UN DESA Policy Brief No. 125: Improving compatibility of approaches to identify, verify and align investments to sustainability goals

This policy brief reviews existing approaches to sustainable investment and explores ways to improve their interoperability. Interoperability does not mean that all systems and tools need to operate in the same way. Rather, there should be clarity regarding how the tools interact, and sufficient comparability and interoperability between approaches so they are usable and accepted as credible across multiple jurisdictions.

This policy brief reviews existing approaches to sustainable investment and explores ways to improve their interoperability. Interoperability does not mean that all systems and tools need to operate in the same way. Rather, there should be clarity regarding how the tools interact, and sufficient comparability and interoperability between approaches so they are usable and accepted as credible across multiple jurisdictions.

Sustainable investment has been the hot topic for the financial industry in recent years, but its impact remains unclear. More and more investors are incorporating Environmental, Social and Governance (EGS) issues into their investment decision-making and are marketing financial products with sustainability characteristics. Yet, a deeper analysis of these products and investment strategies raises doubts on their contribution to sustainable development. For example, ESG funds often include investment in companies with doubtful or unproven sustainability credentials.

Policymakers need to ensure the credibility of investment products and strategies that reference sustainability goals as a sales pitch. This is critical to build trust and support investor demand; and has recently been a focus for the G20 (see Box 1). Regulators and other market participants have introduced a variety of mandatory and voluntary approaches to help investors align investments with sustainability goals. These approaches include: definitions, taxonomies, standards, ratings, and verification schemes. These can help ensure that sustainable investment products and strategies do not mislead investors and achieve impact.

Yet, this multiplication of sustainable finance approaches has itself become a problem. While these approaches provide useful tools, they are currently being developed in silos, which risks generating inconsistencies and challenges to accessing information. Eventually, this could entail additional costs for market participants and companies, and a higher risk of green- and SDG-washing practices, hindering efforts to align financial flows with sustainability goals. Markets can also become more fragmented if different standards are applied in different regions.

Divergence in existing approaches

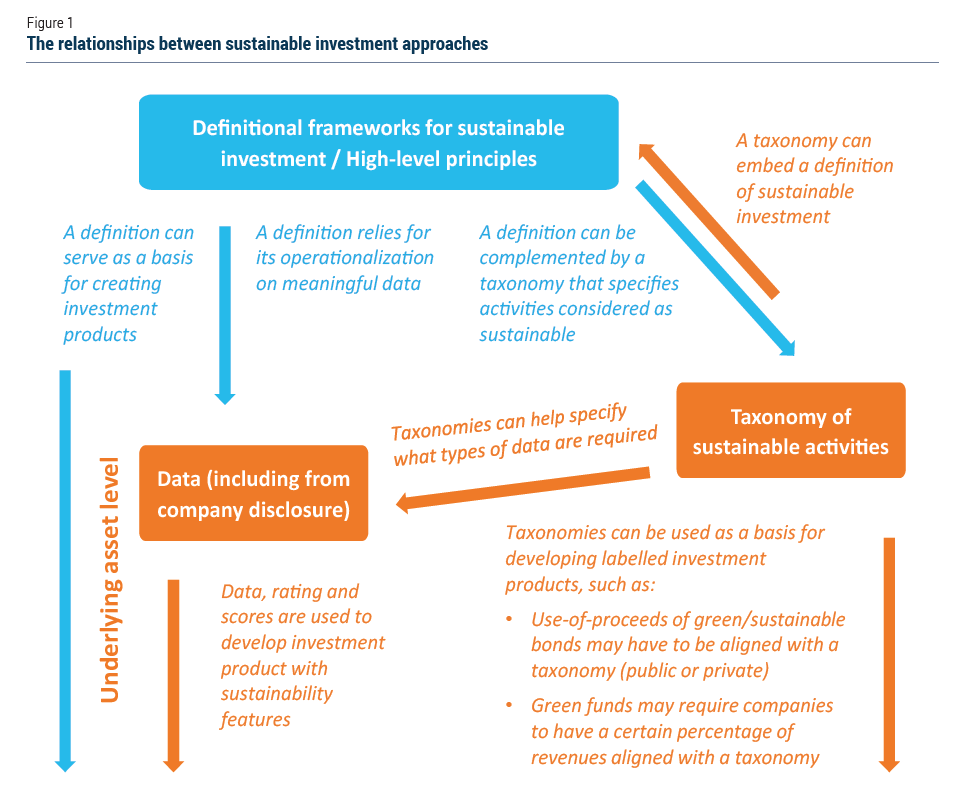

It is useful to categorize existing approaches according to the main objectives they pursue to better understand how they may interact (see Figure 1). Three broad categories can be distinguished. These are not mutually exclusive but rather are often combined to ensure the credible alignment of investment with sustainability goals.

◆ Defining: Without a common understanding of what sustainable investment means in practice, different actors have divergent interpretations, and investment products/strategies with vastly different levels of sustainability are bundled together under the heading of “sustainable investment”. This can overrepresent the impact that these investments have, and can, over the long run, reduce trust and thus capital inflows into sustainable finance. To address this issue, initiatives have emerged to define the broad characteristics / minimum criteria for sustainable investments.

◆ Identifying: Initiatives to help identify sustainable investments include activity-based taxonomies, which help investors understand what activities (and thus what companies) are compatible with sustainability goals. Other tools include sustainability ratings and scores, which assess the sustainability of companies and projects and identify investment opportunities. In addition, it is also important to identify companies that are not yet categorized as ‘sustainable’ but are transitioning to sustainability. Therefore, trajectory tools have been developed to identify transition pathways (often tailored to different sectors) for companies to align their business with sustainability goals. For example, these pathways can define the carbon reduction required for companies to be compatible with climate goals. Investors can then decide to select companies that are on these pathways for their sustainable investment.

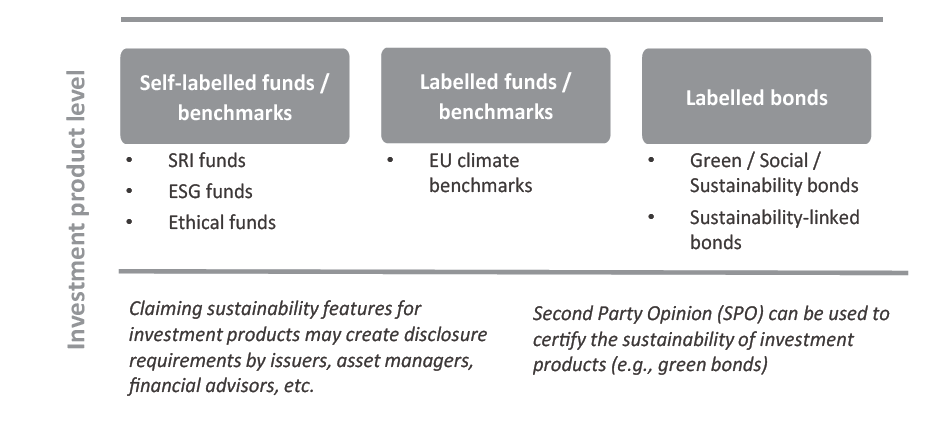

◆ Assuring: Labels, standards, and benchmarks aim to provide assurance and transparency about the sustainability of an investment product/portfolio. These initiatives communicate to investors that an investment product/strategy meets sustainability criteria. Asset managers and advisors can also self-disclose their adherence to a definitional framework for sustainable investment or be asked to provide transparency on how they plan to achieve their sustainability objectives.

Interoperability

Interoperability requires international collaboration. Innovation from both the private sector and regulators have allowed the market for sustainable investment to flourish. But the time has come for some convergence in each of the categories listed above. An interesting parallel is sustainability reporting frameworks. There have been competing frameworks for many years in this space, which are now being consolidated, in part through the recently launched International Sustainability Standards Board (ISSB). Intergovernmental platforms could consider whether convergence in the space of sustainable investment is also achievable.

Interoperability requires international collaboration. Innovation from both the private sector and regulators have allowed the market for sustainable investment to flourish. But the time has come for some convergence in each of the categories listed above. An interesting parallel is sustainability reporting frameworks. There have been competing frameworks for many years in this space, which are now being consolidated, in part through the recently launched International Sustainability Standards Board (ISSB). Intergovernmental platforms could consider whether convergence in the space of sustainable investment is also achievable.

At the global level, governments could use the UN Financing for Development Forum for this purpose. Efforts are also underway in other forums. For example, the International Platform on Sustainable Finance (IPSF) issued in November 2021 a report on a common ground taxonomy that reviews the EU and China taxonomies while identifying commonalities and differences. The G20 SFWG also intends to look at facilitating the comparability, interoperability and consistency of alignment approaches. Adopting common principles for approaches to sustainable investment can help increase interoperability. While creating common global standards should be a long-term goal, a certain level of geographic and market specificity – and thus multiplication of initiatives – will always be required. For example, some countries may choose not to create activity-based taxonomies and instead rely on sustainability assessment methodologies developed by data providers. Therefore, the most effective way of achieving global convergence is to ensure adherence to common principles that all new approaches could incorporate, and existing approaches could adopt if they their current approach falls short. Box 2 presents principles that have largely been endorsed by the G20 Sustainable Finance Working Group (SFWG). These principles create a strong basis for increasing interoperability and consistency among approaches to sustainable investment. They are also integrated in the Sustainable Development Investing (SDI) definition put forward by the Global Investors for Sustainable Development (GISD) Alliance.

Policymakers can also promote interoperability by ensuring consistency in assessment and verification methodologies and terminologies. Currently, ESG and SDG rating agencies deploy proprietary methodologies with little transparency. They also tend to measure different things. Some sustainability scores measure sustainability risks a company faces (such as the impact of climate change on the company’s financial performance), while others measure the company’s impact on society (such as the impact of the company’s activities on climate change). A single score cannot capture these two aspects. As a result of these and other often-diverging methodologies and objectives, a company’s score or rating varies widely across agencies. Policymakers should support collaboration among sustainability rating agencies on the development of a common framework for ratings, which can ensure that a common language and process is used by all rating agencies. Similarly, the market of verifiers, certifiers, second-opinion providers, and third-party reviewers also struggles with consistent methodologies for verification and labeling. Policymakers can also support the development of a common framework for assurance. These policy actions can strengthen the coherence between approaches, and facilitate use by market participants who will be able to interpret the sustainability signals emanating from these approaches more easily and with more confidence.

Policymakers should also consider ways to standardize disclosure by investment managers and financial advisors. Financial market participants marketing investment products and/or strategies as sustainable should disclose how they intend to achieve their sustainability goals. Disclosure by investment managers has to be consistent and comparable among different products and across markets to be meaningful. If each sustainable investment product follows its own disclosure framework, the intended transparency will not be achieved.

Be mindful of the effects on developing countries

Is sustainable investing about managing risks or creating positive impact? This difference cannot be more striking in the case of developing countries. If it is about managing risks, taking ESG issues into account is likely to dis-incentivize some investments in developing countries. Indeed, developing countries face a range of climate-related and other transition risks that leave them more exposed than developed countries. According to Moody’s, 60 per cent of its sovereign credit ratings of developing countries are currently negatively affected by ESG considerations.2 In the short-term, this narrow focus on risk is more likely to increase the cost of financing for developing countries. On the other hand, if sustainability investing is about creating a positive impact, then investors should target investment in countries with higher needs where their impact will be greater.

Is sustainable investing about managing risks or creating positive impact? This difference cannot be more striking in the case of developing countries. If it is about managing risks, taking ESG issues into account is likely to dis-incentivize some investments in developing countries. Indeed, developing countries face a range of climate-related and other transition risks that leave them more exposed than developed countries. According to Moody’s, 60 per cent of its sovereign credit ratings of developing countries are currently negatively affected by ESG considerations.2 In the short-term, this narrow focus on risk is more likely to increase the cost of financing for developing countries. On the other hand, if sustainability investing is about creating a positive impact, then investors should target investment in countries with higher needs where their impact will be greater.

Developed country approaches to sustainable investment may have unintended consequences if not enough attention is paid to developing country constraints. While sustainable finance holds some promise in increasing alignment, it also presents constraints for developing countries.

Absence of data. Taxonomies, labels and other tools ostensibly apply to investors domiciled and regulated in developed country jurisdictions, but many of these investors have global investment mandates that cover developing countries. The design of the sustainable finance approaches and tools should be carefully considered to ensure that they incentivize investment in developing countries. The lack of verifiable data could mean that investors are unable to account for the sustainability of these investments in developing countries. For example, investors could struggle to determine the level of taxonomy alignment for investments located in developing countries, which would the de facto be considered as non-aligned. One way to address this would be to allow for investors to use estimates for assessing the Taxonomy-alignment of their exposures to undertakings established in a third country, or allow references to local taxonomies designed with similar principles and objectives.

Relative lack of capital market development. As long as some developing countries have undeveloped or underdeveloped capital markets, large institutional investors will struggle to direct funds to investments located in these countries. Sustainable finance policies applied to institutional investors in developed countries will therefore not affect these countries to the same degree as developing countries with greater capital market development. Investors can nonetheless rely on other vehicles, such as impactdriven private equity funds. Therefore, these countries could still be impacted by sustainable finance policies from developed countries even if this impact is likely to lower than for countries with more developed capital markets.

Donors and international organizations should raise awareness regarding the actions that developing countries can take to benefit from the sustainability shift in developed capital markets. At the same time, developing countries with more developed capital markets may wish to deploy their own sustainable finance policies and approaches. Capacity-building assistance from donors can then also focus on integrating sustainable investment approaches in capital market development plans, while working at the regional/global level to avoid market fragmentation.

Conclusions

Policymakers can reduce the risk of market fragmentation and investor confusion by increasing the interoperability of approaches to sustainable investing. In the first place, they should consider ambitious norms for investment products branded as sustainable, based on common principles defined internationally. Impact measurement can also be harmonized through a holistic approach that covers all the SDGs (and not solely climate). Governments could leverage existing intergovernmental platforms to make progress in this area and enhance interoperability and consistency of national/regional approaches to sustainability-aligned investment.

Policymakers should also have heightened consideration for the impact that financial market norms could have on investments in developing countries. Risks for negatively impacting capital flows into developing countries are real, especially in countries with relatively developed capital markets. Further research should be undertaken by international organizations and the investment community on these risks as those have been relatively disregarded so far.

Follow Us