World Economic Situation And Prospects: December 2021 Briefing, No. 156

Reversing the setback to global poverty—will a commodity super-cycle help?

The COVID-19 pandemic wreaked twin economic and social crises that resulted in the first increase in global poverty in decades. The number of people living in extreme poverty—at $1.90 per day globally—is estimated to have escalated by 10 per cent in 2020 and remains at the highest level in almost a decade (figure 1). Island economies registered among the highest increases in both number and share of poor population (Cabo Verde, Jamaica, Madagascar) as well as some landlocked economies (Chad, Ethiopia, Uganda). Prior to the pandemic, poverty was projected to decrease by 2 per cent globally, in line with a slow pace of decline since 2014. Since the pandemic, the path to ending extreme poverty by 2030 as set out in Sustainable Development Goal 1.1, has become bumpy.

The COVID-19 pandemic wreaked twin economic and social crises that resulted in the first increase in global poverty in decades. The number of people living in extreme poverty—at $1.90 per day globally—is estimated to have escalated by 10 per cent in 2020 and remains at the highest level in almost a decade (figure 1). Island economies registered among the highest increases in both number and share of poor population (Cabo Verde, Jamaica, Madagascar) as well as some landlocked economies (Chad, Ethiopia, Uganda). Prior to the pandemic, poverty was projected to decrease by 2 per cent globally, in line with a slow pace of decline since 2014. Since the pandemic, the path to ending extreme poverty by 2030 as set out in Sustainable Development Goal 1.1, has become bumpy.

With the world now further away from achieving Goal 1 of the 2030 Agenda for Sustainable Development, decreasing this human tragedy will require greatly accelerated progress in reducing poverty. However, the ongoing global economic recovery is estimated to lead to an only gradual improvement in global poverty, and this is subject to short-term growth prospects that may be relatively optimistic, given that countries are facing immense challenges, uncertainties and risks ahead. There is also substantial heterogeneity in the world, with the number of extreme poor increasing in some regions, such as Africa.

Prolonged elevated levels of global poverty would have adverse implications in the fight against the pandemic and its variants as poverty is arguably the greatest risk factor for acquiring and succumbing to disease worldwide. High poverty levels also pose major risks to domestic stability given poverty and insecurity are mutually reinforcing. These factors, in turn, may affect international migration as they are important as push factors for individuals with the means to migrate to countries with higher productivity levels and, currently, labour shortages.

Prolonged elevated levels of global poverty would have adverse implications in the fight against the pandemic and its variants as poverty is arguably the greatest risk factor for acquiring and succumbing to disease worldwide. High poverty levels also pose major risks to domestic stability given poverty and insecurity are mutually reinforcing. These factors, in turn, may affect international migration as they are important as push factors for individuals with the means to migrate to countries with higher productivity levels and, currently, labour shortages.

Remarkable progress was made in reducing poverty and inequality during the 2000–14 commodity boom. In Africa, per capita income increased 2.5 per cent on average per year between 2000 and 2014, life expectancy significantly increased, under-five mortality declined, and access to education improved. In Latin America, the progress reflected real labour income gains for lower-skilled workers, especially in services, with a smaller but positive role for government cash transfer programmes, such as in Bolivia and Brazil.

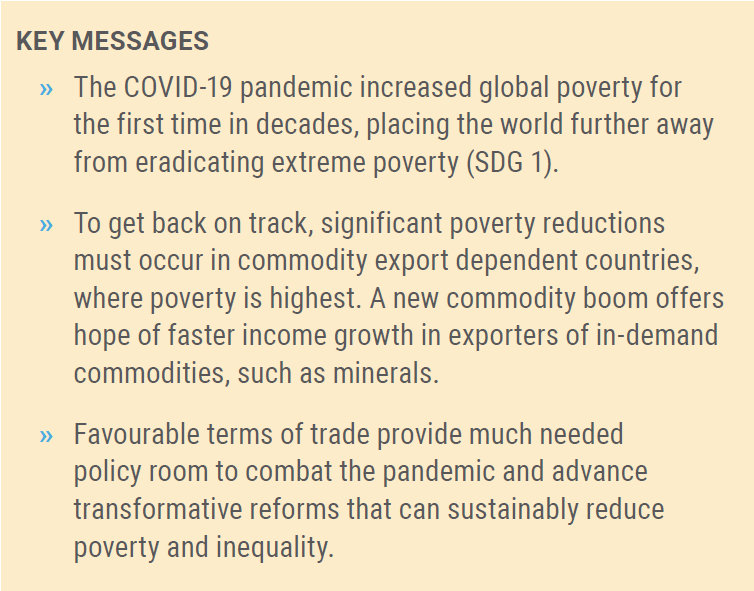

However, global poverty eradication decelerated significantly with the commodity price crash of 2014-2015, when international prices nearly halved for energy commodities and decreased substantially for non-energy commodities and precious metals, remaining weak thereafter. The crash in prices dealt a severe blow to households, firms and governments in commodity exporters, i.e., countries where more than 60 per cent of total merchandise exports are composed of commodities. As a result, the pace of global poverty reduction decelerated abruptly from about 8 per cent per year prior to the crash to just 1-2 per cent per year since then, reflecting the fact that most of the extreme poor live in commodity export-dependent countries (figure 2). While an average 6 per cent of people live on less than $1.90 a day in non-commodity exporting countries, the ratio increases to 22 per cent in commodity exporting countries.

Due to a lack of fiscal space, namely the inability to issue more debt, the capacity of governments in commodity exporting developing countries to support private savings during the pandemic crisis was relatively limited and this, in turn, likely contributed to the collapse in aggregate demand and rise in poverty. Now, countries have started to reduce policy support, with central banks tightening monetary policy in the face of rising inflation and governments unwinding extraordinary fiscal support to establish fiscal prudence, especially after a steep increase to elevated public debt levels (e.g., Bolivia, Paraguay, Sudan, Zambia). Public indebtedness is nevertheless projected to remain above pre-pandemic levels in the next few years. Elevated debt will likely limit governments’ ability to address the longer-term legacies of the pandemic when economic recoveries gain traction.

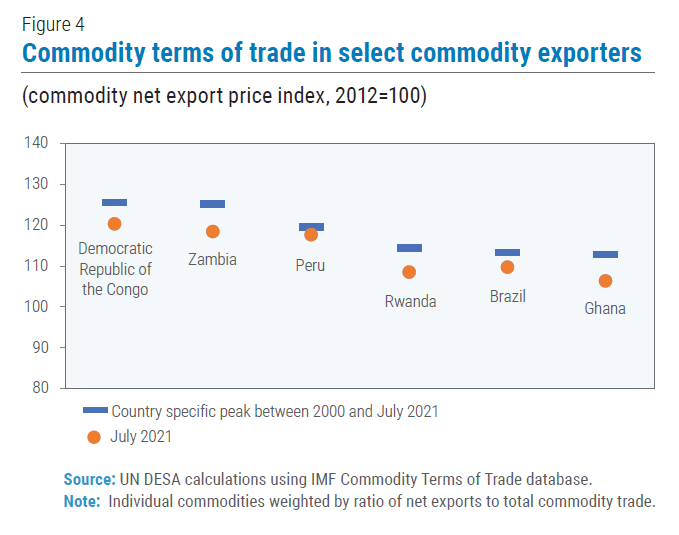

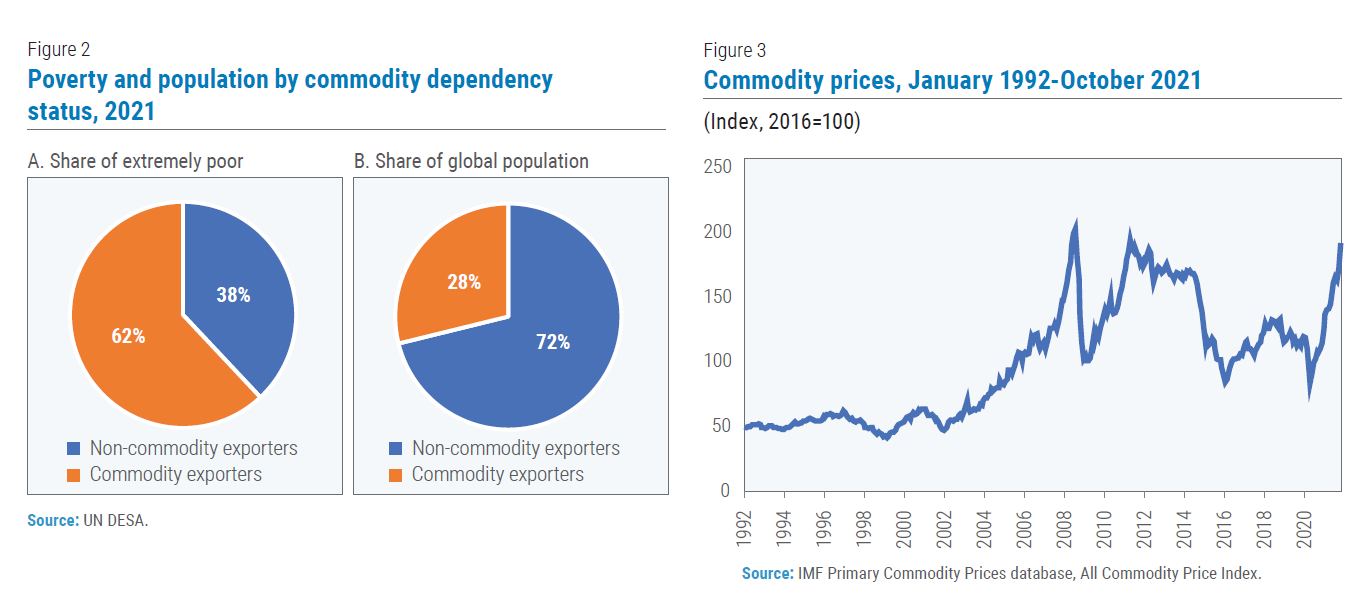

Reversing the setback to poverty dealt by the pandemic will be very challenging for commodity exporters. However, resurgent commodity prices have brought hope for income growth and poverty reduction in resource-dependent economies. The prices of several commodities, such as oil, copper, lumber and corn are at multi-year highs. The Bloomberg Commodity Index, a broad measure of prices, has advanced 66 per cent since April 2020, while the IMF Global Price Index of All Commodities is close to all-time highs (figure 3). Commodity terms of trade—the ratio between a country’s commodity export and import prices—are close to the highest level since the 2000s for several African and Latin American commodity exporters (figure 4). In Peru, commodity terms of trade are currently the most favourable since 1980 due to record copper and other metals prices.

Should commodity prices remain elevated, the production of commodities could once again rise and attract workers, increasing wages and employment, with possible externalities to other sectors, including some of the most impacted by the pandemic. Sectors with higher labour intensity (in particular, low skilled), such as agriculture and minerals, usually benefit comparatively more from positive price shocks, as opposed to energy and hydrocarbons production, which typically employ more skilled labour and capital-intensive technology.

Should commodity prices remain elevated, the production of commodities could once again rise and attract workers, increasing wages and employment, with possible externalities to other sectors, including some of the most impacted by the pandemic. Sectors with higher labour intensity (in particular, low skilled), such as agriculture and minerals, usually benefit comparatively more from positive price shocks, as opposed to energy and hydrocarbons production, which typically employ more skilled labour and capital-intensive technology.

There are reasons to believe a prolonged period of higher commodity prices could occur. Low interest rates, fiscal stimulus across developed economies and pent-up demand coupled with excess savings after a prolonged lockdown period are boosting a growing global economy, which would support commodity prices. Chinese imports of commodities, such as aluminium and corn, increased significantly this year, contributing to high commodity price indexes.

Furthermore, developed economies are projected to grow more strongly than in recent years amid rising business investment in physical capital and multi-year government infrastructure projects, such as in China, India, the European Union and the United States, among other countries. Such investments will consume large quantities of raw materials. Monetary support also continues to be robust as central bankers, including the Federal Reserve, are seen to continue mostly accommodative stances. This creates less pressure to dial back monetary stimulus and raise interest rates, which bodes well for commodities demand.

Investments in low-carbon technologies may also support a boom in certain commodities by promoting higher consumption of metals and minerals. Electric cars require six times more mineral inputs than conventional cars, and wind energy plants contain nine times more minerals than gas-fired power plants. To meet the Paris Agreement goals, lithium demand is projected to increase by over 40 times by 2040, demand for graphite, cobalt and nickel should increase 20–25 times and copper demand is estimated to more than double. Prices for lithium are currently three times as high as at the beginning of the year and cobalt prices doubled. Transitioning to global net zero emissions could provide a $13 trillion windfall for producers of copper, nickel, cobalt and lithium over the next two decades.

Supply constraints may continue to contribute to high commodity prices for longer. Natural gas and coal prices have reached record highs amid supply shortages and rebounding demand for electricity. This indirectly impacts production of other commodities, including fertilizers and some metals. Additional price spikes may occur in the near-term due to very low inventories and persistent supply bottlenecks. With climate change progressing, adverse weather events, such as high summer temperatures, droughts and floods, continue to affect many commodity markets, having increased summer demand for electricity this year and reduced the supply of some agricultural commodities, hydroelectricity, metals and coal. Environmental concerns weigh on steel manufacturing as China curbs steel output. The pandemic has also adversely affected mining activity, for example in Latin America. The price of copper—the most widely used metal in energy generation, transmission infrastructure and energy storage, including green technologies—stands at its highest level since 2011 and may rise by half by 2025.

However, the current spike in commodity prices has noticeably different fundamentals compared to the previous years-long rally, in the 2000s. Back then, China was undergoing a process of rapid urbanization which fuelled a decades-long construction boom in the country and constituted a powerful growth engine for developing country commodity exporters. The current infrastructure spree, on the contrary, has already lost steam given increased wariness of over indebtedness in the Chinese construction sector and mounting primary commodity prices potentially feeding inflation, which has led to regulatory action. Iron ore prices more than halved since problems at China’s second largest property developer deepened in late July.

Energy markets have substantially changed as well, with shale drilling now presenting an option to quickly raise the production of oil and natural gas. A breakthrough in talks between the US and Iran to revive the 2015 nuclear deal could also mean more oil available to world markets, though the outcome of the talks is still uncertain. Moreover, new COVID-19 variants pose ongoing risks to the global economy and commodities markets for as long as substantial parts of the world remain unvaccinated. Oil prices crashed more than 10 per cent in late November as the new Omicron variant added to concerns over a projected inflated crude surplus early next year.

All in all, the commodity-wide price boom of the 2000s is unlikely to be replicated in the same terms. Given ongoing plans to decarbonize economies, fossil fuels face soft price trajectories in the medium- to long-term. Sector-specific sustained high prices may materialize though, especially in non-energy commodities. Importantly, sustained high global food and energy prices could slow growth in energy-importing countries and exacerbate food insecurity in low-income countries which would be detrimental to poverty eradication.

Favourable terms of trade alone will not be enough to lastingly reduce poverty and inequality in commodity exporters. Volatility in prices can easily transform windfalls into losses, as experienced by exporters in 2014. Elevated public debt in many countries will likely limit the fiscal space to undertake social transfer programmes, due to weak fiscal balances and the need to treat possible scarring effects. Going forward, the path to sustainable reductions in poverty faces critical challenges. It will require that countries confront COVID-19, while laying the groundwork for structural reforms and diversification away from commodities. Favourable commodity price tailwinds may give strength to a renewed reform drive to address enduring structural problems.

Enhancing tax revenue collection by making tax systems more progressive would be an important move to reduce inequality and generate fiscal space for pro-poor policies and support to inclusive economic growth. This could include measures such as limiting tax exemptions, lowering income thresholds to increase the high-income tax base, and fighting tax evasion and avoidance. In terms of fiscal expenditures, social transfers could be better targeted as, for example, high informality precludes many individuals from being eligible for benefits such as pensions. Moreover, given the accelerated pace of technology advances, it is necessary to prioritize the retraining of workers and access to quality education. Lastly, prioritizing economic diversification into non-resource sectors will be key to creating resilience to commodity price volatility, paying special attention to labour intensive industries, capable of generating the greatest reductions in poverty. Former commodity export- dependent countries, such as Malaysia, Republic of Korea and Singapore provide useful case studies of successful transitions. Adequately planned and appropriately sequenced reforms can help reduce the effects from the pandemic and recoup the poverty eradication gains of the last decade.

Follow Us