- عربي

- 中文

- English

- Français

- Русский

- Español

Debt, Affordable Finance, and a Future for the Least Developed Countries

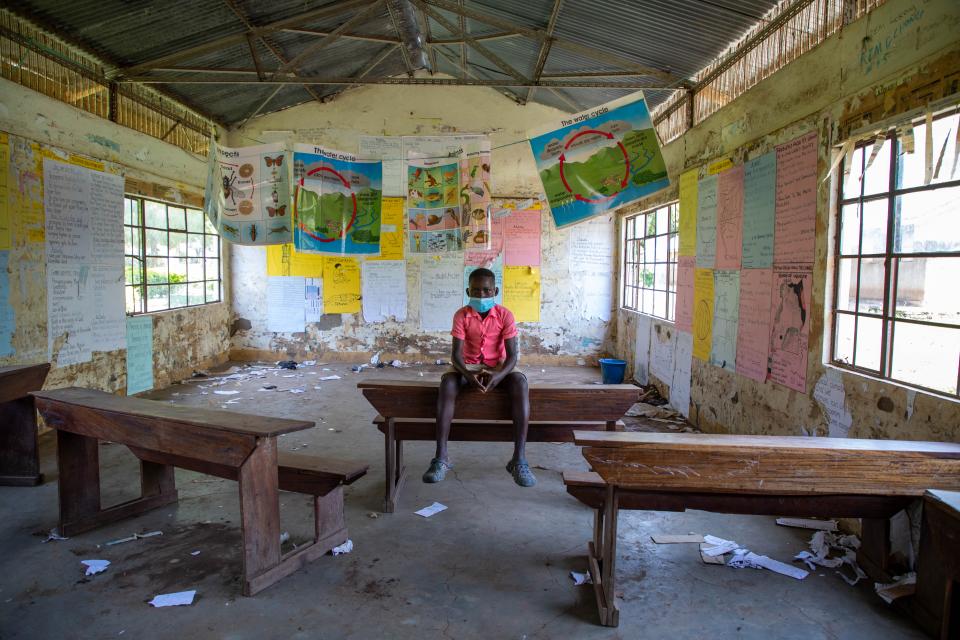

The hard-won development gains of the Least Developed Countries were virtually wiped out by COVID-19.

A new report - the 2022 Financing Sustainable Development Report of the Interagency Task Force on Financing for Development – highlights some eye-opening facts about the challenges the Least Developed Countries (LDCs) face as they struggle to get a handle on the pandemic.

One of the defining features of Least Developed Countries is their vulnerability to external shocks and the setbacks ushered in by COVID-19 were felt especially acutely in LDCs, as well as other Low-Income Countries (LICs).

For example, in 2021, just one year into the pandemic, 77 million more people around the world had been cast back into extreme poverty. And the average income for the poorest two-fifths of the population fell by an estimated 6.7 per cent in the same period – while at the same time food prices rose to their highest point in a decade.

Debt Sustainability and the Cost of Borrowing Are Huge Challenges for LDCs

Just as more money is needed to tackle the pandemic and reach the Sustainable Development Goals, the available resources and fiscal space for LDCs have decreased.

Almost two-thirds (60 per cent) of LDCs and LICs are either in debt distress or at high risk of debt distress, a number that has doubled since 2015. A country in debt distress is one that is not able to make payments on its debts owed.

And for the most vulnerable countries, that debt comes with a higher price. LDCs borrow only half as much revenue as a share of GDP as developed countries but spend three times more on interest repayments.

For more than half of the countries in Sub-Saharan Africa, debt servicing swallows up more than a quarter of all government revenue. With risks to debt sustainability rising, most developing countries have already - or are expected to - withdraw most fiscal stimulus measures.

The report emphasises that international support and efforts to improve debt crisis prevention are urgently needed.

Other Financing Options Are Not Particularly Favourable for LDCs

In the early days of the pandemic, bilateral Official Development Assistance (ODA) by OECD Development Assistance Committee (DAC) members to LDCs and Africa increased in real terms by 1.8 percent to $34 billion.

However, ODA grants to LDCs are gradually being replaced by loans - loans with increasing interest rates and shorter maturity periods.

After a dip in the first year of the pandemic, Foreign Direct Investment (FDI) saw a 77% increase globally in 2021, most of which was concentrated in developed countries. Only 19% of foreign direct investment was directed to Least Developed Countries.

Blended finance, which attracts commercial capital towards projects that contribute to sustainable development, while providing financial returns to investors, is being touted as an important option to help catalyze more finance in developing countries. But for every $100 mobilised in 2020, LDCs will receive only $9.

Implementing the Commitments of the Doha Programme of Action will help LDCs get back on track to achieve the SDGs.

The international community, including the LDCs themselves, has a lot of work to do to ensure that the LDCs can recover from the pandemic and make meaningful progress towards achieving the SDGs.

The recently adopted Doha Programme of Action for the Least Developed Countries for the Decade 2022-2031 (DPoA) helps set a framework for getting there.

Within one of its key priority areas - mobilizing international solidarity, reinvigorated global partnerships and innovative tools and instruments - UN member states agreed, among other things, to take action to facilitate sustainable and innovative financing for the LDCs, including through:

- Ensuring the fulfilment of respective ODA commitments to Least Developed Countries;

- Addressing the debt distress of Least Developed Countries by 2025 and providing coordinated and appropriate debt solutions, in order to work towards sustainable debt levels;

- Significantly scaling-up support in the form of concessional financing and equity for existing financing mechanisms that deliver catalytic investment capital to mobilize sustainable private investment to aid achievement of the SDGs.

But LDCs need more than finance to deal with their multiple challenges.

Strengthening domestic policies and using available funds to invest in development initiatives, infrastructure and people are equally crucial steps. Additionally, global action on climate change mitigation and domestic action on adaptation are necessary to prevent further devastating climate shocks in the LDCs.

All of these are essential for LDCs to reverse recent trends and have a chance to achieve the SDGs.

Using the DPoA as a framework for innovation, cooperation and action, all stakeholders must be part of this effort to ensure that no one is left behind.