Boosting domestic savings in Africa

Boosting domestic savings in Africa

Regular banks cater only to a fifth of all Africans. If they can better tap into the vast pool of financial resources now outside the formal banking system, more money would be available for investment.

Regular banks cater only to a fifth of all Africans. If they can better tap into the vast pool of financial resources now outside the formal banking system, more money would be available for investment.What if wealthy Africans decided to invest their earnings in Africa instead of overseas? And if the 80 per cent of Africans now without bank accounts got access to formal financial services? And if African governments put their domestic revenues into productive investments? “Rates of savings [would] go up significantly and Africa could perhaps be in a position to meet more than its resource needs,” answers Samuel Gayi, a senior economist on Africa at the Geneva-based United Nations Conference on Trade and Development (UNCTAD).

African countries’ ability to finance a greater share of their development needs from domestic sources “would give them much-needed flexibility in the formulation and implementation of policies” to address development challenges, direct resources into high-priority areas and “strengthen state capacity,” finds a 2007 UNCTAD report, Economic Development in Africa: Reclaiming Policy Space, Domestic Resource Mobilization.

Africa is estimated to lose hundreds of billions of dollars in domestic revenues annually through capital flight, tax evasion, the repatriation of profits by transnational corporations and high debt repayments. At the same time, the continent’s large informal sector holds considerable financial resources that are not deposited in savings accounts or pass through other formal financial channels.

Yet until recently, most international conferences and summit meetings to address the financing of Africa’s social and economic development have generally focused on ways to mobilize more foreign resources. That is changing. But flows of official development assistance (ODA) to Africa remain volatile, and as the UNCTAD report notes, “dependence on external resource flows” leaves countries vulnerable to external shocks. Moreover, the region’s share of global foreign direct investment (FDI) has stayed low.

Pan-African fund

As a result, African governments are increasingly turning their attention to the need to better mobilize domestic resources. At a summit meeting of the African Union in Ghana in July 2007, the continent’s leaders launched an initiative to mobilize local resources to finance Africa’s infrastructure development. The Pan-African Infrastructure Development Fund (PAIDF), under the continent’s development blueprint, the New Partnership for Africa’s Development (NEPAD), is seeking to raise money mainly from public and private pension funds and asset-management firms in Africa.

A credit union in the Gambia: Micro-finance institutions use innovative methods to help rural Africans save and borrow.

A credit union in the Gambia: Micro-finance institutions use innovative methods to help rural Africans save and borrow.The PAIDF will invest directly in large-scale infrastructure projects in Africa, including in energy, roads, information and communications technologies and water, as well as in the stocks of companies that own, control, operate or manage infrastructure and related assets. Firmino Mucavele, then head of the NEPAD Secretariat in Pretoria, South Africa, said the goal is to invest in projects that will have high yields.

A target of raising $1 bn for the fund was set for July 2008. Some $625 mn had already been raised by the time of the launch. The PAIDF’s potential shareholders are reputable pension funds in the region, including the Public Investment Corporation of South Africa, which has assets exceeding $90 bn, and similar pension funds in Nigeria, Ghana, Namibia and Botswana. As Mr. Mucavele noted, totalling such figures from just a few countries suggests that hundreds of billions of dollars can potentially be tapped. “We don’t want all of it,” he told journalists at UN headquarters in New York. “Instead of going for loans, let us take 5 per cent and invest it in something we all agree on.”

Until now, managers of Africa’s public and private pension funds, in the search for security and high returns, have invested much of their resources in external companies and stocks, contributing to Africa’s outflow of resources. By seeking to direct just a small portion of those flows inward, alongside a number of other initiatives, African governments are now trying to strengthen the continent’s national savings.

Low savings rates

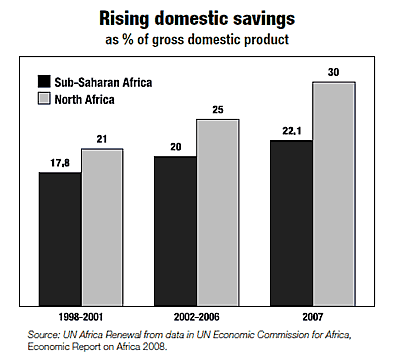

Sub-Saharan Africa has the lowest savings rate in the developing world. While figures vary from country to country, gross domestic savings in the region averaged about 18 per cent of gross domestic product (GDP) in 2005, compared with 26 per cent in South Asia and nearly 43 per cent in East Asia and Pacific countries, according to World Bank estimates.

In some countries, those rates are even on the decline. South Africa alone accounts for almost 40 per cent of sub-Saharan Africa’s total GDP. Yet in 2006 the country’s gross domestic savings rate declined to 13 per cent, from 26.7 per cent in the early 1980s. “This downward trend has been persistent for over two decades,” Elias Masilela, a board member of the South Africa Savings Institute, commented in June of that year.

In Uganda the savings rate is only 10 per cent of GDP. Japheth Katto, the chief executive officer of the country’s Capital Markets Authority, recently said the rate will not improve in the near future “unless concerted efforts [are] made to increase financial-sector outreach.”

Although a handful of countries have achieved higher savings rates, the bottom line is that the region’s savings rate “is not commensurable with the investment needs of 25 per cent of GDP required to reduce poverty by 2015,” argues Jean Thisen, a senior economic affairs officer with the UN Economic Commission for Africa (ECA), headquartered in Addis Ababa, Ethiopia.

Savings barriers

There are many reasons for Africa’s low savings rates, including inadequate financial services. Physical distance from banking institutions and high minimum deposit and balance requirements mean that the majority of the population does not get access to banking services. As a result, only 20 per cent of African families have bank accounts.

In East Africa, Ethiopia, Uganda and Tanzania each have less than one bank branch per every 100,000 people. The ratio is better for some Southern African countries. Namibia has more than four, Zimbabwe more than three and Botswana nearly four.

Banks’ minimum balance requirements and the cost of maintaining an account are too high for many people. Opening a bank account in Cameroon requires a $700 deposit, according to a 2007 World Bank policy research report. That is more than the annual income of many Cameroonians.

Many banks also insist on considerable documentation to open an account. Banks in Cameroon, Sierra Leone, Uganda, and Zambia require at least four documents, including an identity card or passport, recommendation letter, wage slip and proof of address. In a continent where many people work in the informal sector and more than 60 per cent live in rural areas, gathering such documentation can be a challenge.

Even when people have extra money, there may be little incentive to save. In Ghana the interest paid on savings is insignificant, while annual interest rates on loans range between 23 and 25 per cent.

The low level of formal savings deposits means that many banks have limited funds to lend out and enables them to charge high interest rates. As a result, the World Bank estimates, firms in sub-Saharan Africa fund between one-half and three-quarters of their new investments from internal company savings. While such “self-investment” may be productive, industry experts say that retained earnings are normally not sufficient, and this constrains the operations of many businesses.

Waiting to be tapped

In Africa, many economic activities take place in the informal sector. While many households have notable savings, “The problem is that these are being held in the non-financial form,” Mr. Gayi told Africa Renewal. “These are not being significantly channelled into productive investments.”

Many Africans still keep most of their savings in livestock, stockpiles of goods for trading, grain, jewellery or construction material. Data are limited, but some experts estimate that about 80 per cent of all household assets in rural Africa are in non-financial forms.

To tap into such assets, it is necessary to “introduce new financial products or instruments that respond to the saving needs of households,” says Mr. Gayi of UNCTAD. Savings products that “permit easy accessibility” and allow for “small transactions at frequent intervals” would encourage households to shift to the formal system, thereby making such assets available for productive investments, he says.

In Uganda, according to an extensive survey reported by the UN Capital Development Fund (UNCDF), people with access to formal bank accounts saved three times more in the 12 months studied than those who held their assets in the “semi- and informal sectors.”

The UNCDF noted in its 2004 report that in Rwanda about half a million savings passbook accounts, with an average account size of $57, pulled almost $40 mn into circulation in 2001. “Although this may not appear significant,” argued the UNCDF, “proper circulation of these funds into credit products could have a significant multiplier effect in the Rwandan economy.”

Banks reform and reach out

In many African countries, governments and banks are changing the way they do business. In Nigeria, a series of banking-sector reforms initiated in 2004 limited government ownership in banks and brought greater competition. As a result, bigger banks bought out smaller ones and new ones merged. Although the overall number of banks declined, most had a stronger capital base and the number of branches increased by over 600. With enhanced capacity, Nigerian banks started making inroads into other countries in the region. They introduced new products and services.

The Standard Trust Bank branch in Ghana, now United Bank of Africa, introduced a “zero-deposit” account, allowing people to open accounts without initially putting in any money, thereby increasing its customer base.

In Ghana, financial-sector liberalization has brought greater competition, forcing banks to be more innovative and to work harder to attract customers. In 2006, Barclays Bank, Ghana, started working with susu agents, who deposit the collective savings of their customers with the bank in return for a fee and access to a loan facility.

Susu is the oldest form of money-collecting system in Ghana. In such arrangements, groups of people regularly pay a fixed sum into a pool held by a susu collector. Each member of the group gets a turn to receive the entire sum at the end of a given cycle, for investment and other needs. In some cases, customers get their money back after every 31 days, minus a day’s contribution to cover the expenses of maintaining the fund.

Many market women would rather save their money with a susu collector than leave their wares unwatched in the marketplace to make a trip to a bank. Unlike conventional bankers, susu collectors usually pass by each customer’s stall or home to collect the daily, weekly or monthly contributions, depending on the terms. There is almost no paperwork involved for the customer. Collecting agents rely on personal relationships, trust and various forms of collateral to reach markets that are beyond the reach of formal banks.

There are an estimated 5,000 susu collectors in Ghana with more than 2 million customers. Barclays Bank is currently working with 100 agents and hopes to work with more.

Following a financial-sector reform in Benin in the 1990s, the government introduced a programme of rural savings and loan institutions to better serve the poor. “The economy grew at an annual rate of 5 per cent during the last five years as a result of these interventions,” stated the 2004 UNCDF report. With the right financial policies and the provision of secure and accessible savings systems, the UNCDF observed, savings rates would improve and economies would grow through increased domestic investment.

To increase savings, “Banking regulations need to be adapted to encourage those micro-financing institutions with the capacity to legally mobilize savings from clients or the general public,” says Mr. Thisen of the ECA.

Bringing back post office savings

For decades, governments have used their extensive networks of post offices to mobilize small amounts of savings and provide basic financial services in rural and urban areas. In recent years, financial-sector reforms in many African countries have expanded the range of products offered by these postal banks.

The Kenya Post Office Savings Bank, established in 1978, provides a range of services and operates an advanced banking system. Last year the Post Bank, as it is commonly known, mobilized KSh12 bn (US$1=68.7 Kenyan shillings) in savings and realized KSh174 mn in profits, mainly from investment of the funds. Bank managers believe the returns could be improved through further expansion and diversification of products and services. The bank is seeking an amendment in the country’s Post Office Savings Act to enable it to offer loans and credit facilities to low-income earners and micro-enterprises.

The World Savings Banks Institute (WSBI) estimates that in some countries the number of postal savings accounts exceeds that of all deposit accounts with mainstream banks. Benin’s postal savings bank managed roughly 360,000 savings accounts in 2001, compared with 162,000 deposit accounts in conventional banks. In Kenya, the number of postal accounts almost matched the total number of bank deposit accounts in 2003.

According to Hugues Kamewe, a financial sector adviser at the WSBI, postal savings institutions have a vital role to play in the economic and social infrastructure of African countries, where the majority of the economically active population does not have access to mainstream banks.

New technology helping

Recent developments in mobile phone technology can help expand financial access for the poor, and hopefully mobilize savings. In South Africa, the Democratic Republic of the Congo, Zambia and Kenya, mobile phone banking is taking services to remote areas where conventional banks have been physically absent or too expensive. Subscribers can open accounts, check their balances, pay their bills or transfer money (see Africa Renewal, January 2008).

Though few Africans have bank accounts, nearly 80 million have cell phones, according to the International Telecommunication Union. FinMark Trust, a research group seeking to make financial services more accessible, reports that 17 per cent of those who do not have bank accounts in Kenya and Botswana nevertheless own mobile phones. In Kenya, as many as 1 million people use M-Pesa, a mobile-payment scheme.

Aiming for investment

“Increasing savings and ensuring that they are directed to productive investment are central to accelerating economic growth,” finds a 2005 report of the UN Department of Economic and Social Affairs, Mobilizing Domestic Resources for Development. It argues that “these objectives should therefore be central concerns of national policymakers.”

Currently, however, African countries do not have the capacity to effectively channel domestic savings into productive investment because of “shallow financial systems” and ineffective financial institutions, notes Mr. Gayi of UNCTAD. He called for “innovative thinking,” and suggested that countries set up a long-term investment fund. “Resources for this could be pooled from a wide array of financial-sector operators with large cash reserves, such as insurance companies, private banks or pension funds.”

When there are commodity booms and unexpectedly high export earnings, Mr. Gayi says, “part of the windfall income can also be allocated to this fund” to kick-start the process. “Policies that help African countries enhance the mobilization and use of their domestic resources could be beneficial for the economy in general.”