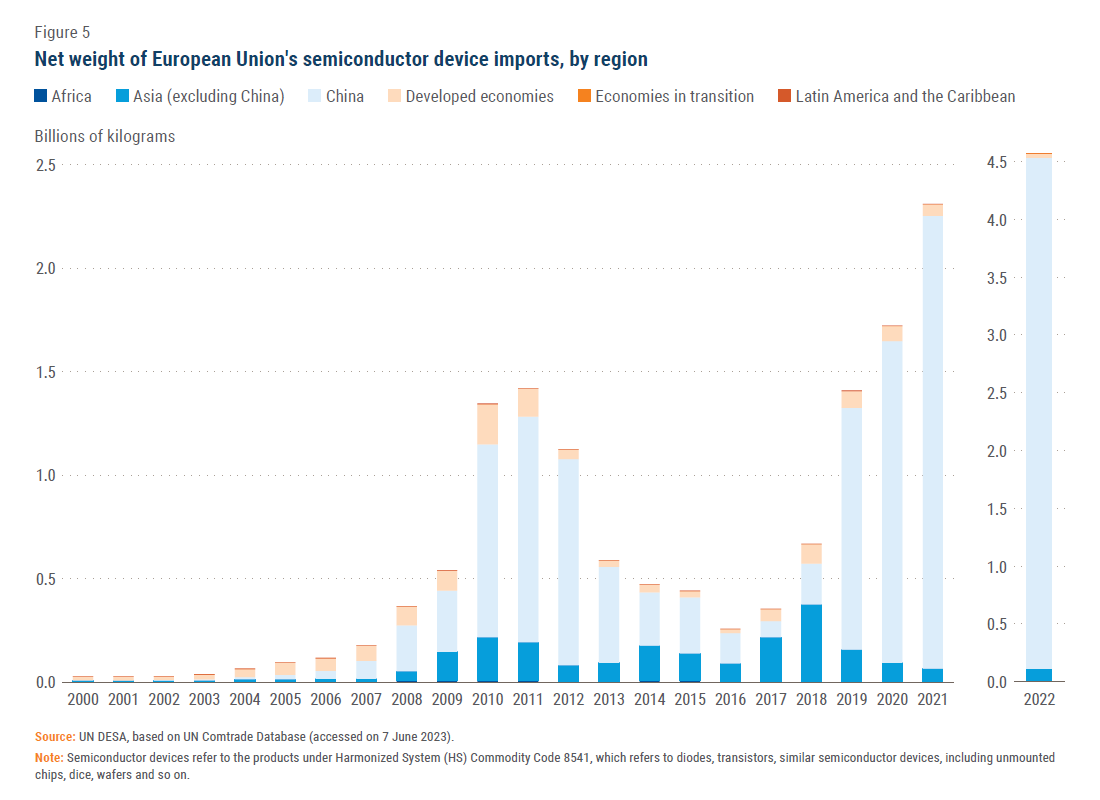

Despite recent policy announcements and committed new investments, strengthening the resilience of microchips supply chains (including developed countries’ plans of reshoring or nearshoring), will likely take years to materialize. According to Intel, the construction of a semiconductor factory alone could take about three years. This is consistent with the data which does not show that microchip supply chain diversification is already taking place for developed countries. For the European Union, for instance, the majority of its semiconductor devices have been imported from Asia for over a decade, particularly from China; such a pattern has continued in the past few years (figure 5).

Meanwhile, the race to develop new supply chains – although it could enhance resilience – may prolong challenges and even create new ones for the microchip industry. For one, increased competition, along with geopolitical tensions, could lead to export controls, limited access to certain technologies, materials, machines, products and markets. This could consequently hinder economies of scale as well as the industry’s R&D levels and production capacity.

Moreover, although recent policies may attract domestic and foreign investment in the short run, in the long-term these policies collectively could increase the costs of microchip products. BCG and SIA (2021) estimates that developing “self-sufficient” local supply chains would require at least $1 trillion incremental upfront investment, which could result in a 35 to 65 per cent overall increase in semiconductor prices and ultimately higher costs of electronic devices for consumers.

Furthermore, talent shortages could constrain efforts to enhance the resilience of the microchips supply chain. Semiconductor talent was in short supply in 2022, as labour shortages have prevailed in developed countries since the pandemic. The race to localize semiconductor supply chains and countries seeking breakthroughs in innovation could intensify the global competition for talent, and exacerbate the chip talent and skill shortage issues. Deloitte (2023) estimates that the semiconductor workforce – estimated at more than 2 million direct semiconductor employees worldwide in 2021 – will need to grow by more than 1 million skilled workers by 2030 to support the industry’s growth. To ensure available skilled talent to fill the new jobs, governments could adopt various policies, including investing further in expanding science and engineering education, providing training in specific technical areas through partnerships with universities and industries, and supporting mobility of skills.

As countries build new supply chains and enhance microchip production capacity, one separate unintended consequence could be on the climate. Microchip manufacturing causes significant emissions, responsible for as much CO2 emissions as half of U.S. households (Mohr and others, 2023). If without efforts to reduce greenhouse gas (GHG) emissions along the entire supply chains, chip makers’ carbon footprint could widen significantly in the next few years. That said, a few major chip manufacturers have announced ambitions to decarbonize. For instance, Intel commits to net-zero GHG emissions in its global operations by 2040. Taiwan Semiconductor Manufacturing Company (TSMC) pledged to reach net zero emissions by 2050. Countries could also step-up regulatory efforts to encourage chip producers to record and minimize emissions across their supply chain.

Conclusion

Microchips are ubiquitous in people’s daily lives and the world economy, and their centrality is set to grow further. The shortages during recent crises have underscored their importance and encouraged countries to diversify supply chains and enhance resilience. Both developed and developing countries have taken actions, including committing new public spending, providing incentives to attract private domestic and international investments, and strengthening collaboration with strategic partners.

While such diversification could take years to materialize, the race to develop new supply chains could come with their own set of challenges. Losing economies of scale, skill shortages, and potential protectionism could all increase costs in the short to medium term. Moreover, there are opportunity costs to investing in the industry, as well as mitigating its adverse environmental impacts. In the longer term, greater competition, innovation across the supply chain, new jobs, and improved resilience could – if realised – result in some benefits at the global level.

Follow Us