World Economic Situation And Prospects: July 2017 Briefing, No. 104

- Modest improvement in the growth outlook for emerging economies but risks remain

- Diplomatic rift poses economic challenges for Qatar

- Fragile and uneven economic recovery in Africa and South America

Global issues

Modest improvement in the growth outlook for emerging economies but risks remain

The global economy has continued to strengthen on a gradual path. In Europe and the United States of America, the near-term growth outlook remains favourable, supported by a moderate recovery in investment and better labour market conditions. At the same time, economic activity in several large emerging economies has strengthened, amid a rebound in international trade and relatively higher global commodity prices. Notably, the growth performance in China and India has remained robust, while Argentina, Brazil and the Russian Federation have exited recessions. Buoyed by strong investor sentiments, financial market conditions have improved, as reflected by high equity prices and low bond yields. Meanwhile, market volatility, as measured by the Chicago Board Options Exchange (CBOE) VIX index dropped to a 23-year low in June.

While these developments are indicative of an improving outlook, the global economy still faces significant uncertainties and downside risks, including potentially excessive financial market optimism, complacency on the part of policymakers and a rise in protectionism.

Emerging economies, in particular, remain highly susceptible to shocks, given persistent structural weaknesses and uncertainty in the international policy environment. Low commodity prices have continued to weigh on investment growth in the large commodity exporters, including Brazil, Chile and the Russian Federation. Meanwhile, high political uncertainty is weighing on investor sentiments in countries such as Brazil, South Africa and Turkey. Importantly, many emerging economies, including China and the Republic of Korea are facing growing financial sector vulnerabilities, mainly arising from elevated debt levels.

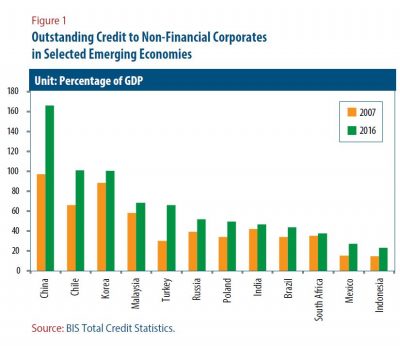

Against this backdrop, monetary policy shifts are taking place in developed countries. In June 2017, the United States Federal Reserve (Fed) raised its key policy rate for the fourth time since December 2015, and announced plans to gradually reduce the size of its balance sheet. While stronger prospects for growth in the United States will benefit the rest of the world through improved aggregate demand, rising interest rates by the Fed pose a downside risk to the emerging economies. Specifically, as global financial conditions tighten, corporates will face higher borrowing costs, which will weigh on their capacity increase investment. For the emerging economies, high corporate leverage not only constrains capital expenditure, but also poses a risk to financial stability. Recent data from the Bank for International Settlements (BIS) showed that corporate debt of non-financial emerging market corporates increased from 60.7 per cent of Gross Domestic Product (GDP) in 2008 to 102.1 per cent of GDP in 2016. Among the major emerging economies, China has seen the sharpest increase in corporate debt in the past few years, with debt levels standing at over 160 per cent of GDP in 2016 (figure 1). As the Fed normalizes its monetary policy, there is a risk of an abrupt tightening of financing conditions, forcing emerging economies’ corporates to deleverage sharply.

The fragility of corporate balance sheets in several emerging economies has also been exacerbated by the rise in dollar-denominated debt post-crisis. Given that an increase in interest rates in the United States will support the continued broad-based strength of the dollar, this raises debt servicing costs and currency mismatch risks for corporates as well as governments that have high dollar debt burden. Of note, the Federal Reserve Economic Data (FRED) Trade Weighed US Dollar Index has appreciated by almost 20 per cent since early 2014. For many emerging economies, this has contributed to a rise in gross external debt as a share of GDP over the past two years (figure 2). A potential further appreciation of the dollar will increase the risk of corporate distress and raise fiscal sustainability concerns. This will in turn exert further downward pressure on domestic currencies, generating a vicious cycle of increasing debt servicing costs and weakening exchange rates.

The renewed decline in global crude oil prices further adds to the vulnerabilities in several commodity-dependent economies, particularly in Africa, Latin America and Western Asia. In late June, the Brent spot price fell to a seven-month low of below $45 per barrel, due mainly to oversupply concerns despite renewed commitments by the Organization of the Petroleum Exporting Countries (OPEC) and the Russian Federation to extend production cuts to March 2018. Although prices have since recovered modestly, the persistent weakness in commodity-related revenue will adversely affect the fiscal and corporate sectors in many economies. This may in turn have negative spillovers to the banking sector as banks face a deterioration in asset quality, amid an increase in the risk of defaults.

In this environment, policymakers need to remain focused on efforts to mitigate rising financial imbalances and to enhance resilience to shocks. Macro-prudential tools, such as loan-to-value and debt service-to-income ratios can curb unsustainable credit growth in targeted sectors, including households and the property sector. Meanwhile, the use of liquidity operations to smooth excessive financial market volatility can help to ensure undisrupted market intermediation. Importantly, the emerging economies need to progress further on structural reforms. Countries with more diversified economic structures and strong financial systems, healthy fiscal and external positions, low debt levels and ample policy buffers are better prepared to withstand periods of sudden adjustments in global financial markets.

In this environment, policymakers need to remain focused on efforts to mitigate rising financial imbalances and to enhance resilience to shocks. Macro-prudential tools, such as loan-to-value and debt service-to-income ratios can curb unsustainable credit growth in targeted sectors, including households and the property sector. Meanwhile, the use of liquidity operations to smooth excessive financial market volatility can help to ensure undisrupted market intermediation. Importantly, the emerging economies need to progress further on structural reforms. Countries with more diversified economic structures and strong financial systems, healthy fiscal and external positions, low debt levels and ample policy buffers are better prepared to withstand periods of sudden adjustments in global financial markets.

Developed economies

Housing markets speed up in North America and Australia

House prices in the United States are nearly as high today as they were at the peak of the housing market bubble in 2006-07, which ultimately acted as one of the triggers of the Global Financial Crisis of 2008-09. In Australia and Canada, housing markets were relatively unscathed by the Global Financial Crisis, and house prices in both countries have continued to rise steadily nationwide, with particularly strong gains in cities such as Melbourne, Sydney and Toronto. At the national level, average house prices have risen by 15 per cent in Canada and more than 50 per cent in Australia since 2007. While high house prices by themselves do not necessarily signal the formation of an unsustainable bubble, they do require policymakers to carefully monitor developments in the fundamentals underpinning the housing market.

In the United States, underlying fundamentals are more closely aligned with house prices than they were in 2006-07. The level of investment in housing remains nearly 15 per cent below pre-crisis peaks, despite being a driving force behind economic growth in recent quarters; household indebtedness has been on the rise since 2013, but also remains below previous peaks; and mortgage delinquency rates continue to decline. Mortgage interest rates remain low in the United States, but should be closely monitored in the context of rising house prices. If house prices continue to exhibit strong growth as interest rates rise, this may become a cause for concern.

In Canada, housing investment has also been a strong force behind economic growth for the last three years. While mortgage arrears remain very low, the outstanding stock of residential mortgages has doubled in size since 2006, meriting close monitoring by policymakers going forward. In Australia, investment in housing has declined since late 2016, which suggests that the peak of the housing market may have turned. The Reserve Bank of Australia has warned that some borrowers, especially those with lower income, may struggle to meet mortgage payments when interest rates rise from their prevailing low rates. While adjustment in the housing market may unfold gradually, there is a risk that Australia will experience an abrupt housing market adjustment, driving a sharp slowdown in economic growth.

Europe: Solid growth in the EU, while inflation weighs on household consumption in the UK

The European Union (EU) economy continued to expand at a solid pace in the first quarter, with GDP growing by 0.6 per cent compared to the previous quarter. On a year-on-year basis, growth was relatively stable at 2.1 per cent. The range of quarter-on-quarter growth rates reached from a high of 1.7 per cent in Romania, 1.6 per cent in Latvia and 1.5 per cent in Slovenia to a low of 0.2 per cent in the United Kingdom. The strongest contributing factors were fixed investment and household consumption, which rose by 1.4 per cent and 0.4 per cent, respectively. Amid the start of negotiations over the conditions for exit from the EU, the weaker spots in the United Kingdom’s economic performance are moving to the foreground. Nominal wage growth slowed to a multi-year low of 1.7 per cent for the three months to April, constituting a decline in wages by 0.6 per cent in real terms. Household purchasing power has been increasingly crimped by inflation, which reached 2.9 per cent in May, due mainly to the weakening of the pound in the wake of the decision to leave the EU. The impact of this, in turn, has been reflected in retail sales figures, which fell by 1.2 per cent in May compared to the previous month.

The recent dynamics of housing prices in EU members from Eastern Europe, along with the surge in outstanding mortgage loans in a number of those countries, raises concerns of another housing market bubble emerging in the region. Strong housing demand is explained by low interest rates and favourable labour market conditions. As a precautionary measure, the central banks in the Czech Republic and Slovakia have tightened their respective banking sector regulations to maintain stability of the financial system.

Economies in transition

CIS: EU sanctions against the Russian Federation extended further

The external economic environment for the Russian Federation remains challenging. In late June, the EU extended its sanctions on the Russian Federation for another 6 months, until January 2018. These sanctions include the curtailing of access of a number of state-owned Russian companies and banks to long-term financing in the EU’s capital markets, as well as restricting access to oil exploration and production technology. Further tightening of similar sanctions is under consideration in the United States. In a reciprocal move, the Government of the Russian Federation extended its food import ban on the EU and most of the Organisation for Economic Co-operation and Development (OECD) countries until the end of 2018. The combined effect of low oil prices and prolonged economic sanctions has led to a weakening of the rouble. Although the Russian economy has largely adapted to the sanctions, which were introduced in 2014, they nevertheless dampen consumer and business confidence. In mid-June, the central bank of the Russian Federation trimmed its key policy rate by a further 25 basis points to 9 per cent as inflation remains close to target. Meanwhile, net immigration to the country remains high and outward remittances to the smaller Commonwealth of Independent States (CIS) economies surged in the first quarter, supported by the noticeably stronger rouble compared to a year ago.

The external environment has also created challenges for the energy exporters in the region. In June, the Government of Turkmenistan responded to falling natural gas revenues by largely abandoning the free provisioning of electricity, gas and water to the population, while in Uzbekistan the central bank hiked its policy rate from 9 per cent to 14 per cent due to perceived inflationary risks and in preparation for a transition to a floating exchange rate. In contrast, in the European part of the CIS, policy rates were cut by 100 basis points in Belarus and Moldova to 12 and 8 per cent respectively, despite the uptick in inflation in Moldova.

In Ukraine, a massive cyber-attack in late June disrupted the functioning of the financial sector and prompted the National Bank of Ukraine to intervene in the foreign exchange market in order to smooth heightened currency volatility.

In South-Eastern Europe, the economy of the former Yugoslav Republic of Macedonia stagnated in the first quarter. Although domestic demand strengthened moderately, driven in part by stronger government capital expenditure, net exports contributed negatively to growth.

Developing economies

Africa: Growth momentum diverges across regions

South Africa and Nigeria, two of the largest African economies, are in recession with bleak prospects in the near-term. South Africa officially entered a recession in the first quarter of 2017, with output shrinking at a seasonally adjusted annualized rate of 0.7 per cent, following a 0.3 per cent contraction in the previous quarter. All economic sectors contracted, with the exception of the mining and agriculture sectors. From the expenditure side, household consumption and government spending declined, while investment grew modestly. Rising political and policy uncertainties are weighing on the economy. In addition, investor uncertainty has increased in the mining sector, amid the proposed introduction of new shareholder regulations.

Better prospects are seen in other regions. Economies in East Africa, including Ethiopia and the United Republic of Tanzania, are growing at about 6 per cent annually. However, there has been limited positive spillover effects to Somalia and South Sudan. In West Africa, Senegal and Ghana also show good prospects with strong first quarter growth. Encouraging growth is observed across North Africa as well. The latest GDP data released by Egypt, Morocco and Tunisia indicate an accelerated recovery, supported by solid improvement in the agricultural and tourism sectors.

East Asia: Exports continue to improve but momentum likely to moderate

Several major economies in East Asia continued to experience a recovery in export growth into the second quarter of 2017. In April and May, export growth gained momentum in China, Indonesia, the Philippines, the Republic of Korea and Thailand. Other economies in the region, including Malaysia and Taiwan Province of China, also continued to see a robust expansion in overseas shipments. For most of these countries, exports were mainly driven by double-digit growth in shipments of electronics, in particular semiconductors and consumer electronic products. For Thailand, Malaysia, Indonesia and the Philippines, trade performance was also supported by higher exports of primary commodities. By export market, the region saw an increase in demand from the United States and Europe, amid strengthening growth and labour market conditions in these economies.

Looking ahead, leading indicators, including Manufacturing Purchasing Managers’ Indices and export orders, suggest further expansion in the region’s export growth. The momentum, however, is likely to moderate going into the second half of the year, weighed down by a dissipating base effect and stabilizing commodity prices. In addition, the trade outlook remains subject to high uncertainty in the external environment, in particular the risk of more restrictive trade policies in the United States.

South Asia: Nepal’s economic growth is picking up visibly

Following the devastating effects from the earthquake in 2015, economic growth in Nepal has remained subdued for the most part, owing to the loss of productive capacity, delays in reconstruction and unfavourable monsoon seasons that affected the agricultural sector. Trade disruptions and restrained foreign investment inflows have also weighed on the recovery. However, in recent months, several indicators are pointing towards a pick-up in economic activity. Official estimates show that GDP growth is expected to strengthen to 6.9 per cent in the fiscal year (FY)2017, the highest figure in more than two decades, after reaching just 0.1 per cent in FY2015 and 3.0 per cent in FY2016. The growth revival is driven by the robust expansion of the agricultural and manufacturing sectors. In particular, agricultural output is benefiting from a good monsoon, improving conditions on the supply of inputs and better irrigation facilities. The manufacturing sector is expected to expand by almost 10 per cent in FY2017, amid a steady supply of energy. Meanwhile, reconstruction efforts have also gained pace recently, especially large public and private infrastructure projects. The government also unveiled its annual budget for FY2018, which includes a substantial outlay of financial resources that will be channelled to local governments. Nevertheless, the Nepalese economy continues to face the challenge of maintaining high and inclusive growth rates, amid major structural difficulties, including infrastructure gaps, productive capacity problems and political uncertainties.

Western Asia: Economic impact of the regional diplomatic rift

On 5 June, Bahrain, Egypt, Saudi Arabia and the United Arab Emirates severed diplomatic ties with Qatar. Shortly after, the Comoros, Maldives, Mauritania, Senegal, and Yemen followed suit. The economic impact on Qatar was observed immediately. Business ties and transport links were also suspended, hampering cross-border flows of goods, services, and capital in and out of Qatar. Of note, 86 per cent of Qatar’s exports comprise of natural gas and crude oil, destined to East Asian countries. While no significant impact on Qatar’s exports has been observed yet, imports and finance were noticeably impacted. As Qatar had imported a substantial amount of vegetables and dairy products through the land route from Saudi Arabia, the country had to resort to costlier alternatives, including importing goods from Iran and Turkey by air. The three-month Qatar Interbank Offered Rate, a representative indicator of domestic financing costs, rose by 50 basis points in June, reflecting liquidity pressures on the Qatari banking system. As a result, Qatar is expected to experience moderate cost-push inflation, beyond the present forecast of 2.4 per cent for 2017. Considering the high level of foreign assets held by its sovereign wealth fund and central bank, Qatar is expected to weather the pressures on trade and finance. However, if the present situation persists, it is likely to damage economic relations between the member countries of the Gulf Cooperation Council (GCC) which has been gearing up for the GCC economic integration.

Latin America and the Caribbean: Recent data for South America present a mixed picture

Recently released macroeconomic data for South America present a mixed picture, indicating a fragile and uneven recovery in the sub-region. Argentina recorded stronger-than-expected growth in the first quarter of 2017 as fixed investment, government consumption and private consumption expanded firmly. Compared to the previous three months, GDP grew by 1.1 per cent, the third consecutive quarter of positive growth and the fastest pace in almost two years. At the same time, however, the unemployment rate increased by 1.6 percentage points to 9.2 per cent in the first quarter. Against a backdrop of elevated unemployment, stubbornly high inflation and ongoing fiscal austerity, consumer confidence dropped considerably in June, raising concerns over the strength of the recovery going forward. Meanwhile, Ecuador’s economy expanded by 2.6 per cent on a year-on-year basis in the first quarter, amid robust growth in exports and private consumption. On a quarter-on-quarter basis, however, GDP contracted by 0.6 per cent due to a slump in construction spending and weak government expenditure. In Chile, year-on-year growth slowed to 0.1 per cent in the first quarter, the weakest pace since 2009. Economic output was weighed down by a six-week strike at the world’s largest copper mine. As a result, total copper production fell by 14.4 per cent and net exports declined sharply. However, robust domestic demand has bolstered hopes that growth will pick up over the course of the year.

Follow Us