World Economic Situation And Prospects: November 2016 Briefing, No. 96

- Surge in global bond issuance may pose a risk to the global economy

- Saudi Arabia raises $17.5 billion in record sovereign bond sale by an emerging economy

- Egypt devalues pound to alleviate persistent foreign currency shortages

Global issues

Surge in global bond issuance may pose a risk to the global economy

Amid historic low yields in most parts of the world and continued bond-purchasing programmes by major central banks, year-to-date data suggest global bond issuance in 2016 has continued the rapid pace seen in recent years, especially among developing countries. Saudi Arabia, for example, recently raised $17.5 billion in the largest-ever bond sale by an emerging economy (see the Western Asia section for more discussion).

In particular, outstanding corporate bond levels have soared in many emerging economies during the post-crisis period, as firms searching for higher-yield assets take advantage of the loose financing conditions and large capital inflows. While corporate leverage has stabilized somewhat in recent quarters for some developing economies, it has been rising in a number of larger developing economies, notably China. Rising leverage does not necessarily pose a risk in itself, as long as it reflects financial deepening that is commensurate with economic development. However, risks emerge when corporate debt rises and profits fall, and when debt is channeled into sectors that may not boost overall productivity. Moreover, growing corporate debt would eventually constrain investment – even in productive firms – when it hampers their ability to bear further risk.

High corporate leverage in a country may also increase its government’s contingent liabilities. Amid worsening fiscal positions, this will further constrain large-scale government spending to support growth.

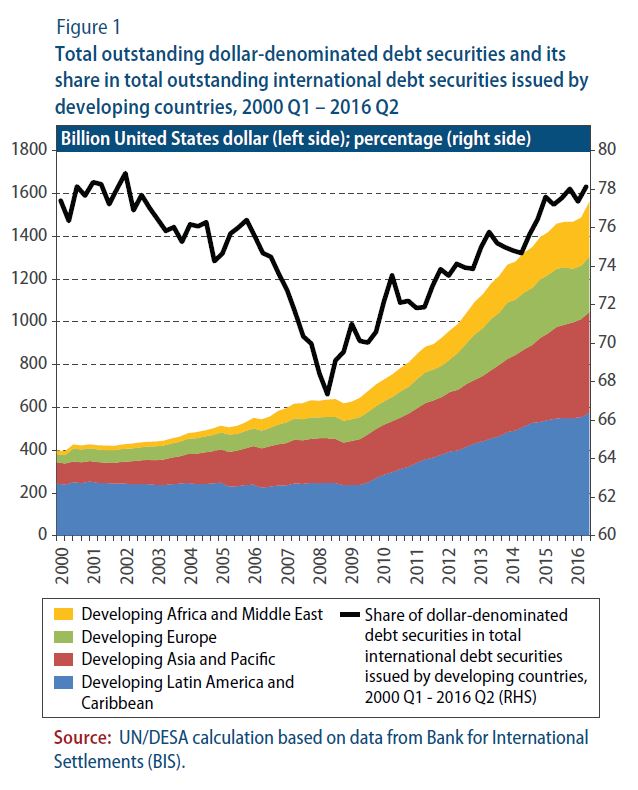

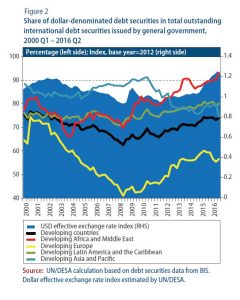

Of note, many international bond issuances have been denominated in the United States dollar, posing a higher exchange-rate risk for borrowers. Figure 1 illustrates the rapid growth of outstanding dollar-denominated debt securities – predominately bonds – issued by developing countries in international markets since the Global Financial Crisis. This outstanding dollar debt has risen from pre-crisis levels of around $600 billion to $1.5 trillion as of the second quarter of 2016. The share of dollar debt securities in total outstanding international debt securities issued by developing countries has been steadily increasing since the financial crisis, reversing the downward trend observed in the pre-crisis period. This rising importance of dollar-denominated debt securities is largely driven by government bond issuance by most developing regions, except for Asia and the Pacific (figure 2).

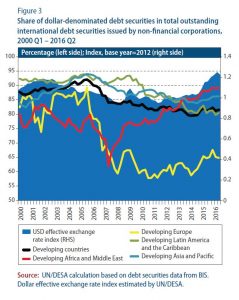

However, trends are less uniform across regions in corporate debt securities (figure 3). Among all developing regions, non-financial corporations in the developing Africa and Middle East region experienced the most dramatic increase in exposure to risks associated with the dollar’s appreciation. The dollar-denominated debt securities as a share of total outstanding international debt securities in this region rose from a low of 62 per cent in the second quarter of 2007 to almost 90 per cent as of the second quarter of 2016.

While the timing and pace of further policy rate hikes in the United States remain uncertain, interest rate differentials relative to other developed economies are expected to widen. This gap will likely renew upward pressure on the dollar, adding to the debt-servicing cost of countries with significant dollar-denominated debt. In fact, the strong appreciation of the effective dollar exchange rate since early 2014 has already resulted in significantly higher debt-servicing costs for some countries. For example, this is the case for Mozambique, which initiated a restructuring of its international debt, a move prompted in part by the 55 per cent depreciation of the currency against the dollar since January 2015. In some cases, countries have been financing rising debt-servicing costs by issuing additional dollar debt. This could eventually lead to concerns of default, which in turn would put further downward pressure on local currencies, potentially leading to a vicious cycle of rising debt-servicing cost and continuing currency depreciation.

In addition, ongoing corporate deleveraging in some developing economies – partly in response to the strong dollar – is central in assessing corporate debt-related risk. The impact of this process will depend critically on whether firms are able to deleverage in an orderly fashion, which would in turn be determined by corporate profits and financing conditions. In the case of disorderly deleveraging, the banking system would face significant pressures as firms fail to repay their bank loans, amplifying existing fragilities.

In addition, ongoing corporate deleveraging in some developing economies – partly in response to the strong dollar – is central in assessing corporate debt-related risk. The impact of this process will depend critically on whether firms are able to deleverage in an orderly fashion, which would in turn be determined by corporate profits and financing conditions. In the case of disorderly deleveraging, the banking system would face significant pressures as firms fail to repay their bank loans, amplifying existing fragilities.

Given the strong trade, finance and investment linkages across economies, corporate debt problems in one country may profoundly affect neighboring countries. However, spillover impacts and transmission channels of financial shocks vary from country to country. For example, high corporate debt in countries where there is a large share of external debt would pose direct risks to their international creditors. On the other hand, while China’s escalating corporate debt is staggering and poses considerable risk to the country’s growth outlook, international debt securities account for less than 2 per cent of its total outstanding debt securities. At about 10 per cent of gross domestic product (GDP), China’s external debt is also significantly lower than the 26 per cent of GDP for developing economies as a whole. Despite limited direct exposure of the rest of the world to China’s corporate debt, financial vulnerabilities in China still pose risks to regional and global growth. In the case of disorderly deleveraging, the shock to domestic demand in China would radiate abroad through trade and outward direct investment channels, and could heighten volatility in global financial markets.

Developed economies

United States: Turn in the inventory cycle

In the third quarter of 2016, GDP growth in the United States accelerated to 2.2 per cent on an annualised basis, following three consecutive disappointing quarters. The rebound is primarily linked to a turn in the inventory cycle. After five consecutive quarters of inventory destocking, the change in private inventories contributed 0.6 percentage points to GDP growth in the third quarter. Net trade also made a strong positive contribution, reflecting particularly a boost in agricultural exports. Private sector fixed investment, on the other hand, continues to stifle growth in the United States. Heightened uncertainty, as a result of expected policy changes following the presidential election on November 8, will maintain downward pressure on investment in the near future.

GDP growth of 2.2 per cent is somewhat higher than the Federal Reserve’s current estimates of longer-run trend growth, which lies within a range of 1.7-2.0 per cent. Estimates of trend growth in the United States – which stood at 2.5-2.8 per cent in 2011 – have been revised down significantly over the last few years, reflecting the persistent slowdown in productivity growth seen since the Global Financial Crisis, which is now widely viewed as permanent.

The Federal Open Market Committee (FOMC) left interest rates unchanged at the November meeting, but indicated that the “case for an increase in the federal funds rate has continued to strengthen”, and the Fed Fund futures continues to forecast an interest rate rise at the next FOMC meeting in December. This accords with an expected uptick in inflation in December, when the contribution of the oil price to inflation is expected to reach a turning point. If the oil price were to remain at average levels in the first week of November, its year-on-year increase would reach 24 per cent in December 2016. However, the FOMC may remain more cautious if financial market volatility stays elevated in the aftermath of the election.

Japan: Deflationary pressures to ease

In September 2016, the Bank of Japan (BoJ) announced a new set of unconventional monetary policy measures aimed at boosting inflation and reviving growth. The policy of “quantitative and qualitative monetary easing with yield curve control” aims to anchor expectations for 10-year government bond yields, with the current target set at 0 per cent. Since the policy was announced, the market yield on 10-year government bonds has indeed hovered just below 0 per cent, while the yen has depreciated by about 2.5 per cent against the US dollar. Nonetheless, the yen remains nearly 15 per cent stronger against the US dollar than its average value in 2015. This has strongly restrained export volumes, which declined by 1.2 per cent in the first half of 2016 relative to a year earlier. Crucially, the strong yen has also been one of the important forces that pushed the economy back into deflation in early 2016. Year-on-year inflation was -0.5 per cent in September for the All Items Index, while consumer prices, excluding food and energy, were stagnant.

In the final months of 2016, the modest depreciation of the yen, coupled with a pivotal shift in the contribution of the oil price to inflation, will ease deflationary pressures to some degree. Energy prices reduced the all items consumer price inflation by about 0.5 percentage points in September. By December, this contribution is expected to turn positive, reflecting the year-on-year rise in the oil price. However, with stagnant prices in other sectors and entrenched expectations that continue to hold back wage growth, inflation is expected to remain well below the BoJ’s target of 2 per cent in 2017.

Europe: The EU and Canada sign a trade agreement

After seven years of negotiations, the European Union (EU) and Canada signed the Comprehensive Economic and Trade Agreement (CETA), after all EU member states agreed to it. The agreement stands to remove almost all tariffs between the two sides and is expected to generate additional trade amounting up to $12 billion. In other economic news, France registered third-quarter GDP growth of 0.2 per cent quarter-on-quarter, after a slight contraction in the previous quarter. Public investment was the main driver of growth, while private consumption and business investment were weak. Spain’s economy expanded by 0.7 per cent quarter-on-quarter in the third quarter, driven by both domestic and external demand. Regarding the inflation picture, Germany’s consumer price index increased by 0.8 per cent in October, the highest increase since May 2015. The fading impact of falling energy prices played a major role in the pickup in prices, which may become more pronounced in the near term.

Economies in transition

CIS: Outlook for the Russian banking system improves

The economy of the Russian Federation is showing further signs of exiting the two-year recession. In the third quarter of 2016, GDP grew by 0.1 per cent on a quarter-on-quarter basis. While industrial output shrunk by 0.8 per cent in September, this was largely due to base year effect. Real disposable income contracted at a slower pace of -2.5 per cent (August: -7 per cent). Since private consumption is likely to remain subdued, growth expectations are associated with industry. In October, the Purchasing Manager’s Index (PMI) reached a four-year high of 52.4; output in the manufacturing sector is expanding despite the ongoing decrease in foreign orders.

In October, Moody’s upgraded its outlook for the Russian banking system from negative to stable, citing improvements in loan to deposit ratios, improved capitalization thanks to continuing state injections, pledges to further assistance, especially to the sanction-affected banks, as well as lower dependency on the wholesale market.

In Kazakhstan, the giant Kashagan oil field in the Caspian Sea was relaunched in October after three years of suspended production. Moving to a stable commercial production will be gradual, but field output may reach 370,000 barrels per day by the end of 2017. The country’s current account is expected to record a deficit in 2016 and higher oil output should alleviate balance of payment pressures. In October, Tajikistan formally began construction of the Rogun dam, which will significantly change the energy supply pattern of the region and address the problem of chronic energy shortages.

Amid weakening inflationary pressures, the National Bank of Ukraine cut its policy rate from 15 to 14 per cent, while the National Bank of Moldova reduced its policy rate from 9.5 to 9 per cent.

In South-Eastern Europe, Serbia’s GDP expanded by 2.5 per cent in the third quarter. In October, the Government of Serbia negotiated an additional budget support loan from the United Arab Emirates worth $1 billion (a similar loan was granted in 2014), earmarked for the repayment of foreign debt taken earlier at less beneficial terms. The overall impact of the loan on public debt should be neutral. The country nevertheless intends to preserve its precautionary stand-by agreement with the International Monetary Fund (IMF).

Developing Economies

Africa: Egypt devalues currency amid persistent foreign currency shortages

In November, the Central Bank of Egypt devalued the Egyptian pound by more than 30 per cent against the United States dollar and announced a free-float of the currency, in an effort to alleviate severe foreign currency shortages in the economy. The devaluation of the domestic currency was also one of the conditions of the $12 billion loan agreement between the Egyptian authorities and the IMF. Investors reacted positively to the central bank’s decision, with Egyptian equity markets rising by 3.4 per cent following the announcement.

While the weaker exchange rate is expected to improve Egypt’s external competitiveness going forward, it has also increased risks to short-term growth. Alongside a hike in fuel prices and the recent introduction of a value-added tax, rising import costs will add to already elevated inflation, which stood at 14.1 per cent in September. Furthermore, the central bank’s decision to raise its key policy rate by 300 basis points to 14.75 per cent may not substantially lower inflationary pressures, given that the rise in consumer prices has mostly been driven by supply-side shocks. Instead, higher debt-servicing costs will likely weigh further on household spending. In addition, the significantly weaker currency has raised concerns over its impact on Egypt’s external debt, which rose at a rapid pace of 16 per cent to 17.6 per cent of GDP in the fiscal year 2015/16.

Meanwhile, ongoing domestic political uncertainties and elevated security threats in the North Africa sub-region continue to pose headwinds to Egypt’s vital tourism sector and investment prospects.

East Asia: China on track to achieve 2016 growth target

China registered a 6.7 per cent year-on-year growth in the third quarter of 2016, placing the economy firmly on track to hit its 2016 growth target of 6.5 to 7 per cent. In quarter-on-quarter terms, the economy expanded at a relatively sustained pace of 1.8 per cent in the third quarter. The services sector continued to drive overall output growth, followed by the industrial sector. While annual growth of the industrial sector has slightly decelerated in the third quarter, it was offset by the acceleration of the agricultural sector.

A notable development in the third quarter was the return of producer price inflation in September, following four and a half years of deflation. This was driven mainly by higher producer prices in the heavy metal and coal industries, amid a reduction in overcapacity and the gradual recovery of commodity prices. Producer price inflation supports corporate profits and provides some relief for firms in servicing historically high debt. Consumption growth (including both public and private) remains the dominant driver of the Chinese economy, but the National Bureau of Statistics is concerned about the sustainability of the current growth trajectory of private consumption. Ongoing efforts to address industrial overcapacity and the fall of certain agricultural commodity prices are likely to hamper wage growth of workers in affected sectors, which could weigh on overall private consumption growth.

South Asia: Monetary easing continues in India amid lower inflationary pressures

In October, the Reserve Bank of India cut its key policy rate by 25 basis points to 6.25 per cent, the lowest level since 2011, further deepening the monetary easing cycle initiated last year. Since January 2015, the repurchase rate has been reduced by 175 basis points. Amid lower inflationary pressures, the move was aimed at providing further support to economic activity, especially investment, which remains largely subdued. In September, consumer price inflation declined to 4.3 per cent year-on-year, the slowest pace since August 2015, mainly due to the fall in food prices.

Furthermore, the outlook for food inflation is expected to improve, due to greater sowing and measures to reduce supply-bottlenecks. As a result, the Reserve Bank of India may further ease its monetary policy stance in the coming months. However, inflation pressures could also revive in the near term due to the impending hikes in salaries and pensions for government employees. So far, the monetary easing cycle has had only limited effects on investment demand, which remains constrained by stressed balance sheets of banks and corporates and low capacity utilization.

Western Asia: Saudi Arabia raises $17.5 billion in the largest-ever bond sale by an emerging economy

Against a backdrop of lower oil prices, the countries of the Cooperation Council for the Arab States of the Gulf (GCC) are undertaking various policy measures to manage fiscal pressures, including spending and subsidy cuts, tax increases and, more recently, new issuances of debt. In October, Saudi Arabia raised $17.5 billion in its first international bond issuance. It is the largest-ever bond sale made by an emerging economy and is close to a fifth of its 2016 fiscal deficit, expected to reach about 13 per cent of GDP.

The bond sale attracted a much larger-than-expected demand amid low global interest rates, a search for yield among investors and the recent recovery in oil prices. Saudi Arabia’s mounting public debt remains, significantly, at sustainable levels.

The successful bond issuance has increased liquidity and confidence in financial markets, and it could also pave the way for further international bond issuances by the government and corporates in the near term. It could also favour the privatization plan for the oil giant Saudi Aramco in 2018, a key component of the medium-term strategy “Saudi Vision 2030” aimed at reducing the country’s heavy dependency on oil.

Brazil: Real economy remains weak, while confidence and financial indicators improve

Recently released data show that weakness in Brazil’s economy persisted in the third quarter of 2016 even as confidence and financial market indicators continued to improve. Industrial activity contracted by 1.1 per cent quarter-on-quarter and by 5.5 per cent year-on-year. The decline was most pronounced in the segment of durable consumer goods, where output was 12 per cent below last year’s level.

Brazil’s unemployment rate averaged 11.8 per cent in the third quarter, almost 3 percentage points higher than a year ago. In the face of a worsening labour market, the retail sales volume declined by about 6 per cent. The broad-based weakness in the real economy contrasts markedly with favourable trends in business and consumer confidence as well as financial market metrics.

In October, consumer confidence reached its highest level in almost two years. The real has appreciated by more than 20 per cent against the dollar since the beginning of 2016 and the main stock market index is up by about 40 per cent. These gains reflect optimism that the economy will soon emerge from the worst recession in history, bolstered by less political uncertainty as well as more credible and stringent monetary and fiscal policy. Against a backdrop of declining inflationary pressures, Brazil’s central bank cut interest rates in October for the first time in four years, reducing its benchmark rate by 25 basis points to 14 per cent. This move is likely to signal the start of a longer monetary easing cycle.

Follow Us