World Economic Situation And Prospects: July 2021 Briefing, No. 151

Global economic recovery threatens to leave many developing countries behind

Global economic recovery threatens to leave many developing countries behind

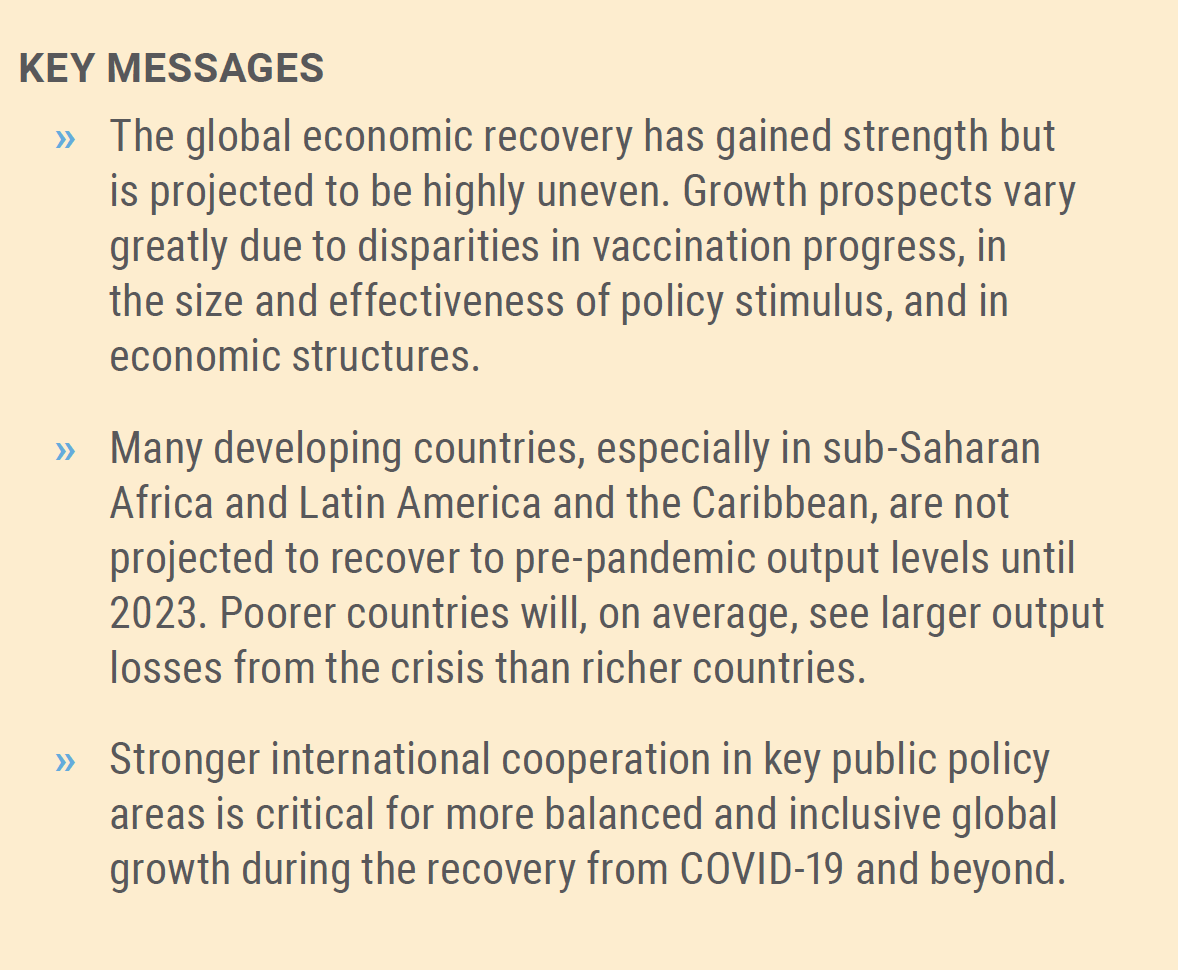

The past few months have brought a string of upbeat news on the global economy, suggesting a vigorous recovery from the COVID-19 crisis. World merchandise trade has soared and is already well above the pre-pandemic level (figure 1). Similarly, global industrial production has seen a V-shaped recovery since the middle of last year. The prices of key raw materials, such as copper, iron ore and lumber, reached record levels in the second quarter of 2021. Crude oil prices climbed to a 2-year high above $70 per barrel in June. Meanwhile, capital flows to developing countries have rebounded since late 2020, driven by extraordinarily accommodative monetary conditions, abundant global liquidity, and strong risk appetite among investors.

Against this backdrop, macroeconomic forecasters have raised their global growth projections for 2021 and 2022—often by a significant margin. In the World Economic Situation and Prospects (WESP) as of mid-2021, UN DESA projects world gross product to expand by 5.4 per cent in 2021 and 4.1 per cent in 2022—upward revisions of 0.7 percentage points from the forecasts presented in January. Developed countries are projected to grow by 5 per cent in 2021, a full percentage point faster than previously expected, whereas developing countries’ 2021 growth forecast has been lifted by 0.4 percentage points to 6.1 per cent. According to the World Bank,3 the current global recovery is set to be faster than any of the previous recoveries from a worldwide recession since the end of World War II.

All that glitters is not gold

All that glitters is not gold

However, beneath these positive headline numbers, a more worrisome picture emerges. For one, the projected 2021 high growth rates are to a large extent the result of base effects and do not necessarily signal a sustained upturn in economic activity. Countries around the world suffered severe output contractions last year, especially in the second quarter when lockdown measures were in full force. The deep 2020 slump has resulted in a low comparison base and significant statistical carry-over, inflating the year-over-year growth rates in 2021. This effect is particularly pronounced in countries that experienced a strong economic rebound during the latter part of 2020, such as China, India, Malaysia, Peru and Turkey. The challenge for countries emerging from the crisis will be to sustain a strong growth momentum in the coming years.

Second, and more importantly, the global recovery is projected to be highly uneven, with growth prospects diverging strongly across regions and countries. Above all, this reflects global disparities in the rate of vaccination against COVID-19, which determines governments’ ability to safely reopen the economy. In addition, the size and effectiveness of economic stimulus measures taken in response to the pandemic significantly affect the shortand medium-term growth outlook. Countries’ sectoral structure of production and trade also matters for the strength of recovery. For example, countries that heavily depend on international tourism, where recovery is still a long way off, are struggling to revive their economies. Conversely, countries that are strongly integrated into global merchandise trade, which rebounded much faster than initially expected, are better positioned to quickly recover from the crisis.

This begs the question which countries are lagging furthest behind in the recovery. In the following section, we use several GDP-related metrics, based on UN DESA’s latest forecast revisions, to dive deeper into the global divergence in economic prospects. This will help to inform global policy needs in the final section.

How have the growth forecasts changed since January?

The improvement in global growth projections is primarily driven by the stronger-than-expected recoveries in China and the United States of America, which together account for about 40 per cent of world output. China is the only G20 country besides Turkey that achieved positive GDP growth in 2020. With private consumption and investment rebounding, the growth projection for this year has been raised from 7.2 per cent to 8.2 per cent, the fastest pace in a decade.5 Meanwhile, massive fiscal stimulus and a rapid vaccine rollout are boosting economic activity in the United States. Real GDP is set to return to the pre-pandemic level in the second quarter of 2021—a significantly faster recovery than after the global financial crisis, when it took the US economy more than three years to reach its pre-crisis peak. The growth projection for the United States in 2021 has been lifted from 3.4 per cent to 6.2 per cent, the fastest pace since 1984. The significant upward revisions to growth in China and the United States alone have contributed a full percentage point to the global growth forecast for 2021.

The favourable outlook for the world’s two largest economies contrasts sharply with ongoing weakness in other parts of the global economy. In fact, for almost half of the countries, including many developing and transition economies, growth projections have been downgraded in the latest forecasting round. Under current projections, a significant number of countries are at risk of falling further behind economically, undermining poverty reduction and sustainable development progress. Following a downward revision, per capita GDP in sub-Saharan Africa is now projected to stagnate in 2021 and increase by less than 1 per cent in 2022. This comes after an estimated decline in per capita GDP of 5.2 per cent in 2020.

Likewise, short-term growth prospects have worsened for the group of 46 least developed countries (LDCs).7 LDCs are now expected to grow by only 4 per cent in 2021, 0.9 percentage points less than forecast in January and far below the 7 per cent rate targeted in Sustainable Development Goal 8.

One reason for the weak economic recovery in LDCs and many middle-income countries (MICs) is the slow vaccination progress. Hampered by vaccine nationalism and initial funding shortfalls, COVAX, the global vaccine distribution initiative, faced severe shortages in the first half of 2021. As a result, most developing countries have been lagging far behind in the global vaccination race. As of mid-June, developed countries had administered 73 doses per 100 people, upper-middle-income countries 43 doses, lower-middle-income countries 12 doses and LDCs 3 doses. Several LDCs have not yet administered a single dose, while in others the vaccination campaign has just been launched.

A second factor that is weighing on the economic recovery of the LDCs and many MICs is their limited ability to provide fiscal support. In sharp contrast to the developed economies, most of these countries have not been able to cushion the fallout from the pandemic with large-scale fiscal stimulus. As of April 2021, the MICs—which are home to three quarters of the global population— accounted for only 12 per cent of the global fiscal stimulus. The figures are even more staggering for the LDCs. While making up almost 14 per cent of the global population, they have accounted for a minuscule 0.15 per cent of the fiscal stimulus.11 Moreover, the crisis has weighed heavily on public finances, constraining fiscal space and raising the risk of debt distress going forward. In 2020, the average government debt-to-GDP ratio increased to 64.8 per cent in MICs (from 54.9 per cent in 2019) and to 62.1 per cent in LDCs (from 56.1 per cent in 2019), the highest levels since the mid-2000s.12 As a share of average tax revenues, government debt in LDCs stands at about 650 per cent, far higher than in MICs (510 per cent) and developed countries (350 per cent). Elevated debt-totax- revenue ratios present a long-standing vulnerability for LDCs.

When will countries return to their pre-pandemic GDP?

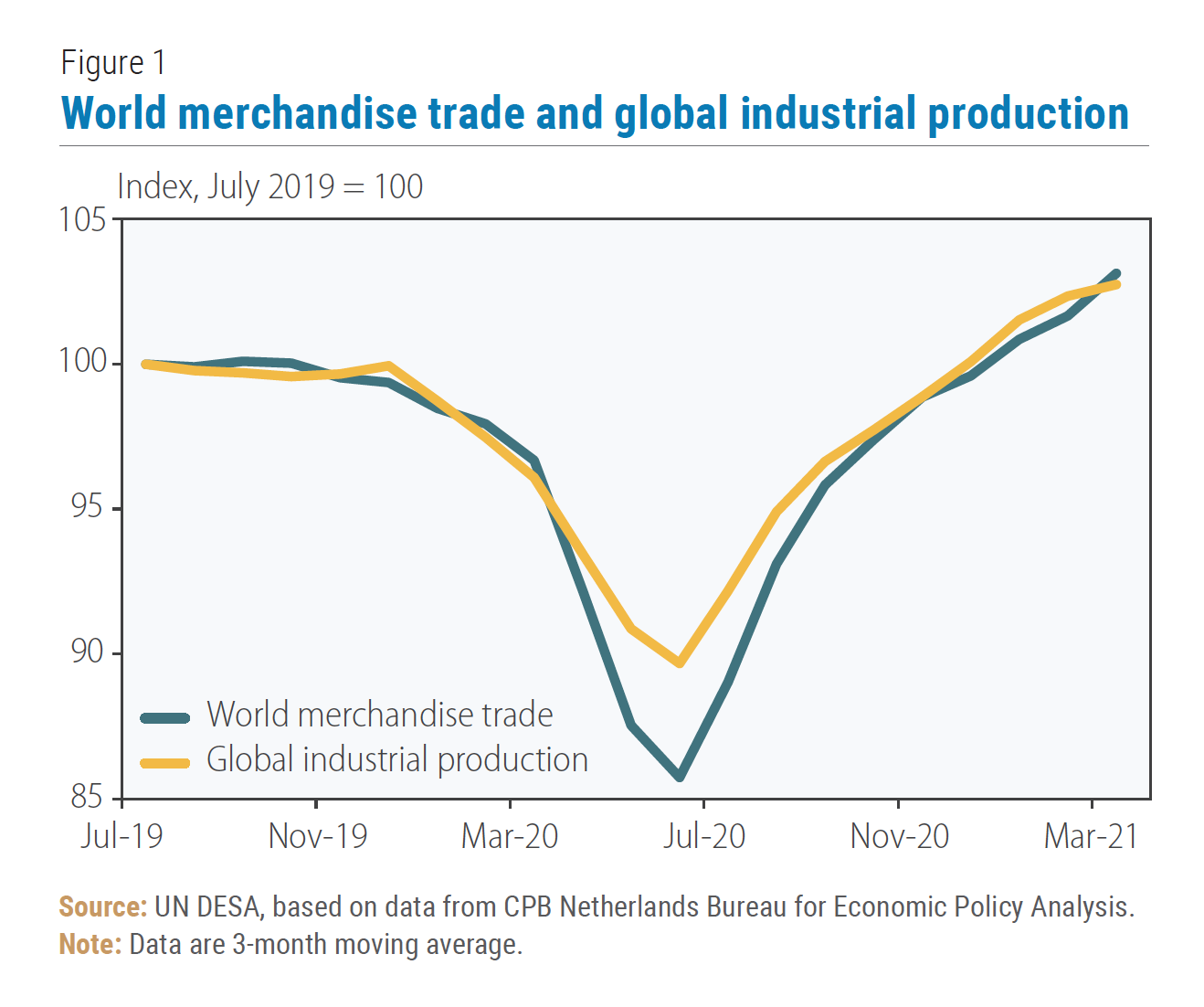

With annual growth rates providing only a partial, if not misleading, view of the economic performance, alternative measures need to be considered. An important benchmark in countries’ recovery from the COVID-19 shock is the time it takes to return to the pre-pandemic GDP.13 As shown in figure 2, many countries are struggling to make up the output losses suffered in 2020. In more than 60 per cent of countries worldwide, the 2021 GDP is projected to remain below the 2019 level. The outlook is particularly dire for Latin America and the Caribbean, where most countries are not expected to return to the pre-pandemic GDP level before 2023.

Latin America and the Caribbean’s difficulties in regaining lost ground are due to multiple factors. The pandemic has hit the region harder than any other part of the world—resulting in the highest per-capita death rate (187 deaths per 100,000 people as of 13 June 2021)14 and the biggest GDP contraction in 2020 (-7.3 per cent). In many places, new infections have soared in recent months. Except for a few countries, such as Bermuda, Chile, the Dominican Republic and Uruguay, vaccination progress has generally been slow in the region. Furthermore, while South America’s commodity exporters are expected to gain from soaring commodity prices, other countries are not well positioned to benefit from the improved global economic outlook. Strong reliance on tourism (especially in the small island developing States (SIDS) of the Caribbean), heightened social tensions and political instability, and pressing fiscal constraints are weighing on the recovery prospects of many economies. The region’s recovery is also hampered by its low trend growth rate. In the six years before the pandemic, Latin America and the Caribbean’s economic output grew at an average annual rate of only 0.2 per cent—by far the lowest of any region in the world. A myriad of structural impediments, including deep inequalities, weak governance, high levels of informality, and low investment in physical and human capital, have been holding back productivity growth.

How big are the output losses compared to prepandemic projections?

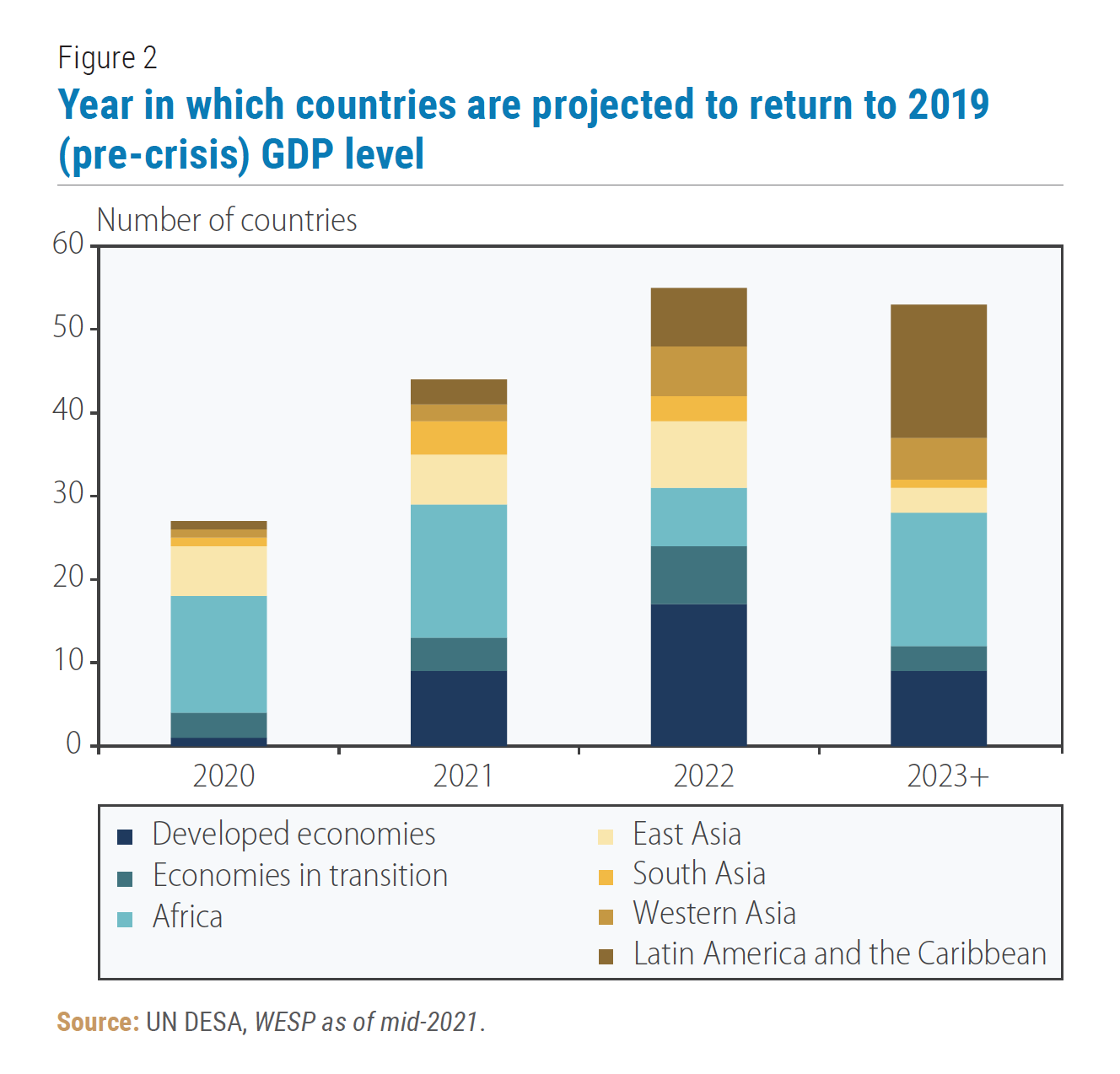

For a more comprehensive estimate of the output losses— accounting for the large cross-country differences in trend growth—one can compare the latest GDP projections with those made before the pandemic.15 Figure 3 shows that the average 2022 GDP in developed countries is projected to be about 4 per cent lower than what was expected prior to the COVID-19 crisis. The projected losses are greater for the economies in transition (about 6.5 per cent on average) and the developing countries (about 7.5 per cent). Moreover, there is a high level of dispersion among developing and transition economies. In one out of four of these countries, the 2022 GDP is projected to be at least 10 per cent below the pre-crisis projection. By comparison, just one developed country is projected to experience a loss of more than 10 per cent. As illustrated in figure 4, there is an overall positive relationship between the output change in 2022 and the GDP per capita level in the sample of 179 countries. Poorer countries are, on average, projected to see larger output losses than richer countries. 16 A striking observation is the wide variation in output losses among MICs. While this group includes some of the strongest-performing countries, it also comprises countries that are projected to experience the largest output losses relative to the pre-pandemic forecasts. Among the most severely affected countries are several SIDS (for example, Cabo Verde, Maldives, Sao Tome and Principe) as well as a number of countries where the pandemic coincided with other sources of instability (for example, Lebanon, Myanmar, Suriname).

For a more comprehensive estimate of the output losses— accounting for the large cross-country differences in trend growth—one can compare the latest GDP projections with those made before the pandemic.15 Figure 3 shows that the average 2022 GDP in developed countries is projected to be about 4 per cent lower than what was expected prior to the COVID-19 crisis. The projected losses are greater for the economies in transition (about 6.5 per cent on average) and the developing countries (about 7.5 per cent). Moreover, there is a high level of dispersion among developing and transition economies. In one out of four of these countries, the 2022 GDP is projected to be at least 10 per cent below the pre-crisis projection. By comparison, just one developed country is projected to experience a loss of more than 10 per cent. As illustrated in figure 4, there is an overall positive relationship between the output change in 2022 and the GDP per capita level in the sample of 179 countries. Poorer countries are, on average, projected to see larger output losses than richer countries. 16 A striking observation is the wide variation in output losses among MICs. While this group includes some of the strongest-performing countries, it also comprises countries that are projected to experience the largest output losses relative to the pre-pandemic forecasts. Among the most severely affected countries are several SIDS (for example, Cabo Verde, Maldives, Sao Tome and Principe) as well as a number of countries where the pandemic coincided with other sources of instability (for example, Lebanon, Myanmar, Suriname).

More balanced global recovery requires stronger and more effective international cooperation

The above analysis points to significant weaknesses in large parts of the world, including much of sub-Saharan Africa, Latin America, and most SIDS and LDCs. Many of these countries are not expected to recover to pre-pandemic output levels until 2022. At that time, the GDP of one out of four developing countries and transition economies is projected to be over 10 per cent lower than their pre-pandemic forecast. This is cause for alarm. Even before the pandemic, a significant number of countries in these regions were falling behind in economic development. For much of Latin America and the Caribbean and sub-Saharan Africa, the risk of another lost decade in terms of economic growth was already looming large. The COVID-19 crisis has further exacerbated structural weaknesses, widening inequalities, worsening employment conditions, and disrupting human capital accumulation. Longer-term stagnation or decline in per capita incomes could spur social unrest and undermine sustainable development.

Global recovery efforts must therefore be guided by the objective of preventing a growing cross-country divergence in economic fortunes. Stronger international cooperation is critical for more balanced and inclusive global growth during the recovery from COVID-19 and beyond. The list of policy needs is long and challenging. It starts with fairer and more equitable distribution of vaccines around the world. It also includes new global and regional approaches for addressing urgent liquidity needs and rising debt vulnerabilities—including by strengthening the international debt architecture—with special consideration of the needs in LDCs, SIDS, and MICs.17 Revitalizing the multilateral trading system, with a view to promote sustainable development, and delivering on aid promises are other key policy objectives. The much needed reform of the global tax system should above all benefit those developing countries that are currently hardest hit by multinationals’ tax avoidance.18 At the same time, public investments in social safety nets, education, and climate resilience should be promoted in order to reduce countries’ fragility to future shocks. Leaving no one behind is not only one of the core principles underpinning the 2030 Agenda for Sustainable Development—it should be a call for action guiding all our recovery efforts.

Global recovery efforts must therefore be guided by the objective of preventing a growing cross-country divergence in economic fortunes. Stronger international cooperation is critical for more balanced and inclusive global growth during the recovery from COVID-19 and beyond. The list of policy needs is long and challenging. It starts with fairer and more equitable distribution of vaccines around the world. It also includes new global and regional approaches for addressing urgent liquidity needs and rising debt vulnerabilities—including by strengthening the international debt architecture—with special consideration of the needs in LDCs, SIDS, and MICs.17 Revitalizing the multilateral trading system, with a view to promote sustainable development, and delivering on aid promises are other key policy objectives. The much needed reform of the global tax system should above all benefit those developing countries that are currently hardest hit by multinationals’ tax avoidance.18 At the same time, public investments in social safety nets, education, and climate resilience should be promoted in order to reduce countries’ fragility to future shocks. Leaving no one behind is not only one of the core principles underpinning the 2030 Agenda for Sustainable Development—it should be a call for action guiding all our recovery efforts.

Follow Us