World Economic Situation And Prospects: October 2021 Briefing, No. 154

The ECB’s bank lending survey: The euro area’s economic pulse is coming back

Introduction

The global pandemic has left severe scars on economic activity across the globe. This is no less true for the economies of the euro area, which saw widespread lockdowns after the outbreak of the pandemic in the spring of 2020 and various renewed phases of ramping down public life thereafter due to surges in pandemic infection rates. With the onset of broad vaccination campaigns, vaccination rates have been steadily increasing and the euro area economy has been on a path of recovery. A host of fiscal policies provided strong support in this respect, and monetary policy has been maintaining a very accommodative stance as well. Against this background, taking the pulse of economic activity in the euro area is a relevant proposition, not least as an input for assessing both the realised effects and the prospective merits of continued policy support measures. To do so, the October Monthly Briefing takes a closer look at the results of the most recent bank lending survey by the European Central Bank (ECB), which provides some insights into the shape of economic activity in the euro area.

Background of the ECB’s bank lending survey

The euro area bank lending survey (BLS) is published quarterly by the ECB and provides information on bank lending conditions in the euro area, notably regarding the supply of and demand for loans to firms and households. This information is used as additional input by the governing council of the ECB in its monetary policy decision making process. The most recent BLS was conducted by the ECB in the second half of June 2021 and published in July 2021. It included a total of 142 banks and the response rate was 100 per cent.

Results of the most recent BLS

From the results of the most recent BLS, several points stand out that are relevant for characterizing the economic trajectory of the euro area:

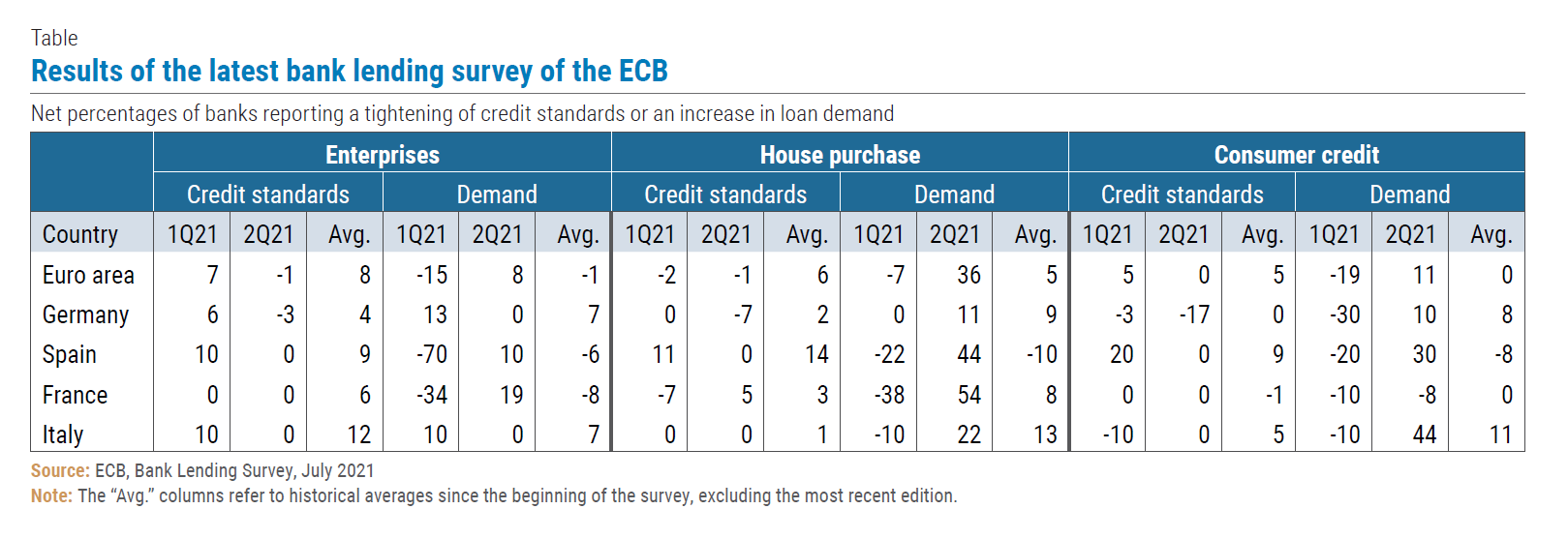

1. Solid demand for credit by firms and consumers

The surveyed banks reported in aggregate a moderate increase in the demand by firms for loans in the second quarter of 2021 (see table). On balance, that is after subtracting the percentage of banks reporting a decrease in demand from that reporting an increase, 8 per cent of the banks reported an increase in demand. This constitutes a marked reversal from a net percentage of 15 per cent of banks reporting a decrease in demand in the previous quarter, reflecting the overall improvement in economic conditions and the positive impact of the reopening of businesses. Notably, this has been the first time since the third quarter of 2019 that financing needs for fixed investment contributed positively to loan demand, which bodes well for productive capacity and productivity trends in the future.

Regarding consumer loans, the survey responses indicated an even stronger upward trend. A net 11 per cent of banks indicated stronger demand, with especially high net percentages of 44 per cent and 30 per cent reporting stronger demand in Italy and Spain, respectively. A range of factors is driving this, including the low level of interest rates, significant income transfer payments, rising real estate prices and—linked to all these—higher consumer confidence. Even more so than for firms, there has been a remarkable reversal from the previous quarter, when 19 per cent of banks reported weaker demand for consumer loans, with significantly negative net percentages across the large economies in the euro area.

2. Demand for housing loans is exceptionally strong

The demand for housing loans is seen as increasing by a net percentage of 36 per cent of banks, which is exceptionally high both compared to the previous quarter and the historical average. In France and Spain, the reported net percentages were particularly high, standing at 54 per cent and 44 per cent, respectively. These results tie in with the booming real estate market in many economies of the euro area, in terms of both strong demand from buyers and significantly rising prices. There is especially the delicate nexus between low interest rates and higher house prices, which leads into the emerging debate about whether and to which extent monetary policy is contributing to the creation of new risks to financial and economic stability. From this angle, it is not reassuring that the survey results indicate a concurrent slight loosening in lending standards for housing loans, as an explosion in credit together with weaker lending conditions can open the door for undesirable credit risks to seep into banks’ balance sheets.

3. Credit standard tightening for enterprises has levelled off

Banks indicated a slight loosening in credit standards for firms, which is a sharp change from the previous quarter, when a net percentage of 7 per cent of banks reported a tightening in credit standards, and the even more pronounced tightening that occurred in the second half of 2020. This levelling off of credit standard tightening is mirroring the trajectory of the euro area economies, with banks putting greater emphasis on tighter credit standards at the height of the economic crisis caused by the pandemic.

Interestingly, in the current survey, large firms saw a greater degree of loosening in standards than small and medium-sized firms, illustrating the continued struggle of smaller firms with the fallout from the pandemic and giving some hint that fiscal support remains necessary for—and also has to reach—especially small firms. In addition, the levelling off in credit standard tightening can also be linked to the various forms of monetary policy support granted to the banking sector.

Conclusion

The results from the bank lending survey point to a solid recovery, even a resurgence of the euro area economy. Remarkable are, in particular, the reversals from very contractionary indications in the previous quarter to strongly expansionary ones in the most recent period. A major caveat is that the data do not speak to the actual volume of loans, for which other data sources can be used. But even with its limitations the survey provides a valuable snapshot of the current underlying trends in the euro area economy.

Follow Us