UN DESA | DPAD | Development Policy Analysis Division

Capacity Development and Advisory Services

Millennium Development Goals

Uzbekistan highlights

An additional 5 per cent of GDP in public spending would be needed to attain development goals

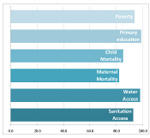

| MDG progress achieved by 2015 under a business-as-usual scenario |

|

Most MDG targets can be achieved in Uzbekistan by 2015 if a growth-driven strategy is successfully implemented, enabling public resource mobilization to spur service delivery in health, water and sanitation, and education. The Government would have to scale up spending by little less than 5% of GDP per year, compared to a business-as-usual scenario. Most of this spending would need to be channelled to the health sector, where there has been less progress, in order to accelerate the reduction in child and maternal mortality.

New tax revenues would be needed to finance MDG strategies

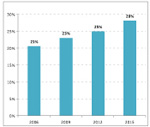

| Tax revenue in tax financing scenario |

|

Tax revenue would have to be raised by more than 7% of GDP in 2015, compared to 2006, should the Uzbek Government pursue financing existing MDG gaps without compromising public debt targets. This would represent an enormous challenge, considering that the tax burden is already somewhat high. At the same time, financing the required MDG-related spending through foreign or domestic borrowing would have to be considered cautiously, as this option would likely push up public debt to unsustainable levels.

Financing MDG achievement through domestic borrowing may slow down the economy

| Effect of public domestic borrowing on private spending and GDP growth |

|

Financing additional public spending requirements to target the MDGs using domestic borrowing would be the costliest of four financing options. In this case, Government debt would almost double, reaching 49% of GDP by 2015, and the amount of domestic savings available to finance private investment would be reduced. This approach would also slow down economic growth and force the Government to scale up public spending in MDG sectors further still in order to offset the reduction of private spending.

Related documents

- Country study "Assessing Development Strategies to Achieve the MDGs in the Republic of Kyrgyzstan" (2011).

- Country study "Assessing Development Strategies to Achieve the MDGs in the Republic of Philippines" (2011).