World Economic Situation and Prospects: December 2022 Briefing, No. 167

Energy crisis poses threat to Europe’s industrial sector

Energy crisis poses threat to Europe’s industrial sector

Europe is facing a difficult and uncertain economic outlook. Governments, households, and firms are grappling with the energy and cost-of-living crisis that was aggravated by the war in Ukraine. As high energy prices are increasingly feeding through to other sectors of the economy, inflationary pressures have become more broad-based. In October 2022, year-on-year consumer price inflation in the European Union climbed to a record high of 11.5 per cent. The cost of energy remained the biggest driver of overall inflation, with energy prices rising by 38.7 per cent from a year ago. Core inflation – excluding energy, food, alcohol, and tobacco – also accelerated, reaching 6 per cent. High and persistent inflation is eroding the purchasing power of households and driving up the production costs of firms, while also adding pressure on central banks to hike interest rates further. Both the European Central Bank and the Bank of England delivered jumbo-sized rate hikes of 75 basis points in November 2022, coming on top of increases earlier in the year, while hinting at further increases in the coming months. Against the backdrop of high inflation and rapidly tightening monetary policy, many analysts are expecting European economies to suffer a recession over the winter.

The economic downturn may, however, be less severe than suggested by recent forecasts. In the past few weeks, there has been a string of good news on the energy front for Europe. Natural gas prices have retreated from their peaks in August, gas storages are almost completely filled, and autumn temperatures have been milder than normal. These trends have fuelled hopes that Europe may be able to avoid the worst-case scenario of massive gas shortages, rationing, and industrial shutdowns in the coming months. Nonetheless, such positive short-term developments should not obscure the challenges Europe’s energy-dependent industries are facing due to high gas and electricity prices, which will likely remain elevated for some time. Industries with gas-intensive production or with high absolute demand for gas could still see disruptions this winter. Moreover, persistently high prices could create lasting damage, eroding Europe’s competitiveness in high-energy manufacturing activities, causing losses in market share, and prompting companies to relocate to countries with lower energy costs.

Sharp reversal in natural gas prices

After hitting an all-time high in the third quarter of 2022, natural gas prices in Europe have receded sharply in the past few months (figure 1). Dutch front-month natural gas futures at the Title Transfer Facility (TTF), the region’s leading trading hub, hovered around €120 per megawatt hour (MWh) in late November, down from €320 in late August, but far above levels recorded before the war. For comparison, natural gas futures traded at €16 in March 2021. During the first eleven months of 2022, prices averaged €130, almost three times the 2021 average of €48.

After hitting an all-time high in the third quarter of 2022, natural gas prices in Europe have receded sharply in the past few months (figure 1). Dutch front-month natural gas futures at the Title Transfer Facility (TTF), the region’s leading trading hub, hovered around €120 per megawatt hour (MWh) in late November, down from €320 in late August, but far above levels recorded before the war. For comparison, natural gas futures traded at €16 in March 2021. During the first eleven months of 2022, prices averaged €130, almost three times the 2021 average of €48.

The drop in natural gas prices since August is due to increased supply from alternative sources, filling of gas storages, and reduced demand. The EU’s pipeline imports of natural gas from the Russian Federation declined steeply in 2022, falling by 45 per cent in the second quarter from a year ago. Accordingly, the Russian Federation’s share in the EU’s total extra-EU natural gas imports (net mass) decreased from almost 45 per cent in 2021 to an estimated 25 per cent in the second quarter of 2022. To compensate for this reduction, the EU rapidly scaled up its purchases from other suppliers, especially Norway, Qatar, and the United States. The EU’s net gas imports rose by 3 per cent year-on-year in the second quarter of 2022, defying earlier expectations of a decline. Pipeline imports from Norway increased by 16 per cent. Liquified natural gas (LNG) became the most important import supply source, growing by 49 per cent. LNG imports from the United States, by far the largest supplier of the EU, rose by 117 per cent. Strong imports allowed governments and energy companies across Europe to fill up the gas storages much faster than expected. By mid-November, the average filling level of gas storage facilities in the EU stood at 95 per cent, covering an estimated 28 per cent of the bloc’s yearly gas consumption. In Germany, Europe’s largest gas consumer, gas storage reached 99 per cent of capacity. This rapid scaling up of gas supplies from alternative sources, however, came at a steep price. Expenditure on gas imports soared to an estimated €75 billion in the second quarter of 2022, up from €20 billion a year ago. Some observers have also warned that amid a lack of imports from the Russian Federation, storages will likely be depleted by the second quarter of 2023, triggering a renewed scramble for natural gas.

At the same time, private households, businesses, and government entities have undertaken a variety of measures to reduce demand for energy, especially gas, in response to high prices. European Union Member States agreed to voluntarily cut their natural gas demand by 15 per cent between 1 August 2022 and 31 March 2023 through measures of their own choice. In several countries, such as Denmark, France, Germany, and Spain, heating of public buildings has been reduced to 19°C and illuminated advertisements are banned during night times. Preliminary analysis suggests that countries are on track to meet the established target. In August and September 2022, EU gas consumption was about 15 per cent lower than the average of the previous 5 years. This follows a reduction of about 11 per cent in the first half of 2022. Efforts to reduce gas consumption have been helped by unusually mild temperatures in autumn, which significantly curbed demand for heating across Europe. The European-average temperature for October 2022 was 1.92°C above the 1991-2020 average, setting a record for October. Forecasters are also expecting a warmer-than-usual winter

Europe’s energy-intensive industries are hit hard by the crisis

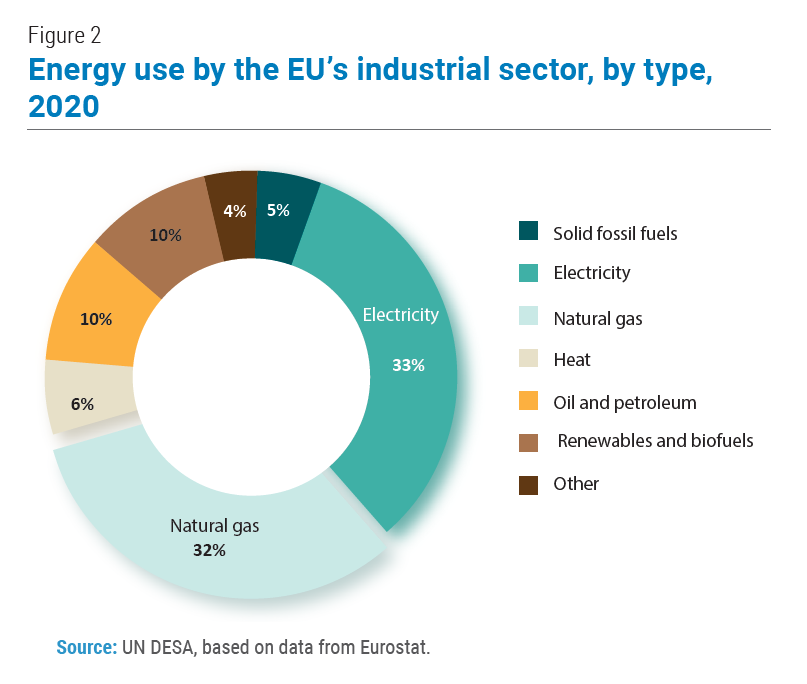

Europe’s industrial sector also depends heavily on natural gas as an input factor. In 2020, natural gas accounted for 32 per cent of the final energy consumption of the EU’s industry (figure 2). Since natural gas has a roughly 40 per cent lower carbon intensity than coal per unit of energy content, it was long promoted as a transition technology to facilitate the shift away from coal power generation. However, most industrial producers cannot easily switch from natural gas to a different type of energy. Adjustments require time and large up-front costs, and alternatives are often inferior to gas-operated industrial processes. For example, operational expenses are about two to three times as high using electrical instead of gas-powered furnaces. Moreover, delivery times for necessary components are currently very long due to persistent supply chain problems.

Europe’s industrial sector also depends heavily on natural gas as an input factor. In 2020, natural gas accounted for 32 per cent of the final energy consumption of the EU’s industry (figure 2). Since natural gas has a roughly 40 per cent lower carbon intensity than coal per unit of energy content, it was long promoted as a transition technology to facilitate the shift away from coal power generation. However, most industrial producers cannot easily switch from natural gas to a different type of energy. Adjustments require time and large up-front costs, and alternatives are often inferior to gas-operated industrial processes. For example, operational expenses are about two to three times as high using electrical instead of gas-powered furnaces. Moreover, delivery times for necessary components are currently very long due to persistent supply chain problems.

Energy-intensive industries, such as chemicals and petrochemicals, cement, paper, and iron and steel, are hit particularly hard by soaring energy costs. These industries play an important role for Europe’s economy. The iron and steel, minerals, refineries, and chemical industries combined employed an estimated 3.2 million people in the EU in 2019, accounting for about 11 per cent of total industrial employment.12 They also contributed about 15 per cent of total value added of manufacturing. Since a large share of energy-intensive products are intermediate goods, any disruptions to production can have a wider impact on industrial output and competitiveness.

Due to their production structure, some countries are affected more severely by the energy crisis than others. Germany, for example, combines a large manufacturing sector with high energy use in industrial production. In 2021, value added of the manufacturing sector accounted for 18 per cent of GDP, about twice as much as in France or Greece. Industrial energy use in Germany is concentrated in the chemical and petrochemical, non-metallic minerals (which includes cement, ceramic, and glass), and iron and steel industries (figure 3).

Over the past year, and especially since the start of the war in Ukraine, the performance of energy-intensive and non-energy- intensive industries in the EU has increasingly diverged (figure 4). In September 2022, output in energy-intensive industries was 6 per cent lower than at the beginning of the year. In Germany, annual production in the chemical industry is estimated to decline by 8.5 per cent in 2022. One in five intermediate goods producers in Germany has reported production cuts because of increasing energy prices.

Short-term crisis response must be complemented by longer-term strategies

Policy responses have so far mainly focused on the short-term management of the energy crisis. The European Commission has proposed several measures to improve stability in European gas markets. Plans include the introduction of a new EU instrument to limit excessive gas price hikes. This proposed market correction mechanism – which still needs to be approved by EU countries – consists of a price ceiling of €275 on front-month TTF derivatives. The price cap would come into force when two conditions are met: (1) the front-month TTF derivate price exceeds €275 for two weeks; and (2) the difference between the TTF price and the global LNG reference price is €58 or more. In addition, aggregation of EU demand and joint gas purchases to negotiate better prices have been proposed. At the national level, European governments have deployed a wide range of measures to shield energy consumers from soaring energy costs, including reductions in energy and value added taxes, retail and wholesale price regulation, transfers to vulnerable groups, and targeted business support. As of late November 2022, EU governments allocated an estimated €600 billion for these measures. Germany alone earmarked €264 billion in funding, including a so-called ‘Economic Defense Shield’ for households and firms.

Beyond the short term, the European Commission has proposed the REPowerEU plan, which aims to mobilize additional investments of €210 billion until 2027 to phase out Russian energy imports and make the region more independent from unreliable suppliers and volatile fossil fuels. The plan calls for a massive scaling- up and speeding-up of renewable energy power generation. The plan, however, still needs to be approved by Member States and the proposed measures require national implementation or coordination between countries.

Going forward, policies will have to increasingly address longer-term challenges to the region’s industrial competitiveness. If energy and gas prices stay elevated, many energy-intensive businesses in competitive industries may lose market shares and move to locations with cheaper energy. The EU’s fertilizer industry, for example, has warned that high natural gas prices are driving up input costs and undermining the sector’s global competitiveness. In Germany, pundits have voiced fears of deindustrialization after its largest chemical company announced that it would be permanently downsizing its operations in Europe to escape high energy costs. While such fears may be overblown, Europe’s policymakers face difficult trade-offs as they adjust to new geopolitical and energy market realities.

Follow Us