- عربي

- English

- Français

- Русский

- Español

LDC Insight #7: FDI and investment facilitation in ASEAN least developed countries

29 March 2023 / Amelia U. Santos-Paulino and Kee Hwee Wee

ASEAN least developed countries have attracted 2 to 5 times more FDI in the last decade. Investment facilitation played an important role in attracting foreign direct investment in these countries.

Foreign direct investment (FDI) flows to the Association of Southeast Asian Nations (ASEAN) least developed countries (i.e. Cambodia, Lao PDR and Myanmar) have increased remarkably in the last decade. Annual average FDI inflows in 2011-2020 in these least developed countries (LDCs) expanded by a factor of 2 to 5 times as compared with in 2001-2010. During this period, inflows in Lao PDR rose by 5 times, Cambodia by 4 times, and in Myanmar doubled (figure 1). The outlook for FDI in ASEAN LDCs is promising because of improving investment opportunities and more multinational enterprises (MNEs) are relocating operations to these countries.

Investment in Cambodia and Lao People’s Democratic Republic held steady in 2021. Despite the various waves of the pandemic, inflows in Cambodia and Lao PDR remained high at $3.5 billion and $1.1 billion in 2021, which exceeded the annual average of $2.3 billion and $0.9 billion in 2011-2020, respectively. Due to the lingering impact of the pandemic and social tensions, FDI inflows to Myanmar fell by 54 per cent to $1.0 billion – declining more than half the annual average of the last decade ($2.2 billion). Despite the strong investment inflows, these countries attract significantly lower FDI as compared with the region’s annual average of $12.9 billion in 2011-2020.

Figure 1. Annual average FDI flows in Cambodia, Lao PDR and Myanmar, 2001-2010 and 2011-2020 (Millions of Dollars)

Source: UNCTAD and ASEAN Secretariat.

The role of investment facilitation

Investment facilitation measures in place played an important role in attracting foreign direct investment (FDI) in these ASEAN countries, according to the ASEAN Investment Report 2022.

The different types of investment facilitation measures identified in the report highlighted the key role such measures have played in attracting FDI. “The ASEAN LDCs have streamlined investment procedures and application processes, adopted Special Economic Zones (SEZ) programmes, and established one-stop service as well as other measures to facilitate investment. Over the past few years, ASEAN Member States have undertaken significant efforts to attract and retain FDI. They are stepping up this endeavour through the adoption of an ASEAN Investment Facilitation Framework (AIFF) in 2021, reflecting the region’s continued commitment to improving the ease of doing business and the investment environment”, says Savinder Singh, Deputy Secretary General of ASEAN for ASEAN Economic Community.

ASEAN countries are also actively using digital technologies to assist investors access information, make enquiries and support online investment application. The use of digital technologies was visible even before the pandemic but was heightened since 2020. All three least developed countries in the ASEAN group have in place consultative mechanisms with the private sector for investment policies.

The report also highlights that investment facilitation measures vary in sophistication and coverage between the ASEAN LDCs and as compared with the other ASEAN Member States because of the different stages of development and institutional experience.

While investment facilitation measures in ASEAN LDCs are relatively less sophisticated as compared with other ASEAN member states, significant efforts are being made to advance facilitation measures and implementation. These include the ongoing development or plan to develop a single digital platform. For instance, Cambodia has established an online information system for investors, and for other administrative procedures such submitting investment application forms and making payments of fees and taxes associated with their investments. Lao PDR and Myanmar are evaluating approaches to establish a single digital platform.

Investment facilitation measures will become even more important tools to attract FDI with the introduction of the international minimum tax rate (UNCTAD, 2022). ASEAN LDCs need to prepare themselves and make the necessary adjustments in their FDI promotion efforts.

ASEAN Investment Facilitation Framework

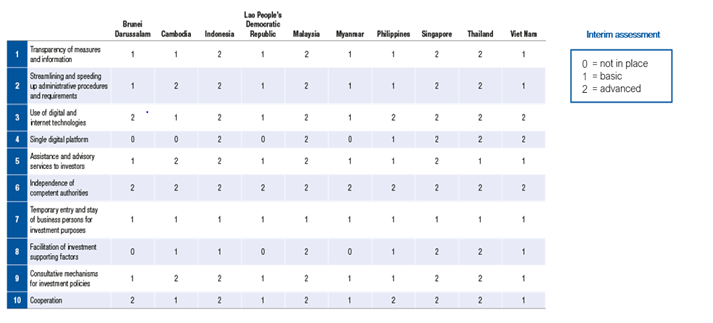

ASEAN countries have made notable inroads in implementing investment facilitation measures. The 10 main types of investment facilitation measures included in the ASEAN Investment Facilitation Framework (AIFF) are: transparency and provision of information; streamlining and speeding up of administrative procedures and requirements; use of digital and internet technologies; single digital platform; assistance and advisory services to investors; independence of competent authorities; temporary entry and stay for business persons; facilitation of investment-supporting factors; consultative mechanisms for investment policies and cooperation (figure 2).

Despite advancement, there is room for improvement. The report recommends ASEAN member states to focus on the set of measures that would have the highest impact in facilitating investment (i.e., improving the information available for investors, making investment rules, regulations and processes more transparent, and streamlining administrative procedures). The ASEAN LDCs would need to do more to catch up with the advanced member States in most of the 10 types of investment facilitation measures under the AIFF. ASEAN LDCs could adopt a holistic approach in investment facilitation to include not just investment administrative issues but also cover the broader context of the business environment such as support for setting up a business, obtaining business registration, approvals and licenses, and other business-related administrative requirements and processes. An enterprise registration portal similar to UNCTAD’s GER.co, which provides information on online information portals and online single windows could be considered.1

Figure 2. AIFF implementation by ASEAN member states, 2022

Source: ASEAN Investment Report 2022, interim AIFF assessment.

“Timely implementation of the AIFF provisions will help advance the investment environment of the ASEAN LDCs. Capacity building and sharing of experiences between the more developed ASEAN member states and the LDCs would be useful”, expressed James Zhan, Director of UNCTAD’s Investment and Enterprise Division.

Investment facilitation during the pandemic

The pandemic led ASEAN LDCs to expedite efforts in the implementation of investment facilitation measures. For instance, investment procedures for significant projects and to manufacture medical products related to COVID-19 were simplified.

Cambodia provided stimulus packages, primarily targeting the apparel manufacturing and tourism industries, and made greater use of online and digital facilities. The Lao PDR Government reduced various types of administrative fees, supported businesses with deferrals on payment of water and electricity services, and also extended online facilities. Myanmar adopted a range of responses to help investors expedite implementation of projects. These measures included (i) fast-tracking large-scale private investment projects, (ii) reviewing the status and impact of approved or implemented projects and (iii) prioritizing high-impact or near-completion projects in health care and key economic infrastructure. Many investment-related public services were kept open during the pandemic, by providing more facilities online such as for investment applications and business licences.

The role of SEZs

ASEAN LDCs are establishing industrial facilities through special economic zones to facilitate investment (see ASEAN Investment Report 2017, World Investment Report (2019); and UNCTAD 2021 (for examples of Africa LDCs)).2 SEZs are an important tool in attracting foreign investment, which can promote technology transfer, skills development and productivity. Special economic zones, and industrial parks, offer a pathway for countries to provide investors with targeted incentives, streamlined regulations and better infrastructure that might not be possible at an economy wide level. They have also proved successful in attracting foreign firms that are integrated in GVCs leading to stronger manufacturing and exports performance.

In Cambodia, there are 20 SEZs in operation out of 54 announced or designated. Most of these SEZs are located along the border with Thailand and Viet Nam, and at Sihanoukville and Phnom Penh. While manufacturing activity outside the zones is heavily concentrated on the garment industry, SEZs have attracted a much broader spectrum of foreign investors in light manufacturing. Several of these SEZs are engaged in production and exports spanning from electronics and electrical products to plastics, food, furniture and car parts.

In Lao PDR, SEZ development is given a central role in the country’s investment promotion strategy. Twelve SEZs are in operation, though not all are fully developed. Some, especially border zones, have attracted many factories that have connections with factories in neighbouring countries.

The Special Economic Zone Law, enacted in 2014, paved the way for development of SEZs in Myanmar. Two SEZs are in development (Kyauk Phyu in Rakhine State, Dawei in Thanintharyi Region) and one is in operation (Thilawa in Yangon Region). In each SEZ, there can be free zones and promotion zones, which enjoy different ranges of investment incentives. The Thilawa SEZ is divided into a promotion zone and a free zone, with each offering different tax benefits.

***

FDI to the three ASEAN LDCs rose rapidly in the last decade due to the improved investment environment and resulting increasing investment opportunities. However, the pandemic slowed down the growth. In the case of Myanmar, the socio-political context has impacted inflows in recent years. With improving investment environment and continued efforts to put in place more investment facilitation measures, the prospects for higher FDI flows in the three ASEAN LDCs in the next decade is promising. Relocation of investment from China, other Asian economies – including ASEAN countries - to these LDCs will remain a key feature as MNEs adopt a strategy to shift labour intensive and cost oriented activities. The AIFF will play a role in encouraging these LDCs to expedite implementing further measures to facilitate FDI, although Cambodia is already more liberal at attracting investment.

Amelia U. Santos-Paulino is Chief, Investment Issues and Analysis Section and Kee Hwee Wee is Senior Economist, Investment Issues and Analysis Section at UNCTAD. They are both co-authors of the ASEAN Investment Report.

1 See Business Facilitation Programme | UNCTAD and UNCTAD Investment Policy Monitor: “Investment facilitation – Progress on the ground”, January 2022, Special issue 6.

2 UNCTAD (2021). Handbook on Special Economic Zones in Africa: Towards economic diversification across the continent. UNCTAD, Geneva.