Active Staff

When and how to make changes to your plan

During the annual enrolment campaign, which is held annually from 1st June to 30th June or between annual enrolment campaigns following a qualifying event.

Between annual campaigns, you and your eligible dependants may be allowed to enroll in the UNHQ-administered health insurance plans only if at least one of the following qualifying events occurs and enrollment is completed within 31 days of such an occurrence through the Umoja employee self-service portal, for United Nations staff, or through the submission of a completed application form, for staff of the United Nations agencies participating in the United Nations health insurance programme:

- Date of staff member’s initial fixed-term or temporary appointment or re-appointment of at least three months’ duration with the organization

- Date of marriage or divorce of the staff member, if after the staff member’s entry on duty

- Date of birth or legal adoption, if after the staff member’s entry on duty

- Date of recognition by the organization in the case of stepchildren

- Loss of insurance coverage of a recognized spouse as a result of loss of employment (qualifying event is the date of the spouse’s loss of employment) beyond his or her control upon presentation of certification from the former employer of the period of insurance coverage while employed.

How to file a claim

Quick Facts:

- Member claims for reimbursement must always be submitted directly to the Third-Party Administrator (TPA) no later than two years (Aetna, Empire Blue cross and UN WWP) and no later than one year (Cigna Dental and UN MIP) from the date the medical or dental expense was incurred.

- In the case of disputed claims, the staff member must exhaust the multilevel appeal process with the third-party administrator before requesting assistance from the Health and Life Insurance Section. The process is indicated in the explanation of benefits or denial letter mailed to the participant by the third-party administrator and the applicable benefits booklet.

Where to submit your medical or dental claim:

As all claim processes are administered and processed by the respective TPAs, we kindly refer you to your TPA member page in order to access information related to the claim processes and requirements. Please find below a list of the member pages for the different plans available through the UN HLIS:

Member login for Empire Blue Cross PPO

How to avoid steep premium increases for health insurance

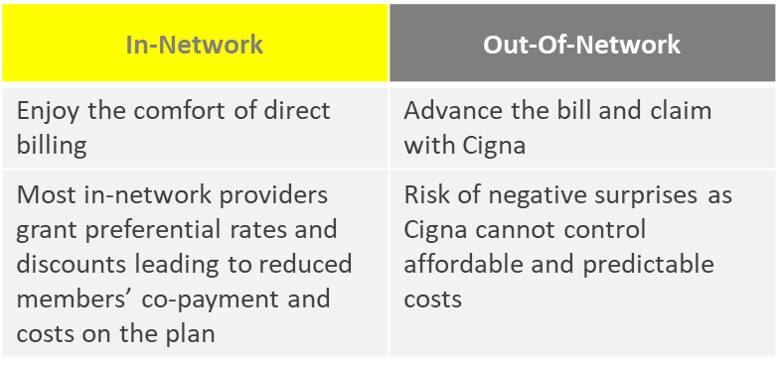

Visit in-network providers

The UNHQ-administered health insurance plans cover both in-network and out-of-network treatments, however, you are encouraged to visit in-network providers. With in-network providers, invoices will be settled directly with the respective Third-Party Administrator (TPA) and the total service cost, including your share of the payable amount, will be much lower. To find available in-network providers, please visit the Aetna, Empire Blue Cross, or Cigna webpages and kindly keep in mind the following points when searching and visiting providers:

- All covered specialists are available in-network, including physiotherapy

- Always ask the in-network provider if they are part of the network and if the invoice will be submitted as an in-network claim

- Always make sure to verify that the treating practitioner is indeed part of the network as some facilities offer both in-network and out-of-network caregivers

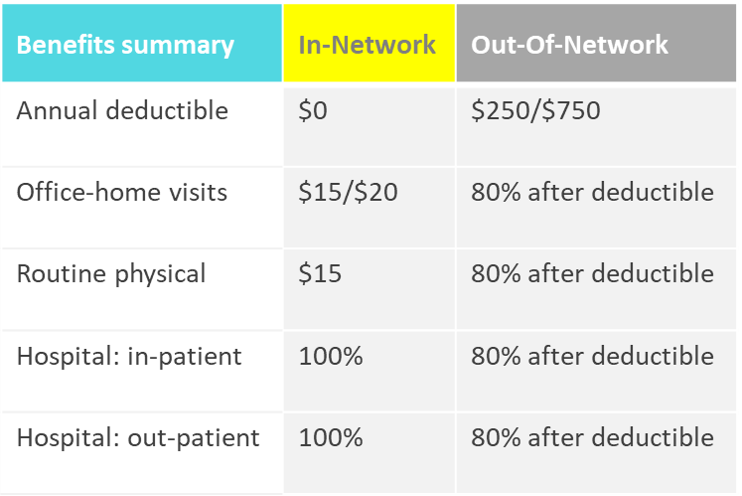

Coverage level of in- versus out of network care:

By visiting in-network providers, we cannot only avoid premium increases for all plan participants but also keep immediate out-of-pocket costs as low as possible.

Aetna PPO & Empire Blue Cross PPO

UN MIP and UN WWP

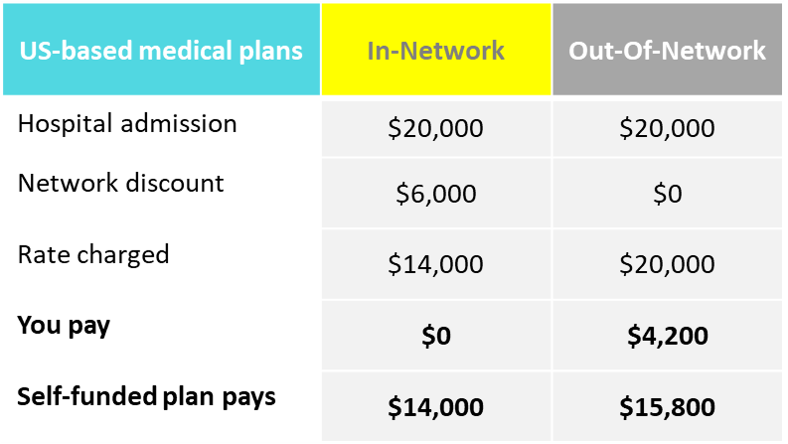

Example of in- versus out of network care

As another way to further support cost containment efforts for our plans, we strongly encourage you to obtain pre-authorization for in-patient hospitalization services and day surgery as failure to do so might result in higher premiums for all plan participants in the future.

Eliminate abuse and reject fraudulent claims

What is fraud?

In a nutshell, health insurance fraud is committed when a dishonest health care provider or plan participant intentionally submits, or causes someone else to submit, false or misleading information.

Why does it matter?

The promotion and maintenance of a culture of transparency, integrity and accountability is an integral part of UN principles, a requirement for combating fraud and corruption and a primary responsibility of staff at all levels.

However, health insurance fraud also has a significant impact on all plan participants. Although only a small percentage of health care providers and customers might commit fraud, all parties are disadvantaged in the long run as a result.

As UNHQ offers self-funded plans to all plan participants, fraud will result in higher premiums paid by all staff and retirees to cover the cost of the plan. In addition, fraudsters jeopardize access to cashless care for themselves, their loved ones and dear colleagues.

That is why it is important to know what to look out for when it comes to recognizing and reporting fraud, so that you can help prevent it. For more information, we kindly invite you to review our Fraud Awareness Campaign Brochure.

Interactive Elements

Guidance Material

FAQs

Does HLIS provide walk-in client services?

The UN Heath and Life Insurance Section is located on the 3rd floor of the FF building (304 E 45th St, New York, Ny 10017), where we welcome walk-in clients on Tuesday from 9 am to 12:30 pm and Thursday from 12:00 pm to 3:30 pm from May 2nd, 2023 onwards. Clients will be seen on a first come first serve basis. Please have your UN index number handy as you will need it to register with the UN HLIS Client Services.

How can retirees contact HLIS via mail?

To guarantee access to excellent client service, we are pleased to inform you that staff members can reach HLIS through email at hlis@un.org.

Why should I make every effort to select in-network providers?

Out-of-network providers charge higher costs and expose the patient to financial risk, since the plans will cap reimbursements based on a reasonable and customary rate and not the actual provider’s charges.

How are benefits coordinated if I am covered by two or more plans?

The United Nations health insurance programme does not reimburse the cost of services that have been or are expected to be reimbursed under another insurance, social security, or similar arrangement. For those participants covered by two or more plans, the United Nations health insurance programme coordinates benefits to ensure that the participant receives as much coverage as possible, but not in excess of expenses incurred. Plan participants covered under the United Nations health insurance programme are expected to advise the Third-Party Administrators when a claim can also be made against another insurer.

How can I help fighting fraud, waste, and abuse?

You are strongly encouraged to review your explanation of benefits or claim statement carefully to ensure that only services received from their provider are billed. Furthermore, it is the responsibility of the plan participants to report any questionable charges to the third-party administrators so that they can be investigated.

What does the UN HLIS do to audit claim fraud?

The insurance carriers are responsible for conducting monitoring and compliance exercises to highlight potential fraud. Those who engage in fraud will be reported to the authorities within the United Nations and the country in which the fraud occurred for appropriate action, such as non-payment of suspected fraudulent claims, suspension of any subsidy, termination of coverage, criminal investigation, and other administrative actions, including termination of employment, for any staff member involved.

What is the effective date of my insurance coverage?

- Appointment/re-appointment: provided that the application is made within the prescribed 31-day time frame, coverage for a staff member newly enrolled in a health insurance plan commences either on the first day of a qualifying contract (minimum of 3 months for health insurance) or on the first day of the following month.

- Change in payrolling office/agency: coverage commences either on the first day of a qualifying contract (minimum of 3 months for medical and dental insurance) or on the first day of the month following a qualifying contract.

- Qualifying live event: coverage commences on the first day the dependant becomes eligible (for example on the day a child is born or adopted or on the marriage date for a spouse) or on the termination date (for example on the divorce date).

- Annual Enrollment Campaign: coverage commences 1st July.

Can I make changes to my insurance coverage between annual enrollment campaigns?

Only if at least one of the following qualifying events occurs and enrollment is completed within 31 days of such an occurrence:

- Appointment or re-appointment

- Transfer or assignment to a new duty station

- Marriage or divorce of a staff member

- Marriage or full-time employment of a covered child

- Birth, legal adoption, or death

- Presentation of proof of loss of employment and loss of coverage by the staff member under a spouse’s health insurance plan

I am on special leave without pay and would like to add a dependant during the annual enrollment campaign. I intend to return from leave soon. What do I have to do?

The annual enrollment campaign commences on 1st June and ends on 30th June. Staff members on special leave without pay should make changes through the Umoja ESS Portal during the campaign.

Where can I find changes in plan benefits and yearly premium rates?

You can find specific details on benefits as well as premiums rates in the latest Information Circular on the Policy Documents page of this website.

My daughter will turn 21 this year. Will she still be covered?

Dependent children are eligible to be covered under the programme until the end of the calendar year in which they attain the age of 25, provided that they are not married or full-time employed.

Where can I find additional information about UNSMIS?

UNSMIS is administered by UNOG. More information can be found here: https://medical-insurance.unog.ch/about-unsmis.

Why does the UN Worldwide Plan apply annual deductibles of 200 USD and 600 USD for a family?

The MMBP (Major Medical Benefits Plan) covers 80% of the difference between the accepted costs and the amount reimbursed under the Basic Medical Benefits Plan. To be entitled to any reimbursement under the Major Medical Benefits Plan, a calendar year maximum co-payment of 200 USD per plan individual or 600 USD per family has to be reached.

Does the UN provide a term insurance scheme for the Group Life Insurance?

There is only one UN Group Life Insurance Plan. Kindly refer to ST/IC/2002/63 and ST/IC/2006/21.

Who is included in a "family"? Who can I include in my plan?

You can find specific details on eligible dependants in the IC uploaded on the Policy Documents Page of this website. Please note that only primary dependants (dependent children and a recognized spouse) are eligible.

I heard that there is a GA mandate of 50% cost sharing under UN WWP whereas this is not the case as evident in the salary slip. It states that the UN share is less than the employee share.

The 50% cost sharing is based on the total premium for all plan participants. If you earn more, you contribute more than 50%. If you earn less, you contribute less than 50%.

Why is the annual insured value in the UN Worldwide Plan capped at 250,000 USD per year? What am I supposed to do in unfortunate serious incidents where the costs may exceed that amount?

Financial hardship may apply in the event of serious illness.

If I want to replace one of my dependent children with a newborn child, what is the process? Can I assign more than 6 children as beneficiaries?

You will have to terminate the insurance for one child next June and enroll the newborn child in June or within 31 days after the birth of your child. There is no limit in the number of dependent children under the UNHQ-administered health insurance plans.

Can I enroll former dependants (now over 25) in the UNHQ-administered health insurance plans and pay the total premium?

No, this is not possible.

Does my son, currently studying in the US and 23 years of age, also qualify to be covered under the UN WWP? My duty station is Kenya.

The sole exception to the measures in the US arises in the case of a dependent child who attends school or university in the United States and is required by the educational institution to enroll in its health insurance plan. In such a case, the student’s health insurance plan at the school or university will be primary and the UN Worldwide Plan will be secondary.

How can I keep my MIP coverage after separation from the UN and to whom should I reach out to for this matter?

You cannot. The UNHQ-administered health insurance plans are only for active staff, former staff under specific conditions, and their eligible dependants.

As a single employee, is there an option to have secondary dependants (in this case, parents) insured too, by adding a premium?

No, only primary dependants (eligible spouses and children) can join the plan. Secondary dependants, such as parents and siblings are not allowed to enroll in a UNHQ-administered health insurance plan.

Is the deadline to make changes 31 days or 30 days?

The deadline to make changes is 31 days after the qualifying event.

When my adult son is no longer eligible to be covered at the end of December (he turns 25 this year), will the premium deducted from my pay be adjusted automatically?

Your adult son will be removed from the plan at the end of the year he becomes 25. However, your premium will only be adjusted if there is a difference in coverage level.

What would be the additional cost of having dental coverage in the US if I decide to stay covered under the Empire Blue Cross PPO plan as well?

An explanation on how to calculate premium contributions can be found in the footnote of Annex 1 of the Information Circular.

As a subscriber to Empire Blue Cross and Cigna Dental, do I need to do anything during the annual enrollment campaign?

Current subscribers do not have to do anything if they do not plan to switch plans or change the dependants covered under their policy.

If I am going to telecommute from Europe or other places outside of the US, can I switch to UN WWP?

The current policy requires that staff members duty stationed in the US have to enroll in US-based plans so you cannot enroll in the UN Worldwide plan if your duty station is New York.

Could you please explain the differences between US based plans?

Please refer to the Health Plan Pages on this website for a definition of US-based plans.

Is there any difference in my and my spouse’s coverage under the same plan? Are there different limits and thresholds?

No, there is no difference in coverage between the staff member and dependants enrolled under the same plan.

My spouse is currently insured by his employer. Can I add him to my plan at a later date should he lose his job, or would I have to do it during the annual enrollment campaign only?

You need to enroll your spouse during the annual enrollment campaign. The policy will not allow enrollment at a later date.

Is my spouse covered under my insurance when I retire? Is there a minimum eligibility requirement?

Your spouse can be covered under your insurance when you retire if the eligibility criteria are satisfied.

I'm expecting a baby later this year. Will I be able to add my new baby and my husband to my plan?

You can add your baby within 31 days of your baby's birth. There is no qualifying event to add your husband when your baby is born. Your husband can only be added during the annual enrollment campaign, or within 31 days of marriage.

My dependants are studying outside the NY metro area, will there be any issues on coverage with Empire and Cigna Dental?

Dependants outside of the NY Metro Area are covered by the Empire Blue Cross and Cigna Dental plans.

How can we get a copy of the "fine print" terms and conditions for the life insurance coverage prior to adhering to the plan?

The documents containing information related to the UN Group Life Insurance Plan are ST/AI/2002/6, ST/IC/2002/63, ST/AI/2002/63/Amend.1 and ST/IC/2006/21.

I am covered under my husband's health insurance at another company. If he loses his job, can I join the UN health insurance outside the annual enrollment period?

Yes, you may join the UN Health Insurance outside of the annual campaign upon presentation of proof of loss of coverage by the staff member under a spouse’s health insurance plan. Please refer to the Information Circular.

What is the cost difference between the Aetna PPO and Empire Blue Cross PPO?

Please refer to the Information Circular for an elaborate comparison.

Please define the range of a "plan year".

The Plan Year ranges from 1st July to 30th June of each year.

If I have half of my family located in the USA and others located outside the US, which plan is suitable for me?

Both Aetna and Empire Blue Cross have international coverage. The UN Worldwide Plan administered by Cigna is not configured to provide adequate coverage in the USA and you are not allowed to enroll in the UN Worldwide Plan if your duty station is New York.

Do you issue Life Insurance certificates?

Yes, the HLIS issues Life Insurance Certification for After Service Life Insurance participants (retired staff members).

Why do premiums increase ?

Premiums increase after utilization increases so increases in premiums are a direct result of increased utilization and medical inflation.

Can my spouse, who is my dependant and enrolled in the UN insurance with Empire Blue Cross, apply for Medicare as a green card holder upon filing joint UN tax return for the past five years?

Your spouse can apply at the local Social Security Administration office for Medicare Part B. Only they can determine if your spouse is eligible.

Is there an option for family members no longer eligible as dependants (over 25) to still have coverage under Empire Blue Cross and/or Cigna Dental?

Only in cases of children certified as disabled by either the UN Medical Department or the UNJSPF.

My son (currently 18 years old) will attend a university abroad. My experience during Home Leave was that Empire Blue Cross was difficult to use, and I did not get any partial reimbursement. If the university offers a student health insurance, I might cover him under such an option. Could I remove him from the UN insurance in September? Is this considered a qualifying event?

No, you would have to drop him during the annual enrollment campaign.

My father and mother are under my care and are both 67 years old and unemployed with me being their care provider. When I joined UNICEF, I had only included my children in my Cigna insurance as dependants. Would I be able to add my parents to my plan as well since they are not covered by any other medical plan?

No, you will not be able to add secondary dependants but only eligible primary family members.

Once you make changes in Umoja ESS, how do you know that they have been processed?

You will receive an enrollment confirmation with the respective information.

I am covered under the Aetna health insurance plan and my premium is very high for just me and my daughter. How many more eligible family members could I enroll in the same plan while maintaining the current premium amount?

You are currently paying premiums for two participants and cannot add another eligible family member for the same rate. If you add another participant, you will be charged the family premium under the Aetna plan.