World Economic Situation And Prospects: November 2020 Briefing, No. 143

The European Central Bank’s unconventional policies—is hyperinflation looming?

The European Central Bank’s unconventional policies—is hyperinflation looming?

Monetary policy across the world has entered ever more uncharted territory over the past years. Gone are the times when changes in policy interest rates were the sole policy variable of public and financial market attention. Today, central bank announcements are as much or even more about unconventional policy tools—such as asset purchase programmes—than they are about interest rates. The European Central Bank (ECB) is no exception in this regard. In reaction to the COVID-19 crisis, it has initiated massive asset purchases, which come on top of similar such programmes over the past years and besides significant fiscal spending programmes. This has prompted critics to warn that the asset purchases of the ECB will cause drastically higher inflation rates. Under the impression of a flood of money entering the market, too much money is seen as chasing too few goods. This is reinforced by the run-up in the price of various assets such as real estate and equities. As a consequence, even the spectre of looming hyperinflation is making the rounds. The following analysis uses elements of central bank accounting and monetary theory to examine the validity of such concerns for the euro area.

The featured observation: explosive growth in the balance sheet of the ECB

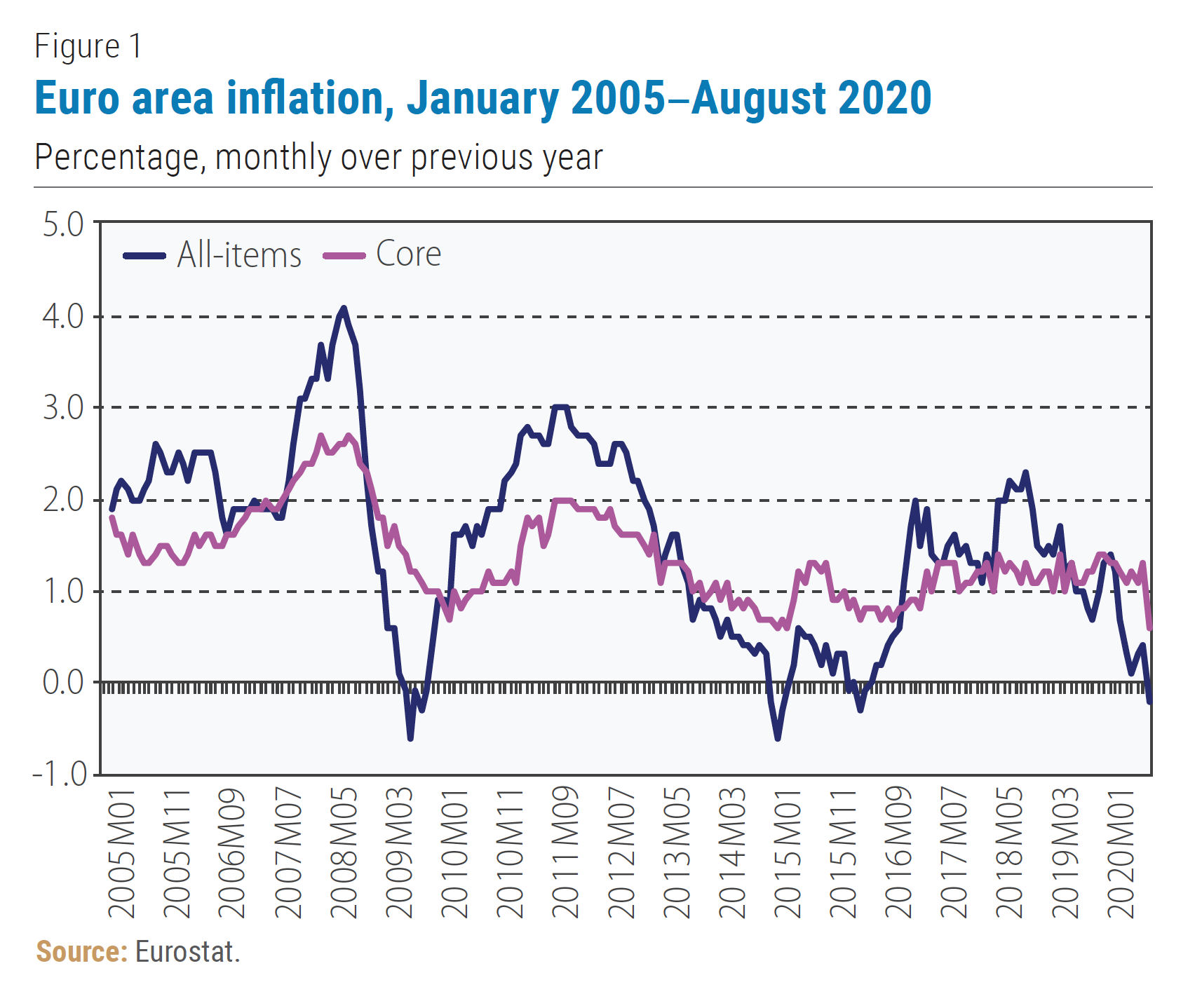

The mandate of the ECB stipulates that it has to hold inflation below but close to 2 per cent. Over the past couple of years, the euro area’s headline inflation rate has oscillated between dipping into negative territory and slightly exceeding the 2 per cent-mark (figure 1). In August of this year, it again fell into negative territory, reaching -0.2 per cent. Core inflation, which excludes volatile prices for energy and unprocessed food, has persistently remained below the policy target. All this constituted the initial anchor for an accommodative monetary policy stance: providing support to the economy in order to drive inflation up towards the policy target. However, the still seemingly more benign situation of merely undershooting the policy target was compounded at various points over the past years by moments of outright panic. In the wake of the global financial crisis of 2008 and 2009, the euro area experienced various episodes of instability. These took on different forms. Some of them were linked to doubts in financial markets regarding the sustainability of public debt levels in some countries, as reflected in interest rate shocks when investors demanded higher compensation for the perceived risks. In other phases, inflation threatened to become negative, with deflation fears starting to make the rounds in financial markets. Yet another form of emergency entailed an imminent threat of the euro area economy freezing up due to a liquidity crunch. A drastic form of this occurred in the spring of this year as a consequence of the sudden and widespread stoppage of economic activity in the euro area.

The mandate of the ECB stipulates that it has to hold inflation below but close to 2 per cent. Over the past couple of years, the euro area’s headline inflation rate has oscillated between dipping into negative territory and slightly exceeding the 2 per cent-mark (figure 1). In August of this year, it again fell into negative territory, reaching -0.2 per cent. Core inflation, which excludes volatile prices for energy and unprocessed food, has persistently remained below the policy target. All this constituted the initial anchor for an accommodative monetary policy stance: providing support to the economy in order to drive inflation up towards the policy target. However, the still seemingly more benign situation of merely undershooting the policy target was compounded at various points over the past years by moments of outright panic. In the wake of the global financial crisis of 2008 and 2009, the euro area experienced various episodes of instability. These took on different forms. Some of them were linked to doubts in financial markets regarding the sustainability of public debt levels in some countries, as reflected in interest rate shocks when investors demanded higher compensation for the perceived risks. In other phases, inflation threatened to become negative, with deflation fears starting to make the rounds in financial markets. Yet another form of emergency entailed an imminent threat of the euro area economy freezing up due to a liquidity crunch. A drastic form of this occurred in the spring of this year as a consequence of the sudden and widespread stoppage of economic activity in the euro area.

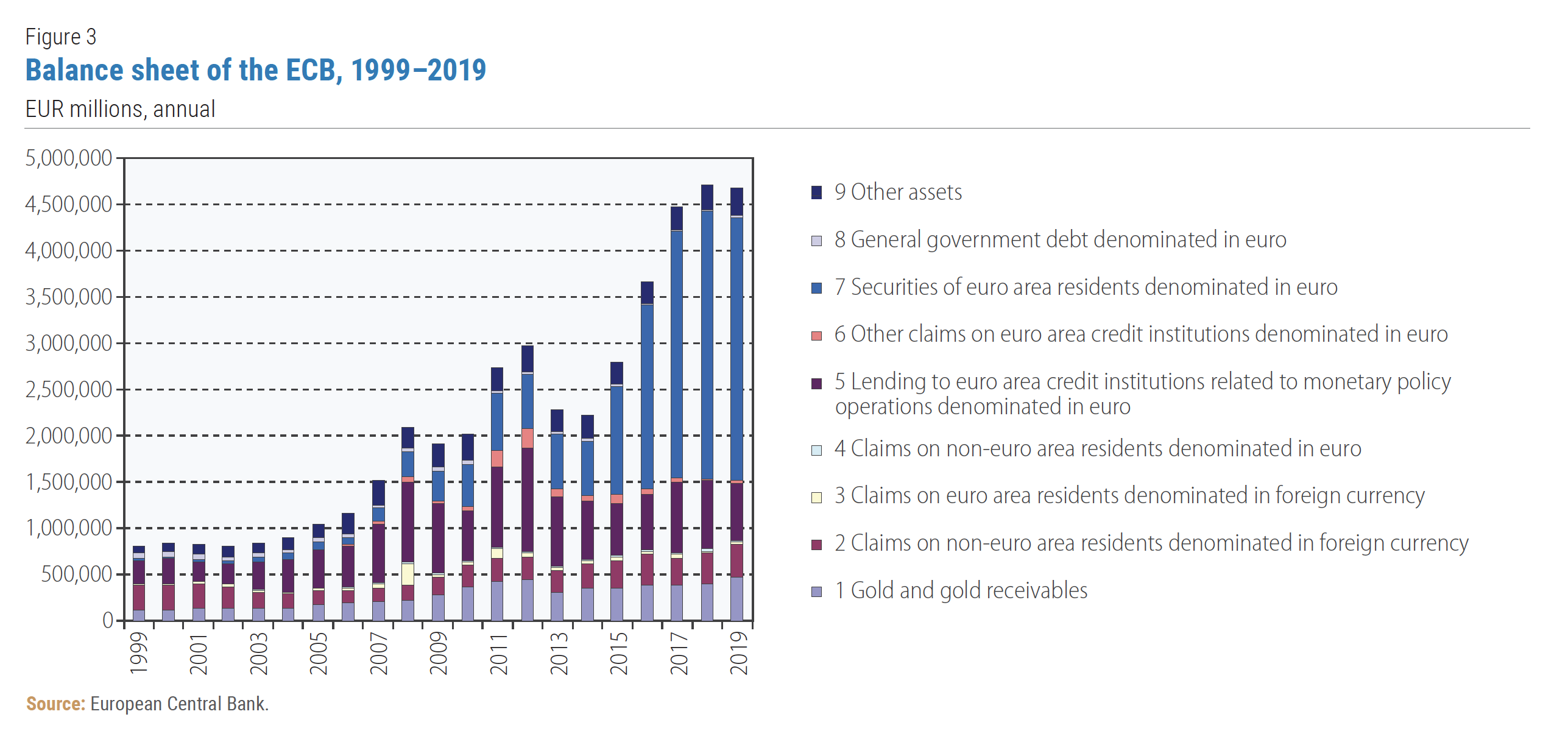

As its policy interest rates have long been close to zero or even negative (figure 2), the ECB had to deal with these crises by using increasingly unconventional means. This has included, in particular, various asset purchase programmes, such as the pandemic emergency purchase programme (PEPP) launched with a volume of 750 billion euros in March and increased to a total volume of 1,350 billion euros in June. As bond prices are inversely related to yields, the upward pressure on bond prices because of the demand coming from the ECB is driving down market yields. Policymakers would argue that this forms an important part of ensuring the effective transmission of their policy in financial markets. The more immediate result of these asset purchases has been a veritable explosion in the size of the ECB’s balance sheet. From 2007 to 2019, the ECB balance sheet more than tripled, and a major driver of this has been the sharp expansion in securities (figure 3).

As its policy interest rates have long been close to zero or even negative (figure 2), the ECB had to deal with these crises by using increasingly unconventional means. This has included, in particular, various asset purchase programmes, such as the pandemic emergency purchase programme (PEPP) launched with a volume of 750 billion euros in March and increased to a total volume of 1,350 billion euros in June. As bond prices are inversely related to yields, the upward pressure on bond prices because of the demand coming from the ECB is driving down market yields. Policymakers would argue that this forms an important part of ensuring the effective transmission of their policy in financial markets. The more immediate result of these asset purchases has been a veritable explosion in the size of the ECB’s balance sheet. From 2007 to 2019, the ECB balance sheet more than tripled, and a major driver of this has been the sharp expansion in securities (figure 3).

Taking a closer look at the balance sheet composition, the position containing securities is split up further into other securities and securities held for monetary policy purposes. Remarkably, the latter stood at zero in a balance sheet with total assets of 2,075 billion euros in 2008, before steadily increasing to 2,632 billion euros or more than 56 per cent of total assets in 2019. As a share of GDP (figure 4), the balance sheet of the ECB tripled from around 13 per cent in 2006 to 39 per cent in 2019. By comparison, the United States Federal Reserve’s balance sheet also saw an increase as a share of GDP and even exceeded that of the ECB in 2013 and 2014, but then gradually declined to less than 20 per cent in 2019. With the measures taken in reaction to the current crisis, both percentages have started to further increase significantly in recent months.

Assessing the potential inflationary impact of the ECB’s policies

Interactions between commercial banks and the central bank

Some central bank accounting principles can be helpful in understanding the implications of the ECB’s policies. As the central bank buys securities, it books these as an addition on the asset side of its balance sheet. On the opposite side, it has to book an additional liability. In broad terms, the payment for the asset purchase might go to the reserve account of a financial institution at the central bank, increasing the liability of the central bank to credit institutions. Alternatively, the central bank could also increase the currency in circulation, which is a further liability position that can offset an increase in assets. The sum of reserves and currency in circulation is also called the monetary base. This accounting background shows the unique position of a central bank: being able to create money out of nothing. But to the critical observer, this also raises the question regarding the actual effects of the ECB’s policies. In particular, does the sharp increase in asset purchases by the ECB mean so much additional money supply that a future inflation shock is inevitable?

Some central bank accounting principles can be helpful in understanding the implications of the ECB’s policies. As the central bank buys securities, it books these as an addition on the asset side of its balance sheet. On the opposite side, it has to book an additional liability. In broad terms, the payment for the asset purchase might go to the reserve account of a financial institution at the central bank, increasing the liability of the central bank to credit institutions. Alternatively, the central bank could also increase the currency in circulation, which is a further liability position that can offset an increase in assets. The sum of reserves and currency in circulation is also called the monetary base. This accounting background shows the unique position of a central bank: being able to create money out of nothing. But to the critical observer, this also raises the question regarding the actual effects of the ECB’s policies. In particular, does the sharp increase in asset purchases by the ECB mean so much additional money supply that a future inflation shock is inevitable?

The asset purchases have led to a sharp increase in the monetary base, which is the sum of currency in circulation, the deposits that banks have to hold in their current accounts in the Eurosystem (minimum reserve requirement) and excess reserves in the Eurosystem (deposit facility). However, a decomposition shows that the overall increase was primarily driven by higher required and excess deposits in the Eurosystem (figure 5).

The asset purchases have led to a sharp increase in the monetary base, which is the sum of currency in circulation, the deposits that banks have to hold in their current accounts in the Eurosystem (minimum reserve requirement) and excess reserves in the Eurosystem (deposit facility). However, a decomposition shows that the overall increase was primarily driven by higher required and excess deposits in the Eurosystem (figure 5).

Interactions between commercial banks and the economy

The monetary base is the most narrow concept of money supply and covers essentially the interactions between commercial banks and the central bank. But the outcome in terms of inflation depends on what subsequently happens in the other direction, namely between commercial banks and the economy, that is households and firms. Commercial banks can use their reserves at the central bank to make loans in the economy, which in turn would set off further economic demand, thereby creating a cascading chain of economic activity. The more this money creation in the real economy happens, the greater would one expect to be economic activity and the potential for higher inflation.

Consequently, one way to capture potentially inflationary effects of the monetary base is to look at how much this translates into greater money supply in the economy at large. The variable M3 constitutes a wider money supply measure, comprising the monetary base and other components such as, for example, time deposits. In the euro area, M3 has grown since 2006 with a trajectory that followed closely the 4.5 per cent-trend line (figure 6), which could be used as one benchmark for price stability. By contrast, the more narrow monetary base has increased much more sharply during this time span. This provides one indication that while money supply has increased between the ECB and commercial banks, it has not translated into a likewise increase in the broader money supply in the economy. The reasons for such substantial divergence are likely to include both supply side constraints in the banking sector and more cautious investment behaviour by firms, especially when combined with a dearth of viable investment projects.

Consequently, one way to capture potentially inflationary effects of the monetary base is to look at how much this translates into greater money supply in the economy at large. The variable M3 constitutes a wider money supply measure, comprising the monetary base and other components such as, for example, time deposits. In the euro area, M3 has grown since 2006 with a trajectory that followed closely the 4.5 per cent-trend line (figure 6), which could be used as one benchmark for price stability. By contrast, the more narrow monetary base has increased much more sharply during this time span. This provides one indication that while money supply has increased between the ECB and commercial banks, it has not translated into a likewise increase in the broader money supply in the economy. The reasons for such substantial divergence are likely to include both supply side constraints in the banking sector and more cautious investment behaviour by firms, especially when combined with a dearth of viable investment projects.

However, there were fluctuations around the M3 trend line. For example, M3 growth accelerated in 2007 and 2008, when it consistently hovered at more than 10 per cent. A similar scenario might currently be playing out. The most recent monthly data indicate that annual M3 growth has accelerated from around 5 per cent in February 2020 to around 10 per cent in August 2020.

A second way for measuring how a given monetary base affects economic activity and possibly inflation uses the concept of velocity of money. In one hypothetical scenario, a given monetary base may hardly be used, leading to a rather moderate level of economic activity as measured by GDP. In another scenario, the same monetary base may be used by banks much more intensively to give out loans and the public may exchange currency at a much greater frequency, leading to much higher overall GDP. This turnover of money is also referred to as velocity. If the turnover is higher, it would be associated with more vibrant economic activity as expressed by, for example, GDP and inflation.

For the euro area, while the monetary base has risen almost fourfold since 2006, the velocity of money has sharply decreased by around two thirds over the same time period (figure 7). Put differently, the greater amount of available money is being turned over far less frequently. This provides a further hint of the absence of inflationary pressures in the economy.

For the euro area, while the monetary base has risen almost fourfold since 2006, the velocity of money has sharply decreased by around two thirds over the same time period (figure 7). Put differently, the greater amount of available money is being turned over far less frequently. This provides a further hint of the absence of inflationary pressures in the economy.

Conclusion

Taken together, monetary aggregates have provided little ground for sharply higher inflation if looked at over longer time horizons, although the recent uptick in the broader money supply should be monitored more closely moving forward. While this can be seen as reassuring by those fearing higher inflation, it also hints at the very problem of the ECB, namely moving inflation up towards its policy target, or at least preventing deflation.

That the policy measures have so far had such a benign monetary impact can be an indication of other, more pressing problems than inflation. For one, it may hint at credit saturation, as banks find it increasingly harder to generate lending opportunities with acceptable risk levels. This would apply especially under the current crisis conditions, when banks tend to tighten lending conditions even further.

In addition, there might be more pronounced precautionary behaviour by banks given their current balance sheet structure. In the euro area, the state of the banking sector remains a major concern, for example in terms of equity ratios and bad loans. The pronounced increase in deposits at the ECB is a rather worrying sign regarding the stability of bank balance sheets. Even if hyperinflation might not be on the horizon, if the reason for this is deposit hoarding at the ECB by banks because of the dire situation in parts of the European banking sector, the challenge at hand might not be less daunting.

There is also the question of how best to anticipate any build-up of inflation pressure in the future. Besides other strands of analysis using, for example, wage data or capacity utilisation statistics, monetary variables can also play a useful role. One scenario to watch out for would be, for example, an increasing monetary base combined with higher velocity of money. For the latter, credit flows to non-financial institutions could then be included as a possible predictor. Irrespective of these considerations, given that deflation currently seems more of a danger than hyperinflation, the first portion of any future uptick in inflation will be a desirable step for the ECB towards achieving its formal policy target.

Follow Us