Productivity has been the driving force behind the five- sometimes six-day workweek, but there is a growing body of evidence that shows a shorter week is equally, if not more productive in many respects. Juliet Schor is a champion of the four-day week and led the charge in the early 90s with her book The Overworked American, which studies the pitfalls of choosing money over time. Schor is an economist and sociologist at Boston College and heads the research for global trials of companies instituting four-day workweeks. Journalist Rhoda Metcalfe spoke with Juliet Schor about her four-day week mission, as part of the IMF Podcast series about Women in Economics.

IMF

We are on the verge of a technological revolution that has the potential to increase productivity, global growth, and income around the world. However, it may also result in job loss and worsen inequality. According to a new analysis from the International Monetary Fund (IMF), almost 40% of jobs globally are exposed to AI. In advanced economies, about 60% of jobs may be impacted by AI, while in emerging markets and low-income countries, that exposure is expected to be 40% and 26% respectively. While many jobs may benefit from AI integration, some jobs may disappear and lead to lower wages and reduced hiring. In developing economies, the risk of technology worsening inequality among nations is higher due to a lack of skilled workforce and infrastructure.

Well-informed policy decisions are needed in shaping AI's impact on productivity growth, the labor market, and industrial concentration.

While import prices account for much of Europe’s inflation, its outlook largely depends on how companies absorb wage gains as higher prices erode workers’ purchasing power. IMF economist Frederik Toscani studies inflation and monetary policy in the Euro Area and is coauthor of a new paper that breaks inflation down into labor costs, import costs, taxes, and profits.

In this podcast, Toscani says corporate profits account for 45 percent of price rises since the start of 2022.

Frederik Toscani is an economist in the European Department of the IMF, covering the Euro Area.

Photo Credit: ©IMF Podcast.

The IMF reports how recent events have shown central banks can deal with financial stress without compromising their inflation-fighting stance despite trade-offs between price and financial stability.

The global economy’s gradual recovery from both the pandemic and Russia’s invasion of Ukraine remains on track. China’s reopened economy is rebounding strongly. Supply chain disruptions are unwinding, while dislocations to energy and food markets caused by the war are receding. Simultaneously, the massive and synchronized tightening of monetary policy by most central banks should start to bear fruit, with inflation moving back towards targets. The IMF forecasts in the World Economic Outlook that growth will bottom out at 2.8 percent this year before rising modestly to 3 percent next year.

According to the IMF, the global economy is poised to slow this year, before rebounding next year. Growth will remain weak by historical standards, as inflation and Russian war on Ukraine continue.

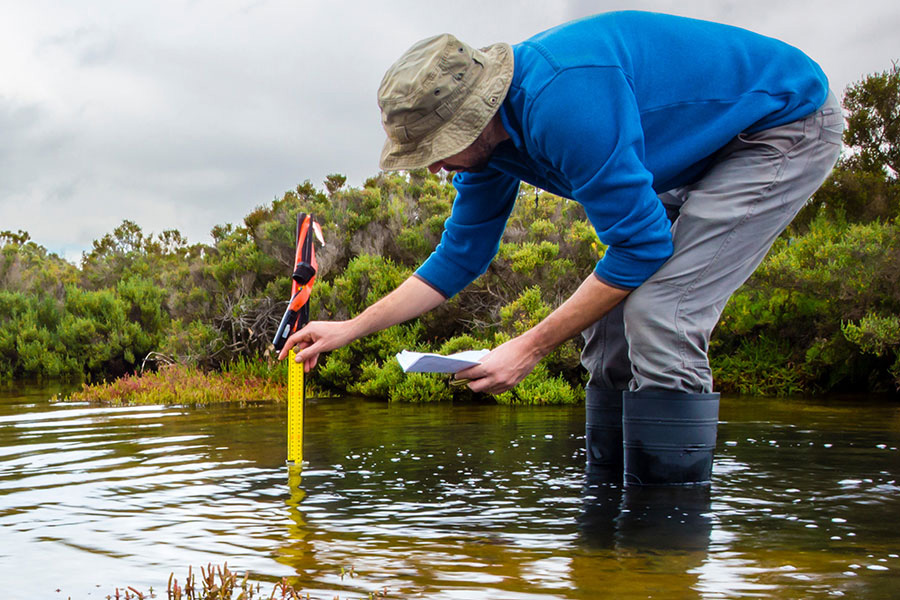

Information gaps impede the understanding of the impact of policies—from measures to incentivize cuts in emissions, to regulations that reduce risks and boost resilience to climate shocks. Without comprehensive and comparable data to monitor progress, it’s impossible to know what works, and where course corrections are needed. This underscores the importance of the new IMF Data Gaps Initiative to make statistics more detailed, and timely. Energy is the sector needing change the most. It is the largest contributor to greenhouse gas emissions, around three-quarters of the total.

Net-zero rhetoric does not match reality. New IMF analysis of current global climate targets shows they would only deliver an 11 percent cut of emissions, rather than the 25-50 per cent needed.

Governments confront difficult trade-offs amid increases in food and energy prices. IMF discusses how policymakers can help people bounce back from the crisis and better cope with future challenges.

While consumers' expectations of where prices are going are something that economists have been tracking for a long time, understanding how those expectations are formed provides valuable insight toward controlling inflation. New research by economists Carlo Pizzinelli (IMF), Peter Andre (Briq Institute), Christopher Roth (University of Cologne), and Johannes Wohlfart (University of Copenhagen) shows a surprising divide between what experts think and consumers believe drives inflation and other economic trends. Carlo Pizzinelli is the author of an article in the latest Finance and Development based on the study. In this IMF podcast, Pizzinelli sits down with Journalist Rhoda Metcalfe to discuss how the collective consumer mind influences economic policy. Transcript

Carlo Pizzinelli is an economist in the IMF Research Department.

A tentative recovery in 2021 has been followed by increasingly gloomy developments in 2022 as risks began to materialize. Global output contracted in the second quarter of this year. Several shocks have hit a world economy already weakened by the pandemic: higher-than-expected inflation worldwide triggering tighter financial conditions; a worse-than-anticipated slowdown in China; and further negative spillovers from the war in Ukraine. IMF reports a decrease in the baseline forecast for growth to slow from 6.1 percent last year to 3.2 percent in 2022.

What is inflation, why is it happening, and what can governments do about it? IMF answers these questions in their newest series, Ask an Economist. Send your questions to AskanEconomist@imf.org

Tensions over trade, technology standards, and security have been growing for many years, undermining growth and trust in the current global economic system. Uncertainty around trade policies reduced global gross domestic product in 2019 by nearly 1 percent, according to IMF research. And since the war in Ukraine started, our monitoring indicates that around 30 countries have restricted trade in food, energy, and other key commodities. To restore trust that the rules-based global system can work well, we must weave our economic fabric in new and better ways.