World Economic Situation And Prospects: October 2017 Briefing, No. 107

- Capital inflows to emerging economies gain momentum

- Carbon dioxide emissions from international transport set to increase as global trade rebounds and tourism soars

- Africa’s economic growth is catching up with population growth

- Latin America and the Caribbean will see a mild recovery after two years of contraction

Global issues

Capital inflows to emerging economies gain momentum

Recent trends in global financial markets are driven by the interaction among the improving economic conditions in the world economy, a decline in some global policy uncertainties since early 2017, and expectations for a smooth and gradual transition to the monetary policy stance in the United States of America. Investors’ risk appetite has strengthened and stock markets have risen visibly not only in developed countries, but also in several emerging economies. In addition, financial volatility has declined noticeably in 2017. The optimistic global financial and liquidity environment, coupled with the ongoing recovery in global trade, is supporting the pick-up in global growth.

Against this backdrop, capital flows into emerging economies have gained momentum recently, reversing the trend observed in previous years, where large capital outflows were registered. This has been facilitated by the improving economic conditions in emerging economies. After almost a decade-long decline, the positive growth differential with developed countries is rising again. Also, while some large emerging economies are slowly recovering from deep downturns, such as Brazil and the Russian Federation, others have gone through major macroeconomic adjustments in response to the lower commodity prices and capital inflows observed between 2014 and 2016. Greater exchange rate flexibility, high levels of reserves and, in many cases, improved policy frameworks, have also helped the macroeconomic adjustments in several countries.

The resurgence in capital inflows has led to a reduction of financial spreads and the appreciation of domestic currencies. For instance, bond spreads have reached historically low levels in developing countries in Asia and Europe, while exchange rates have also recovered from the downward trend observed in previous years in Brazil, Mexico, the Russian Federation, South Africa and Turkey (figure 1). In addition, stock markets have risen visibly, with the MSCI index for emerging economies reaching a multi-year record high in September 2017, 20 per cent above September 2016.

The recovery in capital inflows in emerging economies has been driven by equity and bond flows. Portfolio flows have risen in Asia and Latin America, particularly in countries such as Brazil, India, Indonesia, Malaysia, Mexico and Thailand. Importantly, portfolio capital outflows from China have also moderated, which has encouraged authorities to remove some monetary rules supporting the renminbi recently. In addition, cross-border banking flows are recovering after a substantial decline in 2015 and 2016, particularly in Brazil, China, and the Russian Federation. The recovery in banking flows will underpin credit growth, contingent on the momentum of emerging economies’ business cycle. Meanwhile, foreign direct investment (FDI) in developing countries is expected to see a modest recovery in 2017, after falling by about 2 per cent in 2016, due to the improving economic prospects, the pick-up in global trade and higher corporate profits. The moderately positive picture for FDI encompasses most regions, except for Latin America, where FDI is expected to remain subdued.

Besides this ongoing trend, the normalization of the monetary policy in the United States, persisting policy uncertainties in the international environment and political risks in some economies continue to pose important risks. In particular, sudden changes in expectations or monetary policy mistakes by major central banks can generate large spikes in financial volatility with significant effects on capital flows into emerging economies. In fact, recent evidence confirms that global financial conditions tend to generate large spillovers into local financial markets and to disrupt domestic monetary policy efforts to manage financial conditions. Therefore, emerging economies should implement a combination of macroeconomic, foreign exchange and macro-prudential policies to favour the positive and contain the negative effects of the boom-and-bust cycles of capital flows.

Carbon dioxide emissions from international transport set to increase as global trade rebounds and tourism soars

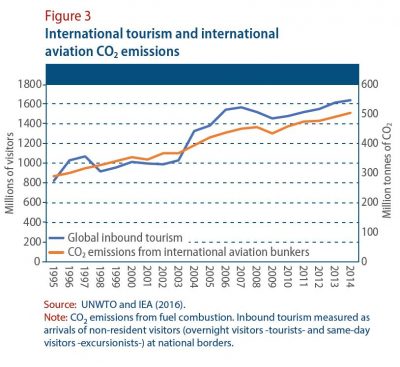

In line with stronger world trade and world tourism growth, the volume of international transport is expected to grow significantly in the coming years. While on the one hand this is a welcome sign of a healthier economy, it also comes at an environmental cost from the associated rise in carbon dioxide (CO2) emissions from aviation and shipping (see figures 2 and 3). In 2014, total emissions from these two industries amounted to about 3.5 per cent of global emissions. If ranked as a country, international shipping and aviation would be the fifth largest CO2 emitter in the world, approximately equal to the sum of total emissions in Japan or Africa. Moreover, each industry would rank as a top-ten emitter.

The bulk of trade occurs via international shipping, which moves about 80 per cent of global trade volume. Tourism is witnessing uninterrupted solid growth not recorded since the 1960s, with about half of all tourists worldwide arriving by air. Furthermore, international shipping and aviation emissions do not fall under the purview of the Paris Agreement.

Emissions from these modes of transport have been on the rise and will continue to rise if left unchecked. According to the International Energy Agency, CO2 emissions from fuel combustion from international marine and aviation in 2014 were, respectively, 69 per cent and 95 per cent higher than in 1990, growing faster than road transport. Total CO2 emissions from fuel combustion increased only 58 percent in the same period. In business-as-usual scenarios, emissions from both sectors are projected to double or even triple by 2050, despite improvements in fleet efficiency.

Emissions from these modes of transport have been on the rise and will continue to rise if left unchecked. According to the International Energy Agency, CO2 emissions from fuel combustion from international marine and aviation in 2014 were, respectively, 69 per cent and 95 per cent higher than in 1990, growing faster than road transport. Total CO2 emissions from fuel combustion increased only 58 percent in the same period. In business-as-usual scenarios, emissions from both sectors are projected to double or even triple by 2050, despite improvements in fleet efficiency.

It is thus important to restrict CO2 emissions in these sectors more effectively, as well as improve energy efficiency. In 2016, the International Civil Aviation Organization adopted the Carbon Offsetting Scheme for International Aviation (CORSIA), which mandates that, starting 2021, aircraft operators will be required to purchase offsets for growth in CO2 emissions above a baseline level. In the shipping sector, by contrast, policy options are currently only under consideration. The International Maritime Organization will have a first greenhouse gas emissions reduction strategy in April 2018 and a definitive strategy will not be ready before 2023.

Developed economies

United States: Fed accelerates withdrawal of stimulus

On 20 September, the United States Federal Reserve (Fed) announced that it will start the process of gradually reducing the size of its balance sheet this month. This marks a decisive shift in the monetary stance, and is a clear signal that the Fed now considers the economy healthy enough to accelerate the process of withdrawing the exceptional stimulus measures that have been in place for nearly a decade.

The underlying pace of economic growth in the United States remains steady, and on track to average 2.1-2.2 per cent per annum in 2017-2018, in line with projections in the World economic situation and prospects as of mid-2017 Non-residential investment saw some revival in the first half of 2017, after contracting in 2016, supported by a broadly-based rise in external demand. Household spending remains relatively solid, posting annualized gains of 2.5 per cent in the first half of 2017. However, consumer spending has been financed largely from savings since 2016, as income growth remains weak despite strong job creation. While the unemployment rate in the United States dipped to its lowest level since 2001 in mid-2017, personal income growth has slowed significantly for the last 18 months, averaging just 2.6 per cent on an annualized basis, compared to an average of more than 5 per cent in 2014-2015.

Japan: Domestic demand growth leads the economic expansion

Japan has seen some rebound in activity in the first half of 2017. The continuously accommodative macroeconomic policy stance prompts a robust economic growth, which is led by a rapid domestic demand expansion. In the second quarter of this year, net exports, which had supported the growth of late, contributed negatively to gross domestic product (GDP) growth for the first time in four quarters. In the same period, domestic demand contributed positively to the real GDP growth rate for the third consecutive quarter. Private consumption jumped significantly, private investment remains robust, and public investment surged in response to measures introduced in the supplementary budget. Corporate profits continued to grow, albeit at a moderate pace, helped by the weak Japanese yen against the major currencies of the trading partners. Since the previous inventory cycle has just ended, Japanese firms are in a position to expand their production levels in the short run. The forecast for GDP growth has been revised up to 1.7 per cent in 2017, compared to 1.0 per cent growth in 2016.

Europe: Economic growth is forecast to remain robust

Economic activity in Europe remains robust, with real GDP growth forecast to continue at 1.7 per cent in 2018. Private consumption will remain a major driver of this performance, especially in view of rising disposable incomes due to falling unemployment rates, emerging upward pressure on wages and the continued low level of interest rates. While the expansionary monetary policy stance will also continue to underpin business investment and construction activity, the expected beginning of a more marked reduction in the monetary stimulus by the European Central Bank will have some dampening effect, leading to a slight downtick in growth to 1.6 per cent in 2019. Inflation will accelerate to 1.7 per cent in 2018 and 2.1 per cent in 2019, driven by stronger domestic demand and currency depreciation in the United Kingdom, although the appreciation of the euro will limit inflationary pressures.

Economies in transition

Ukraine returns to international capital markets

Thanks to higher energy prices and partial adjustment to the less favourable external environment, growth in the CIS should accelerate from 0.3 per cent in 2016 to 2.2 per cent in 2017 and 2.3 per cent in 2018, while inflation is on a downward trend. In response to the moderating inflation, which hit a record low of 3.2 per cent in August, the central bank of the Russian Federation in September has cut its key policy rate for the fourth time in 2017, by 50 basis points to 8.5 per cent. Since the annual inflation target of 4 per cent is achievable, gradual interest rate reduction is expected to continue, with the aim of lowering the bank lending rates and revitalizing the flow of business and consumer credit. The total number of Russian banks has shrunk by over 30 per cent since 2014 due to the tighter prudential supervision and stricter capital requirements, and most of the banking sector’s assets belong to state-owned banks not exposed to significant risks. However, certain systemic problems in the sector apparently remain. In August, the central bank took over the largest private lender, and in September, the 12th largest Russian commercial bank was nationalized. Despite these developments and the expectations of slow economic growth, the Fitch credit rating agency in September upgraded the sovereign credit rating of the Russian Federation from “stable” to “positive”, referring to the flexible exchange rate and inflation targeting policies and fiscal rules.

In September, the Association Agreement between the European Union (EU) and Ukraine, signed in 2014, fully entered into force. Ukraine was also able to return to international capital markets, issuing $3 billion in Eurobonds, after the massive foreign debt restructuring in 2015.

Developing economies

Africa: Economic growth catching up with population growth

Africa’s economic growth performance is projected to stand at 2.6 per cent in 2017 (excluding Libya). This marks a rebound from subdued growth of 1.6 per cent witnessed in 2016, but remains barely above African population growth for 2017 estimated at 2.5 per cent. The modest expansion is the result of strengthening external demand and a modest increase in commodity prices over the year, as well as improvement in domestic conditions, namely growth in private consumption, an increase in investment and strong government expenditure, especially in infrastructure. Four of the continent’s largest economies—Algeria, Angola, Nigeria and South Africa—are growing at a relatively low rate, which is also reflected in the average for the region as a whole.

Macroeconomic fundamentals improved this year. Rising commodity prices allowed for a moderate easing of fiscal pressures and improvement in the continent’s current account balance. Oil-exporting countries saw an enhancement in oil revenues, while import bills were cut. The current account deficit remains high in oil-importing countries, particularly in East Africa where some countries sustain high capital imports for infrastructure projects and a higher cost of fuel imports driven by the increase in global oil prices. Interest rates decreased slightly compared to 2016 in view of an easing of inflationary pressures in several countries. However, the inflation rate remains high. Exchange rates have stabilized further this year across the region. Main risks to the growth outlook include volatility in commodity prices and a slump in the global economy, which could affect trade, investment and remittance flows towards African economies. Political instability and security issues remain important risks to several countries.

East Asia: Growth outlook remains favourable but downside risks are high

The short-term growth outlook for East Asia remains favourable, buoyed by robust domestic and external demand. Private consumption is likely to remain the key driver of growth for most countries in the region. In the first half of 2017, household spending strengthened in Malaysia, the Republic of Korea and Thailand, supported by modest inflationary pressures, low interest rates and an improvement in consumer confidence. In the Republic of Korea, the Government’s plan to expand welfare benefits and promote stronger job creation will also provide further impetus to consumer spending going forward.

East Asia’s growth will also continue to be lifted by the recovery in exports, which has been driven in part by an improvement in demand from the United States and Europe. For several countries, including the Republic of Korea and Taiwan Province of China, the surge in exports has been largely attributed to the increase in global demand for electronic products. Public investment is also expected to remain strong in the Philippines, Taiwan Province of China and Thailand, as their respective Governments embark on large infrastructure projects, aimed at alleviating structural bottlenecks. Private investment activity in the region, however, has remained relatively subdued, as high uncertainty weighs on investor sentiments.

Downside risks to the growth outlook include the ongoing backlash against globalization, elevated financial sector vulnerabilities and rising geopolitical tensions.

South Asia: investment demand remains feeble in India, but it is gaining momentum in other economies

The economic outlook remains largely favourable in most countries of South Asia, underpinned by robust private consumption and sound macroeconomic policies. However, the performance of investment demand displays contrasting trends across countries. In India, private investment remains largely anaemic, and it is a major macroeconomic concern. Moreover, robust public investments in infrastructure have been critical to avoid a further deterioration in investment recently. In the first quarter of FY2017/18, gross fixed capital formation increased by a meagre 1.6 per cent year-on-year. Furthermore, from a medium-term perspective, gross fixed capital formation as a share of GDP has continued to decline, from about 40 per cent in 2010 to less than 30 per cent in 2017. Low capacity utilization in industrial sectors and balance sheet problems in the banking and corporate sector are playing an important role behind this trend. By contrast, the performance of investment in other economies is more vigorous. In Pakistan, investment continues to be moderately robust, amid solid growth, large infrastructure projects under the China-Pakistan Economic Corridor and other public development initiatives. In Nepal, fixed investment is rising strongly, as the reconstruction efforts after the devastating earthquake in 2015 gain pace, including large public and private infrastructure projects. Meanwhile, investment is also gaining momentum in Bangladesh, a major factor behind the growth acceleration observed recently, particularly through infrastructure projects and new initiatives in the energy sector. Besides these different trends, and given the large infrastructure and energy deficits across the region, investment should be a key policy priority in South Asia to promote productivity growth and significant progress towards the sustainable development goals.

Western Asia: outlook overshadowed by oil market and geopolitical factors

The economic outlook for Western Asia remains weak, overshadowed by oil market developments and geopolitical factors. Major oil-exporting economies, mainly the member states of the Gulf Cooperation Council, exhibit weak economic expansion in real terms due to the lower crude oil production levels in compliance with the production reduction agreement led by the Organization of the Petroleum Exporting Countries. However, the increasing oil export revenues due to the recovery in oil prices sustain the expansion of domestic demand, albeit at a very slow pace.

Meanwhile, the geopolitical situation in the region continues to influence the economies in Western Asia. The Iraqi economy regained a degree of stability as the security situation improved in various parts of the country. Despite the ongoing armed violence, the Syrian economy also showed a sign of stabilization as the foreign exchange rate had been stable at around 510 Syrian Pounds per US Dollar over the last 12 months. However, the dire economic situation continues in Yemen as various humanitarian crises deteriorate. The economies of Jordan and Lebanon remain weak, being under the heavy influence of the political and security situation in Iraq and Syria. The reopening on 30 August of the Iraq-Jordan border crossing is expected to impact the Jordanian economy positively. Until the closure of the border crossing in 2015, Iraq had been the largest regional trading partner of Jordan.

Latin America and the Caribbean: On track for a mild recovery after two years of contraction

Against the backdrop of more favourable global conditions, Latin America and the Caribbean is set to see a mild economic recovery in 2017/18. After two consecutive years of contraction, the region’s GDP is projected to grow by about 1.0 per cent this year and 2.4 per cent in 2018. The return to positive aggregate growth is mostly attributable to Argentina and Brazil, which have emerged from recession. South America’s economies benefit from stronger external demand, a moderate upturn in commodity prices and benign external financing conditions. Falling inflation and looser monetary policy continue to support private consumption and investment. However, the sub-region’s recovery remains shallow and uneven amid ongoing political uncertainty in several countries, continuing needs for fiscal consolidation and structural impediments to growth such as inadequate infrastructure and weak labour productivity. Mexico and Central America are expected to see moderate growth in 2017/18, supported by strong remittance flows. Despite tighter monetary policy and uncertainty over United States trade and migration policies, the growth prospects of the Mexican economy have slightly improved thanks to strong private consumption and exports. Aggregate economic growth in the Caribbean is projected to gain some momentum during the forecast period. However, the pace of expansion will remain modest as many countries face significant structural constraints, institutional weaknesses and macroeconomic imbalances.

Follow Us