World Economic Situation And Prospects: November 2019 Briefing, No. 132

- Lack of innovation a key structural challenge for many developing countries

- Economic diversification impeded by structural barriers in the CIS and Africa

- Weak productivity growth contributing to bleak economic outlook in Latin America

English: PDF (168 kb)

Global issues: The challenge of innovation in developing countries

The economic situation in many developing countries has deteriorated considerably in recent years. Between 2010 and 2014, aggregate GDP expanded at an average pace of 6.0 per cent, but growth slowed to an average of 4.2 per cent between 2015 and 2018. The slowdown in growth has been particularly pronounced in Africa, Latin America and Western Asia. In 2019, average GDP growth in developing countries could fall below 4.0 per cent, amid lingering fragilities in Argentina, Brazil and South Africa, and weaker economic conditions in Mexico, Saudi Arabia and Turkey. There are many reasons behind this trend, including the knock-on effects from the collapse in commodity prices, protracted domestic weaknesses and, in many cases, deteriorating investor and consumer confidence due to policy uncertainties. For many developing countries, the escalation in trade tensions has dampened export flows and investment plans.

The economic situation in many developing countries has deteriorated considerably in recent years. Between 2010 and 2014, aggregate GDP expanded at an average pace of 6.0 per cent, but growth slowed to an average of 4.2 per cent between 2015 and 2018. The slowdown in growth has been particularly pronounced in Africa, Latin America and Western Asia. In 2019, average GDP growth in developing countries could fall below 4.0 per cent, amid lingering fragilities in Argentina, Brazil and South Africa, and weaker economic conditions in Mexico, Saudi Arabia and Turkey. There are many reasons behind this trend, including the knock-on effects from the collapse in commodity prices, protracted domestic weaknesses and, in many cases, deteriorating investor and consumer confidence due to policy uncertainties. For many developing countries, the escalation in trade tensions has dampened export flows and investment plans.

The growth slowdown in developing countries also highlights structural factors, which include limitations in their innovation and technological capabilities. In the short term, an innovative and adaptable productive structure supports a faster recovery in the event of a downturn, facilitating the adjustment to macroeconomic shocks. In the current context, this would allow for a smoother adjustment to rising trade protectionism. In the medium term, innovation is a key engine that drives the transformation of the productive and export structure towards more sophisticated activities. Thus, fostering innovation capabilities translates into higher growth and more sustainable development trajectories.1

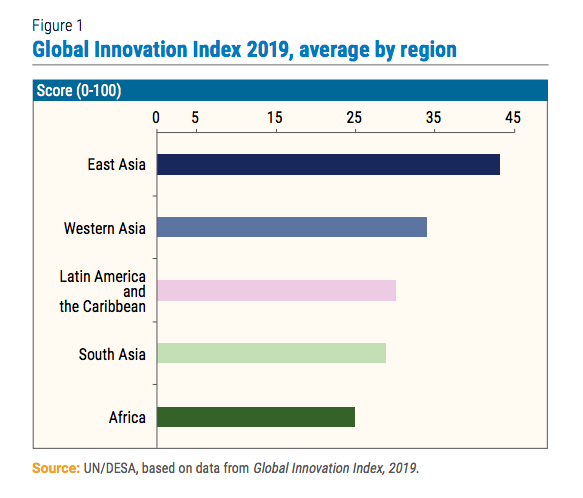

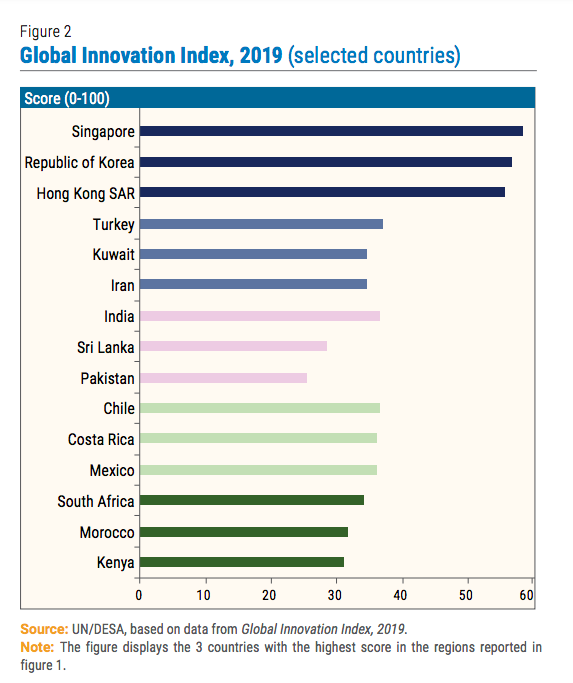

In recent decades, progress on innovation has differed markedly across developing countries. While difficulties exist in measuring innovation, some indices combine economic, technological and institutional aspects to provide a comprehensive assessment. For example, the Global Innovation Index uses a wide-ranging set of indicators of institutions, human capital, research, infrastructure, market and business sophistication and technology outputs.2 Figure 1 shows the Global Innovation Index across developing regions, while figure 2 displays the index for the three countries with the highest score in each region. Notably, East Asia performs better than other developing regions, with an average score of 43.1. Higher innovation indices are not only the case for Hong Kong SAR, Republic of Korea and Singapore, but also for countries like China, Malaysia and Viet Nam. These economies have been able to visibly strengthen their innovation activities and technological capabilities in recent decades. Other developing regions, by contrast, show a much lower score, especially Africa and South Asia.

In recent decades, progress on innovation has differed markedly across developing countries. While difficulties exist in measuring innovation, some indices combine economic, technological and institutional aspects to provide a comprehensive assessment. For example, the Global Innovation Index uses a wide-ranging set of indicators of institutions, human capital, research, infrastructure, market and business sophistication and technology outputs.2 Figure 1 shows the Global Innovation Index across developing regions, while figure 2 displays the index for the three countries with the highest score in each region. Notably, East Asia performs better than other developing regions, with an average score of 43.1. Higher innovation indices are not only the case for Hong Kong SAR, Republic of Korea and Singapore, but also for countries like China, Malaysia and Viet Nam. These economies have been able to visibly strengthen their innovation activities and technological capabilities in recent decades. Other developing regions, by contrast, show a much lower score, especially Africa and South Asia.

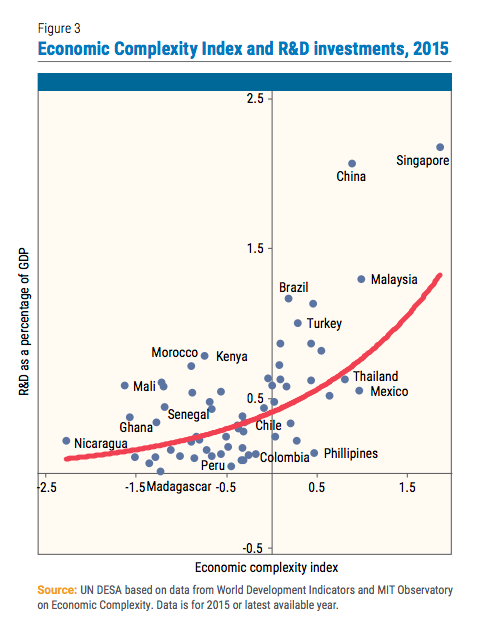

These patterns are confirmed by other measures of innovation and technological capabilities, such as R&D investments and the Economic Complexity Index (ECI). R&D investments reflect efforts to generate, absorb and use knowledge, constituting a crucial input for introducing product and process innovations at the firm level. Meanwhile, the ECI combines information on the diversity and ubiquity of a country’s exports.3 Figure 3 displays a correlation plot of the ECI and R&D investment across developing countries. As expected, there is a positive correlation, and countries with more diverse and specialized exports tend to exhibit higher R&D efforts. Again, countries from East Asia tend to score high according to both R&D investments and the ECI, while countries from Africa and Latin America tend to exhibit a relatively weaker performance.

Figure 3 also underscores that the ECI and R&D investments reflect distinct aspects of innovation, emphasizing its multiple dimensions. For example, the Philippines displays a relatively high ECI, as its export structure contains a large share of medium-high and high technology products. However, technological effort in the Philippines is limited, with a very low level of R&D investment, 0.13 per cent of GDP. This reflects several weaknesses in its innovation ecosystem, including an inadequate number of scientists and engineers, deficient infrastructure, and weak linkages between the private sector, universities and public institutions. By contrast, Kenya exhibits a relatively low level of ECI, as exports are highly concentrated in a few agricultural products and textiles. Yet, Kenya has strengthened its efforts to increase R&D investment in the last decade, to about 0.8 per cent of GDP, by designing comprehensive innovation policy frameworks.

Figure 3 also underscores that the ECI and R&D investments reflect distinct aspects of innovation, emphasizing its multiple dimensions. For example, the Philippines displays a relatively high ECI, as its export structure contains a large share of medium-high and high technology products. However, technological effort in the Philippines is limited, with a very low level of R&D investment, 0.13 per cent of GDP. This reflects several weaknesses in its innovation ecosystem, including an inadequate number of scientists and engineers, deficient infrastructure, and weak linkages between the private sector, universities and public institutions. By contrast, Kenya exhibits a relatively low level of ECI, as exports are highly concentrated in a few agricultural products and textiles. Yet, Kenya has strengthened its efforts to increase R&D investment in the last decade, to about 0.8 per cent of GDP, by designing comprehensive innovation policy frameworks.

Strong innovation and technological capabilities in East Asia have acted as an engine of growth, contributing also to enhanced resilience of their economies. By contrast, the poor performance of many countries in Africa, Latin America, South Asia and Western Asia is in part attributable to weaknesses in their innovation ecosystems. While there are significant differences across regions and countries, crucial factors include a limited scientific community and low levels of skills in the labour force, usually including mismatches between educational outcomes and industry requirements. Innovation is also concentrated in low-tech sectors with limited spillovers, and manufacturing innovation is highly informal. In addition, private investments in R&D are low and there are limited cooperation efforts between the private sector, universities and research institutions, amid weak institutional frameworks.

Against this backdrop, more formal approaches to promote innovation activities have gained increasing prominence in the the policy agendas across developing countries in the last decade.4 In many cases, this includes major modifications of the institutional frameworks as well. Altogether, this is an immense challenge, but transforming innovation from a barrier to an engine for development is essential to drive a sustained rise in living standards.

Developed economies

North America: Low labour force participation and high inequality impede inclusive growth in the United States

Economic activity in the United States has decelerated, prompting a third interest rate cut at the October meeting of the Federal Open Market Committee. Manufacturing production declined by 2.5 per cent in the first 9 months of the year. A particularly sharp decline in the production of motor vehicles was recorded, reflecting the impact of tariffs and trade disruption on the auto sector. Despite the recent deceleration, labour markets appear relatively strong, with the unemployment rate at its lowest level since 1969. However, the employed share of the population, while on an upward trend, remains well below levels prevailing a decade ago, reflecting a significant deterioration in labour force participation. The flow of re-entrants into the labour market continues to slow, and stands at its lowest rate in 50 years, suggesting that weak labour force participation will continue to act as a structural barrier to economic growth.

Job quality is also uneven, and inequality remains a significant obstacle to a higher sense of subjective well-being in the United States. After-tax income inequality in the United States is the highest in all developed economies and has continued to rise steadily since the mid-1970s. Inequalities in health and access to quality healthcare are also stark. Individuals with lower levels of education, who also have fewer job options, tend to report lower levels of health in general. The quality of available healthcare shows significant racial and ethnic disparities, which may partly explain racial life expectancy differentials that are as high as 7.6 years for men and 6.2 years for women. Life expectancy also differs significantly across income levels and geographical location. The share of the population with no form of health insurance began to rise again in 2018, following several years of improvement, suggesting that health inequalities may widen further.

Developed Asia: Labour shortage in Japan poses a challenge for the ageing society

Despite declining real wages throughout 2019, the labour market remains tight in Japan. The unemployment rate edged down to 2.2 per cent in August, and labour shortage became more severe in several economic sectors. Japan officially opened its door to semi-skilled foreign workers in April, but the new immigration policy is not expected to resolve the situation in the short run. The critical staff shortage in the medical and nursing care sectors is expected to continue, although the rapidly ageing society requires these sectors to be sufficiently staffed. In recent years, the Government has shifted its budgetary focus towards expanding social protection measures, including those for elderly citizens. However, the widening staff shortage in the medical and nursing care sectors poses a threat to socio-economic development in Japan.

Europe: Intellectual property rights and clean energy demand an integrated policy framework

The research and innovation performance in the European Union shows a steady improvement along several dimensions, such as broadband penetration and Doctorate graduates, but by many measures lags behind global innovation leaders such as Japan and the Republic of Korea. The environment for innovation may be impacted by ongoing policy debate in several areas, including intellectual property rights and climate policy. Innovation may be supported by an effective legal framework that protects intellectual property rights. This incentivizes R&D across the board, especially by small and medium-size firms. A key aspect of current global trade tensions relates to the global protection of intellectual property rights and barriers to entry that require the handover of technological expertise. Reducing these barriers could support innovation activity for many export-oriented companies in Europe.

Meanwhile, climate policy has stimulated efforts to revamp entire national electricity systems. Despite already significant investment in renewable energy generation, many countries in the region are struggling to wean themselves off their reliance on fossil fuel-based electricity supply. In some cases, environmentally damaging emissions have even increased after the implementation of renewable energy investment policies, because electricity imbalances have increased coal-fired electricity generation. This illustrates that innovation policies for specific technologies and applications must be fully integrated within a broader policy framework to ensure progress towards policy targets.

Economies in transition

Commonwealth of Independent States: Low R&D spending impedes economic diversification

For many economies of the Commonwealth of Independent States (CIS), excessive commodity dependence and a narrow export base remain sources of economic vulnerability and are significant constraints on growth prospects. The share of hydrocarbons and related products in total exports approaches 70 per cent for the Russian Federation and exceeds 90 per cent for Azerbaijan. To make progress on economic diversification, it is critical to invest in non-commodity sectors and increase their productivity, boost innovation and enhance intangible assets such as know-how and human capital. However, many CIS countries are lagging behind other countries with a similar level of economic development in the field of innovation, partly reflecting a legacy of the economic transition in the 1990s, which saw a massive emigration of scientists or their relocation to other sectors. The Russian Federation has the highest rank in the 2019 Global Innovation Index among the CIS countries, but ranks only 46th in the world, as spending on R&D is equivalent to only 1 per cent of GDP. Little research is conducted by the private sector, with important exceptions in the areas of IT, finance and the space industry. Even energy companies rely on imported technology to develop new oil and gas fields, which has led to a cancellation of off-shore drilling projects in response to sanctions imposed by the EU and the US. The Government of the Russian Federation has taken certain initiatives to promote innovation, such as providing additional tax breaks for companies developing new products and special tax exemptions for technology parks such as the Skolkovo Innovation Center; however, the outcome so far has been modest. The Governments of Armenia and Belarus are prioritizing development of their respective IT sectors. For those policies to succeed, it is crucial to develop supportive regulatory institutions, including a commitment to intellectual property rights.

Developing economies

Africa: Structural transformation must drive non-resource-based economic growth

Growth in Africa has trended in line with primary commodity prices for several decades. Real GDP growth peaked at about 4–5 per cent annually in the 1970s and 2000s as commodity prices soared. Output expanded by about 2 per cent annually in the 1980s and 1990s when prices were low. Most recently, faced with the largest real oil price decline since 1970 and a severe terms-of-trade shock, growth fell in the 2010s to about 3 per cent annually.

The need for systematic structural transformation from resource-based economies to more diversified economies is clear and has been thoroughly acknowledged. However, economic diversification across the continent remains low with only a few exceptions, including Egypt and South Africa, although recent improvements are evident in a few countries, such as Ethiopia, Morocco and Rwanda. International support for African economic diversification has also remained far from steady. For instance, United Nations Industrial Development Decades have only been established in years of low commodity prices and slow economic growth.

The launch earlier this year of the African Continental Free Trade Area aims to create a single market for goods and services which, once finalized, will cover 1.2 billion consumers with an aggregate income of $2.5 trillion. Since a significant portion of intra-African trade occurs in manufacturing, this is expected to promote industrialization and more productive jobs for a work force that is predicted to increase rapidly in the next decade. While any visible results will take years to develop, this regional agreement remains one of the most promising concerted efforts towards economic transformation and growth.

East Asia: Large infrastructure gaps obstruct sustainable development prospects of the region’s LDCs

Despite the challenging external environment, the short-term growth prospects of the least developed countries (LDCs) in the region remain favourable. Buoyed by resilient domestic demand, the economies of Cambodia, Lao People’s Democratic Republic and Myanmar are projected to sustain strong GDP growth of over 6 per cent in 2019 and 2020. Alongside robust private consumption, growth will also remain driven by strong inflows of foreign direct investment. Meanwhile, the Pacific Island LDCs, which include Kiribati, the Solomon Islands and Vanuatu, are expected to continue growing at a steady pace, supported by tourism revenues and infrastructure projects financed by development assistance flows.

The region’s LDCs, however, are confronted with severe structural impediments that are constraining their medium-term growth prospects. Notably, poorly diversified economic structures and critical shortfalls in essential infrastructure has contributed to persistently low productivity levels. This poses a significant challenge to boosting competitiveness and raising growth potential in these economies. For the Pacific Island LDCs, high vulnerability to natural catastrophes and weather-related shocks is further dampening their sustainable development prospects.

Given that the LDCs have very limited resources to overcome these structural weaknesses on their own, cooperation and support from the international community remains crucial. UN ESCAP estimates that it could cost up to $37.6 billion per year, which amounts to about 12 per cent of GDP, to meet the infrastructure investment needs of the LDCs in the Asia-Pacific region.

South Asia: Growing inequalities are holding back development in South Asia

Rapid economic growth has long been the engine behind development for many countries in South Asia, but growing inequalities are beginning to loom as a structural barrier for continued development. While significant progress has been made across the region in bringing down poverty, improving health and other important indicators of human development, social and economic inequalities have often risen in tandem. The disparities across regional, ethnic, demographic, economic, religious and other dimensions seem increasingly hard to bridge. The deepening rural-urban divide is troubling policymakers across the subregion. Sectarian tensions and intolerance, often closely related to political and economic inequalities, are fuelling violent incidents in several countries. Meanwhile, despite progress in selected areas, gender inequality remains pervasive across South Asia.5 Policymakers in South Asia will need to invest much more in policies to bring down these rampant inequalities.

Western Asia: Social unrest highlights structural economic barriers in Lebanon

In Lebanon, the Government’s proposal for an austerity budget next year ignited widespread street protests. While the demonstrations are driven by demands for comprehensive governance reforms, they also point to a structural barrier for economic development in Lebanon: overreliance on external resources.

The Government has been seeking fiscal reform measures to cap the growing public debt. The ratio of gross public debt to GDP reached 151 per cent in 2018. In the first seven months of 2019, 33 per cent of government expenditure was on interest payments. However, the Government faces a narrow tax base. The corporate sector in Lebanon is small compared to the domestic demand base, reflecting an overreliance on external resources to supply both goods and finance. In 2018, goods exports stood at $3.8 billion, while goods imports stood at $19 billion. The gap was financed by service trade surpluses, workers’ remittances and foreign capital inflows. However, under this economic structure, the tax base leans heavily on the consumers’ side.

An expansion of the export-oriented corporate sector is essential to break this current structural barrier. Although it is challenging to shift the structure in the short run, the shift is critical to expanding the tax base. It will also ease constraints on the balance of payments, which have worsened amid dwindling foreign capital inflows. Moreover, it would nurture domestic economic dynamism to create decent employment opportunities.

Latin America and the Caribbean: Low productivity growth holds back economic performance

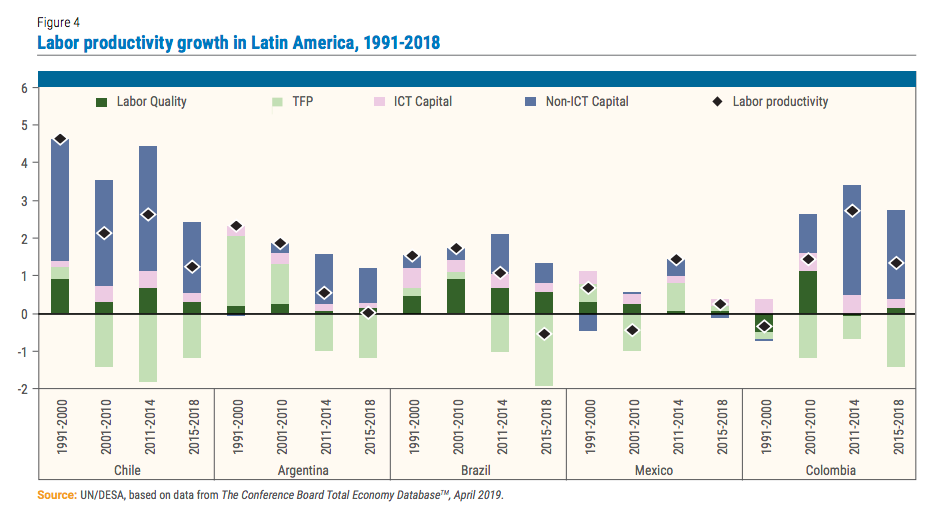

Latin America and the Caribbean is mired in a prolonged economic slump. The region’s aggregate GDP today is lower than it was in 2014. Much of the poor economic performance of the past few years is due to structural factors, most notably weak productivity growth. Since 2000, about three-quarters of the region’s overall GDP growth has come from an expansion of the labour force rather than through productivity gains. Figure 4 illustrates the downward trend in labour productivity growth in the region’s largest economies. The weakness seen since 2015 reflects two main factors: slowing capital accumulation and negative contributions from total factor productivity, which aims to capture the efficiency with which inputs of capital and labour are utilized.

One of the factors behind persistently low productivity rates lies in a polarized production structure.6 On one side of the spectrum, there are a few highly productive large companies, many of which are operating internationally. On the other side, there is a multitude of small, often informal, companies that have low productivity and absorb the bulk of low-skill workers. The difference in productivity levels between these two groups is significantly higher than in developed economies. Largely missing are dynamic and rapidly-growing midsize companies that could add competitive pressures and help spur productivity growth.

1 Some argue that developing countries need to enhance their capital stock before focusing on innovation, as capital investment is a crucial source of growth. Yet, innovation is a cumulative process needed to avoid, or ameliorate, situations of “lock-in” in commodities and low technology sectors. Thus, a crucial issue is how developing countries can effectively innovate and build technological capabilities together with capital accumulation.

2 The Global Innovation Index is the result of a collaboration between Cornell University, INSEAD and the World Intellectual Property Organization (WIPO). See https://www.globalinnovationindex.org/Home.

4 Cirera, X., and William F. Maloney (2017). The innovation paradox: Developing-country capabilities and the unrealized promise of technological catch-up. Washington, D.C. For a more detailed discussion in Latin America, see Navarro, Benavente, and Crespi (2016). The new imperative of innovation: Policy perspectives for Latin America and the Caribbean. Inter-American Development Bank. Washington, D.C.

5 UNDP Human Development Indices and Indicators: 2018 Statistical Update, http://hdr.undp.org/sites/default/files/2018_human_development_statistical_update.pdf

6 See for example McKinsey Global Institute (2019). Latin America’s missing middle: Rebooting inclusive growth. Available from https://www.mckinsey.com/featured-insights/americas/latin-americas-missing-middle-of-midsize-firms-and-middle-class-spending-power.

Follow Us