World Economic Situation And Prospects: August 2021 Briefing, No. 152

Spillover effects of US monetary policy in developing economies

Spillover effects of US monetary policy in developing economies

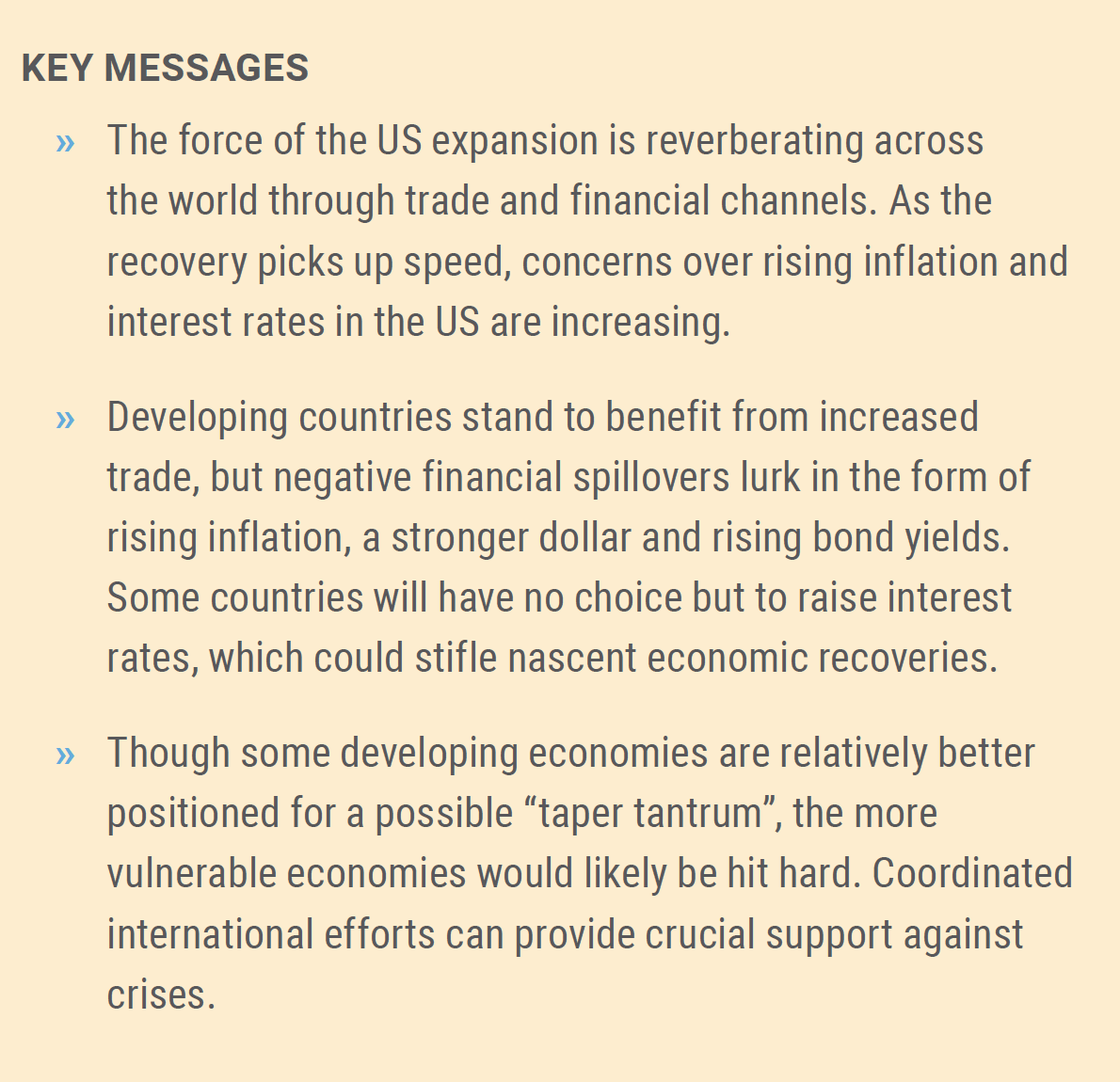

Economic activity is bouncing back in several countries, supported by increased government spending, stimulatory monetary policy, health and border measures to limit COVID-19 infections and deaths, and the rollout of vaccines. In recent weeks, most countries have seen an uptick in the number of COVID-19 infections, associated with the rise of a new, more transmissible variant. Yet, countries with higher vaccination rates have been able to gradually reopen their economies as reflected in increased consumer demand and prices (figure 1).

US in the lead

Pent-up US demand, underpinned by federal stimulus and pandemic-fuelled savings, is fuelling economic growth in Asia, Europe and Latin America. This contrasts with the situation after the global financial crisis when households prioritized repaying debt.

Once the main locomotive for global growth, the US had lost that role to China following the 2008 financial crisis. At the time, China introduced the largest fiscal stimulus package in the world, totalling 1 per cent of world gross product, and was the first major economy to emerge from the crisis. Now, Chinese growth rebounded strongly and rapidly from the pandemic, but it is expected to slow later in the year as the country aims to rein in credit. In Europe, the economic recovery is predicted to be slower due to weak consumer spending.

In contrast, the US is expected to grow the fastest among developed economies through 2022 after approving fiscal stimulus spending of unprecedented levels in peacetime. The expenditure plan—worth $1.9 trillion or about 2 per cent of global output—is expected to single-handedly raise GDP by up to half a percentage point in China, Europe and Japan, and by up to 1 percentage point in Canada and Mexico. A record US current account deficit is also expected, contributing to projected global trade growth above pre-pandemic levels this year.

As the strength of the US expansion reverberates across the world, it is also causing disruptions, including shipping bottlenecks, booming commodity prices and currency fluctuations. This is raising concern in some countries over currencies, inflation and a move toward higher interest rates which risks stifling nascent economic recoveries, on top of worsening COVID-19 outbreaks.

Inflation fears

With the recovery gaining steam, the risks of deflation and high unemployment stemming from the pandemic have receded. Applications for unemployment benefits are gradually falling in the US, showing a healing labour market. A surge in consumer demand is driving up prices for goods and services that were hit hard by the pandemic, such as automobiles and rental cars, apparel, air travel, hotels, entertainment and recreation. In June, the US inflation rate reached a 13-year high, triggering concerns over a new inflationary period akin to the 1970s.

Inflation may ease later this year to the extent it reflects one-off factors, including supply-chain bottlenecks, higher shipping costs and a semiconductor shortage that is reducing the supply of automobiles in the US. However, more persistent inflation pressures could build due to labour shortages and capacity constraints, which could be passed on to consumer prices more strongly. There is also growing concern over potential asset price bubbles, particularly in property.

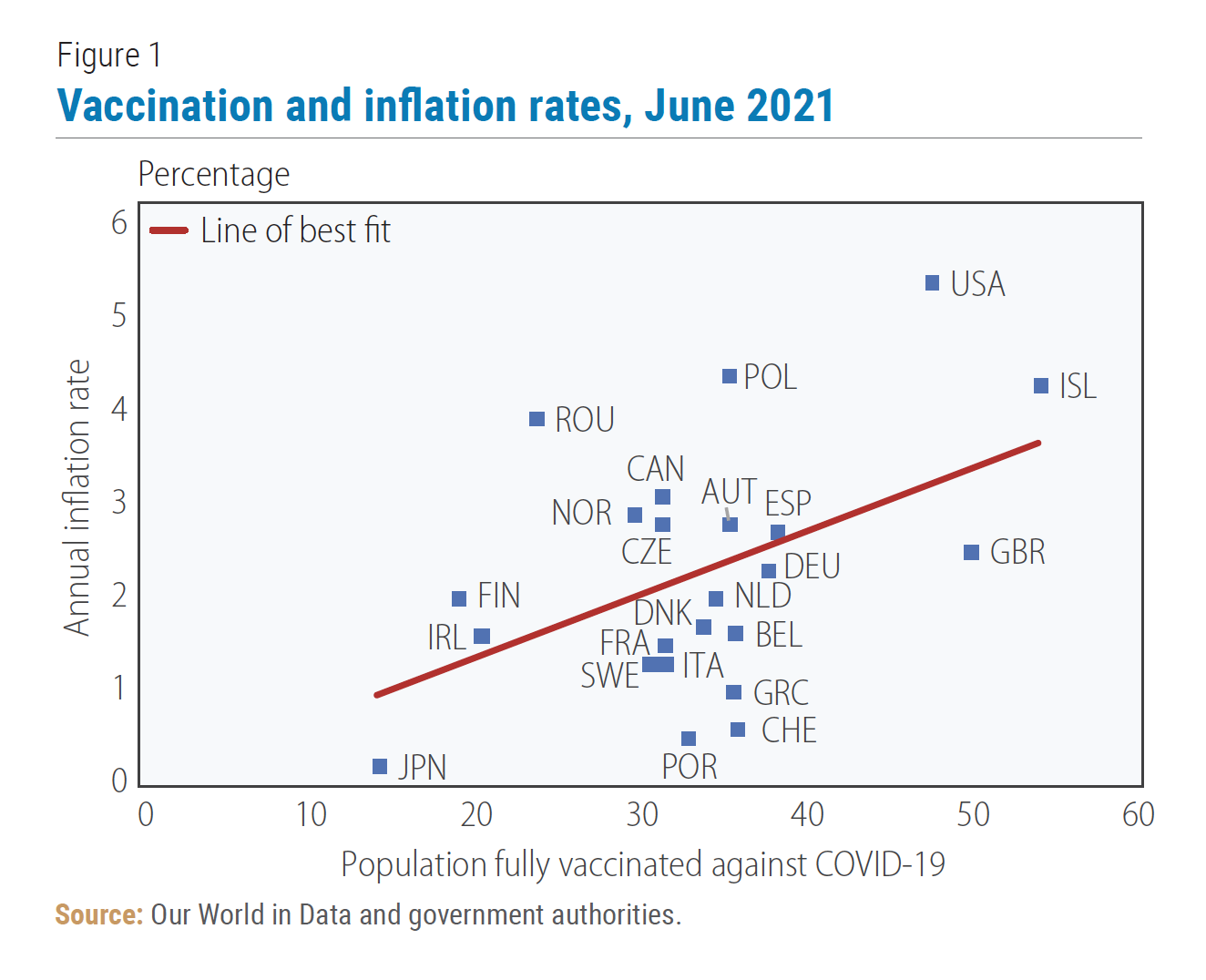

If households and businesses start expecting a continuous rise in prices, inflation expectations could become unanchored and self-fulfilling. Some signs of changing expectations have become apparent. In June, US median consumer inflation expectations for the next 5 to 10 years ascended to 2.8 per cent, the highest level since 2014 (figure 2). The US 10-year breakeven inflation rate—a measure of the market’s inflation expectations over the next 10 years on average—reached its highest value since 2013 in May, 2.5 per cent. Higher inflation for several years would affect economic activity in various ways—from squeezed household budgets and difficulties for businesses in planning longer-term investments, to higher borrowing costs, which could hurt asset prices, such as stocks and housing.

If households and businesses start expecting a continuous rise in prices, inflation expectations could become unanchored and self-fulfilling. Some signs of changing expectations have become apparent. In June, US median consumer inflation expectations for the next 5 to 10 years ascended to 2.8 per cent, the highest level since 2014 (figure 2). The US 10-year breakeven inflation rate—a measure of the market’s inflation expectations over the next 10 years on average—reached its highest value since 2013 in May, 2.5 per cent. Higher inflation for several years would affect economic activity in various ways—from squeezed household budgets and difficulties for businesses in planning longer-term investments, to higher borrowing costs, which could hurt asset prices, such as stocks and housing.

The significant level of monetary support in place since mid-2020 is thus expected to be reduced sooner. US Federal Reserve officials signalled in mid-June they expect to raise interest rates by late 2023, a year earlier than anticipated. Some voices inside the Fed favour an even earlier move, fearing a disruptive, abrupt pull of the policy brakes later. Central banks in other developed economies have also signalled plans to tighten monetary policy by tapering or halting monthly bond purchases. Interest rate markets in some developed countries have factored in a central bank rate increase as soon as this year.

Ripple effects in developing economies

Robust growth and changes in monetary policy in the US resonate through the global financial system as the dollar dominates international debt markets and foreign-exchange reserves. Global trade is also affected as the country accounts for almost a third of final consumption expenditure globally. Countries around the world are expected to benefit from surging trade, but several also face the risk of increasing inflation, a stronger dollar and rising bond yields. This could stifle their recoveries, especially at a time when debt in the developing economies is high.

Although the outbreak of the pandemic saw investors massively retreat from securities markets in developing countries such as Brazil, India, Kenya and Thailand, the Federal Reserve’s decision to lower interest rates to near zero helped avert a global recession and encouraged portfolio flows back into developing economies in Africa, Asia and Latin America. Debt in large developing economies increased by $11 trillion during the pandemic, reaching a record of over $86 trillion at the end of March 2021.

Though external financing to roll over debt is relatively abundant, escalating prices in the US and interest rate increases by the Federal Reserve may push up bond yields. This would increase the cost of borrowing for countries competing to sell their debt, since buyers would demand higher returns, potentially triggering a fresh bout of capital flight and currency weakness that could unsettle developing economies. The US economy itself could have repercussions from widespread and persistent stress in major developing economies due to US banks’ exposure to potential loan defaults by corporations and governments in developing countries and indirect exposure via US businesses with strong ties to these countries.

Debt sustainability in flux

Around the world, ultra-loose monetary policy has given cover to central banks and governments, including very indebted ones, to boost their economies with inexpensive lending and plentiful government expenditure. Confidence that the Federal Reserve is going to try to hold its rates for two years has given breathing room to central bankers in developing economies that, under normal circumstances, would be increasing rates.

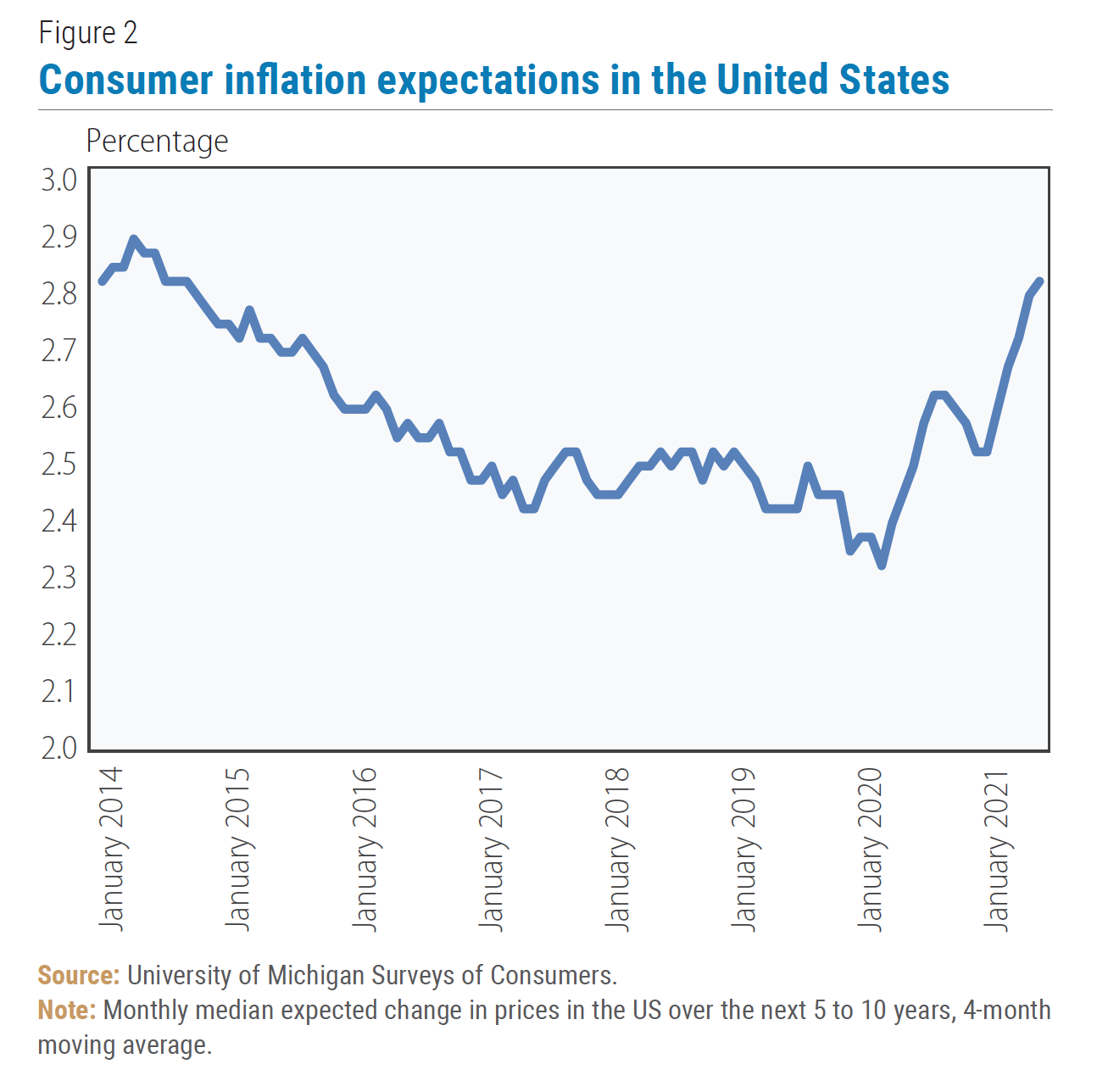

However, inflation and higher yields are a threat to debt sustainability in some developing countries, especially in the context of COVID-19. While most developed countries have been able to secure funds throughout the pandemic at a fraction of a percentage point—below their average cost by more than 1 per cent—some developing economies have faced much higher refinancing costs in 2021 (figure 3). A few, such as Brazil and India, managed to obtain lower-than-average refinancing costs in exchange for selling bonds with shorter maturities than in the past, making its finances less sustainable.

However, inflation and higher yields are a threat to debt sustainability in some developing countries, especially in the context of COVID-19. While most developed countries have been able to secure funds throughout the pandemic at a fraction of a percentage point—below their average cost by more than 1 per cent—some developing economies have faced much higher refinancing costs in 2021 (figure 3). A few, such as Brazil and India, managed to obtain lower-than-average refinancing costs in exchange for selling bonds with shorter maturities than in the past, making its finances less sustainable.

An end to the current low-interest rate environment or a slower-than-expected recovery risk derailing debt rollover for some countries. Egypt, Ghana and South Africa are particularly at risk from rate rises due to high cost of debt and large refinancing needs (figure 4). Compared to the debt crises of the late 20th century though, larger reliance on domestic instead of foreign lending mitigates some of the vulnerability to capital outflows in Brazil, India and South Africa.

If the dollar climbs higher following rising interest rates, the credit ratings of some sovereigns would likely be downgraded, which would further raise borrowing costs and could potentially lead to defaults and bailouts becoming necessary. So far, though, developing countries generally have been able to finance their larger fiscal deficits by relying on a mix of domestic and foreign investors and their central banks.

If the dollar climbs higher following rising interest rates, the credit ratings of some sovereigns would likely be downgraded, which would further raise borrowing costs and could potentially lead to defaults and bailouts becoming necessary. So far, though, developing countries generally have been able to finance their larger fiscal deficits by relying on a mix of domestic and foreign investors and their central banks.

In 2021, developing economies are estimated to pay $1.1 trillion in debt service costs, of which $373 billion is public debt servicing. Interest payments can take up to half of government revenues in countries such as Lebanon, Sri Lanka and Zambia. This spending limits government resources to fight the pandemic and address long-term priorities, such as education and climate change adaptation.

Between a rock and a hard place

The start of the global recovery has been bittersweet as the threat of higher borrowing costs weighs on countries, especially those in precarious fiscal situations. Most countries borrowed heavily during the pandemic to cover increased expenses and sinking revenues. In developing countries, since much of that borrowing is in US dollars, faced with higher US interest rates, these economies are finding themselves with a difficult choice between raising their own interest rates to prevent capital flight and defend the value of their currency, possibly triggering a recession, or allowing the currency to depreciate and face soaring costs for repaying dollar-denominated debt, and inflation.

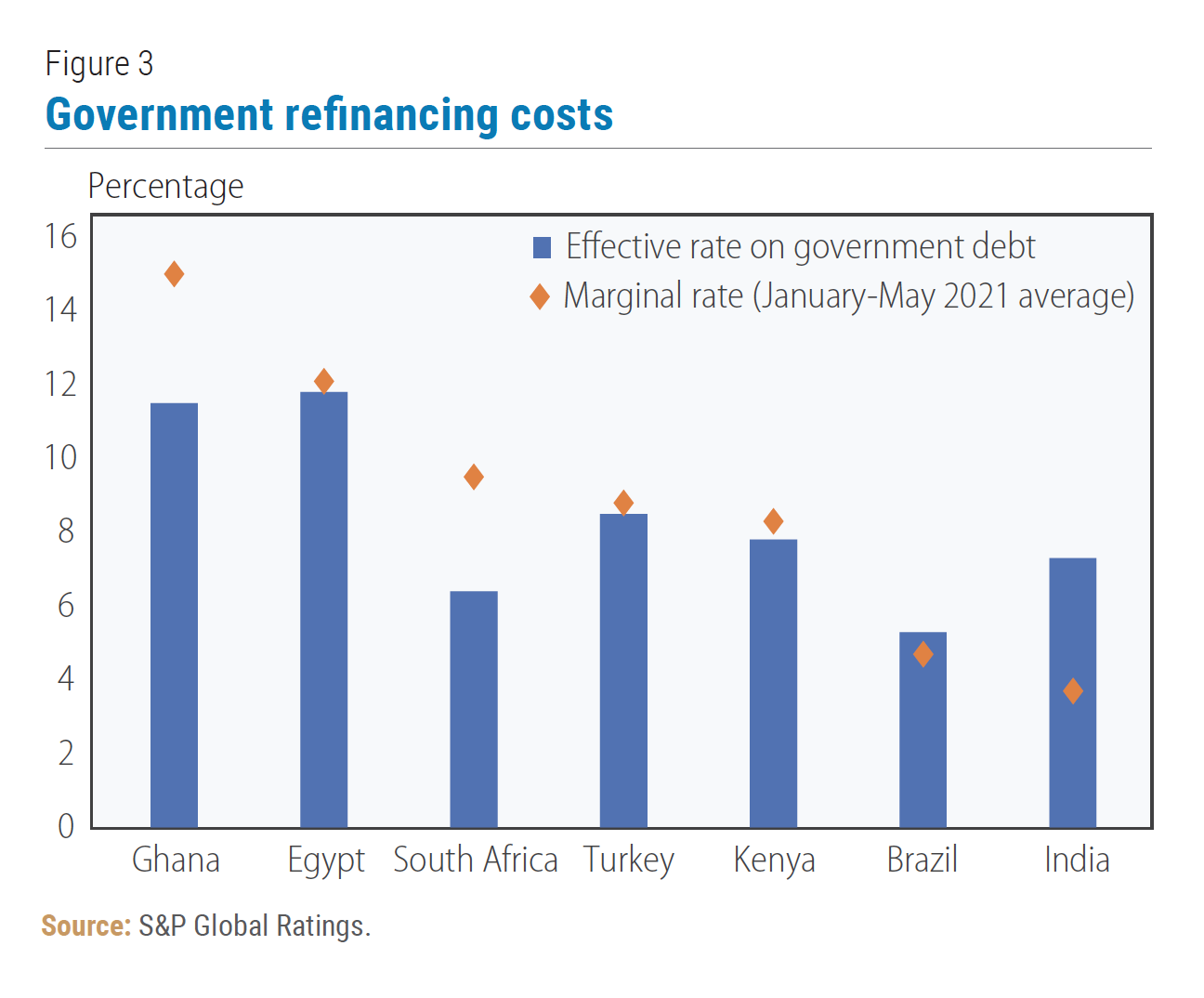

The closer the economic and regional ties, the more countries will be forced into shadowing US monetary policy despite their own macroeconomic conditions. For dollarized economies, including small economies in Africa and Latin America, raising rates is a necessity even if it might not change outcomes. Though it is too early for developing countries to tighten monetary policy given incipient economic recoveries, some may have no choice. Central banks in Brazil, Mexico and Turkey raised interest rates recently to control inflation caused by weakening currencies and rising commodity prices, pushing up borrowing costs even though the countries are still grappling with COVID-19 (figure 5). However, even a brief gust of inflation can unsettle investors and bring down currencies, hampering the ability of businesses and households to service foreign-denominated debt.

The closer the economic and regional ties, the more countries will be forced into shadowing US monetary policy despite their own macroeconomic conditions. For dollarized economies, including small economies in Africa and Latin America, raising rates is a necessity even if it might not change outcomes. Though it is too early for developing countries to tighten monetary policy given incipient economic recoveries, some may have no choice. Central banks in Brazil, Mexico and Turkey raised interest rates recently to control inflation caused by weakening currencies and rising commodity prices, pushing up borrowing costs even though the countries are still grappling with COVID-19 (figure 5). However, even a brief gust of inflation can unsettle investors and bring down currencies, hampering the ability of businesses and households to service foreign-denominated debt.

Taper tantrum: then and now

US Treasury yields soared in February and March, from below 1.2 per cent to close to 1.8 per cent, as the easing of coronavirus lockdown restrictions raised investor expectations of a strong US economic recovery and rising inflation. They have since receded over growing concern about the pace of the economic recovery, amid new waves of infection from a more transmissible COVID-19 variant.

Nevertheless, the market tantrum earlier this year sufficed to trigger capital flight from developing economies. Although the situation partly reversed, it called to memory the “taper tantrum” shock of 2013. Concerns over something similar will likely continue through 2023, especially if faster tightening by the Fed becomes expected.

Growing US interest rates are often considered to adversely affect developing economies as in the past they significantly raised debt burdens, triggered substantial capital outflows and tightened financial conditions, increasing the risk of financial crisis.

There are reasons to think this time will be different though. In 2013, vulnerable developing economies (such as Brazil, India, Indonesia, South Africa and Turkey) had elevated current account deficits and high dependence on foreign capital. Foreign investors sought to take advantage of the higher yields in these markets amid very accommodative US monetary policy. Now, those economies have much smaller current account deficits, comparatively fewer external flows, reasonably valued real exchange rates, fewer external financing needs as a share of foreign reserves, and many have already begun tightening policy themselves. Advance signalling of tapering plans by the Fed should also minimize the risk of panic this time around.

Dark clouds and silver linings

In an increasingly interconnected world, the rise of US interest rates will cause global spillovers. For developing countries, decreasing debt levels and delivering growth will become much more difficult with tighter financial conditions. Yet, some mitigating factors are worth considering.

So far this year, the financial spillovers to developing countries from higher US Treasury yields have been limited since the increases appear to have been substantially driven by improved growth prospects for the US. Recent evidence points to changes in Treasury yields driven by monetary news (e.g., US inflation worries or a hawkish turn in Fed policy) having much larger adverse effects on developing economy asset prices than yields driven by favourable US growth prospects, which are likely to have a relatively benign influence on developing economies through increased US import demand and investor confidence.

Higher growth prospects in developing countries can, in turn, improve debt sustainability—as can reforms and other measures to crowd-in private investment. Despite a notable rise in debt in recent years especially during the pandemic, past crises such as those in the 1980s and 1990s seem unlikely due to more prudent macroeconomic policies, freer currencies and more resilient financial sectors.

Moreover, the chances of a developing country crisis due to US interest rate rises depend on a mix of factors, including country-specific risks and the currency and composition of external debt, some of which can be adjusted. Managing expectations and sustaining the credibility that developing country central banks can deliver to markets is key.

Still, economies with higher macroeconomic vulnerabilities are likely to come under pressure from higher yields, due to increased domestic-currency bond yields and collapsing stock prices and currencies. Coordinated international efforts can play a crucial supportive role by providing timely access to liquidity and helping to expand fiscal space, including through grants and debt forgiveness, to fight the pandemic and meet critical social needs.

Other large risks also loom over developing economies, including low immunization rates, inflationary pressures from commodity prices, weak recoveries and a return to pre-pandemic low growth rates. Though the international community must remain vigilant and ready to intervene against sudden changes in financing conditions in vulnerable developing economies, continued support is needed in other pressing areas as well, especially in access to medical equipment and vaccines.

Follow Us