World Economic Situation and Prospects: October 2022 Briefing, No. 165

What does a strong U.S. dollar mean for developing countries?

What does a strong U.S. dollar mean for developing countries?

In recent months, the U.S. dollar has reached historic high levels in two decades, as the United States Federal Reserve increased its interest rates aggressively since March 2022, amid stubbornly high inflation. Higher interest rates and the relative stability of the United States’ economy have boosted the dollar’s appeal and triggered the ‘flight to safety’ in the international capital market. The impact of the Ukraine conflict on energy prices has deteriorated the economic outlook in Europe, while COVID-19 shutdowns continue to undermine China’s near-term growth prospects. For the developing countries, rising interest rates in the United States, and the appreciation of the U.S. dollar are translating to rising costs of imports, higher inflationary pressures, rising debt servicing and borrowing costs and worsening fiscal and current account balances, undermining the prospects of their full economic recovery from the pandemic.

Currency depreciation and capital outflows

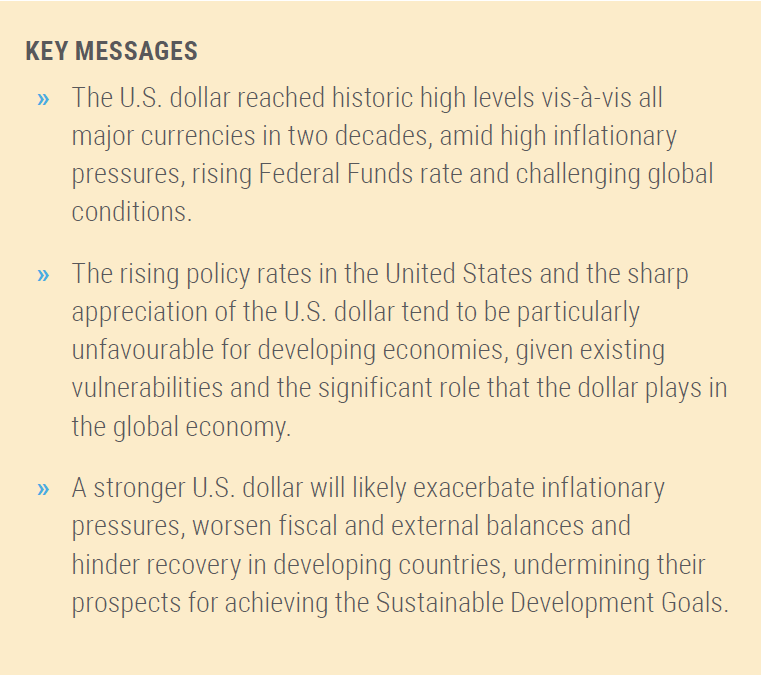

The U.S. dollar index climbed by around 20 per cent against a basket of global currencies during the past year (Figure 1). Between June and September this year, the dollar index reached high historical values as the United States Federal Reserve raised its policy rates by 225 basis points.

The global interest rate shock has been accompanied by capital outflows from developing countries, mainly driven by the higher yields on long-term government bonds across advanced economies and the investor’s quest for relatively safe assets. Thus, between March and July 2022, close to US$ 32 billion had flowed out of the developing and emerging markets.

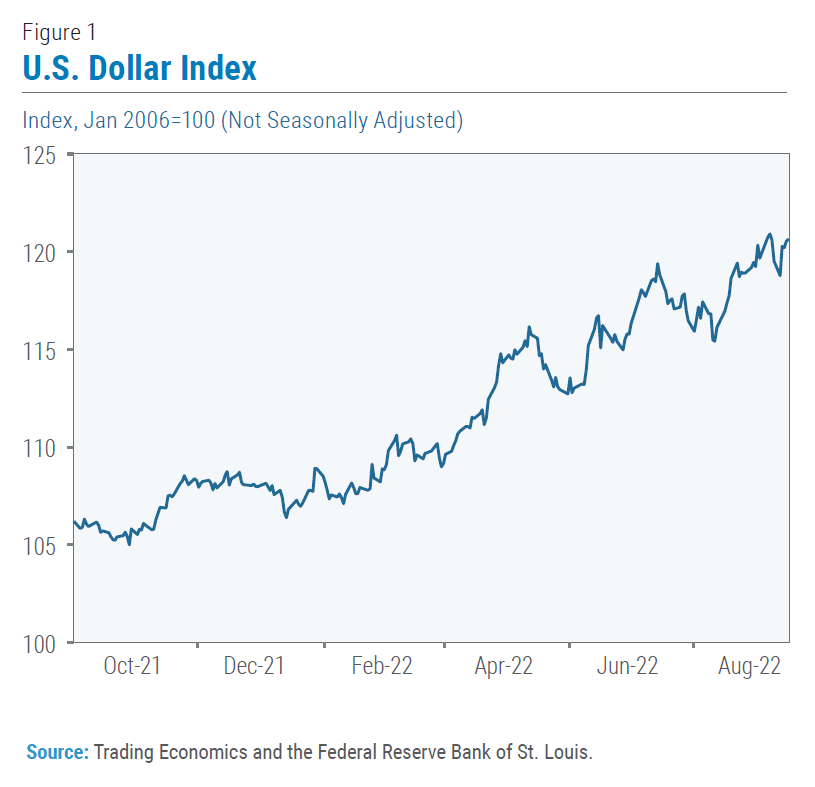

Against the backdrop of international investors reducing their exposures in developing markets and capital outflows, the currencies of many developing countries have weakened significantly vis-à-vis the U.S. dollar during 2022. The Argentine peso, the Pakistan rupee, the South African rand, the Indian rupee, and the Indonesian rupiah depreciated significantly against the U.S. dollar since the start of 2022 (Figure 2). However, some Latin American currencies—such as the Mexican peso and the Brazilian real—benefited from stronger commodities prices and remained resilient during the first half of 2022. In this context, many central banks in developing countries have intervened strongly to slow currency depreciation by selling their foreign-exchange reserves. However, for some developing economies, implementing the currency adjustment has been difficult, especially given the limited stock of liquid reserves.

Against the backdrop of international investors reducing their exposures in developing markets and capital outflows, the currencies of many developing countries have weakened significantly vis-à-vis the U.S. dollar during 2022. The Argentine peso, the Pakistan rupee, the South African rand, the Indian rupee, and the Indonesian rupiah depreciated significantly against the U.S. dollar since the start of 2022 (Figure 2). However, some Latin American currencies—such as the Mexican peso and the Brazilian real—benefited from stronger commodities prices and remained resilient during the first half of 2022. In this context, many central banks in developing countries have intervened strongly to slow currency depreciation by selling their foreign-exchange reserves. However, for some developing economies, implementing the currency adjustment has been difficult, especially given the limited stock of liquid reserves.

A few countries are bucking the trend

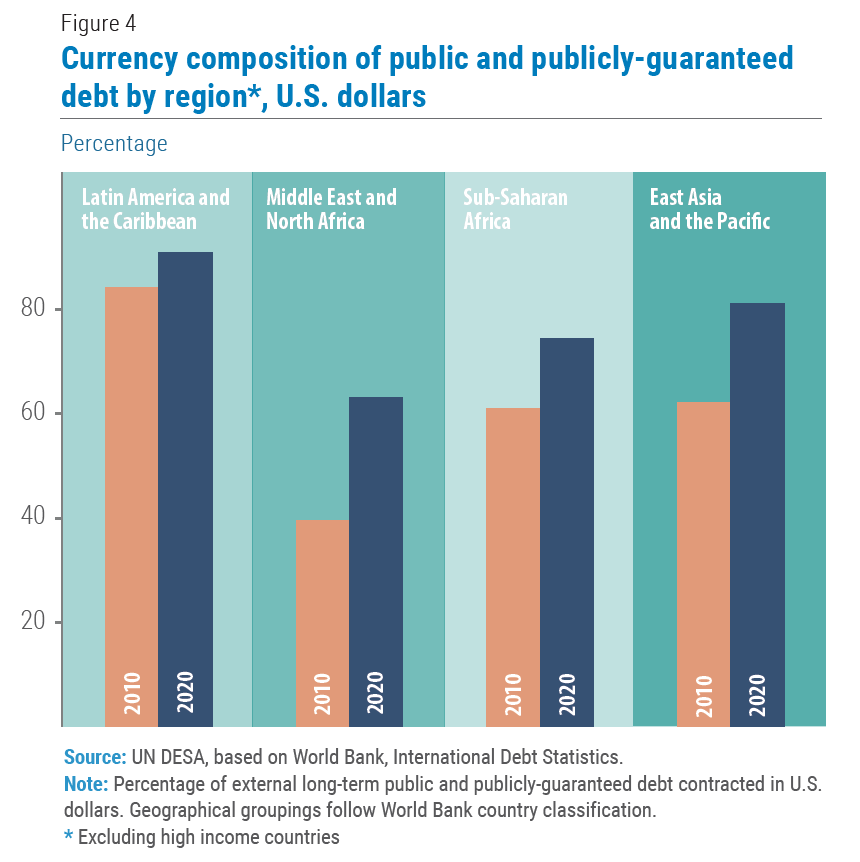

Several Commonwealth of Independent States (CIS) currencies also bucked the trend and appreciated vis-à-vis the U.S. dollar. While the Russian ruble precipitously fell at the beginning of the war in Ukraine amid widespread economic sanctions against the Russian Federation, it rebounded quickly and paradoxically became the best-performing currency globally in terms of its appreciation vis-à-vis the “hard” currencies (Figure 3). The ruble’s value soared despite double-digit inflation and contraction in the Russian economy, while half of its central bank’s reserves overseas remained frozen.

This phenomenon is explained by a confluence of factors. Following the initial fall of the ruble, the Russian central bank sharply increased its policy rate and imposed tight capital controls, while the Government required exporters to sell a large share of their foreign exchange earnings at the domestic market, bolstering demand for the ruble. Also, the European gas importers were required to convert their payments to the Russian gas supplier into rubles. Meanwhile, the current account balance of the Russian Federation improved amid higher hydrocarbon prices and increasing oil exports to Asia while imports fell because of the sanctions. As a result, the Russian current account surplus reached an estimated US$183.1 billion in January–August 2022, way above the US$60.9 billion recorded for the same period last year. Similarly, most of the CIS currencies sharply depreciated after the beginning of the war in Ukraine but the trend reversed quickly with significant inflows of capital from the Russian Federation. Many countries in the CIS and Georgia absorbed significant capital inflows from the Russian Federation (for example, money transfers from the Russian Federation to Armenia almost tripled in the first half of 2022 compared with the same period of last year, exceeding US$1 billion), as many Russian nationals and businesses, including the export-oriented IT sector, which is paid in dollars, relocated to these countries. This is, however, likely to be a short-lived phenomenon and these countries will possibly face significant downside risks should the flow reverse.

A stronger dollar is worsening external debt burdens of the developing countries

Many developing countries are particularly vulnerable to a stronger dollar because their external debt stocks and debt service payments are mostly denominated in U.S. dollars. Governments in developing countries collect their tax and non-revenues in local currencies but service most of their external debt in foreign currencies, mostly denominated in U.S. dollars. Thus, when the domestic currency depreciates vis-à-vis U.S. dollar, the debt service burden of the country can increase proportionately without any offsetting increases in tax revenue. Developing countries with high levels of external debt are particularly vulnerable to sudden tightening global financial conditions, as many governments borrow from the international capital market in the short-term to service their long-term debt repayment obligations.

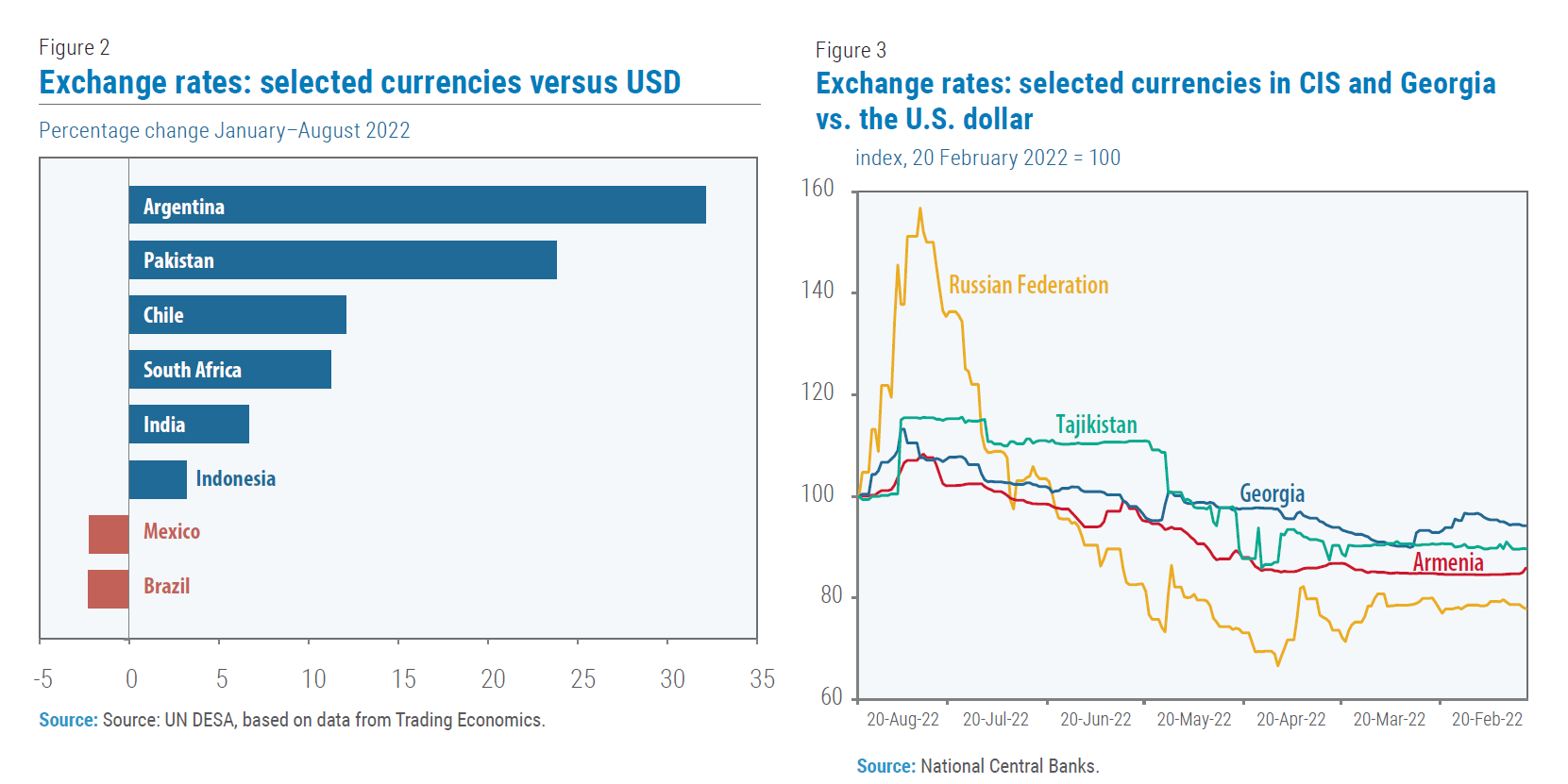

During the decade prior to the COVID-19 pandemic, developing countries benefited from strong capital inflows, particularly in Asia and Latin America. Low interest rates and abundant global liquidity encouraged many developing countries to borrow from the international capital market, which led to an increase in external debt in many countries. Also, fiscal support to mitigate the impacts of COVID-19 pushed debt levels in some countries to record highs. According to the World Bank, the external debt stock of low– and middle-income countries in 2020 rose, on average, by 5.6 percent and for many countries the increase was in double digits. Significantly weaker exchange rates, tighter global financial conditions and slow economic growth have increased debt risks and vulnerabilities across developing countries. The most affected countries are those where debt denominated in foreign currency represents a large share of their exports. In some countries, paying interest to creditors has become particularly challenging, especially in those that are facing large currency depreciations. Among regions, the share of dollar-denominated debt differs significantly (Figure 4). In Middle East and North Africa, the share is relatively low compared to other regions, meanwhile, in Latin America this share accounted by around 90 per cent in 2020.

During the decade prior to the COVID-19 pandemic, developing countries benefited from strong capital inflows, particularly in Asia and Latin America. Low interest rates and abundant global liquidity encouraged many developing countries to borrow from the international capital market, which led to an increase in external debt in many countries. Also, fiscal support to mitigate the impacts of COVID-19 pushed debt levels in some countries to record highs. According to the World Bank, the external debt stock of low– and middle-income countries in 2020 rose, on average, by 5.6 percent and for many countries the increase was in double digits. Significantly weaker exchange rates, tighter global financial conditions and slow economic growth have increased debt risks and vulnerabilities across developing countries. The most affected countries are those where debt denominated in foreign currency represents a large share of their exports. In some countries, paying interest to creditors has become particularly challenging, especially in those that are facing large currency depreciations. Among regions, the share of dollar-denominated debt differs significantly (Figure 4). In Middle East and North Africa, the share is relatively low compared to other regions, meanwhile, in Latin America this share accounted by around 90 per cent in 2020.

A stronger dollar also hurts economic growth

Additionally, in the long run a strong dollar can negatively impact economic growth in the developing countries by increasing the cost of capital and reducing public and private investments. As the United States Federal Reserve raise interest rates, the central banks around the world follow suit and raise interest rates to prevent capital outflows and ease downward pressures on their exchange rate. But interest rate hikes increase the cost of domestic borrowing and reduce both public and private investments in the economy.

A strong dollar also adversely affects the price of imports, especially for developing countries that heavily rely on imports to meet domestic demand for food and energy. Most international trade is conducted in U.S. dollars. Between 1999–2019, the U.S. dollar share of global trade accounted for 96 per cent of trade invoicing in the Americas, 74 per cent in the Asia-Pacific region, and 79 per cent in the rest of the world. Europe is the only exception, where the euro is the dominant currency. While a strong dollar can help to contain inflationary pressures in the United States, it has the opposite effect on inflation in net food and energy importing developing economies. In the current geopolitical context, a stronger dollar is undermining food and energy security of many developing countries, as the import prices of food grains and oil—denominated in local currencies—have risen sharply in recent months.

The “pass-through effect” of a domestic currency’s depreciation vis-à-vis the U.S. dollar depends on country characteristics. In general, greater openness to trade and financial transactions, less credible central banks, more volatile inflation and exchange rates, and lower levels of market competition are associated with higher pass-through effects on inflation. There is empirical evidence that economies with greater exchange rates pass-through to domestic prices and high shares of debt denominated in US dollars face a difficult policy trade-off between stabilization and inflation in managing adverse external shocks. The policy challenges for the developing countries are even more daunting now. There is little room to maneuver given the persistent supply-side bottlenecks aggravating inflationary pressures and high levels of dollar-denominated external debt.

The “pass-through effect” of a domestic currency’s depreciation vis-à-vis the U.S. dollar depends on country characteristics. In general, greater openness to trade and financial transactions, less credible central banks, more volatile inflation and exchange rates, and lower levels of market competition are associated with higher pass-through effects on inflation. There is empirical evidence that economies with greater exchange rates pass-through to domestic prices and high shares of debt denominated in US dollars face a difficult policy trade-off between stabilization and inflation in managing adverse external shocks. The policy challenges for the developing countries are even more daunting now. There is little room to maneuver given the persistent supply-side bottlenecks aggravating inflationary pressures and high levels of dollar-denominated external debt.

How long will the dollar rally last?

As announced at the end of its FOMC meeting on 21 September, the United States Federal Reserve will raise its key policy rate to 4.25–4.4 per cent by the end of 2022. The rate hikes will likely continue at least during the first half of 2023, with significant and adverse spillover effects on developing countries already caught in a downward spiral of low growth, high inflation, and high unemployment. The deteriorating economic outlook for developing countries will likely further weaken their exchange rates in the near-term, exacerbating capital outflows and further worsening their financing conditions. Against this backdrop, many developing countries will face a significantly difficult uphill battle to steer a robust recovery, stimulate growth and make progress towards achieving the SDGs.

Follow Us