Document_GEM: UN DESA Policy Briefs series

UN DESA Policy Briefs series

21 July 2022

The COVID-19 crisis has brought to the fore the need to better account for the multidimensional vulnerabilities of countries in the allocation of aid.

12 July 2022

SDG progress has been set back, and the outlook faces uncertainty given the cumulative and amplified impacts of the COVID-19 pandemic, the war in Ukraine and climate change. The crises impact all countries, albeit unequally.

30 June 2022

The promotion of non-discrimination needs to be formally mainstreamed throughout public administration. This brief examines a limited selection: citizens’ charters, public procurement, positive duties, institutional culture, artificial intelligence, workforce diversity, schools of public administration, and public audits.

13 June 2022

While they have been touted for their potential to increase the efficiency of financial transactions and to support financial inclusion, their high volatility and largely unregulated and quasi-anonymous nature has raised concerns over investor protection and financial integrity, and increasingly also financial stability and international spillovers.

13 June 2022

Developing countries will need reliable access to affordable financing, and also need to manage and use these resources well to translate financing into SDG progress, enhanced productivity and fiscal capacity to service debt.

11 May 2022

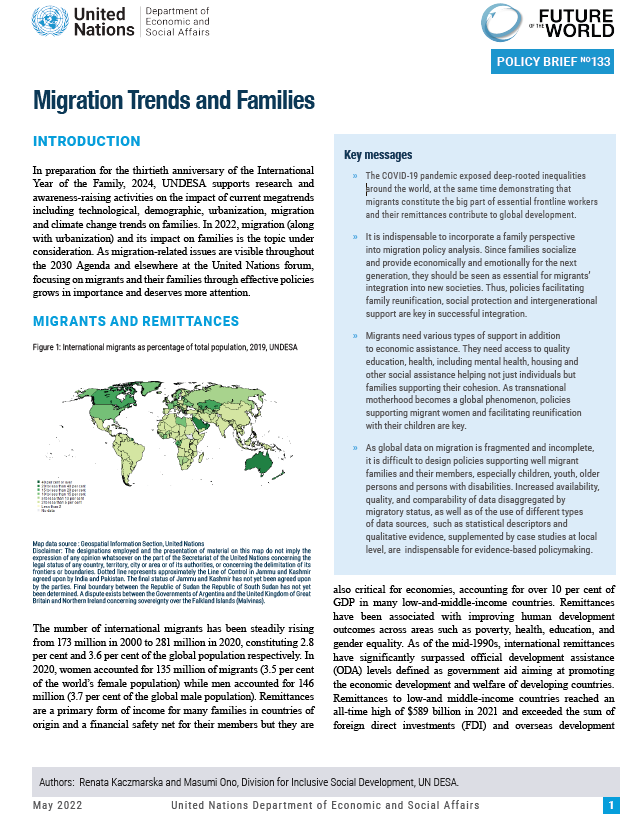

It is indispensable to incorporate a family perspective into migration policy analysis. Since families socialize and provide economically and emotionally for the next generation, they should be seen as essential for migrants’ integration into new societies. Thus, policies facilitating family reunification, social protection and intergenerational support are key in successful integration.

4 May 2022

The Data For Now initiative is supporting countries in developing their capacity to leverage innovative sources, technologies and methods to deliver better, more timely and disaggregated data for sustainable development.

21 March 2022

Credit ratings play an important role providing information on sovereign borrowers. But financial markets, including credit ratings, often over-emphasize short-term economic concerns, and underweight longer-term issues, including environmental and social risks as well as investment in resilience and sustainability.

26 February 2022

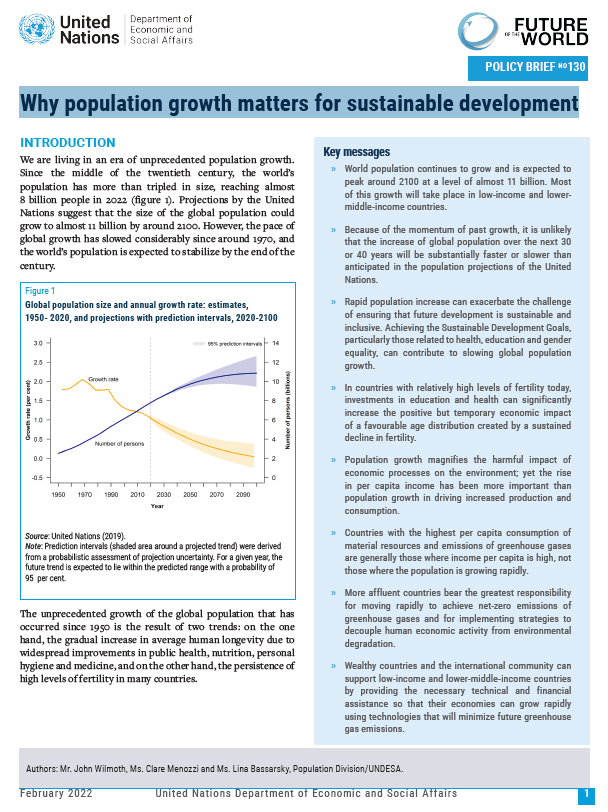

World population continues to grow and is expected to peak at a level of almost 11 billion around the year 2100. Most of this growth will take place in low-income and lower middle-income countries.

Follow Us