World Economic Situation And Prospects: December 2019 Briefing, No. 133

- As energy demand is rising globally, it is imperative to transition to clean energy

- The status of natural gas as a “transition fuel” is waning

- The automotive sector in Europe is undergoing dramatic changes

English: PDF (168 kb)

Global issues: Transitioning to clean energies in a world of rising energy demand

As climate researchers, business leaders, activists and policymakers meet this month for the 25th session of the Conference of the Parties (COP 25) to the UNFCCC1, the planet will be 1°C (1.8°F) warmer than preindustrial levels and the level of carbon dioxide (CO₂) in the atmosphere will have surpassed levels last seen hundreds of thousands of years ago. They will also know that there is little more than 10 years left for global warming to be kept to a maximum of 1.5°C (2.7°F) above preindustrial levels, as foreseen in the Paris Agreement, and that beyond which, even half a degree Celsius will substantially increase the risks of drought, flood, extreme heat and poverty for hundreds of millions of people.

Action in the energy sector will make or break the world’s chances of success at reining in climate change, since the sector accounts for about three quarters of global greenhouse gas (GHG) emissions. This points to an urgent need to phase in low-carbon energy technologies, and also to use energy more efficiently. Yet, current projections are at odds with the changes that are necessary. While most new power generation capacity added globally is coming from renewables—mostly wind and solar energy—most energy consumed globally is still provided by fossil fuels. At the same time, global energy demand continues to rise, and is projected to grow by nearly 50 per cent by 2050.2 More than half of the projected increase will occur in China, India and other countries in East and South Asia, as income levels rise and per capita energy consumption converges towards levels in developed economies. Newly built coal-fired power plants in these and other regions are also locking-in emissions of air pollutants for decades to come, contributing to the rising number of premature deaths from air pollution, which is already the fifth-largest threat to human health globally.

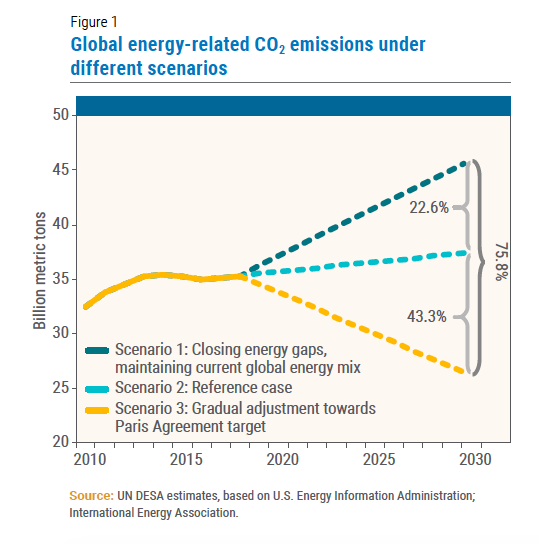

As living standards gradually rise throughout the world, these trends have dire implications in terms of emissions. Figure 1 illustrates the projected level of energy-related CO₂ emissions under a scenario where there is a 30 per cent rise in global energy demand and energy gaps in developing countries are closed, with no shift in the energy mix (Scenario 1). Global emissions would be approximately 23 per cent larger by 2030 compared to the Reference case of the International Energy Outlook 2019 (Scenario 2).3 The Reference case is roughly equivalent to a scenario where countries effectively meet the emissions pledges made in their Nationally Determined Contributions (NDC).4 In aggregate, countries are estimated to be broadly on course regarding their NDC pledges. However, these remain far from the trajectory advised by scientists to achieve the goals of the Paris Agreement and tackle climate change, which requires a decline in emissions of about 25 per cent from 2015 levels by 2030 (Scenario 3).

At the same time, millions of people in the world remain cut off from modern energy services. In fact, global trends on access to energy are projected to fall short of SDG 7 (Ensure access to affordable, reliable, sustainable and modern energy for all). Under current policy plans, by 2040, over 700 million people may remain without electricity, mostly in rural areas in sub-Saharan Africa, and only limited improvement is expected in reducing the traditional use of solid biomass as a cooking fuel.5 Cooking over open fires using solid biomass causes smoky indoor environments, which, in turn, lead to more than 2.6 million premature deaths annually.6

Access to affordable energy is indispensable for social and economic welfare and has long been considered an important enabler of economic development. Electricity infrastructure, in particular, has been found to facilitate economic growth, and countries with better access to electricity tend to have higher incomes.

All this points to the massive challenge of reducing GHG emissions while simultaneously providing accessible, reliable and decarbonized energy. Different strategies are available, however. For instance, the International Energy Agency updates every year an energy scenario in its World Energy Outlook report consistent with not only limiting the global temperature rise in accordance with the Paris Agreement, but also addressing air pollution and universal access to energy as per the SDGs, while delivering robust global economic growth. To succeed, an unprecedented global political and economic effort will be required, including investment and swift scale-up of renewable energy technologies, modernization of electricity transport and distribution, and increase in energy efficiency and energy electrification. Policymakers must also develop plans that aim to close the electricity access gap and follow these up with determined leadership, targeted regulation and increased investments in both on—and off-grid solutions. Crucially, clean-cooking solutions must become a top political priority, replacing biomass usage with cleaner alternatives for cooking. In sum, simultaneous and integrated action must be taken across different areas.

There are many encouraging developments in clean energy, including research and development in solar and wind technologies, standardization and economies of scale in manufacturing. Electric batteries are poised to follow a similar path. Global renewable energy capacity (excluding large hydroelectric dams) grew four-fold between 2010 and 2019. Since 2000, energy efficiency gains have offset more than one-third of the increase in energy-using activities. Several countries have plans to phase out inefficient fossil fuel subsidies, although this also requires careful coordination with social policies to protect the vulnerable. Oil and gas majors have pledged to reduce methane leaks from their operations. But far more needs to be done. Collective and coordinated government action can significantly influence future outcomes.

Developed economies

North America: Substantial share of economy driven by fossil fuel sectors

The economies of Canada and the United States remain heavily dependent on the extraction of fossil fuels. The United States produces more oil and gas than any other country in the world, whereas Canada ranks among the top 5 producers, and also produces a large share of global coal. Oil and gas extraction activities account for about 2 per cent of United States GDP, and 5.5 per cent of GDP in Canada. The sector’s impact on growth dynamics is even larger, as investment into extractive industries is very price sensitive, exhibiting large swings in response to fuel prices. In the United States, investment in mining exploration, shafts, and wells accounted for roughly 30 per cent of the slowdown in non-residential private investment growth between 2018 and 2019. Given the short-term nature of investment activity in the shale industry, which now accounts for over 60 per cent of oil and gas production in the United States, this part of the industry is particularly sensitive to the oil price.

The important role of the fossil fuel sector in the economy acts as an obstacle to more rapid progress towards environmental goals. Progress towards a cleaner energy mix in North America is lagging behind most of Europe. Both countries continue to provide some forms of subsidies to the fossil fuel industry, which include tax breaks, reduced royalty rates, or research and development support programmes. These subsidies conflict with policies to promote the transition away from carbon-intensive activities, including Canada’s national carbon tax. Removing this double standard would accelerate progress towards Canada’s 2030 targets.

Developed Asia: Storm-hit Japan turns to solar home systems for climate resilience

Typhoon Faxai, which hit Tokyo and surrounding areas in September 2019, severely damaged the power grid and caused a widespread power outage. The power outage lasted more than a week for 60,000 businesses and homes, compounding economic and human losses. The scale of damage overwhelmed the availability of workers for the restoration activities. Because of Japan’s shrinking number of construction workers and civil engineers, more prolonged power outages are expected in future extreme weather events. The recent disaster highlighted the benefit of solar home systems as a backup power source. Although high costs remain a barrier to more widespread use of solar home systems in Japan, the transition to renewable energy in Japan may accelerate, aiming to enhance climate resilience.

Europe: The automotive sector is undergoing dramatic change as part of the energy transition

Europe faces numerous challenges tied to the energy transition. A case in point is the dramatic change occurring in the automotive sector—a major employer and source of export revenue in several countries. In Germany, the car industry has struggled to adjust to stricter emissions tests and has had to deal with the fallout from the diesel emissions scandal. Combined with an increasing policy focus on climate change and air quality, both at the national level and in numerous German cities where legal battles emerged over outright bans on certain types of cars, this pressured car manufacturers to fundamentally question their business models. As a result, the automotive sector has seen a drastic reorientation, which has spurred major long-term investment programmes to create mainly electric-based product portfolios and a redefinition of corporate missions. Numerous car manufacturers now emphasize their role as mobility companies, encompassing also areas such as autonomous driving technologies and the operation of car-sharing platforms. The recent announcement by Tesla to build a new manufacturing plant in Germany further increases the pressure on European car manufacturers to make faster progress in aligning their business models with the current requirements of the market.

Among the European Union (EU) members from Eastern Europe, the energy transition poses a serious financial challenge for Poland, where the share of coal in power generation is close to 80 per cent. Estimates of the country’s financial needs to comply with the EU’s 2050 zero-emissions target range from €150 billion to €900 billion, with extremely limited funding available from the EU.

Economies in transition

Commonwealth of Independent States: Dual challenge of improving energy efficiency and energy mix

The region is characterized by high levels of energy intensity of GDP, despite dramatic improvements observed since the 1990s thanks to higher capacity utilization, the shift towards less energy – intensive sectors and convergence of relative prices for energy towards global levels. Almost 90 per cent of primary energy consumption in the Commonwealth of Independent States (CIS) and Georgia comes from fossil fuels, which emit a number of harmful air pollutants, with coal accounting for around 15 per cent of the total. Fossil fuel consumption subsidies, including those related to electricity generation, remain in the region. Renewable energy, mostly confined to hydropower, accounts for only a small share of the total. The scope for improving both energy efficiency and energy mix therefore appears substantial.

Policies to support the energy transition in the CIS should create suitable incentives through appropriate pricing mechanisms, which are sufficiently strong to encourage energy efficiency investments, addressing financing constraints, and using public investments. In Central Asia, there is a significant potential to develop hydropower, creating a subregional energy market. Overall, the speed of energy transition in the CIS remains uncertain, but the urgency of fostering economic diversification and moving away from excessive reliance on hydrocarbons is clear. The planned formation of the future common energy market in the Eurasian Economic Union will be an important factor. On the one hand, it may offer cheap fossil-fuel based energy, undermining financial viability of green energy projects. On the other hand, under the right policies, it may facilitate incentives for a greener economy in the region.

Developing economies

Africa: Renewable energy solutions for rural electrification point to a vast potential

In the joint press release on 31 October, three food agencies of the United Nations (the Food and Agriculture Organization, the International Fund for Agricultural Development, and the World Food Programme) warned that a record 45 million people across southern African countries could be severely food insecure over the next six months because of severe drought.7 This latest warning exemplifies the fact that the impact of climate change is acutely felt in Africa where most of the agricultural land is rain-fed. As rural communities in Africa depend on subsistence agriculture for their livelihoods, extreme weather events directly impoverish the rural population. The global energy transition for a low carbon economy is essential to relieve the suffering of rural Africa.

In this context, off-grid renewable energy solutions point to a vast potential. Access to electricity improves general living conditions, and it enables rural communities to enhance the resilience of agriculture. Electricity enables farmers to apply basic agricultural technology in irrigation, storage and processing. Off-grid renewable energy solutions, including stand-alone solar home systems and mini-grids, have already benefited more than 133 million people in developing countries.8 Rural electrification options through off-grid renewable energy solutions are becoming increasingly cost-competitive against traditional options of on-grid electrification, thanks to the declining cost of photovoltaic systems.

More countries in Africa have strategized their vision for universal access to electricity by 2030 with their commitments to SDG 7. Among others, Kenya targets to achieve universal access to electricity by 2022. In the Kenya National Electrification Strategy, the country laid out a plan to expand off-grid renewable energy solutions as one of the key principles to achieve universal access. Kenya has already raised the electricity access rate from 32 per cent in 2014 to 75 per cent in 2018 by the extensive utilization of off-grid renewable energy solutions.

East Asia: Large infrastructure gaps a major obstacle to sustainable development prospects of region’s LDCs

Despite the challenging external environment, the short-term growth prospects of the least developed countries (LDCs) in the region remain favourable. Buoyed by resilient domestic demand, the economies of Cambodia, Lao People’s Democratic Republic and Myanmar are projected to sustain strong GDP growth of over 6 per cent in 2019 and 2020. Alongside robust private consumption, growth will also remain driven by strong inflows of foreign direct investment. Meanwhile, the Pacific Island LDCs, which include Kiribati, the Solomon Islands and Vanuatu, are expected to continue growing at a steady pace, supported by tourism revenues and infrastructure projects financed by development assistance flows.

The region’s LDCs, however, are confronted with severe structural impediments that are constraining their medium-term growth prospects. Notably, poorly diversified economic structures and critical shortfalls in essential infrastructure have contributed to persistently low productivity levels. This poses a significant challenge to boosting competitiveness and raising growth potential in these economies. For the Pacific Island LDCs, high vulnerability to natural catastrophes and weather-related shocks is further dampening their sustainable development prospects.

Given that the LDCs have very limited resources to overcome these structural weaknesses on their own, cooperation and support from the international community remains crucial. ESCAP estimates that meeting the infrastructure investment needs of the LDCs in the Asia-Pacific region could cost up to $37.6 billion per year, which amounts to about 12 per cent of GDP.

South Asia: Countries face a stranding of their fossil fuel assets

As South Asia is making headway towards universal access to electricity, it remains heavily dependent on fossil fuels to meet the growing energy demand, putting the region in an uncomfortable position to face the global energy transition. India is investing in the national gas grid to increase access to energy and provide a somewhat cleaner alternative to coal. However, with only 5 per cent of electricity production coming from natural gas, it remains far behind the global average. The Islamic Republic of Iran, meanwhile, is still banking on its oil resources, with little diversification into non-oil sectors.

Stranded fossil fuel assets and their associated costs come on top of an already high investment gap for the energy transition in South Asia, particularly in terms of renewable energy capacity and needs for improved energy efficiency. ESCAP’s 2019 Economic and Social Survey of Asia and the Pacific estimates that South Asian countries need to invest an additional 10 per cent of GDP per year in order to achieve the SDGs, about a quarter of which is investment necessary to provide clean energy for all.

Expansion and integration of power grids is particularly needed to further improve the access to electricity and promote economic development in rural regions. While most investments needed for the energy transition will eventually earn a positive return, fiscal space tends to be limited amid concerns over slow economic growth and ongoing budget deficits. It is therefore imperative that policymakers create the right environment to crowd in more private investment in energy transition and promote access to clean energy for all.

Western Asia: Natural gas supply glut hits Qatar amid uncertainty over the energy transition

Qatar’s real GDP contracted by 1.4 per cent in the second quarter of 2019, compared with the same period last year. The energy sector led the contraction, implying that the country’s natural gas production has been declining. Qatar is the largest exporter of liquefied natural gas, filling the growing demand from East Asia, mainly China, Japan and the Republic of Korea. However, rapidly rising global natural gas production resulted in a supply overhang, which has only deepened in 2019. The prospects of future natural gas demand are mixed. Traditionally, natural gas is seen as a transition fuel toward a low-carbon economy because CO2 emissions from natural gas combustion are much lower than from coal and oil. The demand for natural gas was expected to rise in the process of the energy transition. However, natural gas demand growth has stayed weaker than expected. Natural gas remains more expensive than coal in Europe and Asia, hampering the transition out of coal. Moreover, as more policymakers call for leapfrogging to renewables in energy transition strategies, the status of natural gas as a transition fuel is waning. The Qatari economy is expected to be increasingly impacted by the energy transition and the uncertain status of natural gas in the energy transition.

Latin America and the Caribbean: A socially just energy transition requires fundamental policy shifts

Latin America and the Caribbean has contributed relatively little to the global climate crisis in terms of historical emissions. In 2018, the region accounted for only 4.8 per cent of global fossil CO2 emissions, well below its shares in world GDP (7.1 per cent) and world population (8.4 per cent). Per capita emissions are below the global average in almost all countries, including the region’s biggest emitters Argentina, Brazil and Mexico, which were responsible for two thirds of regional emissions in 2018. In transitioning from a fuel-based to a low-carbon economy, the three countries face significant challenges. In Argentina and Mexico, the energy mix is heavily dominated by fossil fuels. In 2017, about 90 per cent of the total primary energy supply came from hydrocarbons (gas, oil and coal). In Brazil, renewable sources, including hydropower, biomass, liquid biofuels and wind, play an important role in the energy mix. However, the bulk of new investments in the energy sector are directed at fossil fuels. A wide range of policies is needed to accelerate progress towards a socially just energy transition in the three countries9. Those include eliminating fossil fuel subsidies; implementing a progressive carbon tax; redirecting investment from fossil fuels to renewable energy sources; recognizing and addressing the social and spatial implications; and increasing the participation of citizens and communities in renewable energy projects.

1 United Nations Framework Convention on Climate Change.

2 U.S. Energy Information Administration (2019), International Energy Outlook 2019.

3 Ibid.

4 Intended reductions in GHG emissions under the UNFCCC.

5 International Energy Agency (2018), New Policies Scenario, World Energy Outlook 2018.

6 Ibid.

7 World Food Programme (2019), As climate shocks intensify, UN food agencies urge more support for southern Africa’s hungry people, Press release, 31 October, available from https://www.wfp.org/news/climate-shocks-intensify-un-food-agencies-urge-more-support-southern-africas-hungry-people.

8 IRENA (2019), Off-grid renewable energy solutions to expand electricity access: An opportunity not to be missed, available from https://www.irena.org/publications/2019/Jan/Off-grid-renewable-energy-solutions-to-expand-electricity-to-access-An-opportunity-not-to-be-missed.

9 See Climate Transparency (2019), Accelerating the energy transition in Latin America: How Argentina, Brazil and Mexico are addressing climate change and the energy transition.

Follow Us